Professional Documents

Culture Documents

2021 CC8

2021 CC8

Uploaded by

ROCKY GAMERCopyright:

Available Formats

You might also like

- 2024-03 Monthly Housing Market OutlookDocument57 pages2024-03 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- Fund Loan Form PDFDocument3 pagesFund Loan Form PDFsarge18100% (1)

- Integration Step by Step Notes: Sap Mm-FiDocument6 pagesIntegration Step by Step Notes: Sap Mm-FiKathiresan Nagarajan0% (1)

- Microeconomics End Term Exam Academic Year: 2021-22 Time: 2 HoursDocument7 pagesMicroeconomics End Term Exam Academic Year: 2021-22 Time: 2 HoursKartik GurmuleNo ratings yet

- ECON 201 Midterm 2012WDocument6 pagesECON 201 Midterm 2012WVaga boundedNo ratings yet

- MEC-001-D15 - ENG - Compressed PDFDocument6 pagesMEC-001-D15 - ENG - Compressed PDFTamash MajumdarNo ratings yet

- MecDocument138 pagesMecvcoolj0% (1)

- CU-2020 B.A. B.Sc. (Honours) Economics Semester-I Paper-CC-1 QPDocument3 pagesCU-2020 B.A. B.Sc. (Honours) Economics Semester-I Paper-CC-1 QPDARPAN ROUTHNo ratings yet

- CU-2021 B.A. B.Sc. (Honours) Economics Semester-1 Paper-CC-1 QPDocument3 pagesCU-2021 B.A. B.Sc. (Honours) Economics Semester-1 Paper-CC-1 QPShubham PatelNo ratings yet

- CU-2021 B.A. B.sc. (Honours) Economics Semester-3 Paper-CC-5 QPDocument3 pagesCU-2021 B.A. B.sc. (Honours) Economics Semester-3 Paper-CC-5 QPsourojeetsenNo ratings yet

- Microeconomics MockDocument3 pagesMicroeconomics MockriyaroxitNo ratings yet

- 2013 ZBDocument4 pages2013 ZBShershah KakakhelNo ratings yet

- Ignou Ma Eco Assignemnts July 2015 SessionDocument11 pagesIgnou Ma Eco Assignemnts July 2015 SessionAnonymous IL3nivBcNo ratings yet

- AssgnDocument5 pagesAssgnMehvaish QadriNo ratings yet

- School of Business and EconomicsDocument19 pagesSchool of Business and EconomicsIshtiaq Ahmed MugdhaNo ratings yet

- Ignouassignments - in 9891268050: Assignment OneDocument25 pagesIgnouassignments - in 9891268050: Assignment OneAjay KumarNo ratings yet

- PYQs - On - Theories - of - Market - StructureDocument3 pagesPYQs - On - Theories - of - Market - StructureTusharNo ratings yet

- MEC 101 - Previous Year QP (2022,2021,2020) - @mec22ignouDocument61 pagesMEC 101 - Previous Year QP (2022,2021,2020) - @mec22ignouAfifaNo ratings yet

- Economics SHDJRNRMFMMFFDocument7 pagesEconomics SHDJRNRMFMMFFSarthak MishraNo ratings yet

- Eco2003f Exam 2010 PDFDocument10 pagesEco2003f Exam 2010 PDFSiphoNo ratings yet

- Exam2008 07A KeyDocument15 pagesExam2008 07A KeyRajaaeajasd Gausdj100% (2)

- Economics EC 7218 - Micro Economic Theory Oct 2018 ADocument1 pageEconomics EC 7218 - Micro Economic Theory Oct 2018 Apremium info2222No ratings yet

- Davangere District 1st and 2nd Pu EconomicsDocument4 pagesDavangere District 1st and 2nd Pu Economicspalluprajwal601No ratings yet

- Msqe Peb 2016Document5 pagesMsqe Peb 2016blahblahNo ratings yet

- Some Important Questions For The Paper Managerial Economics'Document3 pagesSome Important Questions For The Paper Managerial Economics'Amit VshneyarNo ratings yet

- Question Paper Micro IIDocument3 pagesQuestion Paper Micro IIsanmitrazNo ratings yet

- AssignmentDocument2 pagesAssignmentnavneet26101988No ratings yet

- II PUC Economics Paper 2 2020Document4 pagesII PUC Economics Paper 2 2020Shridhar MNo ratings yet

- 28d8633c121419cda48c0d9a622614d6_27f68bd319e3aca1d3f97af3bbb90014Document9 pages28d8633c121419cda48c0d9a622614d6_27f68bd319e3aca1d3f97af3bbb90014deepakdohare1011No ratings yet

- Micro 2013 ZA QPDocument8 pagesMicro 2013 ZA QPSathis JayasuriyaNo ratings yet

- MEC-001 - ENG-D16 - Compressed PDFDocument3 pagesMEC-001 - ENG-D16 - Compressed PDFTamash MajumdarNo ratings yet

- Advanced Microeconomics II Q & ADocument34 pagesAdvanced Microeconomics II Q & AZemichael SeltanNo ratings yet

- 2018ies Exam Question Paper-1Document6 pages2018ies Exam Question Paper-1AnjaliPuniaNo ratings yet

- Half Yearly Examination (2014 - 15) Retest Class - XII: Delhi Public School, Jodhpur Subject - EconomicsDocument4 pagesHalf Yearly Examination (2014 - 15) Retest Class - XII: Delhi Public School, Jodhpur Subject - Economicsmarudev nathawatNo ratings yet

- Exercises Web VersionDocument15 pagesExercises Web VersionDavid SarmientoNo ratings yet

- Eco Old ExamsDocument33 pagesEco Old ExamsbmerinoechevNo ratings yet

- MS 602 - Topic 6 - Revision QuestionsDocument6 pagesMS 602 - Topic 6 - Revision QuestionsPETRONo ratings yet

- ECN2217 - Intermediate Microeconomics 2022Document5 pagesECN2217 - Intermediate Microeconomics 2022Luke GaleaNo ratings yet

- II PUC EconomicsDocument5 pagesII PUC EconomicsArvind KoreNo ratings yet

- Economics EC 7218 - Micro Economic Theory Oct 2018 BDocument1 pageEconomics EC 7218 - Micro Economic Theory Oct 2018 Bpremium info2222No ratings yet

- II Pu Economics QPDocument8 pagesII Pu Economics QPBharathi RNo ratings yet

- Quiz 1 BDocument8 pagesQuiz 1 BTahseenNo ratings yet

- Term 1 Economics Xi Final 2022Document3 pagesTerm 1 Economics Xi Final 2022sindhuNo ratings yet

- BBS 1st Year Business Economics 0009Document6 pagesBBS 1st Year Business Economics 0009Suzain Nath90% (10)

- ADDITIONAL EXERCISES - PS5.text PDFDocument10 pagesADDITIONAL EXERCISES - PS5.text PDFfedericodtNo ratings yet

- Int Mic II AssignmentDocument1 pageInt Mic II AssignmentJagNo ratings yet

- Winter ExamDocument4 pagesWinter ExamJuhee SeoNo ratings yet

- EC2066Document49 pagesEC2066Josiah KhorNo ratings yet

- Econ 2 Deg Exam 2016 - 2017 - FINAL PDFDocument11 pagesEcon 2 Deg Exam 2016 - 2017 - FINAL PDFAriel WangNo ratings yet

- L 2rr-IINAME Date:31/12/2012 - : - Section-A FourDocument14 pagesL 2rr-IINAME Date:31/12/2012 - : - Section-A Fourpartho RoyNo ratings yet

- Extra Credit AssignmentDocument2 pagesExtra Credit AssignmentAnanya ChabaNo ratings yet

- Managerial Economics - Examen Juni 2013Document4 pagesManagerial Economics - Examen Juni 2013Thục LinhNo ratings yet

- Advanced Micro EconomicsDocument5 pagesAdvanced Micro EconomicsDevender K ChouhanNo ratings yet

- Eco100y5 Tt1 2012f MichaelhoDocument3 pagesEco100y5 Tt1 2012f MichaelhoexamkillerNo ratings yet

- Problems 1Document3 pagesProblems 1arnabthapa007No ratings yet

- Advanced Micro Markets StructureDocument6 pagesAdvanced Micro Markets StructureManas MRBNo ratings yet

- Microeconomics-Final.: Time: 2 HoursDocument3 pagesMicroeconomics-Final.: Time: 2 HoursAnu AmruthNo ratings yet

- Individual and Group Assignment On EconomicsDocument2 pagesIndividual and Group Assignment On EconomicsnegussieteklemariamNo ratings yet

- Mec 101Document12 pagesMec 101Abhishek GautamNo ratings yet

- MEC-001 - ENG-J12 - Compressed PDFDocument6 pagesMEC-001 - ENG-J12 - Compressed PDFTamash MajumdarNo ratings yet

- 2017ies Exam Question Paper-1Document5 pages2017ies Exam Question Paper-1AnjaliPuniaNo ratings yet

- Exercises Part2Document9 pagesExercises Part2christina0107No ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Img 20200115 0001Document1 pageImg 20200115 0001KIMBERLY BALISACANNo ratings yet

- Nubirox 302 in High Gloss Solvent Based Alkyd DTM (Formula AC 19630F)Document3 pagesNubirox 302 in High Gloss Solvent Based Alkyd DTM (Formula AC 19630F)MONEMNo ratings yet

- Pivot Boss SummaryDocument36 pagesPivot Boss SummaryVarun Vasurendran100% (2)

- 2016 AccountingDocument16 pages2016 AccountingAlison JcNo ratings yet

- Sakambari BillDocument3 pagesSakambari BillMd Zeeshan AhmedNo ratings yet

- Barton Co. Balance Sheet For Branch December 31, 20x4Document17 pagesBarton Co. Balance Sheet For Branch December 31, 20x4Love FreddyNo ratings yet

- In-Class 2 SolutionsDocument3 pagesIn-Class 2 SolutionssassNo ratings yet

- Global Interstate SystemDocument17 pagesGlobal Interstate SystemPearl TanNo ratings yet

- Sample Questions On CVP AnalysisDocument19 pagesSample Questions On CVP AnalysisThomas Ansah100% (1)

- Reading 8 Topics in Demand and Supply Analysis - AnswersDocument25 pagesReading 8 Topics in Demand and Supply Analysis - AnswersgddNo ratings yet

- JAIBB Comparative Syllabus PDFDocument8 pagesJAIBB Comparative Syllabus PDFshahaneauez alamNo ratings yet

- M&a Modeling Course - Wall Street OasisDocument133 pagesM&a Modeling Course - Wall Street OasisZeehenul Ishfaq100% (2)

- Brother LK3 Instruction ManualDocument16 pagesBrother LK3 Instruction ManualJeremy IdkNo ratings yet

- Btap - Liên T or Gi I T - UpdateDocument7 pagesBtap - Liên T or Gi I T - UpdateToàn NguyễnNo ratings yet

- BUS 5117 Case Study of Ventures in Salt: Compass Minerals International Professor Karl Thompson University of The PeopleDocument5 pagesBUS 5117 Case Study of Ventures in Salt: Compass Minerals International Professor Karl Thompson University of The PeopleMahendra Raj PandayNo ratings yet

- Theory of RicardoDocument15 pagesTheory of RicardoVidhiNo ratings yet

- LLB IV Sem GST Unit I Levy and Collection Tax by DR Nisha SharmaDocument7 pagesLLB IV Sem GST Unit I Levy and Collection Tax by DR Nisha Sharmad. CNo ratings yet

- (Original For Recipient) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Original For Recipient) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountAshishSethiaNo ratings yet

- Saln Form Orimaco 2021Document2 pagesSaln Form Orimaco 2021Metch Abella TitoyNo ratings yet

- Nympha Roxas Strat ComDocument18 pagesNympha Roxas Strat ComManuel LatayanNo ratings yet

- Utility Bill Template 09Document2 pagesUtility Bill Template 09衡治洲No ratings yet

- Chapter 4Document23 pagesChapter 4GHGFYGJNo ratings yet

- Compound and Collective ObligationsDocument3 pagesCompound and Collective ObligationsJoseph AndrewsNo ratings yet

- Supply Chain Risk ManagementDocument61 pagesSupply Chain Risk ManagementTabz Hussain100% (2)

- L202 EP111 General EconomyDocument2 pagesL202 EP111 General Economylnn97No ratings yet

- Theories of ProfitDocument34 pagesTheories of ProfitNithin Kumar VNo ratings yet

- Approaches in Calculating GDPDocument3 pagesApproaches in Calculating GDPAsahi My loveNo ratings yet

2021 CC8

2021 CC8

Uploaded by

ROCKY GAMERCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2021 CC8

2021 CC8

Uploaded by

ROCKY GAMERCopyright:

Available Formats

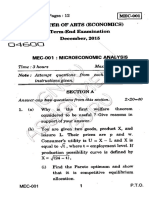

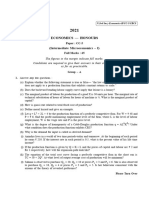

(1) T(4th Sm.

)-Economics-H/CC-8/CBCS

2021

ECONOMICS — HONOURS

Paper : CC-8

(Intermediate Microeconomics-II)

Full Marks : 65

The figures in the margin indicate full marks.

Candidates are required to give their answers in their own words

as far as practicable.

Group - A

1. Answer any ten questions : 2×10

(a) What do you understand by third degree price discrimination?

(b) Define natural monopoly and give an example.

(c) Under what condition will a competitive firm with one fixed input and one variable input maximise

profit?

(d) What is meant by negative externality? Give suitable example.

(e) Explain what do you mean by Pareto efficient allocation.

(f) What are the competitive features of monopolistic competitive market?

(g) Define conjectural variation in the determination of oligopoly market.

(h) What do you mean by mark up pricing?

(i) Explain the difference between adverse selection and moral hazard in insurance markets.

(j) How is elasticity related to market power?

(k) ‘Collective bargaining can benefit labourers only in an imperfectly competitive labour market’.

Explain.

(l) Define contract curve.

(m) Mention two reasons of market failure.

(n) If the monopolist’s demand curve is P = 200 - 10q and his marginal cost is MC = 100 + 5q, what

are the monopolist’s profit maximising price and output?

(o) What do you mean by Free rider problem?

Group - B

2. Answer any three questions : 5×3

(a) How can the equilibrium of oligopolistic market be explained with the help of prisoner’s Dilemma?

Please Turn Over

T(4th Sm.)-Economics-H/CC-8/CBCS (2)

(b) Explain whether a monopolist seeking to maximise profit will operate in the elastic or inelastic part

of the demand curve.

(c) How can the kinked demand curve model explain price rigidity?

(d) Explain whether monopolistic competition give rise to excess capacity.

(e) How will a monopolist using two variable inputs maximise profit? (Assume that the Input markets

to be competitive)

Group - C

3. Answer any three questions :

(a) (i) Show that a monopolist selling in two markets will charge a higher price in the market where

elasticity of demand is lower.

(ii) A monopolist can charge different prices in two separate markets whose demand and cost

functions are as follows :

p1 = 80 – 5q1, p2 = 180 – 20q2 and C = 20 (q1 + q2)

Find out the optimal price quantity combination in each market and his total profit level. If he

cannot choose price discrimination and charges same prices in both markets, how does the

solution change? Explain your answer. 4+3+3

(b) Explain monopolistic and monopsonistic exploitation of labour. Explain the role of trade union in this

context. 3+3+4

(c) (i) In the Edgeworth Box diagram, explain why both consumers’ Marginal Rate of Substitution

are equal at every point on the contract curve.

(ii) In a two person two commodity pure exchange model, the utility functions are

U1 = q11 q12 and U2 = q21 q22 and given that q11 + q21 = q1 º and q12 + q22 = q2 º. Derive

the contract curve as an implicit function of q11 and q12. 4+6

(d) (i) Explain why the long run equilibrium price and output of a monopolistically competitive firm

will change if other firms enter or leave the industry. Use a diagram to explain your answer.

(ii) Suppose that two identical firms are there whose cost function are given by

C1 = 30q1 and C2 = 30q2, where q1 and q2 are output of firm 1 and firm 2 respectively. The

inverse demand function of firm’s output is given by p = 120 - q where q = q 1 +q2. What

are the firm’s output in Nash equilibrium of the Cournot model? 5+5

(e) (i) Dose the soft drink industry conform more closely to monopolistic competition or Oligopoly?

Explain your answer.

(ii) Show that Pareto Optimality conditions are satisfied under perfect competition. 5+5

You might also like

- 2024-03 Monthly Housing Market OutlookDocument57 pages2024-03 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- Fund Loan Form PDFDocument3 pagesFund Loan Form PDFsarge18100% (1)

- Integration Step by Step Notes: Sap Mm-FiDocument6 pagesIntegration Step by Step Notes: Sap Mm-FiKathiresan Nagarajan0% (1)

- Microeconomics End Term Exam Academic Year: 2021-22 Time: 2 HoursDocument7 pagesMicroeconomics End Term Exam Academic Year: 2021-22 Time: 2 HoursKartik GurmuleNo ratings yet

- ECON 201 Midterm 2012WDocument6 pagesECON 201 Midterm 2012WVaga boundedNo ratings yet

- MEC-001-D15 - ENG - Compressed PDFDocument6 pagesMEC-001-D15 - ENG - Compressed PDFTamash MajumdarNo ratings yet

- MecDocument138 pagesMecvcoolj0% (1)

- CU-2020 B.A. B.Sc. (Honours) Economics Semester-I Paper-CC-1 QPDocument3 pagesCU-2020 B.A. B.Sc. (Honours) Economics Semester-I Paper-CC-1 QPDARPAN ROUTHNo ratings yet

- CU-2021 B.A. B.Sc. (Honours) Economics Semester-1 Paper-CC-1 QPDocument3 pagesCU-2021 B.A. B.Sc. (Honours) Economics Semester-1 Paper-CC-1 QPShubham PatelNo ratings yet

- CU-2021 B.A. B.sc. (Honours) Economics Semester-3 Paper-CC-5 QPDocument3 pagesCU-2021 B.A. B.sc. (Honours) Economics Semester-3 Paper-CC-5 QPsourojeetsenNo ratings yet

- Microeconomics MockDocument3 pagesMicroeconomics MockriyaroxitNo ratings yet

- 2013 ZBDocument4 pages2013 ZBShershah KakakhelNo ratings yet

- Ignou Ma Eco Assignemnts July 2015 SessionDocument11 pagesIgnou Ma Eco Assignemnts July 2015 SessionAnonymous IL3nivBcNo ratings yet

- AssgnDocument5 pagesAssgnMehvaish QadriNo ratings yet

- School of Business and EconomicsDocument19 pagesSchool of Business and EconomicsIshtiaq Ahmed MugdhaNo ratings yet

- Ignouassignments - in 9891268050: Assignment OneDocument25 pagesIgnouassignments - in 9891268050: Assignment OneAjay KumarNo ratings yet

- PYQs - On - Theories - of - Market - StructureDocument3 pagesPYQs - On - Theories - of - Market - StructureTusharNo ratings yet

- MEC 101 - Previous Year QP (2022,2021,2020) - @mec22ignouDocument61 pagesMEC 101 - Previous Year QP (2022,2021,2020) - @mec22ignouAfifaNo ratings yet

- Economics SHDJRNRMFMMFFDocument7 pagesEconomics SHDJRNRMFMMFFSarthak MishraNo ratings yet

- Eco2003f Exam 2010 PDFDocument10 pagesEco2003f Exam 2010 PDFSiphoNo ratings yet

- Exam2008 07A KeyDocument15 pagesExam2008 07A KeyRajaaeajasd Gausdj100% (2)

- Economics EC 7218 - Micro Economic Theory Oct 2018 ADocument1 pageEconomics EC 7218 - Micro Economic Theory Oct 2018 Apremium info2222No ratings yet

- Davangere District 1st and 2nd Pu EconomicsDocument4 pagesDavangere District 1st and 2nd Pu Economicspalluprajwal601No ratings yet

- Msqe Peb 2016Document5 pagesMsqe Peb 2016blahblahNo ratings yet

- Some Important Questions For The Paper Managerial Economics'Document3 pagesSome Important Questions For The Paper Managerial Economics'Amit VshneyarNo ratings yet

- Question Paper Micro IIDocument3 pagesQuestion Paper Micro IIsanmitrazNo ratings yet

- AssignmentDocument2 pagesAssignmentnavneet26101988No ratings yet

- II PUC Economics Paper 2 2020Document4 pagesII PUC Economics Paper 2 2020Shridhar MNo ratings yet

- 28d8633c121419cda48c0d9a622614d6_27f68bd319e3aca1d3f97af3bbb90014Document9 pages28d8633c121419cda48c0d9a622614d6_27f68bd319e3aca1d3f97af3bbb90014deepakdohare1011No ratings yet

- Micro 2013 ZA QPDocument8 pagesMicro 2013 ZA QPSathis JayasuriyaNo ratings yet

- MEC-001 - ENG-D16 - Compressed PDFDocument3 pagesMEC-001 - ENG-D16 - Compressed PDFTamash MajumdarNo ratings yet

- Advanced Microeconomics II Q & ADocument34 pagesAdvanced Microeconomics II Q & AZemichael SeltanNo ratings yet

- 2018ies Exam Question Paper-1Document6 pages2018ies Exam Question Paper-1AnjaliPuniaNo ratings yet

- Half Yearly Examination (2014 - 15) Retest Class - XII: Delhi Public School, Jodhpur Subject - EconomicsDocument4 pagesHalf Yearly Examination (2014 - 15) Retest Class - XII: Delhi Public School, Jodhpur Subject - Economicsmarudev nathawatNo ratings yet

- Exercises Web VersionDocument15 pagesExercises Web VersionDavid SarmientoNo ratings yet

- Eco Old ExamsDocument33 pagesEco Old ExamsbmerinoechevNo ratings yet

- MS 602 - Topic 6 - Revision QuestionsDocument6 pagesMS 602 - Topic 6 - Revision QuestionsPETRONo ratings yet

- ECN2217 - Intermediate Microeconomics 2022Document5 pagesECN2217 - Intermediate Microeconomics 2022Luke GaleaNo ratings yet

- II PUC EconomicsDocument5 pagesII PUC EconomicsArvind KoreNo ratings yet

- Economics EC 7218 - Micro Economic Theory Oct 2018 BDocument1 pageEconomics EC 7218 - Micro Economic Theory Oct 2018 Bpremium info2222No ratings yet

- II Pu Economics QPDocument8 pagesII Pu Economics QPBharathi RNo ratings yet

- Quiz 1 BDocument8 pagesQuiz 1 BTahseenNo ratings yet

- Term 1 Economics Xi Final 2022Document3 pagesTerm 1 Economics Xi Final 2022sindhuNo ratings yet

- BBS 1st Year Business Economics 0009Document6 pagesBBS 1st Year Business Economics 0009Suzain Nath90% (10)

- ADDITIONAL EXERCISES - PS5.text PDFDocument10 pagesADDITIONAL EXERCISES - PS5.text PDFfedericodtNo ratings yet

- Int Mic II AssignmentDocument1 pageInt Mic II AssignmentJagNo ratings yet

- Winter ExamDocument4 pagesWinter ExamJuhee SeoNo ratings yet

- EC2066Document49 pagesEC2066Josiah KhorNo ratings yet

- Econ 2 Deg Exam 2016 - 2017 - FINAL PDFDocument11 pagesEcon 2 Deg Exam 2016 - 2017 - FINAL PDFAriel WangNo ratings yet

- L 2rr-IINAME Date:31/12/2012 - : - Section-A FourDocument14 pagesL 2rr-IINAME Date:31/12/2012 - : - Section-A Fourpartho RoyNo ratings yet

- Extra Credit AssignmentDocument2 pagesExtra Credit AssignmentAnanya ChabaNo ratings yet

- Managerial Economics - Examen Juni 2013Document4 pagesManagerial Economics - Examen Juni 2013Thục LinhNo ratings yet

- Advanced Micro EconomicsDocument5 pagesAdvanced Micro EconomicsDevender K ChouhanNo ratings yet

- Eco100y5 Tt1 2012f MichaelhoDocument3 pagesEco100y5 Tt1 2012f MichaelhoexamkillerNo ratings yet

- Problems 1Document3 pagesProblems 1arnabthapa007No ratings yet

- Advanced Micro Markets StructureDocument6 pagesAdvanced Micro Markets StructureManas MRBNo ratings yet

- Microeconomics-Final.: Time: 2 HoursDocument3 pagesMicroeconomics-Final.: Time: 2 HoursAnu AmruthNo ratings yet

- Individual and Group Assignment On EconomicsDocument2 pagesIndividual and Group Assignment On EconomicsnegussieteklemariamNo ratings yet

- Mec 101Document12 pagesMec 101Abhishek GautamNo ratings yet

- MEC-001 - ENG-J12 - Compressed PDFDocument6 pagesMEC-001 - ENG-J12 - Compressed PDFTamash MajumdarNo ratings yet

- 2017ies Exam Question Paper-1Document5 pages2017ies Exam Question Paper-1AnjaliPuniaNo ratings yet

- Exercises Part2Document9 pagesExercises Part2christina0107No ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Img 20200115 0001Document1 pageImg 20200115 0001KIMBERLY BALISACANNo ratings yet

- Nubirox 302 in High Gloss Solvent Based Alkyd DTM (Formula AC 19630F)Document3 pagesNubirox 302 in High Gloss Solvent Based Alkyd DTM (Formula AC 19630F)MONEMNo ratings yet

- Pivot Boss SummaryDocument36 pagesPivot Boss SummaryVarun Vasurendran100% (2)

- 2016 AccountingDocument16 pages2016 AccountingAlison JcNo ratings yet

- Sakambari BillDocument3 pagesSakambari BillMd Zeeshan AhmedNo ratings yet

- Barton Co. Balance Sheet For Branch December 31, 20x4Document17 pagesBarton Co. Balance Sheet For Branch December 31, 20x4Love FreddyNo ratings yet

- In-Class 2 SolutionsDocument3 pagesIn-Class 2 SolutionssassNo ratings yet

- Global Interstate SystemDocument17 pagesGlobal Interstate SystemPearl TanNo ratings yet

- Sample Questions On CVP AnalysisDocument19 pagesSample Questions On CVP AnalysisThomas Ansah100% (1)

- Reading 8 Topics in Demand and Supply Analysis - AnswersDocument25 pagesReading 8 Topics in Demand and Supply Analysis - AnswersgddNo ratings yet

- JAIBB Comparative Syllabus PDFDocument8 pagesJAIBB Comparative Syllabus PDFshahaneauez alamNo ratings yet

- M&a Modeling Course - Wall Street OasisDocument133 pagesM&a Modeling Course - Wall Street OasisZeehenul Ishfaq100% (2)

- Brother LK3 Instruction ManualDocument16 pagesBrother LK3 Instruction ManualJeremy IdkNo ratings yet

- Btap - Liên T or Gi I T - UpdateDocument7 pagesBtap - Liên T or Gi I T - UpdateToàn NguyễnNo ratings yet

- BUS 5117 Case Study of Ventures in Salt: Compass Minerals International Professor Karl Thompson University of The PeopleDocument5 pagesBUS 5117 Case Study of Ventures in Salt: Compass Minerals International Professor Karl Thompson University of The PeopleMahendra Raj PandayNo ratings yet

- Theory of RicardoDocument15 pagesTheory of RicardoVidhiNo ratings yet

- LLB IV Sem GST Unit I Levy and Collection Tax by DR Nisha SharmaDocument7 pagesLLB IV Sem GST Unit I Levy and Collection Tax by DR Nisha Sharmad. CNo ratings yet

- (Original For Recipient) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Original For Recipient) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountAshishSethiaNo ratings yet

- Saln Form Orimaco 2021Document2 pagesSaln Form Orimaco 2021Metch Abella TitoyNo ratings yet

- Nympha Roxas Strat ComDocument18 pagesNympha Roxas Strat ComManuel LatayanNo ratings yet

- Utility Bill Template 09Document2 pagesUtility Bill Template 09衡治洲No ratings yet

- Chapter 4Document23 pagesChapter 4GHGFYGJNo ratings yet

- Compound and Collective ObligationsDocument3 pagesCompound and Collective ObligationsJoseph AndrewsNo ratings yet

- Supply Chain Risk ManagementDocument61 pagesSupply Chain Risk ManagementTabz Hussain100% (2)

- L202 EP111 General EconomyDocument2 pagesL202 EP111 General Economylnn97No ratings yet

- Theories of ProfitDocument34 pagesTheories of ProfitNithin Kumar VNo ratings yet

- Approaches in Calculating GDPDocument3 pagesApproaches in Calculating GDPAsahi My loveNo ratings yet