Professional Documents

Culture Documents

Screenshot 2023-06-23 at 15.54.55

Screenshot 2023-06-23 at 15.54.55

Uploaded by

mnbvfdsa5656Copyright:

Available Formats

You might also like

- Etextbook 978 0078137204 Organizational Behavior Key Concepts Skills Best PracticesDocument62 pagesEtextbook 978 0078137204 Organizational Behavior Key Concepts Skills Best Practicesbeatrice.bump837100% (62)

- Why A BK AmericaDocument38 pagesWhy A BK Americamlo356No ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- Sample Chattel Mortgage With SPADocument2 pagesSample Chattel Mortgage With SPARamil Austria100% (1)

- Non Resident Ordy Rupee Nro AccountDocument5 pagesNon Resident Ordy Rupee Nro AccountAmar SinhaNo ratings yet

- Case Study 6 Revlon, Inc.Document11 pagesCase Study 6 Revlon, Inc.Russell Olinares75% (4)

- Practice problems-EBIT-EPS, Debt Capacity, LeaseDocument3 pagesPractice problems-EBIT-EPS, Debt Capacity, LeasesabihaNo ratings yet

- 1688120722TSDocument3 pages1688120722TSSomesh IngaleNo ratings yet

- Foreign Exchange Manual of State Bank of Pakistan (Chapter 19)Document26 pagesForeign Exchange Manual of State Bank of Pakistan (Chapter 19)MANNAR AHMED SIDDIQUINo ratings yet

- (FAQ On ODI Updated Till 28.02.2019, RBI Website) Direct Investments Outside IndiaDocument16 pages(FAQ On ODI Updated Till 28.02.2019, RBI Website) Direct Investments Outside IndiaUditanshu MisraNo ratings yet

- General Information: Ifci Tax Exemption Long Term Infrastructre Bond SERIES II - Information MemorandumDocument8 pagesGeneral Information: Ifci Tax Exemption Long Term Infrastructre Bond SERIES II - Information Memorandumsiriasvs_bNo ratings yet

- 220ecb and Trade Credits1Document10 pages220ecb and Trade Credits1Mohd ParvezNo ratings yet

- SBP's Foreign Exchange Regulations (Extract)Document11 pagesSBP's Foreign Exchange Regulations (Extract)decemberchildNo ratings yet

- Chapter 15 CPWD ACCOUNTS CODEDocument7 pagesChapter 15 CPWD ACCOUNTS CODEarulraj1971No ratings yet

- Cridit Managment: MBA Banking & Finance 3 TermDocument20 pagesCridit Managment: MBA Banking & Finance 3 Term✬ SHANZA MALIK ✬No ratings yet

- Regulatory Provisions Under EcbDocument6 pagesRegulatory Provisions Under EcbAllwyn FlowNo ratings yet

- Fema 1Document10 pagesFema 1Amit SinghNo ratings yet

- Note of Issue of Fully Convertible DebenturesDocument3 pagesNote of Issue of Fully Convertible DebenturesakhiljindalNo ratings yet

- Extract of Prudentials (Corporate)Document24 pagesExtract of Prudentials (Corporate)Khalil ShaikhNo ratings yet

- STB04012018 A1Document14 pagesSTB04012018 A1Mainak MukherjeeNo ratings yet

- Rbiguideline CPDocument19 pagesRbiguideline CPSalil RavindranNo ratings yet

- Draft Guidelines For Issue of Commercial Paper (CP)Document9 pagesDraft Guidelines For Issue of Commercial Paper (CP)extraterrestrial2024No ratings yet

- Banking Report: Interbank Rates: Submitted byDocument12 pagesBanking Report: Interbank Rates: Submitted byAicha XaheerNo ratings yet

- NBFCDocument21 pagesNBFCTilak SalianNo ratings yet

- Nbfcs - Role and Future: IndiaDocument21 pagesNbfcs - Role and Future: IndiaTilak SalianNo ratings yet

- Banking Regulations Act, RBI Act, Ni ActDocument65 pagesBanking Regulations Act, RBI Act, Ni ActDeepak GuptaNo ratings yet

- Ecb and Trade CreditsDocument10 pagesEcb and Trade CreditsVarun JainNo ratings yet

- 39 NBFCDocument10 pages39 NBFCDivyam ShahNo ratings yet

- Non-Banking Financial CompaniesDocument18 pagesNon-Banking Financial CompaniesBhushan GuptaNo ratings yet

- Tgpala Aicte Income Tax Programme 2015 16 UPDATEDDocument27 pagesTgpala Aicte Income Tax Programme 2015 16 UPDATEDniranjannlgNo ratings yet

- FDI FrameworkDocument6 pagesFDI Frameworkkashvivachhani111No ratings yet

- Audit of NBFCDocument17 pagesAudit of NBFCSriramNo ratings yet

- Foreign Exchange Management (Borroweing and Lending in Rupees) Regulations, 2000Document7 pagesForeign Exchange Management (Borroweing and Lending in Rupees) Regulations, 2000BHARGAVINo ratings yet

- Innovatimmbe Perpetual Debt InstrumentDocument6 pagesInnovatimmbe Perpetual Debt InstrumentArunava BanerjeeNo ratings yet

- ODI May2011Document4 pagesODI May2011Parul ShahNo ratings yet

- Master CircularDocument14 pagesMaster Circularkap-manNo ratings yet

- 1651056046yes tsDocument7 pages1651056046yes tsSomesh IngaleNo ratings yet

- 11 Eco Law Amendments and Additions in Study Material May 2023 38Document6 pages11 Eco Law Amendments and Additions in Study Material May 2023 38GAURAV PRAJAPATINo ratings yet

- Kerela Gramin BankDocument11 pagesKerela Gramin Bankambarishramanuj8771No ratings yet

- Tax Free IncomesDocument45 pagesTax Free IncomesAayush GiriNo ratings yet

- 11.tax Free Incomes FinalDocument45 pages11.tax Free Incomes FinalAyushi DixitNo ratings yet

- Foreign Exchange Management (Borrowing and Lending) Regulations, 2018 - Taxguru - inDocument11 pagesForeign Exchange Management (Borrowing and Lending) Regulations, 2018 - Taxguru - inVinod RahejaNo ratings yet

- Funding Options: External Commercial BorrowingsDocument12 pagesFunding Options: External Commercial BorrowingsKannu KhuranaNo ratings yet

- Funding Options: External Commercial BorrowingsDocument12 pagesFunding Options: External Commercial BorrowingsBhargav Tej PNo ratings yet

- Cridit Managment: MBA Banking & Finance 3 TermDocument13 pagesCridit Managment: MBA Banking & Finance 3 Term✬ SHANZA MALIK ✬No ratings yet

- C.1. Advance Remittance C.1.1. Advance Remittance For Import of GoodsDocument4 pagesC.1. Advance Remittance C.1.1. Advance Remittance For Import of GoodsRaja GopalakrishnanNo ratings yet

- Group Members: Sameia Farhat Sonia G.M Sadia Zia Fatima MazharDocument39 pagesGroup Members: Sameia Farhat Sonia G.M Sadia Zia Fatima MazharSaMeia FarhatNo ratings yet

- FEM (Overseas Investment) REGULATIONS - 2209Document5 pagesFEM (Overseas Investment) REGULATIONS - 2209sandeep AhujaNo ratings yet

- Credit Schemes of State Bank of Pakistan (SBP)Document29 pagesCredit Schemes of State Bank of Pakistan (SBP)M. AdnanNo ratings yet

- Notes On NBFCDocument9 pagesNotes On NBFCgspkishore7953No ratings yet

- Presented byDocument48 pagesPresented byAli KhanNo ratings yet

- External Commercial Borrowings (Ecb) : Release of Foreign Exchange by Authorised DealersDocument10 pagesExternal Commercial Borrowings (Ecb) : Release of Foreign Exchange by Authorised DealersAnonymous rkZNo8No ratings yet

- RBI DocDocument36 pagesRBI DocPritesh RoyNo ratings yet

- External Commercial Borrowings - IndiaDocument4 pagesExternal Commercial Borrowings - IndiaPPPnewsNo ratings yet

- UFCE RBI REGULATION Jan 23Document12 pagesUFCE RBI REGULATION Jan 23renu.balaNo ratings yet

- External Commercial BorrowingDocument8 pagesExternal Commercial BorrowingRatna HubliNo ratings yet

- Escrow Rbi RulesDocument2 pagesEscrow Rbi RulesAtiqur Rahman BarbhuiyaNo ratings yet

- RBI Notfn Jan-Jun 2019 - Intnl TFDocument22 pagesRBI Notfn Jan-Jun 2019 - Intnl TFArjun PatilNo ratings yet

- External Commercial BorrowingDocument10 pagesExternal Commercial BorrowingKunal TapreNo ratings yet

- 11.tax Free Incomes FinalDocument42 pages11.tax Free Incomes FinalAmit PandeyNo ratings yet

- NHPC Application Form DetailsTNC PDFDocument47 pagesNHPC Application Form DetailsTNC PDFHariprasad ManchiNo ratings yet

- NBFCDocument13 pagesNBFCkumarsaorabh131985No ratings yet

- Trade Finance Guru Mantra Part-1Document37 pagesTrade Finance Guru Mantra Part-1sudhir.kochhar3530No ratings yet

- Master Circular: (The Master Circular Is Also Available at RBI Web-Site and May Be Downloaded From There)Document17 pagesMaster Circular: (The Master Circular Is Also Available at RBI Web-Site and May Be Downloaded From There)Divya PurushothamanNo ratings yet

- FEMA Guidelines On Transfer of Securities by An Indian Entity To An NRIDocument3 pagesFEMA Guidelines On Transfer of Securities by An Indian Entity To An NRIPriyanshu GuptaNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Taxation Module 3: Numerical Problems Income From Business or ProfessionDocument5 pagesTaxation Module 3: Numerical Problems Income From Business or ProfessionShankar HunnurNo ratings yet

- Auditing Theory - 074: Process Part 2 CMP Test of Control and Substantive Test in The ConversionDocument6 pagesAuditing Theory - 074: Process Part 2 CMP Test of Control and Substantive Test in The ConversionMaria PauNo ratings yet

- 14Document10 pages14Aaron WidofanNo ratings yet

- Halifax Intermediaries Product GuideDocument14 pagesHalifax Intermediaries Product Guidekkvv11No ratings yet

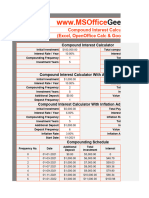

- Compound Interest CalculatorDocument14 pagesCompound Interest CalculatorSiyabongaNo ratings yet

- Ratio Analysis. A) Liquidity Ratio - 1) Current Ratio Current Asset Current LiabilityDocument6 pagesRatio Analysis. A) Liquidity Ratio - 1) Current Ratio Current Asset Current LiabilitysolomonNo ratings yet

- Chapter 12 Suggestions For Case Analysis: Strategic Management and Business Policy, 13e (Wheelen) - PIVDocument21 pagesChapter 12 Suggestions For Case Analysis: Strategic Management and Business Policy, 13e (Wheelen) - PIVMema SlimamNo ratings yet

- IIM Regulation V11Document19 pagesIIM Regulation V11Vikas NagareNo ratings yet

- Equitable Savings Bank v. Palces (G.R. No. 214752, March 09, 2016)Document2 pagesEquitable Savings Bank v. Palces (G.R. No. 214752, March 09, 2016)Lorie Jean UdarbeNo ratings yet

- Homework Assignment - Week 2 - AnswersDocument11 pagesHomework Assignment - Week 2 - AnswersVoThienTrucNo ratings yet

- Module 1 - Introduction To FinanceDocument57 pagesModule 1 - Introduction To FinanceFTU-ERNo ratings yet

- Mortgage Servicing Companies Preparing " Replacement" Mortgage AssignmentsDocument3 pagesMortgage Servicing Companies Preparing " Replacement" Mortgage AssignmentsForeclosure Fraud67% (3)

- Essential Features of BondDocument2 pagesEssential Features of BondAhmad Fakhrurrazi MKNo ratings yet

- TMT - Chellammal, Noonmeal Cook - T.D.T.A Primary School, Subramaniyapuram S.P.F. Intrest Calculation Working SheetDocument38 pagesTMT - Chellammal, Noonmeal Cook - T.D.T.A Primary School, Subramaniyapuram S.P.F. Intrest Calculation Working SheetNAN NMPNo ratings yet

- US BANK v. Ibanez - Amicus Manson BriefDocument53 pagesUS BANK v. Ibanez - Amicus Manson Briefwinstons2311No ratings yet

- Avianca Review QuestionsDocument1 pageAvianca Review QuestionsSalomé M. LópezNo ratings yet

- Bonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskDocument44 pagesBonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskFatimah HamadNo ratings yet

- Adjusting Entries and Adjusted Trial BalanceDocument19 pagesAdjusting Entries and Adjusted Trial Balancesunny sideNo ratings yet

- "Misunderstanding Financial Crises", A Q&A With Gary Gorton - FT AlphavilleDocument7 pages"Misunderstanding Financial Crises", A Q&A With Gary Gorton - FT AlphavilleAloy31stNo ratings yet

- To Identify The Various Sources of Finance and Management of Working CapitalDocument49 pagesTo Identify The Various Sources of Finance and Management of Working CapitalshashiNo ratings yet

- IT All Modules 1,2,3,4 and 5Document82 pagesIT All Modules 1,2,3,4 and 5Anees Fathima SyedNo ratings yet

- FRM-Quiz 8Document2 pagesFRM-Quiz 8Mienh HaNo ratings yet

- Product Disclosure Sheet: HSBC Bank Malaysia Berhad Revolving LoanDocument4 pagesProduct Disclosure Sheet: HSBC Bank Malaysia Berhad Revolving Loanthong_wheiNo ratings yet

- Rust Belt CitiesDocument20 pagesRust Belt CitiesTim KnaussNo ratings yet

Screenshot 2023-06-23 at 15.54.55

Screenshot 2023-06-23 at 15.54.55

Uploaded by

mnbvfdsa5656Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Screenshot 2023-06-23 at 15.54.55

Screenshot 2023-06-23 at 15.54.55

Uploaded by

mnbvfdsa5656Copyright:

Available Formats

PART III – STRUCTURED OBLIGATIONS

19. Non-resident guarantee for domestic fund based and non-fund based

facilities: Borrowing and lending in Indian Rupees between two residents does not attract any

provisions of the Foreign Exchange Management Act, 1999. In cases where a Rupee facility

which is either fund based or non-fund based (such as letter of credit / guarantee / letter of

undertaking / letter of comfort) or is in the form of derivative contract by residents that are

subsidiaries of multinational companies, is guaranteed by a non-resident (non-resident group

entity in case of derivative contracts), there is no transaction involving foreign exchange until

the guarantee is invoked and the non-resident guarantor is required to meet the liability

under the guarantee. The arrangements shall be with the following terms:

i. The non-resident guarantor may discharge the liability by i) payment out of rupee

balances held in India or ii) by remitting the funds to India or iii) by debit to his

FCNR(B)/NRE account maintained with an AD bank in India.

ii. In such cases, the non-resident guarantor may enforce his claim against the resident

borrower to recover the amount and on recovery he may seek repatriation of the

amount if the liability is discharged either by inward remittance or by debit to

FCNR(B)/NRE account. However, in case the liability is discharged by payment out of

Rupee balances, the amount recovered can be credited to the NRO account of the non-

resident guarantor.

iii. General Permission is available to a resident, being a principal debtor to make payment

to a person resident outside India, who has met the liability under a guarantee.

iv. In cases where the liability is met by the non-resident out of funds remitted to India or

by debit to his FCNR(B)/NRE account, the repayment may be made by credit to the

FCNR(B)/NRE/NRO account of the guarantor provided, the amount remitted/credited

shall not exceed the rupee equivalent of the amount paid by the non-resident guarantor

against the invoked guarantee.

v. 16

20. Facility of Credit Enhancement: The facility of credit enhancement by eligible non-

resident entities (viz. Multilateral financial institutions (such as, IFC, ADB, etc.) / regional

financial institutions and Government owned (either wholly or partially) financial institutions,

direct/ indirect equity holder) to domestic debt raised through issue of capital market

instruments, such as Rupee denominated bonds and debentures, is available to all borrowers

eligible to raise ECB under automatic route subject to the following conditions:

i. The underlying debt instrument should have a minimum average maturity of three

years;

16

Deleted vide A.P. (DIR Series) Circular No. 05 dated June 09, 2022. Prior to deletion the deleted portion read as “AD

Category I banks are required to furnish at quarterly interval details of guarantees availed of/ invoked, by all its branches, in

a format specified by RBI (Annex I of Part X of Master Directions – Reporting under Foreign Exchange Management Act dated

January 1, 2016, as amended from time to time), to the Chief General Manager-in-Charge, Foreign Exchange Department,

External Commercial Borrowings Division, Reserve Bank of India, Central Office Building, 11th floor, Fort, Mumbai – 400 001

so as to reach the Department not later than 10th day of the month following quarter to which the data pertain to”.

25

You might also like

- Etextbook 978 0078137204 Organizational Behavior Key Concepts Skills Best PracticesDocument62 pagesEtextbook 978 0078137204 Organizational Behavior Key Concepts Skills Best Practicesbeatrice.bump837100% (62)

- Why A BK AmericaDocument38 pagesWhy A BK Americamlo356No ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- Sample Chattel Mortgage With SPADocument2 pagesSample Chattel Mortgage With SPARamil Austria100% (1)

- Non Resident Ordy Rupee Nro AccountDocument5 pagesNon Resident Ordy Rupee Nro AccountAmar SinhaNo ratings yet

- Case Study 6 Revlon, Inc.Document11 pagesCase Study 6 Revlon, Inc.Russell Olinares75% (4)

- Practice problems-EBIT-EPS, Debt Capacity, LeaseDocument3 pagesPractice problems-EBIT-EPS, Debt Capacity, LeasesabihaNo ratings yet

- 1688120722TSDocument3 pages1688120722TSSomesh IngaleNo ratings yet

- Foreign Exchange Manual of State Bank of Pakistan (Chapter 19)Document26 pagesForeign Exchange Manual of State Bank of Pakistan (Chapter 19)MANNAR AHMED SIDDIQUINo ratings yet

- (FAQ On ODI Updated Till 28.02.2019, RBI Website) Direct Investments Outside IndiaDocument16 pages(FAQ On ODI Updated Till 28.02.2019, RBI Website) Direct Investments Outside IndiaUditanshu MisraNo ratings yet

- General Information: Ifci Tax Exemption Long Term Infrastructre Bond SERIES II - Information MemorandumDocument8 pagesGeneral Information: Ifci Tax Exemption Long Term Infrastructre Bond SERIES II - Information Memorandumsiriasvs_bNo ratings yet

- 220ecb and Trade Credits1Document10 pages220ecb and Trade Credits1Mohd ParvezNo ratings yet

- SBP's Foreign Exchange Regulations (Extract)Document11 pagesSBP's Foreign Exchange Regulations (Extract)decemberchildNo ratings yet

- Chapter 15 CPWD ACCOUNTS CODEDocument7 pagesChapter 15 CPWD ACCOUNTS CODEarulraj1971No ratings yet

- Cridit Managment: MBA Banking & Finance 3 TermDocument20 pagesCridit Managment: MBA Banking & Finance 3 Term✬ SHANZA MALIK ✬No ratings yet

- Regulatory Provisions Under EcbDocument6 pagesRegulatory Provisions Under EcbAllwyn FlowNo ratings yet

- Fema 1Document10 pagesFema 1Amit SinghNo ratings yet

- Note of Issue of Fully Convertible DebenturesDocument3 pagesNote of Issue of Fully Convertible DebenturesakhiljindalNo ratings yet

- Extract of Prudentials (Corporate)Document24 pagesExtract of Prudentials (Corporate)Khalil ShaikhNo ratings yet

- STB04012018 A1Document14 pagesSTB04012018 A1Mainak MukherjeeNo ratings yet

- Rbiguideline CPDocument19 pagesRbiguideline CPSalil RavindranNo ratings yet

- Draft Guidelines For Issue of Commercial Paper (CP)Document9 pagesDraft Guidelines For Issue of Commercial Paper (CP)extraterrestrial2024No ratings yet

- Banking Report: Interbank Rates: Submitted byDocument12 pagesBanking Report: Interbank Rates: Submitted byAicha XaheerNo ratings yet

- NBFCDocument21 pagesNBFCTilak SalianNo ratings yet

- Nbfcs - Role and Future: IndiaDocument21 pagesNbfcs - Role and Future: IndiaTilak SalianNo ratings yet

- Banking Regulations Act, RBI Act, Ni ActDocument65 pagesBanking Regulations Act, RBI Act, Ni ActDeepak GuptaNo ratings yet

- Ecb and Trade CreditsDocument10 pagesEcb and Trade CreditsVarun JainNo ratings yet

- 39 NBFCDocument10 pages39 NBFCDivyam ShahNo ratings yet

- Non-Banking Financial CompaniesDocument18 pagesNon-Banking Financial CompaniesBhushan GuptaNo ratings yet

- Tgpala Aicte Income Tax Programme 2015 16 UPDATEDDocument27 pagesTgpala Aicte Income Tax Programme 2015 16 UPDATEDniranjannlgNo ratings yet

- FDI FrameworkDocument6 pagesFDI Frameworkkashvivachhani111No ratings yet

- Audit of NBFCDocument17 pagesAudit of NBFCSriramNo ratings yet

- Foreign Exchange Management (Borroweing and Lending in Rupees) Regulations, 2000Document7 pagesForeign Exchange Management (Borroweing and Lending in Rupees) Regulations, 2000BHARGAVINo ratings yet

- Innovatimmbe Perpetual Debt InstrumentDocument6 pagesInnovatimmbe Perpetual Debt InstrumentArunava BanerjeeNo ratings yet

- ODI May2011Document4 pagesODI May2011Parul ShahNo ratings yet

- Master CircularDocument14 pagesMaster Circularkap-manNo ratings yet

- 1651056046yes tsDocument7 pages1651056046yes tsSomesh IngaleNo ratings yet

- 11 Eco Law Amendments and Additions in Study Material May 2023 38Document6 pages11 Eco Law Amendments and Additions in Study Material May 2023 38GAURAV PRAJAPATINo ratings yet

- Kerela Gramin BankDocument11 pagesKerela Gramin Bankambarishramanuj8771No ratings yet

- Tax Free IncomesDocument45 pagesTax Free IncomesAayush GiriNo ratings yet

- 11.tax Free Incomes FinalDocument45 pages11.tax Free Incomes FinalAyushi DixitNo ratings yet

- Foreign Exchange Management (Borrowing and Lending) Regulations, 2018 - Taxguru - inDocument11 pagesForeign Exchange Management (Borrowing and Lending) Regulations, 2018 - Taxguru - inVinod RahejaNo ratings yet

- Funding Options: External Commercial BorrowingsDocument12 pagesFunding Options: External Commercial BorrowingsKannu KhuranaNo ratings yet

- Funding Options: External Commercial BorrowingsDocument12 pagesFunding Options: External Commercial BorrowingsBhargav Tej PNo ratings yet

- Cridit Managment: MBA Banking & Finance 3 TermDocument13 pagesCridit Managment: MBA Banking & Finance 3 Term✬ SHANZA MALIK ✬No ratings yet

- C.1. Advance Remittance C.1.1. Advance Remittance For Import of GoodsDocument4 pagesC.1. Advance Remittance C.1.1. Advance Remittance For Import of GoodsRaja GopalakrishnanNo ratings yet

- Group Members: Sameia Farhat Sonia G.M Sadia Zia Fatima MazharDocument39 pagesGroup Members: Sameia Farhat Sonia G.M Sadia Zia Fatima MazharSaMeia FarhatNo ratings yet

- FEM (Overseas Investment) REGULATIONS - 2209Document5 pagesFEM (Overseas Investment) REGULATIONS - 2209sandeep AhujaNo ratings yet

- Credit Schemes of State Bank of Pakistan (SBP)Document29 pagesCredit Schemes of State Bank of Pakistan (SBP)M. AdnanNo ratings yet

- Notes On NBFCDocument9 pagesNotes On NBFCgspkishore7953No ratings yet

- Presented byDocument48 pagesPresented byAli KhanNo ratings yet

- External Commercial Borrowings (Ecb) : Release of Foreign Exchange by Authorised DealersDocument10 pagesExternal Commercial Borrowings (Ecb) : Release of Foreign Exchange by Authorised DealersAnonymous rkZNo8No ratings yet

- RBI DocDocument36 pagesRBI DocPritesh RoyNo ratings yet

- External Commercial Borrowings - IndiaDocument4 pagesExternal Commercial Borrowings - IndiaPPPnewsNo ratings yet

- UFCE RBI REGULATION Jan 23Document12 pagesUFCE RBI REGULATION Jan 23renu.balaNo ratings yet

- External Commercial BorrowingDocument8 pagesExternal Commercial BorrowingRatna HubliNo ratings yet

- Escrow Rbi RulesDocument2 pagesEscrow Rbi RulesAtiqur Rahman BarbhuiyaNo ratings yet

- RBI Notfn Jan-Jun 2019 - Intnl TFDocument22 pagesRBI Notfn Jan-Jun 2019 - Intnl TFArjun PatilNo ratings yet

- External Commercial BorrowingDocument10 pagesExternal Commercial BorrowingKunal TapreNo ratings yet

- 11.tax Free Incomes FinalDocument42 pages11.tax Free Incomes FinalAmit PandeyNo ratings yet

- NHPC Application Form DetailsTNC PDFDocument47 pagesNHPC Application Form DetailsTNC PDFHariprasad ManchiNo ratings yet

- NBFCDocument13 pagesNBFCkumarsaorabh131985No ratings yet

- Trade Finance Guru Mantra Part-1Document37 pagesTrade Finance Guru Mantra Part-1sudhir.kochhar3530No ratings yet

- Master Circular: (The Master Circular Is Also Available at RBI Web-Site and May Be Downloaded From There)Document17 pagesMaster Circular: (The Master Circular Is Also Available at RBI Web-Site and May Be Downloaded From There)Divya PurushothamanNo ratings yet

- FEMA Guidelines On Transfer of Securities by An Indian Entity To An NRIDocument3 pagesFEMA Guidelines On Transfer of Securities by An Indian Entity To An NRIPriyanshu GuptaNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Taxation Module 3: Numerical Problems Income From Business or ProfessionDocument5 pagesTaxation Module 3: Numerical Problems Income From Business or ProfessionShankar HunnurNo ratings yet

- Auditing Theory - 074: Process Part 2 CMP Test of Control and Substantive Test in The ConversionDocument6 pagesAuditing Theory - 074: Process Part 2 CMP Test of Control and Substantive Test in The ConversionMaria PauNo ratings yet

- 14Document10 pages14Aaron WidofanNo ratings yet

- Halifax Intermediaries Product GuideDocument14 pagesHalifax Intermediaries Product Guidekkvv11No ratings yet

- Compound Interest CalculatorDocument14 pagesCompound Interest CalculatorSiyabongaNo ratings yet

- Ratio Analysis. A) Liquidity Ratio - 1) Current Ratio Current Asset Current LiabilityDocument6 pagesRatio Analysis. A) Liquidity Ratio - 1) Current Ratio Current Asset Current LiabilitysolomonNo ratings yet

- Chapter 12 Suggestions For Case Analysis: Strategic Management and Business Policy, 13e (Wheelen) - PIVDocument21 pagesChapter 12 Suggestions For Case Analysis: Strategic Management and Business Policy, 13e (Wheelen) - PIVMema SlimamNo ratings yet

- IIM Regulation V11Document19 pagesIIM Regulation V11Vikas NagareNo ratings yet

- Equitable Savings Bank v. Palces (G.R. No. 214752, March 09, 2016)Document2 pagesEquitable Savings Bank v. Palces (G.R. No. 214752, March 09, 2016)Lorie Jean UdarbeNo ratings yet

- Homework Assignment - Week 2 - AnswersDocument11 pagesHomework Assignment - Week 2 - AnswersVoThienTrucNo ratings yet

- Module 1 - Introduction To FinanceDocument57 pagesModule 1 - Introduction To FinanceFTU-ERNo ratings yet

- Mortgage Servicing Companies Preparing " Replacement" Mortgage AssignmentsDocument3 pagesMortgage Servicing Companies Preparing " Replacement" Mortgage AssignmentsForeclosure Fraud67% (3)

- Essential Features of BondDocument2 pagesEssential Features of BondAhmad Fakhrurrazi MKNo ratings yet

- TMT - Chellammal, Noonmeal Cook - T.D.T.A Primary School, Subramaniyapuram S.P.F. Intrest Calculation Working SheetDocument38 pagesTMT - Chellammal, Noonmeal Cook - T.D.T.A Primary School, Subramaniyapuram S.P.F. Intrest Calculation Working SheetNAN NMPNo ratings yet

- US BANK v. Ibanez - Amicus Manson BriefDocument53 pagesUS BANK v. Ibanez - Amicus Manson Briefwinstons2311No ratings yet

- Avianca Review QuestionsDocument1 pageAvianca Review QuestionsSalomé M. LópezNo ratings yet

- Bonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskDocument44 pagesBonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskFatimah HamadNo ratings yet

- Adjusting Entries and Adjusted Trial BalanceDocument19 pagesAdjusting Entries and Adjusted Trial Balancesunny sideNo ratings yet

- "Misunderstanding Financial Crises", A Q&A With Gary Gorton - FT AlphavilleDocument7 pages"Misunderstanding Financial Crises", A Q&A With Gary Gorton - FT AlphavilleAloy31stNo ratings yet

- To Identify The Various Sources of Finance and Management of Working CapitalDocument49 pagesTo Identify The Various Sources of Finance and Management of Working CapitalshashiNo ratings yet

- IT All Modules 1,2,3,4 and 5Document82 pagesIT All Modules 1,2,3,4 and 5Anees Fathima SyedNo ratings yet

- FRM-Quiz 8Document2 pagesFRM-Quiz 8Mienh HaNo ratings yet

- Product Disclosure Sheet: HSBC Bank Malaysia Berhad Revolving LoanDocument4 pagesProduct Disclosure Sheet: HSBC Bank Malaysia Berhad Revolving Loanthong_wheiNo ratings yet

- Rust Belt CitiesDocument20 pagesRust Belt CitiesTim KnaussNo ratings yet