Professional Documents

Culture Documents

Resume

Resume

Uploaded by

ss_mirganjCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Resume

Resume

Uploaded by

ss_mirganjCopyright:

Available Formats

GAJENDRA KUMAR

: Flat No.-20C, 2nd Floor, Lotus Villas, Jalpura, Secort-1 Greater Noida West (UP)-201306

:+91-9958074185;: gajendrakumar564@gmail.com

FINANCE & ACCOUNTS PROFESSIONAL

Enterprising & dynamic professional with well-rounded ownership, leadership and decision making skills; significant experience

of 16 years in Finance/Accounts & Taxation.

PROFILE & STRENGTHS

Competent, diligent & result oriented professional, offering experience across Manufacturing Accounting, Accounts &

Finance Management, GST & TDS, Inventory Reconciliation, Internal Audit, MIS and Liaison & Coordination; with

Prestigious organization such as NTL Group, Luxor Group & Veeline Group.

Excellent time management skills with proven ability to work accurately and quickly prioritize, coordinate and consolidate

tasks; resilient with a high level of personal integrity and energy experience.

Achievements / Ability

Successfully managing large organization indirect tax i.e. General Accounting, Trade Payable, GST and Budget.

Team leaded for Microsoft NAV implementation & implemented successfully at Veeling Group

Completed the Inventory Reconciliation in Veeline Group which was pending for all most 2 Years.

PROFESSIONAL EXPERIENCE

Veeline Industries Limited, Sikandrabad Jan.-2022 to till date

Manager – Finance & Accounts

Job Responsibility

Preparation and finalizing of month end closing, ledger &Trail Balance scrutiny.

Preparing quarterly Balance sheet & Monthly closing entry in books for Provisions, Revenue Recognition and Expense Deferrals.

MIS on monthly Basis such as monthly Plant profitability, Plant Conversion Cost Review, Compare with Budget.

Preparing statement for monthly MIS such as stock statements, scrap statement and division wise consumption.

Preparing Monthly/Fortnightly Material Consumption Report, Controlling Inventory Liquidation plan and BOM Vs Actual consumption.

Controllership for vendor and customer accounts including 26AS reconciliation and balance confirmation for quarterly audit purpose.

Controlling tax fillings related to GST, TDS and ITR. Managing replies to notices received from Govt authorities and

ensuring timely response to letters.

Preparation & Finalization of RPT, MSME in accordance with Indian GAAP & Accounting Standards.

Resolving Queries under Both Internal Audit, Statutory Audit & IFC Audit as per their requirement on timely basis.

Preparation & Assist of finalization Income tax computation for advance tax, discussion with management for profit

projections for advance tax.

Managing statutory compliances like GST payment, GST return filing (GSTR-1,GSTR-3B, GSTR-6)

Finalization of GST Annual Audit& e-filling Annual Returns GSTR-9, GSTR-9C.

Preparation of replies of notice like GSTASMT-10, DRC-01, DRC-01A, DRC-01B & DRC-01C.

PO Process Review for Orders issued from Sites, Purchase Vouching, and Evaluating Material Inward Register at gate. Rate

Verification and Comparison with PO for local purchase.

Scrutiny related to Vendor Balances, accounts payable, Fixed Assets working, TA /DA bills checking, Cash &Journal

Vouching, Prepaid Entries and their calculations.

Monitor and ensure seamless functioning of 'AR & AP' and accountable for releasing the payments.

Responsible for ensuring vendors' payments; monitoring & maintaining all advance deposits received and balancing them

with general ledger. Accountable for final level checking of domestic remittance.

LUXOR INTERNATIONAL PVT. LTD. (Luxor Group), Noida Feb.-2016-Jan. 2022

Assistant Manager - Finance & Accounts

Preparation and finalizing of month end closing, ledger &Trail Balance scrutiny.

Preparing quarterly Balance sheet &Monthly closing entry in books for Provisions, Revenue Recognition and Expense Deferrals.

Preparing statement for monthly MIS such as stock statements, scrap statement and division wise consumption.

Preparation of Working, Reporting and Supporting to Commercial Head for Monthly Budgets and MIS.

Preparing Monthly/Fortnightly Material Consumption Report, Controlling Inventory Liquidation plan and BOM Vs Actual consumption.

Preparation of Inventory presentation, NOD calculation and reason for increase/decrease in inventory category wise.

Handling quarterly and annual audit for inventory and consumption related area.

Accounts & Records to Maintained Under GST-Stock Register, Input tax credit availed, Output tax payable and paid,

Supervision of timely submission e-way Bill & e-Invoice.

Return Submission-GSTR-1,GSTR-3B, GSTR-6Upload and Submit all return using secure data network.

Preparing of tax plans and ensuring timely assessment and filing of GSTR-9, GSTR-9C,GST-RFD-01A.

Inputs Tax Credit Reconciliation-Match GSTR-2A & GSTR-2B to Minimize differences to maximize set of.

Vendor Tax Credit Reconciliation-Identify track and communicate on vender wise input tax disallowances.

HSN/SAC code-Co-ordination with Purchases. & IT deptt. Maintain Item wise, service wise correct HSN/SAC code in NAV.

Monitor and ensure seamless functioning of 'Accounts Payable' and accountable for releasing the payments.

Responsible for ensuring vendors' payments; monitoring & maintaining all advance deposits received and balancing them

with general ledger. Accountable for final level checking of domestic remittance

NTL LEMNIS INDIA PVT. LTD., Noida Feb. 2011-Feb. 2016

Senior Accounts Officer

Preparing MIS reports (P&L) & Plant Performance Reports, Fixed Asset Register for monitoring movement of key business

indicators to facilitate decision making and fruitful dissemination of information.

Diligently preparing & maintaining statutory books of accounts viz., journal, ledger, cash book and bank/branch

reconciliation in subsidiary compliance with the norms; pivotal in creating and controlling chart of accounts in

Navision/Tally.

Efficiently preparing presentation in Excel/PPT of monthly Flash Report .i.e. sales, purchases, Inventory report, foreign

payment document related to service and purchase and document for bank realization certificate pertaining to export.

Adroitly handling the whole gamut of account activities viz., TDS, Excise Audit, sales tax assessment &appeal cases;

Preparing tax plans and ensuring timely assessment and filing of direct & indirect tax returns including TDS Returns in

compliance statutory acts.

Availing benefits thro’ EPCG scheme for import of P&M, Equipment’s and also claiming Deemed export benefits.

Drafting replies to SCNs and appeals against orders, Interaction with consultants/advocates.

Cyklop Packaging Systems (India) Pvt. Ltd., Gr. Noida July 2007-Feb. 2011

Sr. Executive (Accounts)

Successfully standardized & managed the accounting system of the company and maintained uniform accounting practices

for the smooth running of the business while ensuring compliance with procedures.

Responsible for controlling bank a/c’s and reconciliation on monthly basis; evaluated internal control systems/procedures

and prepared audit reports to highlight shortcomings and implementing necessary recommendations.

Prepared financial reports to determine the financial visibility, played pivotal role in final accounts preparations.

Play pivotal role to establish new project, liaison with various department to run a new project and transfer the factory from

one location to other location.

Preparing and ensuring timely submission Excise & Service Tax, and Sales Tax return in Tally 9.0.

Maintains Excise Records i.e. RG1, RG Part 1 and 2. Assisting accounts team in day to day activities.

Following up with branches collection data for reconciliations.

ACADEMIC & PROFESSIONAL CREDENTIALS

S.No. Course Institute/University Passing Year Grade/Percentage

1 GST Certification Star Resources New Delhi 2016 A

2 PG Diploma In CMA NIPM, Delhi 2014 A

3 Masters in commerce Jai Prakash University, Chapra 2007 65%

4 Diploma in Statutory & Taxation AIIMAS, Siwan 2006 A

Computer Proficiency

Advance Excel, SAP ECC, NAV, TALLY, WEBTAL Date of Birth: 5th June 1984

You might also like

- Kanika JainDocument3 pagesKanika JainThe Cultural CommitteeNo ratings yet

- Senior Accounts/Audit & Taxation Professional: Chetan KhambhaytaDocument3 pagesSenior Accounts/Audit & Taxation Professional: Chetan Khambhaytalala habibiNo ratings yet

- Jatin ResumeDocument2 pagesJatin Resumeelisha.autoneumNo ratings yet

- Resume Swati Sap Fico FresherDocument2 pagesResume Swati Sap Fico FresheraravintharkNo ratings yet

- GB Devadiga240224Document3 pagesGB Devadiga240224ganeshNo ratings yet

- CV - Manoranjan SamantarayDocument2 pagesCV - Manoranjan SamantarayAshis barmaNo ratings yet

- Accounts and Finance ProfessionalDocument3 pagesAccounts and Finance ProfessionalFahad Ahmad Khan100% (1)

- CV - Abhishek SinglaDocument4 pagesCV - Abhishek SinglaMoHiT chaudharyNo ratings yet

- Finance Manager RDocument4 pagesFinance Manager Rgoldbayhotels22No ratings yet

- Suchendra N. Chandan: GAAP, Auditing Finalization of AccountsDocument4 pagesSuchendra N. Chandan: GAAP, Auditing Finalization of AccountsBhavesh PopatNo ratings yet

- Priyaranjancn ProfileDocument4 pagesPriyaranjancn Profilevaishnaviurs06No ratings yet

- Looking For Chartered Accountant (CA)Document2 pagesLooking For Chartered Accountant (CA)Supriya NayakNo ratings yet

- Pise Nilesh Finance ControllerDocument3 pagesPise Nilesh Finance ControllerNilesh PatilNo ratings yet

- Muzafar Resume Accounts SpecialistDocument3 pagesMuzafar Resume Accounts Specialistmuzafar.takeyNo ratings yet

- Gagandeep Singh AjmaniDocument2 pagesGagandeep Singh AjmaniThe Cultural CommitteeNo ratings yet

- Girish Sawant ResumeDocument3 pagesGirish Sawant ResumeRohit PandeyNo ratings yet

- Barun LalDocument3 pagesBarun Lalelvee.hrNo ratings yet

- Bharathraj CV-KochDocument3 pagesBharathraj CV-Kochbhavan pNo ratings yet

- RESUME SAMEER (1)-4Document4 pagesRESUME SAMEER (1)-4soniawasnik9No ratings yet

- CV RSalonoyDocument4 pagesCV RSalonoyNoushad N HamsaNo ratings yet

- KrishnaKanth KDocument2 pagesKrishnaKanth KmaggidiravinderNo ratings yet

- Madhurisarkar (12 0)Document3 pagesMadhurisarkar (12 0)Vipin HandigundNo ratings yet

- CV Lakshya GuptaDocument3 pagesCV Lakshya Guptapuneetaswani1234No ratings yet

- Naukri SrinivasAnumala (12y 0m)Document3 pagesNaukri SrinivasAnumala (12y 0m)Ashwani KumarNo ratings yet

- ARUNJAIN[8_0]Document4 pagesARUNJAIN[8_0]miyado3776No ratings yet

- Work Experience: Subramanyam DDocument4 pagesWork Experience: Subramanyam Dthetrilight2023No ratings yet

- Mohammed Khan (SR Accountant) KSA Wup CCDocument21 pagesMohammed Khan (SR Accountant) KSA Wup CCftimum1No ratings yet

- Abhishek GuptaDocument3 pagesAbhishek Guptadr_shaikhfaisalNo ratings yet

- Resume ShahabDocument2 pagesResume Shahabnasir elahiNo ratings yet

- Nishit MarvaniaDocument3 pagesNishit Marvaniaone_and_only_you0076406No ratings yet

- Srihari Patil: Skill Set Profile SnapshotDocument2 pagesSrihari Patil: Skill Set Profile Snapshotgaurav jainNo ratings yet

- Nikhil ResumeDocument2 pagesNikhil Resumedubaiduck123No ratings yet

- Dev ResmeDocument3 pagesDev ResmeABhshekNo ratings yet

- Deepak Kumar Singh: Contact No.: +977-9823180770Document4 pagesDeepak Kumar Singh: Contact No.: +977-9823180770Deepak SinghNo ratings yet

- Wa0000.Document2 pagesWa0000.www.taxontrackNo ratings yet

- Exe Accountant XDocument7 pagesExe Accountant XManjusha GantaNo ratings yet

- Rahul Sharma ResumeDocument5 pagesRahul Sharma ResumeggmdywzbngNo ratings yet

- XXXXX ResumeDocument3 pagesXXXXX ResumekotisanampudiNo ratings yet

- Resume CharanDocument5 pagesResume CharanNachiketa BiswalNo ratings yet

- Syed Wajeeh Hasan Zaidi-CVDocument4 pagesSyed Wajeeh Hasan Zaidi-CVmba2135156No ratings yet

- Muzafar Resume Tax SpecialistDocument3 pagesMuzafar Resume Tax Specialistmuzafar.takeyNo ratings yet

- Wa0003.Document2 pagesWa0003.bhoomika rathodNo ratings yet

- Satyarth Prakash Dwivedi-CvDocument5 pagesSatyarth Prakash Dwivedi-CvDesi Vanila IceNo ratings yet

- Profile Summary: Suraj TanwarDocument3 pagesProfile Summary: Suraj TanwarBhavesh PopatNo ratings yet

- Sukhvinder SinghDocument2 pagesSukhvinder SinghBhavesh PopatNo ratings yet

- Core Competencies ProfileDocument2 pagesCore Competencies ProfileHarun RashidNo ratings yet

- ACCA Taxation & FinanceDocument2 pagesACCA Taxation & Financetalent.house1985No ratings yet

- CV Formate For Account ExecutiveDocument5 pagesCV Formate For Account Executivejayan_SikarwarNo ratings yet

- Jincy KJ - ResumeDocument2 pagesJincy KJ - ResumethedadswayNo ratings yet

- Meldy Layugan: Career StatementDocument5 pagesMeldy Layugan: Career StatementLynne LayuganNo ratings yet

- Mukesh Saini-ResumeDocument3 pagesMukesh Saini-Resumeca.anup.kNo ratings yet

- I 5 Nfy 08 RSJX SW VQ 485 PDTF 7 PZJFT 8 U GK BZFZW LUWsdaDocument3 pagesI 5 Nfy 08 RSJX SW VQ 485 PDTF 7 PZJFT 8 U GK BZFZW LUWsdaShe Rae PalmaNo ratings yet

- Resume SasikumarDocument5 pagesResume SasikumarS SasikumarNo ratings yet

- Krishna Kanth KDocument2 pagesKrishna Kanth KmaggidiravinderNo ratings yet

- Finance & Credit Controller With 10+ Years of Experience in Dubai.Document5 pagesFinance & Credit Controller With 10+ Years of Experience in Dubai.S SasikumarNo ratings yet

- Finance & Credit Controller With 10+ Years of Experience in Dubai.Document5 pagesFinance & Credit Controller With 10+ Years of Experience in Dubai.S SasikumarNo ratings yet

- Nikita CVDocument2 pagesNikita CVNaveenMehtaNo ratings yet

- Finance & Credit Controller With 10+ Years of Experience in Dubai.Document5 pagesFinance & Credit Controller With 10+ Years of Experience in Dubai.S SasikumarNo ratings yet

- Accounting PracticeDocument4 pagesAccounting PracticeDevaraj BhokareNo ratings yet

- Math9 q1 m4 FinalDocument16 pagesMath9 q1 m4 FinalRachelleNo ratings yet

- Antiragging Committee - Jan-20Document1 pageAntiragging Committee - Jan-20TRH RECRUITMENTNo ratings yet

- Penarth Classified 120516Document2 pagesPenarth Classified 120516Digital MediaNo ratings yet

- Rogalsky - The Working Poor and What GIS Reveals About The Possibilities of Public Transit PDFDocument12 pagesRogalsky - The Working Poor and What GIS Reveals About The Possibilities of Public Transit PDFMiaNo ratings yet

- Chap 4 Section 3 Review Q&A'sDocument3 pagesChap 4 Section 3 Review Q&A'sAashi PatelNo ratings yet

- Part A: Grammar: (60 Marks)Document68 pagesPart A: Grammar: (60 Marks)RakibsowadNo ratings yet

- Shadbala NotesDocument10 pagesShadbala NotesRadhika Goel100% (1)

- Gardenia PlantsDocument6 pagesGardenia PlantsyayayayasNo ratings yet

- Nyalaan ApiDocument28 pagesNyalaan ApiIji XiiNo ratings yet

- Summer Training Project ReportDocument94 pagesSummer Training Project Reportumeshpastor100% (1)

- Ang Dialekto Ay Ang Lokal Na Wika Na Ginagamit Sa Isang LugarDocument4 pagesAng Dialekto Ay Ang Lokal Na Wika Na Ginagamit Sa Isang LugarHazel Joi PacariemNo ratings yet

- Annotated BibliographyDocument2 pagesAnnotated Bibliographyapi-314923435No ratings yet

- Inorganic Chemistry 1 - Alkali Metals RevisioDocument7 pagesInorganic Chemistry 1 - Alkali Metals RevisioAshleyn Mary SandersNo ratings yet

- SCHOOL YEAR 2017 - 2018: 1. Informational DataDocument8 pagesSCHOOL YEAR 2017 - 2018: 1. Informational Datadamyan_salazarNo ratings yet

- Bajaj Electricals Limited Vs Metals & Allied Products and Anr. On 4 August, 1987Document8 pagesBajaj Electricals Limited Vs Metals & Allied Products and Anr. On 4 August, 1987RajesureshNo ratings yet

- Contoh Presentasi Bahasa Inggris Tentang Makanan 2Document4 pagesContoh Presentasi Bahasa Inggris Tentang Makanan 2ardian noorNo ratings yet

- Qualitative ResearchDocument27 pagesQualitative ResearchElizabeth PalasanNo ratings yet

- Water and Its Forms: Name: - DateDocument2 pagesWater and Its Forms: Name: - DateNutrionist Preet PatelNo ratings yet

- b1 Speaking FashionDocument2 pagesb1 Speaking FashionIsaSánchezNo ratings yet

- 04 Laboratory Exercise 18Document7 pages04 Laboratory Exercise 18Erwin HalligNo ratings yet

- The Process of Expository Preaching Sermon Study and Development 1 PDFDocument19 pagesThe Process of Expository Preaching Sermon Study and Development 1 PDFjNo ratings yet

- Early Journal Content On JSTOR, Free To Anyone in The WorldDocument52 pagesEarly Journal Content On JSTOR, Free To Anyone in The Worldmarc millisNo ratings yet

- Samuel C. Certo Modern Management, 12th Edition: Fundamentals of OrganizingDocument34 pagesSamuel C. Certo Modern Management, 12th Edition: Fundamentals of OrganizingOptimistic RiditNo ratings yet

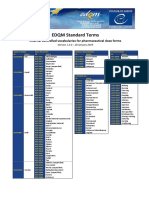

- Standard Terms Internal Vocabularies For Pharmaceutical Dose FormsDocument7 pagesStandard Terms Internal Vocabularies For Pharmaceutical Dose FormsJose De La Cruz De La ONo ratings yet

- Physics Investigatory ProjectDocument18 pagesPhysics Investigatory ProjectMoghanNo ratings yet

- Raj'a (Returning) : Sermon of Amir Ul-MomineenDocument3 pagesRaj'a (Returning) : Sermon of Amir Ul-Momineentausif mewawalaNo ratings yet

- Wilhoit, Summary PDFDocument5 pagesWilhoit, Summary PDFJake SimonsNo ratings yet

- Alexis L Orozco-1@ou EduDocument2 pagesAlexis L Orozco-1@ou Eduapi-545872500No ratings yet

- Discourse Vs - TextDocument11 pagesDiscourse Vs - TextImmo Eagle JuniØrNo ratings yet

- FAGL TcodesDocument3 pagesFAGL TcodesRahul100% (2)

![ARUNJAIN[8_0]](https://imgv2-1-f.scribdassets.com/img/document/750570631/149x198/59608d2adf/1721027995?v=1)