Professional Documents

Culture Documents

1256147_F16 (1)

1256147_F16 (1)

Uploaded by

adamaddy437Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1256147_F16 (1)

1256147_F16 (1)

Uploaded by

adamaddy437Copyright:

Available Formats

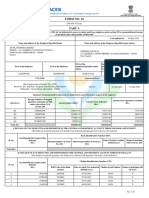

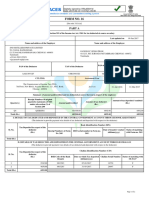

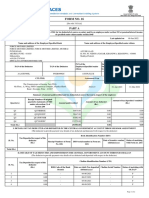

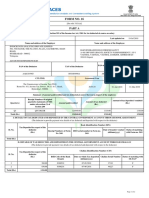

FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary paid to an employee under section 192 or pension/interest income

of specified senior citizen under section 194P

Certificate No. SQAZJNA Last updated on 05-Jun-2024

Name and address of the Employer/Specified Bank Name and address of the Employee/Specified senior citizen

INDERPRASTHA MEDICAL CORPN. LTD.

DELHI MATHURA ROAD, SARITA VIHAR,

SHERSHA KHAN SHARAFUDEEN SEEMA

DELHI - 110076

SHERSHA MAHAL, ITTIVA, CHANAPPARA, KADAKKAL,

Delhi

KOLLAM - 691536 Kerala

+(91)11-29871886

hrss@apollohospitals.com

PAN of the Employee Reference No. provided by the

PAN of the Deductor TAN of the Deductor Employee/Specified senior Employer/Pension Payment order no. provided

citizen by the Employer (If available)

AAACI2398N DELI02126F IRKPS6386E

CIT (TDS) Assessment Year Period with the Employer

From To

The Commissioner of Income Tax (TDS)

Aayakar Bhawan, District Centre, 6th Floor Room no 610, Hall no. 2024-25 01-Apr-2023 31-Mar-2024

4 , Luxmi Nagar, Delhi - 110092

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Receipt Numbers of original

Amount of tax deposited / remitted

quarterly statements of TDS Amount of tax deducted

Quarter(s) Amount paid/credited (Rs.)

under sub-section (3) of (Rs.)

Section 200

Q1 QVKKRAKA 313400.00 28009.00 28009.00

Q2 QVMYJWTE 295800.00 19307.00 19307.00

Q3 QVPXWIBB 365086.00 30115.00 30115.00

Q4 QVRTSNVG 353401.00 32329.00 32329.00

Total (Rs.) 1327687.00 109760.00 109760.00

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

Tax Deposited in respect of the

Sl. No. deductee Date of transfer voucher Status of matching

Receipt Numbers of Form DDO serial number in Form no.

(Rs.) (dd/mm/yyyy) with Form no. 24G

No. 24G 24G

Total (Rs.)

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Challan Identification Number (CIN)

Tax Deposited in respect of the

Sl. No. deductee

(Rs.) BSR Code of the Bank Date on which Tax deposited Challan Serial Number Status of matching with

Branch (dd/mm/yyyy) OLTAS*

1 13390.00 6390009 06-05-2023 32925 F

2 9431.00 6390009 07-06-2023 87618 F

3 5188.00 6390009 07-07-2023 88704 F

4 4439.00 6390009 07-08-2023 28207 F

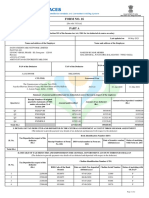

Signature Not Verified

Signed By:PANKAJ AGGARWAL Page 1 of 2

Signing Date:13.06.2024 13:25

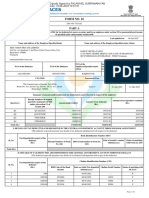

Certificate Number: SQAZJNA TAN of Employer: DELI02126F PAN of Employee: IRKPS6386E Assessment Year: 2024-25

Challan Identification Number (CIN)

Tax Deposited in respect of the

Sl. No. deductee

(Rs.) BSR Code of the Bank Date on which Tax deposited Challan Serial Number Status of matching with

Branch (dd/mm/yyyy) OLTAS*

5 7808.00 6390009 07-09-2023 70646 F

6 7060.00 6390009 07-10-2023 41940 F

7 11178.00 6390009 07-11-2023 03588 F

8 8883.00 6390009 07-12-2023 63464 F

9 10054.00 6390009 06-01-2024 02799 F

10 5562.00 6390009 07-02-2024 68490 F

11 15133.00 6390009 07-03-2024 55009 F

12 11634.00 6390009 06-04-2024 41872 F

Total (Rs.) 109760.00

Verification

I, PANKAJ AGGARWAL, son / daughter of OM PRAKASH AGGARWAL working in the capacity of GENERAL MANAGER (designation) do hereby certify that a sum of

Rs. 109760.00 [Rs. One Lakh Nine Thousand Seven Hundred and Sixty Only (in words)] has been deducted and a sum of Rs. 109760.00 [Rs. One Lakh Nine

Thousand Seven Hundred and Sixty Only] has been deposited to the credit of the Central Government. I further certify that the information given above is true,

complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records.

Place DELHI

Date 08-Jun-2024 (Signature of person responsible for deduction of Tax)

Designation: GENERAL MANAGER Full Name:PANKAJ AGGARWAL

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Legend used in Form 16

* Status of matching with OLTAS

Legend Description Definition

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

U Unmatched

details in bank match with details of deposit in TDS / TCS statement

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

P Provisional

verification of payment details submitted by Pay and Accounts Officer (PAO)

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

F Final mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

O Overbooked amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

Signature Not Verified

Signed By:PANKAJ AGGARWAL Page 2 of 2

Signing Date:13.06.2024 13:25

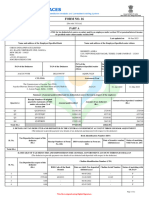

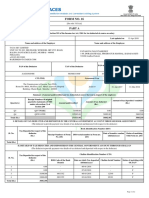

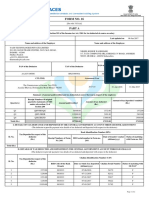

FORM NO. 16

PART B

Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source on salary paid to an employee under section 192 or pension/interest income

of specified senior citizen under section 194P

Certificate No. SQAZJNA Last updated on 05-Jun-2024

Name and address of the Employer/Specified Bank Name and address of the Employee/Specified senior citizen

INDERPRASTHA MEDICAL CORPN. LTD.

DELHI MATHURA ROAD, SARITA VIHAR,

SHERSHA KHAN SHARAFUDEEN SEEMA

DELHI - 110076

SHERSHA MAHAL, ITTIVA, CHANAPPARA, KADAKKAL,

Delhi

KOLLAM - 691536 Kerala

+(91)11-29871886

hrss@apollohospitals.com

PAN of the Deductor TAN of the Deductor PAN of the Employee/Specified senior citizen

AAACI2398N DELI02126F IRKPS6386E

CIT (TDS) Assessment Year Period with the Employer

From To

The Commissioner of Income Tax (TDS)

Aayakar Bhawan, District Centre, 6th Floor Room no 610, Hall no. 2024-25 01-Apr-2023 31-Mar-2024

4 , Luxmi Nagar, Delhi - 110092

Annexure - I

Details of Salary Paid and any other income and tax deducted

A Whether opting out of taxation u/s 115BAC(1A)? No

1. Gross Salary Rs. Rs.

(a) Salary as per provisions contained in section 17(1) 1327686.00

Value of perquisites under section 17(2) (as per Form No. 12BA,

(b) 0.00

wherever applicable)

Profits in lieu of salary under section 17(3) (as per Form No.

(c) 0.00

12BA, wherever applicable)

(d) Total 1327686.00

(e) Reported total amount of salary received from other employer(s) 0.00

2. Less: Allowances to the extent exempt under section 10

(a) Travel concession or assistance under section 10(5) 0.00

(b) Death-cum-retirement gratuity under section 10(10) 0.00

(c) Commuted value of pension under section 10(10A) 0.00

Cash equivalent of leave salary encashment under section 10

(d) 0.00

(10AA)

(e) House rent allowance under section 10(13A) 0.00

(f) Other special allowances under section 10(14) 0.00

Signature Not Verified

Page 1 of 4

Signed By:PANKAJ AGGARWAL

Signing Date:13.06.2024 13:25

Certificate Number: SQAZJNA TAN of Employer: DELI02126F PAN of Employee: IRKPS6386E Assessment Year: 2024-25

Amount of any other exemption under section 10

(g) [Note: Break-up to be filled and signed by employer in the table

provide at the bottom of this form]

(h) Total amount of any other exemption under section 10 0.00

Total amount of exemption claimed under section 10

(i) 0.00

[2(a)+2(b)+2(c)+2(d)+2(e)+2(f)+2(h)]

Total amount of salary received from current employer

3. 1327686.00

[1(d)-2(i)]

4. Less: Deductions under section 16

(a) Standard deduction under section 16(ia) 50000.00

(b) Entertainment allowance under section 16(ii) 0.00

(c) Tax on employment under section 16(iii) 0.00

5. Total amount of deductions under section 16 [4(a)+4(b)+4(c)] 50000.00

6. Income chargeable under the head "Salaries" [(3+1(e)-5] 1277686.00

7. Add: Any other income reported by the employee under as per section 192 (2B)

Income (or admissible loss) from house property reported by

(a) 0.00

employee offered for TDS

(b) Income under the head Other Sources offered for TDS 0.00

Total amount of other income reported by the employee

8. 0.00

[7(a)+7(b)]

9. Gross total income (6+8) 1277686.00

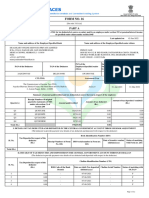

10. Deductions under Chapter VI-A Gross Amount Deductible Amount

Deduction in respect of life insurance premia, contributions to

(a) 0.00 0.00

provident fund etc. under section 80C

Deduction in respect of contribution to certain pension funds

(b) 0.00 0.00

under section 80CCC

Deduction in respect of contribution by taxpayer to pension

(c) 0.00 0.00

scheme under section 80CCD (1)

(d) Total deduction under section 80C, 80CCC and 80CCD(1) 0.00 0.00

Deductions in respect of amount paid/deposited to notified

(e) 0.00 0.00

pension scheme under section 80CCD (1B)

Deduction in respect of contribution by Employer to pension

(f) 0.00 0.00

scheme under section 80CCD (2)

Deduction in respect of health insurance premia under section

(g) 0.00 0.00

80D

Signature Not Verified

Page 2 of 4

Signed By:PANKAJ AGGARWAL

Signing Date:13.06.2024 13:25

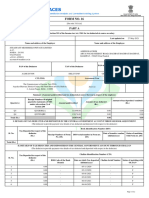

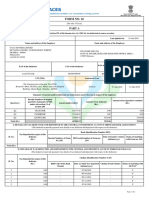

Certificate Number: SQAZJNA TAN of Employer: DELI02126F PAN of Employee: IRKPS6386E Assessment Year: 2024-25

Deduction in respect of interest on loan taken for higher

(h) 0.00 0.00

education under section 80E

Deduction in respect of contribution by the employee to Agnipath

(i) 0.00 0.00

Scheme under section 80CCH

Deduction in respect of contribution by the Central Government

(j) 0.00 0.00

to Agnipath Scheme under section 80CCH

Gross Qualifying Deductible

Amount Amount Amount

Total Deduction in respect of donations to certain funds,

(k) 0.00 0.00 0.00

charitable institutions, etc. under section 80G

Deduction in respect of interest on deposits in savings account

(l) 0.00 0.00 0.00

under section 80TTA

Amount Deductible under any other provision (s) of Chapter VI-A

(m) [Note: Break-up to be filled and signed by employer in the table

provide at the bottom of this form]

Total of amount deductible under any other provision(s) of

(n) 0.00 0.00 0.00

Chapter VI-A

Aggregate of deductible amount under Chapter VI-A

11. 0.00

[10(d)+10(e)+10(f)+10(g)+10(h)+10(i)+10(j)+10(k)+10(l)+10(n)]

12. Total taxable income (9-11) 1277686.00

13. Tax on total income 105538.00

14. Rebate under section 87A, if applicable 0.00

15. Surcharge, wherever applicable 0.00

16. Health and education cess 4222.00

17. Tax payable (13+15+16-14) 109760.00

18. Less: Relief under section 89 (attach details) 0.00

19. Net tax payable (17-18) 109760.00

Verification

I, PANKAJ AGGARWAL, son/daughter of OM PRAKASH AGGARWAL .Working in the capacity of GENERAL MANAGER

(Designation) do hereby certify that the information given above is true, complete and correct and is based on the books of account,

documents, TDS statements, and other available records.

Place DELHI (Signature of person responsible for deduction of tax)

Full

Date 08-Jun-2024 PANKAJ AGGARWAL

Name:

Signature Not Verified

Page 3 of 4

Signed By:PANKAJ AGGARWAL

Signing Date:13.06.2024 13:25

Certificate Number: SQAZJNA TAN of Employer: DELI02126F PAN of Employee: IRKPS6386E Assessment Year: 2024-25

2. (f) Break up for ‘Amount of any other exemption under section 10’ to be filled in the table below

Particular's of Amount for any other

Sl. exemption under section 10 Gross Amount Qualifying Amount Deductible Amount

No.

Rs. Rs. Rs. Rs.

1.

2..

3.

4.

5.

6.

10(k). Break up for ‘Amount deductible under any other provision(s) of Chapter VIA ‘to be filled in the table below

Particular's of Amount deductible under

Sl. any other provision(s) of Chapter VIA Gross Amount Qualifying Amount Deductible Amount

No.

Rs. Rs. Rs. Rs.

1.

2.

3.

4.

5.

6.

DELHI (Signature of person responsible for deduction of

Place

tax)

Full

Date 08-Jun-2024 PANKAJ AGGARWAL

Name:

Signature Not Verified

Page 4 of 4

Signed By:PANKAJ AGGARWAL

Signing Date:13.06.2024 13:25

Certificate Number: SQAZJNA TAN of Employer:DELI02126F PAN of Employee:IRKPS6386E Assessment Year:2024-25 EMPID:1256147

Annexure to Form No.16 PART B [for item nos. 2(f) & 2(g) and 10(m)]

2(f) & 2(g) Break up for 'Amount of any other exemption under section 10' to be filled in the table below

Sl.

No. Particulars of Amount for any other

exemption under section 10 Gross Amount Qualifying Amount Deductible Amount

Rs. Rs. Rs. Rs.

10(m). Break up for 'Amount deductible under any other provision(s) of Chapter VIA' to be filled in the table below

Sl.

No. Particulars of Amount deductible under

any other provision(s) of Chapter VIA Gross Amount Qualifying Amount Deductible Amount

Rs. Rs. Rs. Rs.

Place

DELHI

(Signature of person responsible for deduction of tax)

Date

08-Jun-2024

Designation : GENERAL MANAGER Full Name : PANKAJ AGGARWAL

Signature Not Verified

Signed By:PANKAJ AGGARWAL

Signing Date:13.06.2024 13:25 Page 1 of 1 (Annexure to Form 16 - Part B)

Certificate Number: SQAZJNA EMPID:1256147

Form No.12BA

{See Rule 26A(2)(b)}

Statement showing particulars of perquisites,other fringe benefits or amenities and profits in lieu of salary with value thereof

1. Name and address of the employer: INDRAPRASTHA MEDICAL CORPORATION LIMITED

Apollo Hospitals,E2, Block E, Sector 26, Noida Uttar Pradesh -

201301 UTTAR PRADESH INDIA

2. TAN DELI02126F

3. TDS Assessment Range of the employer:

4. Name, designation and Permanent Account Number or SHERSHA KHAN SHARAFUDEEN SEEMA, Resident, IRKPS6386E

Aadhaar Number of employee:

5. Is the employee a director or a person with substantial No

interest in the company (where the employer is a company):

6. Income under the head 'Salaries' of the employee (other 1,277,686.00

than from perquisites):

7. Financial Year: 2023-2024

8. Valuation of Perquisites:

SL. Nature of perquisites(see rule 3) Value of Amount,if any Amount of

No. perquisite as per recovered from perquisite

rules (Rs.) employee (Rs.) chargeable to tax

Col(3)-Col(4)

(Rs.)

(1) (2) (3) (4) (5)

1 Accommodation 0.00 0.00 0.00

2 Cars/Other automotive 0.00 0.00 0.00

3 Sweeper, gardener, watchman or personal Attendant 0.00 0.00 0.00

4 Gas, electricity, water 0.00 0.00 0.00

5 Interest free or concessional loans 0.00 0.00 0.00

6 Holiday Expenses 0.00 0.00 0.00

7 Free or Concessional Travel 0.00 0.00 0.00

8 Free Meals 0.00 0.00 0.00

9 Free Education 0.00 0.00 0.00

10 Gifts, vouchers, etc. 0.00 0.00 0.00

11 Credit card expenses 0.00 0.00 0.00

12 Club expenses 0.00 0.00 0.00

13 Use of movable assets by employees 0.00 0.00 0.00

14 Transfer of assets to Employees 0.00 0.00 0.00

15 Value of any other benefit/amenity/service/privilege 0.00 0.00 0.00

16 Stock options allotted or transferred by employer being an eligible start-up 0.00 0.00 0.00

referred to in section 80-IAC

17 Stock options (non-qualified options) other than ESOP in col 16 above 0.00 0.00 0.00

18 Contribution by employer to fund and scheme taxable under section 0.00 0.00 0.00

17(2)(vii)

19 Annual accretion by way of interest, dividend etc. to the balance at the 0.00 0.00 0.00

credit of fund and scheme referred to in section 17(2)(vii) and taxable under

section 17(2)(viia)

20 Other benefits or amenities 0.00 0.00 0.00

21 Total value of perquisites 0.00 0.00 0.00

22 Total value of Profits in lieu of salary as per section 17(3) 0.00 0.00 0.00

9. Details of Tax.

a)Tax deducted from salary of the employee u/s 192(1) 109,760.00

b)Tax paid by employer on behalf of the employee u/s 192(1A) 0.00

c)Total Tax Paid 109,760.00

d)Date of payment into Government treasury Various dates as mentioned on Part A of the Form 16

DECLARATION BY THE EMPLOYER

I, PANKAJ AGGARWAL, son/daughter of OM PRAKASH AGGARWAL working as GENERAL MANAGER do hereby

declare on behalf of INDRAPRASTHA MEDICAL CORPORATION LIMITED that the information given above is based on the

books of account,documents and other relevant records or information available with us and the details of value of each such

perquisite are in accordance with section 17 and rules framed thereunder and that such information is true and correct.

Place DELHI

Date 08-Jun-2024 (Signature of person responsible for deduction of tax)

Designation : GENERAL MANAGER Full Name : PANKAJ AGGARWAL

Signature Not Verified

Signed By:PANKAJ AGGARWAL

Signing Date:13.06.2024 13:25 Page 1 of 1 (Form 12BA)

Certificate Number: SQAZJNA EMPID:1256147

FORM NO. 12BB

(See rule 26C)

Statement showing particulars of claims by an employee for deduction of tax under section 192

1. Name and address of the employee : SHERSHA KHAN SHARAFUDEEN SEEMA

2. Permanent Account Number of the employee : IRKPS6386E

3. Financial year : 2023-2024

Details of claims and evidence thereof

Sl. No. Nature of claim Amount(Rs.) Evidence / particulars

(1) (2) (3) (4)

House Rent Allowance:

(i) Rent paid to the landlord for period : Rs.0

(i) Name of the landlord :

1. Rs.0 House Rent Receipts

(ii) Address of the landlord :

(iii) Permanent Account Number of the

landlord :

2. Leave travel concessions or assistance Rs.0 Travel Receipts/Tickets

Deduction of interest on borrowing:

(i) Interest payable/paid to the lender

Self Occupied Interest :

Let-OutInterest :

(ii) Name of the lender

Let-Out :

(iii) Address of the lender

Provisional Certificate from

3. Self Occupied : Rs.0

Bank/Financial Institution/Lender

Let-Out :

(iv) Permanent Account Number of the lender

Self Occupied :

Let-Out :

(a) Financial Institutions

(b) Employer

(c) Others

Signature Not Verified

Signed By:PANKAJ AGGARWAL

Signing Date:13.06.2024 13:25 Page 1 of 2 (Form 12BB)

Certificate Number: SQAZJNA EMPID:1256147

Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

4. Rs. 0 Photocopy of the investment proofs

(ii) Section 80CCC :

(iii) Section 80CCD :

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A.

Verification

I, SHERSHA KHAN SHARAFUDEEN SEEMA, son/daughter of Mr. Sharafudeen A do hereby certify that the information given above is complete and correct.

Place : Mathura Road -New Delhi

Date: 08-Jun-2024

(Signature of the employee)

Designation : Resident Full Name: SHERSHA KHAN SHARAFUDEEN SEEMA

Note: The information/details above, as required for deduction of tax u/s 192 of the Income Tax Act, has been provided by the employee.

Signature Not Verified

Signed By:PANKAJ AGGARWAL

Signing Date:13.06.2024 13:25 Page 2 of 2 (Form 12BB)

You might also like

- Easy Visa Project PDFDocument17 pagesEasy Visa Project PDFRobertKimtai100% (2)

- ANA Code of EthicsDocument2 pagesANA Code of EthicsPhil SimonNo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part ANidhish AgrawalNo ratings yet

- Form 16 2021-2022Document10 pagesForm 16 2021-2022ArchanaNo ratings yet

- Swim Lane Diagram of Hiring ProcessDocument2 pagesSwim Lane Diagram of Hiring ProcessNAMRATA GUPTANo ratings yet

- Form16 Signed-1Document7 pagesForm16 Signed-1akh.278No ratings yet

- Annual 3683form16Document9 pagesAnnual 3683form16modi jiNo ratings yet

- HTMLReportsDocument7 pagesHTMLReportsPushpraj ThakurNo ratings yet

- Form 16 ADocument2 pagesForm 16 ANitya NarayananNo ratings yet

- Form 16Document7 pagesForm 16Pandu YerraNo ratings yet

- Form 16 Lenskart - AspxDocument7 pagesForm 16 Lenskart - AspxPrince JainNo ratings yet

- FS46265257 PDFDocument9 pagesFS46265257 PDFPankaj KumarNo ratings yet

- Ash03799 F16Document10 pagesAsh03799 F16radha krishnaNo ratings yet

- Kansupriya@Deloitte - Com f162022 2023Document10 pagesKansupriya@Deloitte - Com f162022 2023Supriya KandukuriNo ratings yet

- Ddopm6840n 2021-22Document2 pagesDdopm6840n 2021-22Gaurav MishraNo ratings yet

- Part ADocument2 pagesPart Aeshanshaik2010No ratings yet

- Annual 6000352form16Document9 pagesAnnual 6000352form16deepakjhaNo ratings yet

- Form No 16Document3 pagesForm No 16rsharma09170No ratings yet

- Clhps7458a 2019-20Document2 pagesClhps7458a 2019-20Gurudeep singhNo ratings yet

- Form16 Mar 2023Document9 pagesForm16 Mar 2023PRAJAKTA GAJBHIYENo ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023HeetNo ratings yet

- Form 16Document9 pagesForm 16Ponns KarnanNo ratings yet

- Annual I-Mumd44312form16Document7 pagesAnnual I-Mumd44312form16dbind1999No ratings yet

- Aagpe6585l 2022-23Document2 pagesAagpe6585l 2022-23ELUMALAI BALACHANDRANNo ratings yet

- Form No. 16: Part ADocument9 pagesForm No. 16: Part ArakehsNo ratings yet

- Salary Jan 2001Document2 pagesSalary Jan 2001Kharde HrishikeshNo ratings yet

- Pramod KumarDocument2 pagesPramod Kumarmemer.guru07No ratings yet

- FORM16Document10 pagesFORM16Siva Ramakrishna100% (1)

- Form 16: TLG India Private LimitedDocument9 pagesForm 16: TLG India Private LimitedcagopalofficebackupNo ratings yet

- Form16 22 23Document6 pagesForm16 22 23rushigadhave12No ratings yet

- Form 16: Warora Kurnool Transmission LimitedDocument10 pagesForm 16: Warora Kurnool Transmission LimitedBHASKAR pNo ratings yet

- Form 16 FY 2018-19 PDFDocument9 pagesForm 16 FY 2018-19 PDFSujata ChoudharyNo ratings yet

- EyspsDocument2 pagesEyspsrasoolvaliskNo ratings yet

- పెరుగుదల - వికాస నియమాలుDocument6 pagesపెరుగుదల - వికాస నియమాలుIliyas GNo ratings yet

- Form 16Document6 pagesForm 16Ashwani KumarNo ratings yet

- Form16 122726 DBKPS7123E AY-2022-23Document9 pagesForm16 122726 DBKPS7123E AY-2022-23Damodar SurisettyNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part Ahelpdesk svscenterNo ratings yet

- BLJPM3369M 2014-15Document2 pagesBLJPM3369M 2014-15jackproewildNo ratings yet

- Form16 AlphonseIrudayaraj CALCJB635 60008321162 60008048314 510647000007595107 16865879...Document6 pagesForm16 AlphonseIrudayaraj CALCJB635 60008321162 60008048314 510647000007595107 16865879...alphonse INo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinaya ChennadiNo ratings yet

- From16 A PDFDocument2 pagesFrom16 A PDFAadarshNo ratings yet

- Form16-2021-2022 Part ADocument2 pagesForm16-2021-2022 Part Athaarini doraiswamiNo ratings yet

- 20746399_IND_FORM 16 PART A_2021_20220615_500Document8 pages20746399_IND_FORM 16 PART A_2021_20220615_500ron weaslyNo ratings yet

- Form 16ADocument4 pagesForm 16AniranjansankaNo ratings yet

- Karmveer.s@zetwerk - Com F16Document10 pagesKarmveer.s@zetwerk - Com F16karm veer singhNo ratings yet

- Form16 2012 AAXPE4654P 2023-24Document2 pagesForm16 2012 AAXPE4654P 2023-24Srinivas Etikala0% (1)

- Form16 2022 2023Document8 pagesForm16 2022 2023arun poojariNo ratings yet

- Form 16: Here Solutions India Private LimitedDocument10 pagesForm 16: Here Solutions India Private LimitedIt's your ChannelNo ratings yet

- CTS FormB16 202021Document6 pagesCTS FormB16 202021Milind MoreNo ratings yet

- Form16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Document6 pagesForm16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Mankamuthaka VemaratananaNo ratings yet

- Tushar - Jagtap@amdocs - Com f16Document10 pagesTushar - Jagtap@amdocs - Com f16pvd6d52kd2No ratings yet

- Form16 Till 14 Dec 2019Document11 pagesForm16 Till 14 Dec 2019Aviral SankhyadharNo ratings yet

- Abfpw1788f 2017-18 PDFDocument2 pagesAbfpw1788f 2017-18 PDFNikhil121314No ratings yet

- Form 16 Part - ADocument2 pagesForm 16 Part - AdivanshuNo ratings yet

- Form16 742768 PDFDocument6 pagesForm16 742768 PDFAtulsing thakurNo ratings yet

- Ahxxxxxxxq q4 2022-23Document2 pagesAhxxxxxxxq q4 2022-23AMAN DEEP SINGHNo ratings yet

- Jayanth 2022Document6 pagesJayanth 2022Murali K MadugulaNo ratings yet

- Akapr2160g 2019-20Document2 pagesAkapr2160g 2019-20Satyanarayana Sharma ValluriNo ratings yet

- Form 16Document2 pagesForm 16Kushal MalhotraNo ratings yet

- FORM-16-2023-2024sachin kuamrDocument2 pagesFORM-16-2023-2024sachin kuamrgamersingh098123No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 2 Deborah Brandts Sponsors of LiteracyDocument28 pages2 Deborah Brandts Sponsors of Literacyapi-241729915No ratings yet

- Profissao Musicoterapeura UKDocument272 pagesProfissao Musicoterapeura UKPsicologia RodoviáriaNo ratings yet

- The Social Function of Business: Lesson IIDocument12 pagesThe Social Function of Business: Lesson IIcj jamesNo ratings yet

- Onboarding, Training, and Developing Employees: Fundamentals of Human Resource ManagementDocument10 pagesOnboarding, Training, and Developing Employees: Fundamentals of Human Resource ManagementMaham ImtiazNo ratings yet

- Offer Letter of Ms. PutriDocument2 pagesOffer Letter of Ms. PutriMidhun RamNo ratings yet

- October Pay SlipDocument2 pagesOctober Pay SlipanakinpowersNo ratings yet

- Arushi SonalDocument2 pagesArushi Sonalsuvranilsarkar3No ratings yet

- Equal Pay For Equal Work in IndiaDocument11 pagesEqual Pay For Equal Work in IndiaShailesh BhoyarNo ratings yet

- Portfolio 2 - Personal and Professional Communication-2Document4 pagesPortfolio 2 - Personal and Professional Communication-2lilmadhuNo ratings yet

- Points of Similarity:: Comparison of Halsey & Rowan SchemeDocument2 pagesPoints of Similarity:: Comparison of Halsey & Rowan SchemeNiki JosephNo ratings yet

- Effect of Leadership Style On EmployeesDocument96 pagesEffect of Leadership Style On EmployeesChernet DeribeNo ratings yet

- Abolition of Bonded Labour - Class No 26 Dinesh KumarDocument22 pagesAbolition of Bonded Labour - Class No 26 Dinesh Kumar26 Dinesh Kumar PNo ratings yet

- Chubb INA Holdings v. Chang (Motion To Dismiss)Document37 pagesChubb INA Holdings v. Chang (Motion To Dismiss)Ken VankoNo ratings yet

- Restaurant Busperson Job Description - TrainingDocument17 pagesRestaurant Busperson Job Description - Trainingaurelian-popa-8738No ratings yet

- Indian Economy: Mobilization of ResourcesDocument3 pagesIndian Economy: Mobilization of ResourcesSandeep SinghNo ratings yet

- HRF-2020-001 (Employee Information Sheet)Document2 pagesHRF-2020-001 (Employee Information Sheet)Emy SalvadorNo ratings yet

- Chapter 2 Compensation 3490Document6 pagesChapter 2 Compensation 3490Kelvin LeeNo ratings yet

- Labor 1 - Digests - 110515Document15 pagesLabor 1 - Digests - 110515Karla BeeNo ratings yet

- Apm Terminals Corporate BrochureDocument19 pagesApm Terminals Corporate BrochureSky MarshallNo ratings yet

- Return To Work Program KitDocument39 pagesReturn To Work Program Kitsergejenko100% (1)

- Diversity and Multiculturalism: Presented To: Dr. Madiha Shah Presenter: Narjis DianaDocument40 pagesDiversity and Multiculturalism: Presented To: Dr. Madiha Shah Presenter: Narjis DianaTayyabaNo ratings yet

- Human Resource Management: Prof. Parul Singh Fortune Institute 2010Document30 pagesHuman Resource Management: Prof. Parul Singh Fortune Institute 2010yogimeetNo ratings yet

- Oct 2022Document1 pageOct 2022sunil kumarNo ratings yet

- Serrano V. Gallant Maritime Digest: December 20, 2016 V Bdi AzDocument5 pagesSerrano V. Gallant Maritime Digest: December 20, 2016 V Bdi Azhully gullyNo ratings yet

- Income TaxDocument156 pagesIncome TaxApoorv90% (10)

- Near Miss Examples in The WorkplaceDocument2 pagesNear Miss Examples in The WorkplacefmitranoNo ratings yet

- Poquiz Labor Law: Which Shall Be Applied in The Same RegionDocument12 pagesPoquiz Labor Law: Which Shall Be Applied in The Same RegionChillin S DdrNo ratings yet