Professional Documents

Culture Documents

Mandatory-Contributions

Mandatory-Contributions

Uploaded by

pao reyesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mandatory-Contributions

Mandatory-Contributions

Uploaded by

pao reyesCopyright:

Available Formats

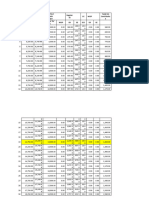

SSS Contribution Table

Range of Monthly Salary Credit Regular EC WISP

Compensation

From To Regular / WISP ER EE ECC ER EE

EC

1 0 4,249.99 4,000.00 0 380.00 180.00 10 0 0

2 4,250.00 4,749.99 4,500.00 0 427.50 202.50 10 0 0

3 4,750.00 5,249.99 5,000.00 0 475.00 225.00 10 0 0

4 5,250.00 5,749.99 5,500.00 0 522.50 247.50 10 0 0

5 5,750.00 6,249.99 6,000.00 0 570.00 270.00 10 0 0

6 6,250.00 6,749.99 6,500.00 0 617.50 292.50 10 0 0

7 6,750.00 7,249.99 7,000.00 0 665.00 315.00 10 0 0

8 7,250.00 7,749.99 7,500.00 0 712.50 337.50 10 0 0

9 7,750.00 8,249.99 8,000.00 0 760.00 360.00 10 0 0

10 8,250.00 8,749.99 8,500.00 0 807.50 382.50 10 0 0

11 8,750.00 9,249.99 9,000.00 0 855.00 405.00 10 0 0

12 9,250.00 9,749.99 9,500.00 0 902.50 427.50 10 0 0

13 9,750.00 10,249.99 10,000.00 0 950.00 450.00 10 0 0

14 10,250.00 10,749.99 10,500.00 0 997.50 472.50 10 0 0

15 10,750.00 11,249.99 11,000.00 0 1,045.00 495.00 10 0 0

16 11,250.00 11,749.99 11,500.00 0 1,092.50 517.50 10 0 0

17 11,750.00 12,249.99 12,000.00 0 1,140.00 540.00 10 0 0

18 12,250.00 12,749.99 12,500.00 0 1,187.50 562.50 10 0 0

19 12,750.00 13,249.99 13,000.00 0 1,235.00 585.00 10 0 0

20 13,250.00 13,749.99 13,500.00 0 1,282.50 607.50 10 0 0

21 13,750.00 14,249.99 14,000.00 0 1,330.00 630.00 10 0 0

22 14,250.00 14,749.99 14,500.00 0 1,377.50 652.50 10 0 0

23 14,750.00 15,249.99 15,000.00 0 1,425.00 675.00 30 0 0

24 15,250.00 15,749.99 15,500.00 0 1,472.50 697.50 30 0 0

25 15,750.00 16,249.99 16,000.00 0 1,520.00 720.00 30 0 0

26 16,250.00 16,749.99 16,500.00 0 1,567.50 742.50 30 0 0

27 16,750.00 17,249.99 17,000.00 0 1,615.00 765.00 30 0 0

28 17,250.00 17,749.99 17,500.00 0 1,662.50 787.50 30 0 0

29 17,750.00 18,249.99 18,000.00 0 1,710.00 810.00 30 0 0

30 18,250.00 18,749.99 18,500.00 0 1,757.50 832.50 30 0 0

31 18,750.00 19,249.99 19,000.00 0 1,805.00 855.00 30 0 0

32 19,250.00 19,749.99 19,500.00 0 1,852.50 877.50 30 0 0

33 19,750.00 20,249.99 20,000.00 0 1,900.00 900.00 30 0 0

34 20,250.00 20,749.99 20,000.00 500 1,900.00 900.00 30 47.50 22.50

35 20,750.00 21,249.99 20,000.00 1,000.00 1,900.00 900.00 30 95.00 45.00

36 21,250.00 21,749.99 20,000.00 1,500.00 1,900.00 900.00 30 142.50 67.50

37 21,750.00 22,249.99 20,000.00 2,000.00 1,900.00 900.00 30 190.00 90.00

38 22,250.00 22,749.99 20,000.00 2,500.00 1,900.00 900.00 30 237.50 112.50

39 22,750.00 23,249.99 20,000.00 3,000.00 1,900.00 900.00 30 285.00 135.00

40 23,250.00 23,749.99 20,000.00 3,500.00 1,900.00 900.00 30 332.50 157.50

41 23,750.00 24,249.99 20,000.00 4,000.00 1,900.00 900.00 30 380.00 180.00

42 24,250.00 24,749.99 20,000.00 4,500.00 1,900.00 900.00 30 427.50 202.50

43 24,750.00 25,249.99 20,000.00 5,000.00 1,900.00 900.00 30 475.00 225.00

44 25,250.00 25,749.99 20,000.00 5,500.00 1,900.00 900.00 30 522.50 247.50

45 25,750.00 26,249.99 20,000.00 6,000.00 1,900.00 900.00 30 570.00 270.00

46 26,250.00 26,749.99 20,000.00 6,500.00 1,900.00 900.00 30 617.50 292.50

47 26,750.00 27,249.99 20,000.00 7,000.00 1,900.00 900.00 30 665.00 315.00

48 27,250.00 27,749.99 20,000.00 7,500.00 1,900.00 900.00 30 712.50 337.50

49 27,750.00 28,249.99 20,000.00 8,000.00 1,900.00 900.00 30 760.00 360.00

50 28,250.00 28,749.99 20,000.00 8,500.00 1,900.00 900.00 30 807.50 382.50

51 28,750.00 29,249.99 20,000.00 9,000.00 1,900.00 900.00 30 855.00 405.00

52 29,250.00 29,749.99 20,000.00 9,500.00 1,900.00 900.00 30 902.50 427.50

53 29,750.00 Over 20,000.00 10,000.00 1,900.00 900.00 30 950.00 450.00

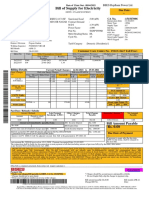

HDMF Contribution (Pag-IBIG)

Contribution Rate Monthly Compensation Employee Employer (if any)

1% P1,500 and Below 1% 2%

2% Over P1,500 2% 2%

Philhealth Contribution

The Contribution table for year 2024 – 2025

Year Monthly Basic Salary Premium Rate Monthly Premium

P10,000 5% P500

2024 ‐ 2025 P10,000.01 ‐ 99,999.99 5% P500 ‐ P5,000

P100,000 5% P5000

Withholding Taxes

The monthly withholding tax table effective January 1, 2023 onwards.

Monthly 1 2 3 4 5 6

₱20,833 ₱20,833

Compensation ₱33,333 - ₱66,667 - ₱166,667 - ₱666,667

and -

Range ₱66,666 ₱166,666 ₱666,666 and above

below ₱33,332

0.00 ₱1,875.00 ₱8,541.80

Prescribed ₱33,541.80 ₱183,541.80

+15% +20% +25%

Withholding 0 +30% over +35% over

over over over

Tax ₱166,667 ₱666,667

₱20,833 ₱33,333 ₱66,667

You might also like

- Vasanth - Utility BillDocument2 pagesVasanth - Utility Billvasanth005No ratings yet

- MTN Invoice - Oct 2021Document2 pagesMTN Invoice - Oct 2021Nana Kwame MensahNo ratings yet

- PPP Latur OverviewDocument9 pagesPPP Latur OverviewAjit AgarwalNo ratings yet

- 2ND Mandatory-Deduction-For-2023Document2 pages2ND Mandatory-Deduction-For-2023EgieMae GarcesNo ratings yet

- 2023 SSS TableDocument2 pages2023 SSS TableJanielee HernandezNo ratings yet

- Final IannaDocument83 pagesFinal IannaJuzetteValerieSarceNo ratings yet

- Azucena MBCPayroll CalculatorDocument14 pagesAzucena MBCPayroll Calculatoracctg2012No ratings yet

- Payroll 2023 1Document19 pagesPayroll 2023 1Carl Dela CruzNo ratings yet

- Martin MBCPayroll CalculatorDocument12 pagesMartin MBCPayroll Calculatoracctg2012No ratings yet

- SSS Table 2014Document13 pagesSSS Table 2014Adrianne LaxamanaNo ratings yet

- Arnaez MBCPayroll CalculatorDocument12 pagesArnaez MBCPayroll Calculatoracctg2012No ratings yet

- SSS Contribution CalculatorDocument3 pagesSSS Contribution Calculatorcool08coolNo ratings yet

- SSS Contribution CalculatorDocument3 pagesSSS Contribution CalculatorJennifer Corpuz- GinesNo ratings yet

- 2023-SSS Contribution TableDocument5 pages2023-SSS Contribution TableJenn Torrente100% (1)

- 2023 Schedule of ContributionsDocument5 pages2023 Schedule of ContributionsDerick jorgeNo ratings yet

- Payroll Olazo MBCDocument8 pagesPayroll Olazo MBCacctg2012No ratings yet

- Chi Charon 101Document189 pagesChi Charon 101Aldrin EyanaNo ratings yet

- Concorde Billing May 1-8, 2011Document33 pagesConcorde Billing May 1-8, 2011Rhoda PasardozaNo ratings yet

- 2023 Contribution Rate TableDocument2 pages2023 Contribution Rate TableMyrick Mae B. RuizNo ratings yet

- Monthly Salary Credit Amount of Contribution Mandatory Provident Fund Employees CompensationDocument4 pagesMonthly Salary Credit Amount of Contribution Mandatory Provident Fund Employees CompensationAlyanna Marie MallorcaNo ratings yet

- Premium Contribution Table - Employed - PhilHealthDocument1 pagePremium Contribution Table - Employed - PhilHealthJohny Lou LuzaNo ratings yet

- 04handout2 CostAcctgRecitationDocument3 pages04handout2 CostAcctgRecitationDummy GoogleNo ratings yet

- Monthly Cash MonitoringDocument14 pagesMonthly Cash MonitoringEden Aguilar PebidaNo ratings yet

- SimuladorCR AHDocument7 pagesSimuladorCR AHNohelia Tito ZelaNo ratings yet

- Worksheet in Basis 2021-22 BudgetDocument9 pagesWorksheet in Basis 2021-22 BudgetChief Of AuditNo ratings yet

- SSS CIR New Contribution Schedule - ER and EE - 22dec20 - 521pm 1Document1 pageSSS CIR New Contribution Schedule - ER and EE - 22dec20 - 521pm 1Marienhela MeriñoNo ratings yet

- F&a Cash Collection Report For October 2022Document5 pagesF&a Cash Collection Report For October 2022Esther AkpanNo ratings yet

- Philippine Health C Rporation: Philheal CircularDocument2 pagesPhilippine Health C Rporation: Philheal CircularEman MayugaNo ratings yet

- Empresa " CARLITOS S.A.C" Libro Mayor - Agosto 2015Document4 pagesEmpresa " CARLITOS S.A.C" Libro Mayor - Agosto 2015mirian huancaNo ratings yet

- Makauno Co.: Semi-Monthly Payroll August 1-15, 2020Document11 pagesMakauno Co.: Semi-Monthly Payroll August 1-15, 2020Chincel G. ANINo ratings yet

- Cronograma Interes SimpleDocument12 pagesCronograma Interes SimpleCristian L Mendoza AsenciosNo ratings yet

- Ea - 2 2 02 0202020202020202020202Document41 pagesEa - 2 2 02 0202020202020202020202Loydifer ..No ratings yet

- Sunshine Hospitality: Salary (P.M.) Net Salary Working DaysDocument7 pagesSunshine Hospitality: Salary (P.M.) Net Salary Working DayssuneelstarNo ratings yet

- CPSC - TruckingDocument32 pagesCPSC - TruckingSari Sari Store VideoNo ratings yet

- Jam Corporation: InformationDocument35 pagesJam Corporation: InformationMon CuiNo ratings yet

- Laboratorio 5Document9 pagesLaboratorio 5Brajham Felix Alberto GarayNo ratings yet

- Fty RTG GHHH HHHHDocument7 pagesFty RTG GHHH HHHHaudicontableNo ratings yet

- School Canteen Records v2 TemplateDocument34 pagesSchool Canteen Records v2 TemplateYeshua Yesha100% (1)

- 5 ReportesDocument2 pages5 ReportesCRESTONES FRUTAS Y VERDURASNo ratings yet

- Days Date Invest P/L Cent Profit / Loss Net BalanceDocument10 pagesDays Date Invest P/L Cent Profit / Loss Net Balanceadv mishraNo ratings yet

- Range of CompensationDocument4 pagesRange of Compensationjasminejazz54321No ratings yet

- Makati Affiliates: Premium ScheduleDocument2 pagesMakati Affiliates: Premium Scheduleapi-25886697No ratings yet

- Employee Id No. Name of Employee: TotalDocument15 pagesEmployee Id No. Name of Employee: TotalRoldan Arca PagaposNo ratings yet

- Analise Financeira Maio 2023Document1 pageAnalise Financeira Maio 2023Gustavo Martins KnoppNo ratings yet

- Business Math PraticeDocument12 pagesBusiness Math PraticeJames CorpuzNo ratings yet

- SSS Table 2021Document2 pagesSSS Table 2021Ding CostaNo ratings yet

- Revised Withholding Tax Table Effective January 1, 2018: Semi-Monthly 1 2 3 4 5 6Document3 pagesRevised Withholding Tax Table Effective January 1, 2018: Semi-Monthly 1 2 3 4 5 6GwenNo ratings yet

- Payroll AccountingDocument26 pagesPayroll AccountingBeboy LacreNo ratings yet

- Rekap BcaDocument4 pagesRekap BcaManyol RFJNo ratings yet

- Hindustan Unilever LTD.: Cash Flow Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. MillionDocument2 pagesHindustan Unilever LTD.: Cash Flow Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. Millionandrew garfieldNo ratings yet

- Egv Entertainment Co.,Ltd Majorcineplex Co.,Ltd.: PAY - ACCOUNT.234-0-2485-6 PAY ACCOUNT 223-0-36814-0 GV กบขDocument8 pagesEgv Entertainment Co.,Ltd Majorcineplex Co.,Ltd.: PAY - ACCOUNT.234-0-2485-6 PAY ACCOUNT 223-0-36814-0 GV กบขhoneypuengNo ratings yet

- Valores Da Conta Outrem 2019Document6 pagesValores Da Conta Outrem 2019Garcia AntónioNo ratings yet

- BC XCDocument6 pagesBC XCKaren Sofía Villa RealNo ratings yet

- 100 Days Challenge Boom and CrashDocument4 pages100 Days Challenge Boom and CrashIsheanesu MusakwaNo ratings yet

- Aguilar Payroll CalculatorDocument27 pagesAguilar Payroll Calculatoracctg2012No ratings yet

- Book 1Document13 pagesBook 1Bea Dela PeniaNo ratings yet

- KjasbflksnfDocument18 pagesKjasbflksnfCristopher IanNo ratings yet

- Base - Proy 2Document16 pagesBase - Proy 2Ivan Fernando Herrera RodriguezNo ratings yet

- Payroll (VLOOKUP, Validation)Document8 pagesPayroll (VLOOKUP, Validation)into the unknownNo ratings yet

- Pasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Document6 pagesPasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Aljon DagalaNo ratings yet

- Emilie Payroll and ChequeDocument5 pagesEmilie Payroll and ChequeEmilie JuneNo ratings yet

- Profitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019From EverandProfitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019No ratings yet

- State Bank of India: Driving Financial Excellence and Empowering India'S EconomyDocument18 pagesState Bank of India: Driving Financial Excellence and Empowering India'S Economybhavak bajajNo ratings yet

- PIB Sutra - October 2022Document43 pagesPIB Sutra - October 2022raj100% (1)

- Total Quality Management: - Customer Satisfaction - Employee Involvement - Process ApproachDocument22 pagesTotal Quality Management: - Customer Satisfaction - Employee Involvement - Process ApproachgerryztNo ratings yet

- 4.1 Case Study Based AssignmentDocument4 pages4.1 Case Study Based AssignmentfaysalNo ratings yet

- China The Next SuperpowerDocument3 pagesChina The Next SuperpowerJustin KatanaNo ratings yet

- Opec 2Document21 pagesOpec 2Suleiman BaruniNo ratings yet

- MS Excel Workshop - One Day TrainingDocument11 pagesMS Excel Workshop - One Day Trainingm60347406No ratings yet

- Monzo - Bank - Statement - 2023 11 01 2023 11 07 - 528Document5 pagesMonzo - Bank - Statement - 2023 11 01 2023 11 07 - 528helenfloresbakeryNo ratings yet

- Electricity Bill AprilDocument1 pageElectricity Bill Aprilyouvsyou333No ratings yet

- Financiele-Verslaggeving 1664Document231 pagesFinanciele-Verslaggeving 1664Ştefania FcSbNo ratings yet

- Marketing Strategies: Michael Karl M. Barnuevo, MbaDocument26 pagesMarketing Strategies: Michael Karl M. Barnuevo, MbaWilnerNo ratings yet

- Aggregate (Sales & Operations) PlanningDocument23 pagesAggregate (Sales & Operations) Planning199388No ratings yet

- New-Product Development and Product Life-Cycle StrategiesDocument21 pagesNew-Product Development and Product Life-Cycle StrategiesThenmozhi TandabanyNo ratings yet

- Configurations of Desire in THDocument188 pagesConfigurations of Desire in THlpNo ratings yet

- Digital Marketing Analysis On UbuyDocument9 pagesDigital Marketing Analysis On UbuyjeffmeyertNo ratings yet

- Company BackgroundDocument2 pagesCompany BackgroundMary Grace Dela CruzNo ratings yet

- 05 Activity 1 BAdoneDocument1 page05 Activity 1 BAdoneTyron Franz AnoricoNo ratings yet

- Chapter2 - Application of Demand and SupplyDocument45 pagesChapter2 - Application of Demand and SupplyMelanie Cruz ConventoNo ratings yet

- Chapter 21 - Financial GlobalizationDocument10 pagesChapter 21 - Financial GlobalizationKatrizia FauniNo ratings yet

- Unilever Palm Oil Suppliers 2021Document13 pagesUnilever Palm Oil Suppliers 2021ferdial2005No ratings yet

- Cost Management of Construction Projects Using BIM TechnologyDocument4 pagesCost Management of Construction Projects Using BIM TechnologyShreeya SNo ratings yet

- C ChanalDocument2 pagesC ChanalRj TechNo ratings yet

- Adobe Scan Jul 25, 2023Document7 pagesAdobe Scan Jul 25, 2023Animated TamashaNo ratings yet

- How Can Pakistan Reduce Foreign DebtDocument2 pagesHow Can Pakistan Reduce Foreign DebtFarah KhanNo ratings yet

- Nkrumah NeocolonialismDocument205 pagesNkrumah Neocolonialismabdelrehman.almNo ratings yet

- MGMT2023-Lecture 1-Intro To Financial ManagementDocument23 pagesMGMT2023-Lecture 1-Intro To Financial ManagementIsmadth2918388No ratings yet

- AST Seatwork - 05 15 2021Document6 pagesAST Seatwork - 05 15 2021Joshua UmaliNo ratings yet