Professional Documents

Culture Documents

CS Chapter 6 MCQ

CS Chapter 6 MCQ

Uploaded by

tkr4vwvmk60 ratings0% found this document useful (0 votes)

0 views1 pageOk

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOk

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

0 views1 pageCS Chapter 6 MCQ

CS Chapter 6 MCQ

Uploaded by

tkr4vwvmk6Ok

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

-·

MUl,JlPLE CHOI.CE ·QUESTIONS

~ / -

-.

EXERCISES

d' s

5. This expenditure relates to normal functioning of the government departments and provision of various

governme~

gra~

rvlces. The main examples of such expenditures are salaries, pensions, Interest. subs1dles,

e state governments, etc.

· . g expen 1ture

1. Leg~l..expenses Incurred to purchase land are (8) Recurnn ·~1 Revenue expenditure (Bl Capita! expenditure (C) Regular expenditure (DJ None of these

•· of these Capital receipts are usually obtained In case of a company:

(A) Capital expenditures (D) None

(0 Revenue expenditures •• (Al From Issue of shares. debentures (Bl B

2. Which of the following is a capital transaction? ( ) p~nt of wages. (CJ Sale of fixed assets or Investments ~ I of the above

8 h

(A) Purchase of goods ,(D) purchase of mac mery 17. Purchased a computer for office Is which .type of expendltur____-

(C) Sale of goods l' (Al Revenue expenditure

(C) Deferr.ed revenue expenditure

. ~ ~ pital expenditure

(D) Regular expenditure

3. Expendlture~!!Jcur.red to acquire fixed assets are cal ed ( ) Prepaid expenses

8

(A) Re~AUe expenditures (D) outstanding expenses 18. A receipt Is a capital receipt:

JO-<apltal expenditures (A) if It satisfies any one of the two conditions: The receipts must create a liability for the government. The

recel~ must cause a decrease In the assets.

4 . An e dlture Is Revenue_expenditure If ) it either affects liabilities or. assets

8 (BJ ~wings are capital receipts as they lead to an increase in the liability of the government.

) A t neither affects llablllt,es nor assets ( None of these

Both (A) and (B) .

L-- (CJ Either (Al. or (8) (D)

(DJ None of these

5. Ca~~ ndlture is incurred for (8) Day-to-day conduct of business 19. An expenditure is Deferred revenue expenditure because

Acquisition of fixed assets

(D) All of these (Al ~ t spent to buy assets

(CJ Malnta!!)lrlg-the existing earning capacity

~ T h e benefit of such expenditure is enjoyed by the business over a number of years.

6. Mo!)_ey-'l'eZeived by sale of machine is a (C) Amount spends in investment

c..,,.--1-'f ' Capital

receipt (8) Revenue receipt

(D) ,None of the above

(0 Deferred revenue receipt (D) None of these

20. Which of the following type of expenses are included in Revenue expenditure?

7. Revenueypenditure is incurred:

(8) To maintain the efficiency of an asset (A) Depreciation on fixed assets

(AJ J.o-improve the efficiency of an asset

To buy a fixed asset (D) It involves withdrawal of capital r , (B) Expenses incurred for day to day running of business

(CJ L..oss'from sale of fixed assets

8. An expenditure is a capital expenditure when: 1 ~ I I of the above

(Al It relates to sale fixed assets c ) E l ' ~s du~ to abno rmal reasons

(D) It relates to maintain the efficiency of 21. Expenses incurred to repair a seco~. d machine, purchase by the firm, to make it usable are treated

(0 It involves withdrawal of capital an as~ under which expenditure?

9. Period/ of benefit of capital expenditure is. (A) Revenue (C) Deferred revenue (D) Capital loss

U Af Only to the current accounting year ' (B) More t han one year

22. Which of the fo lowing type of expenses are included in capital expenditure?

(0 One month

,,.. / (D) One we~k

(A) Depreci · n on fixed assets

10. Premrum received on issue of shares is a (8) nses incurred for day-to-day running of business

..,,-<;i() Capital receipt (BJ Revenue rec~ipt Sale of fixed assets

· (0 Deferred revenue receipt (DJ' None of these (D) Raw material and stores

11 . fixed assets"l~se part of their value every year due to w~ar ~nd tea'r with pa~~age of time, such reduction 23. Match the Column I and Column II :

is calfe°d ______ on fixed assets.

Column - I Column' - II

,(,'(J depreciati~ (BJ deduction (C) production (D) none of these (a) Capital Expenditure i Repairs costing ,Goo carried out on a boiler

12. Fees and , commission received for services rendered, interest and dividend received an investment are (b) Revenue Expenditure ii Advertising expenses '25,000 incurred for launching a new

~~~,'.!)pies of product in the market.

~evenue receipts (B) capital receipts (cJ Defer.red Revenue Expenditure iii Interest received.

(0 Deferred revenue expenditure (DJ None of these (d) Revenue Receipts iv A sum of ,, 5,000 spent on the overhauling of a second-hand

13 Carriage, freight, octroi duty, customs duty, clearing charg!ls, dock dues, and excise duty paid on machinery delivery van.

are~pies of: (A) (a) i (b) ii (C) iii (dJ Iv (bJ Ii (C) Iv (d) i

(C) (a) i (bJ iii (CJ iv (d)li (bl I (C) ii (d) iii

.. _..-t,ilf Capital expenditure

I':'."-----...... (B) Capital

___ _,__ ,. loss (CZJ Revenue expenditure (DJ Revenue loss

currea to acquire nxea assets are called:· 24. Match the Column I and Column II:

ue expenditure Column - I Column - II

(B) Outstanding expenditure

pita! expenditure (a) Preliminary expenses of ,s,ooo Capital Expenditure

) 74 (D) Prepaid expenses

(bl Purchase of old machine for , 9,500. Ii Revenue Expenditure

"7C

You might also like

- Analysis of The Survival of Pension Funds During Hyperinflationary Periods in ZimbabweDocument97 pagesAnalysis of The Survival of Pension Funds During Hyperinflationary Periods in ZimbabweTatenda Takie TakaidzaNo ratings yet

- 2022 Uber 1099-NECDocument2 pages2022 Uber 1099-NECmwgageNo ratings yet

- Investment Declaration Form - 2022-2023Document3 pagesInvestment Declaration Form - 2022-2023Bharathi KNo ratings yet

- US 1040 Main Information Sheet 2021: Email Taxpayer Occupation Spouse Occupation Filing StatusDocument7 pagesUS 1040 Main Information Sheet 2021: Email Taxpayer Occupation Spouse Occupation Filing StatusRaquel Carrero100% (2)

- ScanDocument18 pagesScanGul RukhNo ratings yet

- Adobe Scan 8 Jan 2023Document2 pagesAdobe Scan 8 Jan 2023charvi.22052No ratings yet

- Principles of Auditing 2017Document4 pagesPrinciples of Auditing 2017rajeshwarsagaNo ratings yet

- Macroeconomics QuestionnaireDocument7 pagesMacroeconomics QuestionnaireSarikaNo ratings yet

- Statement of Profitloss OciDocument1 pageStatement of Profitloss Ocigummydummy5678No ratings yet

- Accounting 2021 U1 P1 PDFDocument10 pagesAccounting 2021 U1 P1 PDFStephano OlliviereNo ratings yet

- Exercicios Do Capitulo 8 (Finanças Empresariais)Document3 pagesExercicios Do Capitulo 8 (Finanças Empresariais)Gonçalo AlmeidaNo ratings yet

- Fabv 2018 Board Question Paper Sem 5Document11 pagesFabv 2018 Board Question Paper Sem 5ASHISH NYAUPANENo ratings yet

- S, Both: E. DifferenceDocument6 pagesS, Both: E. Differenceritoja770No ratings yet

- Tybaf Sem6 Fa-Vii Apr19Document5 pagesTybaf Sem6 Fa-Vii Apr19h9833151519No ratings yet

- MCQ EeDocument21 pagesMCQ EedharaniventhanNo ratings yet

- Ruj X:: PJT Jl75U T 1il: Tiff PJTDocument6 pagesRuj X:: PJT Jl75U T 1il: Tiff PJTsangita indrianeNo ratings yet

- Worksheet 1. Input Information: Schedule F Data Taxable YearDocument5 pagesWorksheet 1. Input Information: Schedule F Data Taxable Yearchandra_kumarbrNo ratings yet

- University Foundation - Financial DisclosureDocument7 pagesUniversity Foundation - Financial DisclosureSpotUsNo ratings yet

- Answers To Online Review Questions: The Classical Long-Run ModelDocument6 pagesAnswers To Online Review Questions: The Classical Long-Run ModelannfaiNo ratings yet

- 22.1 Multiple Questions: ChoiceDocument3 pages22.1 Multiple Questions: ChoiceDhaval KothariNo ratings yet

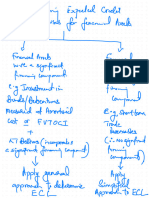

- Insights Into ECLDocument12 pagesInsights Into ECLHunal Kumar MautadinNo ratings yet

- Journal, Ledger MCQDocument7 pagesJournal, Ledger MCQSujan DangalNo ratings yet

- AAM3781 06 Nor 2019Document5 pagesAAM3781 06 Nor 2019Desmond Basson Jr.No ratings yet

- MGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Document4 pagesMGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNo ratings yet

- Adobe Scan 15 Mar 2024Document3 pagesAdobe Scan 15 Mar 2024vk8841688No ratings yet

- Adobe Scan 5 May 2023Document5 pagesAdobe Scan 5 May 2023NarayanNo ratings yet

- Chapter 2 108 131Document25 pagesChapter 2 108 131Arielle CabritoNo ratings yet

- Cost AccountingDocument12 pagesCost Accountingdivyayella024No ratings yet

- Adobe Scan 09 Mar 2023Document20 pagesAdobe Scan 09 Mar 2023Kanishka DixitNo ratings yet

- Class 12Document18 pagesClass 12Yukta ChhajerNo ratings yet

- Class 12 Ut-1 Question Paper EcoDocument4 pagesClass 12 Ut-1 Question Paper EcoAFRAH JALEELANo ratings yet

- FA 2023 (Feb-March) RegularDocument12 pagesFA 2023 (Feb-March) RegularswexyfoipjwkrfskglNo ratings yet

- Cost of CapitalDocument36 pagesCost of CapitalPrashant Kapoor0% (1)

- Business Economics Test 4Document3 pagesBusiness Economics Test 4Suryansh JainNo ratings yet

- CH 09 RevisedDocument36 pagesCH 09 RevisedNiharikaChouhanNo ratings yet

- CBSE Class 12 Economics - National Income and Related Aggregates PDFDocument4 pagesCBSE Class 12 Economics - National Income and Related Aggregates PDFRijak BhatiaNo ratings yet

- Unit 3 Practice Exam: Answer The Questions On A Separate Sheet of Paperplease Do Not Write On This Practice TestDocument6 pagesUnit 3 Practice Exam: Answer The Questions On A Separate Sheet of Paperplease Do Not Write On This Practice TestKristina AnapeNo ratings yet

- The Art and Science of Economic Analysis - The BasicsDocument38 pagesThe Art and Science of Economic Analysis - The Basicsskvenkat13No ratings yet

- The Following Financial Statements Apply To Karl Company Required Calculate The FollowingDocument3 pagesThe Following Financial Statements Apply To Karl Company Required Calculate The FollowingDoreenNo ratings yet

- QuestionsDocument14 pagesQuestionsojasvi3350No ratings yet

- Macro Unit 2 Multiple Choice Question For MacroeconomicsDocument4 pagesMacro Unit 2 Multiple Choice Question For MacroeconomicsSindisiwe JiyanaNo ratings yet

- Chapter-3: National Income: Where It Comes From and Where It GoesDocument30 pagesChapter-3: National Income: Where It Comes From and Where It GoesImtiaz ChowdhuryNo ratings yet

- Accounting For Managerialdecisions - 593 - (22-05-23 08 - 20 - 12 - 090 Am)Document7 pagesAccounting For Managerialdecisions - 593 - (22-05-23 08 - 20 - 12 - 090 Am)wasnikasmita3No ratings yet

- All Combined Economics A Level Paper 3Document666 pagesAll Combined Economics A Level Paper 3DhruvaAgrwalNo ratings yet

- Cost Accounting SEM VI - A7a647e3 3463 45a2 Aeda 9b11352ea07cDocument11 pagesCost Accounting SEM VI - A7a647e3 3463 45a2 Aeda 9b11352ea07csimran KeswaniNo ratings yet

- Mid Term Cheat SheetDocument2 pagesMid Term Cheat SheetnupurNo ratings yet

- Arihant LPGDocument10 pagesArihant LPGMehek BenganiNo ratings yet

- Csec Poa June 2007 p1Document10 pagesCsec Poa June 2007 p1Tavia LordNo ratings yet

- Cost of CapitalDocument11 pagesCost of CapitalMANSI JOSHINo ratings yet

- Some Basic Concept of Macroeconomics _Document3 pagesSome Basic Concept of Macroeconomics _harshit2714sharmaNo ratings yet

- Business Economics - Session 2 (LMS)Document27 pagesBusiness Economics - Session 2 (LMS)Abhimanyu AnejaNo ratings yet

- FA2 - Sem04 ImpairmentDocument5 pagesFA2 - Sem04 Impairmenttitu patriciuNo ratings yet

- Class 12th QuestionBank EconomicsDocument114 pagesClass 12th QuestionBank Economicsgamacode132No ratings yet

- Makaut 2016 QuestionsDocument43 pagesMakaut 2016 QuestionsANIRUDDHA PAULNo ratings yet

- Examination,: Degree MAYDocument2 pagesExamination,: Degree MAYSiva Chandran SNo ratings yet

- MS Economics Set 2Document7 pagesMS Economics Set 2Nikhil ChaudharyNo ratings yet

- Cost Sheet Format 07Document17 pagesCost Sheet Format 07Manickavel SmsNo ratings yet

- TestDocument2 pagesTestDas PadaNo ratings yet

- MG6863 Engineering Economics MCQ 2019 2020Document20 pagesMG6863 Engineering Economics MCQ 2019 2020SundarNo ratings yet

- Bi 17ubi305 - Corporate AccountingDocument18 pagesBi 17ubi305 - Corporate AccountingJmzkx SjxxkNo ratings yet

- Understanding Tariff BSESDocument19 pagesUnderstanding Tariff BSESshakti lasiyNo ratings yet

- Final Accounts Theory and Structures PDFDocument1 pageFinal Accounts Theory and Structures PDFDip KunduNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- City of Hyattsville, Maryland - Final Report - Final Auc260 Conclusion - 2020Document4 pagesCity of Hyattsville, Maryland - Final Report - Final Auc260 Conclusion - 2020route1financeNo ratings yet

- Flexible Benefit PlanDocument2 pagesFlexible Benefit PlanSreenivasa Murthy KotaNo ratings yet

- TUI AG Statements 15 16Document48 pagesTUI AG Statements 15 16goggsNo ratings yet

- Summative Test (BusMath)Document1 pageSummative Test (BusMath)Fatima Elsan OrillanNo ratings yet

- Literature Review On Tax PlanningDocument8 pagesLiterature Review On Tax Planningaflskdwol100% (1)

- EPFO APFC Exam 2015 SolvedDocument46 pagesEPFO APFC Exam 2015 SolvedmanjuNo ratings yet

- Wel 7Document8 pagesWel 7NoobinderNo ratings yet

- IELTS Writing Task 2 - Ageing Population PDFDocument3 pagesIELTS Writing Task 2 - Ageing Population PDFmaniNo ratings yet

- e945qIhDTECxNwlKY1V1 2023 Retirement Planning Cheat SheetDocument1 pagee945qIhDTECxNwlKY1V1 2023 Retirement Planning Cheat SheetTheodore Martinez JrNo ratings yet

- Jobseekers Notification 27-01-21-2Document4 pagesJobseekers Notification 27-01-21-2nickname2010No ratings yet

- C. 14. Investment Banking Insurance and Other Sources of Fee IncomeDocument1 pageC. 14. Investment Banking Insurance and Other Sources of Fee IncomeNguyen Hoai HuongNo ratings yet

- LABOUR COSTING-lesson 6Document35 pagesLABOUR COSTING-lesson 6Kj NayeeNo ratings yet

- EC1B1 - Intro TaxationDocument38 pagesEC1B1 - Intro TaxationZen Marcus RodasNo ratings yet

- 382 Winston Cap 7 TransportationDocument36 pages382 Winston Cap 7 TransportationputriNo ratings yet

- Module 2 - Individuals Estates and Trusts Without Answer-2Document12 pagesModule 2 - Individuals Estates and Trusts Without Answer-2KarenFayeBadillesNo ratings yet

- Finals Tax301Document9 pagesFinals Tax301Pauline De VillaNo ratings yet

- Variable Pay & Executive Compensation Submmitted BY Shweta Nayak SuchitraDocument63 pagesVariable Pay & Executive Compensation Submmitted BY Shweta Nayak SuchitrabsbhavaniNo ratings yet

- LAB1 HW Bar Questions AMBOYDocument3 pagesLAB1 HW Bar Questions AMBOYDon AmboyNo ratings yet

- HBC 2211 TaxationDocument105 pagesHBC 2211 TaxationMAYENDE ALBERTNo ratings yet

- Prosen Sir PDFDocument30 pagesProsen Sir PDFBlue Eye'sNo ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 856116270220718 Assessment Year: 2018-19Document5 pagesItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 856116270220718 Assessment Year: 2018-19sky2flyboy@gmail.comNo ratings yet

- Chapter 10 - Incomes Which Do Not Form Part of Total Income - NotesDocument10 pagesChapter 10 - Incomes Which Do Not Form Part of Total Income - NotesRahul TiwariNo ratings yet

- Form12BB R539 Proof Submission Form PDFDocument4 pagesForm12BB R539 Proof Submission Form PDFHema GarikapatiNo ratings yet

- Work and MotivationDocument25 pagesWork and MotivationArina UlfahNo ratings yet

- File No. HQ-PPII010/1/2022-PP - II-Part (3) Comp-3723 Staff Selection Commission Important NoticeDocument1 pageFile No. HQ-PPII010/1/2022-PP - II-Part (3) Comp-3723 Staff Selection Commission Important NoticeLokeshNo ratings yet

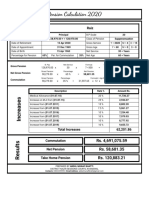

- Pension CalculationDocument1 pagePension CalculationAhmad FarhanNo ratings yet