Professional Documents

Culture Documents

Which is Better Ltd_HW_week4

Which is Better Ltd_HW_week4

Uploaded by

alexa baloghCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Which is Better Ltd_HW_week4

Which is Better Ltd_HW_week4

Uploaded by

alexa baloghCopyright:

Available Formats

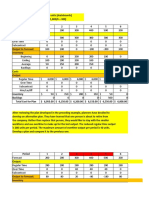

HW2 Which is Better Ltd.

is trading with internal doors, the CEO asked the accountant to

show the difference between using FIFO and Average cost method.

During the first quarter of 20X1 Which is Better Ltd. has the following information on the

changes in inventories.

AVCO Date Transaction Quantity Purchase price Sales FIFO

(unit) ($/unit) price($/unit)

Opening inventory 40 150 6000

14h00 -

h0= January Purchase 60 140 8h00

noo

Sale 60 200 12000

5760 Closing inventory 40 1h0 5600

18240

February Purchase 80 156 12480

-50

so Sale 70 210 144-00

7600 Closing inventory 50 156 7800

March Purchase 50 146 7300

14900

D=

yoo

-

Sale 80 220 17600

2580 Closing inventory 20 1h6 2520

1. Calculate the gross profit and the amount of closing inventory at the end of each

month and at the end of the quarter if the company uses

a. FIFO

b. Average cost

method to calculate COGS.

2. Compare the results of a. and b. and explain the differences (in Income statement

and in Statement of Financial Position)

1.a) FIFO method

Month Revenue ($) COGS ($) Gross Profit ($) Value of closing

" =

inventory ($)

January 12000 8800 3200 5600

February 14700 10280 4h20 9-800

March 17600 12180 5h20 2520

Q1 Total 4h 300 31260 13040 2920

1.b) Average cost method

Month Revenue ($) COGS ($) Gross Profit ($) Value of closing

inventory ($)

January 12000 86h0 3360 5760

February 14700 10640 4060 7600

March 17600 11520 5680 2580

Q1 Total hh 300 37200 13100 2580

January

FIFO AVCO

6000 6000

8h00 8h00

12000 14h00 14h00

'

40

= 700

5600 5760

You might also like

- Anandam Case Study - AFSDocument20 pagesAnandam Case Study - AFSSiddhesh Mahadik67% (3)

- KDS ControllingDocument27 pagesKDS Controllingsampath50% (2)

- Financial Feasibility: 4.1 Total Start Up Cash NeededDocument5 pagesFinancial Feasibility: 4.1 Total Start Up Cash NeededAmna Arif100% (1)

- Formula For Intercompany TransactionsDocument6 pagesFormula For Intercompany Transactionskonyatan100% (1)

- P1 Reviewer ISAPDocument13 pagesP1 Reviewer ISAPVenus B. MacatuggalNo ratings yet

- Fam - Inventory, Lifo, FifoDocument13 pagesFam - Inventory, Lifo, FifoSahil suranaNo ratings yet

- CMA SS August 2018Document12 pagesCMA SS August 2018Goremushandu MungarevaniNo ratings yet

- CGT21027 - Macpherson Refrigerator Case AnalysisDocument13 pagesCGT21027 - Macpherson Refrigerator Case AnalysisBhargav Sri DhavalaNo ratings yet

- Perniagaan Aisyah Humaira Cash BudgetDocument4 pagesPerniagaan Aisyah Humaira Cash Budget2022452662No ratings yet

- Price Output Relationship in Ice Market FinalDocument13 pagesPrice Output Relationship in Ice Market Finaldeeptitripathi09No ratings yet

- Accounting Fifo LifoDocument7 pagesAccounting Fifo LifoFariha tamannaNo ratings yet

- English VersionDocument106 pagesEnglish VersionAmrFarahatNo ratings yet

- Partnership OperationsDocument9 pagesPartnership OperationsJay Mark Marcial JosolNo ratings yet

- Chapter 20 Valuation of Stock Q1 The Concept of Prudence Requires Profit To Be Stated On A Realistic Basis. in Particular, Profit Should Not BeDocument2 pagesChapter 20 Valuation of Stock Q1 The Concept of Prudence Requires Profit To Be Stated On A Realistic Basis. in Particular, Profit Should Not Bemelody shayanwakoNo ratings yet

- 2019 Final solutionDocument1 page2019 Final solutionjoehe2625No ratings yet

- Cma Budget ExcelDocument6 pagesCma Budget ExcelDristi SinghNo ratings yet

- CrionDocument6 pagesCrionPreticia ChristianNo ratings yet

- MewDocument9 pagesMewJ I Anik BertNo ratings yet

- AgeingDocument4 pagesAgeingkrishna aroraNo ratings yet

- Master BudgetDocument13 pagesMaster BudgetShobha SheikhNo ratings yet

- Total Cash Available (1 + 2) 82,500 124,000 89,275Document6 pagesTotal Cash Available (1 + 2) 82,500 124,000 89,275Nischal LawojuNo ratings yet

- Exercises On DividendsDocument16 pagesExercises On DividendsGrace RoqueNo ratings yet

- Working Paper CH 7 - Sheet1Document2 pagesWorking Paper CH 7 - Sheet1azkahilmii12No ratings yet

- Answer 26 Sophia Test 2017Document2 pagesAnswer 26 Sophia Test 2017skye SNo ratings yet

- St. Therese Montessori School of San PabloDocument3 pagesSt. Therese Montessori School of San PabloJersey Ann AlcazarNo ratings yet

- Budet ExerciseDocument5 pagesBudet ExerciseVarun yashuNo ratings yet

- Cable TV Installation Satellite TV Installation DSL Installation 0 $0Document30 pagesCable TV Installation Satellite TV Installation DSL Installation 0 $0Fatma MohomedNo ratings yet

- Achas, Ashley - Chapter 2 Assignment 1Document8 pagesAchas, Ashley - Chapter 2 Assignment 1Gwen Stefani DaugdaugNo ratings yet

- Fin ZC415 Ec-3r First Sem 2019-2020Document5 pagesFin ZC415 Ec-3r First Sem 2019-2020srideviNo ratings yet

- Reggie's BudgetDocument5 pagesReggie's BudgetYazan AdamNo ratings yet

- Walsh Company Schedule of Cash Receipts For First Six Month of 2008 Month Sales Other Receipts Amount Jan Feb March April May JanDocument6 pagesWalsh Company Schedule of Cash Receipts For First Six Month of 2008 Month Sales Other Receipts Amount Jan Feb March April May JanmoonfruitNo ratings yet

- Accounting Project 2Document14 pagesAccounting Project 2Akash Tewari Student, Jaipuria LucknowNo ratings yet

- Day 4 - Class ExerciseDocument10 pagesDay 4 - Class Exerciseum23328No ratings yet

- Dec 14Document16 pagesDec 14Natasha AzzariennaNo ratings yet

- Tut Mene AccDocument7 pagesTut Mene Accnatasya angelNo ratings yet

- Example KPI With GraphsDocument4 pagesExample KPI With GraphsSathesh AustinNo ratings yet

- Assginment 2 - OmDocument6 pagesAssginment 2 - OmAaron WagiuNo ratings yet

- Cash Inflows: Cash Surplus/loan RequirementDocument7 pagesCash Inflows: Cash Surplus/loan RequirementMIRZA WAQAR BAIGNo ratings yet

- FM 2Document4 pagesFM 2Adityansu SumanNo ratings yet

- Aggregate Planning Example SolvedDocument16 pagesAggregate Planning Example SolvedAbdullah ShahidNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Cash Flow StatementsDocument4 pagesCash Flow StatementsKehkashanNo ratings yet

- Worksheet Master BudgetDocument6 pagesWorksheet Master BudgetRUPIKA R GNo ratings yet

- Depreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Document14 pagesDepreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Agitha Juniaty PasalliNo ratings yet

- Answer 27 Max AnswerDocument2 pagesAnswer 27 Max Answerskye SNo ratings yet

- Cash MangementDocument5 pagesCash MangementSandeep DashNo ratings yet

- Thornado Partnership Statement of Liquidation August 1, 2016 To October 31, 2016Document3 pagesThornado Partnership Statement of Liquidation August 1, 2016 To October 31, 2016Joannah maeNo ratings yet

- Budgeting 30 NOvDocument8 pagesBudgeting 30 NOvHaris HasanNo ratings yet

- Resource PlanningDocument7 pagesResource Planningnguyencongdanh18112004No ratings yet

- FINE3025 Exercise 2Document3 pagesFINE3025 Exercise 2低調用戶929No ratings yet

- Assign AcctDocument12 pagesAssign AcctNaeemullah baig100% (1)

- Net Income Linear (Net Income)Document8 pagesNet Income Linear (Net Income)Sathesh AustinNo ratings yet

- Net Income Linear (Net Income)Document8 pagesNet Income Linear (Net Income)Cristina DragneNo ratings yet

- Cash Budget Sir. Zain FileDocument10 pagesCash Budget Sir. Zain FilertsaccofficerNo ratings yet

- Human Resources Budget Plan Presented by Mr. Mohamed Sayed Country HR ManagerDocument13 pagesHuman Resources Budget Plan Presented by Mr. Mohamed Sayed Country HR ManagerMohamed Sayed SoliamnNo ratings yet

- Problem 1-6 Transaction Statement Cash Boats: AssetsDocument7 pagesProblem 1-6 Transaction Statement Cash Boats: AssetsSamarth LahotiNo ratings yet

- CMA-Budgeting Assignment: Chosen Production IndustryDocument5 pagesCMA-Budgeting Assignment: Chosen Production IndustryJ I Anik BertNo ratings yet

- Tugas 5 - InventoryDocument11 pagesTugas 5 - InventoryMuhammad RochimNo ratings yet

- Alimpuyo Master BudgetDocument7 pagesAlimpuyo Master BudgetRia Joy Cabantao AlimpuyoNo ratings yet

- Cat OneDocument2 pagesCat Onegerrad cortezNo ratings yet

- Assignment 4 Abraam Fahmy & Amany FayekDocument9 pagesAssignment 4 Abraam Fahmy & Amany FayekabraamNo ratings yet

- Bus ComDocument14 pagesBus ComSITTIE AINNAH SHIREEHN DIDAAGUNNo ratings yet

- The Conversion Cycle: Principles of Accounting Information Systems, Asia EditionDocument31 pagesThe Conversion Cycle: Principles of Accounting Information Systems, Asia EditionKurt OrfanelNo ratings yet

- The Coal-Fired Power Plant Based On Minimizing The Total Cost Inventory System Optimization ResearchDocument4 pagesThe Coal-Fired Power Plant Based On Minimizing The Total Cost Inventory System Optimization ResearchMuhammad Hassan BalochNo ratings yet

- SCM620 Brent William Ph4 IP1Document7 pagesSCM620 Brent William Ph4 IP1Jennifer Gable Brent0% (1)

- Abc AnalysisDocument11 pagesAbc AnalysisManima MahendranNo ratings yet

- Case Report - MISDocument5 pagesCase Report - MISVarun KumarNo ratings yet

- Acc101 Probset1 v2Document5 pagesAcc101 Probset1 v2BamPanggatNo ratings yet

- MGT404 SolutionDocument2 pagesMGT404 SolutionRaheel Babar0% (1)

- Sample Thesis Inventory SystemDocument71 pagesSample Thesis Inventory SystemMary Joy Robles ManalaysayNo ratings yet

- Achievement Test 3.chapters 5&6Document9 pagesAchievement Test 3.chapters 5&6Quỳnh Vũ100% (1)

- Accounting For Merchandising OperationsDocument58 pagesAccounting For Merchandising OperationsHEM CHEA100% (11)

- Chapter 8 - Valuation of Inventories - A Cost-Basis ApproachDocument16 pagesChapter 8 - Valuation of Inventories - A Cost-Basis ApproachheryadiNo ratings yet

- Ind As 2: Inventories: (I) MeaningDocument6 pagesInd As 2: Inventories: (I) MeaningDinesh KumarNo ratings yet

- Inventories (Finacc1)Document2 pagesInventories (Finacc1)Liyana ChuaNo ratings yet

- An Inventory Management Package For RDocument38 pagesAn Inventory Management Package For RKeo Dính ChuộtNo ratings yet

- Cost Acc Chapter 7Document14 pagesCost Acc Chapter 7ElleNo ratings yet

- Gross Sales To Be PrintDocument11 pagesGross Sales To Be PrintMiguel MerandillaNo ratings yet

- The Revenue Cycle: Group 1Document43 pagesThe Revenue Cycle: Group 1Ratih PratiwiNo ratings yet

- Lean Thinking Exam - 1newDocument2 pagesLean Thinking Exam - 1newPebo GreenNo ratings yet

- Inventory ControlDocument3 pagesInventory Controlshardul2020100% (3)

- 215 Chap04 ForecastingDocument30 pages215 Chap04 Forecastingtyrone21No ratings yet

- Chapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Document32 pagesChapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Judith DelRosario De RoxasNo ratings yet

- Marginal CostingDocument63 pagesMarginal Costingprachi aroraNo ratings yet

- Michaan's Auctions ResultsDocument42 pagesMichaan's Auctions ResultsL. A. PatersonNo ratings yet

- CH2 QuizkeyDocument5 pagesCH2 QuizkeyiamacrusaderNo ratings yet

- Introduction of Inventory ManagementDocument4 pagesIntroduction of Inventory ManagementPrathyusha ReddyNo ratings yet

- Acctg 121Document3 pagesAcctg 121YricaNo ratings yet

- An ABC AnalysisDocument6 pagesAn ABC AnalysisDavisTranNo ratings yet