Professional Documents

Culture Documents

QUiz-1A-answers

QUiz-1A-answers

Uploaded by

Hannah AgravanteCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QUiz-1A-answers

QUiz-1A-answers

Uploaded by

Hannah AgravanteCopyright:

Available Formats

QUIZ # 1 ANSWERS

1A

Theories

1. D

2. A

3. D

4. B

5. A

6. A

7. B

8. D

9. B

10. B

Computational

11. C (35,000 + 75,000 + 350,000) = 460,000

Cash on hand 400,000

Cash in Bank – current account (1.2M + 30K stale check) 1,230,000

Cash in Bank – peso savings deposit (5M – 800K bond) 4,200,000

Cash in Bank – dollar (unrestricted) ($100K x ₱45) 4,500,000

Cash in money-market account 500,000

3-month unrestricted time deposit ($20K x ₱45) 900,000

Treasury note, purchased 12/1/20x1, maturing 2/28/20x2 400,000

Redeemable P/S, purchased 12/1/20x1, due on 3/1/20x2 740,000

Cash and cash equivalents - adjusted balance 12,870,000

12. D

13. B

14. B

Solution:

July 31, Office supplies expense 4,200

20x1

Transportation expense 10,500

Repairs and maintenance 3,000

Miscellaneous expense 9,000

Receivable from custodian 1,800

Petty cash fund 28,500

15. E

Solution:

Coins and currencies 2,550

Check drawn to the order of the PCF custodian 3,000

Petty cash vouchers:

Gasoline for delivery equipment 3,000

Medical supplies for employees 2,040 5,040

IOU’s:

Advances to employees 2,220

Total as accounted (cash count) 12,810

Total accountability (ledger balance) (15,000)

Shortage ( 2,190)

The entry to record the replenishment is as follows:

Dec. 31, Transportation expenses 3,000

20x1

Medical supplies 2,040

Advances to employees 2,220

Cash short or over 2,190

Cash in bank 9,450

16. C

Solution:

Checking account #101 175,000

Checking account #201 (10,000)

Money market account 25,000

90-day certificate of deposit, due 2/28/04 50,000

Cash and cash equivalents 240,000

17. A – (740 + 240 + 230 + 170 + 8 + 8 = 1,396 per count – 1,400 accountability) = 4 shortage

18. A

Solution:

Balance per bank statement, 12/31/x1 38,075

Deposit in transit, 12/31/x1 5,200

Outstanding checks, 12/31/x1 (6,750)

Amount erroneously credited by bank to ABC's account, 12/28/x1 (400)

Adjusted balance 36,125

19. D

Solution:

18,050 + 3,250 – 2,750 = 18,550

20. -

21. -

22. -

23. C (See solutions below)

24. A (See solutions below)

25. A (See solutions below)

Solutions:

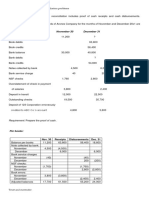

Per books

30-Jun Receipts Disbursements 31-Jul

Balance per books 5,600 30,700 27,000 9,300

Note collected by bank:

June 2,250 (2,250)

July 3,000 3,000

Bank service charges

June (20) (20)

July 100 (100)

NSF checks: (880) (880)

June 1,400 (1,400)

July

Book errors:

June 1,900 (1,900)

July 1,200 1,200

Adjusted balances 8,850 30,750 27,600 12,000

Per bank

30-Jun Receipts Disbursements 31-Jul

Balance per bank 10,200 27,900 21,300 16,800

Deposits in transit

June 6,000 (6,000)

July 11,250 11,250

Outstanding checks

June (9,750) (9,750)

July 17,850 (17,850)

Bank errors:

June 2,400 (2,400)

July (1,800) 1,800

Adjusted balances 8,850 30,750 27,600 12,000

26.

You might also like

- Project-Charter (Mohammad Adnan)Document4 pagesProject-Charter (Mohammad Adnan)Mohammad Adnan80% (5)

- CostAccounting 2016 VanderbeckDocument396 pagesCostAccounting 2016 VanderbeckAngel Kitty Labor88% (32)

- Bank Reconciliations PROBLEMS With Solutions PDFDocument5 pagesBank Reconciliations PROBLEMS With Solutions PDFlei vera80% (5)

- RESA - AP-702S (MCQs Solutions To Problems)Document12 pagesRESA - AP-702S (MCQs Solutions To Problems)Mellani100% (1)

- Proof of Cash ProblemDocument3 pagesProof of Cash ProblemKathleen Frondozo71% (7)

- Proof of Cash and Bank Recon StatementDocument7 pagesProof of Cash and Bank Recon StatementJean BritoNo ratings yet

- Chapter 4 - Teacher's Manual - Ifa Part 1aDocument16 pagesChapter 4 - Teacher's Manual - Ifa Part 1aCharmae Agan CaroroNo ratings yet

- Exercises Finalaccounts ExDocument2 pagesExercises Finalaccounts ExSounak NathNo ratings yet

- Bank Reconciliation: QuizDocument4 pagesBank Reconciliation: QuizBrgy Baloling50% (2)

- Bank Reconciliation Dollar CompDocument5 pagesBank Reconciliation Dollar CompCJ alandy100% (2)

- Measuring Team ProductivityDocument27 pagesMeasuring Team ProductivityAdhitya Setyo Pamungkas100% (1)

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia PartDocument15 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia PartMike Joseph E. Moran100% (3)

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1aDocument16 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1aMiguel AmihanNo ratings yet

- Cash, BNK Recon and AR Answer KeyDocument6 pagesCash, BNK Recon and AR Answer KeyNanya BisnestNo ratings yet

- Samplepractice Exam 15 October 2020, Questions and Answers - CHAPTER 13 Chapter 15 Bank - StudocuDocument1 pageSamplepractice Exam 15 October 2020, Questions and Answers - CHAPTER 13 Chapter 15 Bank - Studocumarcusmangawang3No ratings yet

- Requirement No. 1: PROBLEM NO. 1 - Peso CorporationDocument13 pagesRequirement No. 1: PROBLEM NO. 1 - Peso CorporationDreiu EsmeleNo ratings yet

- Bank Reconciliation: Problem 1: True or FalseDocument5 pagesBank Reconciliation: Problem 1: True or FalseJannelle SalacNo ratings yet

- Pretest - Cash and ReceivablesDocument5 pagesPretest - Cash and ReceivablesMycah AliahNo ratings yet

- AP 5907 CashDocument8 pagesAP 5907 CashClariceLacanlaleDarasinNo ratings yet

- AK Audit of Cash ACP103Document3 pagesAK Audit of Cash ACP103km dummieNo ratings yet

- Quiz Part 2 (Bank Reconciliation)Document2 pagesQuiz Part 2 (Bank Reconciliation)YameteKudasaiNo ratings yet

- ACCT103 Supplementary Notes Cash and Cash EquivalentsDocument1 pageACCT103 Supplementary Notes Cash and Cash EquivalentsChrislyn Janna BeljeraNo ratings yet

- Business Combi CH 6 de JesusDocument9 pagesBusiness Combi CH 6 de JesusMerel Rose FloresNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument6 pagesCpa Review School of The Philippines Mani LaSophia PerezNo ratings yet

- Pangakun UAS 2018 - JawabanDocument16 pagesPangakun UAS 2018 - Jawabansepuluh 10No ratings yet

- Proof of Cash123Document5 pagesProof of Cash123rufamaegarcia07No ratings yet

- Computations AE 04 2Document17 pagesComputations AE 04 2Julienne UntalascoNo ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- Intermediate Accounting 1 Second Grading Examination Key AnswersDocument12 pagesIntermediate Accounting 1 Second Grading Examination Key AnswersAbegail Joy De GuzmanNo ratings yet

- Exercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostDocument5 pagesExercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostKailah CalinogNo ratings yet

- (03B) Cash SPECIAL Quiz ANSWER KEYDocument6 pages(03B) Cash SPECIAL Quiz ANSWER KEYGabriel Adrian ObungenNo ratings yet

- Exam PapersDocument8 pagesExam PapersTASH TASHNANo ratings yet

- Samplepractice Exam 15 October 2020 Questions and AnswersDocument6 pagesSamplepractice Exam 15 October 2020 Questions and AnswersMartha Nicole MaristelaNo ratings yet

- Suggested Answers - Audit of Cash AR Liab HandoutsDocument10 pagesSuggested Answers - Audit of Cash AR Liab HandoutsBanna SplitNo ratings yet

- Espanola Far 201 QuizDocument7 pagesEspanola Far 201 QuizCINDY MAE SARAH ESPANOLANo ratings yet

- IA Activity 1Document13 pagesIA Activity 1Sunghoon SsiNo ratings yet

- Solution - Problems 1-8 Cash and Cash EquivalentsDocument3 pagesSolution - Problems 1-8 Cash and Cash Equivalentsanon_965241988No ratings yet

- Loa - Application 1 Quiz 1Document5 pagesLoa - Application 1 Quiz 1Genevieve VargasNo ratings yet

- FInancial Accounting and Reporting1C6Document19 pagesFInancial Accounting and Reporting1C6Yen YenNo ratings yet

- FAR Problem Quiz 1 SolDocument3 pagesFAR Problem Quiz 1 SolEdnalyn CruzNo ratings yet

- Acc 135 Jan Past ExamDocument4 pagesAcc 135 Jan Past ExamNatasha MugoniNo ratings yet

- UntitledDocument5 pagesUntitledShevina Maghari shsnohsNo ratings yet

- Adadasd 2321Document4 pagesAdadasd 2321Prime JavateNo ratings yet

- Assignment 1Document12 pagesAssignment 1Ira YbanezNo ratings yet

- IA Chapter-1-3Document7 pagesIA Chapter-1-3Christine Joyce EnriquezNo ratings yet

- Cash Practical Auditing Solution ManualDocument24 pagesCash Practical Auditing Solution ManualCharlyneNo ratings yet

- On January 1Document6 pagesOn January 1Warren Nahial ValerioNo ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingYami HeatherNo ratings yet

- Bank Reconciliation PDFDocument2 pagesBank Reconciliation PDFFazal Rehman MandokhailNo ratings yet

- Chapter 7 Practice SolutionsDocument5 pagesChapter 7 Practice Solutionslemanhan240103No ratings yet

- MASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Document35 pagesMASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Mark Gelo WinchesterNo ratings yet

- Bank Recon and POC ProblemsDocument3 pagesBank Recon and POC ProblemsJanine IgdalinoNo ratings yet

- Bank Recon and PCFDocument2 pagesBank Recon and PCFAiza Ordoño0% (1)

- Solution Manual Ch. 1 19Document55 pagesSolution Manual Ch. 1 19Aira Mae TaborNo ratings yet

- Bank Recon Sample ProblemsDocument4 pagesBank Recon Sample ProblemsKathleen100% (1)

- FIRST PB FAR Solutions PDFDocument6 pagesFIRST PB FAR Solutions PDFStephanie Joy NogollosNo ratings yet

- PRELIM Quiz 1 Cash, CE, PCF, Bank ReconDocument8 pagesPRELIM Quiz 1 Cash, CE, PCF, Bank ReconApril Faye de la CruzNo ratings yet

- Intacc Problems Empleo and RoblesDocument44 pagesIntacc Problems Empleo and RoblesChristen HerceNo ratings yet

- Cash Basis To Accrual AccountingDocument8 pagesCash Basis To Accrual Accountingcortezzz100% (2)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Esthetic Group Project Presentation 20231121 083949 0000Document12 pagesEsthetic Group Project Presentation 20231121 083949 0000Hannah AgravanteNo ratings yet

- Act 1 MilDocument2 pagesAct 1 MilHannah AgravanteNo ratings yet

- Subsidy and Tax Policy - 20231121 - 065330 - 0000Document9 pagesSubsidy and Tax Policy - 20231121 - 065330 - 0000Hannah AgravanteNo ratings yet

- PhilosophyDocument2 pagesPhilosophyHannah AgravanteNo ratings yet

- Philo Act FinalDocument1 pagePhilo Act FinalHannah AgravanteNo ratings yet

- Reaction PaperDocument1 pageReaction PaperHannah AgravanteNo ratings yet

- Understanding The SelfDocument1 pageUnderstanding The SelfHannah AgravanteNo ratings yet

- Anesthetic Consideration in Thyroid SurgeryDocument36 pagesAnesthetic Consideration in Thyroid Surgerymaulina13No ratings yet

- Murphy'S Laws: Anything That Can Go Wrong Will Go WrongDocument2 pagesMurphy'S Laws: Anything That Can Go Wrong Will Go WrongAshwin ReddyNo ratings yet

- Ex5500 PDFDocument7 pagesEx5500 PDFRoberto Chang PalmaNo ratings yet

- RailTel Annual Report For Web-CompressedDocument228 pagesRailTel Annual Report For Web-CompressedAmit SahooNo ratings yet

- Channel DecisionsDocument30 pagesChannel Decisionsuzmatabassum1996No ratings yet

- ADM Marketing Module 4 Lesson 4 Promotional ToolsDocument20 pagesADM Marketing Module 4 Lesson 4 Promotional ToolsMariel Santos75% (8)

- Experiencing Postsocialist CapitalismDocument251 pagesExperiencing Postsocialist CapitalismjelisNo ratings yet

- Entry Level Linguist ResumeDocument4 pagesEntry Level Linguist Resumejbzhnbyhf100% (1)

- Christmas Vigil MassDocument106 pagesChristmas Vigil MassMary JosephNo ratings yet

- Suntrust VeronaDocument12 pagesSuntrust Veronalyanca majanNo ratings yet

- Chapter 6Document18 pagesChapter 6Lydelle Mae CabaltejaNo ratings yet

- UNHCR Hygiene Promotion GuidelinesDocument112 pagesUNHCR Hygiene Promotion GuidelinesBrandie ShackelfordNo ratings yet

- FracShield Composite Frac PlugDocument3 pagesFracShield Composite Frac PlugJOGENDRA SINGHNo ratings yet

- List of TradeMark Forms & Therein PDFDocument17 pagesList of TradeMark Forms & Therein PDFShreeneetRathiNo ratings yet

- Soc TB 25 May 2017Document37 pagesSoc TB 25 May 2017Ipie BsaNo ratings yet

- Free CV Template 31Document1 pageFree CV Template 31Aaron WilsonNo ratings yet

- SAP Idoc Steps by Step ConfigDocument7 pagesSAP Idoc Steps by Step Configgirish85No ratings yet

- DX-790-960-65-16.5i-M Model: A79451600v02: Antenna SpecificationsDocument2 pagesDX-790-960-65-16.5i-M Model: A79451600v02: Antenna SpecificationsakiselNo ratings yet

- Pentaho CE Vs EE ComparisonDocument4 pagesPentaho CE Vs EE Comparisonbangipool100% (1)

- Machine Tool TestingDocument4 pagesMachine Tool Testingnm2007k100% (1)

- The-Impact-On-Load-balancing-In-Cloud-Computing 2020Document5 pagesThe-Impact-On-Load-balancing-In-Cloud-Computing 2020Nikola JovanovicNo ratings yet

- Basic First Aid Handbook v2Document47 pagesBasic First Aid Handbook v2maeveley9dayne9chuaNo ratings yet

- Reducing Major Defects in Radiators Manufacturing: Kumar P., Sonawane B.S., Sontakke R.R., Surves.B., Wasnik A.RDocument5 pagesReducing Major Defects in Radiators Manufacturing: Kumar P., Sonawane B.S., Sontakke R.R., Surves.B., Wasnik A.RKrushnaNo ratings yet

- Final PDF - To Be Hard BindDocument59 pagesFinal PDF - To Be Hard BindShobhit GuptaNo ratings yet

- MTCNA Lab Guide INTRA 1st Edition - Id.en PDFDocument87 pagesMTCNA Lab Guide INTRA 1st Edition - Id.en PDFreyandyNo ratings yet

- Mapeh GR9 First Quarter ReviewerDocument8 pagesMapeh GR9 First Quarter ReviewerRalph Emerson SantillanNo ratings yet

- AKAR - Gearless Permanent Magnet Synchronous MotorDocument22 pagesAKAR - Gearless Permanent Magnet Synchronous MotordepolisdooNo ratings yet