Professional Documents

Culture Documents

charges-REPCA

charges-REPCA

Uploaded by

SHUAIB ALAMCopyright:

Available Formats

You might also like

- Activity Balancing Your Checking AccountDocument4 pagesActivity Balancing Your Checking AccountMellanie Garcia100% (1)

- Gar 1990Document74 pagesGar 1990Aashish Kumar57% (7)

- New Dgtca SocDocument2 pagesNew Dgtca SocchintankantariaNo ratings yet

- Sba 2 0 Ivy PDFDocument2 pagesSba 2 0 Ivy PDFChandan SahNo ratings yet

- Roaming Current Account 1Document5 pagesRoaming Current Account 1raviNo ratings yet

- Privilege Banking SocDocument3 pagesPrivilege Banking SocBAMS Marine Services Pvt. Ltd.No ratings yet

- Shubhaarambh SocDocument2 pagesShubhaarambh SocCrAzY PuLkiTNo ratings yet

- New StartupDocument2 pagesNew StartupAmey ChavanNo ratings yet

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95No ratings yet

- Pca 14 6Document2 pagesPca 14 6Arora MathewNo ratings yet

- From Kotak WebsiteDocument20 pagesFrom Kotak WebsiteHimadri Shekhar VermaNo ratings yet

- Annexure BDocument3 pagesAnnexure BMayapur CommunicationNo ratings yet

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Document2 pagesMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNo ratings yet

- Wealth CA Schedule of ChargesDocument6 pagesWealth CA Schedule of ChargesSayan Kumar PatiNo ratings yet

- Digital Savings Account Effective July 2021Document3 pagesDigital Savings Account Effective July 2021Nikhil KumarNo ratings yet

- SOC Savings AdityaDocument2 pagesSOC Savings AdityaDenny PjNo ratings yet

- Axis Bank Service ChargesDocument4 pagesAxis Bank Service ChargesRanjith MeelaNo ratings yet

- Saving SheetDocument6 pagesSaving Sheetiihm19dl148rohitNo ratings yet

- Cadel Soc 01 01 23 D Lite (CADEL)Document2 pagesCadel Soc 01 01 23 D Lite (CADEL)Mukunda MukundaNo ratings yet

- Soc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFDocument2 pagesSoc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFJella RamakrishnaNo ratings yet

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocument2 pagesTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNo ratings yet

- SOC Next Gen Savings AccountDocument2 pagesSOC Next Gen Savings AccountSUBHRAKANTA DASNo ratings yet

- Service-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Document2 pagesService-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Mukunda MukundaNo ratings yet

- New Start Up Account SocDocument1 pageNew Start Up Account SocMoorthi VNo ratings yet

- Broking Idirect Linked Savings AccountDocument7 pagesBroking Idirect Linked Savings Accounttrue chartNo ratings yet

- family-360-banking-socs-01Document17 pagesfamily-360-banking-socs-01rahul2621991No ratings yet

- Schedule of Charges Yes Bank 6Document2 pagesSchedule of Charges Yes Bank 6Sayantika MondalNo ratings yet

- Preferred AccountDocument2 pagesPreferred AccountaurummaangxinchenNo ratings yet

- Parameter Au Samriddhi Current AccountDocument2 pagesParameter Au Samriddhi Current Accounthiteshmohakar15No ratings yet

- current-account-dlDocument2 pagescurrent-account-dlr6334943No ratings yet

- Shubhaarambh Soc PDFDocument1 pageShubhaarambh Soc PDFSanjayNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- Current Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILDocument1 pageCurrent Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILKulwinder Singh MayaanNo ratings yet

- Sbprime - Bde'sDocument16 pagesSbprime - Bde'sParteek JangraNo ratings yet

- Common Service ChargesDocument3 pagesCommon Service ChargesatharvxunoNo ratings yet

- Service Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Mukunda MukundaNo ratings yet

- Schedule of Charges and Fees Burgundy (CABGY) 20102020Document2 pagesSchedule of Charges and Fees Burgundy (CABGY) 20102020Mukunda MukundaNo ratings yet

- Wealth Management Private Banking Service ChargesDocument5 pagesWealth Management Private Banking Service ChargesgahsgtsjNo ratings yet

- Selfe Savings SOC December 2022Document2 pagesSelfe Savings SOC December 2022naresh kumarNo ratings yet

- Au Digital Savings Account - 31 - MarchDocument5 pagesAu Digital Savings Account - 31 - MarchZach KingNo ratings yet

- Advantage Woman Savings AccountDocument7 pagesAdvantage Woman Savings Accounthimanshi.himanshi.chaudharyNo ratings yet

- Service Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Document3 pagesService Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Mukunda MukundaNo ratings yet

- IDBI Royale Plus Account Sep 01 2018Document2 pagesIDBI Royale Plus Account Sep 01 2018Sumit KumarNo ratings yet

- ICICI Bank Service ChargesDocument7 pagesICICI Bank Service ChargesRanjith MeelaNo ratings yet

- Services ProvidedDocument15 pagesServices ProvidedParul AroraNo ratings yet

- Niyo SBM SOCDocument1 pageNiyo SBM SOCRobi RoboNo ratings yet

- KFS Current ACDocument23 pagesKFS Current ACFakharNo ratings yet

- Soc Ca 01.01.22Document4 pagesSoc Ca 01.01.22Abhishek ShivappaNo ratings yet

- Service Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022Mukunda MukundaNo ratings yet

- Schedule of Charges Effective January 1, 2020: Traders Current AccountDocument3 pagesSchedule of Charges Effective January 1, 2020: Traders Current Accountjpsmu09No ratings yet

- Nri Schedule of ChargesDocument4 pagesNri Schedule of ChargesRishiNo ratings yet

- Cash Transaction Charges For Savings Account HoldersDocument6 pagesCash Transaction Charges For Savings Account HoldersMaheshkumar AmulaNo ratings yet

- Burgundy Fees and Charges 01042023Document7 pagesBurgundy Fees and Charges 01042023Nagaraj VukkadapuNo ratings yet

- Standard Schedule of Charges - 3Document6 pagesStandard Schedule of Charges - 3devloprsiteNo ratings yet

- Rca SocDocument3 pagesRca SocKrishna Kiran VyasNo ratings yet

- Basic Saving Account With Complete KYCDocument2 pagesBasic Saving Account With Complete KYCVarsha100% (1)

- Super Savings Account: Common Service ChargesDocument2 pagesSuper Savings Account: Common Service ChargesSantosh ThakurNo ratings yet

- NeekiDocument2 pagesNeekiRamNo ratings yet

- Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDocument2 pagesGrace Period Granted - 1 Month As Per RBI Guidelines To Restore MABprasanNo ratings yet

- Au Digital Savings AccountDocument5 pagesAu Digital Savings AccountQuaint ZoneNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- New Features in R12 Oracle Cash ManagementDocument50 pagesNew Features in R12 Oracle Cash Managementerpswan100% (1)

- Unit Two General and Subsidiary Ledgers: AU Ethiopian Government Accounting 2019Document10 pagesUnit Two General and Subsidiary Ledgers: AU Ethiopian Government Accounting 2019TIZITAW MASRESHANo ratings yet

- Best Sir Rizwanullah (IBF Hourly)Document3 pagesBest Sir Rizwanullah (IBF Hourly)ABDUL NABEELNo ratings yet

- Global Corporate and Investment Banking An Agenda For ChangeDocument96 pagesGlobal Corporate and Investment Banking An Agenda For ChangeSherman WaltonNo ratings yet

- Guidelines For Preparation of Statement of Financial Transactions (SFT)Document5 pagesGuidelines For Preparation of Statement of Financial Transactions (SFT)Mathavan RajkumarNo ratings yet

- Private Sector Capital For China's SOEs - China First Capital Press ReleaseDocument2 pagesPrivate Sector Capital For China's SOEs - China First Capital Press ReleasepfuhrmanNo ratings yet

- Financial Analysis - Kotak Mahindra BankDocument43 pagesFinancial Analysis - Kotak Mahindra BankKishan ReddyNo ratings yet

- Recording Business TransactionsDocument57 pagesRecording Business TransactionsLyka DaparNo ratings yet

- Tariqullah Islamic Finance Book - Volume - 1Document112 pagesTariqullah Islamic Finance Book - Volume - 1Tkt Sheik Abdullah0% (1)

- ISQ List of Reference Books PDFDocument4 pagesISQ List of Reference Books PDFSarim ShahidNo ratings yet

- Innovation Edge. Mobile Banking (English)Document68 pagesInnovation Edge. Mobile Banking (English)BBVA Innovation Center100% (1)

- 610 Quiz 1 S09 PDFDocument2 pages610 Quiz 1 S09 PDFTodsawat FluKeNo ratings yet

- Cheque Collection PolicyDocument5 pagesCheque Collection Policymuraligm2003No ratings yet

- EXAM Chapter 14 HW, Practice Quiz, Quiz, ProblemsDocument15 pagesEXAM Chapter 14 HW, Practice Quiz, Quiz, Problemsj loNo ratings yet

- About UsDocument2 pagesAbout UsprakashkiranNo ratings yet

- 20 Contoh Soalan Seksyen B ENGLISHDocument6 pages20 Contoh Soalan Seksyen B ENGLISHAshi MizuNo ratings yet

- Monetary Policy of BangladeshDocument11 pagesMonetary Policy of BangladeshGobinda sahaNo ratings yet

- Project Report On Internet BankingDocument131 pagesProject Report On Internet BankingRahul Agarwal40% (5)

- Cross-Company - Inter-Company Transactions - SAP BlogsDocument26 pagesCross-Company - Inter-Company Transactions - SAP Blogspuditime100% (1)

- Rescue 9Document51 pagesRescue 9abhishek pandeyNo ratings yet

- Irshad CVDocument4 pagesIrshad CVADLG LayyahNo ratings yet

- 81 PNB Vs de Ong AceroDocument1 page81 PNB Vs de Ong Aceroluigimanzanares0% (1)

- Reading Test4 AnswersDocument5 pagesReading Test4 Answerssankha ghoshNo ratings yet

- Chronology of Data Breaches - Privacy Rights Clearinghouse - June 4, 2014Document558 pagesChronology of Data Breaches - Privacy Rights Clearinghouse - June 4, 2014St. Louis Public RadioNo ratings yet

- International Economics: Exchange-Rate SystemsDocument23 pagesInternational Economics: Exchange-Rate SystemsKaranPatilNo ratings yet

- Nepal Bank Limited: Summer Training Project Report ON "Deposit Schemes of Nepal Bank"Document61 pagesNepal Bank Limited: Summer Training Project Report ON "Deposit Schemes of Nepal Bank"Aditya VermaNo ratings yet

- Chapter 14Document7 pagesChapter 14Ignatius LysanderNo ratings yet

- CPD TestDocument5 pagesCPD Testchandra mohan vermaNo ratings yet

charges-REPCA

charges-REPCA

Uploaded by

SHUAIB ALAMCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

charges-REPCA

charges-REPCA

Uploaded by

SHUAIB ALAMCopyright:

Available Formats

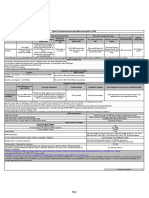

Repriced Current Accounts (REPCA)

Variant REPCA

Monthly Average Balance (MAB)

<Nil/ Amount>

Requirement (Rs)

Free limits

Cash deposit at base location* <No free limit>

Cash deposit at non base location* <No free limit>

Branch transaction <No free limit>

DD/PO issuance <No free limit>

Cheque leaves issuance <200> leaves per month

Cash withdrawal at non base location Rs <50,000> per month

RTGS payment done through Internet / Mobile

<Free>

Banking

RTGS payment done through branch <Chargeable>

NEFT payment done through Internet / Mobile

<Free>

Banking

NEFT payment done through branch <Chargeable>

Mobile alert <Chargeable>

Cheque return – Deposited by Customer (Rs) <No free limit>

Charges applicable / Charges beyond free limit

Cash deposit in base location* Rs <3> per Rs <1,000>

Cash deposit in non base location* Rs <5> per Rs <1,000>

Branch transaction Rs <25> per transaction

DD/PO issuance Rs <2> per Rs <1,000>

Cheque Book Rs <2> per leaf

Cash withdrawal at non base location Rs <2> per Rs <1,000>

RTGS payment Rs <20> per transaction

NEFT payment Rs <4.75> per transaction

Mobile alert Rs <25> per month

Cheque return – Deposited by customer Rs <100> per instrument

Cheque return – Issued by customer (including fund

Rs <750> per instrument

transfer)

Debit Card Related

Business Gold Debit Card for Standard, SBA plus and Merchant Plus

World Debit Card for SBA Gold plus Rs <250> per year

Coral paywave Debit Card for SBA Platinum plus and SBA Elite

ATM cash withdrawal at other bank ATM (India) (Rs per transaction) Rs <20> per transaction

ATM charges - Balance Enquiry at Non-ICICI Bank ATM Rs <8.5> per transaction

ATM transactions at other bank ATM (outside India) Rs <125> per transaction

Purchase transaction charges <NIL>

Replacement of lost/stolen Debit Card, Replacement of PIN Rs <200> per instance

Other Common Charges

Within <14> days - Nil, beyond <14> days but within <6> months - Rs

Account closure charges

<1,000>, beyond <6> months - Rs <500>

Physical statement charge Rs <25> per month

Transaction up to Rs <10,000>: Rs <3.50> per transaction; Rs <10,001> to Rs

IMPS transaction charge

<1> lakh: Rs <5> per transaction; Rs <1> lakh to Rs <2> lakh: Rs <15> per

Branch based transactions including Stop Payment, Standing Instruction, DD Cancellation, DD

Duplicate, DD revalidation, Duplicate Statement, Bankers' Report, Certificate of Balance for Rs 100 per instance

Previous Year, Old Record Retrieval, Signature Verification

Glossary of Terms

*Base location: Base Location refers to all the Branches which belong to the same clearing zone in which the account is opened.

Non-Base Location: Non Base location refers to all the branches which belong to other clearing zone apart from where the account is opened.

All cash transactions of Rs <10> lakh and above on a single day would require prior intimation and approval of the Branch at least one working day in advance.

For any services or charges not covered under this brochure, please visit any of our branches or write at corporatecare@icicibank.com

The service charges are subject to change without any prior intimation to customer. However, the prevailing charges would be hosted at www.icicibank.com . Charge cycle period

shall be as per calendar month.

All charges are exclusive of GST as applicable from time to time

For details Terms and Conditions, please visit www.icicibank.com

You might also like

- Activity Balancing Your Checking AccountDocument4 pagesActivity Balancing Your Checking AccountMellanie Garcia100% (1)

- Gar 1990Document74 pagesGar 1990Aashish Kumar57% (7)

- New Dgtca SocDocument2 pagesNew Dgtca SocchintankantariaNo ratings yet

- Sba 2 0 Ivy PDFDocument2 pagesSba 2 0 Ivy PDFChandan SahNo ratings yet

- Roaming Current Account 1Document5 pagesRoaming Current Account 1raviNo ratings yet

- Privilege Banking SocDocument3 pagesPrivilege Banking SocBAMS Marine Services Pvt. Ltd.No ratings yet

- Shubhaarambh SocDocument2 pagesShubhaarambh SocCrAzY PuLkiTNo ratings yet

- New StartupDocument2 pagesNew StartupAmey ChavanNo ratings yet

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95No ratings yet

- Pca 14 6Document2 pagesPca 14 6Arora MathewNo ratings yet

- From Kotak WebsiteDocument20 pagesFrom Kotak WebsiteHimadri Shekhar VermaNo ratings yet

- Annexure BDocument3 pagesAnnexure BMayapur CommunicationNo ratings yet

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Document2 pagesMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNo ratings yet

- Wealth CA Schedule of ChargesDocument6 pagesWealth CA Schedule of ChargesSayan Kumar PatiNo ratings yet

- Digital Savings Account Effective July 2021Document3 pagesDigital Savings Account Effective July 2021Nikhil KumarNo ratings yet

- SOC Savings AdityaDocument2 pagesSOC Savings AdityaDenny PjNo ratings yet

- Axis Bank Service ChargesDocument4 pagesAxis Bank Service ChargesRanjith MeelaNo ratings yet

- Saving SheetDocument6 pagesSaving Sheetiihm19dl148rohitNo ratings yet

- Cadel Soc 01 01 23 D Lite (CADEL)Document2 pagesCadel Soc 01 01 23 D Lite (CADEL)Mukunda MukundaNo ratings yet

- Soc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFDocument2 pagesSoc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFJella RamakrishnaNo ratings yet

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocument2 pagesTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNo ratings yet

- SOC Next Gen Savings AccountDocument2 pagesSOC Next Gen Savings AccountSUBHRAKANTA DASNo ratings yet

- Service-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Document2 pagesService-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Mukunda MukundaNo ratings yet

- New Start Up Account SocDocument1 pageNew Start Up Account SocMoorthi VNo ratings yet

- Broking Idirect Linked Savings AccountDocument7 pagesBroking Idirect Linked Savings Accounttrue chartNo ratings yet

- family-360-banking-socs-01Document17 pagesfamily-360-banking-socs-01rahul2621991No ratings yet

- Schedule of Charges Yes Bank 6Document2 pagesSchedule of Charges Yes Bank 6Sayantika MondalNo ratings yet

- Preferred AccountDocument2 pagesPreferred AccountaurummaangxinchenNo ratings yet

- Parameter Au Samriddhi Current AccountDocument2 pagesParameter Au Samriddhi Current Accounthiteshmohakar15No ratings yet

- current-account-dlDocument2 pagescurrent-account-dlr6334943No ratings yet

- Shubhaarambh Soc PDFDocument1 pageShubhaarambh Soc PDFSanjayNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- Current Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILDocument1 pageCurrent Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILKulwinder Singh MayaanNo ratings yet

- Sbprime - Bde'sDocument16 pagesSbprime - Bde'sParteek JangraNo ratings yet

- Common Service ChargesDocument3 pagesCommon Service ChargesatharvxunoNo ratings yet

- Service Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Mukunda MukundaNo ratings yet

- Schedule of Charges and Fees Burgundy (CABGY) 20102020Document2 pagesSchedule of Charges and Fees Burgundy (CABGY) 20102020Mukunda MukundaNo ratings yet

- Wealth Management Private Banking Service ChargesDocument5 pagesWealth Management Private Banking Service ChargesgahsgtsjNo ratings yet

- Selfe Savings SOC December 2022Document2 pagesSelfe Savings SOC December 2022naresh kumarNo ratings yet

- Au Digital Savings Account - 31 - MarchDocument5 pagesAu Digital Savings Account - 31 - MarchZach KingNo ratings yet

- Advantage Woman Savings AccountDocument7 pagesAdvantage Woman Savings Accounthimanshi.himanshi.chaudharyNo ratings yet

- Service Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Document3 pagesService Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Mukunda MukundaNo ratings yet

- IDBI Royale Plus Account Sep 01 2018Document2 pagesIDBI Royale Plus Account Sep 01 2018Sumit KumarNo ratings yet

- ICICI Bank Service ChargesDocument7 pagesICICI Bank Service ChargesRanjith MeelaNo ratings yet

- Services ProvidedDocument15 pagesServices ProvidedParul AroraNo ratings yet

- Niyo SBM SOCDocument1 pageNiyo SBM SOCRobi RoboNo ratings yet

- KFS Current ACDocument23 pagesKFS Current ACFakharNo ratings yet

- Soc Ca 01.01.22Document4 pagesSoc Ca 01.01.22Abhishek ShivappaNo ratings yet

- Service Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022Mukunda MukundaNo ratings yet

- Schedule of Charges Effective January 1, 2020: Traders Current AccountDocument3 pagesSchedule of Charges Effective January 1, 2020: Traders Current Accountjpsmu09No ratings yet

- Nri Schedule of ChargesDocument4 pagesNri Schedule of ChargesRishiNo ratings yet

- Cash Transaction Charges For Savings Account HoldersDocument6 pagesCash Transaction Charges For Savings Account HoldersMaheshkumar AmulaNo ratings yet

- Burgundy Fees and Charges 01042023Document7 pagesBurgundy Fees and Charges 01042023Nagaraj VukkadapuNo ratings yet

- Standard Schedule of Charges - 3Document6 pagesStandard Schedule of Charges - 3devloprsiteNo ratings yet

- Rca SocDocument3 pagesRca SocKrishna Kiran VyasNo ratings yet

- Basic Saving Account With Complete KYCDocument2 pagesBasic Saving Account With Complete KYCVarsha100% (1)

- Super Savings Account: Common Service ChargesDocument2 pagesSuper Savings Account: Common Service ChargesSantosh ThakurNo ratings yet

- NeekiDocument2 pagesNeekiRamNo ratings yet

- Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDocument2 pagesGrace Period Granted - 1 Month As Per RBI Guidelines To Restore MABprasanNo ratings yet

- Au Digital Savings AccountDocument5 pagesAu Digital Savings AccountQuaint ZoneNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- New Features in R12 Oracle Cash ManagementDocument50 pagesNew Features in R12 Oracle Cash Managementerpswan100% (1)

- Unit Two General and Subsidiary Ledgers: AU Ethiopian Government Accounting 2019Document10 pagesUnit Two General and Subsidiary Ledgers: AU Ethiopian Government Accounting 2019TIZITAW MASRESHANo ratings yet

- Best Sir Rizwanullah (IBF Hourly)Document3 pagesBest Sir Rizwanullah (IBF Hourly)ABDUL NABEELNo ratings yet

- Global Corporate and Investment Banking An Agenda For ChangeDocument96 pagesGlobal Corporate and Investment Banking An Agenda For ChangeSherman WaltonNo ratings yet

- Guidelines For Preparation of Statement of Financial Transactions (SFT)Document5 pagesGuidelines For Preparation of Statement of Financial Transactions (SFT)Mathavan RajkumarNo ratings yet

- Private Sector Capital For China's SOEs - China First Capital Press ReleaseDocument2 pagesPrivate Sector Capital For China's SOEs - China First Capital Press ReleasepfuhrmanNo ratings yet

- Financial Analysis - Kotak Mahindra BankDocument43 pagesFinancial Analysis - Kotak Mahindra BankKishan ReddyNo ratings yet

- Recording Business TransactionsDocument57 pagesRecording Business TransactionsLyka DaparNo ratings yet

- Tariqullah Islamic Finance Book - Volume - 1Document112 pagesTariqullah Islamic Finance Book - Volume - 1Tkt Sheik Abdullah0% (1)

- ISQ List of Reference Books PDFDocument4 pagesISQ List of Reference Books PDFSarim ShahidNo ratings yet

- Innovation Edge. Mobile Banking (English)Document68 pagesInnovation Edge. Mobile Banking (English)BBVA Innovation Center100% (1)

- 610 Quiz 1 S09 PDFDocument2 pages610 Quiz 1 S09 PDFTodsawat FluKeNo ratings yet

- Cheque Collection PolicyDocument5 pagesCheque Collection Policymuraligm2003No ratings yet

- EXAM Chapter 14 HW, Practice Quiz, Quiz, ProblemsDocument15 pagesEXAM Chapter 14 HW, Practice Quiz, Quiz, Problemsj loNo ratings yet

- About UsDocument2 pagesAbout UsprakashkiranNo ratings yet

- 20 Contoh Soalan Seksyen B ENGLISHDocument6 pages20 Contoh Soalan Seksyen B ENGLISHAshi MizuNo ratings yet

- Monetary Policy of BangladeshDocument11 pagesMonetary Policy of BangladeshGobinda sahaNo ratings yet

- Project Report On Internet BankingDocument131 pagesProject Report On Internet BankingRahul Agarwal40% (5)

- Cross-Company - Inter-Company Transactions - SAP BlogsDocument26 pagesCross-Company - Inter-Company Transactions - SAP Blogspuditime100% (1)

- Rescue 9Document51 pagesRescue 9abhishek pandeyNo ratings yet

- Irshad CVDocument4 pagesIrshad CVADLG LayyahNo ratings yet

- 81 PNB Vs de Ong AceroDocument1 page81 PNB Vs de Ong Aceroluigimanzanares0% (1)

- Reading Test4 AnswersDocument5 pagesReading Test4 Answerssankha ghoshNo ratings yet

- Chronology of Data Breaches - Privacy Rights Clearinghouse - June 4, 2014Document558 pagesChronology of Data Breaches - Privacy Rights Clearinghouse - June 4, 2014St. Louis Public RadioNo ratings yet

- International Economics: Exchange-Rate SystemsDocument23 pagesInternational Economics: Exchange-Rate SystemsKaranPatilNo ratings yet

- Nepal Bank Limited: Summer Training Project Report ON "Deposit Schemes of Nepal Bank"Document61 pagesNepal Bank Limited: Summer Training Project Report ON "Deposit Schemes of Nepal Bank"Aditya VermaNo ratings yet

- Chapter 14Document7 pagesChapter 14Ignatius LysanderNo ratings yet

- CPD TestDocument5 pagesCPD Testchandra mohan vermaNo ratings yet