Professional Documents

Culture Documents

dev- taxation- new

dev- taxation- new

Uploaded by

Dev0 ratings0% found this document useful (0 votes)

2 views2 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views2 pagesdev- taxation- new

dev- taxation- new

Uploaded by

DevCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

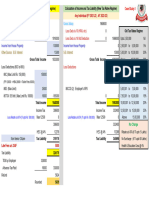

PARTICULARS Amount Rs.

income from business

Add Gift from Ex-wife

Winning from lotteries 1900000 comapy will deduct TDS and so it is charged separately

gift to wife not taxable

gross taxable income (a)

0 to 250,000 NIL

250,000 to 500,000=250,000* 5%

500000 to 750000= 250000*15%

1000000 to 1250000=250000* 20%

1250000 to 1500000= 250000 *25

1500000 to 8100000=6600000 *30%

total income tax

add surge 10%

total income tax payable

AS in the new regime the IT is less than old regime

so we will go fro new tax regime which will save 22,000

Amount RS.

7,500,000

600,000

8,100,000

NIL

12,500

37,500

50,000

62,500

1,980,000

2,167,500

216,750

2,384,250

You might also like

- Quiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSDocument5 pagesQuiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSHunternotNo ratings yet

- Income Tax - Corporations Sample Problems: SolutionsDocument12 pagesIncome Tax - Corporations Sample Problems: SolutionsYellow BelleNo ratings yet

- Business Taxation SolutionDocument3 pagesBusiness Taxation SolutionBillie MatchocaNo ratings yet

- Financial Planning: Alqaab Arshad Amish Bhalla ShawezDocument6 pagesFinancial Planning: Alqaab Arshad Amish Bhalla ShawezAlqaab ArshadNo ratings yet

- Tax CalculatorDocument3 pagesTax CalculatorAbhi RamachandranNo ratings yet

- Calculate TaxDocument8 pagesCalculate TaxPhilipp WiegandNo ratings yet

- Tax Slabs: Ca. Dipayan DasDocument4 pagesTax Slabs: Ca. Dipayan DasNoob GamerNo ratings yet

- Problems and Solutions On Advance Tax: Problem No. 1Document8 pagesProblems and Solutions On Advance Tax: Problem No. 1NishantNo ratings yet

- CS Executive Tax Laws Amendments by Vipul ShahDocument41 pagesCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNo ratings yet

- Assingment 1 Payroll TheoryDocument15 pagesAssingment 1 Payroll TheoryJenmark John JacolbeNo ratings yet

- Income TAX: Particular Case 1 Case 2Document15 pagesIncome TAX: Particular Case 1 Case 2Shekh SalmanNo ratings yet

- Salary - Tax CalculatorDocument7 pagesSalary - Tax CalculatorsonamNo ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- OldvsnewDocument2 pagesOldvsnewda MNo ratings yet

- Trần Hoài Anh Hs150639 Ib1602Document3 pagesTrần Hoài Anh Hs150639 Ib1602Vũ Nhi AnNo ratings yet

- Sols-Dr RajniDocument5 pagesSols-Dr Rajnialex breymannNo ratings yet

- Income Tax FY 2020-21-2Document25 pagesIncome Tax FY 2020-21-2umeshapkNo ratings yet

- Ques. Defered TaxDocument40 pagesQues. Defered TaxKALYANI JAYAKRISHNAN 2022155No ratings yet

- Presented by Archana Gupta 0221031 Bharat Gaikwad 0221023Document12 pagesPresented by Archana Gupta 0221031 Bharat Gaikwad 0221023Bharat GaikwadNo ratings yet

- Computation Taxable Income: SolutionDocument10 pagesComputation Taxable Income: SolutionHoorNo ratings yet

- Computation Taxable Income: SolutionDocument10 pagesComputation Taxable Income: SolutionHoorNo ratings yet

- Sec. 24 NircDocument17 pagesSec. 24 NircCharie Mae YdNo ratings yet

- Choose Your Tax RegimeDocument3 pagesChoose Your Tax Regimejanesh singhNo ratings yet

- O LEVEL TAXATION WORK FinalDocument23 pagesO LEVEL TAXATION WORK FinaljaycyakimawisemusicNo ratings yet

- AFM IBSB Leverages WordDocument16 pagesAFM IBSB Leverages WordSangeetha K SNo ratings yet

- Individuals Assign3Document7 pagesIndividuals Assign3jdNo ratings yet

- Income-Tax Rates Under The New Tax Regime V/s The Old Tax RegimeDocument2 pagesIncome-Tax Rates Under The New Tax Regime V/s The Old Tax Regimeharish vNo ratings yet

- Income Tax TableDocument6 pagesIncome Tax TableMarian's PreloveNo ratings yet

- Section TWO 2024Document5 pagesSection TWO 2024basuonyshowNo ratings yet

- 1.1.1 Tax On Income From Employment / Personal Income Tax: Direct TaxesDocument6 pages1.1.1 Tax On Income From Employment / Personal Income Tax: Direct TaxesGetu WeyessaNo ratings yet

- Jan To Jul 2022 Tax TablesDocument1 pageJan To Jul 2022 Tax Tablesgracia murevanemweNo ratings yet

- Digital Marketing AssignmentDocument3 pagesDigital Marketing Assignmentsourajit kunduNo ratings yet

- Sol 1Document1 pageSol 1alex breymannNo ratings yet

- Tax Reform Acceleration and InclusionDocument28 pagesTax Reform Acceleration and InclusionWilliam Alexander Matsuhara AlegreNo ratings yet

- Fabm2 Q2 W4 5Document8 pagesFabm2 Q2 W4 5maeesotoNo ratings yet

- How To Save Tax For Salary Above 20 LakhsDocument12 pagesHow To Save Tax For Salary Above 20 LakhsvijaytechskillupgradeNo ratings yet

- Income Tax Calculator FY 2023 24 Age Below 60 YearsDocument4 pagesIncome Tax Calculator FY 2023 24 Age Below 60 YearsRrrNo ratings yet

- Pakistan Salary Income Tax Calculator Tax Year 2021 2022Document4 pagesPakistan Salary Income Tax Calculator Tax Year 2021 2022Kashif NiaziNo ratings yet

- LO 7 - Explain The Effect of Various Tax Rates and Tax Rate Changes On Deferred Income TaxesDocument52 pagesLO 7 - Explain The Effect of Various Tax Rates and Tax Rate Changes On Deferred Income TaxesMhamza KarachiNo ratings yet

- Ecu - 08606 Lecture 5Document23 pagesEcu - 08606 Lecture 5DanielNo ratings yet

- RTGS 2022 August-December 2022 Tax TablesDocument1 pageRTGS 2022 August-December 2022 Tax TablesTinovimba MawoyoNo ratings yet

- Income Tax ExercisesDocument3 pagesIncome Tax ExercisesLaguna HistoryNo ratings yet

- .Apr 2022Document10 pages.Apr 2022SWAPNIL JADHAVNo ratings yet

- R2.TAXML Solution CMA September 2022 Exam.Document5 pagesR2.TAXML Solution CMA September 2022 Exam.Raziur RahmanNo ratings yet

- 1 BTAXREV Week 2 Income TaxationDocument48 pages1 BTAXREV Week 2 Income TaxationgatotkaNo ratings yet

- Orca Share Media1540033147945Document17 pagesOrca Share Media1540033147945Melady Sison CequeñaNo ratings yet

- Finals Exam SolutionsDocument6 pagesFinals Exam SolutionsZhengzhou CalNo ratings yet

- Answer 1Document5 pagesAnswer 1mayetteNo ratings yet

- Chapter 2 SolutionsDocument5 pagesChapter 2 SolutionskendozxNo ratings yet

- Union Budget-2020-21 New Tax Rates Vs Existing Tax Rates For IndividualDocument2 pagesUnion Budget-2020-21 New Tax Rates Vs Existing Tax Rates For IndividualCA Upendra Singh ThakurNo ratings yet

- WorkingDocument4 pagesWorkingHaresh RajputNo ratings yet

- Solution 15 To 21Document9 pagesSolution 15 To 21pratham kannanNo ratings yet

- Higher SkillsDocument14 pagesHigher SkillsArun ThomasNo ratings yet

- Only Fill Yellow Cells: WorkingsDocument2 pagesOnly Fill Yellow Cells: WorkingsvikrammoolchandaniNo ratings yet

- Latest Income Tax Slabs - Fundfolio by Sharique SamsudheenDocument1 pageLatest Income Tax Slabs - Fundfolio by Sharique SamsudheensalmanNo ratings yet

- Chapter 11 TaxDocument11 pagesChapter 11 Taxkp_popinjNo ratings yet

- Areesha Shakeel Fa18-Baf-002 Please Determined Tax Liability On Taxable Income For The Tax Year 2020 in Following CasesDocument2 pagesAreesha Shakeel Fa18-Baf-002 Please Determined Tax Liability On Taxable Income For The Tax Year 2020 in Following CasesLaiba TufailNo ratings yet

- 12 - Income Taxation For Individual (Illustrations)Document3 pages12 - Income Taxation For Individual (Illustrations)Allan SantosNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- ITM PROJECT (2) (1)Document19 pagesITM PROJECT (2) (1)DevNo ratings yet

- Channel Evaluation MeasureDocument4 pagesChannel Evaluation MeasureDevNo ratings yet

- patro exam 13-7Document117 pagespatro exam 13-7DevNo ratings yet

- Dar Solved AnsDocument20 pagesDar Solved AnsDevNo ratings yet

- Boarding Pass (BLR-BBI)Document1 pageBoarding Pass (BLR-BBI)DevNo ratings yet

- Questions PDFDocument9 pagesQuestions PDFDevNo ratings yet

- Green MeasuresDocument1 pageGreen MeasuresDevNo ratings yet

- Boarding Pass (BLR BBI)Document1 pageBoarding Pass (BLR BBI)DevNo ratings yet

- MC Digital Banking Exec Sum En-1Document27 pagesMC Digital Banking Exec Sum En-1DevNo ratings yet

- Boarding Pass (BLR-BBI)Document1 pageBoarding Pass (BLR-BBI)DevNo ratings yet

- Parameters Units Value C (I) Green LeadershipDocument6 pagesParameters Units Value C (I) Green LeadershipDevNo ratings yet

- Internship Certificate1Document1 pageInternship Certificate1DevNo ratings yet

- Organization Theory: Case Study: Shaking Up ExxonDocument11 pagesOrganization Theory: Case Study: Shaking Up ExxonDevNo ratings yet

- Compliance & ReportingDocument1 pageCompliance & ReportingDevNo ratings yet

- Green Leadership:: Sustainability Policy: Designated CSO & Sustainability GroupDocument1 pageGreen Leadership:: Sustainability Policy: Designated CSO & Sustainability GroupDevNo ratings yet

- ROYAL Enfield Report Latest-1Document12 pagesROYAL Enfield Report Latest-1Dev100% (1)