Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

0 viewscrib sheet 2

crib sheet 2

Uploaded by

daveyirvancrib sheet for final of acc 430 taxes

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Activities No. 2Document5 pagesActivities No. 2Joshua Cabinas60% (5)

- CH 13 NotesDocument19 pagesCH 13 NotesBec barron100% (1)

- Accuracy Checking - US TaxationTestDocument10 pagesAccuracy Checking - US TaxationTestAmit ManyalNo ratings yet

- F3 Study NotesDocument251 pagesF3 Study NotesHamza AliNo ratings yet

- 450 499 PDFDocument44 pages450 499 PDFSamuelNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test BankCharles Davis100% (38)

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test Bankbrianbradyogztekbndm100% (47)

- Financial Management For Decision MakersDocument3 pagesFinancial Management For Decision MakerssgdrgsfNo ratings yet

- Full download Individual Taxation 2013 Pratt 7th Edition Test Bank file pdf free all chapterDocument43 pagesFull download Individual Taxation 2013 Pratt 7th Edition Test Bank file pdf free all chaptersujasobrien100% (4)

- Full Download PDF of Individual Taxation 2013 Pratt 7th Edition Test Bank All ChapterDocument42 pagesFull Download PDF of Individual Taxation 2013 Pratt 7th Edition Test Bank All Chaptermaizonsudar100% (6)

- 14Document106 pages14Alex liaoNo ratings yet

- South-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1Document23 pagesSouth-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1donna100% (52)

- South-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1Document32 pagesSouth-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1markcamachoyrpbjxgeft100% (28)

- South Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFDocument36 pagesSouth Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFemma.ingram210100% (15)

- Practice Exam SOLUTIONS - Vol 2 (2020)Document49 pagesPractice Exam SOLUTIONS - Vol 2 (2020)Ledger PointNo ratings yet

- In Class Chap 12 SolutionDocument15 pagesIn Class Chap 12 SolutionDannickNo ratings yet

- Solution 1: Calculation of Total Assessable Income, Taxable Income, Tax LiabilityDocument14 pagesSolution 1: Calculation of Total Assessable Income, Taxable Income, Tax LiabilityDevender SharmaNo ratings yet

- Chapter 11 PDFDocument12 pagesChapter 11 PDFJay BrockNo ratings yet

- W9. After-Tax Analysis PDFDocument31 pagesW9. After-Tax Analysis PDFCHRISTOPHER ABIMANYUNo ratings yet

- South Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions ManualDocument44 pagesSouth Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions Manualvernier.decyliclnn4100% (26)

- Chapter 6Document13 pagesChapter 6vitbau98100% (1)

- Latihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Document7 pagesLatihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Yoga Cipta NugrahaNo ratings yet

- Income Tax Fundamentals (Assignment 1 - FIN 4017 Questions Summer 2022) (11339)Document5 pagesIncome Tax Fundamentals (Assignment 1 - FIN 4017 Questions Summer 2022) (11339)Maria PatinoNo ratings yet

- Accounting Changes and Error Corrections Tutorial (3753)Document3 pagesAccounting Changes and Error Corrections Tutorial (3753)Rawan YasserNo ratings yet

- Ias 12Document45 pagesIas 12Reever RiverNo ratings yet

- Chapter 8 - Income TaxesDocument6 pagesChapter 8 - Income TaxesHaddy GayeNo ratings yet

- AJ09 Fundamentals of Investing PDF 34 47Document14 pagesAJ09 Fundamentals of Investing PDF 34 47ichroniNo ratings yet

- IAS 12 Income Tax 1Document57 pagesIAS 12 Income Tax 1sikute kamongwaNo ratings yet

- Principles of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFDocument21 pagesPrinciples of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFrosyseedorff100% (12)

- AC2101 Seminar 7-8 Deferred Tax OutlineDocument33 pagesAC2101 Seminar 7-8 Deferred Tax OutlinelynnNo ratings yet

- Solution of Textbook 1Document4 pagesSolution of Textbook 1BảoNgọcNo ratings yet

- Full Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full ChapterDocument36 pagesFull Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full Chapterurocelespinningnuyu100% (24)

- Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111Document36 pagesSolutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111epha.thialol.lqoc100% (54)

- Gitman IM Ch01Document8 pagesGitman IM Ch01Endah DipoyantiNo ratings yet

- Homework Chapter 4Document10 pagesHomework Chapter 4ChaituNo ratings yet

- Annual Gross IncomeDocument4 pagesAnnual Gross IncomeMarilyn Perez OlañoNo ratings yet

- Chapter 4 PDFDocument14 pagesChapter 4 PDFJay BrockNo ratings yet

- Text 67C92BDA872B 1Document3 pagesText 67C92BDA872B 1AVNo ratings yet

- Ch4-Recordedlecture-Fall2023 17 5166787619170306Document38 pagesCh4-Recordedlecture-Fall2023 17 5166787619170306ronny nyagakaNo ratings yet

- Chapter 7 PDFDocument18 pagesChapter 7 PDFJay BrockNo ratings yet

- TaxationDocument12 pagesTaxationjanahh.omNo ratings yet

- Salary Sacrifice Arrangements What Is Salary Sacrifice?Document4 pagesSalary Sacrifice Arrangements What Is Salary Sacrifice?alanNo ratings yet

- IASSS16e Ch16.Ab - AzDocument33 pagesIASSS16e Ch16.Ab - AzLovely DungcaNo ratings yet

- Income Tax Basics - July 2023Document6 pagesIncome Tax Basics - July 2023maharajabby81No ratings yet

- CH 12 NotesDocument23 pagesCH 12 NotesBec barronNo ratings yet

- CH 6 Case 4Document3 pagesCH 6 Case 4Hazem HalabiNo ratings yet

- Chapter 5 Tax 2014 Some SolutionsDocument5 pagesChapter 5 Tax 2014 Some Solutionstherock25No ratings yet

- AYB320 0122 TrustsTutorialDocument20 pagesAYB320 0122 TrustsTutorialLinh ĐanNo ratings yet

- Mr. Zulfiqar Computation of Taxable Income For Tax Year 2009 RupeesDocument5 pagesMr. Zulfiqar Computation of Taxable Income For Tax Year 2009 Rupeesmeelas123No ratings yet

- Corp SolsDocument90 pagesCorp Solssayray55100% (1)

- Final Document On Tax LawDocument13 pagesFinal Document On Tax LawkimtexNo ratings yet

- Info Card 2016-17Document12 pagesInfo Card 2016-17Nick KNo ratings yet

- Tax Liability Excluding Surcharges $1,701,563.00Document2 pagesTax Liability Excluding Surcharges $1,701,563.00njenga geraldNo ratings yet

- Chapter 15 & 17 Q & SDocument7 pagesChapter 15 & 17 Q & Sgabie stgNo ratings yet

- Taxnz221 WS1 Actsols 02Document16 pagesTaxnz221 WS1 Actsols 02Joshua EbarleNo ratings yet

- Fabm2 Q2 W4 5Document8 pagesFabm2 Q2 W4 5maeesotoNo ratings yet

- Learning Task Week 3 & 4 AccountingDocument7 pagesLearning Task Week 3 & 4 AccountingMariane Gale SuaNo ratings yet

- 2019 PROBLEM EXERCISES IN INCOME TAXATION and TRAIN LAW (B)Document11 pages2019 PROBLEM EXERCISES IN INCOME TAXATION and TRAIN LAW (B)MGVMonNo ratings yet

- Computation of Taxable Income and Tax LiabilityDocument9 pagesComputation of Taxable Income and Tax LiabilityaNo ratings yet

- Fundamentals of Corporate Finance 9th Edition Brealey Solutions ManualDocument16 pagesFundamentals of Corporate Finance 9th Edition Brealey Solutions Manualmisentrynotal6ip1lp100% (24)

- Financial Reporting and Analysis 7th Edition by Gibson ISBN Solution ManualDocument46 pagesFinancial Reporting and Analysis 7th Edition by Gibson ISBN Solution Manualphyllis100% (40)

- Instructor's Manual: Financial Markets and InstitutionsDocument97 pagesInstructor's Manual: Financial Markets and InstitutionsSharNo ratings yet

- Chips Not DoneDocument42 pagesChips Not DoneKrestyl Ann GabaldaNo ratings yet

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- The Income Statements: Teori AkuntansiDocument25 pagesThe Income Statements: Teori AkuntansirifaNo ratings yet

- Determinants of Islamic Banking Profitability: Mhassan@uno - EduDocument31 pagesDeterminants of Islamic Banking Profitability: Mhassan@uno - EduAmtul AyoubNo ratings yet

- What Is A BudgetDocument7 pagesWhat Is A BudgetMichaelNo ratings yet

- Amazon Development Center India Pvt. LTD: Amount in INRDocument1 pageAmazon Development Center India Pvt. LTD: Amount in INRshammas PANo ratings yet

- SAMPLE PDF Macroeconomics XII 2021-22 Edition by Subhash DeyDocument124 pagesSAMPLE PDF Macroeconomics XII 2021-22 Edition by Subhash DeyAbhinav Kalra100% (1)

- Financial Accounting 300: Year Test 1 2023 - Suggested SolutionDocument19 pagesFinancial Accounting 300: Year Test 1 2023 - Suggested SolutionLayola MdlaloNo ratings yet

- Reo Notes - TaxDocument20 pagesReo Notes - TaxgeexellNo ratings yet

- Syllabus 2Document5 pagesSyllabus 2Cai ManuelNo ratings yet

- Business Finance: Formula and Budget PreparationDocument15 pagesBusiness Finance: Formula and Budget PreparationJims OlanoNo ratings yet

- Chapter 7 Macroeconomic MeasurDocument1 pageChapter 7 Macroeconomic MeasurKathleen CornistaNo ratings yet

- Accounting Clerk Exam - Answer KeyDocument5 pagesAccounting Clerk Exam - Answer KeyErwin Dave M. DahaoNo ratings yet

- Chapter 11 National Income AccountingDocument20 pagesChapter 11 National Income AccountingMuhammad Zarif IshakNo ratings yet

- The Role of GovernmentDocument2 pagesThe Role of GovernmentAdvait DadhaNo ratings yet

- San Miguel Corporation vs. Semillano, 623 SCRA 114, G.R. No. 164257 July 5, 2010Document16 pagesSan Miguel Corporation vs. Semillano, 623 SCRA 114, G.R. No. 164257 July 5, 2010Trea CheryNo ratings yet

- ITR Model FY 22-23Document15 pagesITR Model FY 22-23achinNo ratings yet

- BSAIS 1st Year FAR - Prelim ModuleDocument30 pagesBSAIS 1st Year FAR - Prelim ModuleRalphFlorence MancillaNo ratings yet

- (A) Jorge Company CVP Income Statement (Estimated) For The Year Ending December 31, 2014Document4 pages(A) Jorge Company CVP Income Statement (Estimated) For The Year Ending December 31, 2014Kim QuyênNo ratings yet

- Horizontal Analysis (Income Statement) 20200225Document3 pagesHorizontal Analysis (Income Statement) 20200225jocel4montefalcoNo ratings yet

- Mock Exam 1 Professional Appraisal PracticeDocument13 pagesMock Exam 1 Professional Appraisal PracticeNathaniel RasosNo ratings yet

- Group Case Review 4Document12 pagesGroup Case Review 4Anamika ShakyaNo ratings yet

- Chapter 8 Notes Aggregate Expenditure ModelDocument14 pagesChapter 8 Notes Aggregate Expenditure ModelBeatriz CanchilaNo ratings yet

- Self SufficiencyDocument14 pagesSelf SufficiencyErica Joy EstrellaNo ratings yet

- Income Target Market RRLDocument3 pagesIncome Target Market RRLColline AtanacioNo ratings yet

- CA Intermediate Paper-8BDocument250 pagesCA Intermediate Paper-8BAnand_Agrawal19No ratings yet

- Far 02 Conceptual Framework For Financial Reporting CompressDocument11 pagesFar 02 Conceptual Framework For Financial Reporting CompressDaphnie Loise CalderonNo ratings yet

crib sheet 2

crib sheet 2

Uploaded by

daveyirvan0 ratings0% found this document useful (0 votes)

0 views2 pagescrib sheet for final of acc 430 taxes

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcrib sheet for final of acc 430 taxes

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

0 views2 pagescrib sheet 2

crib sheet 2

Uploaded by

daveyirvancrib sheet for final of acc 430 taxes

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

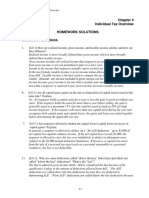

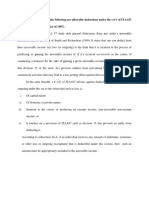

$20,000 received annually at the end of $100,000 (1 − t) = $60,000 The six steps of the tax research process

years 1 through 5 followed by $13,000 1. Get the facts

received annually at the end of years 6 (after-tax income of Transaction 1 = 2. Identify the issues

through 10. The discount rate is 15 after-tax income of Transaction 2) 3. Locate authority

percent. 4. Analyze authority

t = 40% marginal tax rate 5. Repeat steps 1-4

($20,000 × 3.352 discount factor) + 6. Communicate conclusions

0.497 discount factor ($13,000 × 3.352 Mr. Fuentes’s after-tax yield on the

discount factor) = $88,697 corporate bonds is 3.23 percent (4.75% Milt realized a $15,000 long-term capital

before-tax yield − [4.75% × 32% gain (collectibles gain) taxed at a

marginal tax rate]). maximum rate of 28 percent.

Total income $ 95,600 AGI $ 462,700 Ms. Lincoln’s medical expense

Above-the-line deduction for one-half AGI threshold (400,000) deduction is $9,510 ($14,340 − $4,830

SE tax (2,953) Excess AGI $ 62,700 [$64,400 AGI × 7.5%]), and her tax

AGI $ 92,647 $62,700 excess AGI ÷ $1,000 (rounded savings from the deduction is $2,092

Standard deduction (27,700) up) 63 ($9,510 × 22%). The after-tax cost of the

QBI deduction (20% × ($41,800 − Maximum total credit $ 6,000 expenses is $12,248 ($14,340 − $2,092).

$2,953)) (7,769) Phaseout ($50 × 63) (3,150)

Taxable income $ 57,178 Child credit $ 2,850 The present value decreases as the

Income tax on $57,178 (married filing discount rate increases.

jointly) $ 6,421 $6,500 child credit [$2,000 × 3 children

under age 17 plus one non-child A taxpayer is neutral concerning paying

The tax character of income is dependent ($500)]. an identical amount of implicit or

determined strictly by tax law. explicit tax.

The Kilos’ realized gain on sale was Entity variable one controlled subsidiary $52,000 total income − $1,800 =

$715,000 ($1,150,000 amount realized − to another controlled subsidiary. $50,200 AGI − $27,700 standard

$435,000 cost basis), and their taxable deduction = $22,500 taxable income.

long-term capital gain was $215,000 The child tax credit for non-child

($715,000 − $500,000 exclusion). Their dependents is limited to $500. Because only 50 percent of the meal

tax is $51,170 ($215,000 × 23.8% expense is deductible, the after-tax cost

combined 20% income tax and 3.8% is $6,981 ($7,800 − [$3,900 × 21%]).

Medicare contribution tax).

$888 taxable income. Although Besito Even as a cash-based taxpayer, Firm F In the one-year deferral method

earned only $180 of the prepaid rent can deduct only $4,720 of the interest authorized by the IRS, only the portion

this year, (15 days in December × $12), payment (the interest relating to the of the prepayment allocable to services

the income is recognized in the year four months from September 1 through performed in the year of receipt is

payment is received. December 31). included in taxable income for such

year. The remaining prepayment is

TRW’s NOL deduction is limited to 80% BDF’s 2023 payroll tax is $12,832 included in taxable income for the

of taxable income in years 2023 through ([$160,200 × 6.2%] + [$200,000 × following year.

2026. The remaining NOL is deducted in 1.45%]).

2027.

21% × $31,000 excess of book income ZEJ’s bad debt expense for financial Qualified business income of $280,000 ×

over taxable income = $6,510 deferred statement purposes is $770,000, the 20% = $56,000 tentative deduction.

tax liability. year-end addition to the allowance for Deduction cannot exceed the greater of

No deferred tax asset or liability from bad debts.

permanent book/tax difference. ZEJ’s tax deduction for bad debts is $50,000 (50% × $100,000 wages) or

21% × $55,000 excess of taxable income $840,000, the amount of actual write- $26,250 (25% × $100,000 wages + 2.5%

over book income = $11,550 deferred offs of accounts receivable. × $50,000 unadjusted basis of tangible

tax asset. depreciable property).

Section 179 does not apply because the Since the tentative deduction is more

Self-employment tax = $16,955 = total acquisition cost exceeds than $50,000 (greater of 1) or 2) above),

$120,000 × 92.35% × 15.30%. $4,050,000. Ms. Alvarez’s QBI deduction is $50,000,

before the overall taxable income

limitation.

Total cost of depreciable personalty If the equipment is purchased in 2022, Mr. Zan can deduct $1,880 of the

$ 1,580,000 100% of the cost is immediately expenditures ($5,000 − $3,120 excess

Section 179 election/2023 dollar deductible through bonus depreciation expenditures over $50,000) and must

amount(1,160,000) (or a combination of Section 179 and capitalize the $51,240 remainder. He

Tax basis after 179 deduction $ bonus depreciation). can elect to amortize the capitalized

420,000 cost over 180 months at the rate of

80% bonus depreciation(336,000) Firm L cannot deduct any of the Section $284.67 per month. First-year

Tax basis after bonus depreciation 179 expense because it has no taxable amortization would be $854 (3 months

$ 84,000 income. The entire $21,300 × $284.67), and Mr. Zan’s first-year

Year 1 percentage for 7-year MACRS nondeductible expense is carried over deduction would be $2,734 ($1,880 +

0.1429 into 2024. $854).

Year 1 regular MACRS depreciation

$ 12,004 $135,000 ÷ 180 months = $750 per If Lynn is a noncorporate business, the

Total deduction ($1,160,000 + $336,000 month amortization. Underhill’s first- 20 percent recapture rule is

+ $12,004) $ 1,508,004 year deduction is $1,500 (2 months × inapplicable. Because Lynn claimed only

________________________________ $750). straight-line depreciation on the

$24,500 × 92.35% × 15.3%. warehouse, the entire $82,300 gain is

Section 1231 gain.

Underhill’s book amortization for Roof Corporation has $15,500 He must recognize the interest as

purchased goodwill is zero. nonrecaptured Section 1231 losses from income in 2023 under the doctrine of

Consequently, the $1,500 tax deduction year 1 and year 3 ($1,500 remaining constructive receipt.

is a favorable difference between book from year 1, after recapture against year

and taxable income. At a 21% tax rate, 2 gain and $14,000 from year 3). ($9,882,590 + $447,600 permanent

the difference results in a $315 deferred Therefore, the entire $7,500 Section differences) × 21% = tax expense per

tax liability. 1231 gain recognized in year 4 is books

recaptured as ordinary income.

Lynn must recognize $16,460 gain (20% Because Mr. Zhao does not own at least

× $82,300 recognized gain) as ordinary In year 5, Roof has $8,000 80 percent of ZJL’s outstanding stock

income under the 20 percent recapture nonrecaptured Section 1231 loss immediately after the exchange, he

rule. The $65,840 remaining gain is remaining from year 3, after recapture must recognize the entire $154,000

Section 1231 gain. of the year 4 gain. Therefore, $8,000 of realized gain ($400,000 FMV of stock

the year 5 gain is ordinary and the received − $246,000 adjusted basis of

$1,000 remaining gain is treated as a business assets transferred) on the

capital gain. exchange of property for stock.

Hardy realizes a $30,000 gain ($90,000 Qualifying property takes a substituted FF realized a $35,300 gain ($250,000

amount realized [$77,500 FMV of basis. insurance reimbursement − $214,700

property acquired + $12,500 boot adjusted basis) on the involuntary

received] − $60,000 tax basis of Employees don't include the value of conversion of its warehouse. Because FF

transferred property). Hardy recognizes any compensatory fringe benefits in spent at least $250,000 on the

$12,500 gain equal to the boot received. gross income because the benefit construction of a replacement building

Its basis in the property acquired is doesn't consist of a direct cash and the replacement occurred within

$60,000 (substituted basis of property payment. the two taxable years following the year

transferred). of the conversion, it does not recognize

The $4,733,000 taxable gift ($4,750,000 any of the realized gain. FF’s basis in the

Foreign tax credit limitation: $449,400 × − $17,000 annual exclusion) is less than replacement building is $264,700

($240,000 foreign source income ÷ Mr. Ito’s $12.92 million lifetime ($300,000 cost − $35,300 unrecognized

$2,140,000 taxable income) = $50,400 exclusion, so no amount of the gift is gain).

subject to gift tax.

Which of these corporations form an Dividend deduction for recipient corp State M apportionment percentage:

affiliated group eligible to file a 115.94% ÷ 3 = 38.65% would be 0.3865.

consolidated tax return? Groups that Less than 20% = 50%

own 80% or more of the other group. 20% - 79% = 65% State N apportionment percentage:

80% or more = 100% 184.06% ÷ 3 = 61.35% would be 0.6135.

Mr. Forest, a single taxpayer, recognized of Section 1244 stock. What is the $50,000 ordinary and $202,000 capital

a $252,000 loss on the sale character of this loss?

You might also like

- Activities No. 2Document5 pagesActivities No. 2Joshua Cabinas60% (5)

- CH 13 NotesDocument19 pagesCH 13 NotesBec barron100% (1)

- Accuracy Checking - US TaxationTestDocument10 pagesAccuracy Checking - US TaxationTestAmit ManyalNo ratings yet

- F3 Study NotesDocument251 pagesF3 Study NotesHamza AliNo ratings yet

- 450 499 PDFDocument44 pages450 499 PDFSamuelNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test BankCharles Davis100% (38)

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test Bankbrianbradyogztekbndm100% (47)

- Financial Management For Decision MakersDocument3 pagesFinancial Management For Decision MakerssgdrgsfNo ratings yet

- Full download Individual Taxation 2013 Pratt 7th Edition Test Bank file pdf free all chapterDocument43 pagesFull download Individual Taxation 2013 Pratt 7th Edition Test Bank file pdf free all chaptersujasobrien100% (4)

- Full Download PDF of Individual Taxation 2013 Pratt 7th Edition Test Bank All ChapterDocument42 pagesFull Download PDF of Individual Taxation 2013 Pratt 7th Edition Test Bank All Chaptermaizonsudar100% (6)

- 14Document106 pages14Alex liaoNo ratings yet

- South-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1Document23 pagesSouth-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1donna100% (52)

- South-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1Document32 pagesSouth-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1markcamachoyrpbjxgeft100% (28)

- South Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFDocument36 pagesSouth Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFemma.ingram210100% (15)

- Practice Exam SOLUTIONS - Vol 2 (2020)Document49 pagesPractice Exam SOLUTIONS - Vol 2 (2020)Ledger PointNo ratings yet

- In Class Chap 12 SolutionDocument15 pagesIn Class Chap 12 SolutionDannickNo ratings yet

- Solution 1: Calculation of Total Assessable Income, Taxable Income, Tax LiabilityDocument14 pagesSolution 1: Calculation of Total Assessable Income, Taxable Income, Tax LiabilityDevender SharmaNo ratings yet

- Chapter 11 PDFDocument12 pagesChapter 11 PDFJay BrockNo ratings yet

- W9. After-Tax Analysis PDFDocument31 pagesW9. After-Tax Analysis PDFCHRISTOPHER ABIMANYUNo ratings yet

- South Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions ManualDocument44 pagesSouth Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions Manualvernier.decyliclnn4100% (26)

- Chapter 6Document13 pagesChapter 6vitbau98100% (1)

- Latihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Document7 pagesLatihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Yoga Cipta NugrahaNo ratings yet

- Income Tax Fundamentals (Assignment 1 - FIN 4017 Questions Summer 2022) (11339)Document5 pagesIncome Tax Fundamentals (Assignment 1 - FIN 4017 Questions Summer 2022) (11339)Maria PatinoNo ratings yet

- Accounting Changes and Error Corrections Tutorial (3753)Document3 pagesAccounting Changes and Error Corrections Tutorial (3753)Rawan YasserNo ratings yet

- Ias 12Document45 pagesIas 12Reever RiverNo ratings yet

- Chapter 8 - Income TaxesDocument6 pagesChapter 8 - Income TaxesHaddy GayeNo ratings yet

- AJ09 Fundamentals of Investing PDF 34 47Document14 pagesAJ09 Fundamentals of Investing PDF 34 47ichroniNo ratings yet

- IAS 12 Income Tax 1Document57 pagesIAS 12 Income Tax 1sikute kamongwaNo ratings yet

- Principles of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFDocument21 pagesPrinciples of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFrosyseedorff100% (12)

- AC2101 Seminar 7-8 Deferred Tax OutlineDocument33 pagesAC2101 Seminar 7-8 Deferred Tax OutlinelynnNo ratings yet

- Solution of Textbook 1Document4 pagesSolution of Textbook 1BảoNgọcNo ratings yet

- Full Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full ChapterDocument36 pagesFull Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full Chapterurocelespinningnuyu100% (24)

- Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111Document36 pagesSolutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111epha.thialol.lqoc100% (54)

- Gitman IM Ch01Document8 pagesGitman IM Ch01Endah DipoyantiNo ratings yet

- Homework Chapter 4Document10 pagesHomework Chapter 4ChaituNo ratings yet

- Annual Gross IncomeDocument4 pagesAnnual Gross IncomeMarilyn Perez OlañoNo ratings yet

- Chapter 4 PDFDocument14 pagesChapter 4 PDFJay BrockNo ratings yet

- Text 67C92BDA872B 1Document3 pagesText 67C92BDA872B 1AVNo ratings yet

- Ch4-Recordedlecture-Fall2023 17 5166787619170306Document38 pagesCh4-Recordedlecture-Fall2023 17 5166787619170306ronny nyagakaNo ratings yet

- Chapter 7 PDFDocument18 pagesChapter 7 PDFJay BrockNo ratings yet

- TaxationDocument12 pagesTaxationjanahh.omNo ratings yet

- Salary Sacrifice Arrangements What Is Salary Sacrifice?Document4 pagesSalary Sacrifice Arrangements What Is Salary Sacrifice?alanNo ratings yet

- IASSS16e Ch16.Ab - AzDocument33 pagesIASSS16e Ch16.Ab - AzLovely DungcaNo ratings yet

- Income Tax Basics - July 2023Document6 pagesIncome Tax Basics - July 2023maharajabby81No ratings yet

- CH 12 NotesDocument23 pagesCH 12 NotesBec barronNo ratings yet

- CH 6 Case 4Document3 pagesCH 6 Case 4Hazem HalabiNo ratings yet

- Chapter 5 Tax 2014 Some SolutionsDocument5 pagesChapter 5 Tax 2014 Some Solutionstherock25No ratings yet

- AYB320 0122 TrustsTutorialDocument20 pagesAYB320 0122 TrustsTutorialLinh ĐanNo ratings yet

- Mr. Zulfiqar Computation of Taxable Income For Tax Year 2009 RupeesDocument5 pagesMr. Zulfiqar Computation of Taxable Income For Tax Year 2009 Rupeesmeelas123No ratings yet

- Corp SolsDocument90 pagesCorp Solssayray55100% (1)

- Final Document On Tax LawDocument13 pagesFinal Document On Tax LawkimtexNo ratings yet

- Info Card 2016-17Document12 pagesInfo Card 2016-17Nick KNo ratings yet

- Tax Liability Excluding Surcharges $1,701,563.00Document2 pagesTax Liability Excluding Surcharges $1,701,563.00njenga geraldNo ratings yet

- Chapter 15 & 17 Q & SDocument7 pagesChapter 15 & 17 Q & Sgabie stgNo ratings yet

- Taxnz221 WS1 Actsols 02Document16 pagesTaxnz221 WS1 Actsols 02Joshua EbarleNo ratings yet

- Fabm2 Q2 W4 5Document8 pagesFabm2 Q2 W4 5maeesotoNo ratings yet

- Learning Task Week 3 & 4 AccountingDocument7 pagesLearning Task Week 3 & 4 AccountingMariane Gale SuaNo ratings yet

- 2019 PROBLEM EXERCISES IN INCOME TAXATION and TRAIN LAW (B)Document11 pages2019 PROBLEM EXERCISES IN INCOME TAXATION and TRAIN LAW (B)MGVMonNo ratings yet

- Computation of Taxable Income and Tax LiabilityDocument9 pagesComputation of Taxable Income and Tax LiabilityaNo ratings yet

- Fundamentals of Corporate Finance 9th Edition Brealey Solutions ManualDocument16 pagesFundamentals of Corporate Finance 9th Edition Brealey Solutions Manualmisentrynotal6ip1lp100% (24)

- Financial Reporting and Analysis 7th Edition by Gibson ISBN Solution ManualDocument46 pagesFinancial Reporting and Analysis 7th Edition by Gibson ISBN Solution Manualphyllis100% (40)

- Instructor's Manual: Financial Markets and InstitutionsDocument97 pagesInstructor's Manual: Financial Markets and InstitutionsSharNo ratings yet

- Chips Not DoneDocument42 pagesChips Not DoneKrestyl Ann GabaldaNo ratings yet

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- The Income Statements: Teori AkuntansiDocument25 pagesThe Income Statements: Teori AkuntansirifaNo ratings yet

- Determinants of Islamic Banking Profitability: Mhassan@uno - EduDocument31 pagesDeterminants of Islamic Banking Profitability: Mhassan@uno - EduAmtul AyoubNo ratings yet

- What Is A BudgetDocument7 pagesWhat Is A BudgetMichaelNo ratings yet

- Amazon Development Center India Pvt. LTD: Amount in INRDocument1 pageAmazon Development Center India Pvt. LTD: Amount in INRshammas PANo ratings yet

- SAMPLE PDF Macroeconomics XII 2021-22 Edition by Subhash DeyDocument124 pagesSAMPLE PDF Macroeconomics XII 2021-22 Edition by Subhash DeyAbhinav Kalra100% (1)

- Financial Accounting 300: Year Test 1 2023 - Suggested SolutionDocument19 pagesFinancial Accounting 300: Year Test 1 2023 - Suggested SolutionLayola MdlaloNo ratings yet

- Reo Notes - TaxDocument20 pagesReo Notes - TaxgeexellNo ratings yet

- Syllabus 2Document5 pagesSyllabus 2Cai ManuelNo ratings yet

- Business Finance: Formula and Budget PreparationDocument15 pagesBusiness Finance: Formula and Budget PreparationJims OlanoNo ratings yet

- Chapter 7 Macroeconomic MeasurDocument1 pageChapter 7 Macroeconomic MeasurKathleen CornistaNo ratings yet

- Accounting Clerk Exam - Answer KeyDocument5 pagesAccounting Clerk Exam - Answer KeyErwin Dave M. DahaoNo ratings yet

- Chapter 11 National Income AccountingDocument20 pagesChapter 11 National Income AccountingMuhammad Zarif IshakNo ratings yet

- The Role of GovernmentDocument2 pagesThe Role of GovernmentAdvait DadhaNo ratings yet

- San Miguel Corporation vs. Semillano, 623 SCRA 114, G.R. No. 164257 July 5, 2010Document16 pagesSan Miguel Corporation vs. Semillano, 623 SCRA 114, G.R. No. 164257 July 5, 2010Trea CheryNo ratings yet

- ITR Model FY 22-23Document15 pagesITR Model FY 22-23achinNo ratings yet

- BSAIS 1st Year FAR - Prelim ModuleDocument30 pagesBSAIS 1st Year FAR - Prelim ModuleRalphFlorence MancillaNo ratings yet

- (A) Jorge Company CVP Income Statement (Estimated) For The Year Ending December 31, 2014Document4 pages(A) Jorge Company CVP Income Statement (Estimated) For The Year Ending December 31, 2014Kim QuyênNo ratings yet

- Horizontal Analysis (Income Statement) 20200225Document3 pagesHorizontal Analysis (Income Statement) 20200225jocel4montefalcoNo ratings yet

- Mock Exam 1 Professional Appraisal PracticeDocument13 pagesMock Exam 1 Professional Appraisal PracticeNathaniel RasosNo ratings yet

- Group Case Review 4Document12 pagesGroup Case Review 4Anamika ShakyaNo ratings yet

- Chapter 8 Notes Aggregate Expenditure ModelDocument14 pagesChapter 8 Notes Aggregate Expenditure ModelBeatriz CanchilaNo ratings yet

- Self SufficiencyDocument14 pagesSelf SufficiencyErica Joy EstrellaNo ratings yet

- Income Target Market RRLDocument3 pagesIncome Target Market RRLColline AtanacioNo ratings yet

- CA Intermediate Paper-8BDocument250 pagesCA Intermediate Paper-8BAnand_Agrawal19No ratings yet

- Far 02 Conceptual Framework For Financial Reporting CompressDocument11 pagesFar 02 Conceptual Framework For Financial Reporting CompressDaphnie Loise CalderonNo ratings yet