Professional Documents

Culture Documents

Taxation Mock Test no. 9 for May 2022

Taxation Mock Test no. 9 for May 2022

Uploaded by

ap.quatrroCopyright:

Available Formats

You might also like

- ToolsCorp Corporation's Business PlanDocument7 pagesToolsCorp Corporation's Business PlanericNo ratings yet

- Ice Fili Case AnalysisDocument11 pagesIce Fili Case AnalysisZahid KhanNo ratings yet

- Jurnal Malay Reserve LandDocument28 pagesJurnal Malay Reserve Landazman4776100% (1)

- Adidascorporatestrategy 1Document35 pagesAdidascorporatestrategy 1flinks100% (3)

- Lee Case StudyDocument2 pagesLee Case StudyRodolfo Mapada Jr.100% (2)

- Taxation Paper EMBA 16042022Document4 pagesTaxation Paper EMBA 16042022Rohit B .S. Prabhu Verlekar100% (1)

- DT 1 QDocument23 pagesDT 1 QG INo ratings yet

- mcc tax mock 3Document12 pagesmcc tax mock 3akshat.gupta.0812.mpspnNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- Sa 3 DT NovDocument9 pagesSa 3 DT NovRishabh GargNo ratings yet

- Lecture 99 FinalDocument15 pagesLecture 99 Finaltaswaraliarain4No ratings yet

- Capital Gain & IFOS - PaperDocument6 pagesCapital Gain & IFOS - PaperLaavanya JainNo ratings yet

- 64561bos260421 Inter p4Document10 pages64561bos260421 Inter p4GowriNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- 5_6071092042769891925Document9 pages5_6071092042769891925manas nikhilNo ratings yet

- Capital Gain & IFOS - PaperDocument6 pagesCapital Gain & IFOS - PaperVenkataRajuNo ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- Series I - QuestionsDocument11 pagesSeries I - QuestionsAlok MishraNo ratings yet

- MTP Taxation Question Paper 2Document12 pagesMTP Taxation Question Paper 2CursedAfNo ratings yet

- MTP 2 TaxDocument10 pagesMTP 2 TaxPrathmesh JambhulkarNo ratings yet

- Inp 2234 Tax Question PaperDocument11 pagesInp 2234 Tax Question PaperAnshit BahediaNo ratings yet

- Tax (Old) Q Mtp1 Ipc Oct21Document10 pagesTax (Old) Q Mtp1 Ipc Oct21Karan Singh RanaNo ratings yet

- IMP 2413 A TAXATION _QUESTION PAPER RECD ON 22-03-24 3.4Document13 pagesIMP 2413 A TAXATION _QUESTION PAPER RECD ON 22-03-24 3.4anon_996890467No ratings yet

- May 2024 Full Length DT Test 2Document6 pagesMay 2024 Full Length DT Test 2Jyoti ManwaniNo ratings yet

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument11 pagesTest Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionRaghavanNo ratings yet

- Assignment - DTDocument2 pagesAssignment - DTKhushi ThakurNo ratings yet

- UntitledDocument11 pagesUntitleddeepika devsaniNo ratings yet

- Direct-Taxes mcomDocument3 pagesDirect-Taxes mcomfakruddin7866shaikhNo ratings yet

- Tax Mock Test PaperDocument17 pagesTax Mock Test Papermanyagoyall20No ratings yet

- Bos 59265Document46 pagesBos 59265oproducts96No ratings yet

- CS Executive OLD SYLLABUS MCQs JUNE 2024 by CA Vivek GabaDocument269 pagesCS Executive OLD SYLLABUS MCQs JUNE 2024 by CA Vivek GabaParitoshNo ratings yet

- iNCOME TAX MODEL Q.PDocument3 pagesiNCOME TAX MODEL Q.PAndalNo ratings yet

- Part - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceDocument12 pagesPart - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceShashwat SharmaNo ratings yet

- Vol 1 31032019 PDFDocument9 pagesVol 1 31032019 PDFPradeep KattimaniNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperLaavanya JainNo ratings yet

- 2231 Accounts Full CourseDocument6 pages2231 Accounts Full Coursebkbalaji110No ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperVenkataRajuNo ratings yet

- 7401D001 Direct TaxesDocument22 pages7401D001 Direct TaxesMadhuram SharmaNo ratings yet

- CA Inter Taxation Q MTP 2 May 23Document11 pagesCA Inter Taxation Q MTP 2 May 23sureshstipl sureshNo ratings yet

- Tax Old Q Mtp1 Ipc Oct21Document10 pagesTax Old Q Mtp1 Ipc Oct21abhishankar2904No ratings yet

- 71668bos57670 Inter p4q PDFDocument11 pages71668bos57670 Inter p4q PDFmonikaNo ratings yet

- Taxation MTP 1 QuestionsDocument9 pagesTaxation MTP 1 QuestionsVishal Kumar 5504No ratings yet

- Roll No. ..................................... : Part-I 1Document20 pagesRoll No. ..................................... : Part-I 1Khushal kaleNo ratings yet

- Tax - MTP2 - QP - M24 @CAInterLegendsDocument17 pagesTax - MTP2 - QP - M24 @CAInterLegendsPrince ManglaNo ratings yet

- Capital Gain 2Document11 pagesCapital Gain 2Aishwarya SundararajNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- 0 ScheduleDocument7 pages0 ScheduleKusuma MNo ratings yet

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- Term Test 1Document5 pagesTerm Test 1lalshahbaz57No ratings yet

- High Level MCQDocument160 pagesHigh Level MCQT-ushar banarsiNo ratings yet

- Residential Status, Exempt Income & AMT - PaperDocument6 pagesResidential Status, Exempt Income & AMT - PaperBharatbhusan RoutNo ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- 1686044906DTS-2 Taxation CA InteranswerDocument11 pages1686044906DTS-2 Taxation CA InteranswerViraj SharmaNo ratings yet

- Sem - IV Taxation - I Sample Paper-1Document5 pagesSem - IV Taxation - I Sample Paper-1yadavkari497No ratings yet

- CAF 2 TAX Spring 2022Document6 pagesCAF 2 TAX Spring 2022Sumair IqbalNo ratings yet

- MTP 19 50 Questions 1712317445Document13 pagesMTP 19 50 Questions 1712317445Nitin KumarNo ratings yet

- 27-3-24... 4110 GR I... Int-3019... Tax Mcq... QueDocument7 pages27-3-24... 4110 GR I... Int-3019... Tax Mcq... Quenikulgauswami9033No ratings yet

- IncomeTax-2Document6 pagesIncomeTax-2Aditya .cNo ratings yet

- CA Inter Tax Q MTP 2 May 2024 Castudynotes ComDocument13 pagesCA Inter Tax Q MTP 2 May 2024 Castudynotes ComineffableadityisticNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Income Tax marathon Schedule SUNDAYDocument2 pagesIncome Tax marathon Schedule SUNDAYap.quatrroNo ratings yet

- Day 5 inter 24 bookDocument5 pagesDay 5 inter 24 bookap.quatrroNo ratings yet

- Offline Marathon November 23Document12 pagesOffline Marathon November 23ap.quatrroNo ratings yet

- branch accounting free class notes (2)Document3 pagesbranch accounting free class notes (2)ap.quatrroNo ratings yet

- 1. InvestmentDocument3 pages1. Investmentap.quatrroNo ratings yet

- 5_6172219306907012723Document6 pages5_6172219306907012723ap.quatrroNo ratings yet

- Department Accounts ICAIDocument13 pagesDepartment Accounts ICAIap.quatrroNo ratings yet

- 0 5 6075878191115798578Document14 pages0 5 6075878191115798578ap.quatrroNo ratings yet

- CA Final Paper 1Document1 pageCA Final Paper 1ap.quatrroNo ratings yet

- Taxation CLass Test 1Document6 pagesTaxation CLass Test 1ap.quatrroNo ratings yet

- Taxation Class Test 6Document5 pagesTaxation Class Test 6ap.quatrroNo ratings yet

- CA Inter Paper 4Document1 pageCA Inter Paper 4ap.quatrroNo ratings yet

- CA Inter Paper 3Document1 pageCA Inter Paper 3ap.quatrroNo ratings yet

- CA Inter Paper 6Document1 pageCA Inter Paper 6ap.quatrroNo ratings yet

- Includes: ExceptDocument1 pageIncludes: Exceptap.quatrroNo ratings yet

- VIDYA SAGAR Analysis-COSTDocument2 pagesVIDYA SAGAR Analysis-COSTap.quatrroNo ratings yet

- Basic Cocepts 1Document1 pageBasic Cocepts 1ap.quatrroNo ratings yet

- Managerial Economics in A Global Economy: Demand TheoryDocument21 pagesManagerial Economics in A Global Economy: Demand TheoryArif DarmawanNo ratings yet

- SOURAV'S SIP ON SBI MUTUAL FUND (Introduction)Document106 pagesSOURAV'S SIP ON SBI MUTUAL FUND (Introduction)sourabha86100% (1)

- Black Book ProjectDocument49 pagesBlack Book Projectshubham hanbarNo ratings yet

- Urban Strategies For The Future Urban Development of Skopje and TurinDocument486 pagesUrban Strategies For The Future Urban Development of Skopje and TurinognenmarinaNo ratings yet

- P1.T4.Valuation & Risk Models Chapter 16. Option Sensitivity Measures: The "Greeks" Bionic Turtle FRM Study NotesDocument24 pagesP1.T4.Valuation & Risk Models Chapter 16. Option Sensitivity Measures: The "Greeks" Bionic Turtle FRM Study NotesImran MobinNo ratings yet

- 01 Hire PurchaseDocument15 pages01 Hire Purchaseagarwalharsh2341No ratings yet

- Silver BrochureDocument8 pagesSilver BrochurelaxmiccNo ratings yet

- Summer Training Report (Saran Sir) FinalDocument81 pagesSummer Training Report (Saran Sir) Finalaman1203No ratings yet

- Starting A BusinessDocument2 pagesStarting A BusinessYeasy AgustinaNo ratings yet

- Classic Pen ABCDocument5 pagesClassic Pen ABCdebojyoti88No ratings yet

- CA Inter Indirect Tax May 23 AmendedDocument413 pagesCA Inter Indirect Tax May 23 AmendedKhkmNo ratings yet

- PMT Home Assignment Pre Midsem 2024Document1 pagePMT Home Assignment Pre Midsem 2024imon.landageNo ratings yet

- Multiple Choice Questions 1 Which of The Following Will Increase TheDocument2 pagesMultiple Choice Questions 1 Which of The Following Will Increase Thetrilocksp SinghNo ratings yet

- Tenth Edition: Vice-Chairman, Prophet Professor Emeritus, University of California, BerkeleyDocument4 pagesTenth Edition: Vice-Chairman, Prophet Professor Emeritus, University of California, BerkeleyAHSAN MANZOORNo ratings yet

- Rizal's Life in AteneoDocument68 pagesRizal's Life in AteneoVince Kristoffer RasNo ratings yet

- Case Study InvestmentDocument6 pagesCase Study Investmentaroosha 2110No ratings yet

- Forex ManagementDocument29 pagesForex Managementvise008dNo ratings yet

- World-Wide Medical Massage Chairs Market Aspect, Production, Supply and Desire Forecast Covered Inside The Latest Research Obtainable at TMRDocument4 pagesWorld-Wide Medical Massage Chairs Market Aspect, Production, Supply and Desire Forecast Covered Inside The Latest Research Obtainable at TMRtrunkbeam5No ratings yet

- CAR BasicsDocument9 pagesCAR BasicsAbhinav Chauhan0% (1)

- 18 Accelerating Sales and Profits Herb Sorensen TNSDocument36 pages18 Accelerating Sales and Profits Herb Sorensen TNSEvelyn0% (1)

- Steven Shreve. Lectures On Stochastic Calculus and FinanceDocument365 pagesSteven Shreve. Lectures On Stochastic Calculus and FinanceSee Keong LeeNo ratings yet

- Healthy Market Share Gains - VESUVIUS INDIADocument7 pagesHealthy Market Share Gains - VESUVIUS INDIAsarvo_44No ratings yet

- LBO Interviews Questions BIWSDocument5 pagesLBO Interviews Questions BIWSartemidualikNo ratings yet

- Nova Chemical CorporationDocument28 pagesNova Chemical Corporationrzannat94100% (2)

- Utility TheoryDocument21 pagesUtility Theoryfiza akhterNo ratings yet

Taxation Mock Test no. 9 for May 2022

Taxation Mock Test no. 9 for May 2022

Uploaded by

ap.quatrroCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation Mock Test no. 9 for May 2022

Taxation Mock Test no. 9 for May 2022

Uploaded by

ap.quatrroCopyright:

Available Formats

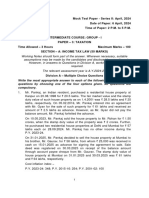

Income tax Mock Test Series for CA Inter May 2022 30 Marks (Time :- 45 min)

TAXATION MOCK TEST NO – 9

CA- INTER MAY 22 ATTEMPT

Chapters Covered:- Income under the head Capital Gains, Taxation of Gifts, Clubbing of

Income and Set-off & Carry Forward of Losses

Total Marks:- 30

Targeted time to complete:- 45 minutes for attempting and 5 minutes for reading the paper

Remember:- The best stage to make mistakes is during Preparation, so that only 1 thing is

left during exams – Perfection..!!!

Instructions for the Test

1) Similar to ICAI patter, we have divided this test into 2 parts – Part A for MCQ Questions and

Part B for Descriptive types Questions.

2) In case of MCQ questions, there is no need for any explanation whereas in case of

Descriptive questions, all working notes are required to be given as part of answer.

3) Students can take necessary assumptions wherever required but these are to be specifically

mentioned by the students in their answer.

Part – A:- MCQ Type Questions

Write the most appropriate answer to each of the following multiple-choice questions by choosing

one of the four options given. (ICAI will provide OMR sheet but here in this test you can write the

correct answer in your sheet)

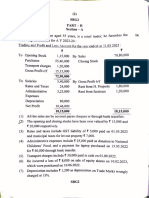

Mr Akshaya Biyani celebrated his 26th birthday on 15th May 2021 and arranged a grand party at

Radisson Blu hotel. On this occasion, he invited his friends, blood relatives and distant relatives to

attend the party. The ceremony was very grand, the feast was also very spectacular. All the

arrangements and decorations were absolutely wonderful. At the end of party, Mr Akshaya was

awarded by following gifts:-

Gifts received from Type of Gift Remarks

Mother One 22K Gold Chain She purchased on the same day for Rs. 37,822

Father One 22K Gold Bracelet He purchased on the same day for Rs 56,075

Wife 4 Gold Rings She purchased these rings on 15.5.2020 for Rs

35,500 each. FMV on 15th May 2021 is Rs

37,429 each.

Sister Painting This painting is made by her. FMV is Rs

45,000

Cousin Brother (Father’s One Gold Chain He purchased it on the same day for Rs

Brother’s Son) 18,200.

Closest Cousins I-20 Car Value of Rs. 4,10,000

(mother’s sister’s

sons/daughters)

Friends and other distant Cash Rs. 1,51,000

relatives

CA SANCHIT GROVER (Insta ID:- Sanchit.Grover.372) Page 1

Income tax Mock Test Series for CA Inter May 2022 30 Marks (Time :- 45 min)

Mr Akshaya desires to set up a new manufacturing unit with his friend in partnership on 1.12.2021.

For making investment in the firm, he sold following jewellery which he has received on his 26th

birthday celebration as gifts:

• Mother's gifted Gold Chain for Rs 42,150

• Father's gifted Gold Bracelet for Rs 60,180

• Cousin brother's gifted Gold Chain for Rs 20,600

His wife gave him Rs 1 lakh as a gift so that he could invest sufficient money in the unit.

On 1st December 2021, he invested Rs 6,00,000 (including the amount received on sale of above

gifts and amount received from his wife) and his friend invested Rs 4,00,000 in the firm.

On 1st February 2022, his wife again gave him Rs 1 lakh as a gift to invest such money in the firm

and apart from that he invested Rs 50,000 more from his individual savings. On this day, his friend

also invested Rs 1,00,000 in the firm.

Since the firm is a manufacturing unit and at initial stage, the firm requires sufficient fund so Mr

Akshaya sold his wife's gifted Gold Rings for Rs 40,250 each as on 31st March 2022 and he

deployed the funds as partner's capital in the firm on 1 st April, 2022.

Based on the facts of the case scenario given above, choose the most appropriate answer to the

following questions:

Q1) What is the gift amount taxable in the hands of Mr Akshaya for PY 2021-22?

a) Rs 1,51,000

b) Rs 1,69,200

c) Rs 5,79,200

d) Rs 5,61,000 (2 Marks)

Q2) What is the amount of capital gain taxable in the hand of Mr Akshaya for PY 2021-22?

a) Short-term capital gains Rs 10,833

b) Short-term capital gains Rs 29,833

c) Short-term capital gains Rs 15,583

d) No, capital gains is taxable in his hands, since he received the capital assets as gift. (2 Marks)

Q3) Is any amount taxable in the hands of Akshaya's wife in respect of sale of jewellery by Mr

Akshaya, if yes, what shall be the taxable amount in her hands for PY 2021-22?

a) No

b) Yes; Rs 15,284

c) Yes; Rs 19,000

d) Yes; Rs 11,284 (2 Marks)

Q4) During AY 2022-23, Mr Kabir has a loss of Rs 6 lakhs under the head "Income from house

property", loss of Rs 5 lakhs from business/profession and income of Rs 3 lakhs from long term

capital gains. He filed his return of income for AY 2022-23 on 31.12.2022.

Determine the total income of Mr Kabir for AY 2022-23 and the amount of loss which can be carried

forward in a manner most beneficial to him; (2 Marks)

a) Total income Nil; loss of Rs 4,00,000 from house property and loss of Rs 4,00,000 from business

or profession. ,

CA SANCHIT GROVER (Insta ID:- Sanchit.Grover.372) Page 2

Income tax Mock Test Series for CA Inter May 2022 30 Marks (Time :- 45 min)

b) Total income Rs 1,00,000; loss of Rs 4,00,000 from house property.

c) Total income Nil; No loss is allowed to be carried forward.

d) Total income Nil; loss of Rs 6,00,000 from house property

Q5) Mr Rana is a resident of India residing in Meerut. During FY 2010-11, he purchased an

agricultural land situated in Bahadurpur for Rs 10 lacs: This. land is situated in an area which has

aerial distance of 3 km from the local limits of Municipality of Bahadurpur. Total population of this

area is 80,000 as per the last preceding census.

During FY 2021-22, Mr Rana sold this land to Mr Jeet for Rs 25 lacs on 29.1.2022. Mr Rana

invested Rs 5 lakhs in bonds of NHAI on 31.7.2022. CII for FY 2010-11 and FY 2021-22 is 167 and

317 respectively. Compute the amount of capital gain taxable in the hands of Mr Rana for AY 2022-

23: ·

a) Rs 1,01,796

b) Rs 6,01,796

c) Rs 15,00,000

d) None of the above (2 Marks)

Part B:- Descriptive Type Questions

Q1) Ms. Pooja a resident individual provides the following information of her income/losses for

the year ended on 31st March, 2022:

S. No. Particulars (Rs. )

1. Income from salary (Computed) 2,20,000

2. Income from House Property (let out) (Net Annual Value) 1,50,000

3. Share of loss from firm in which she is partner 10,000

4. Loss from specified business covered under section 35AD 20,000

5. Income from textile business before adjusting the following items: 3,00,000

(a) Current year depreciation 60,000

(b) Unabsorbed depreciation of earlier year 2,25,000

(c) Brought forward loss of textile business of the A.Y. 2018-19 90,000

6. Long-term capital gain on sale of debentures 75,000

7. Long-term capital loss on sale of equity shares (STT not paid) 1,00,000

8. Long-term capital gain on sale of equity shares listed in recognized 1,50,000

stock exchange (STT paid at the time of acquisition and sale)

During the previous year 2021-22, Ms. Pooja has repaid Rs. 5,25,000 towards housing loan from a

scheduled bank. Out of this Rs. 3,16,000 was towards payment of interest and rest towards principal.

Compute the gross total income of Ms. Pooja and ascertain the amount of loss that can be carried

forward assuming she has not opted for Sec 115BC. Ms. Pooja has always filed her return within the

due date specified under section 139(1) of the Income-tax Act, 1961. (8 Marks)

Q2) Mr. Govind purchased 600 shares of "Y" limited at Rs. 130 per share on 26.02.1979. "Y" limited

issued him, 1,200 bonus shares on 20.02.1984. The fair market value of these share at Mumbai Stock

Exchange as on 1.04.2001 was Rs. 900 per share and Rs. 2,000 per share as on 31.01.2018. On

31.01.2021 he converted 1000 shares as his stock in trade. The shares was traded at Mumbai Stock

Exchange on that ·date at closing price of Rs. 2,100 per share.

CA SANCHIT GROVER (Insta ID:- Sanchit.Grover.372) Page 3

Income tax Mock Test Series for CA Inter May 2022 30 Marks (Time :- 45 min)

On 07.07.2021 Mr. Govind sold all 1800 shares @Rs. 2,400 per share at Mumbai Stock Exchange

and securities transaction tax was paid. Compute total income of Mr. Govind for the assessment-year

2022-23. (5 Marks)

Q3) Mr. Deepak has a residential house property taxable under section 22. Such property was

acquired on 12-08-2005 for Rs. 2,00,000. The property is sold for Rs. 22,00,000 on 01-06-2021. The

subregistrar refused to register the documents for the said value, as according to him, stamp duty

value based on State Government guidelines was Rs. 28,00,000. Mr. Deepak preferred an appeal to

the revenue divisional officer who fixed the value of the house Rs. 25,00,000. He acquired another

residential house on 31-03-2022 for Rs. 17,00;000 for self-occupation. On 01-03-2023, he sold such

new residential house for Rs. 30,00,000.

Compute his capital gain for the A.Y. 2022-23 and 2023-24. (Cost Inflation Index : 2001-02; 2005-

06 and 2021-2 are, 100; 117 and 317) (4 Marks)

Q4) ) Miss Himanshi (68 years) is a resident individual. During the assessment year 2022-23, she has

income from Long-term capital gain on transfer of equity shares Rs. 1,80,000 (Securities transaction

tax has been paid on acquisition and transfer of the said shares) and income from other sources Rs.

2,75,000. Compute her tax liability for Assessment year 2022-23. (3 Marks)

CA SANCHIT GROVER (Insta ID:- Sanchit.Grover.372) Page 4

You might also like

- ToolsCorp Corporation's Business PlanDocument7 pagesToolsCorp Corporation's Business PlanericNo ratings yet

- Ice Fili Case AnalysisDocument11 pagesIce Fili Case AnalysisZahid KhanNo ratings yet

- Jurnal Malay Reserve LandDocument28 pagesJurnal Malay Reserve Landazman4776100% (1)

- Adidascorporatestrategy 1Document35 pagesAdidascorporatestrategy 1flinks100% (3)

- Lee Case StudyDocument2 pagesLee Case StudyRodolfo Mapada Jr.100% (2)

- Taxation Paper EMBA 16042022Document4 pagesTaxation Paper EMBA 16042022Rohit B .S. Prabhu Verlekar100% (1)

- DT 1 QDocument23 pagesDT 1 QG INo ratings yet

- mcc tax mock 3Document12 pagesmcc tax mock 3akshat.gupta.0812.mpspnNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- Sa 3 DT NovDocument9 pagesSa 3 DT NovRishabh GargNo ratings yet

- Lecture 99 FinalDocument15 pagesLecture 99 Finaltaswaraliarain4No ratings yet

- Capital Gain & IFOS - PaperDocument6 pagesCapital Gain & IFOS - PaperLaavanya JainNo ratings yet

- 64561bos260421 Inter p4Document10 pages64561bos260421 Inter p4GowriNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- 5_6071092042769891925Document9 pages5_6071092042769891925manas nikhilNo ratings yet

- Capital Gain & IFOS - PaperDocument6 pagesCapital Gain & IFOS - PaperVenkataRajuNo ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- Series I - QuestionsDocument11 pagesSeries I - QuestionsAlok MishraNo ratings yet

- MTP Taxation Question Paper 2Document12 pagesMTP Taxation Question Paper 2CursedAfNo ratings yet

- MTP 2 TaxDocument10 pagesMTP 2 TaxPrathmesh JambhulkarNo ratings yet

- Inp 2234 Tax Question PaperDocument11 pagesInp 2234 Tax Question PaperAnshit BahediaNo ratings yet

- Tax (Old) Q Mtp1 Ipc Oct21Document10 pagesTax (Old) Q Mtp1 Ipc Oct21Karan Singh RanaNo ratings yet

- IMP 2413 A TAXATION _QUESTION PAPER RECD ON 22-03-24 3.4Document13 pagesIMP 2413 A TAXATION _QUESTION PAPER RECD ON 22-03-24 3.4anon_996890467No ratings yet

- May 2024 Full Length DT Test 2Document6 pagesMay 2024 Full Length DT Test 2Jyoti ManwaniNo ratings yet

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument11 pagesTest Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionRaghavanNo ratings yet

- Assignment - DTDocument2 pagesAssignment - DTKhushi ThakurNo ratings yet

- UntitledDocument11 pagesUntitleddeepika devsaniNo ratings yet

- Direct-Taxes mcomDocument3 pagesDirect-Taxes mcomfakruddin7866shaikhNo ratings yet

- Tax Mock Test PaperDocument17 pagesTax Mock Test Papermanyagoyall20No ratings yet

- Bos 59265Document46 pagesBos 59265oproducts96No ratings yet

- CS Executive OLD SYLLABUS MCQs JUNE 2024 by CA Vivek GabaDocument269 pagesCS Executive OLD SYLLABUS MCQs JUNE 2024 by CA Vivek GabaParitoshNo ratings yet

- iNCOME TAX MODEL Q.PDocument3 pagesiNCOME TAX MODEL Q.PAndalNo ratings yet

- Part - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceDocument12 pagesPart - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceShashwat SharmaNo ratings yet

- Vol 1 31032019 PDFDocument9 pagesVol 1 31032019 PDFPradeep KattimaniNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperLaavanya JainNo ratings yet

- 2231 Accounts Full CourseDocument6 pages2231 Accounts Full Coursebkbalaji110No ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperVenkataRajuNo ratings yet

- 7401D001 Direct TaxesDocument22 pages7401D001 Direct TaxesMadhuram SharmaNo ratings yet

- CA Inter Taxation Q MTP 2 May 23Document11 pagesCA Inter Taxation Q MTP 2 May 23sureshstipl sureshNo ratings yet

- Tax Old Q Mtp1 Ipc Oct21Document10 pagesTax Old Q Mtp1 Ipc Oct21abhishankar2904No ratings yet

- 71668bos57670 Inter p4q PDFDocument11 pages71668bos57670 Inter p4q PDFmonikaNo ratings yet

- Taxation MTP 1 QuestionsDocument9 pagesTaxation MTP 1 QuestionsVishal Kumar 5504No ratings yet

- Roll No. ..................................... : Part-I 1Document20 pagesRoll No. ..................................... : Part-I 1Khushal kaleNo ratings yet

- Tax - MTP2 - QP - M24 @CAInterLegendsDocument17 pagesTax - MTP2 - QP - M24 @CAInterLegendsPrince ManglaNo ratings yet

- Capital Gain 2Document11 pagesCapital Gain 2Aishwarya SundararajNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- 0 ScheduleDocument7 pages0 ScheduleKusuma MNo ratings yet

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- Term Test 1Document5 pagesTerm Test 1lalshahbaz57No ratings yet

- High Level MCQDocument160 pagesHigh Level MCQT-ushar banarsiNo ratings yet

- Residential Status, Exempt Income & AMT - PaperDocument6 pagesResidential Status, Exempt Income & AMT - PaperBharatbhusan RoutNo ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- 1686044906DTS-2 Taxation CA InteranswerDocument11 pages1686044906DTS-2 Taxation CA InteranswerViraj SharmaNo ratings yet

- Sem - IV Taxation - I Sample Paper-1Document5 pagesSem - IV Taxation - I Sample Paper-1yadavkari497No ratings yet

- CAF 2 TAX Spring 2022Document6 pagesCAF 2 TAX Spring 2022Sumair IqbalNo ratings yet

- MTP 19 50 Questions 1712317445Document13 pagesMTP 19 50 Questions 1712317445Nitin KumarNo ratings yet

- 27-3-24... 4110 GR I... Int-3019... Tax Mcq... QueDocument7 pages27-3-24... 4110 GR I... Int-3019... Tax Mcq... Quenikulgauswami9033No ratings yet

- IncomeTax-2Document6 pagesIncomeTax-2Aditya .cNo ratings yet

- CA Inter Tax Q MTP 2 May 2024 Castudynotes ComDocument13 pagesCA Inter Tax Q MTP 2 May 2024 Castudynotes ComineffableadityisticNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Income Tax marathon Schedule SUNDAYDocument2 pagesIncome Tax marathon Schedule SUNDAYap.quatrroNo ratings yet

- Day 5 inter 24 bookDocument5 pagesDay 5 inter 24 bookap.quatrroNo ratings yet

- Offline Marathon November 23Document12 pagesOffline Marathon November 23ap.quatrroNo ratings yet

- branch accounting free class notes (2)Document3 pagesbranch accounting free class notes (2)ap.quatrroNo ratings yet

- 1. InvestmentDocument3 pages1. Investmentap.quatrroNo ratings yet

- 5_6172219306907012723Document6 pages5_6172219306907012723ap.quatrroNo ratings yet

- Department Accounts ICAIDocument13 pagesDepartment Accounts ICAIap.quatrroNo ratings yet

- 0 5 6075878191115798578Document14 pages0 5 6075878191115798578ap.quatrroNo ratings yet

- CA Final Paper 1Document1 pageCA Final Paper 1ap.quatrroNo ratings yet

- Taxation CLass Test 1Document6 pagesTaxation CLass Test 1ap.quatrroNo ratings yet

- Taxation Class Test 6Document5 pagesTaxation Class Test 6ap.quatrroNo ratings yet

- CA Inter Paper 4Document1 pageCA Inter Paper 4ap.quatrroNo ratings yet

- CA Inter Paper 3Document1 pageCA Inter Paper 3ap.quatrroNo ratings yet

- CA Inter Paper 6Document1 pageCA Inter Paper 6ap.quatrroNo ratings yet

- Includes: ExceptDocument1 pageIncludes: Exceptap.quatrroNo ratings yet

- VIDYA SAGAR Analysis-COSTDocument2 pagesVIDYA SAGAR Analysis-COSTap.quatrroNo ratings yet

- Basic Cocepts 1Document1 pageBasic Cocepts 1ap.quatrroNo ratings yet

- Managerial Economics in A Global Economy: Demand TheoryDocument21 pagesManagerial Economics in A Global Economy: Demand TheoryArif DarmawanNo ratings yet

- SOURAV'S SIP ON SBI MUTUAL FUND (Introduction)Document106 pagesSOURAV'S SIP ON SBI MUTUAL FUND (Introduction)sourabha86100% (1)

- Black Book ProjectDocument49 pagesBlack Book Projectshubham hanbarNo ratings yet

- Urban Strategies For The Future Urban Development of Skopje and TurinDocument486 pagesUrban Strategies For The Future Urban Development of Skopje and TurinognenmarinaNo ratings yet

- P1.T4.Valuation & Risk Models Chapter 16. Option Sensitivity Measures: The "Greeks" Bionic Turtle FRM Study NotesDocument24 pagesP1.T4.Valuation & Risk Models Chapter 16. Option Sensitivity Measures: The "Greeks" Bionic Turtle FRM Study NotesImran MobinNo ratings yet

- 01 Hire PurchaseDocument15 pages01 Hire Purchaseagarwalharsh2341No ratings yet

- Silver BrochureDocument8 pagesSilver BrochurelaxmiccNo ratings yet

- Summer Training Report (Saran Sir) FinalDocument81 pagesSummer Training Report (Saran Sir) Finalaman1203No ratings yet

- Starting A BusinessDocument2 pagesStarting A BusinessYeasy AgustinaNo ratings yet

- Classic Pen ABCDocument5 pagesClassic Pen ABCdebojyoti88No ratings yet

- CA Inter Indirect Tax May 23 AmendedDocument413 pagesCA Inter Indirect Tax May 23 AmendedKhkmNo ratings yet

- PMT Home Assignment Pre Midsem 2024Document1 pagePMT Home Assignment Pre Midsem 2024imon.landageNo ratings yet

- Multiple Choice Questions 1 Which of The Following Will Increase TheDocument2 pagesMultiple Choice Questions 1 Which of The Following Will Increase Thetrilocksp SinghNo ratings yet

- Tenth Edition: Vice-Chairman, Prophet Professor Emeritus, University of California, BerkeleyDocument4 pagesTenth Edition: Vice-Chairman, Prophet Professor Emeritus, University of California, BerkeleyAHSAN MANZOORNo ratings yet

- Rizal's Life in AteneoDocument68 pagesRizal's Life in AteneoVince Kristoffer RasNo ratings yet

- Case Study InvestmentDocument6 pagesCase Study Investmentaroosha 2110No ratings yet

- Forex ManagementDocument29 pagesForex Managementvise008dNo ratings yet

- World-Wide Medical Massage Chairs Market Aspect, Production, Supply and Desire Forecast Covered Inside The Latest Research Obtainable at TMRDocument4 pagesWorld-Wide Medical Massage Chairs Market Aspect, Production, Supply and Desire Forecast Covered Inside The Latest Research Obtainable at TMRtrunkbeam5No ratings yet

- CAR BasicsDocument9 pagesCAR BasicsAbhinav Chauhan0% (1)

- 18 Accelerating Sales and Profits Herb Sorensen TNSDocument36 pages18 Accelerating Sales and Profits Herb Sorensen TNSEvelyn0% (1)

- Steven Shreve. Lectures On Stochastic Calculus and FinanceDocument365 pagesSteven Shreve. Lectures On Stochastic Calculus and FinanceSee Keong LeeNo ratings yet

- Healthy Market Share Gains - VESUVIUS INDIADocument7 pagesHealthy Market Share Gains - VESUVIUS INDIAsarvo_44No ratings yet

- LBO Interviews Questions BIWSDocument5 pagesLBO Interviews Questions BIWSartemidualikNo ratings yet

- Nova Chemical CorporationDocument28 pagesNova Chemical Corporationrzannat94100% (2)

- Utility TheoryDocument21 pagesUtility Theoryfiza akhterNo ratings yet