Professional Documents

Culture Documents

Finance terminology

Finance terminology

Uploaded by

Dhivya LakshmirajanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance terminology

Finance terminology

Uploaded by

Dhivya LakshmirajanCopyright:

Available Formats

troublesome terms

Finance

Fixed costs Reserves

Costs that are fixed in relation to output. In other words, fixed costs Reserves are accumulated, retained profit and show up in a firm’s

can vary, but not because business is especially bad or good. Rent is total equity within its balance sheet. The important thing is to realise

a good example, as are interest charges. The latter can rise or fall if that reserves aren’t cash waiting to be used. They simply show

interest rates change, but are not changed by strong or weak trading. that profits have been made in the past: they may have been used

already to buy assets.

The following financial terms often cause problems for students in exams. You may think you

Liquidity

know fixed costs and budgeting. But do you know them well enough to impress an examiner? The ease with which a company can find the cash to pay its bills.

If liquidity is high (or ‘strong’) it will be easy to meet obligations. If

liquidity is poor (or ‘weak’) there may be delays to payments because

Audited accounts Credit period

there is insufficient cash in the bank account. Ideally a business

should be able to cope with a major customer going bankrupt (and

therefore not paying its bills) and still have the cash to pay staff,

Accounts drawn up at the end of a trading period that have been The time a firm takes to pay its suppliers (called payables) and the suppliers and so on.

approved by an independent, external accounting practice. It is time it has to wait, on average, to get paid by customers. Lengthening

important to note when accounts have not been audited (6-monthly, the time taken to pay suppliers will help cash flow, as will shortening

or interim accounts), but also to acknowledge that some remarkable

accounting scandals have been fully audited, i.e. the process is far

the time it takes to get paid by customers. Large companies gain a

huge competitive advantage from their ability to boss customers and Margin of safety

from a guarantee of the validity of the published data. bully suppliers.

The amount by which sales can fall before a firm starts making

losses. Therefore it’s sales minus breakeven point, measured in

Average rate of return (ARR) Discounted cash flow (DCF)

units. Students often forget the formula, or get it confused with the

breakeven point. Return on capital

This method of investment appraisal seems easy to understand, but Discounting forecast future cash flows progressively over time to take Operating profit

× 100

often trips students up in exams. ARR is average annual profit as into account the time value (opportunity cost) of capital. This single Capital employed

a percentage of the sum invested into a project. The maths can be method of investment appraisal allows both the volume and timing of Return on capital employed (ROCE) shows whether management has

tricky to calculate, but even more important is the ability to interpret cash flows to be taken into account in a single calculation. been efficient in making a good return on the capital invested into

an ARR result. A figure of 20%, for instance, would mean an annual the business. If the return on capital is less than the rate of interest, it

profit of 20% on your investment. This is terrific at a time when may not be worth running the business at all.

interest rates are more like 2–3% a year.

Financial year

Budgeting

The 12-month period chosen by the company as the best Reward for risk

representation of its financial position. For example, a toy business

might have a 1 February–31 January financial year, to reflect the Although this term is not mentioned in A-level specifications, it is the

Establishing, at the start of a financial year, a ceiling on spending pre-Christmas sales peak and the after-Christmas stock position. Most perfect way to make sense of ARR and ROCE results. If the ARR is

and a baseline for sales for each manager within an organisation.

This helps managers know how their success or failure will be

financial years are April–March, as that is the tax year.

Overdraft 16% per year and the interest rate is 3%, the reward for risk is 13%

per year. In the same way, a 20% ROCE with a 5% interest rate gives

measured, motivating them to give everything to achieve success. The a 15% reward for risk.

An allowance by a bank that a current-account holder can spend more

troublesome bit is that the same term (budgeting) applies equally to

than is in the account, up to a pre-agreed maximum. This ‘overdraft After this analysis, you can make (and justify) a judgement about

keeping costs controlled and keeping revenues high.

facility’ might be £2,000, but the person or business might only whether it’s a high enough reward given the risks involved in the

occasionally dip into it by getting, for example, £400 overdrawn. project in question.

The difficulty in an exam is to distinguish overdraft usage from the

Contribution overdraft facility.

The amount each unit sold contributes to covering the fixed costs of

Working capital

the business. Once fixed costs are covered, all further contribution is

profit. This is how business decisions are made, by ignoring the fixed

Overtrading The finance for the day-to-day running of the business. The

troublesome aspect of this term is to distinguish between the working

costs and focusing on the gap between price and variable cost per

Growing so rapidly as to outstrip the firm’s financial capacity, capital available and the working capital actually being used by the

unit. Don’t confuse contribution with profit.

especially liquidity. Rapid growth puts a huge strain on cash flow. If business. Ideally a business would have plenty of working capital

the firm has poor liquidity, it may run out of cash and be unable to available, but as little as possible used (tied up) in stock/inventories or

continue trading. credit to customers (debtors/receivables).

BusinessReviewExtras

Download this poster at Ian Marcousé is the author of business A-level textbooks for

www.hoddereducation.co.uk/businessreviewextras AQA and Edexcel, all published by Hodder Education.

32 Business Review November 2019 www.hoddereducation.co.uk/businessreview 33

You might also like

- 2021 Debit Issuer Study White PaperDocument18 pages2021 Debit Issuer Study White PaperJack PurcherNo ratings yet

- FM Theory PDFDocument55 pagesFM Theory PDFJeevan JazzNo ratings yet

- SDE Philippines Financial StatementsDocument41 pagesSDE Philippines Financial StatementsRonaldNo ratings yet

- Buy or Rent A House Calculations - Ankur WarikooDocument6 pagesBuy or Rent A House Calculations - Ankur WarikooVivek GuptaNo ratings yet

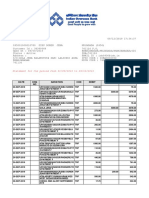

- Statement 095001000010780Document4 pagesStatement 095001000010780Sibu SorenNo ratings yet

- Sbi Project ReportDocument114 pagesSbi Project Reportthyristorscr78% (9)

- A Project Report On Comparison Between HDFC Bank & ICICI BankDocument75 pagesA Project Report On Comparison Between HDFC Bank & ICICI Bankvarun_bawa25191592% (12)

- W2 3 Financial Ratio Analysis - 2 Ok - 240123 - 154210Document58 pagesW2 3 Financial Ratio Analysis - 2 Ok - 240123 - 154210Chi NguyễnNo ratings yet

- Guide To Cash Flow Management1606Document9 pagesGuide To Cash Flow Management1606Ricardo JiménezNo ratings yet

- 4 FundraisingDocument16 pages4 FundraisingGaurav SwamyNo ratings yet

- P1 Nov14 FmarticleDocument1 pageP1 Nov14 FmarticleStena NadishaniNo ratings yet

- Ratios: Interpreting Financial StatementsDocument3 pagesRatios: Interpreting Financial StatementsMr RizviNo ratings yet

- Cajournal Jan2023 13Document3 pagesCajournal Jan2023 13ajitNo ratings yet

- FM Tea B-62Document12 pagesFM Tea B-62sayali bangaleNo ratings yet

- Getting To The Optimal: Timing and Financing Choices: You Can Take It Slow.. or Perhaps NotDocument22 pagesGetting To The Optimal: Timing and Financing Choices: You Can Take It Slow.. or Perhaps NotsultaniiuNo ratings yet

- Corporate Finance - Capital Structure - Dayana MasturaDocument12 pagesCorporate Finance - Capital Structure - Dayana MasturaDayana MasturaNo ratings yet

- Dec 2021 - Due Diligence in Business Restructuring - Disha GadaDocument6 pagesDec 2021 - Due Diligence in Business Restructuring - Disha GadaPRAGYA RATHINo ratings yet

- Working Capital Management: Details in Fixed Income)Document1 pageWorking Capital Management: Details in Fixed Income)Ngân HàNo ratings yet

- Equity and Debt MarketDocument2 pagesEquity and Debt MarketCrystel Joyce UltuNo ratings yet

- Financial Reporting, Statements and AnalysisDocument26 pagesFinancial Reporting, Statements and AnalysisArunKumarNo ratings yet

- Chapter 2 - 211031 - 121711Document34 pagesChapter 2 - 211031 - 121711CY YangNo ratings yet

- Financial Ratio AnalysisDocument5 pagesFinancial Ratio AnalysisPhuoc TruongNo ratings yet

- IGCSE Business Studies: Financial Information and Decisions: Study Online atDocument2 pagesIGCSE Business Studies: Financial Information and Decisions: Study Online atDefa RoseNo ratings yet

- F9 文字题宝典Document10 pagesF9 文字题宝典Kevin Ch LiNo ratings yet

- FABM2 - Q1 - V2a Page 102 114Document12 pagesFABM2 - Q1 - V2a Page 102 114Kate thilyNo ratings yet

- Finman22 Working Capital Management B5Document5 pagesFinman22 Working Capital Management B5Anacristina PincaNo ratings yet

- APO-3 - Prada - FLPDocument10 pagesAPO-3 - Prada - FLPtushar agrawalNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument35 pagesInvesting and Financing Decisions and The Balance Sheetfmj6687No ratings yet

- Oct 14 TT Treasury Essentials 46Document1 pageOct 14 TT Treasury Essentials 46ted brentNo ratings yet

- Maximum CashDocument7 pagesMaximum CashdeeNo ratings yet

- Credit Analysis and Distress PredictionDocument57 pagesCredit Analysis and Distress Predictionrizki nurNo ratings yet

- Ch. 1 Introduction To AccountingDocument14 pagesCh. 1 Introduction To AccountingvaishnavibankarNo ratings yet

- Your Financial Review Checklist: For Even The Smallest Business, Periodic Financial Reviews Are A Fact of LifeDocument2 pagesYour Financial Review Checklist: For Even The Smallest Business, Periodic Financial Reviews Are A Fact of LifeMDS TeamNo ratings yet

- Accounts Receivable and Inventory ManagementDocument12 pagesAccounts Receivable and Inventory ManagementjohnpenoniaNo ratings yet

- SAFEsDocument5 pagesSAFEsLawrence Ansah-AddoNo ratings yet

- Intacc NotesDocument10 pagesIntacc NotesIris FenelleNo ratings yet

- Adobe Scan 03-May-2021Document22 pagesAdobe Scan 03-May-2021Mohit RanaNo ratings yet

- Corporate Finance 1 PDFDocument324 pagesCorporate Finance 1 PDFHE HUNo ratings yet

- Financial RatiosDocument13 pagesFinancial Ratiosakash ThakurNo ratings yet

- Financial RatiosDocument9 pagesFinancial RatiosTariq qandeelNo ratings yet

- 3 Working Capital and Current Assets ManagementDocument8 pages3 Working Capital and Current Assets ManagementJamaica DavidNo ratings yet

- Session 2: SlidesDocument19 pagesSession 2: SlidesFranco ImperialNo ratings yet

- Financial Management Sem 3Document4 pagesFinancial Management Sem 3Sidhesh KatkarNo ratings yet

- Accounting BasicsDocument10 pagesAccounting BasicsMitanshi ShahNo ratings yet

- Corporate Governance: Defining The End Game: "If I Have To Choose Between You and Me - I Like Me Better."Document39 pagesCorporate Governance: Defining The End Game: "If I Have To Choose Between You and Me - I Like Me Better."Amine IzamNo ratings yet

- Business Analysis and Valuation 3 4Document23 pagesBusiness Analysis and Valuation 3 4Budi Yuda PrawiraNo ratings yet

- Financial Ratio Analysis: Helmi Salam S C1H017001 Carissa Sandra S C1H017007 Salma Meidiana C1H017018Document26 pagesFinancial Ratio Analysis: Helmi Salam S C1H017001 Carissa Sandra S C1H017007 Salma Meidiana C1H017018salma_meiNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisGina FabunanNo ratings yet

- Project of Financial Reporting AnalysisDocument29 pagesProject of Financial Reporting AnalysisAhmad Mujtaba PhambraNo ratings yet

- Accounting & FinanceDocument57 pagesAccounting & Financemani_selvaNo ratings yet

- MEGA Valuation Bundle of MaterialsDocument10 pagesMEGA Valuation Bundle of MaterialsLorenaNo ratings yet

- chp4 SBMDocument28 pageschp4 SBMMercury's PlaceNo ratings yet

- Financial Analysis of Vantage LTD and Dunhop LTDDocument23 pagesFinancial Analysis of Vantage LTD and Dunhop LTDAJ MNo ratings yet

- Long-Term Debt-Paying Ability: Total AssetsDocument2 pagesLong-Term Debt-Paying Ability: Total AssetsIannie May ManlogonNo ratings yet

- Sa Oct08 Irons PDFDocument3 pagesSa Oct08 Irons PDFIfra38No ratings yet

- Task 17Document1 pageTask 17shashikant prasadNo ratings yet

- Capital Struchoices (Modified)Document16 pagesCapital Struchoices (Modified)mogibol791No ratings yet

- Entrepreneurship: Creating A Successful Financial PlanDocument38 pagesEntrepreneurship: Creating A Successful Financial Planas ddadaNo ratings yet

- Corporate Finance What Is It?: Aswath DamodaranDocument13 pagesCorporate Finance What Is It?: Aswath DamodaranRoberto Cisneros MendozaNo ratings yet

- Evaluating Distressed SecuritiesDocument12 pagesEvaluating Distressed Securitieslazaros-apostolidis1179No ratings yet

- Ratio Analysis Involves The Construction of Ratios Using SpecificDocument8 pagesRatio Analysis Involves The Construction of Ratios Using SpecificEddie CalzadoraNo ratings yet

- Reviewer in Business FinanceDocument3 pagesReviewer in Business FinancebaekhyunNo ratings yet

- Wellers Infographic What To Include in Your Management Accounts-1Document1 pageWellers Infographic What To Include in Your Management Accounts-1knowledge musendekwaNo ratings yet

- Gr11 FinancialStatements TheoryDocument14 pagesGr11 FinancialStatements Theorysethumotha72No ratings yet

- Accounting: Assets Liabilities + Equity A L + EDocument4 pagesAccounting: Assets Liabilities + Equity A L + EjermaineNo ratings yet

- Dividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksFrom EverandDividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksNo ratings yet

- TacticsDocument1 pageTacticsDhivya LakshmirajanNo ratings yet

- 4.2 Costs, Scale of Production and Break-Even Analysis - LearnerDocument23 pages4.2 Costs, Scale of Production and Break-Even Analysis - LearnerDhivya Lakshmirajan100% (1)

- 4.3 - LearnerDocument9 pages4.3 - LearnerDhivya LakshmirajanNo ratings yet

- 1.2.1 Business Activity in Terms of Primary, Examples To Illustrate The ClassificationDocument25 pages1.2.1 Business Activity in Terms of Primary, Examples To Illustrate The ClassificationDhivya LakshmirajanNo ratings yet

- 1.3 - LearnerDocument19 pages1.3 - LearnerDhivya LakshmirajanNo ratings yet

- 1.1 Business ActivityDocument32 pages1.1 Business ActivityDhivya LakshmirajanNo ratings yet

- HSBC Premier TcsDocument3 pagesHSBC Premier TcsDreamworxx DevelopmentsNo ratings yet

- Revised Application For Direct Import Bill (New)Document2 pagesRevised Application For Direct Import Bill (New)gautamNo ratings yet

- Challan No. ITNS 281 : Assessment YearDocument1 pageChallan No. ITNS 281 : Assessment YearTpm UmasankarNo ratings yet

- Origin and Development of Auditing: Research Paper CommereceDocument4 pagesOrigin and Development of Auditing: Research Paper CommereceCarlo VillanNo ratings yet

- Negotiable Instrument (Part III) M.CDocument6 pagesNegotiable Instrument (Part III) M.Csad nuNo ratings yet

- EM 531 - Lecture Notes 7Document45 pagesEM 531 - Lecture Notes 7Hasan ÖzdemNo ratings yet

- Asset Reconstruction CompanyDocument4 pagesAsset Reconstruction CompanyParas MittalNo ratings yet

- Wa0045.Document7 pagesWa0045.Pieck AckermannNo ratings yet

- Master Template v1Document79 pagesMaster Template v1KiranNo ratings yet

- Insurance Law ProjectDocument20 pagesInsurance Law ProjectGaurav sharma100% (3)

- ACTIVITY 01 - Accounting Environment and Accounting Framework (A.y 2022-2023)Document13 pagesACTIVITY 01 - Accounting Environment and Accounting Framework (A.y 2022-2023)Clarito, Trisha Kareen F.No ratings yet

- LBO ModelingDocument31 pagesLBO Modelingricoman1989No ratings yet

- Simple and Compound Interest QuizDocument2 pagesSimple and Compound Interest QuizManny MannyNo ratings yet

- Exercise 21Document8 pagesExercise 21raihan aqilNo ratings yet

- FAR AssessmentDocument4 pagesFAR AssessmentLuna VNo ratings yet

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument9 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanNo ratings yet

- If Silent, Branch Will Carry Its Own PPEDocument20 pagesIf Silent, Branch Will Carry Its Own PPENicko Angelo E. CrisostomoNo ratings yet

- Mortgage: DR Amirthalingam SDocument25 pagesMortgage: DR Amirthalingam SVishal AnandNo ratings yet

- 2 Double Entry System PowerPoint PresentationDocument11 pages2 Double Entry System PowerPoint PresentationSudheer Vishwakarma100% (3)

- Factsheet - 20 October 2023Document2 pagesFactsheet - 20 October 2023Shivani NirmalNo ratings yet

- Cheque Truncation Kaza Sudhakar RBIDocument27 pagesCheque Truncation Kaza Sudhakar RBIpkcoolboy85No ratings yet

- Functional Analysis of Digital PaymentDocument57 pagesFunctional Analysis of Digital PaymentSejal MehrotraNo ratings yet

- Chapter 7 - 18may 2022Document51 pagesChapter 7 - 18may 2022Hazlina HusseinNo ratings yet

- BSP Circular No. 805-13: Senior Citizens Priority Lane in BSP Supervised Financial InstitutionsDocument2 pagesBSP Circular No. 805-13: Senior Citizens Priority Lane in BSP Supervised Financial InstitutionsAndrei Anne PalomarNo ratings yet