Professional Documents

Culture Documents

FM

FM

Uploaded by

lalitabipinmahida0 ratings0% found this document useful (0 votes)

3 views14 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views14 pagesFM

FM

Uploaded by

lalitabipinmahidaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 14

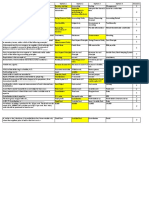

Sr.

No, Question Option 1 Option 2 Option 3 Option 4 Answers

Identify Which of the Machine breakdown Advertising costs

following costs of costs

management is likely to have Buildings insurance

1 the least control? Wage costs costs 4

Choose from of the following Factory rates Production manager's

is most likely to be an salary

allocated production overhead Power used on

cost to the finishing cost Salary of the finishing finishing cost center

2 centre? cost center supervisor machines 2

Select from of the following is Indirect departmental Direct product cost Direct departmental Service department

a valid classification of the cost cost correct cost

salary paid to the foreman in

charge of the packing

3 department? 3

4 Identify what Packing cost is production cost selling cost administration cost distribution cost 4

Select ,the allotment of whole

item of cost to cost centre or

5 cost units is known as : cost allocation cost apportionment cost absorption cost disbursement 1

Illustrate from the following

6 which is Indirect cost Indirect overheads overheads Work overheads Chargeable overheads 2

Explain which Cost is incurred

7 to secure orders selling overheads Office overheads Variable overheads Factory overheads 1

Identify the Material which

8 cannot be charged directly Direct material indirect material overheads Factory overheads 2

Explain a cost that is easily

traceable to a cost object is

9 known as: Direct cost Indirect cost . Variable cost Fixed cost 1

Identify which of the

following is not a regulatory

10 institutions in Indian financial RBI CIBIL SEBI IRDA 2

system.

Choose which is the central

11 banking authority in India? RBI NABARD Ministry of Finance SEBI 1

12 Find the odd one out : commercial paper share certificate Certificate of deposit Treasury bill 2

When the concept of ratio is

defined in respected to the

items shown in the financial

13 statements, it is termed as Accounting ratio Financial ratio Costing ratio liquidty ratio 1

Determine the users of ratio Creditors and financial

14 analysis? Management institutions Investors All the stakeholders 4

The ascertainment of trends

15 helps in making Standards Forecasts Budget Bills 2

Identify the serious limitation Price level changes

16 of ratio analysis? Window dressing not considered Personal bias Actual pricing 2

What is the value of the firm The value of debt and The value of assets

17 usually based on? equity. The value of debt. The value of equity. plus liabilities. 3

Shareholders wealth increases Market value of the Dividend & market Market price of the

18 with the increase in: EPS firm value of the firm equity share 3

Leasing of machinery can be Capital budgeting

19 categorized as Financing decision Investment decision Fixed asset decision 1

Present value of a single

amount is simply termed as

20 current value of? Present Payments Future Payments Annuity Payments Discount payments 2

What does net present value Future values of Present values of Present values of Future values of future

21 give? present cash flows present cash flows future cash flows cash flows 3

Which of the following is not a

22 source of long-term finance Equity shares Preference shares Commercial papers Reserve and surplus 3

Traditional function of finance To get capital from To appoint finance

23 means? available source To use efficiently To distribute profit manager 1

What do you mean by raising To get capital for

24 finance? business To use capital To distribute profit None of the above 1

Traditional function of finance To get capital from To appoint finance

25 means? available source To use efficiently To distribute profit manager 1

Which of the followings is an

26 executive finance function? Financial planning Production planning Purchase planning None of the above 1

Provision of finance is the

27 function of________ Production manager Marketing manager Finance manager None of the above 3

Credit sales comes under which

28 of the followings? Financial policy Financial function Financial control None of the above 1

Decision about the assets in

which the long term funds to be Asset management

29 invested is called_______. policy Financial planning policy current asset policy None of the above 1

30 Finance functions are Planning for funds Raising of funds Allocation of Resources All of the above 4

In his traditional role the

financial manager is responsible Proper utilization of Arrangements of Acquiring capital assets efficient management of

31 for funds financial resources of organization capital 2

Which of the followings is not an

objectives of financial Maximization of wealth Arrangements of Mobilization of funds at Ensuring discipline in the

32 management? of shareholders financial resources an acceptable cost organization 4

________ is concerned with the

branch of economics relating the

behavior of principals and their Corporate Social

33 agents. Financial management Profit maximization Agency theory Responsibility 3

_______ is concerned with the

maximization of a firm's earnings Shareholder wealth Stakeholder

34 after taxes. maximization Profit maximization maximization EPS maximization 2

What is the most appropriate Shareholder Wealth Stakeholder

35 goal of the firm? maximization Profit maximization maximization EPS maximization 1

Which of the following Profit maximization will

statements is correct regarding not lead to increasing Profit maximization does Profit maximization is

profit maximization as the Profit maximization short-term profits at the consider the impact on concerned more with

primary goal of the firm? considers the firm's risk expense of lowering individual shareholder's maximizing net income

36 level. expected future profits. EPS. than the stock price. 4

The __________ decision

involves determining the

appropriate make-up of the

right-hand side of the balance

37 sheet. asset management financing investment capital budgeting 2

The __________ decision

involves a determination of the

total amount of assets needed,

the composition of the assets,

and whether any assets need to

be reduced, eliminated, or

38 replaced. asset management financing investment accounting 3

How are earnings per share Use the income Use the income

calculated? statement to determine statement to determine

earnings after taxes (net Use the income earnings after taxes (net

income) and divide by Use the income statement to determine income) and divide by

the previous period's statement to determine earnings after taxes (net the forecasted period's

earnings after taxes. earnings after taxes (net income) and divide by earnings after taxes.

Then subtract 1 from the income) and divide by the number of common Then subtract 1 from the

previously calculated the number of common and preferred shares previously calculated

39 value. shares outstanding. outstanding. value. 2

The __________ decision

involves efficiently managing the

assets on the balance sheet on a

day-to-day basis, especially

40 current assets. asset management financing investment accounting 1

All constituencies with a stake in

the fortunes of the company are

41 known as ________. shareholders stakeholders creditors customers 2

Which of the following EPS maximization does

statements is not correct EPS maximization not specify the timing or EPS maximization EPS maximization is

regarding earnings per share ignores the firm's risk duration of expected naturally requires all concerned with

42 (EPS) maximization as the level. EPS. earnings to be retained. maximizing net income. 4

primary goal of the firm?

_______ is concerned with the

maximization of a firm's stock Shareholder wealth Stakeholder welfare

43 price. maximization Profit maximization maximization EPS maximization 1

Finance Function comprises Safe custody of funds Expenditure of funds Procurement of finance Procurement & effective

44 only only only use of funds 4

When owners are managers

(such as in a sole proprietorship),

45 a firm will have agency costs. TRUE FALSE 2

The primary goal of a financial

manager should be to maximize

the value of shares issued to new

46 investors in the corporation. TRUE FALSE 2

Maximization of the current

earnings of the firm is the main

47 goal of the financial manager. TRUE FALSE 2

In capital budgeting, the financial

manager tries to identify

investment opportunities that

are worth more to the firm than

48 they cost to acquire. TRUE FALSE 1

When evaluating a project in

which a firm might invest, the

size but not the timing of the

49 cash flows are important. TRUE FALSE 2

The board of directors has the

power to act on behalf of the

shareholders to hire and fire the

operating management of the

firm. In a legal sense, the

directors are "principals" and the

50 shareholders are "agents". TRUE FALSE 2

The principal-agent problem managers follow their

describes a situation where: managers disagree with own inclinations, which shareholders prevent

employees on often differ from the managers from firms fail to maximise

51 production issues aims of shareholders maximising profits. long-term investment 2

A(n) would be an example of a

principal, while a(n) would be an

example of

52 an agent. shareholder; manager manager; owner accountant; bondholder shareholder; bondholder 1

The principal–agent relationship is smarter than the provides guidance to the

53 entails that the principal hires the agent. agent. agent. is hired by the agent. 1

Which of the following is not an

ingredient of a principal–agent Asymmetric

54 problem? Conflict of interest. information. Equilibrium. Surplus available. 3

Which one of the following is the Ann, the controller,

best example of an agency Mike, the president, travels to Orlando,

problem? Assume the company Juan, the chief financial travels to China to Florida to visit Disney

is paying the employees' travel officer, travels to France attend an international World with friends. Luisa, the marketing

expenses. to meet with the bank convention related to While there, she talks director, travels to

that is loaning the firm the company's line of with her friends about California to attend a

money to build a factory business. While there, employment sales convention. While

in France. While in he tours the Great Wall opportunities at the there she visits

55 France, he tours Paris. of China. firm. Disneyland. 3

Which one of the following giving senior managers

represents the best effort to paying senior managers bonuses consisting of

reduce the agency problem? a cash bonus each year shares of company increasing the salary of Providing company cars

based on the number of share whenever the the company president to all managers

people employed by the company improves its every time the company employed by the firm for

56 company production efficiency opens a new store more than one year 2

Which of the following is an Senior management

example of an agency cost? A company always buys receives stock options Managers can use the

the latest computer enabling them to buy company float plane to Sales reps are provided

equipment for its company stock at an fly to their cottages on with company cars to

57 employees exercise price well weekends use when visiting clients 3

above the current stock

price

Agency problems are best problems arising due to problems arising due to

defined as: potential misalignment the complete alignment issues surrounding

difficulties arising in between the interests of of the interests of whether or not to

dealings with real estate owners, creditors, and owners, creditors, and outsource production to

58 agencies managers managers an external agency 2

Managers can ignore the

objective of shareholder wealth

in the short-run in favour of

other stakeholders’ interests, but

59 not in the long run TRUE FALSE 1

Sole proprietorships can be

60 vulnerable to agency costs TRUE FALSE 1

Stock options are an example of

61 an agency cost TRUE FALSE 2

Agency costs do not include

expenses of monitoring and

controlling the actions of

62 management TRUE FALSE 2

Of the following list, which is a A firm’s chief executive

potential implication for agency The likelihood of officer (CEO) is more

issues when shareholders More shareholders have management pleasing able to choose his or her

are dispersed? a controlling say in what all shareholders is friends to sit on the

63 happens in the firm. greatly improved. board of directors. None of the above 3

Why do shareholders have a Because they are

greater preference for risk than Shareholders can investing in the stock

do managers? Shareholders are always diversify risk by holding market, shareholders

richer than managers, many securities, while a must naturally prefer Managers do not like risk

and can afford to take manager’s career is more because it hurts the

64 more risk. tied up with the firm. risk than do managers. value of the company. 2

Which of the following is not a

65 source of corporate financing? Equity Retained earnings Bonds Fixed capital 4

Which of the following is the Control the dispersal of

least important of the financial Keep an up-to-date Contain costs and foster Raise funds to support funds to ensure

manager’s responsibilities? record on past productivity the ongoing operations efficiency and adequate

66 operations improvements and planned investments returns 1

Financial markets that facilitate

the flow of long-term funds with

maturities of more than one year

67 are known as ________ money markets capital markets primary markets secondary markets 2

Financial markets facilitating the

issuance of new securities are

68 known as _________ money markets capital markets primary markets secondary markets 3

_______ are not considered

69 capital market securities. bonds mortgages retail CDs stocks 3

____ are financial contracts

whose values are obtained from

70 the values of underlying assets. Bonds Mortgages Stocks Derivatives 4

In a(n) _________ market, all

information about any securities

for sale is continuously and freely

71 available to investors. inefficient efficient perfect imperfect 3

____ are depository financial

72 institutions. Savings banks Finance companies Mutual funds Securities firms 1

The main source of funds for

________________ is deposits

from households, businesses,

and government agencies, while

their main use of funds is the

purchase of government and

corporate securities and

mortgages and other loans to mutual fundsmutual

73 households. savings institutions commercial banks funds finance companies 1

The federal government

74 commonly acts as a surplus unit. TRUE FALSE 2

An investor who holds bonds has

partial ownership in a

75 corporation. TRUE FALSE 2

When security prices fully reflect

all available information, the

markets for these securities are

76 said to be efficient. TRUE FALSE 1

Securities firms can act both as

77 brokers and as dealers. TRUE FALSE 2

Functions of financial services

78 exclude ----------------------. Mobilization of savings Allocation of fund Specialized services Collection of tax 4

Debenture having face value Rs.

100 is issued by company for Rs.

120. Coupon rate is 12%.

79 Calculate return on debt 10% 11% 12% 10.50% 1

200 shares with face value Rs. 10

of Infosys Ltd. Purchased at Rs.

200 each. Dividend received is

20%. Shares sold for at Rs. 250

80 each. Calculate return on equity 24% 25% 26% 28% 3

The following are the examples

81 of financial assets except? Stocks Bank loan Bond Raw material 4

The following are important

functions of financial markets: I.

Source of financing II. Provide

liquidity III. Reduce risk IV.

82 Source of information I and IV only II and III only I, II and III only I, II, III and IV 4

The sale of financial assets is also

83 referred to as the Capital decision CFO decision Financing decision Investment decision 3

The construction of new

manufacturing plant is also

84 referred to as the Capital decision CFO decision Financing decision Investment decision 4

We say about a particular

investment that it is risky, its raw material is

85 because it is dangerous it has low returns its returns are uncertain unavailable 3

The risk that can be eliminated

86 by diversification is called specific risk security risk market risk beta 1

The ratio between the amount of

profit and investment is called

87 the NPV opportunity cost risk premium rate of return 4

An investment should be Rate of Return > Rate of Return < Rate of Return =

88 accepted if Opportunity Cost Opportunity Cost Opportunity Cost A, B and C are irrelevant 1

The interest rate earned if a

financial asset is held until its

89 maturity is called term structure spinning yield spread 3

What is the maximum duration

for which term money can be

90 lent/borrowed? 1 day 15 days 30 days 1 year 4

What is the minimum duration

for which term money can be

91 lent/borrowed? 1 day 15 days 30 days 1 year 2

Which among the following Survey of Professional

surveys is not conducted by Inflation Expectations Forecasters on

Reserve Bank of India? Consumer Confidence Survey of Households Macroeconomic Annual Survey of

92 Survey (CCS) (IESH) Indicators Industries 4

Who is the issuing authority of

93 coins in India? RBI Government of India Ministry of Finance Both 1 and 2 2

Which of the followings is not

an objectives of financial Maximization of Arrangements of Mobilization of funds Ensuring discipline in

94 management? wealth of shareholders financial resources at an acceptable cost the organization 4

What is the most appropriate Shareholder Wealth Stakeholder

95 goal of the firm? maximization Profit maximization maximization EPS maximization 1

Which of the following Profit maximization Profit maximization Profit maximization Profit maximization is

96 statements is correct regarding considers the firm's will not lead to does consider the concerned more with 4

profit maximization as the risk level. increasing short-term impact on individual maximizing net

primary goal of the firm? profits at the expense shareholder's EPS. income than the stock

of lowering expected price.

future profits.

Which of the following is not a

97 source of corporate financing? Equity Retained earnings Bonds Fixed capital 4

Financial markets facilitating

the issuance of new securities

98 are known as money markets capital markets primary markets secondary markets 3

The ratio between the amount

of profit and investment is

99 called the NPV opportunity cost risk premium rate of return 4

Gross Profit Ratio for a firm

remains same but the Net

Profit Ratio is decreasing. The

reason for Increase in Costs of

100 such behavior could be: Goods Sold If Increase in Expense Increase in Dividend Decrease in Sales 2

Capital required for running

the business smoothly and

efficiently on day-to-day basis working capital of

101 is known as Leverage Analysis Ratio Analysis company. Cost of Capital 3

Ratio analysis shows whether

financial position of company

102 is Improving Detoriating Same as the previous More than the previous 1

The principal-agent problem managers follow their

describes a situation where: own inclinations,

managers disagree with which often differ shareholders prevent

employees on from the aims of managers from firms fail to maximise

103 production issues shareholders maximising profits. long-term investment 2

To whom dividend is given at To preference

104 a fixed rate in a company? To equity shareholders shareholders To debenture holders To promoters 2

105 Which one of the following is the Juan, the chief financial Mike, the president, Ann, the controller, Luisa, the marketing 3

best example of an agency officer, travels to France travels to China to travels to Orlando, director, travels to

problem? Assume the company is to meet with the bank attend an international Florida to visit Disney California to attend a

paying the employees' travel that is loaning the firm convention related to the World with friends. sales convention. While

expenses. money to build a factory company's line of While there, she talks there she visits

in France. While in business. While there, with her friends about Disneyland.

France, he tours Paris. he tours the Great Wall employment

of China. opportunities at the firm.

Why do shareholders have a Because they are

greater preference for risk than do Shareholders can investing in the stock

managers? Shareholders are always diversify risk by holding market, shareholders

richer than managers, many securities, while a must naturally prefer Managers do not like risk

and can afford to take manager’s career is more because it hurts the value

106 more risk. tied up with the firm. risk than do managers. of the company. 2

The liquidty status of certificate

of deposits which is morele is

107 negotiable is considered as certificate liquidity term liquidity more liquid less liquid 3

We say about a particular

investment that it is risky, its raw material is

108 because it is dangerous it has low returns its returns are uncertain unavailable 3

A(n) would be an example of a

principal, while a(n) would be an

example of

109 an agent. shareholder; manager manager; owner accountant; bondholder shareholder; bondholder 1

The ratio between the amount of

110 profit and investment is called the NPV opportunity cost risk premium rate of return 4

Inventory Turnover measures the Average Sales Cost of Goods Sold Total Purchases Total Assets

111 relationship of inventory with: 2

Which of the following statements is A Higher Receivable Interest Coverage Ratio Increase in Net Profit Ratio Lower Debt-Equity Ratio

112 correct? Turnover is not desirable depends upon Tax Rate means increase in Sales means lower Financial Risk 4

The interest rate earned if a

financial asset is held until its

113 maturity is called term structure spinning yield spread 3

The commercial paper issued

with low interest rate thus the

114 commercial paper are categorized payables rating commercial rating poor credit rating better credit rating 4

as

A dollar today is worth more than a risk of nonpayment in the the dollar can be invested inflation will reduce None of the above

dollar to be received in the future future. today and earn interest. purchasing power of a

115 because future dollar. 2

An investment should be Rate of Return > Rate of Return < Rate of Return =

116 accepted if Opportunity Cost Opportunity Cost Opportunity Cost A, B and C are irrelevant 1

Ownership of goods under hire Payment of down payment Payment of first instalment Payment of last instalment At the time of agreement

purchase agreement is transferred at

117 the time of 3

118 The cheapest source of finance is debenture equity share capital preference share retained earning 4

Which of the following has the Equity shares Loans Bonds Preference shares

119 highest cost of capital? 1

The three major sources of long-term

funds are surplus, internal cash

funds, debit capital, and equity

120 capital. TRUE FALSE 1

(Gross profit / Net sales) x (Gross profit x Sales / (Net profit / Total assets) x

121 Return on Investment Ratio (ROI) = 100 Fixed assets) x 100 (Net profit / Sales) x 100 100 4

Weighted Average Cost of Capital is Ka Kw Ko Ke

122 generally denoted by: 3

A firm should select the capital produces the highest cost of maximizes the value of the minimizes taxes. equates the value of debt

123 structure that: capital. firm. with the value of equity. 2

The optimal capital structure has debt-equity ratio is equal to weight of equity is equal to debt-equity ratio is such Debt-equity ratio results in

been achieved when the: 1. the weight of debt that the cost of debt the lowest possible

exceeds the cost of equity weighted average cost of

124 capital. 4

Which one of the following giving senior managers

represents the best effort to paying senior managers a bonuses consisting of

reduce the agency problem? cash bonus each year shares of company share increasing the salary of Providing company cars

based on the number of whenever the company the company president to all managers

people employed by the improves its production every time the company employed by the firm for

125 company efficiency opens a new store more than one year 2

A firm with high operating leverage low fixed costs in its high variable costs in its high fixed costs in its high price per unit.

126 has: production process. production process. production process. 3

Which of the following is not a

127 source of corporate financing? Equity Retained earnings Bonds Fixed capital 4

Which of the following is the Control the dispersal of

least important of the financial Contain costs and foster Raise funds to support funds to ensure

manager’s responsibilities? Keep an up-to-date productivity the ongoing operations efficiency and adequate

128 record on past operations improvements and planned investments returns 1

Which of the followings is not an Maximization of wealth of Arrangements of financial Mobilization of funds at an Ensuring discipline in the

129 objectives of financial management? shareholders resources acceptable cost organization 4

The size of the accounts payable is Cash float Accounts receivable Credit sales A new personal computer

affected by the level of the firm’s for the office

cost of goods sold and the average

130 payment period. 4

What is the most appropriate goal Shareholder Wealth Stakeholder

131 of the firm? maximization Profit maximization maximization EPS maximization 1

What is the net present value? the future value of a the present value of a the future value of a the present value of a

project’s cash flows plus its project’s cash flows plus project’s cash flows minus project’s cash flows minus

132 initial cost its initial cost its initial cost its initial cost 4

Which among the following Survey of Professional

surveys is not conducted by Inflation Expectations Forecasters on

Reserve Bank of India? Consumer Confidence Survey of Households Macroeconomic Annual Survey of

133 Survey (CCS) (IESH) Indicators Industries 4

Which of the following is an Senior management

example of an agency cost? receives stock options

enabling them to buy

A company always buys company stock at an Managers can use the

the latest computer exercise price well company float plane to Sales reps are provided

equipment for its above the current stock fly to their cottages on with company cars to use

134 employees price weekends when visiting clients 3

You might also like

- EECOMEDYCLUBbusiness Plan Template 2019Document38 pagesEECOMEDYCLUBbusiness Plan Template 2019Robert FearNo ratings yet

- MCQ and AnswersDocument118 pagesMCQ and AnswersMelvin100% (1)

- Finance ManagementDocument20 pagesFinance Managementurvipatel1191No ratings yet

- Finance ManagementDocument14 pagesFinance ManagementLOHO MatembaNo ratings yet

- MA Week 1Document61 pagesMA Week 1Lam BiNo ratings yet

- BS3 & BS4 Finance and Ops MGMTDocument5 pagesBS3 & BS4 Finance and Ops MGMTemma_nationNo ratings yet

- M. Com. Sem II Question - Banks - Corporate - FinanceDocument34 pagesM. Com. Sem II Question - Banks - Corporate - FinanceAjish JoyNo ratings yet

- 4 Financial Forecasting, Planning, and BudgetingDocument20 pages4 Financial Forecasting, Planning, and BudgetingMarlon LadesmaNo ratings yet

- Faa MCQ'S-1Document2 pagesFaa MCQ'S-1Onkar ShindeNo ratings yet

- ACTG243-Chapter-01-SlidesDocument47 pagesACTG243-Chapter-01-Slidessang nguyenNo ratings yet

- Financial Key Performance Indicators: Module 9 - Finance For Non-FinanceDocument48 pagesFinancial Key Performance Indicators: Module 9 - Finance For Non-FinanceŠyed FarîsNo ratings yet

- Chap 2Document51 pagesChap 2k60.2113150049No ratings yet

- FM IntroductionDocument29 pagesFM Introductionritam chakrabortyNo ratings yet

- Business A-Level Notes - Theme 2Document7 pagesBusiness A-Level Notes - Theme 2connectotuNo ratings yet

- Lecturer Commerce TestDocument2 pagesLecturer Commerce TestJunaid KhanNo ratings yet

- Comprehensive Finance Guide v1.2Document74 pagesComprehensive Finance Guide v1.2sacd.wizomoonNo ratings yet

- 03 - Management AccountingDocument2 pages03 - Management AccountingCelsozeca2011No ratings yet

- Chapter 1 PDFDocument21 pagesChapter 1 PDFThanh NguyenNo ratings yet

- 2130-Accounting For ManagersDocument1 page2130-Accounting For Managerskrushnakakde884No ratings yet

- Module 1 Introduction To FMDocument13 pagesModule 1 Introduction To FMZaid Ismail ShahNo ratings yet

- Introduction To Financial Accounting Final Exam Lecture QuestionsDocument2 pagesIntroduction To Financial Accounting Final Exam Lecture QuestionsSaif Ali KhanNo ratings yet

- Module-1 - BAV For Students ReferenceDocument54 pagesModule-1 - BAV For Students ReferenceYash LataNo ratings yet

- AE 191 M-TEST 1 With Answer KeyDocument3 pagesAE 191 M-TEST 1 With Answer KeyVenus PalmencoNo ratings yet

- 1 IntroductionDocument51 pages1 IntroductionKrishnakant MishraNo ratings yet

- CF (Collected)Document76 pagesCF (Collected)Akhi Junior JMNo ratings yet

- Introduction To Financial ManagementDocument66 pagesIntroduction To Financial Managementthabit jumaNo ratings yet

- The Great Summer Sale: Financial Statement Analysis Mcqs - Multiple Choice Questions and AnswersDocument1 pageThe Great Summer Sale: Financial Statement Analysis Mcqs - Multiple Choice Questions and AnswersAhsan NaseemNo ratings yet

- Financial Valuation Complete Guide 1682974043 PDFDocument104 pagesFinancial Valuation Complete Guide 1682974043 PDFMerve KöseNo ratings yet

- Financial Ratios: Liquidity: Lesson 2.2Document73 pagesFinancial Ratios: Liquidity: Lesson 2.2Friendlyn AzulNo ratings yet

- Ca - Unit 1Document22 pagesCa - Unit 1SHANMUGHA SHETTY S SNo ratings yet

- Lecture 1 PDFDocument46 pagesLecture 1 PDFsyingNo ratings yet

- Introduction To CFDocument21 pagesIntroduction To CFANKIT AGARWALNo ratings yet

- C1 IntroDocument13 pagesC1 IntroNgọc Phương HoàngNo ratings yet

- Management Accounting Concepts and Techniques PDFDocument310 pagesManagement Accounting Concepts and Techniques PDFvishnupriya100% (1)

- CH - 01 - Financial Management An OverviewDocument37 pagesCH - 01 - Financial Management An OverviewSanchit AroraNo ratings yet

- SlideLizard Quiz TemplatesDocument23 pagesSlideLizard Quiz TemplatesPraveen kumarNo ratings yet

- Managerial Economics: Shape The Ofa - That Furthers TheDocument19 pagesManagerial Economics: Shape The Ofa - That Furthers TheMohamed RafiqueNo ratings yet

- Sessions 8 (Updated)Document82 pagesSessions 8 (Updated)MinSu YangNo ratings yet

- CF (Collected)Document92 pagesCF (Collected)Akhi Junior JMNo ratings yet

- Chapter 1 ReefatDocument25 pagesChapter 1 ReefatMahmudul HasanNo ratings yet

- CF1_Lec3_Financial_Analysis_SVDocument31 pagesCF1_Lec3_Financial_Analysis_SVAnh Nguyễn MaiNo ratings yet

- AFM Study TextDocument224 pagesAFM Study TextleandrealouisNo ratings yet

- Planning Working Capital ManagementDocument39 pagesPlanning Working Capital ManagementRonn RaymundoNo ratings yet

- Chapter 3Document21 pagesChapter 3manthq21404caNo ratings yet

- International Financial ManagementDocument23 pagesInternational Financial ManagementMughal AsifNo ratings yet

- 8068 - Assignment 1 - Merged - RemovedDocument13 pages8068 - Assignment 1 - Merged - RemovedSiddharth NarwarNo ratings yet

- Corporate-Finance MCQ'sDocument5 pagesCorporate-Finance MCQ'sAjish JoyNo ratings yet

- Chapter 1.2Document39 pagesChapter 1.2Sherefedin AdemNo ratings yet

- Strategy: Five Aspects of Industry AnalysisDocument7 pagesStrategy: Five Aspects of Industry AnalysisAce AceNo ratings yet

- FMSM END GAME NOTES-Executive-RevisionDocument57 pagesFMSM END GAME NOTES-Executive-RevisionRevanthi DNo ratings yet

- Corporate Finance: Suresh HerurDocument49 pagesCorporate Finance: Suresh Herurlove_abhi_n_22No ratings yet

- Basic Corporate Finance Concepts: Joint Venture & AcquisitionDocument29 pagesBasic Corporate Finance Concepts: Joint Venture & AcquisitionSalil SheikhNo ratings yet

- Econometrics Chapter - 1Document29 pagesEconometrics Chapter - 1Ashenafi ZelekeNo ratings yet

- AssignmentDocument5 pagesAssignmentanu9224No ratings yet

- Week 2Document80 pagesWeek 2王振權No ratings yet

- Cost-Management BOOK 7Document184 pagesCost-Management BOOK 7Shazs EnterprisesNo ratings yet

- Managerial Accounting and Cost Concepts: Mcgraw-Hill/IrwinDocument65 pagesManagerial Accounting and Cost Concepts: Mcgraw-Hill/IrwinBradNo ratings yet

- Financial Ratios: E Ciency: Lesson 2.4Document25 pagesFinancial Ratios: E Ciency: Lesson 2.4JOSHUA GABATERONo ratings yet

- Session 9 Introduction To Management AccountingDocument52 pagesSession 9 Introduction To Management Accounting靳雪娇No ratings yet

- AFM - Summary PDFDocument114 pagesAFM - Summary PDFHiểu LêNo ratings yet

- The Power of Public Investment Management: Transforming Resources Into Assets for GrowthFrom EverandThe Power of Public Investment Management: Transforming Resources Into Assets for GrowthNo ratings yet

- 华尔街日报 2019 03 08 PDFDocument28 pages华尔街日报 2019 03 08 PDFRodger ZhaoNo ratings yet

- Questions MCQDocument15 pagesQuestions MCQRaj TakhtaniNo ratings yet

- Reendell CoDocument1 pageReendell CouhsradNo ratings yet

- Intangible AssetsDocument4 pagesIntangible AssetsDianna DayawonNo ratings yet

- DPR-Chatiisgarh For Club DevelopmentDocument22 pagesDPR-Chatiisgarh For Club Developmentsohalsingh1No ratings yet

- 4 5 AnswersDocument4 pages4 5 AnswersKesselNo ratings yet

- Session 19 - Nestle EIS For Financial ReportingDocument11 pagesSession 19 - Nestle EIS For Financial ReportingRahul ChiplunkarNo ratings yet

- Asian Paints Final Report (Fundamental)Document20 pagesAsian Paints Final Report (Fundamental)Harushika MittalNo ratings yet

- Advance Accounting AssignmentDocument3 pagesAdvance Accounting AssignmentDalia ElarabyNo ratings yet

- Demand Letter Business PermitDocument3 pagesDemand Letter Business PermitJazz Adaza100% (1)

- AMBO-104 Accounting For Managers Assignment AssignmentDocument12 pagesAMBO-104 Accounting For Managers Assignment AssignmentEsha VermaniNo ratings yet

- Chapter 1Document28 pagesChapter 1Gazi JayedNo ratings yet

- Tally Project 130721003449 Phpapp01Document61 pagesTally Project 130721003449 Phpapp01Jaspreet SinghNo ratings yet

- Economics Course 5Document13 pagesEconomics Course 5BawalidNo ratings yet

- Financial Ratio Analysis AcknowledgeDocument9 pagesFinancial Ratio Analysis AcknowledgeKandaroliNo ratings yet

- Accounts p1Document5 pagesAccounts p1arkNo ratings yet

- Consignment PDFDocument31 pagesConsignment PDFBijay Aryan DhakalNo ratings yet

- La Trobe Cash QuestionDocument2 pagesLa Trobe Cash QuestionKimberly MarkNo ratings yet

- Honey Care Africa - Business Model Management StrategicDocument23 pagesHoney Care Africa - Business Model Management StrategicAdriani Eka JuniartiNo ratings yet

- DPR Financial Model Final 30.07.10Document194 pagesDPR Financial Model Final 30.07.10deshmukhvaibhav2009No ratings yet

- MGMT Theory & Prac - Chap-4Document5 pagesMGMT Theory & Prac - Chap-4Kashi MalikNo ratings yet

- CAPITAL BUDGETING QuizDocument139 pagesCAPITAL BUDGETING QuizJessie KimNo ratings yet

- Financial Statement AnalysisDocument63 pagesFinancial Statement AnalysisHarsh DalmiaNo ratings yet

- Establishing A Business in CambodiaDocument2 pagesEstablishing A Business in CambodiaSovan Meas100% (1)

- Cost Acctg 1617 2ndsem CE AKDocument10 pagesCost Acctg 1617 2ndsem CE AKanon_684731700% (1)

- Pan Card Redispatch LetterDocument2 pagesPan Card Redispatch LetterFfs Mdu50% (10)

- Sample Problems Share-Based CompensationDocument9 pagesSample Problems Share-Based CompensationKenneth M. Gonzales100% (2)

- Quiz2 With AnswersDocument11 pagesQuiz2 With AnswersJogja AntiqNo ratings yet

- Stock Valuation: Prepared By: Wael Shams EL-DinDocument40 pagesStock Valuation: Prepared By: Wael Shams EL-DinmaheraldamatiNo ratings yet