Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

0 viewsComputation 2023

Computation 2023

Uploaded by

vishwakarmanitesh1000Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Income Tax Computation FormatDocument2 pagesIncome Tax Computation Formatrathan50% (4)

- SampleDocument2 pagesSamplekorean languageNo ratings yet

- Sample PDFDocument2 pagesSample PDFkorean languageNo ratings yet

- Financials - SignedDocument3 pagesFinancials - Signedsruthiconsultancy357No ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- Total Income StatementDocument1 pageTotal Income StatementsamaadhuNo ratings yet

- Profits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoDocument3 pagesProfits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoAkhil ThannikalNo ratings yet

- Alli Rani Kavitha 22-23Document2 pagesAlli Rani Kavitha 22-23avjiti2580No ratings yet

- Computation 2022-2023Document2 pagesComputation 2022-2023yiyirek783No ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- $RN8C7G2Document3 pages$RN8C7G2akxerox47No ratings yet

- Profits and Gains of Business or ProfessionDocument3 pagesProfits and Gains of Business or ProfessionKumar GajulaNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Computation FY 18-19 PDFDocument6 pagesComputation FY 18-19 PDFRuch JainNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- Coi AmbekarDocument2 pagesCoi AmbekarCorman LimitedNo ratings yet

- Ku Way Yik - Tax Booklet - DraftDocument19 pagesKu Way Yik - Tax Booklet - Draftestherkw940No ratings yet

- ComputationDocument1 pageComputationsneh.officialworkNo ratings yet

- Total Income StatementDocument2 pagesTotal Income StatementMohan Ganesh S/o A.MurugesanNo ratings yet

- Mashood K ITR COMPUTATION AY 2022-23Document3 pagesMashood K ITR COMPUTATION AY 2022-23sidvikventuresNo ratings yet

- Computationofincome2023 1Document2 pagesComputationofincome2023 1rtaxhelp helpNo ratings yet

- Aamir 22-23 Income StatementDocument1 pageAamir 22-23 Income StatementMohammed MoizNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- COMPUTATIONDocument1 pageCOMPUTATIONprateek gangwaniNo ratings yet

- Book 1Document2 pagesBook 1NandhakumarNo ratings yet

- Computation AY 2024-25Document2 pagesComputation AY 2024-25b2bservices007No ratings yet

- COMPUTATIONDocument2 pagesCOMPUTATIONramakrishna6469No ratings yet

- Book 1Document1 pageBook 1gras2007No ratings yet

- Dimension Data India PVT LTD: Pay Slip For The Month of August 2019Document1 pageDimension Data India PVT LTD: Pay Slip For The Month of August 2019Ashok ChauhanNo ratings yet

- Computation 1689418073299164986Document2 pagesComputation 1689418073299164986hors3110rajNo ratings yet

- Computation - Vijay SharmaDocument2 pagesComputation - Vijay Sharmaankit sharmaNo ratings yet

- Vinod Singh Computation Revised-3Document4 pagesVinod Singh Computation Revised-3vinodNo ratings yet

- Computation of Income: Income Under Head Other SourcesDocument1 pageComputation of Income: Income Under Head Other SourcesCA Devanshu N. SinhaNo ratings yet

- Rahul CompDocument2 pagesRahul CompCorman LimitedNo ratings yet

- Income Tax Calulator With Computation of IncomeDocument18 pagesIncome Tax Calulator With Computation of IncomeSurendra DevadigaNo ratings yet

- Comp 22-23Document1 pageComp 22-23Rohit IrkalNo ratings yet

- Nirmal Singh Comp2Document2 pagesNirmal Singh Comp2ca.lakshaykhannaNo ratings yet

- Shashikant Ganpatrao Londhe AJIPL6191Q: Income From Business/ProfessionDocument1 pageShashikant Ganpatrao Londhe AJIPL6191Q: Income From Business/ProfessionravindraNo ratings yet

- Adobe Scan 24-May-2023Document1 pageAdobe Scan 24-May-2023biswaranjansatpathyNo ratings yet

- M Venkateswara RaoDocument2 pagesM Venkateswara Raovenkat marellaNo ratings yet

- Ay 22-23 Dattatri Kadam With Sign & StampDocument13 pagesAy 22-23 Dattatri Kadam With Sign & StampRAJESH DNo ratings yet

- Computation 21 1Document1 pageComputation 21 1Laba MeherNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- Ask Fy 2022-23 FNLDocument3 pagesAsk Fy 2022-23 FNLsgnvsureshNo ratings yet

- AY2021-22 ANISETTY SINDHU-EFPPS3410N-ComputationDocument3 pagesAY2021-22 ANISETTY SINDHU-EFPPS3410N-Computationforty oneNo ratings yet

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Document1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- Ashok COMPUTATION 2019-20Document2 pagesAshok COMPUTATION 2019-20SHIFAZ SULAIMANNo ratings yet

- Aapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022Document1 pageAapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022ayush bhatnagarNo ratings yet

- Mohammed HaneefDocument2 pagesMohammed Haneefkarnsoni2202No ratings yet

- Computation 22-23 AyDocument2 pagesComputation 22-23 AysonuNo ratings yet

- CompDocument4 pagesCompCorman LimitedNo ratings yet

- Revision TXDocument26 pagesRevision TXFatemah MohamedaliNo ratings yet

- ComputationDocument1 pageComputationcrypted004No ratings yet

- Draft Comp 23-24-1Document2 pagesDraft Comp 23-24-1Vishal SinghNo ratings yet

- CompDocument3 pagesCompchalukrcNo ratings yet

- Hansa Polymer's Bal 23-24Document1 pageHansa Polymer's Bal 23-24ppsindNo ratings yet

- Chennagiri Raviteja 2023-24Document3 pagesChennagiri Raviteja 2023-24ravi.ramana64No ratings yet

- Profits and Gains of Business or ProfessionDocument1 pageProfits and Gains of Business or ProfessionirshadNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

Computation 2023

Computation 2023

Uploaded by

vishwakarmanitesh10000 ratings0% found this document useful (0 votes)

0 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

0 views1 pageComputation 2023

Computation 2023

Uploaded by

vishwakarmanitesh1000Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

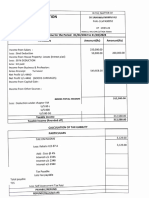

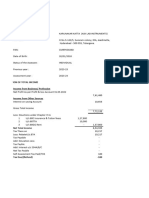

NITESH BECHAN VISHWAKARMA

PAN No : CANPV8281P DOB : 12/01/1998

P.Y.Ended : 31.03.2023 Asst. Year : 2023 - 2024

COMPUTATION OF TOTAL INCOME

PARTICULARS Rs. Rs.

I. Income from Business/Profession

Tution Fee Income 4,74,000

Less :- Adoch Expenses 85,320

Deemed Income U/s 44AD 3,88,680 3,88,680

II Income from Other Sources

Intrest on SB 174

Interest on IT Refund - 174

GROSS TOTAL INCOME 3,88,854

Less: Deductions Under Chapter VIA

U/S 80C

LIC Premium -

HL Repayment - -

U/S 80D

Mediclaim Premium - -

U/S 80TTA

Bank Interest 174 174

NET TOTAL INCOME 3,88,680

Rounded Off U/s 288A 3,88,680

INCOME TAX CALCULATION

Income Tax Payable on above Income 6,934

Less : Rebate Us 87A 6,934

-

Add : Education Cess @ 4% -

-

Add : Fees for Default in Furnishing Return of

Income( Section 234 F ) 1,000 1,000

Less : Tax Deducted at Source - -

Self Assessment Tax Payable & Paid/ (Refund Due) 1,000

You might also like

- Income Tax Computation FormatDocument2 pagesIncome Tax Computation Formatrathan50% (4)

- SampleDocument2 pagesSamplekorean languageNo ratings yet

- Sample PDFDocument2 pagesSample PDFkorean languageNo ratings yet

- Financials - SignedDocument3 pagesFinancials - Signedsruthiconsultancy357No ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- Total Income StatementDocument1 pageTotal Income StatementsamaadhuNo ratings yet

- Profits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoDocument3 pagesProfits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoAkhil ThannikalNo ratings yet

- Alli Rani Kavitha 22-23Document2 pagesAlli Rani Kavitha 22-23avjiti2580No ratings yet

- Computation 2022-2023Document2 pagesComputation 2022-2023yiyirek783No ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- $RN8C7G2Document3 pages$RN8C7G2akxerox47No ratings yet

- Profits and Gains of Business or ProfessionDocument3 pagesProfits and Gains of Business or ProfessionKumar GajulaNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Computation FY 18-19 PDFDocument6 pagesComputation FY 18-19 PDFRuch JainNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- Coi AmbekarDocument2 pagesCoi AmbekarCorman LimitedNo ratings yet

- Ku Way Yik - Tax Booklet - DraftDocument19 pagesKu Way Yik - Tax Booklet - Draftestherkw940No ratings yet

- ComputationDocument1 pageComputationsneh.officialworkNo ratings yet

- Total Income StatementDocument2 pagesTotal Income StatementMohan Ganesh S/o A.MurugesanNo ratings yet

- Mashood K ITR COMPUTATION AY 2022-23Document3 pagesMashood K ITR COMPUTATION AY 2022-23sidvikventuresNo ratings yet

- Computationofincome2023 1Document2 pagesComputationofincome2023 1rtaxhelp helpNo ratings yet

- Aamir 22-23 Income StatementDocument1 pageAamir 22-23 Income StatementMohammed MoizNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- COMPUTATIONDocument1 pageCOMPUTATIONprateek gangwaniNo ratings yet

- Book 1Document2 pagesBook 1NandhakumarNo ratings yet

- Computation AY 2024-25Document2 pagesComputation AY 2024-25b2bservices007No ratings yet

- COMPUTATIONDocument2 pagesCOMPUTATIONramakrishna6469No ratings yet

- Book 1Document1 pageBook 1gras2007No ratings yet

- Dimension Data India PVT LTD: Pay Slip For The Month of August 2019Document1 pageDimension Data India PVT LTD: Pay Slip For The Month of August 2019Ashok ChauhanNo ratings yet

- Computation 1689418073299164986Document2 pagesComputation 1689418073299164986hors3110rajNo ratings yet

- Computation - Vijay SharmaDocument2 pagesComputation - Vijay Sharmaankit sharmaNo ratings yet

- Vinod Singh Computation Revised-3Document4 pagesVinod Singh Computation Revised-3vinodNo ratings yet

- Computation of Income: Income Under Head Other SourcesDocument1 pageComputation of Income: Income Under Head Other SourcesCA Devanshu N. SinhaNo ratings yet

- Rahul CompDocument2 pagesRahul CompCorman LimitedNo ratings yet

- Income Tax Calulator With Computation of IncomeDocument18 pagesIncome Tax Calulator With Computation of IncomeSurendra DevadigaNo ratings yet

- Comp 22-23Document1 pageComp 22-23Rohit IrkalNo ratings yet

- Nirmal Singh Comp2Document2 pagesNirmal Singh Comp2ca.lakshaykhannaNo ratings yet

- Shashikant Ganpatrao Londhe AJIPL6191Q: Income From Business/ProfessionDocument1 pageShashikant Ganpatrao Londhe AJIPL6191Q: Income From Business/ProfessionravindraNo ratings yet

- Adobe Scan 24-May-2023Document1 pageAdobe Scan 24-May-2023biswaranjansatpathyNo ratings yet

- M Venkateswara RaoDocument2 pagesM Venkateswara Raovenkat marellaNo ratings yet

- Ay 22-23 Dattatri Kadam With Sign & StampDocument13 pagesAy 22-23 Dattatri Kadam With Sign & StampRAJESH DNo ratings yet

- Computation 21 1Document1 pageComputation 21 1Laba MeherNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- Ask Fy 2022-23 FNLDocument3 pagesAsk Fy 2022-23 FNLsgnvsureshNo ratings yet

- AY2021-22 ANISETTY SINDHU-EFPPS3410N-ComputationDocument3 pagesAY2021-22 ANISETTY SINDHU-EFPPS3410N-Computationforty oneNo ratings yet

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Document1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- Ashok COMPUTATION 2019-20Document2 pagesAshok COMPUTATION 2019-20SHIFAZ SULAIMANNo ratings yet

- Aapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022Document1 pageAapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022ayush bhatnagarNo ratings yet

- Mohammed HaneefDocument2 pagesMohammed Haneefkarnsoni2202No ratings yet

- Computation 22-23 AyDocument2 pagesComputation 22-23 AysonuNo ratings yet

- CompDocument4 pagesCompCorman LimitedNo ratings yet

- Revision TXDocument26 pagesRevision TXFatemah MohamedaliNo ratings yet

- ComputationDocument1 pageComputationcrypted004No ratings yet

- Draft Comp 23-24-1Document2 pagesDraft Comp 23-24-1Vishal SinghNo ratings yet

- CompDocument3 pagesCompchalukrcNo ratings yet

- Hansa Polymer's Bal 23-24Document1 pageHansa Polymer's Bal 23-24ppsindNo ratings yet

- Chennagiri Raviteja 2023-24Document3 pagesChennagiri Raviteja 2023-24ravi.ramana64No ratings yet

- Profits and Gains of Business or ProfessionDocument1 pageProfits and Gains of Business or ProfessionirshadNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet