Professional Documents

Culture Documents

ERM_Banking_Industry_1721022025

ERM_Banking_Industry_1721022025

Uploaded by

shubham guptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ERM_Banking_Industry_1721022025

ERM_Banking_Industry_1721022025

Uploaded by

shubham guptaCopyright:

Available Formats

Enterprise Risk

Management

Banking Industry

K Siddartha Shastry

Overview

The Indian banking industry is one of the largest and most complex in the world,

with over 100 scheduled commercial banks and more than 96,000 branches. It has

undergone a significant evolution since the country's independence in 1947, and

today it plays a vital role in the economic development of India.

The Indian banking system is divided into three categories:

• Scheduled Commercial Banks (SCBs): These are the largest banks in India

and are regulated by the Reserve Bank of India (RBI). SCBs account for the

majority of banking activity in India.

• Co-operative Banks: These banks are owned and operated by their members

and are regulated by the RBI and state governments. Co-operative banks play

an important role in providing banking services to rural and semi-urban areas.

Global Risk Management Institute 1

• Non-Banking Financial Companies (NBFCs): These are financial institutions

that do not have a banking license from the RBI. NBFCs offer a variety of

financial products and services, such as loans, investments, and insurance.

The Indian banking industry is facing a number of challenges, including:

• High non-performing loans: The Indian banking system has a high level of

non-performing loans, which are loans that are not being repaid by borrowers.

This is a major challenge for the industry and is affecting its profitability.

• Low interest rates: Interest rates in India are at historic lows, which is making

it difficult for banks to make profits.

• Digital transformation: The Indian banking industry is undergoing a digital

transformation, which is changing the way banks operate. Banks need to

invest in new technologies to stay competitive.

• Regulatory changes: The RBI is constantly changing regulations, which can

be challenging for banks to keep up with.

Despite these challenges, the Indian banking industry is expected to continue to grow

in the coming years. The country's economy is growing rapidly, and there is a

growing demand for banking services. The industry is also expected to benefit from

the digital transformation.

Here are some of the key trends in the Indian banking industry:

• Digitalization: The Indian banking industry is undergoing a digital

transformation, with banks investing in new technologies to improve their

Global Risk Management Institute 2

operations and customer service. This includes the use of mobile banking,

internet banking, and artificial intelligence.

• The rise of fintech: Fintech companies are using technology to provide

financial services that are more convenient and affordable than traditional

banking services. This is posing a challenge to traditional banks, but it is also

creating new opportunities for collaboration.

• The growth of the retail banking sector: The retail banking sector is growing

rapidly, as more and more people in India are becoming financially included.

This is driving demand for banking services such as loans, savings accounts,

and credit cards.

• The expansion of the rural banking sector: The RBI is expanding the reach of

banking services to rural areas. This is being done through the Pradhan Mantri

Jan Dhan Yojana (PMJDY), which aims to provide financial services to all

Indian households.

Global Risk Management Institute 3

PESTLE Analysis

POLITICAL Factors:

• Capital flight (long-term risk): Investors may withdraw their money from

banks in countries with political instability, which can lead to a shortage of

capital and make it difficult for banks to operate.

Example: - The Russian Financial Crisis of 1998: The Russian Financial

Crisis was a major financial crisis that affected Russia and several other

countries in Eastern Europe. The crisis was triggered by a number of factors,

including the collapse of the ruble, a decline in oil prices, and political

instability. Capital flight was a major factor in the crisis, as investors withdrew

their money from Russia in fear of losing their investments.

• Trade policies (Short-term risk): Governments can impose tariffs or other

trade restrictions on financial services, which can make it more difficult for

banks to operate across borders. This can reduce competition in the banking

industry and make it more difficult for banks to access foreign capital.

Example: - SWIFT ban on Russia leading to difficulties for Indian banks to

deal with Russian banks.

ECONOMIC Factors:

• Monetary policy (mid-term risk): Governments can set interest rates and

other monetary policy tools, which can affect the cost of borrowing for banks

and their customers. This can have a significant impact on the lending

activities of banks.

Global Risk Management Institute 4

Example: - Repo and reverse repo rates affect Banks’ lending capacity.

• Inflation (mid-term risk): Inflation is the rate at which prices are rising.

When inflation is high, the value of money decreases, which can make it more

difficult for banks to make money.

• Unemployment (long-term risk): Unemployment is the rate at which people

are without jobs. When unemployment is high, people are less likely to be

able to repay their loans, which can lead to losses for banks.

• Exchange rates (short term risk): Exchange rates are the prices of

currencies relative to each other. When exchange rates fluctuate, it can make

it more difficult for banks to do business internationally.

SOCIAL Factors:

• Customer Behavior: Improper service may lead to dissatisfied customers

affecting banks’ reputation and customers’ confidence in them.

Example: - In 2022, a customer of the ICICI Bank had her account hacked and her

money was stolen. The bank was slow to respond to the customer's complaint and

did not reimburse her for her losses. This caused the customer a great deal of

financial hardship and stress.

The customer, identified as Mr. Rahul Gupta, had his account hacked and

Rs. 50,000 was stolen. He immediately reported the incident to the bank, but the

bank was slow to respond. It took the bank two weeks to investigate the matter and

to reimburse Mr. Gupta for his losses.

Global Risk Management Institute 5

• Public trust: Banks need to maintain the trust of the public in order to attract

and retain customers. Any perceived wrongdoing, such as money laundering

or fraud, can damage a bank's reputation and make it difficult to attract new

customers

Example: - Nirav Modi fraud led to a lot of consumers pulling out their deposits

from Punjab National Bank.

TECHNOLOGICAL Factors:

• The rise of fintech companies (long term risk): Fintech companies are

startups that use technology to provide financial services. These companies

are often more agile and innovative than traditional banks, and they can offer

lower fees and better customer service. This is forcing banks to innovate and

improve their services in order to compete.

Example: - Zerodha as a discount broker against brokerage offered at high

fees by traditional banks.

• Development of new technologies and risks associated with them (UPI):

System Rundowns (short term risk): Bank servers often fail and since a

huge part of economy runs on UPI these days, the bank operations are affected

on a large scale.

• Cybersecurity threats (short term risk): Almost all of confidential

information related to bank accounts these days are stored on cloud servers

Global Risk Management Institute 6

and constant cyberattacks from hackers can expose the confidential

information.

• The development of new financial technologies (: New financial

technologies, such as blockchain and artificial intelligence, can disrupt the

banking industry and make it more difficult for banks to compete. For

example, blockchain technology could be used to create a more secure and

efficient way to process payments. This could make it easier for customers to

send and receive money, and it could also reduce the need for banks to

intermediary.

ENVIRONMENTAL Factors:

• Climate change: Climate change is a major environmental challenge that is

affecting banks in a number of ways. For example, rising sea levels could

inundate coastal areas where banks have branches and ATMs. Extreme

weather events, such as hurricanes and floods, could also damage bank

infrastructure and disrupt operations.

• Public opinion: Public opinion about environmental issues is also important

for banks. If the public perceives that a bank is not doing enough to address

environmental concerns, it could damage the bank's reputation and make it

more difficult to attract customers.

Example: - If banks are not issuing enough green bonds these days, it’s

affecting their public image. Environmentally aware citizens are better

retained with good sustainable practices.

Global Risk Management Institute 7

LEGAL Factors:

• Litigation: Banks are also exposed to litigation, which can be costly and time-

consuming. For example, banks may be sued by customers who allege that

they were the victims of fraud or that the bank failed to meet its obligations.

Example: - Banks have been sued by customers who allege that they were the

victims of fraud, such as identity theft or credit card fraud. For example, in

2017, Wells Fargo was sued by customers who alleged that the bank had

opened unauthorized accounts in their names. The lawsuit resulted in a $142

million settlement.

• Anti-money laundering laws: Banks are also subject to anti-money

laundering laws, which are designed to prevent the financing of terrorism and

other criminal activities. These laws can make it more difficult for banks to

do business with certain customers or to process certain types of transactions.

Example: - Standard Chartered Bank has been accused of facilitating terrorist

financing on multiple occasions. In 2012, the bank was fined $340 million by

the New York Department of Financial Services for violating anti-money

laundering laws. The bank was accused of processing payments for sanctioned

entities and individuals, including al-Qaeda and the Taliban.

Global Risk Management Institute 8

Bow Tie Analysis

Hazard 1:

THREATS CONSEQUENCES

Poor performance of the More stringent procedures before

corporates will affect their ability lending and cautiousness leading to

to pay back their loans lower credit creation resulting in

simultaneously affecting balance lower revenues for the bank.

sheet of the bank it has taken

loan from. Giving out

loans.

Banks will charge higher interest

rates if risk of default increases,

Higher Interest rates on floating which will make it expensive to

loans given out by bank may lead borrow, ultimately hampering credit

to inability of debtors to pay back capacity of the bank and their

their loans timely. revenues.

Credit

Events like recession or inflation

mean that debtors will spend

Defaults Rising NPAs in a bank can reduce

more than their basic needs, customer confidence and trust

reducing their ability to have leading to withdrawals and lower

enough cash to pay back loans. no of deposits; making it difficult

to raise capital due to poor

financials.

Earthquakes, Tsunamis,

hurricanes may disrupt

operations of corporates who

have taken out loans from the High no of NPAs would mean Bank

bank. would not be able to recover

interest on their loans and

consequently not be able to pay

back interests to its depositors.

Eg;- Maturity Mismatch, Interest

Fluctuation in foreign exchange Rate Mismatch

rates may lead to international

debtors to not be able to payback

their loans timely.

Controls:

1. Using interest rate derivatives: Interest rate derivatives, such as

interest rate swaps and futures, can be used to hedge against interest

rate risk. These instruments allow companies to exchange their interest

rate exposure with another party, which can help to reduce their risk.

2. Strengthening their credit risk management: Banks need to improve

their ability to assess the creditworthiness of their borrowers. This

Global Risk Management Institute 9

includes having better systems for collecting and analyzing data, and

using more sophisticated risk models.

3. Hedging: Hedging is a technique that can be used to reduce the risk of

losses due to exchange rate fluctuations. Banks can hedge their

exposure to foreign exchange risk by using a variety of instruments,

such as forward contracts, futures contracts, and options.

4. Insurance: Banks can protect themselves from financial losses by

purchasing insurance against natural disasters. This insurance can help

to cover the costs of repairing or rebuilding damaged property, as well

as the costs of lost revenue.

Hazard 2:

THREATS CONSEQUENCES

Online

Banking

System

System

Breakdowns

Global Risk Management Institute 10

Controls:

1. Periodic review and maintenance of bank management systems.

2. Strong Cybersecurity framework

3. Train Employees on the systems and hire software providers after proper due

diligence.

4. Increasing physical security of cloud systems

Global Risk Management Institute 11

Risk Assessment Matrix

Based on above information, 14 key risks have been defined and they are scored on

basis of Impact (how much it will affect the bank) and Likelihood (how often they

can occur). The scale for scoring is from 1-5, defined as:

Score Category

1 Very low

2 low

3 Moderate

4 High

5 Very High

Risk Score is calculated on the basis of multiplying likelihood and impact scores;

Risk Score = Likelihood * Impact.

Risk

Risk Risk Description Likelihood Impact Score

R1 Exchange Rates Fluctuations 5 3 15

R2 Natural Disasters 1 5 5

R3 Asset Liability Mismatch 3 5 15

R4 Political Instability 2 4 8

R5 Rising Non-Performing Assets 2 4 8

R6 Liquidity Crunch 3 4 12

R7 Server/Network Failure 5 4 20

Global Risk Management Institute 12

R8 Corporate Defaults (twin b/s) 2 5 10

R9 Dealing with sanctioned banks 1 3 3

R10 Technological Disruption 4 5 20

R11 Litigation 2 3 6

R12 Economic Downturns 3 5 15

R13 Interest rate/Monetary Policy changes 5 2 10

R14 Climate Change-Lack of green financing 5 4 20

GRAPHICAL PRESENTATION:

Impact: Very Low Low Medium High Very High

Very Severe R13 Severe Critical R7,

Moderate R1 R14 Critical

High

R10

Sustainable Moderate Severe Critical Critical

Likelihood

High

Severe Critical

R6 R3,

Sustainable Moderate Moderate

R12

Medium

Moderate Critical

Sustainable Sustainable R11 Severe R4 R8

Low ,R5

Very Sustainable Severe

Sustainable Sustainable R9 Moderate R2

Low

Risk Assessment Matrix for the Banking Industry

Global Risk Management Institute 13

Key areas of ESG compliance in the Indian

Banking Industry:

Green Products already used in the banking sector:

Go Online: Online banking includes internet banking, mobile banking, tab

banking, phone banking, RTGS and NEFT transactions etc. The functions involved

are pay bills online, online deposits, fund transfer, account statements etc. Through

these banking activities banks are ultimately consume less paper, less energy and

less expenditure on natural resources.

Card based transactions: Banks have introduced a variety of card-based

transactions by launching green channel counters (GCC). GCC promotes card-based

transactions to their customers not only to reduce the consumption of paper and

energy but also to save the time of customers. A variety of cards such as ATM, Credit

and Debit cards, green remit cards, Foreign Travel Card, eZ Pay Card, Gift Card,

Smart Payout Card etc. are available for customers.

Green Finance: Bank should finance environment friendly projects and

environment friendly products such as solar equipment, recycled furniture, vehicle

finance for low carbon emissions vehicles, home finance for green buildings etc.

with giving some concessions in processing fee and concessional rate of interest.

Green Infrastructure: Green infrastructure includes IT infrastructure (Data

Centers), green buildings with sufficient natural lightening and air, generate

electricity for their own use and waste recycling plants for recycle their own waste.

Green infrastructure may also be considered Self Service Passbook Printers, Kiosks

(Multi-Function Kiosks and Self-Service Kiosks), Cash Deposit Machines and

Contact Centre etc. It facilitates to reduce banks internal carbon footprint.

Global Risk Management Institute 14

ESG Compliance guidelines set by RBI for Indian banks:

• Sustainable Banking Framework: The Sustainable Banking Framework

was issued by the Reserve Bank of India (RBI) in 2020. The framework sets

out the RBI's expectations of banks in terms of their ESG risk management,

governance, and disclosure. The framework requires banks to:

o Identify, assess, and manage their ESG risks.

o Integrate ESG factors into their decision-making processes.

o Report on their ESG performance.

• Environmental Stress Testing: The RBI has mandated that banks conduct

environmental stress tests to assess their resilience to climate change risks.

These tests should be conducted at least once a year and should cover a range

of climate change scenarios.

• Green Banking: The RBI has encouraged banks to promote green banking

practices, such as lending to renewable energy projects and energy efficiency

initiatives. Banks can also offer green banking products and services, such as

green loans and green deposits.

• Social Banking: The RBI has encouraged banks to promote social banking

practices, such as lending to microfinance institutions and social enterprises.

Banks can also offer social banking products and services, such as social

impact bonds and social impact loans.

• Climate Change Risk Management Framework: The RBI has issued a

Climate Change Risk Management Framework for banks in 2022. The

framework provides guidance on how banks can identify, assess, and manage

their climate change risks.

Global Risk Management Institute 15

• Sustainable Finance: The RBI has also issued guidelines on Sustainable

Finance for banks in 2022. These guidelines provide guidance on how banks

can promote sustainable finance and support the transition to a low-carbon

economy.

Key features of the Climate Change Risk Management Framework set by the

Reserve Bank of India (RBI):

• Scope: The framework applies to all banks, including scheduled commercial

banks, urban cooperative banks, and regional rural banks.

• Risk identification and assessment: Banks are required to identify and assess

their climate change risks, both physical and transition risks. This can be done

by conducting climate risk assessments, and by developing climate risk stress

tests.

• Mitigation and adaptation: Banks are required to develop mitigation and

adaptation strategies to address their climate change risks. This can be done

by investing in renewable energy, energy efficiency, and climate-resilient

infrastructure.

• Reporting: Banks are required to report on their climate change risk

management practices. This can be done by publishing an annual climate risk

report, or by disclosing climate risk information in their financial statements.

• Governance: Banks are required to establish a climate change risk

management committee to oversee their climate change risk management

practices.

• Training: Banks are required to train their staff on climate change risk

management.

Global Risk Management Institute 16

key features of the Sustainable Finance Guidelines set by the Reserve Bank of

India (RBI):

• Identification and assessment of ESG risks: Banks are required to identify and

assess their ESG risks, such as their exposure to climate change and other

environmental challenges. This can be done by conducting environmental and

social impact assessments, and by developing climate risk stress tests.

• Integrating ESG factors into decision-making: Banks are encouraged to

integrate ESG factors into their decision-making processes, such as when

lending money or investing in projects. This can be done by considering the

environmental and social impact of their lending decisions, and by supporting

sustainable businesses and projects.

• Reporting on ESG performance: Banks are required to report on their ESG

performance, such as the amount of money they have lent to sustainable

projects. This can be done by publishing an annual ESG report, or by

disclosing ESG information in their financial statements.

• Promoting green banking: Banks are encouraged to promote green banking

practices, such as lending to renewable energy projects and energy efficiency

initiatives. This can be done by developing green banking products and

services, and by providing training to their staff on green banking.

• Supporting the transition to a low-carbon economy: Banks are encouraged to

support the transition to a low-carbon economy by financing sustainable

projects and by developing green products and services.

Global Risk Management Institute 17

You might also like

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceFrom EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceRating: 4 out of 5 stars4/5 (9)

- Long Quiz On Co-Ownership & Possession 2 RW9Document4 pagesLong Quiz On Co-Ownership & Possession 2 RW9Chicklet Arpon100% (1)

- Retail Banking in India (FULL)Document53 pagesRetail Banking in India (FULL)Vinidra WattalNo ratings yet

- Emerging Trends of Banking SystemDocument12 pagesEmerging Trends of Banking SystemChoden ChdnNo ratings yet

- Banking: Industries in IndiaDocument41 pagesBanking: Industries in IndiaManavNo ratings yet

- Retail Banking JUNE 2022Document10 pagesRetail Banking JUNE 2022Rajni KumariNo ratings yet

- Ankitha - Ret BankDocument25 pagesAnkitha - Ret BankMOHAMMED KHAYYUMNo ratings yet

- Studying The Different Sources of Finance in BANKING INDUSTRIESDocument23 pagesStudying The Different Sources of Finance in BANKING INDUSTRIESManas GuptaNo ratings yet

- Systems Thinking Assignment Hard & Soft Systems ThinkingDocument9 pagesSystems Thinking Assignment Hard & Soft Systems ThinkingAnshul MehtaNo ratings yet

- Research Report Shivika Kotak RemovedDocument22 pagesResearch Report Shivika Kotak Removedsunnykumar.m2325No ratings yet

- Retail Banking in India - The Comprehensive Industry ReportDocument4 pagesRetail Banking in India - The Comprehensive Industry Reportankit71420No ratings yet

- Challenges & Opportunities - Banking Reforms in IndiaDocument5 pagesChallenges & Opportunities - Banking Reforms in IndiaJAGRITI SINGHNo ratings yet

- Emerging Trends in Banking and Finance: VPM's R.Z.SHAH College of Arts, Science & Commerce, Mulund, MumbaiDocument3 pagesEmerging Trends in Banking and Finance: VPM's R.Z.SHAH College of Arts, Science & Commerce, Mulund, MumbaiSwarnim GottliebNo ratings yet

- PobDocument24 pagesPobgillyhicksNo ratings yet

- Sector Project 1Document5 pagesSector Project 12k20dmba102 RiyaGoelNo ratings yet

- Challenges for the Banking sector of BangladeshDocument4 pagesChallenges for the Banking sector of BangladeshSazzadul HossainNo ratings yet

- Customer Satisfaction Regarding Consumer Loan With Specialreference To PUNJAB AND SIND BANKDocument60 pagesCustomer Satisfaction Regarding Consumer Loan With Specialreference To PUNJAB AND SIND BANKSaurabh Mehta0% (1)

- Lessons 1 - 3Document106 pagesLessons 1 - 3Devica UditramNo ratings yet

- Study On Retail BankingDocument47 pagesStudy On Retail Bankingzaru1121No ratings yet

- Chapter - 1Document8 pagesChapter - 1rajkumariNo ratings yet

- RB Chapter 1 - Introduction To Retail BankingDocument7 pagesRB Chapter 1 - Introduction To Retail BankingHarish YadavNo ratings yet

- Retail Banking Front Office Management ActivityDocument66 pagesRetail Banking Front Office Management ActivitysargunkaurNo ratings yet

- Challenges of Commercial Bank in 2020Document2 pagesChallenges of Commercial Bank in 2020Dibesh PadiaNo ratings yet

- Ibank 3 PDFDocument6 pagesIbank 3 PDFsomprakash giriNo ratings yet

- Assignment On Banking and Financial ServicesDocument6 pagesAssignment On Banking and Financial ServicesNikhil Roy100% (1)

- Task2 Part5 Mozohunt Ritikkumar Srivastava194 RemovedDocument22 pagesTask2 Part5 Mozohunt Ritikkumar Srivastava194 RemovedAanya SinghNo ratings yet

- Indian Bank - CompanyAnalysis7687888989Document17 pagesIndian Bank - CompanyAnalysis7687888989yaiyajieNo ratings yet

- Modern Banking in IndiaDocument13 pagesModern Banking in Indiaakashscribd01No ratings yet

- Introduction To The IndustryDocument18 pagesIntroduction To The Industrynikunjsih sodhaNo ratings yet

- Banking Sector Refers To The Industry or The Section of The Economy Devoted To The ProperDocument5 pagesBanking Sector Refers To The Industry or The Section of The Economy Devoted To The ProperYt NoobNo ratings yet

- Project On Retail BankingDocument44 pagesProject On Retail BankingabhinaykasareNo ratings yet

- Macroeconomic AnalysisDocument7 pagesMacroeconomic AnalysisRishu GuptaNo ratings yet

- Tanya Maheshwari Canara Bank Mozo Hunt Task 2part4 RemovedDocument16 pagesTanya Maheshwari Canara Bank Mozo Hunt Task 2part4 Removedsunnykumar.m2325No ratings yet

- Recent Trends in BankingDocument23 pagesRecent Trends in Bankinghonda5768No ratings yet

- Banking Insurance Assignment SolveDocument25 pagesBanking Insurance Assignment SolveDixitaba DodiyaNo ratings yet

- Universal Banking: Prepared By: Priyanka Khandelwal PG20095094Document10 pagesUniversal Banking: Prepared By: Priyanka Khandelwal PG20095094Priyanka KhandelwalNo ratings yet

- Industry Reports - ISB Consulting Casebook 2021Document36 pagesIndustry Reports - ISB Consulting Casebook 2021BalajiNo ratings yet

- Banking Sector in India - Challenges and OpportunitiesDocument6 pagesBanking Sector in India - Challenges and OpportunitiesDeepika SanthanakrishnanNo ratings yet

- Banking Module 1Document26 pagesBanking Module 1mansisharma8301No ratings yet

- Retail Banking Front Office Management Activity For HDFC Bank by Nisha Wadekar This Project Is Very Useful To StudentDocument51 pagesRetail Banking Front Office Management Activity For HDFC Bank by Nisha Wadekar This Project Is Very Useful To Studentganeshkhale7052No ratings yet

- The World and The Indian Banking Industry: Munich Personal Repec ArchiveDocument10 pagesThe World and The Indian Banking Industry: Munich Personal Repec ArchivesravanthhhhNo ratings yet

- Retail BankingDocument15 pagesRetail BankingjazzrulzNo ratings yet

- International Banking and FinanceDocument7 pagesInternational Banking and FinanceravikungwaniNo ratings yet

- Thesis On Banking in IndiaDocument4 pagesThesis On Banking in Indiamichellebojorqueznorwalk100% (2)

- Social Banks and The Future of Sustainable FinanceDocument11 pagesSocial Banks and The Future of Sustainable Financejaabisg100% (1)

- Retail Banking in IndiaDocument17 pagesRetail Banking in Indianitinsuba198050% (2)

- Financial Services KMN FinalDocument27 pagesFinancial Services KMN FinalkmnarayanNo ratings yet

- E Banking - HDFCDocument7 pagesE Banking - HDFCmohammed khayyumNo ratings yet

- Study On HSBC BankDocument48 pagesStudy On HSBC Bankvarun_new87No ratings yet

- Retail Banking An Introduction Research Methodology: Title of Project Statement of The Problem Objective of The StudyDocument9 pagesRetail Banking An Introduction Research Methodology: Title of Project Statement of The Problem Objective of The StudySandeep KumarNo ratings yet

- Commercial Banks: Functions and Present PositionDocument22 pagesCommercial Banks: Functions and Present Positionraghvendragaur22No ratings yet

- Project Report On Indian Banking Sector and Barclays: Submitted To: Pranav Sir Submitted By: Lalit Tiwari (DM10B19Document25 pagesProject Report On Indian Banking Sector and Barclays: Submitted To: Pranav Sir Submitted By: Lalit Tiwari (DM10B19lit143No ratings yet

- Recent Trends in BankingDocument8 pagesRecent Trends in BankingNeha bansalNo ratings yet

- 4.2 Internship Report 18MGT 021Document14 pages4.2 Internship Report 18MGT 021aumitksrtNo ratings yet

- Commercial Banking System and Role of RBI PG QP JUNE 2024 PDFDocument4 pagesCommercial Banking System and Role of RBI PG QP JUNE 2024 PDFBalamuralikrishna YadavNo ratings yet

- Problems Faced by Commercial BanksDocument29 pagesProblems Faced by Commercial BanksPantula ChandanaNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Bank Fundamentals: An Introduction to the World of Finance and BankingFrom EverandBank Fundamentals: An Introduction to the World of Finance and BankingRating: 4.5 out of 5 stars4.5/5 (4)

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- The Functional Microfinance Bank: Strategies for SurvivalFrom EverandThe Functional Microfinance Bank: Strategies for SurvivalNo ratings yet

- Chapter 5Document20 pagesChapter 5Clyette Anne Flores Borja100% (1)

- Stock Market WidgetsDocument12 pagesStock Market WidgetsshanysunnyNo ratings yet

- Form HA-4632Document2 pagesForm HA-4632GARY SELLSNo ratings yet

- Land Law Sem 2 Notes (PX)Document39 pagesLand Law Sem 2 Notes (PX)Isa MajNo ratings yet

- BFNI Presentation Nov20Document83 pagesBFNI Presentation Nov20Ab ZaherNo ratings yet

- Financial Literacy of High School Students: Lewis MandellDocument2 pagesFinancial Literacy of High School Students: Lewis MandellDUDE RYANNo ratings yet

- ChaRM Overview 7.2SP6 2018Document67 pagesChaRM Overview 7.2SP6 2018Muhammad HassimNo ratings yet

- Rktarai DetailDocument9 pagesRktarai DetailDeepak SwainNo ratings yet

- Minsky's Moment - The EconomistDocument5 pagesMinsky's Moment - The EconomistnochereversibleNo ratings yet

- Suggested Answers (Chapter 3)Document8 pagesSuggested Answers (Chapter 3)kokomama231No ratings yet

- Performance of Private Credit Funds A First LookDocument37 pagesPerformance of Private Credit Funds A First LookIván WdiNo ratings yet

- Islamic Financial Planning Course OutlineDocument4 pagesIslamic Financial Planning Course OutlineUsaama AbdilaahiNo ratings yet

- Strategic Management: Implementing Strategies: Marketing IssuesDocument37 pagesStrategic Management: Implementing Strategies: Marketing IssuesAli ShanNo ratings yet

- Invoice 7218740Document2 pagesInvoice 7218740Johanny SantosNo ratings yet

- SCDL Questions and Answers On Business LawDocument8 pagesSCDL Questions and Answers On Business LawantolexNo ratings yet

- Company Law Review Shree Prakash UpretiDocument10 pagesCompany Law Review Shree Prakash Upretiरेडिट रेेडिटNo ratings yet

- Case 22-19361-MBKDocument122 pagesCase 22-19361-MBKasdasdasdNo ratings yet

- Strategic Financing DecisionsDocument4 pagesStrategic Financing DecisionsushaNo ratings yet

- Annexure A MAXDocument2 pagesAnnexure A MAXrittechNo ratings yet

- Industrial Development Policy 2015-20Document24 pagesIndustrial Development Policy 2015-2045satishNo ratings yet

- Contract 103 One Way 13 May 2020Document19 pagesContract 103 One Way 13 May 2020ruby caldeNo ratings yet

- Investments AssignmentDocument4 pagesInvestments Assignmentapi-276122905No ratings yet

- 3PL-DCI - Trucking Investment ProposalDocument23 pages3PL-DCI - Trucking Investment ProposalSami AhmadNo ratings yet

- Advanced Tally Erp 9 PDFDocument3 pagesAdvanced Tally Erp 9 PDFrajasekarNo ratings yet

- ENERGEX S Regulatory Proposal 2010-2015Document362 pagesENERGEX S Regulatory Proposal 2010-2015graceenggint8799No ratings yet

- Digest RULE 39 - PantaleonDocument22 pagesDigest RULE 39 - Pantaleonbookleech100% (1)

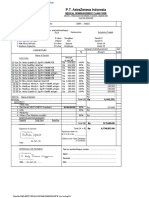

- P.T. Astrazeneca Indonesia: Medical Reimbursement Claim FormDocument15 pagesP.T. Astrazeneca Indonesia: Medical Reimbursement Claim FormPono PonoNo ratings yet

- Ramalingam Raju - Letter To SEBIDocument3 pagesRamalingam Raju - Letter To SEBIAnonymous DxkU726vkMNo ratings yet

- Duration 2 Hours Max Marks 70Document25 pagesDuration 2 Hours Max Marks 70AgANo ratings yet