Professional Documents

Culture Documents

finder

finder

Uploaded by

Akshat GuptaCopyright:

Available Formats

You might also like

- JPMCredit Option Pricing ModelDocument8 pagesJPMCredit Option Pricing ModelsaikamathNo ratings yet

- Option Pricing ModelDocument24 pagesOption Pricing ModelPriyanka AmazonNo ratings yet

- Corporate Finance by Ivo WelchDocument28 pagesCorporate Finance by Ivo WelchLê AnhNo ratings yet

- Derivatives Assignment: Submitted By: Yash Ahuja Roll No-22 Pgdm-FinanceDocument5 pagesDerivatives Assignment: Submitted By: Yash Ahuja Roll No-22 Pgdm-Financemagicm,an1488No ratings yet

- Kwok Chap 4Document69 pagesKwok Chap 4Duc Trung PhanNo ratings yet

- Czech University of Life SciencesDocument16 pagesCzech University of Life SciencesTrifan_DumitruNo ratings yet

- Shaleen Assignment 1Document9 pagesShaleen Assignment 1shaleen bansalNo ratings yet

- 1 - Black-Scholes Model PresentationDocument21 pages1 - Black-Scholes Model PresentationHammad ur Rab MianNo ratings yet

- Options Pricing ModelsDocument3 pagesOptions Pricing ModelsGovarthanan NarasimhanNo ratings yet

- Assignment of Stock Market Operation Topic-Valuation of OptionDocument9 pagesAssignment of Stock Market Operation Topic-Valuation of OptionYadwinder SinghNo ratings yet

- Diffusion and Black-Scholes Pricing Formula WikipediaDocument13 pagesDiffusion and Black-Scholes Pricing Formula WikipediaAhmed AlbrashiNo ratings yet

- Option: Offers The Right (But Imposes No Obligation)Document3 pagesOption: Offers The Right (But Imposes No Obligation)meetwithsanjayNo ratings yet

- Black-Scholes Model PDFDocument16 pagesBlack-Scholes Model PDFthe0MummyNo ratings yet

- Finance Derivative Financial Instrument: UnderlyingDocument17 pagesFinance Derivative Financial Instrument: Underlying138238No ratings yet

- CPOMPLETE BehavioralDocument369 pagesCPOMPLETE BehavioralZeusNo ratings yet

- Assignment: Submitted ToDocument8 pagesAssignment: Submitted ToYadwinder SinghNo ratings yet

- Right and Wrong Model For Callable Muni BondsDocument22 pagesRight and Wrong Model For Callable Muni BondssoumensahilNo ratings yet

- Option Pricing and The Black - Scholes Model: A Lecture Note From Master's Level Teaching Perspective - Kapil Dev SubediDocument5 pagesOption Pricing and The Black - Scholes Model: A Lecture Note From Master's Level Teaching Perspective - Kapil Dev Subedikapildeb100% (1)

- Unit 3 FDDocument28 pagesUnit 3 FDsaurabh thakurNo ratings yet

- Derivative Unit IIIDocument19 pagesDerivative Unit IIIumar zaid khanNo ratings yet

- Black Scholes Model DerivativeDocument3 pagesBlack Scholes Model Derivativejyotiguptapr7991No ratings yet

- FD - BS ModelDocument10 pagesFD - BS Modelmudassar.shirgarcivilNo ratings yet

- Black ScholesDocument13 pagesBlack Scholesemanmoon842No ratings yet

- Barrier Option.: University of SussexDocument14 pagesBarrier Option.: University of SussexSujit JainNo ratings yet

- Essay On Options Strategies For Financial TransactionsDocument5 pagesEssay On Options Strategies For Financial TransactionsKimkhorn LongNo ratings yet

- Unit 3 FD PDFDocument28 pagesUnit 3 FD PDFraj kumarNo ratings yet

- Finsearch ReportDocument3 pagesFinsearch ReportTushaar JhamtaniNo ratings yet

- Chapter 5Document46 pagesChapter 5vaman kambleNo ratings yet

- Butterfly Spread OptionDocument8 pagesButterfly Spread OptionVivek Singh RanaNo ratings yet

- Chapter 4 DerivativesDocument38 pagesChapter 4 DerivativesTamrat KindeNo ratings yet

- OptionsDocument20 pagesOptionsmithradharunNo ratings yet

- Exotic OptionsDocument26 pagesExotic OptionsAbhishek Karekar100% (1)

- Black-Scholes and Neural Networks 2020Document22 pagesBlack-Scholes and Neural Networks 2020Habib ZaouiNo ratings yet

- Soa University: Name: Gyanabrata Mohapatra Subject: Financial Derivetives AssignmentDocument10 pagesSoa University: Name: Gyanabrata Mohapatra Subject: Financial Derivetives Assignment87 gunjandasNo ratings yet

- FD Unit IIIDocument10 pagesFD Unit IIIDr.P. Siva RamakrishnaNo ratings yet

- Libor Market Model Specification and CalibrationDocument29 pagesLibor Market Model Specification and CalibrationGeorge LiuNo ratings yet

- Barbell Strategy: The Bond and Money Market Author: Moorad ChoudhryDocument4 pagesBarbell Strategy: The Bond and Money Market Author: Moorad ChoudhryAbid_Raza_9611No ratings yet

- The Black and Scholes Model:: D in (S/K) + (R + 0.5 SD) T SD TDocument8 pagesThe Black and Scholes Model:: D in (S/K) + (R + 0.5 SD) T SD TKaustubh ShilkarNo ratings yet

- Chen Paper2 PDFDocument10 pagesChen Paper2 PDFAyush punjNo ratings yet

- Summary Derivative Option (04!11!2021)Document4 pagesSummary Derivative Option (04!11!2021)Shafa ENo ratings yet

- RandomDocument116 pagesRandomVaidyanathan RavichandranNo ratings yet

- Asian OptionsDocument19 pagesAsian OptionsChirdeep PareekNo ratings yet

- Option Strategies: By: Prashant Sharma Vasu KannaDocument39 pagesOption Strategies: By: Prashant Sharma Vasu KannaNihar ShahNo ratings yet

- New Products, New Risks: Equity DerivativesDocument4 pagesNew Products, New Risks: Equity DerivativesVeeken ChaglassianNo ratings yet

- 10.3934 Qfe.2018.1.230 PDFDocument16 pages10.3934 Qfe.2018.1.230 PDFnegar rostamiNo ratings yet

- The Black-Scholes Option Pricing ModelDocument6 pagesThe Black-Scholes Option Pricing ModelDhruti BhatiaNo ratings yet

- FMPMC 411: Course Learning OutcomesDocument8 pagesFMPMC 411: Course Learning OutcomesAliah de GuzmanNo ratings yet

- Graham3e ppt08Document38 pagesGraham3e ppt08Lim Yu ChengNo ratings yet

- The Black-Scholes Merton ModelDocument8 pagesThe Black-Scholes Merton Modelsid pNo ratings yet

- Pricing OptionsDocument6 pagesPricing Optionspradeep3673No ratings yet

- Options: Minimum Correct Answers For This Module: 3/6Document14 pagesOptions: Minimum Correct Answers For This Module: 3/6Jovan SsenkandwaNo ratings yet

- American Style Options Explained - Key Differences and BenefitsDocument10 pagesAmerican Style Options Explained - Key Differences and BenefitsHyunjin ShinNo ratings yet

- What Are Exotic Options?Document9 pagesWhat Are Exotic Options?miku hrshNo ratings yet

- Delta Hedging Vega RiskDocument30 pagesDelta Hedging Vega RisksjoerdNo ratings yet

- Python Fundamentals For Finance A Survey of Algorithmic Options Trading With Python Van Der Post All ChapterDocument51 pagesPython Fundamentals For Finance A Survey of Algorithmic Options Trading With Python Van Der Post All Chapterkevin.thompson445100% (8)

- BlackscholesmodelnotesDocument4 pagesBlackscholesmodelnotesshweta jaiswalNo ratings yet

- Black ScholesDocument6 pagesBlack Scholesvarshachotalia1305No ratings yet

- The Black and Scholes ModelDocument2 pagesThe Black and Scholes ModelnobuyukiNo ratings yet

- BSM Model - Nobel PrizeDocument4 pagesBSM Model - Nobel Prize21-Nguyễn Châu Ngọc LộcNo ratings yet

- The Strategic Options day Trader: How to win Trade Plans, Master the Financial Markets and Maximize 200% Profit Daily to Become a day Trader MillionaireFrom EverandThe Strategic Options day Trader: How to win Trade Plans, Master the Financial Markets and Maximize 200% Profit Daily to Become a day Trader MillionaireNo ratings yet

- Indigo Case Airlines Profit MarginsDocument5 pagesIndigo Case Airlines Profit MarginsAkshat GuptaNo ratings yet

- PaperManufacturing Porter5ForcesDocument2 pagesPaperManufacturing Porter5ForcesAkshat GuptaNo ratings yet

- Relative Valuation - IdeaforgeDocument3 pagesRelative Valuation - IdeaforgeAkshat GuptaNo ratings yet

- Porter's 5 Forces - ConglomeratesDocument3 pagesPorter's 5 Forces - ConglomeratesAkshat GuptaNo ratings yet

- HeinzDocument8 pagesHeinzAkshat GuptaNo ratings yet

- Poster FinalDocument1 pagePoster FinalKrish vasisthaNo ratings yet

- $50SAT - Eagle2 - Communications - Release Version V1 - 2Document25 pages$50SAT - Eagle2 - Communications - Release Version V1 - 2Usman ShehryarNo ratings yet

- September 23, Infer The Purpose of The Poem Listened ToDocument4 pagesSeptember 23, Infer The Purpose of The Poem Listened ToLouelle GonzalesNo ratings yet

- Themelis Ulloa LandfillDocument15 pagesThemelis Ulloa LandfillHenry Bagus WicaksonoNo ratings yet

- Emmanuel Levinas - God, Death, and TimeDocument308 pagesEmmanuel Levinas - God, Death, and Timeissamagician100% (3)

- Panasonic TH-P42C10M, S, T, K, DDocument122 pagesPanasonic TH-P42C10M, S, T, K, DEliel PinheiroNo ratings yet

- Ballistic - August September 2021Document168 pagesBallistic - August September 2021andrewrowe100% (2)

- IWA City Stories SingaporeDocument2 pagesIWA City Stories SingaporeThang LongNo ratings yet

- Offer For C Check On NT-495-MG Harbour Generator Engine Against Customer Job No. E20006Document1 pageOffer For C Check On NT-495-MG Harbour Generator Engine Against Customer Job No. E20006bkrNo ratings yet

- SBT Sekolah Berprestasi Tinggi (HPS) High Performing SchoolsDocument14 pagesSBT Sekolah Berprestasi Tinggi (HPS) High Performing SchoolsAminNo ratings yet

- Neuro TR Brochure - EN CompressedDocument8 pagesNeuro TR Brochure - EN CompressedJanam KuNo ratings yet

- Relatorio Mano JulioDocument7 pagesRelatorio Mano JulioProGeo Projetos AmbientaisNo ratings yet

- Understanding Sars-Cov-2-Induced Systemic Amyloidosis: BiorxivDocument4 pagesUnderstanding Sars-Cov-2-Induced Systemic Amyloidosis: BiorxivAntonisNo ratings yet

- Course CurriculumDocument3 pagesCourse CurriculumPRASENJIT MUKHERJEENo ratings yet

- Roadmgraybox Ds Oc AeDocument6 pagesRoadmgraybox Ds Oc Aemcclaink06No ratings yet

- ResearchDocument38 pagesResearchHelen McClintockNo ratings yet

- Halimatus Islamiah Analisis Jurnal Internasional K3Document3 pagesHalimatus Islamiah Analisis Jurnal Internasional K3TussNo ratings yet

- SBAS35029500001ENED002Document20 pagesSBAS35029500001ENED002unklekoNo ratings yet

- Jadwal Pertandingan Liga Inggris 2009-2010Document11 pagesJadwal Pertandingan Liga Inggris 2009-2010Adjie SatryoNo ratings yet

- Comfort ZoneDocument4 pagesComfort Zonesigal ardanNo ratings yet

- XXX (Topic) 好处影响1 相反好处 2. 你⾃自⼰己的观点,后⾯面会展开的Document3 pagesXXX (Topic) 好处影响1 相反好处 2. 你⾃自⼰己的观点,后⾯面会展开的Miyou KwanNo ratings yet

- Infosys-Broadcom E2E Continuous Testing Platform Business Process Automation SolutionDocument16 pagesInfosys-Broadcom E2E Continuous Testing Platform Business Process Automation Solutioncharu.hitechrobot2889No ratings yet

- Teaching Language-Learning StrategiesDocument6 pagesTeaching Language-Learning StrategiesviviNo ratings yet

- Catalog de Produse - BTRDocument62 pagesCatalog de Produse - BTRdaliproiectareNo ratings yet

- 4 Thematic Analysis TemplateDocument19 pages4 Thematic Analysis Templateapi-591189885No ratings yet

- The Holy Spirit: A New LifeDocument2 pagesThe Holy Spirit: A New LifeKatu2010No ratings yet

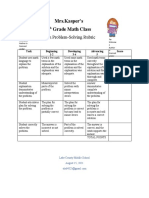

- Problemsolving RubricDocument1 pageProblemsolving Rubricapi-560491685No ratings yet

- In-Band Full-Duplex Interference For Underwater Acoustic Communication SystemsDocument6 pagesIn-Band Full-Duplex Interference For Underwater Acoustic Communication SystemsHarris TsimenidisNo ratings yet

- Dungeon 190Document77 pagesDungeon 190Helmous100% (4)

- Measurement of Thermal Conductivity: Engineering Properties of Biological Materials and Food Quality 3 (2+1)Document17 pagesMeasurement of Thermal Conductivity: Engineering Properties of Biological Materials and Food Quality 3 (2+1)Mel CapalunganNo ratings yet

finder

finder

Uploaded by

Akshat GuptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

finder

finder

Uploaded by

Akshat GuptaCopyright:

Available Formats

VALUING EXOTICS AND VANILLA OPTIONS

-Akshat Gupta (2022066)

VANILLA OPTIONS

Vanilla options are financial instruments that let their holders either buy or sell the underlying

asset at a “price that is determined at inception within a stipulated time period. The holder of a

vanilla option possesses the right to purchase or even sell the underlying without having an

obligation to do so. Whereas when it comes to the writer of the vanilla option, he/she shall

necessarily sell or even purchase, should the option writer decide to exercise his/her right.

TYPES OF VANILLA OPTIONS

• EUROPEAN- Exercised at Maturity

• AMERICAN- Can be Exercised anytime within the contract period

These can be further classified as:

• European Call - The holder has the right to buy underlying at a fixed price at expiry,

whereas the seller has the obligation to sell at that price (Strike).

• European Put - The holder has the right to sell the underlying at a fixed price at expiry,

whereas the seller has the obligation to buy at that price (Strike).

• American Call - The holder has the right to buy underlying at a fixed price on or before

expiry, whereas the seller has the obligation to sell at that price (Strike).

• American Put - The holder has the right to sell underlying at a fixed price on or before

expiry, whereas the seller has the obligation” to buy at that price (Strike).

(Corporate Finance Institute, n.d.)

EXOTIC OPTIONS

Exotic options are “financial instruments (option contracts) that are different from vanilla

options in terms of their:

• Expiry

• Exercise Prices

• Payoffs

• Underlying Assets

Exotic Options lie under the domain of Financial Engineering, which deals in developing

suitable pricing techniques and innovating new types of securities.

COMMON TYPES OF EXOTIC OPTIONS

• Asian Options – Option contracts whose payoffs are calculated by considering the

average price of the underlying asset for the last few periods (predetermined).

• Barrier Options – Contracts activate only if underlying asset’s price reaches a certain

level, i.e., breaks the barrier.

• Bermudan Options – These contracts are a combination of American and European

options. These contracts come with a choice to either exercise at expiry (like European)

or exercise at certain predetermined dates between purchase and expiry (similar to

American).

• Binary Options – These options ensure the payoff based on happening of certain events.

If that event happens, payoff is a predetermined fixed amount, Otherwise the option

expires worthless.

Akshat Gupta 2022066

VALUING EXOTICS AND VANILLA OPTIONS

-Akshat Gupta (2022066)

• Chooser Options – Option holder has the right to decide whether the purchased option

is a call or a put on a fixed date” prior to expiry.

(Corporate Finance Institute - Exotic Options, n.d.)

VALUING OPTIONS CONTRACTS

Some commonly used methods to price options are:

• Black-Scholes Options Pricing Model

• Binomial Options Pricing Model

• Monte-Carlo Simulations

BLACK-SCHOLES OPTION PRICING MODEL

Black-Scholes model was developed by “Fischer Black and Myron Scholes to compute the

prices of the European Options. In this model certain assumptions are taken in order to

eliminate the risk factor.

These Assumptions are:

• Constant Volatility

• No Dividends

• Efficient Markets

• Returns are log-normally distributed

• Interest rates are constant and known

• No transaction costs and commissions

• Markets have enough liquidity

This model explains that a geometric Brownian motion is followed by the asset prices.

The inputs required in this model” are:

• Spot

• Strike

• Time to Maturity

• Risk free Interest Rate

• Implied Volatility

(ElearnMarkets, n.d.)

COMPUTATIONS FOR THE BLACK SCHOLES MODEL (Taking European Call as

reference)

Where:

C = Call Option Price

N =CDF of normal distribution

St = Spot Price

K = Strike Price

Akshat Gupta 2022066

VALUING EXOTICS AND VANILLA OPTIONS

-Akshat Gupta (2022066)

r = Risk Free rate

t = Time to Maturity

σ = Volatility

BINOMIAL OPTIONS PRICING MODEL

Binomial Option Pricing Model or “BOPM is used in financial institutions to come up with a

value of option that can be deemed as fair. In this model, time to maturity of the instrument is

divided into steps/series of intervals. It can be used to price both Vanilla and Exotic Options.

At each step underlying asset’s price is assumed to increase or decrease. This assumption helps

generate a ‘Binomial Tree’ of possible asset prices at expiration.

BOPM has an edge over Black Scholes model because it can be adjusted so that various other

factors can be included in the analysis like dividends and interest rates. Secondly, unlike Black-

Scholes Model, this model can be used to handle American Options as well, which unlike their

European counterparts, can expire any time before or on expiry.

CALCULATION

The BOPM's calculations are based on the idea of risk-neutral valuation. This requires building

a binomial pricing tree and then figuring out the option price. Starting with the underlying

asset's current price, the binomial tree option pricing is constructed by making two branches,

one for an upward and one for a downward price movement, at each time step. An up-factor

and a down-factor, which are derived based on the asset's volatility and the duration of the time

step, define the size of these moves.

The option price is derived by going backwards from the last nodes of the price tree to the

present. The option price is calculated at each node by discounting the projected future value

of the option while accounting for the risk-free interest rate” and the likelihood of both price

increases and decreases.

(Angel One, n.d.)

MONTE CARLO SIMULATIONS

In this method, “A set of random variables are created by a Monte Carlo simulation that have

characteristics resembling the risk factors it is attempting to represent. Numerous potential

outcomes are generated by the simulation, along with their probability. In conclusion, it is

employed to model Options prices and other realistic scenarios.

This method can be used to price both vanilla and exotic options.

A huge number of simulations are run concurrently during a Monte Carlo test. Random changes

are summed up starting with the asset's current value, one for every period of time. Once the

exercise date has been reached, potential future asset values are determined, and from them,

the associated option prices are calculated in accordance with the termination condition (in this

case, max(ST-K, 0)). The data are then combined into a single mean value and discounted to

the present day.

Akshat Gupta 2022066

VALUING EXOTICS AND VANILLA OPTIONS

-Akshat Gupta (2022066)

The model consequently has six parameters: S, the initial share price, K, the strike price, r, the

domestic risk-free interest rate, and q, the foreign security's risk-free interest rate. Time is the

date of expiration, is the rate volatility, and N is the total number of simulations” runs.

This model can be executed using programming languages such as Python or using Excel VBA.

(ResearchPaper by Hamid Shahbandarzadeh1*, Khodakaram Salimifard2, Reza Moghdani3 in

Iranian Journal of Management Studies (IJMS), n.d.)

References

1. (n.d.). Retrieved from Corporate Finance Institute:

https://corporatefinanceinstitute.com/resources/derivatives/vanilla-option/

2. (n.d.). Retrieved from Corporate Finance Institute - Exotic Options:

https://corporatefinanceinstitute.com/resources/derivatives/exotic-options/

3. (n.d.). Retrieved from ElearnMarkets: https://www.elearnmarkets.com/school/units/basics-of-

options/black-scholes-pricing-model

4. (n.d.). Retrieved from Angel One: https://www.angelone.in/knowledge-center/futures-and-

options/binomial-option-pricing-model

5. (n.d.). Retrieved from ResearchPaper by Hamid Shahbandarzadeh1*, Khodakaram Salimifard2,

Reza Moghdani3 in Iranian Journal of Management Studies (IJMS):

https://www.sid.ir/EN/VEWSSID/J_pdf/5063020130101.pdf

6. Corporate Finance Institute. (n.d.). Retrieved from

https://corporatefinanceinstitute.com/resources/derivatives/vanilla-option/

7. Hamid Shahbandarzadeh1, K. S. (n.d.). Retrieved from

https://www.sid.ir/EN/VEWSSID/J_pdf/5063020130101.pdf

Akshat Gupta 2022066

You might also like

- JPMCredit Option Pricing ModelDocument8 pagesJPMCredit Option Pricing ModelsaikamathNo ratings yet

- Option Pricing ModelDocument24 pagesOption Pricing ModelPriyanka AmazonNo ratings yet

- Corporate Finance by Ivo WelchDocument28 pagesCorporate Finance by Ivo WelchLê AnhNo ratings yet

- Derivatives Assignment: Submitted By: Yash Ahuja Roll No-22 Pgdm-FinanceDocument5 pagesDerivatives Assignment: Submitted By: Yash Ahuja Roll No-22 Pgdm-Financemagicm,an1488No ratings yet

- Kwok Chap 4Document69 pagesKwok Chap 4Duc Trung PhanNo ratings yet

- Czech University of Life SciencesDocument16 pagesCzech University of Life SciencesTrifan_DumitruNo ratings yet

- Shaleen Assignment 1Document9 pagesShaleen Assignment 1shaleen bansalNo ratings yet

- 1 - Black-Scholes Model PresentationDocument21 pages1 - Black-Scholes Model PresentationHammad ur Rab MianNo ratings yet

- Options Pricing ModelsDocument3 pagesOptions Pricing ModelsGovarthanan NarasimhanNo ratings yet

- Assignment of Stock Market Operation Topic-Valuation of OptionDocument9 pagesAssignment of Stock Market Operation Topic-Valuation of OptionYadwinder SinghNo ratings yet

- Diffusion and Black-Scholes Pricing Formula WikipediaDocument13 pagesDiffusion and Black-Scholes Pricing Formula WikipediaAhmed AlbrashiNo ratings yet

- Option: Offers The Right (But Imposes No Obligation)Document3 pagesOption: Offers The Right (But Imposes No Obligation)meetwithsanjayNo ratings yet

- Black-Scholes Model PDFDocument16 pagesBlack-Scholes Model PDFthe0MummyNo ratings yet

- Finance Derivative Financial Instrument: UnderlyingDocument17 pagesFinance Derivative Financial Instrument: Underlying138238No ratings yet

- CPOMPLETE BehavioralDocument369 pagesCPOMPLETE BehavioralZeusNo ratings yet

- Assignment: Submitted ToDocument8 pagesAssignment: Submitted ToYadwinder SinghNo ratings yet

- Right and Wrong Model For Callable Muni BondsDocument22 pagesRight and Wrong Model For Callable Muni BondssoumensahilNo ratings yet

- Option Pricing and The Black - Scholes Model: A Lecture Note From Master's Level Teaching Perspective - Kapil Dev SubediDocument5 pagesOption Pricing and The Black - Scholes Model: A Lecture Note From Master's Level Teaching Perspective - Kapil Dev Subedikapildeb100% (1)

- Unit 3 FDDocument28 pagesUnit 3 FDsaurabh thakurNo ratings yet

- Derivative Unit IIIDocument19 pagesDerivative Unit IIIumar zaid khanNo ratings yet

- Black Scholes Model DerivativeDocument3 pagesBlack Scholes Model Derivativejyotiguptapr7991No ratings yet

- FD - BS ModelDocument10 pagesFD - BS Modelmudassar.shirgarcivilNo ratings yet

- Black ScholesDocument13 pagesBlack Scholesemanmoon842No ratings yet

- Barrier Option.: University of SussexDocument14 pagesBarrier Option.: University of SussexSujit JainNo ratings yet

- Essay On Options Strategies For Financial TransactionsDocument5 pagesEssay On Options Strategies For Financial TransactionsKimkhorn LongNo ratings yet

- Unit 3 FD PDFDocument28 pagesUnit 3 FD PDFraj kumarNo ratings yet

- Finsearch ReportDocument3 pagesFinsearch ReportTushaar JhamtaniNo ratings yet

- Chapter 5Document46 pagesChapter 5vaman kambleNo ratings yet

- Butterfly Spread OptionDocument8 pagesButterfly Spread OptionVivek Singh RanaNo ratings yet

- Chapter 4 DerivativesDocument38 pagesChapter 4 DerivativesTamrat KindeNo ratings yet

- OptionsDocument20 pagesOptionsmithradharunNo ratings yet

- Exotic OptionsDocument26 pagesExotic OptionsAbhishek Karekar100% (1)

- Black-Scholes and Neural Networks 2020Document22 pagesBlack-Scholes and Neural Networks 2020Habib ZaouiNo ratings yet

- Soa University: Name: Gyanabrata Mohapatra Subject: Financial Derivetives AssignmentDocument10 pagesSoa University: Name: Gyanabrata Mohapatra Subject: Financial Derivetives Assignment87 gunjandasNo ratings yet

- FD Unit IIIDocument10 pagesFD Unit IIIDr.P. Siva RamakrishnaNo ratings yet

- Libor Market Model Specification and CalibrationDocument29 pagesLibor Market Model Specification and CalibrationGeorge LiuNo ratings yet

- Barbell Strategy: The Bond and Money Market Author: Moorad ChoudhryDocument4 pagesBarbell Strategy: The Bond and Money Market Author: Moorad ChoudhryAbid_Raza_9611No ratings yet

- The Black and Scholes Model:: D in (S/K) + (R + 0.5 SD) T SD TDocument8 pagesThe Black and Scholes Model:: D in (S/K) + (R + 0.5 SD) T SD TKaustubh ShilkarNo ratings yet

- Chen Paper2 PDFDocument10 pagesChen Paper2 PDFAyush punjNo ratings yet

- Summary Derivative Option (04!11!2021)Document4 pagesSummary Derivative Option (04!11!2021)Shafa ENo ratings yet

- RandomDocument116 pagesRandomVaidyanathan RavichandranNo ratings yet

- Asian OptionsDocument19 pagesAsian OptionsChirdeep PareekNo ratings yet

- Option Strategies: By: Prashant Sharma Vasu KannaDocument39 pagesOption Strategies: By: Prashant Sharma Vasu KannaNihar ShahNo ratings yet

- New Products, New Risks: Equity DerivativesDocument4 pagesNew Products, New Risks: Equity DerivativesVeeken ChaglassianNo ratings yet

- 10.3934 Qfe.2018.1.230 PDFDocument16 pages10.3934 Qfe.2018.1.230 PDFnegar rostamiNo ratings yet

- The Black-Scholes Option Pricing ModelDocument6 pagesThe Black-Scholes Option Pricing ModelDhruti BhatiaNo ratings yet

- FMPMC 411: Course Learning OutcomesDocument8 pagesFMPMC 411: Course Learning OutcomesAliah de GuzmanNo ratings yet

- Graham3e ppt08Document38 pagesGraham3e ppt08Lim Yu ChengNo ratings yet

- The Black-Scholes Merton ModelDocument8 pagesThe Black-Scholes Merton Modelsid pNo ratings yet

- Pricing OptionsDocument6 pagesPricing Optionspradeep3673No ratings yet

- Options: Minimum Correct Answers For This Module: 3/6Document14 pagesOptions: Minimum Correct Answers For This Module: 3/6Jovan SsenkandwaNo ratings yet

- American Style Options Explained - Key Differences and BenefitsDocument10 pagesAmerican Style Options Explained - Key Differences and BenefitsHyunjin ShinNo ratings yet

- What Are Exotic Options?Document9 pagesWhat Are Exotic Options?miku hrshNo ratings yet

- Delta Hedging Vega RiskDocument30 pagesDelta Hedging Vega RisksjoerdNo ratings yet

- Python Fundamentals For Finance A Survey of Algorithmic Options Trading With Python Van Der Post All ChapterDocument51 pagesPython Fundamentals For Finance A Survey of Algorithmic Options Trading With Python Van Der Post All Chapterkevin.thompson445100% (8)

- BlackscholesmodelnotesDocument4 pagesBlackscholesmodelnotesshweta jaiswalNo ratings yet

- Black ScholesDocument6 pagesBlack Scholesvarshachotalia1305No ratings yet

- The Black and Scholes ModelDocument2 pagesThe Black and Scholes ModelnobuyukiNo ratings yet

- BSM Model - Nobel PrizeDocument4 pagesBSM Model - Nobel Prize21-Nguyễn Châu Ngọc LộcNo ratings yet

- The Strategic Options day Trader: How to win Trade Plans, Master the Financial Markets and Maximize 200% Profit Daily to Become a day Trader MillionaireFrom EverandThe Strategic Options day Trader: How to win Trade Plans, Master the Financial Markets and Maximize 200% Profit Daily to Become a day Trader MillionaireNo ratings yet

- Indigo Case Airlines Profit MarginsDocument5 pagesIndigo Case Airlines Profit MarginsAkshat GuptaNo ratings yet

- PaperManufacturing Porter5ForcesDocument2 pagesPaperManufacturing Porter5ForcesAkshat GuptaNo ratings yet

- Relative Valuation - IdeaforgeDocument3 pagesRelative Valuation - IdeaforgeAkshat GuptaNo ratings yet

- Porter's 5 Forces - ConglomeratesDocument3 pagesPorter's 5 Forces - ConglomeratesAkshat GuptaNo ratings yet

- HeinzDocument8 pagesHeinzAkshat GuptaNo ratings yet

- Poster FinalDocument1 pagePoster FinalKrish vasisthaNo ratings yet

- $50SAT - Eagle2 - Communications - Release Version V1 - 2Document25 pages$50SAT - Eagle2 - Communications - Release Version V1 - 2Usman ShehryarNo ratings yet

- September 23, Infer The Purpose of The Poem Listened ToDocument4 pagesSeptember 23, Infer The Purpose of The Poem Listened ToLouelle GonzalesNo ratings yet

- Themelis Ulloa LandfillDocument15 pagesThemelis Ulloa LandfillHenry Bagus WicaksonoNo ratings yet

- Emmanuel Levinas - God, Death, and TimeDocument308 pagesEmmanuel Levinas - God, Death, and Timeissamagician100% (3)

- Panasonic TH-P42C10M, S, T, K, DDocument122 pagesPanasonic TH-P42C10M, S, T, K, DEliel PinheiroNo ratings yet

- Ballistic - August September 2021Document168 pagesBallistic - August September 2021andrewrowe100% (2)

- IWA City Stories SingaporeDocument2 pagesIWA City Stories SingaporeThang LongNo ratings yet

- Offer For C Check On NT-495-MG Harbour Generator Engine Against Customer Job No. E20006Document1 pageOffer For C Check On NT-495-MG Harbour Generator Engine Against Customer Job No. E20006bkrNo ratings yet

- SBT Sekolah Berprestasi Tinggi (HPS) High Performing SchoolsDocument14 pagesSBT Sekolah Berprestasi Tinggi (HPS) High Performing SchoolsAminNo ratings yet

- Neuro TR Brochure - EN CompressedDocument8 pagesNeuro TR Brochure - EN CompressedJanam KuNo ratings yet

- Relatorio Mano JulioDocument7 pagesRelatorio Mano JulioProGeo Projetos AmbientaisNo ratings yet

- Understanding Sars-Cov-2-Induced Systemic Amyloidosis: BiorxivDocument4 pagesUnderstanding Sars-Cov-2-Induced Systemic Amyloidosis: BiorxivAntonisNo ratings yet

- Course CurriculumDocument3 pagesCourse CurriculumPRASENJIT MUKHERJEENo ratings yet

- Roadmgraybox Ds Oc AeDocument6 pagesRoadmgraybox Ds Oc Aemcclaink06No ratings yet

- ResearchDocument38 pagesResearchHelen McClintockNo ratings yet

- Halimatus Islamiah Analisis Jurnal Internasional K3Document3 pagesHalimatus Islamiah Analisis Jurnal Internasional K3TussNo ratings yet

- SBAS35029500001ENED002Document20 pagesSBAS35029500001ENED002unklekoNo ratings yet

- Jadwal Pertandingan Liga Inggris 2009-2010Document11 pagesJadwal Pertandingan Liga Inggris 2009-2010Adjie SatryoNo ratings yet

- Comfort ZoneDocument4 pagesComfort Zonesigal ardanNo ratings yet

- XXX (Topic) 好处影响1 相反好处 2. 你⾃自⼰己的观点,后⾯面会展开的Document3 pagesXXX (Topic) 好处影响1 相反好处 2. 你⾃自⼰己的观点,后⾯面会展开的Miyou KwanNo ratings yet

- Infosys-Broadcom E2E Continuous Testing Platform Business Process Automation SolutionDocument16 pagesInfosys-Broadcom E2E Continuous Testing Platform Business Process Automation Solutioncharu.hitechrobot2889No ratings yet

- Teaching Language-Learning StrategiesDocument6 pagesTeaching Language-Learning StrategiesviviNo ratings yet

- Catalog de Produse - BTRDocument62 pagesCatalog de Produse - BTRdaliproiectareNo ratings yet

- 4 Thematic Analysis TemplateDocument19 pages4 Thematic Analysis Templateapi-591189885No ratings yet

- The Holy Spirit: A New LifeDocument2 pagesThe Holy Spirit: A New LifeKatu2010No ratings yet

- Problemsolving RubricDocument1 pageProblemsolving Rubricapi-560491685No ratings yet

- In-Band Full-Duplex Interference For Underwater Acoustic Communication SystemsDocument6 pagesIn-Band Full-Duplex Interference For Underwater Acoustic Communication SystemsHarris TsimenidisNo ratings yet

- Dungeon 190Document77 pagesDungeon 190Helmous100% (4)

- Measurement of Thermal Conductivity: Engineering Properties of Biological Materials and Food Quality 3 (2+1)Document17 pagesMeasurement of Thermal Conductivity: Engineering Properties of Biological Materials and Food Quality 3 (2+1)Mel CapalunganNo ratings yet