Professional Documents

Culture Documents

GST Registration-28

GST Registration-28

Uploaded by

backupshreetCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST Registration-28

GST Registration-28

Uploaded by

backupshreetCopyright:

Available Formats

COMPANY NAME

Regd. Off: - REGISTERED ADDRESS

CIN: [if available], PAN: [company pan]

CERTIFIED TRUE COPY OF THE RESOLUTION PASSED AT THE BOARD MEETING OF

COMPANY NAME HELD ON DATE AT TIME. AT THE REGISTERED OFFICE OF THE

COMPANY

“RESOLVED THAT the Board do hereby appoint Person Name, Director of the

company as Authorised Signatory for enrolment of the Company on the Goods and

Service Tax (GST) System Portal and to sign and submit various documents

electronically and/or physically and to make applications, communications,

representations, modifications or alterations on behalf of the Company before the

Central GST and/or the concerned State GST authorities as and when required.”

“FURTHER RESOLVED THAT Person Name, Director of the company be and is

hereby authorized to represent the Company and to take necessary actions on all

goods and service tax related issues including but not limited to presenting

documents/records etc., on behalf of the Company liaising /representing for

registration of the Company and also to make any alterations, additions, corrections,

to the documents, papers, forms, etc., filed with service tax authorities as and when

required.”

“FURTHER RESOLVED THAT Person Name, Director of the company be and is

hereby authorized on behalf of the company to sign the returns, documents, letters,

correspondences etc. And to represent on behalf of the company, for assessments,

appeals or otherwise before the goods and service tax authorities as and when

required.”

By Order of the Board of Directors

For COMPANY NAME

Director2:

Director: [NAME]

DIN:

CERTIFIED TRUE COPY

*Print this on a company letterhead

Disclaimer

The contents of this document must be used / modified as per need / requirement of

the business. All the documents, templates, checklists, tool lists, strategy sheets

shared as part of the Aladdin Ka Chirag are curated by Bada Business as per the

needs of Indian entrepreneurs / business owners. The documents are standard

templates acknowledged by the industry. The usage of the documents that are part

of Aladdin Ka Chirag is the sole responsibility of the business owner / entrepreneur.

Bada Business takes no responsibility whatsoever of the results generated by the

user / customer upon the usage of Aladdin Ka Chirag.

You might also like

- Partnership DeedDocument6 pagesPartnership DeedArul Thangam Kirupagaran100% (2)

- Maybank Card - Convenience, Savings and Rewards: Maybank Islamic Berhad (787435-M)Document3 pagesMaybank Card - Convenience, Savings and Rewards: Maybank Islamic Berhad (787435-M)Tarmimi RazaliNo ratings yet

- Course Code: CDI 6 Course Title: Fire Protection and Arson Investigation Course DescriptionDocument5 pagesCourse Code: CDI 6 Course Title: Fire Protection and Arson Investigation Course DescriptionApple Asne100% (1)

- GST ResolutionDocument1 pageGST Resolutionrshagautam17621No ratings yet

- BR DraftDocument1 pageBR DraftSujit SinghNo ratings yet

- Board Resolution FormatDocument2 pagesBoard Resolution FormatAshok Sharma100% (3)

- Resolvedthat Arpita KulharDocument1 pageResolvedthat Arpita Kulharbogitav904No ratings yet

- BR - Kolkatta GSTDocument1 pageBR - Kolkatta GSTPoorva KumariNo ratings yet

- Board Resolution For GST Registration in Word FormatDocument1 pageBoard Resolution For GST Registration in Word FormatKartik Jain ASCO, NoidaNo ratings yet

- Board Resolution - Secondary and Primary (Combine BR)Document2 pagesBoard Resolution - Secondary and Primary (Combine BR)pankajkumarbothraNo ratings yet

- Bank Procedure and FormalitiesDocument59 pagesBank Procedure and Formalitiesrakesh19865No ratings yet

- VENDOR REGISTRATION FORM NewDocument4 pagesVENDOR REGISTRATION FORM Newqasimahmed565No ratings yet

- No GST DeclarationDocument1 pageNo GST DeclarationrvisuNo ratings yet

- Bo2f1e 1Document1 pageBo2f1e 1Stephen HaldenNo ratings yet

- Corporate Authorisation Board Resolution 20180530Document1 pageCorporate Authorisation Board Resolution 20180530Snnd NsndNo ratings yet

- How To Register A Company in TanzaniaDocument7 pagesHow To Register A Company in TanzaniaPaschal MazikuNo ratings yet

- 2020.11.30-Notice of 14th Annual General Meeting-MDLDocument13 pages2020.11.30-Notice of 14th Annual General Meeting-MDLMegha NandiwalNo ratings yet

- ArticleDocument2 pagesArticleSahil GhangasNo ratings yet

- Board Resolution Approving S Corporation ElectionDocument1 pageBoard Resolution Approving S Corporation ElectionStephen HaldenNo ratings yet

- X Square Design Studio (Opc) Private LimitedDocument1 pageX Square Design Studio (Opc) Private Limited41vaibhavchunduriNo ratings yet

- Private Limited Company Incorporation and DocumentsDocument18 pagesPrivate Limited Company Incorporation and DocumentsSolubilisNo ratings yet

- Board Resolution For 12 A RegistrationDocument1 pageBoard Resolution For 12 A RegistrationSUMIT SAURABHNo ratings yet

- Startup ChecklistDocument2 pagesStartup Checklistazconsulting.connectNo ratings yet

- LegalDocument32 pagesLegalAkriti SinghNo ratings yet

- CIMB Limited-Liability-Partnership-Account-Mandate-FormDocument2 pagesCIMB Limited-Liability-Partnership-Account-Mandate-Formnaufalbakhudin.fbNo ratings yet

- Certificate of Incorporation: WWW - Mca.gov - inDocument1 pageCertificate of Incorporation: WWW - Mca.gov - inamar nathNo ratings yet

- BusinesEnvironmentandLaw5&6-19-20 03 2022Document66 pagesBusinesEnvironmentandLaw5&6-19-20 03 2022MeSairam UNo ratings yet

- Orrick's Technology Companies Group Start-Up Forms LibraryDocument14 pagesOrrick's Technology Companies Group Start-Up Forms LibraryAxel KrommNo ratings yet

- Business Registration and LicensingDocument30 pagesBusiness Registration and LicensingRheneir MoraNo ratings yet

- At Least One Authorised Employee Name and Details Is MandatoryDocument2 pagesAt Least One Authorised Employee Name and Details Is MandatoryA AphotoshopNo ratings yet

- Gaoler SlidesCarnivalDocument47 pagesGaoler SlidesCarnivalRafikul RahemanNo ratings yet

- EPass2003 User GuideDocument1 pageEPass2003 User GuideGoldy TomarNo ratings yet

- Supplier Accredit AppDocument1 pageSupplier Accredit AppAndrew CamposanoNo ratings yet

- Circular BRAccount Opening ServicesDocument3 pagesCircular BRAccount Opening ServicesjakilNo ratings yet

- Formation of CompaniesDocument7 pagesFormation of Companiesmanoranjan838241No ratings yet

- Topic Name:-: Company Registration ProcedureDocument11 pagesTopic Name:-: Company Registration ProcedureLokesh RajpurohitNo ratings yet

- Authorization Letter Template FN SR 190318 5Document2 pagesAuthorization Letter Template FN SR 190318 5Visakh AntonyNo ratings yet

- Business ImplementationDocument28 pagesBusiness ImplementationMariaAngelaAdanEvangelistaNo ratings yet

- Procedure For Public Limited Company FormationDocument4 pagesProcedure For Public Limited Company Formationlalbabu guptaNo ratings yet

- Client Due Diligent FormDocument4 pagesClient Due Diligent FormM.R DanialNo ratings yet

- Board ResolutionDocument2 pagesBoard ResolutionSUSHIL K KAD & ASSOCIATESNo ratings yet

- Employee Termination Letter: TIP: If The Employee Has An Employment Contract With AnDocument3 pagesEmployee Termination Letter: TIP: If The Employee Has An Employment Contract With AnHarun KianiNo ratings yet

- GST ResolutionDocument1 pageGST ResolutionPriyanshu SinghNo ratings yet

- Letter of Engagement (P)Document6 pagesLetter of Engagement (P)Artemio BacsalNo ratings yet

- Registration of Partnership Firm in DelhiDocument7 pagesRegistration of Partnership Firm in DelhiTushar GuptaNo ratings yet

- Engagement Letter CleanDocument4 pagesEngagement Letter Cleanjose100% (1)

- NEW ACCOUNT - OPENING - FORM - IndiaDocument2 pagesNEW ACCOUNT - OPENING - FORM - IndiaDeepak PanghalNo ratings yet

- Company Registration ServiceDocument28 pagesCompany Registration ServiceRafikul RahemanNo ratings yet

- Action by Written Consent of StockholdersDocument1 pageAction by Written Consent of StockholdersStephen HaldenNo ratings yet

- M-PESA One Account Opening Authorization Form 2022 Existing CustomerDocument2 pagesM-PESA One Account Opening Authorization Form 2022 Existing Customersayno2drugabuseNo ratings yet

- Instructions: Name of Authorized OfficialsDocument1 pageInstructions: Name of Authorized OfficialsdilipNo ratings yet

- Aslam BE AssignmentDocument4 pagesAslam BE Assignmentaslam khanNo ratings yet

- (TEMPLATE) Board Consent (Financing)Document3 pages(TEMPLATE) Board Consent (Financing)Anton GusakovNo ratings yet

- Board ApprovalDocument4 pagesBoard ApprovalAwni SaeedNo ratings yet

- Finder's Fee Agreement: (Date)Document4 pagesFinder's Fee Agreement: (Date)freebanker777741No ratings yet

- Ali Raza Law Assigment 3Document3 pagesAli Raza Law Assigment 3tahleel bashiNo ratings yet

- Sh8a57 1Document1 pageSh8a57 1Stephen HaldenNo ratings yet

- Private Limited Company Registration IndiaDocument1 pagePrivate Limited Company Registration IndiaBIZINDIGONo ratings yet

- Company Registration ProcessDocument8 pagesCompany Registration ProcessSultan AndrewNo ratings yet

- Checklist For Direct Listing Nationwide Exchange Grater 500CrDocument12 pagesChecklist For Direct Listing Nationwide Exchange Grater 500CrBharat ki BaatNo ratings yet

- Template Letter of AuthorityDocument2 pagesTemplate Letter of Authorityyyin6406No ratings yet

- How to Start Your Own Cleaning Business: Low Start up Cost, Fast Growing and ProfitableFrom EverandHow to Start Your Own Cleaning Business: Low Start up Cost, Fast Growing and ProfitableNo ratings yet

- Extct Bill 905431x 677697Document2 pagesExtct Bill 905431x 677697clinica.sante.resultsNo ratings yet

- NREP Electricity Project Licensing in Nepal Mar 2021Document31 pagesNREP Electricity Project Licensing in Nepal Mar 2021Shiva AdhikariNo ratings yet

- 08 Rap Jazz Notes-Atico-MDADocument2 pages08 Rap Jazz Notes-Atico-MDAhrdirectorNo ratings yet

- Treatment of AliensDocument19 pagesTreatment of AliensWinston Mao TorinoNo ratings yet

- PANELCO V. MONTEMAYOR A.C. 5739 September 12, 2007Document1 pagePANELCO V. MONTEMAYOR A.C. 5739 September 12, 2007Donna Grace GuyoNo ratings yet

- Keuppers vs. Judge MurciaDocument2 pagesKeuppers vs. Judge MurciaJam GonzagaNo ratings yet

- FERDINAND E. MARCOS and MANUEL CONCORDIA, PetitionersDocument4 pagesFERDINAND E. MARCOS and MANUEL CONCORDIA, PetitionersLASNo ratings yet

- This Is A List of Scientific Laws Named After of Eponyms, See EponymDocument13 pagesThis Is A List of Scientific Laws Named After of Eponyms, See EponymAnkit KambleNo ratings yet

- Draft of RFQ For Fire Station 50 On Marco Island - June 1, 2020Document38 pagesDraft of RFQ For Fire Station 50 On Marco Island - June 1, 2020Omar Rodriguez OrtizNo ratings yet

- MEP Q7101 v1.0Document65 pagesMEP Q7101 v1.0Mukul SinghNo ratings yet

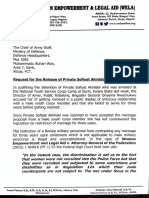

- Letter To The Chief of Army StaffDocument13 pagesLetter To The Chief of Army StaffSahara ReportersNo ratings yet

- Metropolitan Bank & Trust Co. Vs Junnel's Marketing CorporationDocument15 pagesMetropolitan Bank & Trust Co. Vs Junnel's Marketing CorporationJulius ReyesNo ratings yet

- ARTICLE IX (C)Document1 pageARTICLE IX (C)Felix III AlcarezNo ratings yet

- SMC Abella Vs NLRC LA IbiasDocument1 pageSMC Abella Vs NLRC LA IbiasJoeyBoyCruzNo ratings yet

- REPUBLIC ACT NO. 11362 Community ServiceDocument3 pagesREPUBLIC ACT NO. 11362 Community ServiceAngie SmileNo ratings yet

- Commissioner vs. Air India GR L-72443, 29 January 1988: FactsDocument11 pagesCommissioner vs. Air India GR L-72443, 29 January 1988: FactsDarrel John SombilonNo ratings yet

- Lawof Agency (Iii) PDFDocument63 pagesLawof Agency (Iii) PDFIffah FirzanahNo ratings yet

- GSTR1 03ajdpk8658g1z5 032023Document7 pagesGSTR1 03ajdpk8658g1z5 032023SANJEEV KUMARNo ratings yet

- Mahindra and Mahindra Annual Report 2017 2018 PDFDocument359 pagesMahindra and Mahindra Annual Report 2017 2018 PDFShikhar DudejaNo ratings yet

- Mercado Vs LBPDocument9 pagesMercado Vs LBPSuho KimNo ratings yet

- Stages of Crime and Inchoate CrimesDocument2 pagesStages of Crime and Inchoate CrimesNetan ChouhanNo ratings yet

- Feati University Vs Bautista, 18 Scra 1191Document1 pageFeati University Vs Bautista, 18 Scra 1191Earvin Joseph BaraceNo ratings yet

- Components of Dutiable ValueDocument25 pagesComponents of Dutiable ValueJemimah MalicsiNo ratings yet

- Affidavit of Loss - LoloyDocument4 pagesAffidavit of Loss - LoloyJamel AgantalNo ratings yet

- Occupier's Liability (Scotland) Act 1960Document4 pagesOccupier's Liability (Scotland) Act 1960Kean Phang TehNo ratings yet

- Multiple Choice: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument8 pagesMultiple Choice: Identify The Choice That Best Completes The Statement or Answers The QuestionMona Mohamed SafwatNo ratings yet

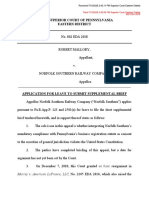

- Mallory V Norfolk 802 EDA 2018 Pennsylvania Superior Court - 07.15.2020 Application To File Supplement Brief (Including Exhibits) - 12ppDocument12 pagesMallory V Norfolk 802 EDA 2018 Pennsylvania Superior Court - 07.15.2020 Application To File Supplement Brief (Including Exhibits) - 12ppJeffrey RobbinsNo ratings yet

- DSSB ClerkDocument4 pagesDSSB Clerkjfeb40563No ratings yet