Professional Documents

Culture Documents

SETC Tax Credit Origin 189451

SETC Tax Credit Origin 189451

Uploaded by

r.i.c.h.a.rdca.l.dwell.u.sa1Copyright:

Available Formats

You might also like

- SETC IRS 2024 PDF - COVID-19 Self-Employed Tax Credits: Form 7202 Eligibility & Application - SETC Wikipedia - by WWW - SETC.meDocument5 pagesSETC IRS 2024 PDF - COVID-19 Self-Employed Tax Credits: Form 7202 Eligibility & Application - SETC Wikipedia - by WWW - SETC.meSETC Application for Families First Coronavirus Response Act (FFCRA)No ratings yet

- Celebration (Kool and The Gang) Chord SongbookDocument3 pagesCelebration (Kool and The Gang) Chord SongbookFrances AmosNo ratings yet

- The 3D Printing Handbook - Technologies, Design and ApplicationsDocument347 pagesThe 3D Printing Handbook - Technologies, Design and ApplicationsJuan Bernardo Gallardo100% (7)

- Maharaja Sayajirao University of Baroda B.com SyllabusDocument105 pagesMaharaja Sayajirao University of Baroda B.com SyllabusKartik ChaturvediNo ratings yet

- SETC Tax Credit Origin 173319Document1 pageSETC Tax Credit Origin 173319ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Origin 181249Document1 pageSETC Tax Credit Origin 181249r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 215877Document1 pageSETC Tax Credit Origin 215877r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 220344Document1 pageSETC Tax Credit Origin 220344r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 202146Document1 pageSETC Tax Credit Origin 202146ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Origin 125462Document1 pageSETC Tax Credit Origin 125462r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 161940Document2 pagesSETC Tax Credit Origin 161940r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 148838Document1 pageSETC Tax Credit Origin 148838ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Origin 197710Document1 pageSETC Tax Credit Origin 197710r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 124672Document1 pageSETC Tax Credit Origin 124672r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 141227Document2 pagesSETC Tax Credit Origin 141227r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 228870Document1 pageSETC Tax Credit Origin 228870ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Guide 207692Document1 pageSETC Tax Credit Guide 207692ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Guide 130316Document2 pagesSETC Tax Credit Guide 130316r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 181590Document2 pagesSETC Tax Credit Guide 181590r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What Is The SETC Tax Credit? 193993Document2 pagesWhat Is The SETC Tax Credit? 193993r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What Is The SETC Tax Credit? 231916Document1 pageWhat Is The SETC Tax Credit? 231916ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Guide 135424Document2 pagesSETC Tax Credit Guide 135424r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 217099Document2 pagesSETC Tax Credit Guide 217099r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 130540Document2 pagesSETC Tax Credit Guide 130540r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 173649Document2 pagesSETC Tax Credit Guide 173649r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 156569Document2 pagesWhat is the SETC Tax Credit? 156569r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 149468Document1 pageWhat is the SETC Tax Credit? 149468ri.chardcaldw.ellus.a1No ratings yet

- What Is The SETC Tax Credit? 144091Document2 pagesWhat Is The SETC Tax Credit? 144091r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 139950Document2 pagesWhat is the SETC Tax Credit? 139950r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 229963Document2 pagesWhat is the SETC Tax Credit? 229963r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 171534Document1 pageWhat is the SETC Tax Credit? 171534ri.chardcaldw.ellus.a1No ratings yet

- What Is The SETC Tax Credit? 218816Document1 pageWhat Is The SETC Tax Credit? 218816ri.chardcaldw.ellus.a1No ratings yet

- What Is The SETC Tax Credit? 124756Document1 pageWhat Is The SETC Tax Credit? 124756ri.chardcaldw.ellus.a1No ratings yet

- What is the SETC Tax Credit? 181271Document2 pagesWhat is the SETC Tax Credit? 181271r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- IRS Glossary: SETC Tax Credit Terms You Should Be Aware of - WikiSauceDocument4 pagesIRS Glossary: SETC Tax Credit Terms You Should Be Aware of - WikiSaucePanel Rank (panelrank.com)No ratings yet

- Re 2020 Year-End Tax Planning For IndividualsDocument3 pagesRe 2020 Year-End Tax Planning For Individualselnara safronovaNo ratings yet

- Tax Credit One Pager QR-RBCDocument1 pageTax Credit One Pager QR-RBCErick MorenoNo ratings yet

- The CARES Act and The Benefits For Small Businesses - March 31 2020Document30 pagesThe CARES Act and The Benefits For Small Businesses - March 31 2020Jonathan FoxNo ratings yet

- Understanding The Eligibility Criteria For The Self-Employed Tax Credit 197265Document2 pagesUnderstanding The Eligibility Criteria For The Self-Employed Tax Credit 197265galenajmdtNo ratings yet

- How to Claim the SETC Tax Credit 170982Document2 pagesHow to Claim the SETC Tax Credit 170982r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Payroll and Covid19 InfolineDocument9 pagesPayroll and Covid19 Infolinenh nNo ratings yet

- COVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsDocument4 pagesCOVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsKirk PetersenNo ratings yet

- COVID 19 Unemployment AssistanceDocument4 pagesCOVID 19 Unemployment AssistanceDennis GarrettNo ratings yet

- How to Claim the SETC Tax Credit 129157Document2 pagesHow to Claim the SETC Tax Credit 129157r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- How to Claim the SETC Tax Credit 142769Document2 pagesHow to Claim the SETC Tax Credit 142769r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Payroll Accounting 2019 5Th Edition Landin Solutions Manual Full Chapter PDFDocument38 pagesPayroll Accounting 2019 5Th Edition Landin Solutions Manual Full Chapter PDFentrickaretologyswr100% (12)

- Payroll Accounting 2019 5th Edition Landin Solutions ManualDocument17 pagesPayroll Accounting 2019 5th Edition Landin Solutions Manualsilingvolumedvh2myq100% (24)

- A. Employment Expenses: 1. Registered PlansDocument2 pagesA. Employment Expenses: 1. Registered PlansAndi RavNo ratings yet

- General 1099 Tax CreditDocument1 pageGeneral 1099 Tax CreditCraig Pisaris-HendersonNo ratings yet

- Estate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCDocument4 pagesEstate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- Frequently Asked Questions During The Coronavirus Emergency: Self-Employed NJ WorkersDocument2 pagesFrequently Asked Questions During The Coronavirus Emergency: Self-Employed NJ Workersdavid rockNo ratings yet

- How to Claim the SETC Tax Credit 212496Document2 pagesHow to Claim the SETC Tax Credit 212496r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- How to Claim the SETC Tax Credit 216290Document1 pageHow to Claim the SETC Tax Credit 216290ri.chardcaldw.ellus.a1No ratings yet

- Incorporation For Physicians in British Columbia CanadaDocument9 pagesIncorporation For Physicians in British Columbia CanadachadNo ratings yet

- 2022 Tax UpdatesDocument12 pages2022 Tax UpdatesJagmohan TeamentigrityNo ratings yet

- Tax Law Snapshot 2014Document4 pagesTax Law Snapshot 2014HosameldeenSalehNo ratings yet

- On The Precipice: The "Fiscal Cliff": Collaborative Financial Solutions, LLCDocument4 pagesOn The Precipice: The "Fiscal Cliff": Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- Section-By-Section Coronavirus Tax Relief MeasuresDocument4 pagesSection-By-Section Coronavirus Tax Relief MeasuresFox News80% (5)

- Covid 19 - Q - A Payroll Tax 1Document2 pagesCovid 19 - Q - A Payroll Tax 1Katherine CiancioNo ratings yet

- 2020-04-02 COVID-19 Small Business Relief ResourcesDocument6 pages2020-04-02 COVID-19 Small Business Relief ResourcesBenny RubinNo ratings yet

- Full Payroll Accounting 2019 5Th Edition Landin Solutions Manual Online PDF All ChapterDocument40 pagesFull Payroll Accounting 2019 5Th Edition Landin Solutions Manual Online PDF All Chapterkadinkaspadial538100% (7)

- Paycheck Protection Program 2.0 FAQDocument2 pagesPaycheck Protection Program 2.0 FAQKFORNo ratings yet

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet

- How to Claim the SETC Tax Credit 212496Document2 pagesHow to Claim the SETC Tax Credit 212496r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 181271Document2 pagesWhat is the SETC Tax Credit? 181271r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 217099Document2 pagesSETC Tax Credit Guide 217099r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 135424Document2 pagesSETC Tax Credit Guide 135424r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 130316Document2 pagesSETC Tax Credit Guide 130316r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 130540Document2 pagesSETC Tax Credit Guide 130540r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What Is The SETC Tax Credit? 193993Document2 pagesWhat Is The SETC Tax Credit? 193993r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Field Crop Pest MamagementDocument95 pagesField Crop Pest Mamagementruikong6141100% (2)

- B.SC Fashion Design R2018 C&SDocument85 pagesB.SC Fashion Design R2018 C&SvivekNo ratings yet

- Full Ebook of One World Now The Ethics of Globalization Peter Singer Online PDF All ChapterDocument24 pagesFull Ebook of One World Now The Ethics of Globalization Peter Singer Online PDF All Chapterclcudinegoct100% (5)

- Speaking/Conversation Placement-Test Interview: From Commonsense-Esl. ComDocument3 pagesSpeaking/Conversation Placement-Test Interview: From Commonsense-Esl. ComEmilia VoNo ratings yet

- Objectivity in Journalism (Williams & Stroud, 2020)Document4 pagesObjectivity in Journalism (Williams & Stroud, 2020)Dexter CaroNo ratings yet

- Carter Procession Closure MapDocument1 pageCarter Procession Closure Mapcookiespiffey21No ratings yet

- ATV930 950 Installation Manual EN NHA80932 01Document129 pagesATV930 950 Installation Manual EN NHA80932 01ahilsergeyNo ratings yet

- Shadbala NotesDocument10 pagesShadbala NotesRadhika Goel100% (1)

- C Engleza Scris Var 02Document4 pagesC Engleza Scris Var 02M MmNo ratings yet

- YEW TEE SQUARE-20122022-3-LayoutDocument1 pageYEW TEE SQUARE-20122022-3-Layouttrang leNo ratings yet

- O243762e MilDocument36 pagesO243762e MilSgly ZemogNo ratings yet

- Squatting Should Not Be Illegal. in Fact, It Should Be EncouragedDocument2 pagesSquatting Should Not Be Illegal. in Fact, It Should Be EncouragedNguyen Trong Phuc (FUG CT)No ratings yet

- Pulse OximetryDocument29 pagesPulse OximetryAnton ScheepersNo ratings yet

- Corporate QA-QC ManagerDocument7 pagesCorporate QA-QC ManagerDeo MNo ratings yet

- Topic 06 - Introduction To Differential Calculus - Cake TinDocument4 pagesTopic 06 - Introduction To Differential Calculus - Cake Tinmmi0% (1)

- WRITING NewDocument21 pagesWRITING Newtini cushingNo ratings yet

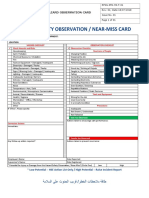

- RPSG-IMS-HS-F - 01 - Hazard Observation CardDocument2 pagesRPSG-IMS-HS-F - 01 - Hazard Observation CardRocky BisNo ratings yet

- Powerful Computing and Dynamic Scheduling: Digital EngineDocument2 pagesPowerful Computing and Dynamic Scheduling: Digital EngineLeomark RespondeNo ratings yet

- Discourse Vs - TextDocument11 pagesDiscourse Vs - TextImmo Eagle JuniØrNo ratings yet

- UserGuide - 510 - 570 - 653 PDFDocument25 pagesUserGuide - 510 - 570 - 653 PDFMurugananthamParamasivamNo ratings yet

- Rogalsky - The Working Poor and What GIS Reveals About The Possibilities of Public Transit PDFDocument12 pagesRogalsky - The Working Poor and What GIS Reveals About The Possibilities of Public Transit PDFMiaNo ratings yet

- A Study in Satin I by TiggerDocument120 pagesA Study in Satin I by TiggerCereal69No ratings yet

- Prof Ed Final Drill EditedDocument13 pagesProf Ed Final Drill EditedChaoryl Ross EsperaNo ratings yet

- Cape Sewing - Industrial Sewing TechnologyDocument33 pagesCape Sewing - Industrial Sewing TechnologyMonika GadgilNo ratings yet

- Gratuity Eligibility For Less Than 5 Yrs. (4yrs.240days)Document8 pagesGratuity Eligibility For Less Than 5 Yrs. (4yrs.240days)DILLIP KUMAR MAHAPATRA0% (1)

- Penarth Classified 120516Document2 pagesPenarth Classified 120516Digital MediaNo ratings yet

- Jezza Mariz A. Alo Diane C. Dapitanon Atty. Debbie Love S. Pudpud Criselda Z. RamosDocument1 pageJezza Mariz A. Alo Diane C. Dapitanon Atty. Debbie Love S. Pudpud Criselda Z. RamosLeana ValenciaNo ratings yet

SETC Tax Credit Origin 189451

SETC Tax Credit Origin 189451

Uploaded by

r.i.c.h.a.rdca.l.dwell.u.sa1Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SETC Tax Credit Origin 189451

SETC Tax Credit Origin 189451

Uploaded by

r.i.c.h.a.rdca.l.dwell.u.sa1Copyright:

Available Formats

SETC Tax Credit

Opening

The Self-Employed Tax Credit (SETC) was introduced by the government in response to the financial impact of the

COVID-19 pandemic on self-employed individuals. This refundable tax credit provides up to $32,220 in aid to eligible

self-employed professionals who faced work disruptions due to the pandemic. SETC eligibility requirements.

To be eligible, you need to have earned income from being self-employed in either 2019, 2020, or 2021. This can

include money made as a sole proprietor, independent contractor, or single-member LLC. Must have encountered a

work disruption caused by COVID-19, which could include being under quarantine orders, showing symptoms,

taking care of a COVID-19 patient, or having to handle childcare duties due to school or facility closures.

The SETC can be claimed for expenses incurred between April 1, 2020, and September 30, 2021. Criteria for qualifying

for the SETC

Subject to quarantine or isolation orders at the federal, state, or local level Receiving guidance on self-quarantine

from a healthcare provider Showing signs of COVID-19 and in search of a diagnosis Assisting individuals in

quarantine with their needs Assuming childcare duties as a result of school or facility closures

SETC and Unemployment Benefits Receiving unemployment benefits does not make you ineligible for the SETC, but

you cannot claim the credit for the days you received unemployment compensation. Calculate and apply for the SETC.

The work opportunity tax credit maximum amount of SETC credit you can receive is $32,220, which is determined by

your average daily self-employment income. In order to apply for this credit, you will need to collect your tax returns

from 2019-2021, provide documentation of any work disruptions due to COVID-19, and fill out IRS Form 7202.

Remember to keep track of the deadlines for filing your claim.

Strategies for Overcoming Constraints and Optimizing Advantages

The Special Extra Tax Credit (SETC) can affect your adjusted gross income and may impact your eligibility for other

credits and deductions. Additionally, you cannot claim the SETC for days when you have received employer sick/family

leave wages or unemployment benefits. In order to maximize benefits, it is important to keep accurate records and to

potentially seek professional tax advice. It is crucial for self-employed individuals impacted by the pandemic to

understand and make use of the SETC in order to obtain financial relief.

In conclusion

Understanding the eligibility requirements, application process, and how to maximize benefits will allow self-employed

professionals to fully utilize the valuable financial lifeline provided by the Self-Employed Tax Credit during times of

COVID-19 hardships.

You might also like

- SETC IRS 2024 PDF - COVID-19 Self-Employed Tax Credits: Form 7202 Eligibility & Application - SETC Wikipedia - by WWW - SETC.meDocument5 pagesSETC IRS 2024 PDF - COVID-19 Self-Employed Tax Credits: Form 7202 Eligibility & Application - SETC Wikipedia - by WWW - SETC.meSETC Application for Families First Coronavirus Response Act (FFCRA)No ratings yet

- Celebration (Kool and The Gang) Chord SongbookDocument3 pagesCelebration (Kool and The Gang) Chord SongbookFrances AmosNo ratings yet

- The 3D Printing Handbook - Technologies, Design and ApplicationsDocument347 pagesThe 3D Printing Handbook - Technologies, Design and ApplicationsJuan Bernardo Gallardo100% (7)

- Maharaja Sayajirao University of Baroda B.com SyllabusDocument105 pagesMaharaja Sayajirao University of Baroda B.com SyllabusKartik ChaturvediNo ratings yet

- SETC Tax Credit Origin 173319Document1 pageSETC Tax Credit Origin 173319ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Origin 181249Document1 pageSETC Tax Credit Origin 181249r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 215877Document1 pageSETC Tax Credit Origin 215877r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 220344Document1 pageSETC Tax Credit Origin 220344r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 202146Document1 pageSETC Tax Credit Origin 202146ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Origin 125462Document1 pageSETC Tax Credit Origin 125462r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 161940Document2 pagesSETC Tax Credit Origin 161940r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 148838Document1 pageSETC Tax Credit Origin 148838ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Origin 197710Document1 pageSETC Tax Credit Origin 197710r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 124672Document1 pageSETC Tax Credit Origin 124672r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 141227Document2 pagesSETC Tax Credit Origin 141227r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 228870Document1 pageSETC Tax Credit Origin 228870ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Guide 207692Document1 pageSETC Tax Credit Guide 207692ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Guide 130316Document2 pagesSETC Tax Credit Guide 130316r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 181590Document2 pagesSETC Tax Credit Guide 181590r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What Is The SETC Tax Credit? 193993Document2 pagesWhat Is The SETC Tax Credit? 193993r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What Is The SETC Tax Credit? 231916Document1 pageWhat Is The SETC Tax Credit? 231916ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Guide 135424Document2 pagesSETC Tax Credit Guide 135424r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 217099Document2 pagesSETC Tax Credit Guide 217099r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 130540Document2 pagesSETC Tax Credit Guide 130540r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 173649Document2 pagesSETC Tax Credit Guide 173649r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 156569Document2 pagesWhat is the SETC Tax Credit? 156569r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 149468Document1 pageWhat is the SETC Tax Credit? 149468ri.chardcaldw.ellus.a1No ratings yet

- What Is The SETC Tax Credit? 144091Document2 pagesWhat Is The SETC Tax Credit? 144091r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 139950Document2 pagesWhat is the SETC Tax Credit? 139950r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 229963Document2 pagesWhat is the SETC Tax Credit? 229963r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 171534Document1 pageWhat is the SETC Tax Credit? 171534ri.chardcaldw.ellus.a1No ratings yet

- What Is The SETC Tax Credit? 218816Document1 pageWhat Is The SETC Tax Credit? 218816ri.chardcaldw.ellus.a1No ratings yet

- What Is The SETC Tax Credit? 124756Document1 pageWhat Is The SETC Tax Credit? 124756ri.chardcaldw.ellus.a1No ratings yet

- What is the SETC Tax Credit? 181271Document2 pagesWhat is the SETC Tax Credit? 181271r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- IRS Glossary: SETC Tax Credit Terms You Should Be Aware of - WikiSauceDocument4 pagesIRS Glossary: SETC Tax Credit Terms You Should Be Aware of - WikiSaucePanel Rank (panelrank.com)No ratings yet

- Re 2020 Year-End Tax Planning For IndividualsDocument3 pagesRe 2020 Year-End Tax Planning For Individualselnara safronovaNo ratings yet

- Tax Credit One Pager QR-RBCDocument1 pageTax Credit One Pager QR-RBCErick MorenoNo ratings yet

- The CARES Act and The Benefits For Small Businesses - March 31 2020Document30 pagesThe CARES Act and The Benefits For Small Businesses - March 31 2020Jonathan FoxNo ratings yet

- Understanding The Eligibility Criteria For The Self-Employed Tax Credit 197265Document2 pagesUnderstanding The Eligibility Criteria For The Self-Employed Tax Credit 197265galenajmdtNo ratings yet

- How to Claim the SETC Tax Credit 170982Document2 pagesHow to Claim the SETC Tax Credit 170982r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Payroll and Covid19 InfolineDocument9 pagesPayroll and Covid19 Infolinenh nNo ratings yet

- COVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsDocument4 pagesCOVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsKirk PetersenNo ratings yet

- COVID 19 Unemployment AssistanceDocument4 pagesCOVID 19 Unemployment AssistanceDennis GarrettNo ratings yet

- How to Claim the SETC Tax Credit 129157Document2 pagesHow to Claim the SETC Tax Credit 129157r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- How to Claim the SETC Tax Credit 142769Document2 pagesHow to Claim the SETC Tax Credit 142769r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Payroll Accounting 2019 5Th Edition Landin Solutions Manual Full Chapter PDFDocument38 pagesPayroll Accounting 2019 5Th Edition Landin Solutions Manual Full Chapter PDFentrickaretologyswr100% (12)

- Payroll Accounting 2019 5th Edition Landin Solutions ManualDocument17 pagesPayroll Accounting 2019 5th Edition Landin Solutions Manualsilingvolumedvh2myq100% (24)

- A. Employment Expenses: 1. Registered PlansDocument2 pagesA. Employment Expenses: 1. Registered PlansAndi RavNo ratings yet

- General 1099 Tax CreditDocument1 pageGeneral 1099 Tax CreditCraig Pisaris-HendersonNo ratings yet

- Estate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCDocument4 pagesEstate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- Frequently Asked Questions During The Coronavirus Emergency: Self-Employed NJ WorkersDocument2 pagesFrequently Asked Questions During The Coronavirus Emergency: Self-Employed NJ Workersdavid rockNo ratings yet

- How to Claim the SETC Tax Credit 212496Document2 pagesHow to Claim the SETC Tax Credit 212496r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- How to Claim the SETC Tax Credit 216290Document1 pageHow to Claim the SETC Tax Credit 216290ri.chardcaldw.ellus.a1No ratings yet

- Incorporation For Physicians in British Columbia CanadaDocument9 pagesIncorporation For Physicians in British Columbia CanadachadNo ratings yet

- 2022 Tax UpdatesDocument12 pages2022 Tax UpdatesJagmohan TeamentigrityNo ratings yet

- Tax Law Snapshot 2014Document4 pagesTax Law Snapshot 2014HosameldeenSalehNo ratings yet

- On The Precipice: The "Fiscal Cliff": Collaborative Financial Solutions, LLCDocument4 pagesOn The Precipice: The "Fiscal Cliff": Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- Section-By-Section Coronavirus Tax Relief MeasuresDocument4 pagesSection-By-Section Coronavirus Tax Relief MeasuresFox News80% (5)

- Covid 19 - Q - A Payroll Tax 1Document2 pagesCovid 19 - Q - A Payroll Tax 1Katherine CiancioNo ratings yet

- 2020-04-02 COVID-19 Small Business Relief ResourcesDocument6 pages2020-04-02 COVID-19 Small Business Relief ResourcesBenny RubinNo ratings yet

- Full Payroll Accounting 2019 5Th Edition Landin Solutions Manual Online PDF All ChapterDocument40 pagesFull Payroll Accounting 2019 5Th Edition Landin Solutions Manual Online PDF All Chapterkadinkaspadial538100% (7)

- Paycheck Protection Program 2.0 FAQDocument2 pagesPaycheck Protection Program 2.0 FAQKFORNo ratings yet

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet

- How to Claim the SETC Tax Credit 212496Document2 pagesHow to Claim the SETC Tax Credit 212496r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 181271Document2 pagesWhat is the SETC Tax Credit? 181271r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 217099Document2 pagesSETC Tax Credit Guide 217099r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 135424Document2 pagesSETC Tax Credit Guide 135424r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 130316Document2 pagesSETC Tax Credit Guide 130316r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 130540Document2 pagesSETC Tax Credit Guide 130540r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What Is The SETC Tax Credit? 193993Document2 pagesWhat Is The SETC Tax Credit? 193993r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Field Crop Pest MamagementDocument95 pagesField Crop Pest Mamagementruikong6141100% (2)

- B.SC Fashion Design R2018 C&SDocument85 pagesB.SC Fashion Design R2018 C&SvivekNo ratings yet

- Full Ebook of One World Now The Ethics of Globalization Peter Singer Online PDF All ChapterDocument24 pagesFull Ebook of One World Now The Ethics of Globalization Peter Singer Online PDF All Chapterclcudinegoct100% (5)

- Speaking/Conversation Placement-Test Interview: From Commonsense-Esl. ComDocument3 pagesSpeaking/Conversation Placement-Test Interview: From Commonsense-Esl. ComEmilia VoNo ratings yet

- Objectivity in Journalism (Williams & Stroud, 2020)Document4 pagesObjectivity in Journalism (Williams & Stroud, 2020)Dexter CaroNo ratings yet

- Carter Procession Closure MapDocument1 pageCarter Procession Closure Mapcookiespiffey21No ratings yet

- ATV930 950 Installation Manual EN NHA80932 01Document129 pagesATV930 950 Installation Manual EN NHA80932 01ahilsergeyNo ratings yet

- Shadbala NotesDocument10 pagesShadbala NotesRadhika Goel100% (1)

- C Engleza Scris Var 02Document4 pagesC Engleza Scris Var 02M MmNo ratings yet

- YEW TEE SQUARE-20122022-3-LayoutDocument1 pageYEW TEE SQUARE-20122022-3-Layouttrang leNo ratings yet

- O243762e MilDocument36 pagesO243762e MilSgly ZemogNo ratings yet

- Squatting Should Not Be Illegal. in Fact, It Should Be EncouragedDocument2 pagesSquatting Should Not Be Illegal. in Fact, It Should Be EncouragedNguyen Trong Phuc (FUG CT)No ratings yet

- Pulse OximetryDocument29 pagesPulse OximetryAnton ScheepersNo ratings yet

- Corporate QA-QC ManagerDocument7 pagesCorporate QA-QC ManagerDeo MNo ratings yet

- Topic 06 - Introduction To Differential Calculus - Cake TinDocument4 pagesTopic 06 - Introduction To Differential Calculus - Cake Tinmmi0% (1)

- WRITING NewDocument21 pagesWRITING Newtini cushingNo ratings yet

- RPSG-IMS-HS-F - 01 - Hazard Observation CardDocument2 pagesRPSG-IMS-HS-F - 01 - Hazard Observation CardRocky BisNo ratings yet

- Powerful Computing and Dynamic Scheduling: Digital EngineDocument2 pagesPowerful Computing and Dynamic Scheduling: Digital EngineLeomark RespondeNo ratings yet

- Discourse Vs - TextDocument11 pagesDiscourse Vs - TextImmo Eagle JuniØrNo ratings yet

- UserGuide - 510 - 570 - 653 PDFDocument25 pagesUserGuide - 510 - 570 - 653 PDFMurugananthamParamasivamNo ratings yet

- Rogalsky - The Working Poor and What GIS Reveals About The Possibilities of Public Transit PDFDocument12 pagesRogalsky - The Working Poor and What GIS Reveals About The Possibilities of Public Transit PDFMiaNo ratings yet

- A Study in Satin I by TiggerDocument120 pagesA Study in Satin I by TiggerCereal69No ratings yet

- Prof Ed Final Drill EditedDocument13 pagesProf Ed Final Drill EditedChaoryl Ross EsperaNo ratings yet

- Cape Sewing - Industrial Sewing TechnologyDocument33 pagesCape Sewing - Industrial Sewing TechnologyMonika GadgilNo ratings yet

- Gratuity Eligibility For Less Than 5 Yrs. (4yrs.240days)Document8 pagesGratuity Eligibility For Less Than 5 Yrs. (4yrs.240days)DILLIP KUMAR MAHAPATRA0% (1)

- Penarth Classified 120516Document2 pagesPenarth Classified 120516Digital MediaNo ratings yet

- Jezza Mariz A. Alo Diane C. Dapitanon Atty. Debbie Love S. Pudpud Criselda Z. RamosDocument1 pageJezza Mariz A. Alo Diane C. Dapitanon Atty. Debbie Love S. Pudpud Criselda Z. RamosLeana ValenciaNo ratings yet