Professional Documents

Culture Documents

Partnership Notes

Partnership Notes

Uploaded by

Vishal RangnaniCopyright:

Available Formats

You might also like

- Property Attack OutlineDocument28 pagesProperty Attack OutlineBrady Williams100% (3)

- 1 - Accounting For Partnership Firms - FundamentalsDocument12 pages1 - Accounting For Partnership Firms - FundamentalsAnkit Roy100% (1)

- CrvswiDocument588 pagesCrvswiPrasad NayakNo ratings yet

- Options Trading StrategiesDocument6 pagesOptions Trading Strategiessumeetsj87% (23)

- C-1 (Fundamentals of Partnership)Document6 pagesC-1 (Fundamentals of Partnership)adwitanegi068No ratings yet

- Accounts Full ConceptsDocument91 pagesAccounts Full ConceptsAnmol BehalNo ratings yet

- Study Material CH.-1 Fundamentals of Partnership 2023-24Document28 pagesStudy Material CH.-1 Fundamentals of Partnership 2023-24vsy9926No ratings yet

- CH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Document12 pagesCH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Laksh KhannaNo ratings yet

- Work Sheet On Accounting For Partnership FundamentalsDocument19 pagesWork Sheet On Accounting For Partnership Fundamentals8qk77kkhwbNo ratings yet

- Partnership Firms Part 2 Appropriation of ProfitDocument14 pagesPartnership Firms Part 2 Appropriation of ProfitDeepti BistNo ratings yet

- CH-01 FundamenatsDocument3 pagesCH-01 FundamenatsNitin KumarNo ratings yet

- Chapter 6: Appropriation of Profits: Rohit AgarwalDocument4 pagesChapter 6: Appropriation of Profits: Rohit AgarwalbcomNo ratings yet

- Accounting For Partnership Firms - Fundamentals 2021Document183 pagesAccounting For Partnership Firms - Fundamentals 2021JPS J100% (1)

- Fundamental of PatnershipDocument21 pagesFundamental of PatnershipHamza RiyazNo ratings yet

- Final Account 2020Document30 pagesFinal Account 2020Viransh Coaching ClassesNo ratings yet

- Buku Nota PertnershipDocument33 pagesBuku Nota PertnershipmaiNo ratings yet

- 4 General Accounts of Partnership FirmDocument16 pages4 General Accounts of Partnership FirmNisarga T DaryaNo ratings yet

- CH - 04 Dissolution of Partnership FirmDocument10 pagesCH - 04 Dissolution of Partnership FirmMahathi AmudhanNo ratings yet

- Fundamentals PDFDocument103 pagesFundamentals PDFDhairya JainNo ratings yet

- Chapter 2 - Normal PartnershipDocument18 pagesChapter 2 - Normal PartnershipmaiNo ratings yet

- Chapter 7: PARTNERSHIPDocument45 pagesChapter 7: PARTNERSHIPSuresh LamsalNo ratings yet

- Master Card - Xii AccountancyDocument39 pagesMaster Card - Xii AccountancyAkarshi AggarwalNo ratings yet

- Acc407 CH7 PartnershipDocument26 pagesAcc407 CH7 PartnershipBATRISYIA AMANI MUHAMMAD HALIMNo ratings yet

- Microsoft PowerPoint - PL & BS (Compatibility Mode)Document30 pagesMicrosoft PowerPoint - PL & BS (Compatibility Mode)Riyasat khanNo ratings yet

- CH 01 Accounting For Partnership - Basic ConceptsDocument11 pagesCH 01 Accounting For Partnership - Basic ConceptsMahathi AmudhanNo ratings yet

- PARTNERSHIPDocument72 pagesPARTNERSHIPDivya RaniNo ratings yet

- STD XII Class Note 2 ACCOUNTS 2021 22Document16 pagesSTD XII Class Note 2 ACCOUNTS 2021 22farhaan akhtarNo ratings yet

- Fundamentals of Partnership FirmDocument15 pagesFundamentals of Partnership Firmaayush.verma2105No ratings yet

- 12 AccountancyDocument4 pages12 AccountancyAbhishek DhillonNo ratings yet

- PartnershipDocument6 pagesPartnershipshafayat177No ratings yet

- Accounting For Partnership Firms - FundamentalsDocument5 pagesAccounting For Partnership Firms - FundamentalsPainNo ratings yet

- Accounting For PartnershipDocument15 pagesAccounting For Partnershipnagesh dashNo ratings yet

- Chapter - 2: 14 15 Accounts-XII Quick Revision 14 15 Accounts-XII Quick RevisionDocument4 pagesChapter - 2: 14 15 Accounts-XII Quick Revision 14 15 Accounts-XII Quick RevisionIqra MughalNo ratings yet

- PartnershipDocument6 pagesPartnershipabhishekanandsingh123goNo ratings yet

- Ahmadhiyya International School Syllabus: Subject: ACCOUNTING-Gr-11-Unit: Partnership Accounts-NotesDocument4 pagesAhmadhiyya International School Syllabus: Subject: ACCOUNTING-Gr-11-Unit: Partnership Accounts-NotesMohamed MuizNo ratings yet

- Ahmadhiyya International School Syllabus: Subject: ACCOUNTING-Gr-11-Unit: Partnership Accounts-NotesDocument4 pagesAhmadhiyya International School Syllabus: Subject: ACCOUNTING-Gr-11-Unit: Partnership Accounts-NotesMohamed MuizNo ratings yet

- Partnership AccountDocument67 pagesPartnership Accounttetteh godwinNo ratings yet

- Partnership Fundamentals Conceptual Notes 2023-24Document19 pagesPartnership Fundamentals Conceptual Notes 2023-24Aaryan KarthikeyNo ratings yet

- Partnerships: Igcse - Accounting (9-1) - Mahdi SamdaniDocument5 pagesPartnerships: Igcse - Accounting (9-1) - Mahdi SamdaniNasif KhanNo ratings yet

- 02, Accounting & Financial Analysis: 13, Preparation of Profit and Loss Accounts Loss AccountDocument14 pages02, Accounting & Financial Analysis: 13, Preparation of Profit and Loss Accounts Loss AccountHOD Dept of BBA Vels UniversityNo ratings yet

- Partnership: Basics: DefinitionsDocument13 pagesPartnership: Basics: DefinitionsShiv PatelNo ratings yet

- WK 1 Intro 2 PartnershipDocument6 pagesWK 1 Intro 2 PartnershipkehindeadeniyiNo ratings yet

- CHDocument124 pagesCHDeeran DhayanithiRPNo ratings yet

- Financial StatementsDocument8 pagesFinancial Statementsaryanparwani19No ratings yet

- Flow Chart (L-2)Document1 pageFlow Chart (L-2)JazaNo ratings yet

- PL and BSDocument30 pagesPL and BSAdefolajuwon ShoberuNo ratings yet

- CSEC English A 2023 P2 - 230111 - 163228 PDFDocument7 pagesCSEC English A 2023 P2 - 230111 - 163228 PDF27h4fbvsy8No ratings yet

- E-notes 01 _ Notes (Fundamentals of Partnership Accounting)Document23 pagesE-notes 01 _ Notes (Fundamentals of Partnership Accounting)tanujsingh180089No ratings yet

- C-4 SssDocument4 pagesC-4 SssCHIRAG ROHILLA RAJPUTNo ratings yet

- IPCC Paper I: Accounting Chapter No. 14 CA Shakuntala ChhanganiDocument130 pagesIPCC Paper I: Accounting Chapter No. 14 CA Shakuntala ChhanganiM SheikhaNo ratings yet

- Flow Chart-1Document1 pageFlow Chart-1Pankaj MahajanNo ratings yet

- Session 2 - Syllabus (26.08.2023)Document8 pagesSession 2 - Syllabus (26.08.2023)Saroj AndhariaNo ratings yet

- Partnership AccountDocument9 pagesPartnership Accountndanujoy180No ratings yet

- PartnershipsDocument7 pagesPartnershipsRambo Chillaz NehadiNo ratings yet

- Fundamental of Partnership Revision NotesDocument16 pagesFundamental of Partnership Revision NotesTarun SinghalNo ratings yet

- Final AccountsDocument9 pagesFinal AccountsRositaNo ratings yet

- FORMATDocument10 pagesFORMATShreeram vikiNo ratings yet

- Set 1 Test No.1 Answer KeyDocument4 pagesSet 1 Test No.1 Answer KeyJOHAN JOJONo ratings yet

- Partnership Operations: Accounting Cycle of A PartnershipDocument13 pagesPartnership Operations: Accounting Cycle of A Partnershipred100% (1)

- Chapter 8 Partnership AccountingDocument16 pagesChapter 8 Partnership Accountingk.muhammed aaqibNo ratings yet

- Partnership Firms - Part5 Guarantee and Past AdjustmentDocument15 pagesPartnership Firms - Part5 Guarantee and Past AdjustmentDeepti BistNo ratings yet

- Day 4Document4 pagesDay 4Dipesh MagratiNo ratings yet

- Organization Portfolio A Mission Core Values:: Auto Company ,,ferrari''Document6 pagesOrganization Portfolio A Mission Core Values:: Auto Company ,,ferrari''Almedin CuricNo ratings yet

- About Pos Malaysia BerhadDocument2 pagesAbout Pos Malaysia BerhadWilliam Vong75% (4)

- Pinterest and Tok&Stok Bring Pin It Button Into The Real WorldDocument2 pagesPinterest and Tok&Stok Bring Pin It Button Into The Real WorldMadison SeelyNo ratings yet

- Loyola College (Autonomous), Chennai: An International Management ExtravaganzaDocument13 pagesLoyola College (Autonomous), Chennai: An International Management ExtravaganzaDEVA SRI SAINo ratings yet

- TM Outline - FariisDocument31 pagesTM Outline - FariisLarab MohsinNo ratings yet

- The Overwurked American Juliet B. SchurDocument34 pagesThe Overwurked American Juliet B. SchurCarlos Gen WarashiNo ratings yet

- What Is The Difference Between Bussiness Plan and Project ProposalDocument6 pagesWhat Is The Difference Between Bussiness Plan and Project ProposalshumetNo ratings yet

- Final Project Report OmfedDocument59 pagesFinal Project Report Omfed#pinttu100% (5)

- Urgently Required by Qatar Fertiliser CompanyDocument12 pagesUrgently Required by Qatar Fertiliser CompanyWaqar HussainNo ratings yet

- Labour Law-II DR - Nilamani DasDocument9 pagesLabour Law-II DR - Nilamani DasSid'Hart MishraNo ratings yet

- Sugar Plugin For Excel 6.1.0Document6 pagesSugar Plugin For Excel 6.1.0chicagogroovesNo ratings yet

- Anu Nirma Nirma StoryDocument16 pagesAnu Nirma Nirma StoryPandey AmitNo ratings yet

- Factoring & Forfeiting: Learning ObjectivesDocument7 pagesFactoring & Forfeiting: Learning ObjectivesLohith SanjeevNo ratings yet

- Katalog YSADocument37 pagesKatalog YSAEko Santoso Soedibdjo50% (2)

- Learning Spring Application Development - Sample ChapterDocument35 pagesLearning Spring Application Development - Sample ChapterPackt Publishing100% (1)

- Push and Pull Strategy 1Document6 pagesPush and Pull Strategy 1kiranaishaNo ratings yet

- Trading Spreads and SeasonalsDocument15 pagesTrading Spreads and Seasonalstpman2004-misc67% (3)

- Assignment 1Document2 pagesAssignment 1Rajesh VijayNo ratings yet

- The Dutch East India Company in FuzhouDocument58 pagesThe Dutch East India Company in FuzhouihsoaNo ratings yet

- Patent ValuationDocument11 pagesPatent ValuationAkhil JainNo ratings yet

- Toaz - Info Business Administration Finance Burlington Students Book PRDocument132 pagesToaz - Info Business Administration Finance Burlington Students Book PRMarta García EstévezNo ratings yet

- Chap013.ppt Scheduling OperationsDocument23 pagesChap013.ppt Scheduling OperationsSaad Khadur Eilyes100% (1)

- Philip Crosby - The Fun Uncle of The Quality RevolutionDocument1 pagePhilip Crosby - The Fun Uncle of The Quality RevolutionVbaluyoNo ratings yet

- Salient Features of Real Estate (Regulation & Development) Act 2016Document22 pagesSalient Features of Real Estate (Regulation & Development) Act 2016gargaNo ratings yet

- Aviation Sector in IndiaDocument66 pagesAviation Sector in Indiasrpvicky100% (1)

- Kcs InvoiceDocument1 pageKcs InvoiceSe Jin CoohNo ratings yet

- Bank and Secrecy Law in The PhilippinesDocument18 pagesBank and Secrecy Law in The PhilippinesBlogWatchNo ratings yet

Partnership Notes

Partnership Notes

Uploaded by

Vishal RangnaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Notes

Partnership Notes

Uploaded by

Vishal RangnaniCopyright:

Available Formats

HAPPY LEARNING ACADEMY

CLASS:- 12th SUBJECT:Accountancy

CHAPTER 01 :- FUNDAMENTALS OF PARTNERSHIP FIRM

Partnership Deed/Articles of Partnership:

❖ Written Agreement

❖ Terms & conditions (Agreed by all partners)

❖ To avoid misunderstanding & disputes

❖ Not compulsory under law (Voluntary in nature)

Rules applicable in the absence of Partnership Deed/ If the Partnership agreement is done but it is

silent about the following items:

Profit Sharing Ratio : Equally( Use if there is Two Partners- /Three Partners-

Interest on Capital : Not allowed

Interest on Drawing : Not charged

Salary/Commission : Not Entitled

Interest on Partners loan : Allowed @6% p.a.

Dr. PROFIT AND LOSS ACCOUNT for the Cr.

year ended……………..

Particulars Amount Particulars Amount

To Loss for the year/loss before By Profit for the year/Profit before

interest* Xxx interest* Xxx

To Interest on Partners loan

A xxx

B xxx Xxx

To Rent : Partners Name Xxx

To Manager’s Commission Xxx

To Net Profit transferred to Profit and

Loss Appropriation A/c xxx

xxx Xxx

*If item relating to “Interest on Loan” is present.

HAPPY LEARNING ACADEMY VISHAL SIR :-9408825980(WhatsApp) Page 1

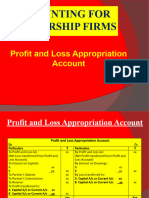

Dr. PROFIT AND LOSS APPROPRIATION ACCOUNT Cr. for the year

ended……………

Particulars Amount Particulars Amount

To Salary/commission/Bonus: By Profit and loss A/c (Profit transferred xxx

To Interest on capital: By Interest on drawings

xxx By Loss transferred to:

To Reserve/General Reserve A/c A’s Capital A/c/Current A/c** xxx

To Provision for Donation A/c B’s Capital A/c/Current A/c** xxx

To Profit transferred to:

A’s Capital A/c/Current A/c** xxx

B’s Capital A/c/Current A/c** xxx xxx

Xxx Xxx

**If Partners capital is Fixed.

Important Note:-

1 Profit and loss appropriation A/c is a nominal account in which we records transaction related to

Partners i.e. any sum due to partners and any sum due from partners.

2 Charge against profit indicates expenses to be deducted from profits while calculating profit and

loss. It is debited to P & L A/c. It is necessary to make charges against profits even if there is loss.

3 If Interest on capital is given as charged against profit it should be recorded in Profit and Loss A/c.

4 Commission of Manager is written in Profit And Loss A/c whereas commission of Partners is

recorded in Profit and Loss Appropriation A/c.

Manager’s Commission is calculated as follows:

(a) On profits before charging such commission:

(b) On profits after charging such

commission:

In the absence of any information, manager’s commission will be calculated on profit before any

adjustment is made according to partnership deed.

5 Rent (for using property) and Interest on Partners loan (for providing loan to the firm) is an

expense. Hence, it is a charge against profit and will be debited to Profit & Loss Account even if the

firm incurs a loss.

Dr. Rent Payable A/c Cr.

Date Particulars Amount Date Particulars Amount

To Balance c/d Xxx By Rent A/c xxx

Dr. Partner’s Loan A/c Cr.

Date Particulars Amount Date Particulars Amount

To Balance c/d Xxx By Balance b/d xxx

By Interest on Partner’s Loan A/c xxx

HAPPY LEARNING ACADEMY VISHAL SIR :-9408825980(WhatsApp) Page 2

If the firm incurs losses than we will distribute the loss in Profit & Loss A/c only and no item of

Appropriation will be distributed (Like Interest on Capital, Salary, Commission etc):

Dr. PROFIT AND LOSS ACCOUNT Cr. for the year ended……………..

Particulars Amount Particulars Amount

To Loss for the year/loss before By Profit for the year/Profit before

interest* Xxx interest* Xxx

To Interest on Partners loan By Net Loss transferred to:

A xxx A’s Capital A/c/Current A/c** xxx

B xxx Xxx B’s Capital A/c/Current A/c** xxx

To Rent : Partners Name Xxx Xxx

To Manager’s Commission Xxx

Xxx Xxx

*If item relating to “Interest on Loan” is present.

**If Partners capital is fixed.

Exception to the above point: Even if the firm incurs losses than we have to prepare Profit & Loss

Appropriation A/c, if Item relating to Interest on Drawing is present in the question. But no item of Appropriation

will be distributed (Like Interest on Capital, Salary and Commission etc).

Dr. PROFIT AND LOSS APPROPRIATION ACCOUNT Cr.

for the year ended……………..

Particulars Amount Particulars Amount

To Profit and loss A/c (Loss transferred By Interest on drawing: xxx

from Profit & loss A/c) A xxx

B xxx

By Loss transferred to:

A’s Capital A/c/Current A/c** xxx xxx

B’s Capital A/c/Current A/c** xxx

Xxx Xxx

**If Partners capital is Fixed.

When Appropriations are more than Profits:

In case where appropriations such as interest on capital, salary of partner etc, are more than available

profits, than the profits will distributed in the ratio of appropriations(IOC: Salary: Commission etc).

Calculation of Interest on Capital: Interest on capital is always provided on the opening capitals of the

partners. Interest is allowed only when there is profit in the firm.

HAPPY LEARNING ACADEMY VISHAL SIR :-9408825980(WhatsApp) Page 3

Calculation of Opening Capital:

Particulars X Y Z

Closing capital Xxx Xxx Xxx

(+)Drawings Xxx Xxx Xxx

(+)Loss during the year Xxx Xxx Xxx

(-)Profits already Credited Xxx Xxx Xxx

(-) additional Capital (if any) Xxx Xxx Xxx

Opening capital Xxx Xxx Xxx

Interest on Capital = Opening Capital X Rate/ 100

Calculation of Interest on Drawing:

(a) Simple Method: Used when there is single amount and date is given**

** If the date of drawing is not given in the question or if the drawing is done during the year than use

6 months for calculating interest on drawing.

(b) Product method: This method is used when drawing is done at unequal intervals and the

amount of drawing is different. Following chart is used

S.no. Date of Drawing Months upto 31st march Amount of Drawing Product

from the date of drawing

(1) (2) (3) (4) (5) = (3) X (4)

TOTAL OF PRODUCT XXX

𝑅𝑎𝑡𝑒 1

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑜𝑛 𝑑𝑟𝑎𝑤𝑖𝑛𝑔 = 𝑇𝑜𝑡𝑎𝑙 𝑜𝑓 𝑃𝑟𝑜𝑑𝑢𝑐𝑡 𝑋 𝑋

100 12

(c) When the rate of interest on drawing is given without the suffix per annum, interest will be

charged without considering time or date of drawing.

(d) In case of same amount have been withdrawn monthly we use Average basis months, which

are as follows:

PERIOD 12 MONTHS 9 MONTHLY 6 MONTHS QUARTERLY

BEGINNING 6.5 5 3.5 7.5

MIDDLE 6 4.5 3 6

END 5.5 4 2.5 4.5

Journal Entries

Interest on Capital

HAPPY LEARNING ACADEMY VISHAL SIR :-9408825980(WhatsApp) Page 4

On allowing Interest on Capital: On closure of Interest on Capital A/c:

Interest on Capital A/c Dr. Profit & loss Appropriation A/c Dr.

To Partner’s Capital A/c To Interest on Capital A/c

Interest on Drawings

On Charging Interest on Drawings: On closure of Interest on Drawing A/c: Interest

Partner’s Capital A/c Dr. on Drawing A/c Dr.

To Interest on Drawing A/c To Profit & loss Appropriation A/c

Salary/Commission

On allowing Salary/Commission payable to a partner: On closure of Salary/Commission account:

Partner’s Salary/Commission A/c Dr. Profit & loss Appropriation A/c Dr.

To Partner’s Capital A/c To Partner’s Salary/ Commission A/c

Interest on Partner’s Loan

On allowing Interest on partner’s loan: On closure of Interest on partner’s loan account:

Interest on Partner’s Loan A/c Dr. Profit & loss A/c Dr.

To Partner’s Loan A/c To Interest on Partner’s Loan A/c

Rent

On allowing Rent payable to a partner: On closure of Rent account:

Rent A/c Dr. Profit & loss A/c Dr.

To Rent Payable A/c To Rent A/c

Reserve

For Transferring a part of Profit to Reserve:

Profit & loss Appropriation A/c

To Reserve/General Reserve A/c

Transferring the Balance

For transferring the credit balance: For transferring the Debit balance:

Profit & loss Appropriation A/c Dr. Partner’s Capital/Current A/c Dr.

To Partner’s Capital/Current A/c To Profit & loss Appropriation A/c or Profit & Loss A/c

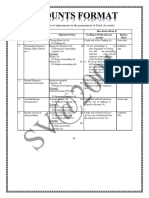

Capital Accounts of a Partner

(a) Fixed Capital Accounts

(b) Fluctuating Capital Accounts

A- In case of Fixed Capital

PERFORMA OF

Dr. PARTNERS CAPITAL ACCOUNTS (When the Capital are fixed)

Cr.

Particulars A B Particulars A B

To Balance b/d Xxx Xxx By Balance b/d Xxx Xxx

(Opening balance-Debit) (Opening balance-credit)

To Cash/Bank A/c* By Cash/Bank A/c* Xxx Xxx

(Permanent withdrawal of capital) Xxx Xxx (Additional Capital introduced)

To Balance c/d By Balance c/d xxx Xxx

(Closing Balance- if Cr. Balance is in xxx xxx (Closing Balance-if Dr. Balance is

excess of Dr. Balance) in excess of Cr. Balance)

xxx Xxx xxx Xxx

HAPPY LEARNING ACADEMY VISHAL SIR :-9408825980(WhatsApp) Page 5

PERFORMA OF

Dr. PARTNERS CURRENT ACCOUNTS (When the Capital are fixed) Cr.

Particulars A B Particulars A B

To Balance b/d Xxx Xxx By Balance b/d Xxx Xxx

(Opening balance-Debit) (Opening balance-Credit)

To Drawing A/c Xxx Xxx By Interest on capital A/c Xxx Xxx

To Interest on Drawing A/c Xxx Xxx By Salary A/c Xxx Xxx

To P & L A/c / P & L Xxx Xxx By Commission A/c Xxx Xxx

Appropriation A/c** By P & L Appropriation A/c

(Share of loss, in case of loss) (Share of profit, in case of

To Balance c/d xxx xxx profit) Xxx Xxx

(Closing Balance- if Cr. By Balance c/d

Balance is in excess of Dr. (Closing Balance-if Dr. Balance

Balance) is in excess of Cr. Balance) xxx xxx

xxx xxx xxx Xxx

B- In case of fluctuating capital

PERFORMA OF

Dr. PARTNERS CAPITAL ACCOUNTS (When the Capital are fluctuating) Cr.

Particulars A B Particulars A B

To Balance b/d Xxx Xxx By Balance b/d Xxx Xxx

i

(Opening balance-Debit) (Opening balance)

To Cash/Bank A/c* Xxx Xxx By Cash/Bank A/c* Xxx Xxx

(Permanent withdrawal of (Additional Capital introduced)

capital) By Interest on capital A/c Xxx Xxx

To Drawing A/c Xxx Xxx By Salary A/c Xxx Xxx

To Interest on Drawing A/c Xxx Xxx By Commission A/c Xxx Xxx

To P & L A/c / P & L Xxx Xxx By P & L Appropriation A/c

Appropriation A/c** (Share of profit, in case of

(Share of loss, in case of loss) profit) Xxx Xxx

To Balance c/d xxx xxx By Balance c/d

(Closing Balance- if Cr. (Closing Balance-if Dr. Balance

Balance is in excess of Dr. is in excess of Cr. Balance) xxx xxx

Balance)

xxx Xxx xxx Xxx

*What to use- Cash A/c or Bank A/c? Write that item which is present in the Balance sheet.

If Balance Sheet is not given, than use whatever you want.

** Check through which Account you have distributed the Loss.

Adjustment of outstanding expenses and incomes:

Particulars A B

Share of Partners in outstanding Expenses X Dr. X Dr.

Share of Partners in Accrued Interest X Cr. X Cr.

Net Effect X X

HAPPY LEARNING ACADEMY VISHAL SIR :-9408825980(WhatsApp) Page 6

Adjustment in the Closed Accounts/Past Adjustments: In Case where the accounts have been closed

but there have been some errors or omissions in the accounts. Then in such case we pass an adjusting

entry instead of altering accounts.

Journal Entry:

Gaining Partner’s Capital/Current** A/c Dr. (who received excess)

To Sacrificing Partner’s Capital/Current** A/c (who received short)

To General Reserve/ Manager’s Commission outstanding A/c (if any) **

Use Current A/c in case Partner’s capital is fixed.

TABLE SHOWING ADJUSTMENTS

PARTICULARS A B C TOTAL

Interest on Capital (IOC) Cr. Xxx Xxx Xxx Xxx

Salary/Commission Cr. Xxx Xxx Xxx Xxx

Remaining Profit(Profit before Interest on capital

-IOC-Salary-commission + IOD) in P.S.R Cr. Xxx Xxx Xxx Xxx

Interest on Drawing (IOD) Dr. (xxx) (xxx) (xxx) (xxx)

Xxx Xxx Xxx xxx Distribution of Profit/Loss in P.S.R. or Cr./Dr. xxx xxx xxx xxx

Profit already distributed or credited in wrong PSR Dr.

Net Effect Xxx Xxx Xxx Xxx

Adjustment of Reserve/Manager’s Commission Dr. xxx xxx xxx Xxx

Net Effect xxx xxx xxx Xxx

Cr.

Guarantee of profit to a partner:

It means that if his share of profit is less than that of guaranteed profit, then he would

be paid the guaranteed share of profit either by (i) any one of the partner, or (ii) by all

the partners in a particular ratio.

A) In Case of Profit:

Dr. PROFIT AND LOSS APPROPRIATION ACCOUNT Cr.

Particulars Amount Particulars Amount

To Profit transferred to Capital A/c: By Profit and loss A/c (Profit transferred xxx

A xxx from Profit & loss A/c)

Less: Trf to C (xxx) Xxx

B xxx

Less: Trf to C (xxx) Xxx

C xxx

Add: Trf From A xxx

Add: Trf From B xxx

xxx

Xxx Xxx

HAPPY LEARNING ACADEMY VISHAL SIR :-9408825980(WhatsApp) Page 7

Journal Entry:

I)Transfer of Profit I)Transfer of Loss

Profit & Loss A/c Dr. In case of loss balance of Profit and loss should not

To Profit & Loss Appropriation A/c be transferred to P & L Appropriation A/c

II)Profit distributed amongst all partner’s Profit II)Loss distributed amongst all partner’s

& Loss Appropriation A/c Dr. All Partner’s Capital/Current A/c Dr.

To All Partner’s Capital/Current A/c To Profit and loss A/c

(with the actual amount of profit that have to be distribute without any adjustments)

III)Deficiency of guaranteed partner to be bring in

by old partner in the ratio specified in question:

Gaining Partner’s Capital/Current A/c Dr.

To Sacrificing Partner’s Capital/Current A/c

Note: If the share is more than the guaranteed amount, then there is no need for any adjustments.

HAPPY LEARNING ACADEMY VISHAL SIR :-9408825980(WhatsApp) Page 8

You might also like

- Property Attack OutlineDocument28 pagesProperty Attack OutlineBrady Williams100% (3)

- 1 - Accounting For Partnership Firms - FundamentalsDocument12 pages1 - Accounting For Partnership Firms - FundamentalsAnkit Roy100% (1)

- CrvswiDocument588 pagesCrvswiPrasad NayakNo ratings yet

- Options Trading StrategiesDocument6 pagesOptions Trading Strategiessumeetsj87% (23)

- C-1 (Fundamentals of Partnership)Document6 pagesC-1 (Fundamentals of Partnership)adwitanegi068No ratings yet

- Accounts Full ConceptsDocument91 pagesAccounts Full ConceptsAnmol BehalNo ratings yet

- Study Material CH.-1 Fundamentals of Partnership 2023-24Document28 pagesStudy Material CH.-1 Fundamentals of Partnership 2023-24vsy9926No ratings yet

- CH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Document12 pagesCH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Laksh KhannaNo ratings yet

- Work Sheet On Accounting For Partnership FundamentalsDocument19 pagesWork Sheet On Accounting For Partnership Fundamentals8qk77kkhwbNo ratings yet

- Partnership Firms Part 2 Appropriation of ProfitDocument14 pagesPartnership Firms Part 2 Appropriation of ProfitDeepti BistNo ratings yet

- CH-01 FundamenatsDocument3 pagesCH-01 FundamenatsNitin KumarNo ratings yet

- Chapter 6: Appropriation of Profits: Rohit AgarwalDocument4 pagesChapter 6: Appropriation of Profits: Rohit AgarwalbcomNo ratings yet

- Accounting For Partnership Firms - Fundamentals 2021Document183 pagesAccounting For Partnership Firms - Fundamentals 2021JPS J100% (1)

- Fundamental of PatnershipDocument21 pagesFundamental of PatnershipHamza RiyazNo ratings yet

- Final Account 2020Document30 pagesFinal Account 2020Viransh Coaching ClassesNo ratings yet

- Buku Nota PertnershipDocument33 pagesBuku Nota PertnershipmaiNo ratings yet

- 4 General Accounts of Partnership FirmDocument16 pages4 General Accounts of Partnership FirmNisarga T DaryaNo ratings yet

- CH - 04 Dissolution of Partnership FirmDocument10 pagesCH - 04 Dissolution of Partnership FirmMahathi AmudhanNo ratings yet

- Fundamentals PDFDocument103 pagesFundamentals PDFDhairya JainNo ratings yet

- Chapter 2 - Normal PartnershipDocument18 pagesChapter 2 - Normal PartnershipmaiNo ratings yet

- Chapter 7: PARTNERSHIPDocument45 pagesChapter 7: PARTNERSHIPSuresh LamsalNo ratings yet

- Master Card - Xii AccountancyDocument39 pagesMaster Card - Xii AccountancyAkarshi AggarwalNo ratings yet

- Acc407 CH7 PartnershipDocument26 pagesAcc407 CH7 PartnershipBATRISYIA AMANI MUHAMMAD HALIMNo ratings yet

- Microsoft PowerPoint - PL & BS (Compatibility Mode)Document30 pagesMicrosoft PowerPoint - PL & BS (Compatibility Mode)Riyasat khanNo ratings yet

- CH 01 Accounting For Partnership - Basic ConceptsDocument11 pagesCH 01 Accounting For Partnership - Basic ConceptsMahathi AmudhanNo ratings yet

- PARTNERSHIPDocument72 pagesPARTNERSHIPDivya RaniNo ratings yet

- STD XII Class Note 2 ACCOUNTS 2021 22Document16 pagesSTD XII Class Note 2 ACCOUNTS 2021 22farhaan akhtarNo ratings yet

- Fundamentals of Partnership FirmDocument15 pagesFundamentals of Partnership Firmaayush.verma2105No ratings yet

- 12 AccountancyDocument4 pages12 AccountancyAbhishek DhillonNo ratings yet

- PartnershipDocument6 pagesPartnershipshafayat177No ratings yet

- Accounting For Partnership Firms - FundamentalsDocument5 pagesAccounting For Partnership Firms - FundamentalsPainNo ratings yet

- Accounting For PartnershipDocument15 pagesAccounting For Partnershipnagesh dashNo ratings yet

- Chapter - 2: 14 15 Accounts-XII Quick Revision 14 15 Accounts-XII Quick RevisionDocument4 pagesChapter - 2: 14 15 Accounts-XII Quick Revision 14 15 Accounts-XII Quick RevisionIqra MughalNo ratings yet

- PartnershipDocument6 pagesPartnershipabhishekanandsingh123goNo ratings yet

- Ahmadhiyya International School Syllabus: Subject: ACCOUNTING-Gr-11-Unit: Partnership Accounts-NotesDocument4 pagesAhmadhiyya International School Syllabus: Subject: ACCOUNTING-Gr-11-Unit: Partnership Accounts-NotesMohamed MuizNo ratings yet

- Ahmadhiyya International School Syllabus: Subject: ACCOUNTING-Gr-11-Unit: Partnership Accounts-NotesDocument4 pagesAhmadhiyya International School Syllabus: Subject: ACCOUNTING-Gr-11-Unit: Partnership Accounts-NotesMohamed MuizNo ratings yet

- Partnership AccountDocument67 pagesPartnership Accounttetteh godwinNo ratings yet

- Partnership Fundamentals Conceptual Notes 2023-24Document19 pagesPartnership Fundamentals Conceptual Notes 2023-24Aaryan KarthikeyNo ratings yet

- Partnerships: Igcse - Accounting (9-1) - Mahdi SamdaniDocument5 pagesPartnerships: Igcse - Accounting (9-1) - Mahdi SamdaniNasif KhanNo ratings yet

- 02, Accounting & Financial Analysis: 13, Preparation of Profit and Loss Accounts Loss AccountDocument14 pages02, Accounting & Financial Analysis: 13, Preparation of Profit and Loss Accounts Loss AccountHOD Dept of BBA Vels UniversityNo ratings yet

- Partnership: Basics: DefinitionsDocument13 pagesPartnership: Basics: DefinitionsShiv PatelNo ratings yet

- WK 1 Intro 2 PartnershipDocument6 pagesWK 1 Intro 2 PartnershipkehindeadeniyiNo ratings yet

- CHDocument124 pagesCHDeeran DhayanithiRPNo ratings yet

- Financial StatementsDocument8 pagesFinancial Statementsaryanparwani19No ratings yet

- Flow Chart (L-2)Document1 pageFlow Chart (L-2)JazaNo ratings yet

- PL and BSDocument30 pagesPL and BSAdefolajuwon ShoberuNo ratings yet

- CSEC English A 2023 P2 - 230111 - 163228 PDFDocument7 pagesCSEC English A 2023 P2 - 230111 - 163228 PDF27h4fbvsy8No ratings yet

- E-notes 01 _ Notes (Fundamentals of Partnership Accounting)Document23 pagesE-notes 01 _ Notes (Fundamentals of Partnership Accounting)tanujsingh180089No ratings yet

- C-4 SssDocument4 pagesC-4 SssCHIRAG ROHILLA RAJPUTNo ratings yet

- IPCC Paper I: Accounting Chapter No. 14 CA Shakuntala ChhanganiDocument130 pagesIPCC Paper I: Accounting Chapter No. 14 CA Shakuntala ChhanganiM SheikhaNo ratings yet

- Flow Chart-1Document1 pageFlow Chart-1Pankaj MahajanNo ratings yet

- Session 2 - Syllabus (26.08.2023)Document8 pagesSession 2 - Syllabus (26.08.2023)Saroj AndhariaNo ratings yet

- Partnership AccountDocument9 pagesPartnership Accountndanujoy180No ratings yet

- PartnershipsDocument7 pagesPartnershipsRambo Chillaz NehadiNo ratings yet

- Fundamental of Partnership Revision NotesDocument16 pagesFundamental of Partnership Revision NotesTarun SinghalNo ratings yet

- Final AccountsDocument9 pagesFinal AccountsRositaNo ratings yet

- FORMATDocument10 pagesFORMATShreeram vikiNo ratings yet

- Set 1 Test No.1 Answer KeyDocument4 pagesSet 1 Test No.1 Answer KeyJOHAN JOJONo ratings yet

- Partnership Operations: Accounting Cycle of A PartnershipDocument13 pagesPartnership Operations: Accounting Cycle of A Partnershipred100% (1)

- Chapter 8 Partnership AccountingDocument16 pagesChapter 8 Partnership Accountingk.muhammed aaqibNo ratings yet

- Partnership Firms - Part5 Guarantee and Past AdjustmentDocument15 pagesPartnership Firms - Part5 Guarantee and Past AdjustmentDeepti BistNo ratings yet

- Day 4Document4 pagesDay 4Dipesh MagratiNo ratings yet

- Organization Portfolio A Mission Core Values:: Auto Company ,,ferrari''Document6 pagesOrganization Portfolio A Mission Core Values:: Auto Company ,,ferrari''Almedin CuricNo ratings yet

- About Pos Malaysia BerhadDocument2 pagesAbout Pos Malaysia BerhadWilliam Vong75% (4)

- Pinterest and Tok&Stok Bring Pin It Button Into The Real WorldDocument2 pagesPinterest and Tok&Stok Bring Pin It Button Into The Real WorldMadison SeelyNo ratings yet

- Loyola College (Autonomous), Chennai: An International Management ExtravaganzaDocument13 pagesLoyola College (Autonomous), Chennai: An International Management ExtravaganzaDEVA SRI SAINo ratings yet

- TM Outline - FariisDocument31 pagesTM Outline - FariisLarab MohsinNo ratings yet

- The Overwurked American Juliet B. SchurDocument34 pagesThe Overwurked American Juliet B. SchurCarlos Gen WarashiNo ratings yet

- What Is The Difference Between Bussiness Plan and Project ProposalDocument6 pagesWhat Is The Difference Between Bussiness Plan and Project ProposalshumetNo ratings yet

- Final Project Report OmfedDocument59 pagesFinal Project Report Omfed#pinttu100% (5)

- Urgently Required by Qatar Fertiliser CompanyDocument12 pagesUrgently Required by Qatar Fertiliser CompanyWaqar HussainNo ratings yet

- Labour Law-II DR - Nilamani DasDocument9 pagesLabour Law-II DR - Nilamani DasSid'Hart MishraNo ratings yet

- Sugar Plugin For Excel 6.1.0Document6 pagesSugar Plugin For Excel 6.1.0chicagogroovesNo ratings yet

- Anu Nirma Nirma StoryDocument16 pagesAnu Nirma Nirma StoryPandey AmitNo ratings yet

- Factoring & Forfeiting: Learning ObjectivesDocument7 pagesFactoring & Forfeiting: Learning ObjectivesLohith SanjeevNo ratings yet

- Katalog YSADocument37 pagesKatalog YSAEko Santoso Soedibdjo50% (2)

- Learning Spring Application Development - Sample ChapterDocument35 pagesLearning Spring Application Development - Sample ChapterPackt Publishing100% (1)

- Push and Pull Strategy 1Document6 pagesPush and Pull Strategy 1kiranaishaNo ratings yet

- Trading Spreads and SeasonalsDocument15 pagesTrading Spreads and Seasonalstpman2004-misc67% (3)

- Assignment 1Document2 pagesAssignment 1Rajesh VijayNo ratings yet

- The Dutch East India Company in FuzhouDocument58 pagesThe Dutch East India Company in FuzhouihsoaNo ratings yet

- Patent ValuationDocument11 pagesPatent ValuationAkhil JainNo ratings yet

- Toaz - Info Business Administration Finance Burlington Students Book PRDocument132 pagesToaz - Info Business Administration Finance Burlington Students Book PRMarta García EstévezNo ratings yet

- Chap013.ppt Scheduling OperationsDocument23 pagesChap013.ppt Scheduling OperationsSaad Khadur Eilyes100% (1)

- Philip Crosby - The Fun Uncle of The Quality RevolutionDocument1 pagePhilip Crosby - The Fun Uncle of The Quality RevolutionVbaluyoNo ratings yet

- Salient Features of Real Estate (Regulation & Development) Act 2016Document22 pagesSalient Features of Real Estate (Regulation & Development) Act 2016gargaNo ratings yet

- Aviation Sector in IndiaDocument66 pagesAviation Sector in Indiasrpvicky100% (1)

- Kcs InvoiceDocument1 pageKcs InvoiceSe Jin CoohNo ratings yet

- Bank and Secrecy Law in The PhilippinesDocument18 pagesBank and Secrecy Law in The PhilippinesBlogWatchNo ratings yet