Professional Documents

Culture Documents

SBI-Contra-Fund-Factsheet-May-2024

SBI-Contra-Fund-Factsheet-May-2024

Uploaded by

Amit ChoudharyCopyright:

Available Formats

You might also like

- I. Case BackgroundDocument7 pagesI. Case BackgroundHiya BhandariBD21070No ratings yet

- Boston Red Sox Spring Training Decision Case StudyDocument3 pagesBoston Red Sox Spring Training Decision Case StudyJairo Ojeda0% (1)

- Export Packing, Marking and LabelingDocument3 pagesExport Packing, Marking and LabelingDeanne Lorraine V. Guinto100% (2)

- SBI Contra Fund Factsheet April 2024Document1 pageSBI Contra Fund Factsheet April 2024skbmnnitNo ratings yet

- SBI Contra Fund FactsheetDocument1 pageSBI Contra Fund FactsheetAman VermaNo ratings yet

- SBI Contra Fund FactsheetDocument1 pageSBI Contra Fund FactsheetAkshad KhedkarNo ratings yet

- SBI Large Midcap Fund Factsheet April 2024Document1 pageSBI Large Midcap Fund Factsheet April 2024Hitesh MiskinNo ratings yet

- SBI Bluechip Fund - One PagerDocument1 pageSBI Bluechip Fund - One PagerjoycoolNo ratings yet

- Sbi Large and Midcap Fund Factsheet (June-2021!2!1)Document1 pageSbi Large and Midcap Fund Factsheet (June-2021!2!1)Gaurav NagpalNo ratings yet

- Sbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFDocument1 pageSbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFavinash sengarNo ratings yet

- SBI Long Term Equity Fund FactsheetDocument1 pageSBI Long Term Equity Fund FactsheetAwakening with EnlightenmentNo ratings yet

- SBI Consumption Opportunities Fund Factsheet April 2024Document1 pageSBI Consumption Opportunities Fund Factsheet April 2024Hitesh MiskinNo ratings yet

- SBI Multi Asset Allocation Fund FactsheetDocument1 pageSBI Multi Asset Allocation Fund FactsheetamanNo ratings yet

- Sbi Mutual FundDocument1 pageSbi Mutual Fundramana purushothamNo ratings yet

- Sbi Nifty Index Fund Factsheet (December-2020!13!11) PDFDocument1 pageSbi Nifty Index Fund Factsheet (December-2020!13!11) PDFSubscriptionNo ratings yet

- SBI Long Term Equity Fund Factsheet 62c6e895 82d5 4411 8714 6dfcec432a91Document1 pageSBI Long Term Equity Fund Factsheet 62c6e895 82d5 4411 8714 6dfcec432a91ja3mf29gNo ratings yet

- SBI Small Cap PDFDocument1 pageSBI Small Cap PDFJasmeet Singh NagpalNo ratings yet

- Sbi Focused Equity Fund Factsheet (May-2019!25!1)Document1 pageSbi Focused Equity Fund Factsheet (May-2019!25!1)Chandrasekar Attayampatty TamilarasanNo ratings yet

- SBI Small Cap Fund FactsheetDocument1 pageSBI Small Cap Fund FactsheetPalam PvrNo ratings yet

- SBI Magnum Global Fund FactsheetDocument1 pageSBI Magnum Global Fund FactsheetHitesh MiskinNo ratings yet

- Sbi Banking and Financial Services Fund Factsheet (August-2021-415-1)Document1 pageSbi Banking and Financial Services Fund Factsheet (August-2021-415-1)charan ThakurNo ratings yet

- HDFC MF Factsheet - July 2021 - 3-55-56Document2 pagesHDFC MF Factsheet - July 2021 - 3-55-56daveNo ratings yet

- cas_summary_report_2024_06_27_002658Document3 pagescas_summary_report_2024_06_27_002658Vj SinghNo ratings yet

- Sbi Magnum Taxgain Scheme Factsheet (March-2017!3!1)Document1 pageSbi Magnum Taxgain Scheme Factsheet (March-2017!3!1)Saranya KrishnamurthyNo ratings yet

- DRL1 CRDocument3 pagesDRL1 CRpankaj_xaviersNo ratings yet

- Noble Tech Industries Private LimitedDocument3 pagesNoble Tech Industries Private Limitedkarthikeyan A INo ratings yet

- For The Worthy Regional Tax Office Islamabad: Chief Commissioner - IrDocument13 pagesFor The Worthy Regional Tax Office Islamabad: Chief Commissioner - IrUsman Shaukat KhanNo ratings yet

- Canara Robeco Emerging Equities PDFDocument1 pageCanara Robeco Emerging Equities PDFJasmeet Singh NagpalNo ratings yet

- SBI Smallcap Fund (1) 09162022Document4 pagesSBI Smallcap Fund (1) 09162022chandana kumar0% (1)

- ValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11Document4 pagesValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11jamsheer.aaNo ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- ValueResearchFundcard BarodaPioneerShortTermBondFund DirectPlan 2017may16Document4 pagesValueResearchFundcard BarodaPioneerShortTermBondFund DirectPlan 2017may16Achint KumarNo ratings yet

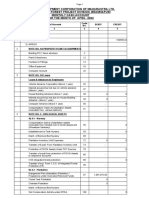

- Forest Development Corporation of Maharastra Ltd. Bramhapuri Forest Project Division, Bramhapuri Monthly Cash Account For The Month of April - 2022Document5 pagesForest Development Corporation of Maharastra Ltd. Bramhapuri Forest Project Division, Bramhapuri Monthly Cash Account For The Month of April - 2022Divisional Manager BramhapuriNo ratings yet

- 28october 2020 India DailyDocument169 pages28october 2020 India DailyPraveen MathewNo ratings yet

- SBI Magnum Income Fund FactsheetDocument1 pageSBI Magnum Income Fund FactsheetKripa Shankar TiwariNo ratings yet

- In Focus in Focus in Focus in Focus Technically Technically Technically TechnicallyDocument4 pagesIn Focus in Focus in Focus in Focus Technically Technically Technically TechnicallylalkarresearchNo ratings yet

- .Trashed 1691267349 OpeningbellDocument6 pages.Trashed 1691267349 Openingbellgerak52526No ratings yet

- ValueResearchFundcard AxisDynamicEquityFund RegularPlan 2019oct11Document4 pagesValueResearchFundcard AxisDynamicEquityFund RegularPlan 2019oct11ChittaNo ratings yet

- Solutions Oriented Scheme-Children'S Fund: Investment ObjectiveDocument1 pageSolutions Oriented Scheme-Children'S Fund: Investment Objectiveparvinder.singh02No ratings yet

- Cas Summary Report 2022 08 19 123504Document5 pagesCas Summary Report 2022 08 19 123504aman feriadNo ratings yet

- Revised 2024-2026 MTEFDocument7 pagesRevised 2024-2026 MTEFMayowa DurosinmiNo ratings yet

- Funds Update: IL&FS Group Related ExposuresDocument6 pagesFunds Update: IL&FS Group Related ExposuresAnuj SaxenaNo ratings yet

- Taxpayer Information Summary (TIS)Document3 pagesTaxpayer Information Summary (TIS)Karft RoyNo ratings yet

- India Daily 22082022 BKDocument71 pagesIndia Daily 22082022 BKRohan RustagiNo ratings yet

- CNVRG: Growth Opportunity in The Underpenetrated Fiber MarketDocument7 pagesCNVRG: Growth Opportunity in The Underpenetrated Fiber MarketJajahinaNo ratings yet

- Fundcard: Edelweiss Low Duration Fund - Direct PlanDocument4 pagesFundcard: Edelweiss Low Duration Fund - Direct PlanYogi173No ratings yet

- ValueResearchFundcard RelianceIncomeFund DirectPlan 2019jun15Document4 pagesValueResearchFundcard RelianceIncomeFund DirectPlan 2019jun15Phani VemuriNo ratings yet

- Cas Summary Report 2024 03 21 064120Document5 pagesCas Summary Report 2024 03 21 064120Arun KumarNo ratings yet

- KRChoksey Dharmaj Crop Guard IPO NoteDocument13 pagesKRChoksey Dharmaj Crop Guard IPO NoteMohammed Israr ShaikhNo ratings yet

- SBI Small and Mid Cap Fund FactsheetDocument1 pageSBI Small and Mid Cap Fund Factsheetfinal bossuNo ratings yet

- November 2010 India DailyDocument147 pagesNovember 2010 India DailymitbanNo ratings yet

- Daily Morning Note: Sebi Allows Declassification of Reit, Invit Sponsor StatusDocument8 pagesDaily Morning Note: Sebi Allows Declassification of Reit, Invit Sponsor StatussubashNo ratings yet

- General Instruction Manual: Accounting Policy, Methods & Systems DepartmentDocument15 pagesGeneral Instruction Manual: Accounting Policy, Methods & Systems DepartmentAldrien CabinteNo ratings yet

- ValueResearchFundcard MotilalOswalMOStFocusedMulticap35Fund RegularPlan 2017may03Document4 pagesValueResearchFundcard MotilalOswalMOStFocusedMulticap35Fund RegularPlan 2017may03vigneshNo ratings yet

- Mutual Fund Portfolio AnalysisDocument6 pagesMutual Fund Portfolio AnalysisIm CandlestickNo ratings yet

- ValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08Document4 pagesValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08pqwertyNo ratings yet

- Figures As On Sep 30,2020: Company/Issuer/Instrument Name Isin Units of Mutual FundsDocument30 pagesFigures As On Sep 30,2020: Company/Issuer/Instrument Name Isin Units of Mutual FundsAryata BhansaliNo ratings yet

- Fund Facts - HDFC Small Cap Fund - March 23Document2 pagesFund Facts - HDFC Small Cap Fund - March 23duttasahil19No ratings yet

- Fundcard: Baroda Pioneer Treasury Advantage Fund - Direct PlanDocument4 pagesFundcard: Baroda Pioneer Treasury Advantage Fund - Direct Planravinandan_pNo ratings yet

- Morning - India Motilal Oswal ResearchDocument16 pagesMorning - India Motilal Oswal Researchvikalp123123No ratings yet

- SEBI Portfolio - Feb 2020Document347 pagesSEBI Portfolio - Feb 2020Tapan LahaNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Destination Zero An Action Plan For Shipping CeosDocument11 pagesDestination Zero An Action Plan For Shipping CeosromainNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDRISHTI MEHRANo ratings yet

- Od 429360170470758100Document1 pageOd 429360170470758100acharyarajendra945No ratings yet

- Academics Committee: Fundamentals of Accountancy, Business & Management 1 Preliminary Exam ReviewerDocument5 pagesAcademics Committee: Fundamentals of Accountancy, Business & Management 1 Preliminary Exam ReviewerAlexa Abary100% (1)

- Public Opinion Poll: Residents of MongoliaDocument55 pagesPublic Opinion Poll: Residents of Mongoliashinkaron88No ratings yet

- Modul GE F35 MultilinDocument8 pagesModul GE F35 MultilinMr IlchamNo ratings yet

- Sameet Dhedhi FinanceDocument2 pagesSameet Dhedhi FinanceSmeet JasoliyaNo ratings yet

- Bharti Airtel Limited: by Chaitali Karate Roll No 50Document29 pagesBharti Airtel Limited: by Chaitali Karate Roll No 50pavanwaniNo ratings yet

- Role of Central and State Government in Promoting EntrepreneurshipDocument11 pagesRole of Central and State Government in Promoting EntrepreneurshipShruti SaxenaNo ratings yet

- Wa0015Document5 pagesWa0015Mithun PrinceNo ratings yet

- SQ Ack 71186Document1 pageSQ Ack 71186Iulian BarbuNo ratings yet

- 2 Creativity Innovation and EntrepreneurshipDocument28 pages2 Creativity Innovation and EntrepreneurshipNarayan MaharjanNo ratings yet

- HRD Final Exam QuestionDocument4 pagesHRD Final Exam QuestionDMacTeejayNo ratings yet

- Unit 16 Product LaunchDocument5 pagesUnit 16 Product LaunchSyrill CayetanoNo ratings yet

- Tran 10781367-1 PDFDocument1 pageTran 10781367-1 PDFNaeem SaiNo ratings yet

- Tem C1 PDFDocument6 pagesTem C1 PDFmae KuanNo ratings yet

- SPMT 4 Axle Line DrawingDocument1 pageSPMT 4 Axle Line DrawingVăn TháiNo ratings yet

- Permission Certificate: Nust Saddle Club Membership FormDocument2 pagesPermission Certificate: Nust Saddle Club Membership FormOsama MaqsoodNo ratings yet

- Dec 2018 VI Program - Participant Profile BookDocument24 pagesDec 2018 VI Program - Participant Profile BookJBNo ratings yet

- Basic Concept - : Goods and Services Tax MCQDocument103 pagesBasic Concept - : Goods and Services Tax MCQBighnesh Prasad SahooNo ratings yet

- Larsen & Toubro Infotech's Hostile Bid For Mindtree LTD.: Much Ado About Nothing! A Teaching CaseDocument10 pagesLarsen & Toubro Infotech's Hostile Bid For Mindtree LTD.: Much Ado About Nothing! A Teaching CaseAbhay ShuklaNo ratings yet

- Feasibility Study of Using Nipa Palm Sap As An Alternative of Sugarcane For Making Sugar.Document154 pagesFeasibility Study of Using Nipa Palm Sap As An Alternative of Sugarcane For Making Sugar.Ruben Osila Dela CruzNo ratings yet

- How To Build An Email List On Ebay PDF Ebook Make Money PDFDocument2 pagesHow To Build An Email List On Ebay PDF Ebook Make Money PDFNyasclemNo ratings yet

- Indirect Tax Revision Notes-CS Exe June 23 Lyst3130Document56 pagesIndirect Tax Revision Notes-CS Exe June 23 Lyst3130tskpestsolutions.chennaiNo ratings yet

- Balance Sheet of Mindtree - in Rs. Cr.Document4 pagesBalance Sheet of Mindtree - in Rs. Cr.shraddhamalNo ratings yet

- Your Quick Guide To ReelsDocument10 pagesYour Quick Guide To ReelsMania AdamiakNo ratings yet

- Case 3 - Wallys Billboard Sign SupplyDocument2 pagesCase 3 - Wallys Billboard Sign SupplyDzulija TalipanNo ratings yet

SBI-Contra-Fund-Factsheet-May-2024

SBI-Contra-Fund-Factsheet-May-2024

Uploaded by

Amit ChoudharyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SBI-Contra-Fund-Factsheet-May-2024

SBI-Contra-Fund-Factsheet-May-2024

Uploaded by

Amit ChoudharyCopyright:

Available Formats

EQUITY-CONTRA FUND

NET ASSET VALUE LAST IDCW Face value: `10

Option NAV (`) Record Date IDCW (in `/Unit) NAV (`)

Reg-Plan-IDCW 61.1422 09-Mar-18 (Dir Plan) 2.90 24.7907

Reg-Plan-Growth 352.5942 09-Mar-18 (Reg Plan) 2.30 19.7427

23-Jun-17 (Dir Plan) 2.90 25.7138

Dir-Plan-IDCW 80.4412

23-Jun-17 (Reg Plan) 2.30 20.5531

Dir-Plan-Growth 381.1600 26-Feb-16 (Dir Plan) 2.30 20.0765

Investment Objective 26-Feb-16 (Reg Plan) 2.00 16.1649

To provide the investor with the Pursuant to payment of IDCW, the NAV of IDCW Option of scheme/plans

opportunity of long-term capital would fall to the extent of payout and statutory levy, if applicable.

appreciation by investing in a diversified

portfolio of equity and equity related

securities following a contrarian

investment strategy. PORTFOLIO

Stock Name (%) Of Total % of AUM Net % Stock Name (%) Of Total % of AUM Net %

Fund Details AUM Derivatives of AUM AUM Derivatives of AUM

Equity Shares Grindwell Norton Ltd. 0.67 - 0.67

• Type of Scheme HDFC Bank Ltd. 3.19 - 3.19 Bharat Petroleum Corporation Ltd. 0.60 - 0.60

State Bank Of India 2.79 - 2.79 Disa India Ltd. 0.58 - 0.58

An open-ended Equity Scheme following GAIL (India) Ltd. 2.76 - 2.76 Wendt (India) Ltd. 0.57 - 0.57

contrarian investment strategy. Reliance Industries Ltd. 2.41 - 2.41 Indian Energy Exchange Ltd. 0.56 - 0.56

Oil & Natural Gas Corporation Ltd. 2.07 - 2.07 Steel Authority Of India Ltd. 0.54 - 0.54

• Date of Allotment: 05/07/1999 Whirlpool Of India Ltd. 1.98 - 1.98 Nuvoco Vistas Corporation Ltd. 0.54 - 0.54

• Report As On: 31/05/2024 ICICI Bank Ltd. 1.94 - 1.94 Lupin Ltd. 0.52 - 0.52

Torrent Power Ltd. 1.89 - 1.89 The Ramco Cements Ltd. 0.51 - 0.51

• AAUM for the Month of May 2024 Axis Bank Ltd. 1.87 - 1.87 Punjab National Bank 0.51 - 0.51

` 30,351.04 Crores Tata Steel Ltd. 1.83 - 1.83 Rallis India Ltd. 0.50 - 0.50

Petronet Lng Ltd. 1.70 - 1.70 Gland Pharma Ltd. 0.49 - 0.49

• AUM as on May 31, 2024 Biocon Ltd. 1.70 - 1.70 K.P.R. Mill Ltd. 0.48 - 0.48

` 30,576.75 Crores Mahindra & Mahindra Ltd. 1.51 - 1.51 Timken India Ltd. 0.47 - 0.47

Cipla Ltd. 1.35 - 1.35 Carborundum Universal Ltd. 0.47 - 0.47

• Fund Manager: Mr. Dinesh Balachandran & Tech Mahindra Ltd. 1.31 - 1.31 Sanofi India Ltd. 0.46 - 0.46

ICICI Prudential Life Insurance Company Ltd. 1.31 - 1.31 Bosch Ltd. 0.45 - 0.45

Mr. Pradeep Kesavan (overseas investments) Kotak Mahindra Bank Ltd. 1.28 1.00 2.28 Prism Johnson Ltd. 0.42 - 0.42

Managing Since: ITC Ltd. 1.28 - 1.28 Coforge Ltd. 0.40 - 0.40

ACC Ltd. 1.20 - 1.20 Neogen Chemicals Ltd. 0.39 - 0.39

Mr. Dinesh May-2018 FSN E-Commerce Ventures Ltd. 1.17 - 1.17 Sula Vineyards Ltd. 0.35 - 0.35

Mr. Pradeep Kesavan Dec-2023 Cummins India Ltd. 1.15 - 1.15 V-Guard Industries Ltd. 0.33 - 0.33

Power Grid Corporation Of India Ltd. 1.14 - 1.14 Ingersoll Rand (India) Ltd. 0.33 - 0.33

Total Experience: Hindalco Industries Ltd. 1.13 - 1.13 Gateway Distriparks Ltd. 0.32 - 0.32

Mr. Dinesh Over 21 Years CESC Ltd. 1.05 - 1.05 Max Financial Services Ltd. 0.26 - 0.26

Life Insurance Corporation Of India 1.03 - 1.03 Aurobindo Pharma Ltd. 0.20 - 0.20

Mr. Pradeep Kesavan Over 18 years National Aluminium Company Ltd. 0.99 - 0.99 Tube Investments Of India Ltd. 0.17 - 0.17

• First Tier Benchmark: S&P BSE 500 TRI Aster Dm Healthcare Ltd. 0.98 - 0.98 Greenply Industries Ltd. 0.17 - 0.17

The Federal Bank Ltd. 0.97 - 0.97 Motherson Sumi Wiring India Ltd. 0.16 - 0.16

• Exit Load: Tata Motors Ltd. 0.97 - 0.97 Automotive Axles Ltd. 0.13 - 0.13

For exit within 1 year from the date of allotment - G R Infra Projects Ltd. 0.95 - 0.95 Prataap Snacks Ltd. 0.08 - 0.08

Equitas Small Finance Bank Ltd. 0.91 - 0.91 Dabur India Ltd. 0.08 0.75 0.83

1 %; Delhivery Ltd. 0.90 - 0.90 Finolex Industries Ltd. 0.07 - 0.07

For exit after 1 year from the date of allotment - Indian Oil Corporation Ltd. 0.88 - 0.88 Tata Technologies Ltd. 0.06 - 0.06

NHPC Ltd. 0.83 - 0.83 NMDC Steel Ltd. 0.05 - 0.05

Nil. NMDC Ltd. 0.81 - 0.81 Nifty Index 27-06-2024 - 2.15 2.15

• Entry Load: N.A. HDFC Asset Management Co. Ltd. 0.80 - 0.80 Bank Nifty Index 26-06-2024 - 5.93 5.93

Grasim Industries Ltd. 0.80 - 0.80 Total 78.25 9.62 87.87

• Plans Available: Regular, Direct Maruti Suzuki India Ltd. 0.79 - 0.79 Foreign Equity Shares

• Options: Growth, IDCW Bharti Hexacom Ltd. 0.79 - 0.79 Cognizant Technology Solutions Corporation 1.79 - -

Info Edge (India) Ltd. 0.77 - 0.77 EPAM Systems Inc 0.85 - -

• SIP Bank Of India 0.77 - 0.77 Total 2.64 - -

Any Day SIP’ Facility - is available for Monthly, Ashok Leyland Ltd. 0.77 - 0.77 Treasury Bills

Quarterly, Semi-Annual and Annual frequencies Infosys Ltd. 0.76 - 0.76 91 Day T-Bill 13.06.24 1.63 - -

Coromandel International Ltd. 0.76 - 0.76 182 Day T-Bill 01.08.24 1.62 - -

through electronic mode like OTM / Debit Hero Motocorp Ltd. 0.75 - 0.75 91 Day T-Bill 25.07.24 0.97 - -

Mandate. Default SIP date will be 10th. In case the Mankind Pharma Ltd. 0.74 - 0.74 Total 4.22 - -

SIP due date is a Non Business Day, then the Voltas Ltd. 0.73 -0.23 0.50 Real Estate Investment Trust

United Spirits Ltd. 0.72 - 0.72 Embassy Office Parks Reit 0.77 - -

immediate following Business Day will be Mahindra & Mahindra Financial Services Ltd. 0.71 0.02 0.73 Total 0.77 - -

considered for SIP processing. Alkem Laboratories Ltd. 0.71 - 0.71 Cash, Cash Equivalents And Others 4.50 - -

Daily - Minimum 500 & in multiples of 1 Bharti Airtel Ltd. 0.70 - 0.70 Grand Total 100.00

Tata Motors Ltd. - Dvr 0.69 - 0.69

thereafter for a minimum of 12 instalments. Ashiana Housing Ltd. 0.69 - 0.69

(Kindly refer notice cum addendum dated June JSW Infrastructure Ltd. 0.68 - 0.68

02, 2020 for further details)

Weekly - Minimum ` 1000 & in multiples of ` 1

thereafter for a minimum of 6 instalments. (or)

Minimum 500 & in multiples of 1 thereafter for a PORTFOLIO CLASSIFICATION BY PORTFOLIO CLASSIFICATION BY

minimum of 12 instalments.

Monthly - Minimum ` 1000 & in multiples of ` 1 INDUSTRY ALLOCATION (%) ASSET ALLOCATION (%)

thereafter for minimum six months (or) minimum

` 500 & in multiples of ` 1 thereafter for Financial Services 18.90

minimum one year. Oil, Gas & Consumable Fuels 10.42

Quarterly - Minimum ` 1500 & in multiples of ` 1 Healthcare 7.15 4.50

thereafter for minimum one year. Automobile And Auto Components 5.62 9.62

Semi Annual - Minimum ` 3000 & in multiples of Metals & Mining 5.35

` 1 thereafter for a minimum of 4 installments. 0.77

Information Technology 5.17 2.64

Annual - Minimum ` 5000 & in multiples of ` 1 Capital Goods 5.08 38.44

thereafter for a minimum of 4 installments. Power 4.91

• Minimum Investment Sovereign 4.22

` 5000 & in multiples of ` 1 13.87

Construction Materials 3.47

• Additional Investment Consumer Durables 3.21

` 1000 & in multiples of ` 1

Fast Moving Consumer Goods 2.51

Quantitative Data Consumer Services 1.94

Services 1.90

25.94

# Chemicals 1.65

Standard Deviation : 11.58%

#

Telecommunication 1.49

Beta : 0.81 Realty 1.46

#

Sharpe Ratio : 1.60 Construction 0.95 Large Cap Smallcap Midcap Foreign Equity Shares

Portfolio Turnover* Textiles 0.48

Cash, Cash Equivalents, And Others Derivatives

Equity Turnover : 0.18 Derivatives 9.62

Cash, Cash Equivalents And Others 4.50 Real Estate Investment Trust

Total Turnover : 1.54

Total Turnover = Equity + Debt + Derivatives

#

Source: CRISIL Fund Analyser

*Portfolio Turnover = lower of total sale or total

SBI Contra Fund

purchase for the last 12 months (including equity This product is suitable for investors who are seeking^:

derivatives) upon Avg. AUM of trailing twelve months. • Long term capital appreciation.

Risk Free rate: FBIL Overnight Mibor rate (6.76% as on • Investments in a diversified portfolio of equity and equity

31st May 2024) Basis for Ratio Calculation: 3 Years

Monthly Data Points related securities following a contrarian investment strategy.

Ratios are computed using Total Return Index (TRI) in Investors understand that their principal ^Investors should consult their financial advisers if in doubt

terms of Para 6.14 of Master Circular for Mutual will be at Very High risk about whether the product is suitable for them.

Funds dated May 19, 2023

17

You might also like

- I. Case BackgroundDocument7 pagesI. Case BackgroundHiya BhandariBD21070No ratings yet

- Boston Red Sox Spring Training Decision Case StudyDocument3 pagesBoston Red Sox Spring Training Decision Case StudyJairo Ojeda0% (1)

- Export Packing, Marking and LabelingDocument3 pagesExport Packing, Marking and LabelingDeanne Lorraine V. Guinto100% (2)

- SBI Contra Fund Factsheet April 2024Document1 pageSBI Contra Fund Factsheet April 2024skbmnnitNo ratings yet

- SBI Contra Fund FactsheetDocument1 pageSBI Contra Fund FactsheetAman VermaNo ratings yet

- SBI Contra Fund FactsheetDocument1 pageSBI Contra Fund FactsheetAkshad KhedkarNo ratings yet

- SBI Large Midcap Fund Factsheet April 2024Document1 pageSBI Large Midcap Fund Factsheet April 2024Hitesh MiskinNo ratings yet

- SBI Bluechip Fund - One PagerDocument1 pageSBI Bluechip Fund - One PagerjoycoolNo ratings yet

- Sbi Large and Midcap Fund Factsheet (June-2021!2!1)Document1 pageSbi Large and Midcap Fund Factsheet (June-2021!2!1)Gaurav NagpalNo ratings yet

- Sbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFDocument1 pageSbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFavinash sengarNo ratings yet

- SBI Long Term Equity Fund FactsheetDocument1 pageSBI Long Term Equity Fund FactsheetAwakening with EnlightenmentNo ratings yet

- SBI Consumption Opportunities Fund Factsheet April 2024Document1 pageSBI Consumption Opportunities Fund Factsheet April 2024Hitesh MiskinNo ratings yet

- SBI Multi Asset Allocation Fund FactsheetDocument1 pageSBI Multi Asset Allocation Fund FactsheetamanNo ratings yet

- Sbi Mutual FundDocument1 pageSbi Mutual Fundramana purushothamNo ratings yet

- Sbi Nifty Index Fund Factsheet (December-2020!13!11) PDFDocument1 pageSbi Nifty Index Fund Factsheet (December-2020!13!11) PDFSubscriptionNo ratings yet

- SBI Long Term Equity Fund Factsheet 62c6e895 82d5 4411 8714 6dfcec432a91Document1 pageSBI Long Term Equity Fund Factsheet 62c6e895 82d5 4411 8714 6dfcec432a91ja3mf29gNo ratings yet

- SBI Small Cap PDFDocument1 pageSBI Small Cap PDFJasmeet Singh NagpalNo ratings yet

- Sbi Focused Equity Fund Factsheet (May-2019!25!1)Document1 pageSbi Focused Equity Fund Factsheet (May-2019!25!1)Chandrasekar Attayampatty TamilarasanNo ratings yet

- SBI Small Cap Fund FactsheetDocument1 pageSBI Small Cap Fund FactsheetPalam PvrNo ratings yet

- SBI Magnum Global Fund FactsheetDocument1 pageSBI Magnum Global Fund FactsheetHitesh MiskinNo ratings yet

- Sbi Banking and Financial Services Fund Factsheet (August-2021-415-1)Document1 pageSbi Banking and Financial Services Fund Factsheet (August-2021-415-1)charan ThakurNo ratings yet

- HDFC MF Factsheet - July 2021 - 3-55-56Document2 pagesHDFC MF Factsheet - July 2021 - 3-55-56daveNo ratings yet

- cas_summary_report_2024_06_27_002658Document3 pagescas_summary_report_2024_06_27_002658Vj SinghNo ratings yet

- Sbi Magnum Taxgain Scheme Factsheet (March-2017!3!1)Document1 pageSbi Magnum Taxgain Scheme Factsheet (March-2017!3!1)Saranya KrishnamurthyNo ratings yet

- DRL1 CRDocument3 pagesDRL1 CRpankaj_xaviersNo ratings yet

- Noble Tech Industries Private LimitedDocument3 pagesNoble Tech Industries Private Limitedkarthikeyan A INo ratings yet

- For The Worthy Regional Tax Office Islamabad: Chief Commissioner - IrDocument13 pagesFor The Worthy Regional Tax Office Islamabad: Chief Commissioner - IrUsman Shaukat KhanNo ratings yet

- Canara Robeco Emerging Equities PDFDocument1 pageCanara Robeco Emerging Equities PDFJasmeet Singh NagpalNo ratings yet

- SBI Smallcap Fund (1) 09162022Document4 pagesSBI Smallcap Fund (1) 09162022chandana kumar0% (1)

- ValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11Document4 pagesValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11jamsheer.aaNo ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- ValueResearchFundcard BarodaPioneerShortTermBondFund DirectPlan 2017may16Document4 pagesValueResearchFundcard BarodaPioneerShortTermBondFund DirectPlan 2017may16Achint KumarNo ratings yet

- Forest Development Corporation of Maharastra Ltd. Bramhapuri Forest Project Division, Bramhapuri Monthly Cash Account For The Month of April - 2022Document5 pagesForest Development Corporation of Maharastra Ltd. Bramhapuri Forest Project Division, Bramhapuri Monthly Cash Account For The Month of April - 2022Divisional Manager BramhapuriNo ratings yet

- 28october 2020 India DailyDocument169 pages28october 2020 India DailyPraveen MathewNo ratings yet

- SBI Magnum Income Fund FactsheetDocument1 pageSBI Magnum Income Fund FactsheetKripa Shankar TiwariNo ratings yet

- In Focus in Focus in Focus in Focus Technically Technically Technically TechnicallyDocument4 pagesIn Focus in Focus in Focus in Focus Technically Technically Technically TechnicallylalkarresearchNo ratings yet

- .Trashed 1691267349 OpeningbellDocument6 pages.Trashed 1691267349 Openingbellgerak52526No ratings yet

- ValueResearchFundcard AxisDynamicEquityFund RegularPlan 2019oct11Document4 pagesValueResearchFundcard AxisDynamicEquityFund RegularPlan 2019oct11ChittaNo ratings yet

- Solutions Oriented Scheme-Children'S Fund: Investment ObjectiveDocument1 pageSolutions Oriented Scheme-Children'S Fund: Investment Objectiveparvinder.singh02No ratings yet

- Cas Summary Report 2022 08 19 123504Document5 pagesCas Summary Report 2022 08 19 123504aman feriadNo ratings yet

- Revised 2024-2026 MTEFDocument7 pagesRevised 2024-2026 MTEFMayowa DurosinmiNo ratings yet

- Funds Update: IL&FS Group Related ExposuresDocument6 pagesFunds Update: IL&FS Group Related ExposuresAnuj SaxenaNo ratings yet

- Taxpayer Information Summary (TIS)Document3 pagesTaxpayer Information Summary (TIS)Karft RoyNo ratings yet

- India Daily 22082022 BKDocument71 pagesIndia Daily 22082022 BKRohan RustagiNo ratings yet

- CNVRG: Growth Opportunity in The Underpenetrated Fiber MarketDocument7 pagesCNVRG: Growth Opportunity in The Underpenetrated Fiber MarketJajahinaNo ratings yet

- Fundcard: Edelweiss Low Duration Fund - Direct PlanDocument4 pagesFundcard: Edelweiss Low Duration Fund - Direct PlanYogi173No ratings yet

- ValueResearchFundcard RelianceIncomeFund DirectPlan 2019jun15Document4 pagesValueResearchFundcard RelianceIncomeFund DirectPlan 2019jun15Phani VemuriNo ratings yet

- Cas Summary Report 2024 03 21 064120Document5 pagesCas Summary Report 2024 03 21 064120Arun KumarNo ratings yet

- KRChoksey Dharmaj Crop Guard IPO NoteDocument13 pagesKRChoksey Dharmaj Crop Guard IPO NoteMohammed Israr ShaikhNo ratings yet

- SBI Small and Mid Cap Fund FactsheetDocument1 pageSBI Small and Mid Cap Fund Factsheetfinal bossuNo ratings yet

- November 2010 India DailyDocument147 pagesNovember 2010 India DailymitbanNo ratings yet

- Daily Morning Note: Sebi Allows Declassification of Reit, Invit Sponsor StatusDocument8 pagesDaily Morning Note: Sebi Allows Declassification of Reit, Invit Sponsor StatussubashNo ratings yet

- General Instruction Manual: Accounting Policy, Methods & Systems DepartmentDocument15 pagesGeneral Instruction Manual: Accounting Policy, Methods & Systems DepartmentAldrien CabinteNo ratings yet

- ValueResearchFundcard MotilalOswalMOStFocusedMulticap35Fund RegularPlan 2017may03Document4 pagesValueResearchFundcard MotilalOswalMOStFocusedMulticap35Fund RegularPlan 2017may03vigneshNo ratings yet

- Mutual Fund Portfolio AnalysisDocument6 pagesMutual Fund Portfolio AnalysisIm CandlestickNo ratings yet

- ValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08Document4 pagesValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08pqwertyNo ratings yet

- Figures As On Sep 30,2020: Company/Issuer/Instrument Name Isin Units of Mutual FundsDocument30 pagesFigures As On Sep 30,2020: Company/Issuer/Instrument Name Isin Units of Mutual FundsAryata BhansaliNo ratings yet

- Fund Facts - HDFC Small Cap Fund - March 23Document2 pagesFund Facts - HDFC Small Cap Fund - March 23duttasahil19No ratings yet

- Fundcard: Baroda Pioneer Treasury Advantage Fund - Direct PlanDocument4 pagesFundcard: Baroda Pioneer Treasury Advantage Fund - Direct Planravinandan_pNo ratings yet

- Morning - India Motilal Oswal ResearchDocument16 pagesMorning - India Motilal Oswal Researchvikalp123123No ratings yet

- SEBI Portfolio - Feb 2020Document347 pagesSEBI Portfolio - Feb 2020Tapan LahaNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Destination Zero An Action Plan For Shipping CeosDocument11 pagesDestination Zero An Action Plan For Shipping CeosromainNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDRISHTI MEHRANo ratings yet

- Od 429360170470758100Document1 pageOd 429360170470758100acharyarajendra945No ratings yet

- Academics Committee: Fundamentals of Accountancy, Business & Management 1 Preliminary Exam ReviewerDocument5 pagesAcademics Committee: Fundamentals of Accountancy, Business & Management 1 Preliminary Exam ReviewerAlexa Abary100% (1)

- Public Opinion Poll: Residents of MongoliaDocument55 pagesPublic Opinion Poll: Residents of Mongoliashinkaron88No ratings yet

- Modul GE F35 MultilinDocument8 pagesModul GE F35 MultilinMr IlchamNo ratings yet

- Sameet Dhedhi FinanceDocument2 pagesSameet Dhedhi FinanceSmeet JasoliyaNo ratings yet

- Bharti Airtel Limited: by Chaitali Karate Roll No 50Document29 pagesBharti Airtel Limited: by Chaitali Karate Roll No 50pavanwaniNo ratings yet

- Role of Central and State Government in Promoting EntrepreneurshipDocument11 pagesRole of Central and State Government in Promoting EntrepreneurshipShruti SaxenaNo ratings yet

- Wa0015Document5 pagesWa0015Mithun PrinceNo ratings yet

- SQ Ack 71186Document1 pageSQ Ack 71186Iulian BarbuNo ratings yet

- 2 Creativity Innovation and EntrepreneurshipDocument28 pages2 Creativity Innovation and EntrepreneurshipNarayan MaharjanNo ratings yet

- HRD Final Exam QuestionDocument4 pagesHRD Final Exam QuestionDMacTeejayNo ratings yet

- Unit 16 Product LaunchDocument5 pagesUnit 16 Product LaunchSyrill CayetanoNo ratings yet

- Tran 10781367-1 PDFDocument1 pageTran 10781367-1 PDFNaeem SaiNo ratings yet

- Tem C1 PDFDocument6 pagesTem C1 PDFmae KuanNo ratings yet

- SPMT 4 Axle Line DrawingDocument1 pageSPMT 4 Axle Line DrawingVăn TháiNo ratings yet

- Permission Certificate: Nust Saddle Club Membership FormDocument2 pagesPermission Certificate: Nust Saddle Club Membership FormOsama MaqsoodNo ratings yet

- Dec 2018 VI Program - Participant Profile BookDocument24 pagesDec 2018 VI Program - Participant Profile BookJBNo ratings yet

- Basic Concept - : Goods and Services Tax MCQDocument103 pagesBasic Concept - : Goods and Services Tax MCQBighnesh Prasad SahooNo ratings yet

- Larsen & Toubro Infotech's Hostile Bid For Mindtree LTD.: Much Ado About Nothing! A Teaching CaseDocument10 pagesLarsen & Toubro Infotech's Hostile Bid For Mindtree LTD.: Much Ado About Nothing! A Teaching CaseAbhay ShuklaNo ratings yet

- Feasibility Study of Using Nipa Palm Sap As An Alternative of Sugarcane For Making Sugar.Document154 pagesFeasibility Study of Using Nipa Palm Sap As An Alternative of Sugarcane For Making Sugar.Ruben Osila Dela CruzNo ratings yet

- How To Build An Email List On Ebay PDF Ebook Make Money PDFDocument2 pagesHow To Build An Email List On Ebay PDF Ebook Make Money PDFNyasclemNo ratings yet

- Indirect Tax Revision Notes-CS Exe June 23 Lyst3130Document56 pagesIndirect Tax Revision Notes-CS Exe June 23 Lyst3130tskpestsolutions.chennaiNo ratings yet

- Balance Sheet of Mindtree - in Rs. Cr.Document4 pagesBalance Sheet of Mindtree - in Rs. Cr.shraddhamalNo ratings yet

- Your Quick Guide To ReelsDocument10 pagesYour Quick Guide To ReelsMania AdamiakNo ratings yet

- Case 3 - Wallys Billboard Sign SupplyDocument2 pagesCase 3 - Wallys Billboard Sign SupplyDzulija TalipanNo ratings yet