Professional Documents

Culture Documents

Problem & Solution_5_July 2018

Problem & Solution_5_July 2018

Uploaded by

Mohammed Shihab UddinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem & Solution_5_July 2018

Problem & Solution_5_July 2018

Uploaded by

Mohammed Shihab UddinCopyright:

Available Formats

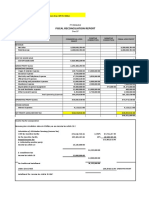

X Limited

TIN: ----------------------

Income Year: 2017-2018

Assessment Year: 2018-2019

Taka Taka

Net Profit as per audited accounts 1,012,920

Adjustments for subsequent/separate consideration

Add: Accounting depreciation 1,114,460

2,127,380

Adjustments for statutory disallowances and allowances

Deduct: Tax depreciation 998,611

Business income 1,128,769

Add: Income from other Sources (inadmissible portion of car price) 139,168

Taxable income 1,267,937

Net Tax Liability

i) Income tax comes @35% 152,152

ii) Tax deducted at source .60% by bank on Export proceeds Minimum tax @.60% 363,021

on Tk. 60,503,530 which is subject to minimum tax

Minimum tax liability comes lower of actual tax liability, therefore, actual tax 363,021

liability

Less : - Advance tax paid by the company

- Tax deducted at source by the bank on export proceed 363,020

Tax payable -

Notes:

Paid-up capital & accumulated profit 24,216,650

Allowable: 10% on Paid-up capital & accumulated profit 2,421,665

Purchase value of car 2,700,000

Difference (Purchase value - allowable limit) 278,335

50% of difference value to be added as income from other sources 139,168

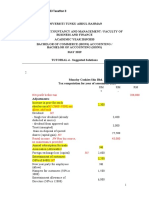

Income Tax Assessment Order of

Jupiter Limited

TIN: ----------------------

Income Year: 2017-2018

Assessment Year: 2018-2019

Taka Taka

Net Profit as per audited accounts 7,233,000

Adjustments for subsequent/separate consideration

Deduct: Non business income

Interest on FDR 200,000 200,000

7,033,000

Add: Expenses charged to Statement of Comprehensive Income

Accounting depreciation 1,870,500

Entertainment 412,370 2,282,870

9,315,870

Adjustments for statutory disallowances and allowances

Add: Inadmissible Expenses incurred

Salary for machinary instalation being capital expenses (100,000x4) 400,000

Professional expenses 50,000

Share money depositeed in cash 120,000 570,000

9,885,870

Deduct: Expenses admissible as per ITO

Tax depreciation 1,690,650

1,690,650

Income from business and revenue gain before entertainment 7,625,220

Less: Admissible entertainment 172,504

Total Income from business after consideration of entertainment 7,452,716

Tax Liability

i) Income tax comes @25% 1,863,179

ii) Minimum tax @.60% on gross receiprs of Taka 107,885,390 which is subject to 647,312

minimum tax

Minimum tax liability comes lower of actual tax liability, therefore, actual tax 1,863,179

liability

Add:

Penalty for late submission of tax @ 10% on tax imposed on the year 274,037

Continuing default penalty 2,200

Tax payable for the year including penalty 2,139,416

Less : - Advance tax paid by the company during the year 1,720,000

Tax recoverable after consideration of advance tax 419,416

Notes:

* Foreign tour expenses Taka 50,000 is within the ceiling

(1% on Sale of Taka 107,865,390 comes Taka 1,078,654) 1,078,654

* Preofessional fee paid 250,000

Tax paid proportonate to the fee (20,000x10) 200,000

Tax not deducted on professional fee of Taka 50,000

* Entertainment allowable 4% 1,000,000 40,000

2% 6,625,220 132,504

7,625,220 172,504

* Gross receipts (107,685,390+200,000)=1107,885,390

* Penalty for late submission of tax return for the year

Penalty for late submission of return @10% of tax imposed on last assessed income 274,037

(Previous year's total tax payable was Taka 2,740,370)

* Continuing default penalty

Last submission date was 15 January 2018 but submitted on 28 February 2018 44 days

Penalty for continuing default per day Taka 50 2,200

You might also like

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- ch04 PDFDocument4 pagesch04 PDFMosharraf HussainNo ratings yet

- Business Examples 2021Document12 pagesBusiness Examples 2021Faizan HyderNo ratings yet

- ICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationDocument6 pagesICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationmuhammadislamkhanNo ratings yet

- International Financial Management - Assignment 1Document2 pagesInternational Financial Management - Assignment 1Ziroat ToshevaNo ratings yet

- Wlatham SolutionDocument3 pagesWlatham Solutionadi_santhi100% (7)

- Tax Performance and Tax EfficiencyDocument44 pagesTax Performance and Tax EfficiencyJR Consultancy100% (1)

- Salient Features of Payment of Bonus Act 1965 PDFDocument3 pagesSalient Features of Payment of Bonus Act 1965 PDFMab Mughal0% (1)

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- CamEd Business School - (Revised) Exam Paper For Dec 2023 (Answers) - 19 December 2023Document9 pagesCamEd Business School - (Revised) Exam Paper For Dec 2023 (Answers) - 19 December 2023Soeung SereyvanttanaNo ratings yet

- Tax Math Solution_July-2017Document4 pagesTax Math Solution_July-2017Mohammed Shihab UddinNo ratings yet

- Carry Over Next Period (Excl. Incentive)Document5 pagesCarry Over Next Period (Excl. Incentive)Divina BidarNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Spring 2019Document7 pagesSuggested Answers Certificate in Accounting and Finance - Spring 2019Abdullah QureshiNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- Advanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Document23 pagesAdvanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Oyebisi OpeyemiNo ratings yet

- Profits Tax Computation Illustration 2023S - Suggested Answers Ver2Document2 pagesProfits Tax Computation Illustration 2023S - Suggested Answers Ver2何健珩No ratings yet

- Taxation Solution 2018 SeptemberDocument9 pagesTaxation Solution 2018 SeptemberIffah NasuhaaNo ratings yet

- Take Home Salary Calculator 1Document4 pagesTake Home Salary Calculator 1Sachin ShikotraNo ratings yet

- Assessment of Companies (Solution) : Solution 1 M/s John Morris IncDocument8 pagesAssessment of Companies (Solution) : Solution 1 M/s John Morris IncIQBALNo ratings yet

- Oho Shop CoiDocument5 pagesOho Shop CoiJAY K SHAH & ASSOCIATESNo ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- Activity On Gross Income and Allowable DeductionsDocument2 pagesActivity On Gross Income and Allowable DeductionsAkawnting MaterialsNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationDocument10 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationNarendra KumarNo ratings yet

- Revision TXDocument26 pagesRevision TXFatemah MohamedaliNo ratings yet

- Suggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Document7 pagesSuggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Muhammad Usama SheikhNo ratings yet

- Corporate Financial Reporting PDFDocument3 pagesCorporate Financial Reporting PDFIshan SharmaNo ratings yet

- Share Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessDocument17 pagesShare Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessBabu babuNo ratings yet

- TaxationsDocument12 pagesTaxationsKansal AbhishekNo ratings yet

- Income Statement PSODocument4 pagesIncome Statement PSOMaaz HanifNo ratings yet

- UNIT-4 - Income-From-BusinessDocument114 pagesUNIT-4 - Income-From-BusinessGuinevereNo ratings yet

- Problem & Solution_June 2019_FDocument3 pagesProblem & Solution_June 2019_FMohammed Shihab UddinNo ratings yet

- مادة الدراساتSlides No.2Document39 pagesمادة الدراساتSlides No.2gehad ahmedNo ratings yet

- Apex QE2012 Paper 1 Suggested Solution Question 2 CleanDocument2 pagesApex QE2012 Paper 1 Suggested Solution Question 2 CleanNicolasNo ratings yet

- AMARILODocument8 pagesAMARILOIngrid Molina GarciaNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Activity 1Document4 pagesActivity 1Louisa de VeraNo ratings yet

- Half - Prime Bank 1st ICB AMCL Mutual Fund 10-11Document1 pageHalf - Prime Bank 1st ICB AMCL Mutual Fund 10-11Abrar FaisalNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- Dizon Lands Realty and Development Corporation - 2.17.2022Document6 pagesDizon Lands Realty and Development Corporation - 2.17.2022Kervin GalangNo ratings yet

- BS 31.03.09Document11 pagesBS 31.03.09Leslie FlemingNo ratings yet

- 4 A TUTORIAL 4 AnswerDocument6 pages4 A TUTORIAL 4 AnswerLee HansNo ratings yet

- IT AY 2022-23 Probs On PGBPDocument15 pagesIT AY 2022-23 Probs On PGBPmojesnandas9935No ratings yet

- B-BTAX313 Module 3 (Revenue Cycle) - Case StudyDocument5 pagesB-BTAX313 Module 3 (Revenue Cycle) - Case Studywill passNo ratings yet

- SBM Errata Sheet 2020 - 080920Document11 pagesSBM Errata Sheet 2020 - 080920Hamza AliNo ratings yet

- Aspen Colombiana Sas (Colombia) : SourceDocument5 pagesAspen Colombiana Sas (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- Application Level Taxation II Nov Dec 2013Document3 pagesApplication Level Taxation II Nov Dec 2013MahediNo ratings yet

- Soal Accounting Interview (6330)Document3 pagesSoal Accounting Interview (6330)Yuda SuryadiNo ratings yet

- M/S Goladi Khola Multipurpose Agriculture Firm: Pokhara-33, KaskiDocument10 pagesM/S Goladi Khola Multipurpose Agriculture Firm: Pokhara-33, KaskiMadhav Prasad KadelNo ratings yet

- Payslip India April - 2023Document3 pagesPayslip India April - 2023RAJESH DNo ratings yet

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashNo ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- Salary and Wages 940,000 Gross Profit 2,600,000 Rent Expense 200,000 Gain On Sale of Building (Note-1) 100,000Document5 pagesSalary and Wages 940,000 Gross Profit 2,600,000 Rent Expense 200,000 Gain On Sale of Building (Note-1) 100,000Samia AkterNo ratings yet

- 2019 Audited Financial Statements - Diamond Quest Marketing CorporationDocument4 pages2019 Audited Financial Statements - Diamond Quest Marketing CorporationJan Gavin GoNo ratings yet

- Current Assets, Loan & AdvancesDocument7 pagesCurrent Assets, Loan & AdvancesRamHari AdhikariNo ratings yet

- Taxation Solution 2017 SeptemberDocument11 pagesTaxation Solution 2017 Septemberzezu zazaNo ratings yet

- Hartalega Holdings Berhad (Malaysia) : Source: - WVB - Financial Standard For Industrial CompaniesDocument6 pagesHartalega Holdings Berhad (Malaysia) : Source: - WVB - Financial Standard For Industrial CompaniesJUWAIRIA BINTI SADIKNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- United Bank Limited and Its Subsidiary CompaniesDocument15 pagesUnited Bank Limited and Its Subsidiary Companieszaighum sultanNo ratings yet

- Examiner Comments-Summer 2017Document12 pagesExaminer Comments-Summer 2017Mahendar BhojwaniNo ratings yet

- Income-Taxation CompressDocument27 pagesIncome-Taxation CompressRochel Ada-olNo ratings yet

- BRS EnterprisesDocument17 pagesBRS EnterprisesgpdharanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Partnership Operations: QuizDocument8 pagesPartnership Operations: QuizLee SuarezNo ratings yet

- Final RevisionDocument7 pagesFinal RevisionNhu Le ThaoNo ratings yet

- HW On Equity Securities CDocument3 pagesHW On Equity Securities CCha PampolinaNo ratings yet

- Iuhd wp6 Evaluation of Public Sector Low Income PDFDocument19 pagesIuhd wp6 Evaluation of Public Sector Low Income PDFGurpal kaurNo ratings yet

- Learning Resource 11 Jerald Jay CatacutanDocument8 pagesLearning Resource 11 Jerald Jay CatacutanRemedios Capistrano CatacutanNo ratings yet

- Strong TieDocument21 pagesStrong TieLaiba SaleemNo ratings yet

- Consumer Behaviour Notes Unit 1 & 2Document20 pagesConsumer Behaviour Notes Unit 1 & 2hiralpatel3085100% (3)

- Reddy Finally ReportDocument71 pagesReddy Finally ReportShivareddyNo ratings yet

- Chapter-9-FM Quiz 6Document9 pagesChapter-9-FM Quiz 6Cheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Valuation Report: Submitted byDocument32 pagesValuation Report: Submitted byUtsab GautamNo ratings yet

- What Is A BudgetDocument7 pagesWhat Is A BudgetMichaelNo ratings yet

- Attachment Test 8Document54 pagesAttachment Test 8piyushkumar151No ratings yet

- 2 PercentageDocument26 pages2 Percentageabhishekchauhan0096429No ratings yet

- BCom Income Tax Procedure and PracticeDocument61 pagesBCom Income Tax Procedure and PracticeUjjwal Kandhawe100% (1)

- EconomicDocument32 pagesEconomicSeyiNo ratings yet

- Peltzman 1973 - Government Subsidies Higher Education JPEDocument28 pagesPeltzman 1973 - Government Subsidies Higher Education JPERenato Paul FlorianNo ratings yet

- Consolidated Digest of Case Laws January 2022 To December 2022Document1,073 pagesConsolidated Digest of Case Laws January 2022 To December 2022Pawan KapoorNo ratings yet

- Financial Analyst Assessment of Company Earnings Quality: Robert Bricker" Previts Robinson Stephen YoungDocument14 pagesFinancial Analyst Assessment of Company Earnings Quality: Robert Bricker" Previts Robinson Stephen Youngmelly amaliaNo ratings yet

- Audit of Liabilities Answer KeyDocument2 pagesAudit of Liabilities Answer KeyLyca MaeNo ratings yet

- Realecon TerminologiesDocument21 pagesRealecon TerminologiesilhoonieNo ratings yet

- 13-B Income Distribution Made by Taxable Estates or Trusts IllustrationDocument27 pages13-B Income Distribution Made by Taxable Estates or Trusts IllustrationSheilamae Sernadilla GregorioNo ratings yet

- Mathematics of Investments - Ordinary Simple AnnuitiesDocument2 pagesMathematics of Investments - Ordinary Simple AnnuitiesBrando MoloNo ratings yet

- Name: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2Document3 pagesName: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2うん こ100% (1)

- 2010 06 24 - 172141 - P3 3aDocument4 pages2010 06 24 - 172141 - P3 3aVivian0% (1)

- CH - 2.1 Concept of Proverty and Various Estimation CommitteeDocument24 pagesCH - 2.1 Concept of Proverty and Various Estimation CommitteejyottsnaNo ratings yet

- Bmath g12Document31 pagesBmath g12yediNo ratings yet