Professional Documents

Culture Documents

ITR 23-24 (MOTHER)

ITR 23-24 (MOTHER)

Uploaded by

bdsconsultant1313Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ITR 23-24 (MOTHER)

ITR 23-24 (MOTHER)

Uploaded by

bdsconsultant1313Copyright:

Available Formats

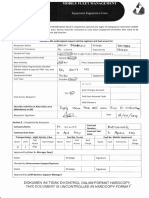

Acknowledgement Number: 695OO966O2 6O723 Date of filing : 26-Jul-2O23*

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessm ent

[Where the data of the Return of lncome in Form ITR-1(SAHAJ), ITR-2, ITR-3, ITR-4(SUGAIV), ITR-5, ITR-6, ITR-7 Year

filed and verifiedl

(Please see Rule 12 of the lncome-tax Rules, 1962) 2023-24

**"*T

t

PAN cHGPR5224J

t:

:

: Name i SEEMA RANI

-i-

tt

I AddTess i PROP. RADHE RADHE AGENCY, AHATTA NARAIN SINGH , BARNALA, 26.PunJAb, 91. INDIA, 148101

, Stutus , lndividual Form Number ITR-4

..

Filed u/s 139(1)-On or before due date e-Filing Acknowledgement Number 695009660260723

Current Year business loss, if any 0

Total lncome 4,51,870

*lg

P

0, Book Profit under MAT, where applicable

o

x

G

F Adjusted Total lncome under AMT, where app cable l4

l! i(

o Net tax payable

i

E I

o t

u lnterest and Fee Payable o

s r

3

lt Total tax, interest and Fee payable 1

IE

x I

f-'.

G

F

Taxes Paid i8

:::l rii

(+) Tax Payable /(-) Refuadable (7-8) ir 9

,i:,i.

i

I

i,r

.10 0:

l

X Additional Tax payable u/s 115TD 11 0,

tt .

f; lnterest payable u/s 115TE 72 0

13 0

L4

(+) Tax Payable /(-) Refundable (13-14) 15

i

lncome Tax Return submitted electronically on 26)ul2o23 O0:04:58 from lP address 151 .39.1O.254 and

verified by SEEMA RANI having PAN cHGPRs224j on 26-)ul-2023 usrng paper

ITR-Verification Form /Electronic Verification Code 7GY85T5G5I generated through Aadhaar OTP nrocie

System Generated

Barcode/QR Code I I I I H|fr [+r HFi [* iil+ f#

CHGPR5224J04695009660260723fdc9ca67 4c3a7 dlaae932O52 1 1cOc465 13 6d3 b4B

uutEUt Sttxu inl3ftL&tluvstLuu;:-1El'e| 3# ^ ^ {!.t..-Jriu

*lf the return is verified after 30 days of transmission oI re[urn dala elect.onically, oi verificaLio,r w ll be 'ors oe,e.] a5 u Jre ol

tl- er- daLe

filing the return (Notification No.05 of 2022 dated 29-07-2022 issued by the DGIT (Systems), CBDT)."

AJAY KUMAR Court Road, Under Flyover,

B.A., LL.B., PGDCA Near HUT B Clothing

TAXATION ADVISOR Barnala - 148101 (Punjab)

AK ACCOUNTS & TAX CONSULTANCY Email akacandtaxconsultancy@smailcom

M. 99882-95011

Name of Assessee SEEMA RANI

Father's Name SUBHASH CHANDER

Address PROP. RADHE RADHE AGENCY,

AHATTA NARAIN SINGH,

BARNALA, PU N JAB, 1 481 01

Status lndividual Assessment Year 2023-2024

Ward ITO WARD-2, BARNALA Year Ended 31 3 2023

PAN CHGPR5224J Date of Birth 1211211983

Residential Status Resident Gender Female

Particular of Business Retail Trading

Nature of Business OTHER SERVICES-Other services n.e.c.(2 1 008)

A.O. Code NWR-W-049-20

Filing Status Original

Return Filed On 2610712023 Acknowledgement No.: 695009660260723

Last Year Return Filed On 27112t2022 Acknowledgement No.: 86978209027 1222

Last Year Return Filed u/s Normal

Aadhaar No: 280620317380 Mobile No Linked with

Aadhaar.

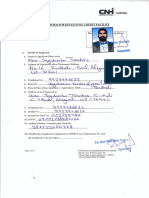

Computation of Total lncome [As per Normal Provisionsl

lncome from Business or Profession (Chapter lV D) 451873

Income u/s 44AD 451873

lncome from Other Sources (Ghapter lV F) 3378

lnterest From Saving Bank fuc(as per Annexure) JJ/O

Gross Total lncome 455251

Less: Deductions (Ghapter Vl-A)

u/s 80TTA (lnterest From Saving Bank Account.) 3378

3378

Total lncome 451873

Round off u/s 288 A 451 870

Adjusted total income (ATl) is not more than Rs. 20 lakh hence AMT not applicable.

NAME OF ASSESSEE : SEEMA RANI A.Y.2023-2024 PAN : CHGPR5224J

Tax Due (Exemption Limit Rs. 250000) 1 0094

Rebate u/s 87A 1 0094

0

Tax Payable 0

Tax calculation on Normal income of Rs 4518701-

Exemption Limit :250000

Tax on (451870-250000) =201870 @5% = 10094

Total Tax = 10094

lncome Declared u/s 44 AD

G ross Receipts/Tu rn over 1489140.00

Book Profit 451873 00 30.34 %

Deemed Profit 119131 20 800%

Net Profit Declared 451873.00 3034%

Bank Account Detail

S. No. Bank Address Account No MIGR NO IFSC Code Tvpe

1 Canara Bank 39761 01 0021 08 CNR80003976 Saving(Primary)

2 Punjab National Bank 004400010422132 PUN80004400 Saving

1

Details of Interest From Bank

S.NO. PARTICULARS AMOUNT

CANARA BANK 3378

TOTAL 3378

I solemnly declare that to the best of my knowledge and belief the information given in the return and

schedules to the return is correct and complete and all the bank accounts being maintained by me have

been detailed above and that the amount of total income and other parliculars shown therein are truly

stated and are in accordance with the provisions of the Income Tax Act, 1961, in respect of income

chargeable to income tax for the previous year relevant to the assessment year mentioned in the return.

It is further certified that I have not maintained any foreign bank account and also I do not have any

foreign income and assets and income other than specified in the ITR Form and computation of income.

I have duly read and understand the contents and particulars of the computation of the income for the

period under consideration.

Signature

(SEEMA RANt)

You might also like

- APICS Dictionary 16thDocument216 pagesAPICS Dictionary 16thnbq6x7w2kqNo ratings yet

- Sole ProprietorDocument3 pagesSole ProprietorUnais AhmedNo ratings yet

- Practice Problems For The Final Exam of ISOM 5700: 1. Short Answer QuestionsDocument5 pagesPractice Problems For The Final Exam of ISOM 5700: 1. Short Answer QuestionsLongyin WangNo ratings yet

- Step by Step Configuration of SAP S4HANA-FI-Part 6Document17 pagesStep by Step Configuration of SAP S4HANA-FI-Part 6Billy BmnNo ratings yet

- Mers Nationsbank Security Agreement - Assignment-Tm-1773-0949Document20 pagesMers Nationsbank Security Agreement - Assignment-Tm-1773-0949Sue Rhoades100% (2)

- End of Year Certificate: Mrs Lyn Lakers School Acres WK508S, 57ADocument1 pageEnd of Year Certificate: Mrs Lyn Lakers School Acres WK508S, 57AMrSplanNo ratings yet

- Itr2022 23Document9 pagesItr2022 23Pavan Kumar SharmaNo ratings yet

- Itr 22-23Document31 pagesItr 22-23NITINNo ratings yet

- Itr&financials F.y.2022 23 1Document9 pagesItr&financials F.y.2022 23 1cma bushra sayyidNo ratings yet

- TIN and Tax Payment Cert RTL - AY 2022-23Document2 pagesTIN and Tax Payment Cert RTL - AY 2022-23Shobbhoy ShachiNo ratings yet

- ITR 22-23 (FATHER)Document3 pagesITR 22-23 (FATHER)bdsconsultant1313No ratings yet

- (View Tax Details) (View Permit Details)Document15 pages(View Tax Details) (View Permit Details)rpburhanpurNo ratings yet

- RMC 2020 No. 3 Availability of The Revised BIR Form 1702Q PDFDocument2 pagesRMC 2020 No. 3 Availability of The Revised BIR Form 1702Q PDFBien Bowie A. CortezNo ratings yet

- Assign 4 6Document11 pagesAssign 4 6Wonwoo JeonNo ratings yet

- 1-mergedDocument4 pages1-mergedshrisaiarcadeNo ratings yet

- F rm.,990-T: Exempt Organization Business Income Tax Return 'Document7 pagesF rm.,990-T: Exempt Organization Business Income Tax Return 'Matias SmithNo ratings yet

- Gouri Shankar Chittlangia CertifiedDocument4 pagesGouri Shankar Chittlangia CertifiedSabuj SarkarNo ratings yet

- IMG_0012Document39 pagesIMG_0012AMRUTHA CITY CYBERNo ratings yet

- CAPE Accounting 2010 U1 P2Document8 pagesCAPE Accounting 2010 U1 P2leah hostenNo ratings yet

- Ilovepdf MergedDocument3 pagesIlovepdf MergedbhitauracscNo ratings yet

- Sample CKYCDocument2 pagesSample CKYCAmit GeraNo ratings yet

- ITR 2019-20 AsconDocument4 pagesITR 2019-20 Asconpateldhrumil205No ratings yet

- Bilant Contabil 2018Document29 pagesBilant Contabil 2018cosmin1991No ratings yet

- Bharat Kosh ProcedureDocument10 pagesBharat Kosh Procedurem.......No ratings yet

- BILLDocument1 pageBILLgunadevanNo ratings yet

- Undertaking For Pending Payments - MergedDocument3 pagesUndertaking For Pending Payments - Mergedvishvishal3019No ratings yet

- Img 20191218 0001Document1 pageImg 20191218 0001rakeshthakur.6688No ratings yet

- Of in The Act: Modification Nos.2551M12551Q Implementation (RA) For CollectionDocument2 pagesOf in The Act: Modification Nos.2551M12551Q Implementation (RA) For CollectionJhenny Ann P. SalemNo ratings yet

- Bistro Americano InvoicesDocument9 pagesBistro Americano Invoicesbakeworld inc salesNo ratings yet

- Uprii ,: Memorandum Circular Clarifies CertainDocument9 pagesUprii ,: Memorandum Circular Clarifies CertainBert AslorNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Proforma InvoiceDocument1 pageProforma Invoiceavadhut gadeNo ratings yet

- BMS34A00204Document3 pagesBMS34A00204Rohit Parmar (Computer Operator, Bangalore)No ratings yet

- Img 20211025 0004Document1 pageImg 20211025 0004jmNo ratings yet

- Equipment Registration FormDocument2 pagesEquipment Registration FormPT. Catur Cahaya Niaga MitraNo ratings yet

- Assam Treasury Rules, 2017, Fileno. FEB.342.2015.Pt - .5, Dtd.08.11.2017Document2 pagesAssam Treasury Rules, 2017, Fileno. FEB.342.2015.Pt - .5, Dtd.08.11.2017Additional Director WPT & BC Deptt BTC Kokrajhar (CHD WPT & BC Deptt.)No ratings yet

- RFP Design Review and Const Supervision New Islamabad Airport RoadsDocument98 pagesRFP Design Review and Const Supervision New Islamabad Airport Roadsmuhammad iqbalNo ratings yet

- 1103 Employment Income Tax Dec UpdatedDocument1 page1103 Employment Income Tax Dec UpdatedMaddahayota College100% (1)

- RMC No. 62-2018 Estate TaxDocument2 pagesRMC No. 62-2018 Estate TaxJade MarkNo ratings yet

- Insuance Rajendra LamsalDocument2 pagesInsuance Rajendra LamsalRajendra LamsalNo ratings yet

- RMC No. 114-2020Document10 pagesRMC No. 114-2020Jayvee OlayresNo ratings yet

- Annex D Inventory List of Unused Receipt RDO 54BDocument1 pageAnnex D Inventory List of Unused Receipt RDO 54BEmy Margrette FlordelizaNo ratings yet

- BMS34A00240Document3 pagesBMS34A00240Rohit Parmar (Computer Operator, Bangalore)No ratings yet

- Chapter 9 PDFDocument24 pagesChapter 9 PDFJolina AynganNo ratings yet

- Tejas Arts 22-23Document30 pagesTejas Arts 22-23pradee5281No ratings yet

- Application FormDocument9 pagesApplication FormJagdamba TractorsNo ratings yet

- BILL of Entry (O&A) PDFDocument3 pagesBILL of Entry (O&A) PDFHiJackNo ratings yet

- 15 Years TimeBound-1991 291091Document6 pages15 Years TimeBound-1991 291091chennigaraju B HNo ratings yet

- Circular Flow of Income PPT (Auto Saved)Document16 pagesCircular Flow of Income PPT (Auto Saved)alexander.charmaineNo ratings yet

- Hparstk 10303Document1 pageHparstk 10303jmNo ratings yet

- Apriavronijs: Date: November 9, 2020Document2 pagesApriavronijs: Date: November 9, 2020Martine Amos AntonioNo ratings yet

- Bharat Service OrderDocument1 pageBharat Service OrderRatnadeep pandeyNo ratings yet

- 1976 Capital Funds For Bicycle PlanDocument1 page1976 Capital Funds For Bicycle PlanRandall MyersNo ratings yet

- Valentino ChocolatesDocument2 pagesValentino ChocolatesMarine HoutmannNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument8 pagesPayment Form: Kawanihan NG Rentas InternasChieMae Benson QuintoNo ratings yet

- Circular Flow of IncomeDocument15 pagesCircular Flow of IncomeJanhavi NangrePatilNo ratings yet

- 7573050E240407PYG1MN5Document1 page7573050E240407PYG1MN5pritamsahu1091No ratings yet

- Hatman Fom 1 - MergedDocument4 pagesHatman Fom 1 - MergedOlu BanjoNo ratings yet

- 1 - Kagiso Mmusi Uif - 20230711 - 0001Document8 pages1 - Kagiso Mmusi Uif - 20230711 - 0001Kagiso Kagi MmusiNo ratings yet

- 2024.05.14 - Cash Dividend DeclarationDocument2 pages2024.05.14 - Cash Dividend DeclarationAngelo MelgazoNo ratings yet

- Boiitungs: (C) Abit RiesDocument6 pagesBoiitungs: (C) Abit RiesAnu SinghNo ratings yet

- Employer'S Monthly Statutory Remittance Payroll DeductionsDocument2 pagesEmployer'S Monthly Statutory Remittance Payroll DeductionsStephen PommellsNo ratings yet

- ilovepdf_merged (24)_compressed_compressed (1) (1)Document35 pagesilovepdf_merged (24)_compressed_compressed (1) (1)bdsconsultant1313No ratings yet

- VALUATION 1Document2 pagesVALUATION 1bdsconsultant1313No ratings yet

- Manmeet Singh_Okanagan CollegeDocument4 pagesManmeet Singh_Okanagan Collegebdsconsultant1313No ratings yet

- HARPREET S 02 MARDocument1 pageHARPREET S 02 MARbdsconsultant1313No ratings yet

- Letter_of_Acceptance_-_SDS_-_003OG000006kocfDocument2 pagesLetter_of_Acceptance_-_SDS_-_003OG000006kocfbdsconsultant1313No ratings yet

- 1677749169sandeepkaurbcom 13457610100Document8 pages1677749169sandeepkaurbcom 13457610100bdsconsultant1313No ratings yet

- Cresent Mock-2 B.lawDocument5 pagesCresent Mock-2 B.lawmuzamil azizNo ratings yet

- Advertised Jobs - May 2024Document5 pagesAdvertised Jobs - May 2024mamernyokNo ratings yet

- Customer Satisfaction Towards JioDocument29 pagesCustomer Satisfaction Towards JioAshwin RNo ratings yet

- Review of Related Literature Financial ManagementDocument19 pagesReview of Related Literature Financial ManagementFav TangonanNo ratings yet

- 1.) Picture of Maslow's Hierarchy of NeedsDocument3 pages1.) Picture of Maslow's Hierarchy of NeedsAdel JohnNo ratings yet

- How Travel Bloggers Make Money - Secrets That You Need To KnowDocument6 pagesHow Travel Bloggers Make Money - Secrets That You Need To Knowhusneara begumNo ratings yet

- Evolution of Insurance Evolution of Insurance Evolution of Insurance Evolution of InsuranceDocument14 pagesEvolution of Insurance Evolution of Insurance Evolution of Insurance Evolution of InsuranceKazi AsaduzzmanNo ratings yet

- Business Plan Template PreferredDocument25 pagesBusiness Plan Template PreferredYusuf SotomiwaNo ratings yet

- Minutes of Meeting On Supply, Installation, Testing, CommissioningDocument24 pagesMinutes of Meeting On Supply, Installation, Testing, CommissioningKashanth VNo ratings yet

- Ternakmart: Business Model CanvasDocument12 pagesTernakmart: Business Model CanvasAry PurwantiniNo ratings yet

- Willowood Bonanza: Brand GRDocument1 pageWillowood Bonanza: Brand GRAnudeep KumarNo ratings yet

- Rup Ratan Pine 01552438118: Economics For Managers Course No: 401Document32 pagesRup Ratan Pine 01552438118: Economics For Managers Course No: 401rifath rafiqNo ratings yet

- Chapter 7 Advertising MediaDocument5 pagesChapter 7 Advertising MediaJammel AcostaNo ratings yet

- Content SMM Assessment Task 2 - Project Template 2018 (T4-20)Document7 pagesContent SMM Assessment Task 2 - Project Template 2018 (T4-20)elenay0418No ratings yet

- Business Angel Investment in The China Market.Document17 pagesBusiness Angel Investment in The China Market.grandiosetreasu18No ratings yet

- 1416191299950-01 1709962772 Mjoyo4oy6pDocument1 page1416191299950-01 1709962772 Mjoyo4oy6pchoudharyibrazNo ratings yet

- sfc2021 PRG 2021tc16ipcb006 12Document79 pagessfc2021 PRG 2021tc16ipcb006 12Klaudija LutovskaNo ratings yet

- Alemu HawandoDocument82 pagesAlemu HawandoJihad AwolNo ratings yet

- David Josephson-Means of Payment in International Trade TransactionsDocument13 pagesDavid Josephson-Means of Payment in International Trade TransactionszzdzjhzjdNo ratings yet

- OM - CH 1 ST - Mary's UDocument70 pagesOM - CH 1 ST - Mary's UDina OmerNo ratings yet

- World Wildlife Fund For Nature: AbbreviationDocument12 pagesWorld Wildlife Fund For Nature: AbbreviationanjanaNo ratings yet

- Shiprocket Manifest: To Be Filled by Delhivery Surface Logistics ExecutiveDocument8 pagesShiprocket Manifest: To Be Filled by Delhivery Surface Logistics ExecutiveBodyPower AcademyNo ratings yet

- Now You Can Pay Your BSNL Mobile Bills at Any BSNL Retailer's OutletDocument1 pageNow You Can Pay Your BSNL Mobile Bills at Any BSNL Retailer's OutletDar JahangeerNo ratings yet

- Advanced AccountingDocument33 pagesAdvanced AccountingvijaykumartaxNo ratings yet

- Target MarketDocument12 pagesTarget MarketLOOPY GAMINGNo ratings yet

- Lecturenote - 972275618FM II Final EditedDocument101 pagesLecturenote - 972275618FM II Final EditedSujan Bhattarai100% (2)