Professional Documents

Culture Documents

Base Value TDS VDS Other as Per Finance Bill 2024 1718068358

Base Value TDS VDS Other as Per Finance Bill 2024 1718068358

Uploaded by

Saleh Muhammed SakiCopyright:

Available Formats

You might also like

- Test Bank For The Language of Medicine 11th Edition by ChabnerDocument18 pagesTest Bank For The Language of Medicine 11th Edition by ChabnerDaniel Miller97% (33)

- Complete DCF Template v3Document1 pageComplete DCF Template v3javed PatelNo ratings yet

- Comparative VDS TDS 2023-24 (Ammended 04 July 2023)Document12 pagesComparative VDS TDS 2023-24 (Ammended 04 July 2023)abu taher100% (2)

- Potato Corner Sample BreakevenDocument1 pagePotato Corner Sample BreakevenOver Mango50% (2)

- The Future of JournalismDocument4 pagesThe Future of JournalismHuy NguyenNo ratings yet

- Sugar Project FinalDocument27 pagesSugar Project FinalAtharvaNo ratings yet

- Rishabh Gupta PDFDocument3 pagesRishabh Gupta PDFrishabhNo ratings yet

- Revised 2024-25 Base Value TDS VDS Other As per TDS Rules 2024 Tax Act 2023 & VAT Act 2012 etc. @ Taeb (01.07.2024) (1)Document38 pagesRevised 2024-25 Base Value TDS VDS Other As per TDS Rules 2024 Tax Act 2023 & VAT Act 2012 etc. @ Taeb (01.07.2024) (1)Arup DattaNo ratings yet

- 01) Comparative VDS TDS 2023-24 (Vvi)Document27 pages01) Comparative VDS TDS 2023-24 (Vvi)hiakashNo ratings yet

- Comparative VDS TDS 2023-24 (Ammended 19 June 2023)Document9 pagesComparative VDS TDS 2023-24 (Ammended 19 June 2023)nowshadaqcNo ratings yet

- VDS Rate & Guideline FY-2021-2022Document14 pagesVDS Rate & Guideline FY-2021-2022mrsrr1999No ratings yet

- WEEKLY REPORT vs ACTUAL MGFI RND week 52Document1 pageWEEKLY REPORT vs ACTUAL MGFI RND week 52Danang Dwi CNo ratings yet

- Degasification CostingDocument1 pageDegasification CostingKrishNo ratings yet

- Financial AnalysisDocument5 pagesFinancial AnalysisAdiel RadiaNo ratings yet

- VAT GuideDocument3 pagesVAT GuideshimladhakaconsultingNo ratings yet

- Revised Structure of Commission and Remuneration T - 240331 - 195127Document3 pagesRevised Structure of Commission and Remuneration T - 240331 - 195127Study PowerNo ratings yet

- VDS TDS RateDocument3 pagesVDS TDS RateTanvir TanmoyNo ratings yet

- Bharat Barometer - Nov'23 - HSIE-202311151202284972889Document11 pagesBharat Barometer - Nov'23 - HSIE-202311151202284972889adityazade03No ratings yet

- Moura DubeauxDocument8 pagesMoura DubeauxDinheirama.comNo ratings yet

- Y-O-Y Sales Growth % 18% 19% 12% 10% 1% 9% 2% 11% 2% - 2%Document7 pagesY-O-Y Sales Growth % 18% 19% 12% 10% 1% 9% 2% 11% 2% - 2%muralyyNo ratings yet

- Maintain NEUTRAL: Acem in CMP Rs 219 Target Rs 191 ( 13%)Document7 pagesMaintain NEUTRAL: Acem in CMP Rs 219 Target Rs 191 ( 13%)9987303726No ratings yet

- Potato Corner Sample BreakevenDocument1 pagePotato Corner Sample Breakevenphuri.siaNo ratings yet

- Fmci Vat RatesDocument19 pagesFmci Vat RatesFahim YusufNo ratings yet

- Pidilite IndustriesDocument7 pagesPidilite IndustriesmuralyyNo ratings yet

- 15710-gdpcr 0Document72 pages15710-gdpcr 0Duc TriNo ratings yet

- DSP The Report Card 1h23Document30 pagesDSP The Report Card 1h23NikhilKapoor29No ratings yet

- Week07 Exercises Amparo 180318Document7 pagesWeek07 Exercises Amparo 180318JosephAmparoNo ratings yet

- Asian Paints 1Document7 pagesAsian Paints 1akaish26No ratings yet

- Tender Capacity Info.Document8 pagesTender Capacity Info.Ove Kabir Eon 1731923No ratings yet

- Heriot-Watt University Finance - December 2020 Section I Case StudiesDocument13 pagesHeriot-Watt University Finance - December 2020 Section I Case StudiesSijan PokharelNo ratings yet

- Direct Imports To Kenya Previously Registered in KenyaDocument3 pagesDirect Imports To Kenya Previously Registered in KenyaisaacNo ratings yet

- Manual InsentivDocument21 pagesManual Insentivandi batikNo ratings yet

- Reporte de Recaudacion y Recuperacion Al 08.06Document2,650 pagesReporte de Recaudacion y Recuperacion Al 08.06Piero RVNo ratings yet

- PT Cost Rate Total Lit Mileage Total KM ('E) Km/Rev Rev ('E) Net RevenueDocument11 pagesPT Cost Rate Total Lit Mileage Total KM ('E) Km/Rev Rev ('E) Net RevenueagraladnNo ratings yet

- Deep Enterprises 24/24-25 GHO/2425/POS/COP/00005: Tax InvoiceDocument4 pagesDeep Enterprises 24/24-25 GHO/2425/POS/COP/00005: Tax InvoiceShakti SharmaNo ratings yet

- Q324 - Form8K - Exhibit99-1 - Earnings - Release - Tables - XLSX - Q324 - Form8K - Exhibit99-1 - Earnings - Release - Tables-FinalDocument9 pagesQ324 - Form8K - Exhibit99-1 - Earnings - Release - Tables - XLSX - Q324 - Form8K - Exhibit99-1 - Earnings - Release - Tables-FinalAndrei CucuNo ratings yet

- Pembahasan Exercise CH 9 Cost of CapitalDocument4 pagesPembahasan Exercise CH 9 Cost of CapitalGhina NabilaNo ratings yet

- DCF Valuation: 1.inputDocument25 pagesDCF Valuation: 1.inputDushyant yadavNo ratings yet

- Sugar Factory Model 2Document37 pagesSugar Factory Model 2Shivika MahajanNo ratings yet

- Dixon InvestorPresentationJan2022Document12 pagesDixon InvestorPresentationJan2022raguramrNo ratings yet

- Presentation (Company Update)Document16 pagesPresentation (Company Update)Shyam SunderNo ratings yet

- FM Sugar CaseDocument16 pagesFM Sugar CaseR RATED GAMERNo ratings yet

- No Quick Turnaround Seen For The San Gabriel: First Gen CorporationDocument2 pagesNo Quick Turnaround Seen For The San Gabriel: First Gen CorporationJohn Kyle LluzNo ratings yet

- WorksheetDocument7 pagesWorksheetVijendra Kumar DubeyNo ratings yet

- AVIS CarsDocument10 pagesAVIS CarsSheikhFaizanUl-HaqueNo ratings yet

- Case Krakatau Steel A Report - Syndicate 11Document10 pagesCase Krakatau Steel A Report - Syndicate 11Philip AnugrahRaskitaNo ratings yet

- Presentation Mar 2010Document41 pagesPresentation Mar 2010Bharath BossNo ratings yet

- IRR - SGS SLOT (2x30) With 100 KG Electrical Vapouriser - United EnggDocument8 pagesIRR - SGS SLOT (2x30) With 100 KG Electrical Vapouriser - United Enggatripathi2009No ratings yet

- N - 5 Sgs1 MTC - KMD (Sri Lubowo)Document87 pagesN - 5 Sgs1 MTC - KMD (Sri Lubowo)tamzisNo ratings yet

- Terra Repaired FileDocument19 pagesTerra Repaired Fileshahid hassanNo ratings yet

- Formulir Target Cakupan Pelayanan Upaya Kegiatan Wajib Puskesmas Wairoro Puskesmas: Wairoro Bulan: Juni Tahun: 2015Document52 pagesFormulir Target Cakupan Pelayanan Upaya Kegiatan Wajib Puskesmas Wairoro Puskesmas: Wairoro Bulan: Juni Tahun: 2015Anonymous cnPBSQUNo ratings yet

- Formulir Target Cakupan Pelayanan Upaya Kegiatan Wajib Puskesmas Wairoro Puskesmas: Wairoro Bulan: Juni Tahun: 2015Document52 pagesFormulir Target Cakupan Pelayanan Upaya Kegiatan Wajib Puskesmas Wairoro Puskesmas: Wairoro Bulan: Juni Tahun: 2015SalsabilahNo ratings yet

- Exide Commission Structure AdvisorDocument5 pagesExide Commission Structure Advisorashok7jNo ratings yet

- 81 Procuremnt Status Reports - 20 October 2016 (Rev. 00)Document49 pages81 Procuremnt Status Reports - 20 October 2016 (Rev. 00)Zain AbidiNo ratings yet

- Accenture Fin Model - Par - V1Document9 pagesAccenture Fin Model - Par - V1shahsamkit08No ratings yet

- Accounting For Managers: Report Over The Financial Performance of JB HifiDocument8 pagesAccounting For Managers: Report Over The Financial Performance of JB HifiMah Noor FastNUNo ratings yet

- Q3 & 9M FY21 - Results Presentation: February 2021Document29 pagesQ3 & 9M FY21 - Results Presentation: February 2021Richa CNo ratings yet

- SACAP Professional Fee Guideline 2015Document3 pagesSACAP Professional Fee Guideline 2015takuva03No ratings yet

- TDS & VDS Rate 2022-2023Document25 pagesTDS & VDS Rate 2022-2023Shariful IslamNo ratings yet

- IPMSDocument4 pagesIPMSSDE NorthNo ratings yet

- Previous Exp 2017 Presentation CCC Limpopo CCCDocument44 pagesPrevious Exp 2017 Presentation CCC Limpopo CCCANDREW STRUGNELLNo ratings yet

- Yr Io PMT Dep Tax Shield ZN After Tacash Flow Pvif @5%pvif @6%Document2 pagesYr Io PMT Dep Tax Shield ZN After Tacash Flow Pvif @5%pvif @6%hary sharmaNo ratings yet

- Financial Discussion Year OneDocument4 pagesFinancial Discussion Year OneShaza ZulfiqarNo ratings yet

- Appoinment Letter-Nusrat JamanDocument2 pagesAppoinment Letter-Nusrat JamanSaleh Muhammed SakiNo ratings yet

- HRC Sharm MenuDocument19 pagesHRC Sharm MenuSaleh Muhammed SakiNo ratings yet

- Appoinment Letter-Farhana YeasminDocument2 pagesAppoinment Letter-Farhana YeasminSaleh Muhammed SakiNo ratings yet

- Payment ScheduleDocument69 pagesPayment ScheduleSaleh Muhammed SakiNo ratings yet

- Deposit Summary - SBD Manufacturing Distribution - 01apr2023Document1 pageDeposit Summary - SBD Manufacturing Distribution - 01apr2023Saleh Muhammed SakiNo ratings yet

- Check # 000001-2Document1 pageCheck # 000001-2Saleh Muhammed SakiNo ratings yet

- Check # 000001-1Document1 pageCheck # 000001-1Saleh Muhammed SakiNo ratings yet

- Quotatio 1Document1 pageQuotatio 1Saleh Muhammed SakiNo ratings yet

- Trial BalanceDocument2 pagesTrial BalanceSaleh Muhammed SakiNo ratings yet

- Sep2 Meterview: Energy Measurement and ManagementDocument2 pagesSep2 Meterview: Energy Measurement and ManagementAdil HameedNo ratings yet

- Nokia Siemens Networks Flexitrunk Brochure Low-Res 15032013Document4 pagesNokia Siemens Networks Flexitrunk Brochure Low-Res 15032013chadi_lbNo ratings yet

- Cma Part 1 Mock 2Document44 pagesCma Part 1 Mock 2armaghan175% (8)

- 5013Document3 pages5013glennfreyolaNo ratings yet

- Ulla-Talvikki Virta Measuring Cycling Environment For Internet of Things ApplicationsDocument66 pagesUlla-Talvikki Virta Measuring Cycling Environment For Internet of Things ApplicationsNikola CmiljanicNo ratings yet

- Advatage and DisadadvatagesDocument5 pagesAdvatage and DisadadvatagesPawan PathakNo ratings yet

- Report On Seismic CodesDocument2 pagesReport On Seismic CodesLakshmiRaviChanduKolusuNo ratings yet

- Middle Level Reading Part 3 PoemDocument10 pagesMiddle Level Reading Part 3 Poem이세희No ratings yet

- I) Height of Retaining Wall H: Preliminary DataDocument10 pagesI) Height of Retaining Wall H: Preliminary DataOmPrakashNo ratings yet

- Worksheet 2A-QP MS (Dynamics)Document6 pagesWorksheet 2A-QP MS (Dynamics)kolNo ratings yet

- Free Money Making Guide PDF VersionDocument15 pagesFree Money Making Guide PDF VersionboulboutNo ratings yet

- IS 15394.2003 Fire Safety in Petroleum RefineriesDocument16 pagesIS 15394.2003 Fire Safety in Petroleum RefineriesnpwalNo ratings yet

- Emote: A Short StoryDocument8 pagesEmote: A Short StoryTrenton R.B.N.No ratings yet

- Resensi Novel B.inggris RikaDocument5 pagesResensi Novel B.inggris RikaRizqi RahmaniaNo ratings yet

- Johns Hopkins RFPDocument7 pagesJohns Hopkins RFPLucky 77No ratings yet

- Key A2 Basic Level English Exam PDFDocument4 pagesKey A2 Basic Level English Exam PDFakhilesh sahooNo ratings yet

- Notice: Medicare: Emergency Medical Treatment and Labor Act Technical Advisory GroupDocument2 pagesNotice: Medicare: Emergency Medical Treatment and Labor Act Technical Advisory GroupJustia.comNo ratings yet

- Resources - Job Application Form - Sample 2Document3 pagesResources - Job Application Form - Sample 2Aung Myo Thu LwinNo ratings yet

- Study of Investment Planing Among Working Womens PDFDocument113 pagesStudy of Investment Planing Among Working Womens PDFAjay S PatilNo ratings yet

- MCQ IadDocument23 pagesMCQ Iads soyaNo ratings yet

- Guidelines and Fundamental Considerations For Axle BalancingDocument40 pagesGuidelines and Fundamental Considerations For Axle BalancingAnonymous PVXBGg9TNo ratings yet

- A Z of Simple Living BookDocument68 pagesA Z of Simple Living Bookdrsubramanian100% (4)

- Sci 09 Sample QPDocument8 pagesSci 09 Sample QPkvindhraNo ratings yet

- Nippon SteelDocument7 pagesNippon SteelAnonymous 9PIxHy13No ratings yet

- National Career Assessment ExaminationDocument1 pageNational Career Assessment ExaminationHomo Ma. PaulaNo ratings yet

- Apostolic Fathers II 1917 LAKEDocument410 pagesApostolic Fathers II 1917 LAKEpolonia91No ratings yet

- 2019 2020 AEB Expression of InterestDocument1 page2019 2020 AEB Expression of InterestCentre AdministratorNo ratings yet

Base Value TDS VDS Other as Per Finance Bill 2024 1718068358

Base Value TDS VDS Other as Per Finance Bill 2024 1718068358

Uploaded by

Saleh Muhammed SakiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Base Value TDS VDS Other as Per Finance Bill 2024 1718068358

Base Value TDS VDS Other as Per Finance Bill 2024 1718068358

Uploaded by

Saleh Muhammed SakiCopyright:

Available Formats

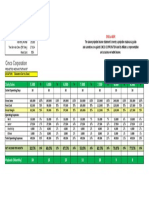

FY: 2024-25

Draft as per Proposed F. Bill TAX & VAT

Base Value, VDS, TDS Others

Abstract

This article has been prepared for informational purpose only (for practice of

myself), and is not intended to provide, and should not be considered/relied

on for Income Tax Advice.

Source of Information:

Income Tax Act, 2023

TDS Rules, 2024

VAT and Supplementary Duty Act, 2012

VAT and Supplementary Duty Rules, 2016

VAT SRO240

Various Website /Online source

Knowledge open the door to opportunity, achievement, success and wealth

Abu Taeb ITP, CA Professional level, 01736440044

taeb.amc@gmail.com

Tax & VAT Rate Ammended up to 07 June 2024 (FY: 2024-25) (With TDS Calculation Example US 90(R4) SL 3 & 4)

Abu Taeb, CA Professional Level, ITP, e-mail: taeb.amc@gmail.com, Con+88 01736440044

For Updated Materials Join CATS: CA & TaxVat Study Group in FB Link: https://www.facebook.com/groups/926593715080159/

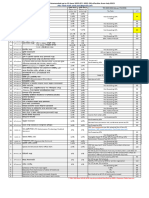

Dr‡m g~mK KZ©b ZvwjKv g~mK Dr†m g~mK Dr†m TDS 2024-2025 As per ITA 2023, Rules 2024

KZ©‡bi nvi KZ©‡bi nvi

bs †mevi †KvW †mev cÖ`vbKvix 2023-24 2024-25

Tax Rate U/S

Gwm †nv‡Uj 15% 15% Rules 4 Serial No 3= On Commission 10%,

Gm On Gross Bill 2%

1 bb Gwm †nv‡Uj 7.5% 7.5% (See Note 1 for TDSCalculation) 90 R-4

001.10/20

†i‡¯Íviv 5.0% 5.0% Rules 4 Serial 19= Other service 10%

2 Gm 002.00 ‡W‡Kv‡iUm© I K¨vUvivm© 15% 15% Annexure B 90 R-4

3 Gm 003.10 ‡gvUi Mvwoi M¨v‡iR I IqvK©kc 10% 10% 8% 90 R-4

4 Gm 003.20 WKBqvW© (RvnvR wbg©vY) 10% 10% 8% 90 R-4

ম্যানুফ্যাকচার িং, প্রসেে বা কনভােশন, পূর্ ত কাজ , রনম্াণ,

ত

5 Gm 004.00 wbg©vY ms¯’v 7.5% 7.5% 89 R-3

প্রসকৌশল বা েম্জার্ীয় কাসজ জনয চু ক্তি (Annexure A) 7%

6 Gm 007.00 weÁvcbx ms¯’v 15.0% 15.0% 5% 92

7 Gm 008.10 QvcvLvbv 10% 10% Supply of Books 3% if Others 5% as per R-3 Annexure A 89 R-3

8 Gm 009.00 wbjvgKvix ms¯’v 10% 15% 10%, if sale of Tea 1% 133

9 Gm 010.10 f‚wg Dbœqb ms¯’v 2% 2% If R-3 Kha= 7% or GA SL 13= 5% 89 R-3

Gm 010.20

feb wbg©vY ms¯’v (K) 1 -1600 eM©dzU ch©šÍ 2% 2%

10 (L) 1601- eM©d‡z Ui Dc‡i 4.50% 4.50% 7% 89 R-3

M) cyb: †iwR‡÷ªk‡bi ‡ÿ‡Î 2% 2%

11 Gm 014. 00 B‡Ûw›Us ms¯’v 5% 5% 8% on Commission 90 R-4

12 Gm 015. 10 ‡d«BU d‡ivqvWv©m© 15% 15% 10% on ommission; 2.5% On Gross Bill with/without commission 90 /124

13 Gm 020.00 Rwic ms¯’v 15% 15% 10%, Gross Bill 2%, Other 10% (See Note 1 Calculation) 90 R-4

14 Gm 021.00 cøv›U ev g~jabx hš¿cvwZ fvov cÖ`vbKvix ms¯’v 15% 15% 5% 109

Avmevec‡Î wecbb †K›`ª (K) Drcv`b ch©v‡q 7.5% 7.5%

15 Gm 024.00 (L) wecYb ch©v‡q (‡kv iyg) (Drcv`b ch©©v‡q 7.5% nv‡i g~mK 5% Annexure A 89 R-3

cwi‡kv‡ai PvjvbcÎ _vKv mv‡c‡ÿ, Ab¨_vq 15%) 7.5% 7.5%

16 Gm 028.00 Kzwiqvi (Courier) I G·‡cÖm †gBj mvwf©m 15% 15% Gross Bill 2%; Bill with com as per Calculation N-1 (Higher of A & B) 90 R-4

c‡Yi wewbg‡q Ki‡hvM¨ cY¨ †givgZ ev mvwf©wms- Gi

17 Gm 031.00 10% 10% Repair & Maintenance 5%, Motor Garage/Workshop 8% 90 R-4

Kv‡R wb‡qvwRZ e¨w³, cÖwZôvb ev ms¯’v

18 Gm 032.00 KbmvjU¨vÝx dvg© I mycvifvBRix dvg© 15% 15% 10% 90 R-4

19 Gm 033.00 BRviv`vi 15% 15% Lease of immovable property TDS 4% 128

20 Gm 034.00 AwWU GÛ GKvDw›Us dvg© 15% 15% 10% 90 R-4

21 Gm 037.00 ‡hvMvb`vi (Procurement Provider) 7.5% 7.5% Industrial Raw materials 3%, Other 5% or Various % Annexure A 89 R-3

22 Gm 040.00 wmwKDwiwU mvwf©m 10% 15% Gross Bill 2%; Bill with com as per Calculation N-1 (Higher of A & B) 90 R-4

23 Gm 043.00 ‡Uwjwfkb I AbjvBb m¤úªPvi gva¨‡g Abyôvb mieivnKvix 15% 15% 5% 92

24 Gm 045.00 AvBb civgk©K 15% 15% 10% 90 R-4

cwienb (K) †c‡UªvwjqvgRvZ cY¨ cwien‡bi †¶‡Î 5% 5% Transport Service 5% 90 R-4

25 Gm 048.00

wVKv`vi (L) Ab¨vb¨ cY¨cwien‡bi †¶‡Î 10% 10%

Vehicle rental service, Carrying service, Ride sharing service,

26 Gm 049.00 hvbevnb fvov cÖ`vbKvix 15% 15% Coworking space providing service, Accommodation providing 90 R-4

service including any sharing economy platform TDS 5%

27 Gm 050.10 AvwK©‡U±, B‡›Uwiqi wWRvBbvi ev B‡›Uwiqi†WK‡iUi 15% 15% 7% 89 R-3

28 Gm 050.20 MÖvwdK wWRvBbvi 15% 15% 7% 89 R-3

29 Gm 051.00 BwÄwbqvwis dvg© 15% 15% 7% 89 R-3

30 Gm 052.00 kã I Av‡jvK miÄvg fvov cÖ`vbKvix 15% 15% Gross Bill 2%; Bill with com as per Calculation N-1 (Higher of A & B) 90 R-4

31 Gm 053.00 ‡evW© mfvq †hvM`vbKvix 10% 10% 10% 90 R-4

32 Gm 054.00 DcMÖn P¨v‡b‡ji gva¨‡g weÁvcb cÖPviKvix 15% 15% 5% 92

33 Gm 058.00 PvU©vW© wegvb ev †nwjKÞvi fvov cÖ`vbKvix ms¯’v 15% 15% 90 R-4

34 Gm 060.00 wbjvgK…Z c‡Y¨i ‡µZv 7.5% 7.5% 10%, if sale of Tea 1% 133

35 Gm 065.00 feb †g‡S I A½b cwi®‹vi/i¶Yv‡e¶YKvix ms¯’v 10% 10% Gross Bill 2%; Bill with com as per Calculation N-1 (Higher of A & B) 90 R-4

36 Gm 066.00 jUvwii wUwKU weµqKvix 10% 15% Income from lottery 20% 118

37 Gm 067.00 Bwg‡MÖkb Dc‡`óv 15% 15% 10% 90 R-4

Gross Bill 2%; Bill with com as per Calculation N-1 (Higher of A & B) 90 R-4

38 Gm 071.00 Abyôvb Av‡qvRK 15% 15%

Services from convention hall, conference centre etc 5% 110

39 Gm 072.00 gvbe m¤•` mieivn ev e¨e¯’vcbv cÖwZôvb 15% 15% Gross Bill 2%; Bill with com as per Calculation N-1 (Higher of A & B) 90 R-4

ITES Tax Exempted as per 6th schedule Part 1 Para 21 (As per ITA 2023)

Z_¨-cÖhyw³ wbf©i †mev (Information Technology Enabled (condition: NBR issued exemption Certificate required)

40 S099.10 5% 5%

Services)

Internet Service = 10% TDS 90 R-4

10% 90 R-4

41 S099.20 Ab¨vb¨ wewea †mev 15% 15% Intangible Assets Tk 25 Lac 10%, Exceed Tk 25 Lac 12% 91

Commission, Discount Fee 10%, 5%, 3% 94

42 S099.30 ¯cÝikxc †mev (Sponsorship Services) 15% 15% 10% 90 R-4

43 Gm 099.60 ‡µwWU †iwUs G‡RwÝ 7.5% 7.5% 10% 90 R-4

Space and Structure Rent/ Office Rent TDS 5% of Gross Rent

Exemption Area:(a) Factory rent (b)Space/structure fully VDS Not required. এই ভযাট হসব ভাডা অরর্র ি অর্াৎ

ত ভাডা থর্সক

used for residential purposes (C)Commercial purpose not ভযাট কর্তন হসব না

1 Gm 074.00 15% 15% 109

more than 150 square feet (d)Rent paid by ITES স্থান ও স্থাপনা ভাডা গ্রনণকা ী : ভাডা গ্রনণকা ী কর্ত তক ভাডা উপ ১৫%

organization reg. under service code S099.10 হাস ম্ূেক আদায় কর সর্ হইসব (অর্াৎ ত পর সশাসে দারয়সে র্াকা বযক্তি

(e)Showroom rent run by women entrepreneurs ভযাট আদায় ক সব)

No VDS as per 3rd schedule if service provided under S. code S012.14

2 Gm 012. 14 B›Uv‡bU ms¯’v 5% 5% TDS Exempted, if service is ITES as per 6th schedule Part 1 Para 21

Internet Service = 10% TDS 90 R-4

No VDS as per 3rd Schedule.

3 Gm 057.00 we`¨yr weZiYKvix 5% 5%

TDS 6%, WH Authority BPDB or semilar organzation 114

No VDS as per 3rd schedule.

4 Gm 080.00 ivBW †kqvwis 5% 5%

TDS 5% 90 R-4

5 Collection of Tax from travel agent 0.30% 95

6 Deduction from Commission of Letter of Credit (LC) 5% 96

7 Local Letter of Credit 3%, 1%, 2% 97

8 Deduction of tax from export proceeds of goods Bank deduct tax @ 0.50% of total export proceed 123

9 Deduction of tax at source from export cash subsidy 10% 112

10 TDS on Interest on Savings Deposit/Term Deposit etc. Trust, AO, Company=20%, PEI, ICAB, ICMAB, SCB=10%; Other 10% 102

Example: Say, Bill amount Tk 50,000 + Commission Tk 6,000= Gross Bill Tk 56,000

Note (1): TDS will be Sec-90 R4(3): (A) TDS On Commission (Tk 6,000X Tax Rate 10%)=Tk 600;

(B) Gross Bill 56,000X Formula 10%X Tax Rate 10%= Tk 560

So, TDS is Tk 600 (Higher of A & B)

If only Gross Bill submitted Tk 56,000 (No commission said in bill) TDS will be Sec-90 R4(3): Goss bill Tk56000X Tax Rate2% =TDS Tk 1,120

Note (2): TDS will be Sec-90 R4(4): (A) TDS On Commission (Tk 6,000X Tax Rate 10%)=Tk 600;

Media buying agency Service (B) Gross Bill 56,000X Formula 2.5%X Tax Rate 10%= Tk 140

So, TDS is Tk 600 (Higher of A & B)

If only Gross Bill submitted Tk 56,000 (No commission said in bill) TDS will be Sec-90 R4(4): Goss bill Tk56000X Tax Rate 0.65% =TDS Tk 364

***NB: Read Annexure A & B for details head wise TDS Rate U/S 89 (R3) & 90 (R4)

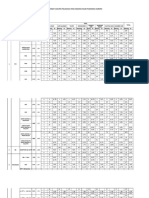

Annexure A

Abu Taeb ITP, CA Professional level, 01736440044 1

Annexure B

Abu Taeb ITP, CA Professional level, 01736440044 2

Annexure C

Abu Taeb ITP, CA Professional level, 01736440044 3

Extract from Page No 75

Explanation of Base Value/amount

মূসক ৬.৩ একটি নমুনা ননম্নে দেওয়া হলঃ ধনি, ভ্যাি সহ দমাি চু ক্তি মূলয ৮৬,৭৯,৬০০/=

যেখানে, ভিভি মূল্য /Base Value = ৭৫,৪৭,৪৭৮.২৬ টাকা (৬ েং কল্াম এর যোগফল্)

মূসক / VAT ১৫% = ১১,৩২,১২১.৭৪ টাকা (১০ েং কল্াম এর যোগফল্)

যমাট মূল্য (সকল্ শুল্ক ও করসহ) = ৮৬,৭৯,৬০০.০০ টাকা (১১ েং কল্াম এর যোগফল্)

এখানে, আয়কর আইে ধারা ৮৯ (ভিভধমাল্া ৩) অেুসানর উৎনস কর হার েভি ৫% হয়, তনি উৎনস

কর [Tax deducted at Source (TDS)/withholding Tax/ Source Tax] হনি ভিভি মূল্যXকর হার,

থ টাকা ৭৫,৪৭,৪৭৮.২৬ X৫%= ৩৭৭,৩৭৩.৯১ টাকা উৎনস কর /TDS কতথে হনি I

অর্াৎ

(ধারা ৮৯ অেুসানর উৎনস কর হার সারণীর জেয পৃষ্ঠা ১ Annex A যিখুে)

https://www.linkedin.com/in/abu-taeb-itp-ca-professional-level-

3a8816129/?lipi=urn%3Ali%3Apage%3Ad_flagship3_feed%3BkaX3fNUcRiir3vjxgR5WAQ%3D%3D

https://www.facebook.com/groups/926593715080159/

Abu Taeb ITP, CA Professional level, 01736440044 4

Abu Taeb ITP, CA Professional level, 01736440044 5

Extract from Page No 27, 28 & 29

Explanation of Base Value/amount

Abu Taeb ITP, CA Professional level, 01736440044 6

Abu Taeb

ITP, CA Professional level

Mail: taeb.amc@gmail.com

01736440044

https://www.linkedin.com/in/abu-taeb-itp-ca-professional-level-

3a8816129/?lipi=urn%3Ali%3Apage%3Ad_flagship3_feed%3BkaX3fNUcRiir3vjxgR5WAQ%3D%3D

https://www.facebook.com/groups/926593715080159/

Source:

Paripatra 2023-24:

https://nbr.gov.bd/uploads/paripatra/%E0%A6%86%E0%A7%9F%E0%A6%95%E0%A6%B0_%E0%A6%AA%E0%A6%B0%E0%A6%B

F%E0%A6%AA%E0%A6%A4%E0%A7%8D%E0%A6%B0_%E0%A7%A8%E0%A7%A6%E0%A7%A8%E0%A7%A9-

%E0%A7%A8%E0%A7%AA.pdf

Paripatra 2016-17: https://nbr.gov.bd/uploads/paripatra/16.pdf

https://fmskillsharing.com/4-easy-steps-to-calculate-your-tax-vat-from-bill/

Abu Taeb ITP, CA Professional level, 01736440044 7

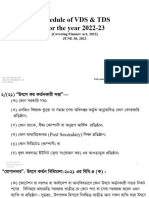

VDS Not applicable in following circumstances / যেই সি যেনে VAT (মুসক) কতথে

হনি ো:

Source: SRO 240:

For full SRO 240 Page No…….

Abu Taeb ITP, CA Professional level, 01736440044 8

Excise Duty

Service Code Description Rate of Duty Tk

Below 1 Lakh Nil

Exceed 1 Lakh but Does not exceed 5 Lakh 150

Exceed 5 Lakh but Does not exceed 10 Lakh 500

Exceed 10 Lakh but Does not exceed 50 Lakh 3,000

E032.00

Exceed 50 Lakh but Does not exceed 1 Crore 5,000

Exceed 1 Crore but Does not exceed 2 Crore 10,000

Exceed 2 Crore but Does not exceed 5 Crore 20,000

Exceed 5 Crore 50,000

Abu Taeb ITP, CA Professional level, 01736440044 9

4 Easy Steps to Calculate your Tax & VAT from Bill.

by fm_skill_sharing

Taxation of goods and services is a complex and diverse area, with a range of

methods and systems in place around the world. In the Bangladesh, taxation of

goods and services is based on the Income Tax Act, 2023 & Value Added Tax &

Supplementary Duty Act 2012. This means that tax is levied on the final purchase

price of goods.

One of the main tax systems in place in the Bangladesh is the value-added tax

(VAT). This is a tax that is levied on the value added (i.e., the difference between

the price of goods and the cost of the goods’ ingredients.) In practice, it is found

that a VAT registered supplier have to follow government regulation to supply

product or service. But an unregistered supplier not willing to follow government

regulation because they are not used to VAT culture or some of them don’t how

to calculate VAT. In this blog you will learn 4 Easy Steps to Calculate your Tax &

VAT from Bill.

Here the question is Who will deduct VAT & Tax from Bill? What do you

mean base amount? How many types of Tax & VAT related bill found in

practice?

I will help you answer all these question in this post. You’ll get a practical

insight on how to calculate tax & VAT from bill. Just follow & utilize this &

boost your productivity. Let’s start.

1. Who will deduct VAT & Tax from Bill?

Answer:

VAT Deduction Reference

S.R.O No.240-AIN/2021/163-VAT

Abu Taeb ITP, CA Professional level, 01736440044 10

The National Board of Revenue has enacted the following rules in accordance with

the provisions of Section 135, Section 49 and Section 127(b) of the Value Added

Tax and Supplementary Duty Act, 2012 (Act No. 47 of 2012), namely: –

In accordance with sub-rule (1) (b) of rule 2 VAT withholding entity

• Any government or any of its ministries

• Department,

• A semi-public or autonomous body

• State-owned enterprises

• Local authorities

• Council or similar body

• Non-governmental organizations approved by the Bureau of NGO

Affairs or the Department of Social Services

• Any bank, insurance company or similar financial institution

• Secondary or higher-level educational institutions and

• limited company

Tax Deduction Reference

Income Tax Act 2023, Section-140 (3)

The Specified Person means-

(a) any company, firm, association, trust or fund;

(b) Public-Private Partnership

(c) any foreign contractor, foreign enterprise or association or organization

established outside Bangladesh;

(d) any hospital, clinic or diagnostic centre;

(e) any e-commerce platform having an annual turnover of more than one

crore taka, other than any specified person, by whatever name called;

(f) hotels, community centers, transport agencies with an annual turnover of

more than one crore taka;

(g) any person other than a farmer engaged in the production and supply of

tobacco leaves, cigarettes, bidis, jorda, gul and other tobacco products;

2. What do you mean base amount? (See Page# 1-3 for explanation)

Answer:

“Base amount” means the higher of the –

1. Contract Value; or

2. Bill or Invoice Amount; or

3. Payment;

Abu Taeb ITP, CA Professional level, 01736440044 11

3. How many types of Tax & VAT related bill found in practice?

There are three types of Tax & VAT Inclusive or Exclusive related bill found in

practice.

1. Bill Inclusive VAT & Tax

2. Bill Exclusive VAT & Inclusive Tax

3. Bill Exclusive VAT & Tax and

4. Bill Inclusive VAT & Exclusive Tax (These types of conflicted bill found rarely).

1. Bill Inclusive VAT & Tax

When any bill attaches this condition “VAT & Tax Inclusive or Tax & VAT as per

government rule” It’s means final consumer have to pay VAT & Supplier required

to pay tax.

Here attached a demo supply bill for calculated VAT & Tax

Abu Taeb ITP, CA Professional level, 01736440044 12

Calculation Process

There are four steps you should memorized.

Step-1 VAT deduct from bill.

Above mention bill included a term “Including Tax & VAT”. So we have to

calculate & deduct VAT as Law (S.R.O No.240-AIN/2021/163-VAT). This bill treated

as supply. VAT rate @ 7.5%.

[N.B – If you are confused to treated a bill for supply, you have to collect

supplier BIN Certificate to identify nature of this bill.]

Demo BIN Certificate

Bill Amount = tk. 61,800

VAT = 61,800 x 7.5/107.5 = 4,311.63 or tk. 4,312

So, you must deduct VAT tk. 4,312.

Step-2 Calculate Base Value.

Base Value = Bill Amount – Value Added Tax

= 61,800 – 4,312

= tk. 57,488

Step-3 Calculate Tax Amount from Base Value.

Tax = Base Value x Rate of Tax

= 57,488 x 3% (Section-89, Rule-3)

= tk. 1,725

Abu Taeb ITP, CA Professional level, 01736440044 13

Step-4 Calculate Payment Amount.

Payment = Base Value – Tax

= 57,488 – 1725

= tk. 55,763

2. Bill Exclusive VAT & Inclusive Tax

In practice you have found some supply bill attached this condition “VAT

Exclusive & Tax Inclusive” Though the final consumer will bear VAT but it’s

separated from bill not included in bill amount & Supplier required to pay tax.

Here attached a demo supply bill for calculated VAT & Tax

Abu Taeb ITP, CA Professional level, 01736440044 14

Calculation Process

There are three steps you should memorized.

Step-1 VAT Directly Calculate on Bill Amount

Above mention bill included a term “Exclusive VAT & Inclusive Tax”. If any bill

attached above term, you should always treat as bill amount = base value. So,

we have to calculate & deduct VAT as Law (S.R.O No.240-AIN/2021/163-VAT). This

bill treated as supply. VAT rate @ 7.5%.

Bill Amount = Base Value

Base Value = tk. 98,000

VAT = 98,000 x 7.5%

= tk. 7,350

So, you must deduct VAT tk. 7,350.

Step-2 Calculate Tax Amount from Base Value.

Tax = Base Value x Rate of Tax

= 98,000 x 3% (Section-89, Rule-3)

= tk. 2,940

Step-3 Calculate Payment Amount.

Payment = Base Value – Tax

= 98,000 – 2,940

= tk. 95,060

3. Bill Exclusive VAT & Tax

In practice occasionally you have found some supply bill attached this

condition “Exclusive VAT & Tax” This type of condition arises from customer &

supplier verbal or written agreement. This bill specialty is Bill amount = Payment

amount. VAT & TAX calculated on gross up method. It’s seeming to be bear VAT

by final consumer & Supplier must pay tax but Local Practice it’s called “VAT &

TAX bear by the company”.

Abu Taeb ITP, CA Professional level, 01736440044 15

Here attached a demo supply bill for calculated VAT & Tax

Calculation Process

There are three steps you should memorized.

Step-1 Tax Amount Calculated on Gross up Method:

Above mention bill included a term “Exclusive VAT & Tax”. If any bill attached

above term, you should calculate Tax amount on gross up method.

Here

Bill Amount = Payment Amount

Payment Amount = tk. 98,000

Tax = Payment Amount x Tax Rate/(100-Tax Rate) (Section-141)

= 98,000 x 3/97

= tk. 3,031 [Tax Rate–(Section-89, Rule-3)]

So, you must deduct Tax tk. 3,031.

Abu Taeb ITP, CA Professional level, 01736440044 16

Step-2 Calculate Base Value.

Base Value = Payment Amount + Tax

= 98,000 + 3,031

= tk. 101,031

Or,

Base Value = Payment Amount x 100/ (100-Tax Rate)

= 98,000 x 100/ (100-3)

= 98,000 x 100/97

= tk. 101,031

Step-3 VAT Amount Calculate on Gross up Method.

VAT = Base Value x VAT Rate

= 101,031 x 7.5% (As per S.R.O No.240-AIN/2021/163-VAT).

= tk. 7,577.32

Step-4 Calculate Actual Bill Amount.

Actual Bill Amount = Base Value + VAT

= 101,031 + 7,577.32

= tk. 108,608.32

4. Inclusive VAT & Exclusive Tax

In practice rarely you have found some supply bill attached this

condition “Inclusive VAT & Exclusive Tax” This type of condition arises from

supplier end due to ignorance of Tax & VAT Law. It is not possible to calculate this

type of bill. Here two questions arise. (a) Which one (Tax & VAT) I calculate first?

(b) Is base value same if we calculate according to the condition “Inclusive VAT &

Exclusive Tax”. Let’s find out answer.

Step-1 Tax Amount Calculated on Gross up Method:

If any bill attached this term “Exclusive Tax”, you should calculate Tax amount on

gross up method.

Here

Bill Amount = Payment Amount

Payment Amount = tk. 98,000 [Let’s Bill Amount = 98,000]

Abu Taeb ITP, CA Professional level, 01736440044 17

Tax = Payment Amount x Tax Rate/(100-Tax Rate)

= 98,000 x 3/97

= tk. 3,031 [Tax Rate–(Section-89, Rule-3)]

So, you must deduct Tax tk. 3,031.

Step-2 Calculate Base Value.

Base Value = Payment Amount + Tax

= 98,000 + 3,031

= tk. 101,031

Or,

Base Value = Payment Amount x 100/ (100-Tax Rate)

= 98,000 x 100/ (100-3)

= 98,000 x 100/97

= tk. 101,031

Step-3 VAT deduct from bill.

If any bill found this term “Inclusive VAT”. So we have to calculate & deduct VAT

as Law (S.R.O No.240-AIN/2021/163-VAT). Let’s this bill treated as supply. VAT rate

@ 7.5%.

Bill Amount = tk. 98,000

VAT = 98,000 x 7.5/107.5 = tk. 6,837

Step-4 Calculate Base Value.

Base Value = Bill Amount – Value Added Tax

= 98,000 – 6,837

= tk. 91,163

(a)Answer: If you found this type of bill you contract with supplier for changing the

bill either “Inclusive VAT & Tax” or “Bill Exclusive VAT & Inclusive Tax”. If

supplier deny to do that you can deduct TAX & VAT both inclusive method.

(b) If we calculate according to the condition “Inclusive VAT & Exclusive

Tax” base value is not same.

Source: Link: https://fmskillsharing.com/4-easy-steps-to-calculate-your-tax-vat-from-bill/

Abu Taeb ITP, CA Professional level, 01736440044 18

আয়কি/ভ্যাি নিষয়ক আইন, নিনধ ও অনযানয তথ্যানে এননিআম্নিি/ iBAS/others ওম্নয়িসাইি

হম্নত ডাউনম্নলাড / দভ্নিনিম্নকশন নলিংকঃ

১. আয়কর আইে ২০২৩

https://lnkd.in/gx2MVmfH

২. অর্ আইে

থ ২০২৩

https://lnkd.in/gHrkvtbb

অর্ আইে

থ ২০২৪

https://nbr.gov.bd/budget/budget/eng

৩. আয়কর ভেনিথ ভিকা ২০২৩-২৪

https://lnkd.in/gUSAmHPE

৪. আয়কর পভরপে ২০২৩-২৪

https://lnkd.in/gU9CEde9

৫. উৎনস কর কতথে/সংগ্রহ সংক্রান্ত অভধনেে আনিি

https://lnkd.in/guEM4m_G

৬. আয়কর ভরটাণ ভিভধমাল্া

থ ২০২৩

https://lnkd.in/grfqfzwi

৭. উৎনস কভতথত কর চূ ডান্ত করিায় ভিষয়ক এস.আর.ও

https://lnkd.in/grCNW7gJ

৮. আয়কর ভরটাণ প্রস্তুতকারী

থ ভিভধমাল্া ২০২৩

https://lnkd.in/g2Tmn8XQ

৯. অেল্াইনে আয়কর ভরটাণ প্রস্তুত

থ

https://etaxnbr.gov.bd/#/landing-page

১০. আয়কর ভরটাণ সকল্

থ ফরম

https://nbr.gov.bd/form/income-tax/eng

১১. আয়কর ভরটাণ প্রিানের

থ তর্য োচাই

https://verification.taxofficemanagement.gov.bd/

১২. এ - চাল্াে প্রস্তুত

https://ibas.finance.gov.bd/acs/account/login?ReturnUrl=%2Facs%2F

১৩. অেল্াইনে চাল্াে ডাউনম্নলাড / দভ্নিনিম্নকশন

http://103.48.16.132/echalan/

১৪. িযাট SRO 240

https://www.facebook.com/groups/926593715080159/permalink/976065606799636/

১৫. TDS Rules 2024

Abu Taeb ITP, CA Professional level, 01736440044 19

https://www.linkedin.com/feed/update/urn:li:activity:7204408229353713665?utm_source=share&

utm_medium=member_desktop

Thank You

Abu Taeb ITP, CA Professional level, 01736440044 20

You might also like

- Test Bank For The Language of Medicine 11th Edition by ChabnerDocument18 pagesTest Bank For The Language of Medicine 11th Edition by ChabnerDaniel Miller97% (33)

- Complete DCF Template v3Document1 pageComplete DCF Template v3javed PatelNo ratings yet

- Comparative VDS TDS 2023-24 (Ammended 04 July 2023)Document12 pagesComparative VDS TDS 2023-24 (Ammended 04 July 2023)abu taher100% (2)

- Potato Corner Sample BreakevenDocument1 pagePotato Corner Sample BreakevenOver Mango50% (2)

- The Future of JournalismDocument4 pagesThe Future of JournalismHuy NguyenNo ratings yet

- Sugar Project FinalDocument27 pagesSugar Project FinalAtharvaNo ratings yet

- Rishabh Gupta PDFDocument3 pagesRishabh Gupta PDFrishabhNo ratings yet

- Revised 2024-25 Base Value TDS VDS Other As per TDS Rules 2024 Tax Act 2023 & VAT Act 2012 etc. @ Taeb (01.07.2024) (1)Document38 pagesRevised 2024-25 Base Value TDS VDS Other As per TDS Rules 2024 Tax Act 2023 & VAT Act 2012 etc. @ Taeb (01.07.2024) (1)Arup DattaNo ratings yet

- 01) Comparative VDS TDS 2023-24 (Vvi)Document27 pages01) Comparative VDS TDS 2023-24 (Vvi)hiakashNo ratings yet

- Comparative VDS TDS 2023-24 (Ammended 19 June 2023)Document9 pagesComparative VDS TDS 2023-24 (Ammended 19 June 2023)nowshadaqcNo ratings yet

- VDS Rate & Guideline FY-2021-2022Document14 pagesVDS Rate & Guideline FY-2021-2022mrsrr1999No ratings yet

- WEEKLY REPORT vs ACTUAL MGFI RND week 52Document1 pageWEEKLY REPORT vs ACTUAL MGFI RND week 52Danang Dwi CNo ratings yet

- Degasification CostingDocument1 pageDegasification CostingKrishNo ratings yet

- Financial AnalysisDocument5 pagesFinancial AnalysisAdiel RadiaNo ratings yet

- VAT GuideDocument3 pagesVAT GuideshimladhakaconsultingNo ratings yet

- Revised Structure of Commission and Remuneration T - 240331 - 195127Document3 pagesRevised Structure of Commission and Remuneration T - 240331 - 195127Study PowerNo ratings yet

- VDS TDS RateDocument3 pagesVDS TDS RateTanvir TanmoyNo ratings yet

- Bharat Barometer - Nov'23 - HSIE-202311151202284972889Document11 pagesBharat Barometer - Nov'23 - HSIE-202311151202284972889adityazade03No ratings yet

- Moura DubeauxDocument8 pagesMoura DubeauxDinheirama.comNo ratings yet

- Y-O-Y Sales Growth % 18% 19% 12% 10% 1% 9% 2% 11% 2% - 2%Document7 pagesY-O-Y Sales Growth % 18% 19% 12% 10% 1% 9% 2% 11% 2% - 2%muralyyNo ratings yet

- Maintain NEUTRAL: Acem in CMP Rs 219 Target Rs 191 ( 13%)Document7 pagesMaintain NEUTRAL: Acem in CMP Rs 219 Target Rs 191 ( 13%)9987303726No ratings yet

- Potato Corner Sample BreakevenDocument1 pagePotato Corner Sample Breakevenphuri.siaNo ratings yet

- Fmci Vat RatesDocument19 pagesFmci Vat RatesFahim YusufNo ratings yet

- Pidilite IndustriesDocument7 pagesPidilite IndustriesmuralyyNo ratings yet

- 15710-gdpcr 0Document72 pages15710-gdpcr 0Duc TriNo ratings yet

- DSP The Report Card 1h23Document30 pagesDSP The Report Card 1h23NikhilKapoor29No ratings yet

- Week07 Exercises Amparo 180318Document7 pagesWeek07 Exercises Amparo 180318JosephAmparoNo ratings yet

- Asian Paints 1Document7 pagesAsian Paints 1akaish26No ratings yet

- Tender Capacity Info.Document8 pagesTender Capacity Info.Ove Kabir Eon 1731923No ratings yet

- Heriot-Watt University Finance - December 2020 Section I Case StudiesDocument13 pagesHeriot-Watt University Finance - December 2020 Section I Case StudiesSijan PokharelNo ratings yet

- Direct Imports To Kenya Previously Registered in KenyaDocument3 pagesDirect Imports To Kenya Previously Registered in KenyaisaacNo ratings yet

- Manual InsentivDocument21 pagesManual Insentivandi batikNo ratings yet

- Reporte de Recaudacion y Recuperacion Al 08.06Document2,650 pagesReporte de Recaudacion y Recuperacion Al 08.06Piero RVNo ratings yet

- PT Cost Rate Total Lit Mileage Total KM ('E) Km/Rev Rev ('E) Net RevenueDocument11 pagesPT Cost Rate Total Lit Mileage Total KM ('E) Km/Rev Rev ('E) Net RevenueagraladnNo ratings yet

- Deep Enterprises 24/24-25 GHO/2425/POS/COP/00005: Tax InvoiceDocument4 pagesDeep Enterprises 24/24-25 GHO/2425/POS/COP/00005: Tax InvoiceShakti SharmaNo ratings yet

- Q324 - Form8K - Exhibit99-1 - Earnings - Release - Tables - XLSX - Q324 - Form8K - Exhibit99-1 - Earnings - Release - Tables-FinalDocument9 pagesQ324 - Form8K - Exhibit99-1 - Earnings - Release - Tables - XLSX - Q324 - Form8K - Exhibit99-1 - Earnings - Release - Tables-FinalAndrei CucuNo ratings yet

- Pembahasan Exercise CH 9 Cost of CapitalDocument4 pagesPembahasan Exercise CH 9 Cost of CapitalGhina NabilaNo ratings yet

- DCF Valuation: 1.inputDocument25 pagesDCF Valuation: 1.inputDushyant yadavNo ratings yet

- Sugar Factory Model 2Document37 pagesSugar Factory Model 2Shivika MahajanNo ratings yet

- Dixon InvestorPresentationJan2022Document12 pagesDixon InvestorPresentationJan2022raguramrNo ratings yet

- Presentation (Company Update)Document16 pagesPresentation (Company Update)Shyam SunderNo ratings yet

- FM Sugar CaseDocument16 pagesFM Sugar CaseR RATED GAMERNo ratings yet

- No Quick Turnaround Seen For The San Gabriel: First Gen CorporationDocument2 pagesNo Quick Turnaround Seen For The San Gabriel: First Gen CorporationJohn Kyle LluzNo ratings yet

- WorksheetDocument7 pagesWorksheetVijendra Kumar DubeyNo ratings yet

- AVIS CarsDocument10 pagesAVIS CarsSheikhFaizanUl-HaqueNo ratings yet

- Case Krakatau Steel A Report - Syndicate 11Document10 pagesCase Krakatau Steel A Report - Syndicate 11Philip AnugrahRaskitaNo ratings yet

- Presentation Mar 2010Document41 pagesPresentation Mar 2010Bharath BossNo ratings yet

- IRR - SGS SLOT (2x30) With 100 KG Electrical Vapouriser - United EnggDocument8 pagesIRR - SGS SLOT (2x30) With 100 KG Electrical Vapouriser - United Enggatripathi2009No ratings yet

- N - 5 Sgs1 MTC - KMD (Sri Lubowo)Document87 pagesN - 5 Sgs1 MTC - KMD (Sri Lubowo)tamzisNo ratings yet

- Terra Repaired FileDocument19 pagesTerra Repaired Fileshahid hassanNo ratings yet

- Formulir Target Cakupan Pelayanan Upaya Kegiatan Wajib Puskesmas Wairoro Puskesmas: Wairoro Bulan: Juni Tahun: 2015Document52 pagesFormulir Target Cakupan Pelayanan Upaya Kegiatan Wajib Puskesmas Wairoro Puskesmas: Wairoro Bulan: Juni Tahun: 2015Anonymous cnPBSQUNo ratings yet

- Formulir Target Cakupan Pelayanan Upaya Kegiatan Wajib Puskesmas Wairoro Puskesmas: Wairoro Bulan: Juni Tahun: 2015Document52 pagesFormulir Target Cakupan Pelayanan Upaya Kegiatan Wajib Puskesmas Wairoro Puskesmas: Wairoro Bulan: Juni Tahun: 2015SalsabilahNo ratings yet

- Exide Commission Structure AdvisorDocument5 pagesExide Commission Structure Advisorashok7jNo ratings yet

- 81 Procuremnt Status Reports - 20 October 2016 (Rev. 00)Document49 pages81 Procuremnt Status Reports - 20 October 2016 (Rev. 00)Zain AbidiNo ratings yet

- Accenture Fin Model - Par - V1Document9 pagesAccenture Fin Model - Par - V1shahsamkit08No ratings yet

- Accounting For Managers: Report Over The Financial Performance of JB HifiDocument8 pagesAccounting For Managers: Report Over The Financial Performance of JB HifiMah Noor FastNUNo ratings yet

- Q3 & 9M FY21 - Results Presentation: February 2021Document29 pagesQ3 & 9M FY21 - Results Presentation: February 2021Richa CNo ratings yet

- SACAP Professional Fee Guideline 2015Document3 pagesSACAP Professional Fee Guideline 2015takuva03No ratings yet

- TDS & VDS Rate 2022-2023Document25 pagesTDS & VDS Rate 2022-2023Shariful IslamNo ratings yet

- IPMSDocument4 pagesIPMSSDE NorthNo ratings yet

- Previous Exp 2017 Presentation CCC Limpopo CCCDocument44 pagesPrevious Exp 2017 Presentation CCC Limpopo CCCANDREW STRUGNELLNo ratings yet

- Yr Io PMT Dep Tax Shield ZN After Tacash Flow Pvif @5%pvif @6%Document2 pagesYr Io PMT Dep Tax Shield ZN After Tacash Flow Pvif @5%pvif @6%hary sharmaNo ratings yet

- Financial Discussion Year OneDocument4 pagesFinancial Discussion Year OneShaza ZulfiqarNo ratings yet

- Appoinment Letter-Nusrat JamanDocument2 pagesAppoinment Letter-Nusrat JamanSaleh Muhammed SakiNo ratings yet

- HRC Sharm MenuDocument19 pagesHRC Sharm MenuSaleh Muhammed SakiNo ratings yet

- Appoinment Letter-Farhana YeasminDocument2 pagesAppoinment Letter-Farhana YeasminSaleh Muhammed SakiNo ratings yet

- Payment ScheduleDocument69 pagesPayment ScheduleSaleh Muhammed SakiNo ratings yet

- Deposit Summary - SBD Manufacturing Distribution - 01apr2023Document1 pageDeposit Summary - SBD Manufacturing Distribution - 01apr2023Saleh Muhammed SakiNo ratings yet

- Check # 000001-2Document1 pageCheck # 000001-2Saleh Muhammed SakiNo ratings yet

- Check # 000001-1Document1 pageCheck # 000001-1Saleh Muhammed SakiNo ratings yet

- Quotatio 1Document1 pageQuotatio 1Saleh Muhammed SakiNo ratings yet

- Trial BalanceDocument2 pagesTrial BalanceSaleh Muhammed SakiNo ratings yet

- Sep2 Meterview: Energy Measurement and ManagementDocument2 pagesSep2 Meterview: Energy Measurement and ManagementAdil HameedNo ratings yet

- Nokia Siemens Networks Flexitrunk Brochure Low-Res 15032013Document4 pagesNokia Siemens Networks Flexitrunk Brochure Low-Res 15032013chadi_lbNo ratings yet

- Cma Part 1 Mock 2Document44 pagesCma Part 1 Mock 2armaghan175% (8)

- 5013Document3 pages5013glennfreyolaNo ratings yet

- Ulla-Talvikki Virta Measuring Cycling Environment For Internet of Things ApplicationsDocument66 pagesUlla-Talvikki Virta Measuring Cycling Environment For Internet of Things ApplicationsNikola CmiljanicNo ratings yet

- Advatage and DisadadvatagesDocument5 pagesAdvatage and DisadadvatagesPawan PathakNo ratings yet

- Report On Seismic CodesDocument2 pagesReport On Seismic CodesLakshmiRaviChanduKolusuNo ratings yet

- Middle Level Reading Part 3 PoemDocument10 pagesMiddle Level Reading Part 3 Poem이세희No ratings yet

- I) Height of Retaining Wall H: Preliminary DataDocument10 pagesI) Height of Retaining Wall H: Preliminary DataOmPrakashNo ratings yet

- Worksheet 2A-QP MS (Dynamics)Document6 pagesWorksheet 2A-QP MS (Dynamics)kolNo ratings yet

- Free Money Making Guide PDF VersionDocument15 pagesFree Money Making Guide PDF VersionboulboutNo ratings yet

- IS 15394.2003 Fire Safety in Petroleum RefineriesDocument16 pagesIS 15394.2003 Fire Safety in Petroleum RefineriesnpwalNo ratings yet

- Emote: A Short StoryDocument8 pagesEmote: A Short StoryTrenton R.B.N.No ratings yet

- Resensi Novel B.inggris RikaDocument5 pagesResensi Novel B.inggris RikaRizqi RahmaniaNo ratings yet

- Johns Hopkins RFPDocument7 pagesJohns Hopkins RFPLucky 77No ratings yet

- Key A2 Basic Level English Exam PDFDocument4 pagesKey A2 Basic Level English Exam PDFakhilesh sahooNo ratings yet

- Notice: Medicare: Emergency Medical Treatment and Labor Act Technical Advisory GroupDocument2 pagesNotice: Medicare: Emergency Medical Treatment and Labor Act Technical Advisory GroupJustia.comNo ratings yet

- Resources - Job Application Form - Sample 2Document3 pagesResources - Job Application Form - Sample 2Aung Myo Thu LwinNo ratings yet

- Study of Investment Planing Among Working Womens PDFDocument113 pagesStudy of Investment Planing Among Working Womens PDFAjay S PatilNo ratings yet

- MCQ IadDocument23 pagesMCQ Iads soyaNo ratings yet

- Guidelines and Fundamental Considerations For Axle BalancingDocument40 pagesGuidelines and Fundamental Considerations For Axle BalancingAnonymous PVXBGg9TNo ratings yet

- A Z of Simple Living BookDocument68 pagesA Z of Simple Living Bookdrsubramanian100% (4)

- Sci 09 Sample QPDocument8 pagesSci 09 Sample QPkvindhraNo ratings yet

- Nippon SteelDocument7 pagesNippon SteelAnonymous 9PIxHy13No ratings yet

- National Career Assessment ExaminationDocument1 pageNational Career Assessment ExaminationHomo Ma. PaulaNo ratings yet

- Apostolic Fathers II 1917 LAKEDocument410 pagesApostolic Fathers II 1917 LAKEpolonia91No ratings yet

- 2019 2020 AEB Expression of InterestDocument1 page2019 2020 AEB Expression of InterestCentre AdministratorNo ratings yet