Professional Documents

Culture Documents

FMTS SampleExam(Q) Befdc3b7121dcac69821a469dca3c331

FMTS SampleExam(Q) Befdc3b7121dcac69821a469dca3c331

Uploaded by

attacker1235Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FMTS SampleExam(Q) Befdc3b7121dcac69821a469dca3c331

FMTS SampleExam(Q) Befdc3b7121dcac69821a469dca3c331

Uploaded by

attacker1235Copyright:

Available Formats

AQ004-3-2 FMTS Final Exam Page 1 of 3

ANSWER ALL QUESTIONS (TOTAL 100 MARKS)

QUESTION 1 (20 marks)

(a) Marty has been offered an injury settlement of RM10,000 payable in three years.

Calculate the present value of injury settlement is if the compound interest rate is 5%.

(3 marks)

(b) Finance company loans money at 20% interest p.a. Calculate the effective monthly

interest rate.

(3 marks)

(c) A man stipulates in his will that RM50,000 from his estate is to be placed in a fund

from which his three daughters are each to receive the same amount when aged 21.

When the man dies the girls are aged 19, 15 and 13. Find the amount each of them will

receive, if the fund earns interest at 12% compounded half yearly.

(7 marks)

(d) John is repaying a debt with payments of RM250 a month. If he misses his payments

for July, August, September, and October, determine the payment required in

November to put him back on schedule, given that the interest is at 14.4% compounded

monthly.

(7 marks)

QUESTION 2 (20 marks)

(a) Mrs Wong changes employers at age 46. She is given RM8500 as her vested benefits in

the company’s pension plans. She invests this money in a registered retirement savings

plan paying 8% annual interest and leaves it there until her ultimate retirement at age

60. She plans 25 annual withdrawals from this fund, the first on her 61st birthday. Find

the size of these withdrawals.

(4 marks)

(b) A parcel of land valued at RM35,000 is sold for a down payment of RM15,000. The

buyer agrees to pay the balance with interest rate of 12% compounded monthly by

paying RM500 per month, for as long as necessary. The first payment is due 2 years

from now. Find the number of payments needed to settle the borrowed amount and the

value of the final payment.

(7 marks)

(c) The Andersons borrow RM15,000 to buy a car. The loan will be repaid over three

years, with monthly payments at 6% interest compounded monthly. Find the total

interest paid in 12 months of the second year.

(9 marks)

QUESTION 3 (20 marks)

(a) A loan of RM10000 is to be settled in one lump sum at the end of year 5. Interest of

10% is to be paid to the finance company separately over the 5 years. Assume first

payment is going to start one period away, find the equal payments to the fund if the

sinking fund earns interest at 8%.

(4 marks)

Level 2 Asia Pacific University of Technology & Innovation YYYYMMDD

AQ004-3-2 FMTS Final Exam Page 2 of 3

(b) Assume that you have a thirty-year mortgage for $200,000 that carries an interest rate

of 9% per annum. The mortgage was taken three years ago. Since then, assume that

interest rate has fallen to 7.5% p.a. and you are thinking of refinancing. The cost of

refinancing is 2.5% of the loan outstanding, which will be inclusive of the loan amount.

Assume also that you can invest you funds at 6% p.a. compounded monthly

(i) Find the new monthly repayment if the loan is refinanced.

(11 marks)

(ii) If the savings made from the repayments every month is reinvested, what is the

present value of the investment?

(5 marks)

QUESTION 4 (20 marks)

(a) Dayang Inc is planning to make an investment of RM300,000 in one of the three

alternative shopping centers in Kedah. Each project's expected cash flows from the

investment are as follows (in RM):

Year Jaya Midi Teko

1 154,000 110,000 86,000

2 134,000 110,000 110,000

3 96,000 110,000 128,000

4 96,000 110,000 178,000

The company's cost of capital is 10% and these projects are mutually exclusive.

(i) Calculate the Net Present Value for the three projects and decide on the best

project.

(6 marks)

(ii) Find the internal rate of return for the best project.

(6 marks)

(b) The one-year forward rate of interest at time t = 1 year is 5% per annum effective. The

gross redemption yield of a two-year fixed interest stock issued at time t = 0, which

pays coupons of 3% per annum annually in arrear and redeemed at 102 is, 5.5% per

annum effective. The issue price at time t = 0 of a three-year fixed interest stock

bearing coupons of 10% per annum payable annually in arrear and redeemed at par is

RM108.9 per RM100 nominal.

(i) Calculate the one-year spot rate per annum effective at time t = 0.

(6 marks)

(ii) Calculate the one-year forward rate per annum effective at time t = 2 years.

(4 marks)

Level 2 Asia Pacific University of Technology & Innovation YYYYMMDD

AQ004-3-2 FMTS Final Exam Page 3 of 3

QUESTION 5 (20 marks)

You are considering the purchase of a 6-year bond, with a coupon rate of 8.5% per annum and

a par value of $1,000.00. The yield curve is flat at 10% per annum. The purchase price of the

bond is $934.67.

(a) Calculate the modified duration of the bond.

(6 marks)

(b) Calculate the approximate convexity of the bond.

(9 marks)

(c) Using the results in (a) and (b) calculate the change in bond price for a 2% increase in

yield.

(5 marks)

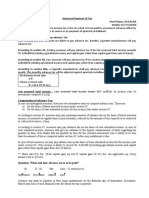

Financial Mathematics Formulae

1 Simple Interest 2 Compound Interest

FV = PV (1 + in ) FV = PV (1 + i )

n

FV FV

PV = PV = = FVv n

(1 + in) (1 + i ) n

3 Annuities (P = 1 p.a.) 4 Arithmetic Annuities (P = Q = 1 p.a.)

sn | =

(1 + i )n − 1 an | =

1− vn an − nv n sn − n

( Ia ) n = ( Is ) n =

i i i i

sn | = (1 + i ) sn |i an | = (1 + i )an | n − an

( Da ) n =

i

=

(1 + i )n − 1 1− vn n (1 + i ) n − sn

s n( m| ) (m ) an( m| ) = (m )

i i ( Ds ) n =

i

Level 2 Asia Pacific University of Technology & Innovation YYYYMMDD

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- McDonalds Franchise AgreementDocument15 pagesMcDonalds Franchise AgreementHoang ViNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- BSA2B Written Report Building and Loan Associations Non Stock Savings and Loan Associations and Trust CorporationsDocument11 pagesBSA2B Written Report Building and Loan Associations Non Stock Savings and Loan Associations and Trust CorporationsNerish Plaza100% (1)

- 102 QP 1003Document6 pages102 QP 1003api-3701114No ratings yet

- Exam FM QuestioonsDocument102 pagesExam FM Questioonsnkfran100% (2)

- Edu 2015 Exam FM Ques TheoryDocument44 pagesEdu 2015 Exam FM Ques TheoryLueshen WellingtonNo ratings yet

- Mba-III-Advanced Financial Management (14mbafm304) - NotesDocument48 pagesMba-III-Advanced Financial Management (14mbafm304) - NotesSyeda GazalaNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument5 pagesInstitute of Actuaries of India: ExaminationsdasNo ratings yet

- BBF201 - 03-Sept 2023 - Assignment 2 (Question)Document4 pagesBBF201 - 03-Sept 2023 - Assignment 2 (Question)Vera Wong PyNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument4 pagesInstitute of Actuaries of India: ExaminationsRochak JainNo ratings yet

- Maf253 Quiz Jan 2023 QDocument2 pagesMaf253 Quiz Jan 2023 QSyamimi Nabila100% (1)

- Universiti Teknologi Mara Final Assessment: Instructions To CandidatesDocument6 pagesUniversiti Teknologi Mara Final Assessment: Instructions To CandidatesINTAN NOOR AMIRA ROSDINo ratings yet

- Amended Jan 2022 BBF20103 Introduction To Financial Management A2QPDocument6 pagesAmended Jan 2022 BBF20103 Introduction To Financial Management A2QPJane HoNo ratings yet

- BSF 1102 - Principles of Finance - November 2022Document6 pagesBSF 1102 - Principles of Finance - November 2022JulianNo ratings yet

- July 2020 BBF20103 Introduction To Financial Management Assignment 2Document5 pagesJuly 2020 BBF20103 Introduction To Financial Management Assignment 2Muhamad SaifulNo ratings yet

- Model Paper Financial ManagementDocument6 pagesModel Paper Financial ManagementSandumin JayasingheNo ratings yet

- sFikv8tLO3DuTOB3I8bY 4762Document2 pagessFikv8tLO3DuTOB3I8bY 4762dipusharma4200No ratings yet

- (See Right Options & Solutions On The Next Sheet "Solution"Document17 pages(See Right Options & Solutions On The Next Sheet "Solution"nishiNo ratings yet

- Asc453 Financial MathematicsDocument4 pagesAsc453 Financial MathematicsNurFatihah Nadirah Noor AzlanNo ratings yet

- OIS CBSE GR-8 Answer Key Compound Interest PDFDocument6 pagesOIS CBSE GR-8 Answer Key Compound Interest PDFlavaramNo ratings yet

- TWO (2) Questions From SECTION B in The Answer Booklet Provided. All Question CarryDocument4 pagesTWO (2) Questions From SECTION B in The Answer Booklet Provided. All Question CarrynatlyhNo ratings yet

- BBCF4023 - MTDocument5 pagesBBCF4023 - MTbroken swordNo ratings yet

- Acs 304. Financial Mathematics IiDocument5 pagesAcs 304. Financial Mathematics IiKimondo KingNo ratings yet

- AFIN209 2018 Semester 1 Final Exam PDFDocument6 pagesAFIN209 2018 Semester 1 Final Exam PDFGeorge MandaNo ratings yet

- Part 1 - Problems: Instructor: Dr. Nazim Nouiehed INDE 301-Fall 2020 MidtermDocument3 pagesPart 1 - Problems: Instructor: Dr. Nazim Nouiehed INDE 301-Fall 2020 MidtermOrangeNo ratings yet

- Set A FinalDocument5 pagesSet A FinalHimanshu BohraNo ratings yet

- Sac 300: Financial Mathematics: Question 1 (30 Marks)Document4 pagesSac 300: Financial Mathematics: Question 1 (30 Marks)Anne Atieno NdoloNo ratings yet

- Topic 3 Revision PackDocument18 pagesTopic 3 Revision PackAyandaNo ratings yet

- Assignment 1 2019 PDFDocument2 pagesAssignment 1 2019 PDFAlice LaiNo ratings yet

- Mid TermAnswersDocument9 pagesMid TermAnswersMoulee DattaNo ratings yet

- 2019 7020 2CDocument3 pages2019 7020 2CekallajudeNo ratings yet

- BM Final ExamDocument10 pagesBM Final ExamMelaku WalelgneNo ratings yet

- FM I AssignmentDocument3 pagesFM I AssignmentApeksha S KanthNo ratings yet

- PGD Engineering EconomicsDocument3 pagesPGD Engineering EconomicsTemitayo EjidokunNo ratings yet

- 2019 December - 231030 - 155131Document6 pages2019 December - 231030 - 155131masnurzuaniNo ratings yet

- Exam Practice Question MBADocument11 pagesExam Practice Question MBAsudhakar dhunganaNo ratings yet

- CFI1201200307 Financial Mathematics IIDocument2 pagesCFI1201200307 Financial Mathematics IIranganaitinotenda1No ratings yet

- Mock Question I II III IV VDocument24 pagesMock Question I II III IV Vapi-381455783% (6)

- Bacs 222'eu1'cat One'08'2021Document2 pagesBacs 222'eu1'cat One'08'2021Joseph KamauNo ratings yet

- Case Study AssignmentDocument3 pagesCase Study AssignmentfalinaNo ratings yet

- HS202-Summer 20 - TH ExamDocument1 pageHS202-Summer 20 - TH Examharry mathewNo ratings yet

- Set C FinalDocument5 pagesSet C FinalHimanshu BohraNo ratings yet

- Assg 1Document3 pagesAssg 1WESTON MALAMANo ratings yet

- Quiz Maf253 - January 2024Document6 pagesQuiz Maf253 - January 2024haqeemdanish302No ratings yet

- Set B FinalDocument5 pagesSet B FinalHimanshu BohraNo ratings yet

- Practice Problems Eng EconomyDocument4 pagesPractice Problems Eng Economymahmoud koriemNo ratings yet

- Man307 2017 18 Final Exam Questions SiUTDocument4 pagesMan307 2017 18 Final Exam Questions SiUTKinNo ratings yet

- Final Exam Engineering EconomyDocument2 pagesFinal Exam Engineering EconomyGelvie Lagos100% (2)

- BFI 300 Corporate Finance Cat II 10.11.2023Document2 pagesBFI 300 Corporate Finance Cat II 10.11.2023mahmoudfatahabukarNo ratings yet

- BCM 3113 Exam 2022 AprilDocument4 pagesBCM 3113 Exam 2022 Aprilkorirenock764No ratings yet

- FM 15-16Document3 pagesFM 15-16BrijmohanNo ratings yet

- TERI - Corporate Finance - Major Test PDFDocument8 pagesTERI - Corporate Finance - Major Test PDFAnanditaKarNo ratings yet

- Test 2 - 19 Jun 2020 PDFDocument4 pagesTest 2 - 19 Jun 2020 PDFAdriana RoslyNo ratings yet

- 15.415.1x Practice Exam FinalDocument10 pages15.415.1x Practice Exam FinalRedRidingNo ratings yet

- CH5 Mathematics of Finance TUTOR QDocument7 pagesCH5 Mathematics of Finance TUTOR Qainafiqaa17No ratings yet

- Banking and Finance Certificate: Please Turn OverDocument10 pagesBanking and Finance Certificate: Please Turn OverDixie CheeloNo ratings yet

- Chapter 06.Document10 pagesChapter 06.maria zaheerNo ratings yet

- INTERNSHIP Manish 0001Document48 pagesINTERNSHIP Manish 0001Kushal KhagtaNo ratings yet

- Investment Policy of BankDocument40 pagesInvestment Policy of BankPrakash BhandariNo ratings yet

- Advanced Payment of TaxDocument2 pagesAdvanced Payment of TaxEngr. Md. Ishtiak HossainNo ratings yet

- Credit Management Report On SIBL Bank - DoDocument47 pagesCredit Management Report On SIBL Bank - DoShivam KarnNo ratings yet

- Project of Management ZunairaDocument21 pagesProject of Management Zunairazunaira shahidNo ratings yet

- Lecture6 - RPGT Class Exercise QDocument4 pagesLecture6 - RPGT Class Exercise QpremsuwaatiiNo ratings yet

- Chap06 Ques MBF14eDocument6 pagesChap06 Ques MBF14eÂn TrầnNo ratings yet

- Lesson 1Document47 pagesLesson 1WilsonNo ratings yet

- 5266financial ManagementDocument458 pages5266financial ManagementMd. Ferdowsur Rahman100% (2)

- The Economist 20.01.2024Document347 pagesThe Economist 20.01.2024milagrosNo ratings yet

- Chapter 1 - Formation of PartnershipDocument31 pagesChapter 1 - Formation of PartnershipAisyah BasirNo ratings yet

- Time Value of MoneyDocument35 pagesTime Value of MoneysandhurstalabNo ratings yet

- Chapter 2 Determinants of Interest RatesDocument2 pagesChapter 2 Determinants of Interest RatesBryan Ivann MacasinagNo ratings yet

- French Telecom Group Altice Is On A PrecipiceDocument2 pagesFrench Telecom Group Altice Is On A PrecipiceRazvan TeleanuNo ratings yet

- Important Finacle 10Document43 pagesImportant Finacle 10Prem Prem KumarNo ratings yet

- AKQZ04Document2 pagesAKQZ04mehdiNo ratings yet

- Tax Laws in Tanzania: Taxation Questions & AnswersDocument11 pagesTax Laws in Tanzania: Taxation Questions & AnswersKessy Juma90% (119)

- CHAP - 05 - Risk Management For Changing Interest RatesDocument45 pagesCHAP - 05 - Risk Management For Changing Interest RatesPhuc Hoang DuongNo ratings yet

- 0-Goddard, McKillop, Wilson, & Finance, 2008)Document14 pages0-Goddard, McKillop, Wilson, & Finance, 2008)Ibrahim KhatatbehNo ratings yet

- Income Under The Head "Income From House Property": Quick Review of The ChapterDocument5 pagesIncome Under The Head "Income From House Property": Quick Review of The ChapterKaustubh BasuNo ratings yet

- Financial Crisis 2008Document15 pagesFinancial Crisis 2008Samar Javed100% (1)

- Financial Algebra Advanced Algebra With Financial Applications 2Nd Edition Gerver Test Bank Full Chapter PDFDocument17 pagesFinancial Algebra Advanced Algebra With Financial Applications 2Nd Edition Gerver Test Bank Full Chapter PDFphongtuanfhep4u100% (12)

- Business Math q2 m9 AnswersDocument4 pagesBusiness Math q2 m9 Answersangel annNo ratings yet

- CITA Company Income Tax Act 2004 (As Amended 2007)Document93 pagesCITA Company Income Tax Act 2004 (As Amended 2007)Ogbu VincentNo ratings yet

- Monetary PolicyDocument21 pagesMonetary PolicyApple Jane Galisa SeculaNo ratings yet

- PDF BookDocument15 pagesPDF BookArshad BashirNo ratings yet

- Pre-Need Manual of Examination - CL2018 - 01Document53 pagesPre-Need Manual of Examination - CL2018 - 01Ipe ClosaNo ratings yet