Professional Documents

Culture Documents

031 VI Neelkanth

031 VI Neelkanth

Uploaded by

Shri Ram Cyber CafeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

031 VI Neelkanth

031 VI Neelkanth

Uploaded by

Shri Ram Cyber CafeCopyright:

Available Formats

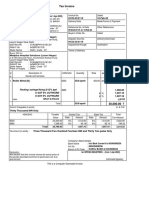

VASU ENTERPRISE

GSTIN NO:- 09ESEPK4170D1ZT CONTACT NO:-+919160112174

Tax Invoice

Invoice No : VS/VI/24-25/031

Invoice date : 11.07.2024

Reverse Charge (Y/N) : N

State : Uttar Pradesh Code 09

Details of receiver - Bill to Details of Consignee

Name : Neelkanth Infrastructures Name : Neelkanth Infrastructures

Address : Varanasi Mob-9554999900 Address : Varanasi Mob-9554999900

Varanasi Mode of Transportation : Vehicle NO :

GSTIN : 09HCDPD7127R1ZT GSTIN : 09HCDPD7127R1ZT

State : UTTAR PRADESH Code 09 State : UTTAR PRADESH Code 09

S.

Product Description HSN/SAC code Qty(Nos) Rate Amount Taxable Value

No.

1 Vacuum interrupter 8535/8538 4.00 6300.00 25200.00 25,200.00

2 Transportation 1.00 500.00 500.00 500.00

Total Invoice amount in words : Total Amount before Tax(A) 25,700.00

Add: SGST 9%(B) 2,313.00

Thrity Thousand Three Hundred Twenty Six only Add: CGST 9%(C) 2,313.00

Total Amount {D=(A+B+C)} 30,326.00

HSN/SAC Taxable Value State Tax @9% Central Tax @9% Inter State Tax @18% Advance paid(E) -

Rate Amount Rate Amount Rate Amount Net Payble Amount{ F=(C-D)} 30,326.00

25,200.00

9% 2,313.00 9% 2,313.00 18% -

Bank Details

Bank : ICICI BANK LIMITED

Account No. : 256605500269

Bank IFSC Code : ICIC0002566

Terms & conditions

Ceritified that the particulars given above are

true and correct

ADVANCE

FOR Vasu Enterprises.

Buyer-TESTING HOUSE

Name-

Seal-

Common Seal Authorised signatory

Address:-Sub Health Center, 0, Unnamed Road, Bhatpura, Auraiya, Uttar Pradesh, 206244

E mail-vasuenterpriseankit@gmail.com

You might also like

- JCB 191 Bill Bidkin June 19Document1 pageJCB 191 Bill Bidkin June 19arjun dalvi0% (1)

- Circular Flow Model WorksheetDocument2 pagesCircular Flow Model Worksheetapi-320972635No ratings yet

- Testing HouseDocument1 pageTesting HouseShri Ram Cyber CafeNo ratings yet

- 030 Testing HouseDocument1 page030 Testing HouseShri Ram Cyber CafeNo ratings yet

- Tax Invoice: F-14, Ground Floor, Sector-9, Noida-201301 GSTIN/UIN: 09ABCCS0954K1Z2 State Name: Uttar Pradesh, Code: 09Document1 pageTax Invoice: F-14, Ground Floor, Sector-9, Noida-201301 GSTIN/UIN: 09ABCCS0954K1Z2 State Name: Uttar Pradesh, Code: 09VIDYANAND THAKURNo ratings yet

- RealmeDocument1 pageRealmePíyûshGuptaNo ratings yet

- Jai Hanuman Cement Non Trade SPCDocument3 pagesJai Hanuman Cement Non Trade SPCFuturetech IncorporationNo ratings yet

- PISRVAS22230233Document1 pagePISRVAS22230233Rahul BajiNo ratings yet

- United India Insurance Company Limited: Ms Sahasareddy Filling StationDocument3 pagesUnited India Insurance Company Limited: Ms Sahasareddy Filling StationchandraNo ratings yet

- Tax Credit Certificate On Supplies: For General Tax Questions Call Our Toll Free 0800117000 or Log Onto URA Web PortalDocument1 pageTax Credit Certificate On Supplies: For General Tax Questions Call Our Toll Free 0800117000 or Log Onto URA Web Portalmawamajid2No ratings yet

- Tax Invoice: F-14, Ground Floor, Sector-9, Noida-201301 GSTIN/UIN: 09ABCCS0954K1Z2 State Name: Uttar Pradesh, Code: 09Document1 pageTax Invoice: F-14, Ground Floor, Sector-9, Noida-201301 GSTIN/UIN: 09ABCCS0954K1Z2 State Name: Uttar Pradesh, Code: 09VIDYANAND THAKURNo ratings yet

- Inv TG B1 50939724 101360733900 September 2021Document2 pagesInv TG B1 50939724 101360733900 September 2021b kranthi kumarNo ratings yet

- Broadband Bill Dec 2020Document1 pageBroadband Bill Dec 2020Irfan AzmiNo ratings yet

- GST Bill Format in ExcelDocument184 pagesGST Bill Format in Excelkrishna chaitanyaNo ratings yet

- Syno Pumps November-23 InvoiceDocument2 pagesSyno Pumps November-23 InvoiceShivansh PatelNo ratings yet

- Om Polymers Tax InvoiceDocument1 pageOm Polymers Tax InvoiceAkash DeriaNo ratings yet

- Om Polymers Tax Invoice Aug 2022Document1 pageOm Polymers Tax Invoice Aug 2022Akash DeriaNo ratings yet

- Samsung Invoice 11105923647-7144234991-27W6I0014459Document1 pageSamsung Invoice 11105923647-7144234991-27W6I0014459Abhinav ShrivastavaNo ratings yet

- ST SupO 3069 2022 23 193255Document1 pageST SupO 3069 2022 23 193255Rajat SharmaNo ratings yet

- RakhiDocument1 pageRakhihardeepcok123No ratings yet

- Invoice 02-ITC MugalDocument1 pageInvoice 02-ITC Mugalinnova.ecsNo ratings yet

- Tax Invoice: F-14, Ground Floor, Sector-9, Noida-201301 GSTIN/UIN: 09ABCCS0954K1Z2 State Name: Uttar Pradesh, Code: 09Document1 pageTax Invoice: F-14, Ground Floor, Sector-9, Noida-201301 GSTIN/UIN: 09ABCCS0954K1Z2 State Name: Uttar Pradesh, Code: 09VIDYANAND THAKURNo ratings yet

- Invoice 7120075281Document1 pageInvoice 7120075281kaku131295No ratings yet

- Telephone Number Amount Payable Due Date: Pay NowDocument3 pagesTelephone Number Amount Payable Due Date: Pay NowIT Team ParkAMRCNo ratings yet

- Shree Jee Textile-01Document1 pageShree Jee Textile-01kshitijchaturvedi265No ratings yet

- Mushak: 6.3: Details of Registered PersonDocument1 pageMushak: 6.3: Details of Registered PersonAnonymous ZGcs7MwsLNo ratings yet

- Xplore (Pre-Post) - XP: Mushak: 6.3Document2 pagesXplore (Pre-Post) - XP: Mushak: 6.3MST FIROZA BEGUMNo ratings yet

- No:-0013826418 - Issue Date 10.09.2020: Alliance Broadband Services Pvt. LTDDocument1 pageNo:-0013826418 - Issue Date 10.09.2020: Alliance Broadband Services Pvt. LTDIrfan AzmiNo ratings yet

- PF Invoice - OhsDocument1 pagePF Invoice - OhsALOKE GANGULYNo ratings yet

- No:-0015560174 - Issue Date 08.03.2021: Alliance Broadband Services Pvt. LTDDocument1 pageNo:-0015560174 - Issue Date 08.03.2021: Alliance Broadband Services Pvt. LTDAbignale VostroeNo ratings yet

- 33s6i0016289Document1 page33s6i0016289RakeshNo ratings yet

- NSD EnterpriseDocument1 pageNSD EnterpriseParminder SinghNo ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document4 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377far03No ratings yet

- Telephone No Amount Payable Due Date: Pay NowDocument3 pagesTelephone No Amount Payable Due Date: Pay NowJAYNo ratings yet

- No:-0019540753 - Issue Date 11.03.2022: Alliance Broadband Services Pvt. LTDDocument1 pageNo:-0019540753 - Issue Date 11.03.2022: Alliance Broadband Services Pvt. LTDShrNo ratings yet

- 2020-04-23 0012724719 590.00 PDFDocument1 page2020-04-23 0012724719 590.00 PDFAnjan MondalNo ratings yet

- C.N Enterprises: Dev Developers Regenta Place Igatpuri, Nasik RoadDocument2 pagesC.N Enterprises: Dev Developers Regenta Place Igatpuri, Nasik Roadsachin panditNo ratings yet

- BroadBand Invoice Apr 24Document1 pageBroadBand Invoice Apr 24Subhra Prakash NaskarNo ratings yet

- Accounting VoucherDocument1 pageAccounting Vouchersharvesh kumarNo ratings yet

- No:-0028017015 - Issue Date 19.04.2024: Alliance Broadband Services Pvt. LTDDocument1 pageNo:-0028017015 - Issue Date 19.04.2024: Alliance Broadband Services Pvt. LTDsubhadeepNo ratings yet

- Sep2023-Oct2023 Cab BillDocument2 pagesSep2023-Oct2023 Cab Billrajesh kumarNo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsSADASIVA MNo ratings yet

- 1242395_20220717001950_computation_2022Document16 pages1242395_20220717001950_computation_2022Jagbandhu MaharanaNo ratings yet

- Inv TN B1 33415617 103013476470 September 2021Document2 pagesInv TN B1 33415617 103013476470 September 2021Ranjith R (RS)No ratings yet

- Tax Invoice: Invoice Number G0057870 Invoice DateDocument1 pageTax Invoice: Invoice Number G0057870 Invoice DateshamNo ratings yet

- GST Invoice Format For Goods in ExcelDocument57 pagesGST Invoice Format For Goods in ExcelJugaadi BahmanNo ratings yet

- GST Invoice Format For Goods in ExcelDocument57 pagesGST Invoice Format For Goods in ExcelJugaadi BahmanNo ratings yet

- 2024-04-19_0028379899_590.00 (3)Document1 page2024-04-19_0028379899_590.00 (3)nandinidutta122011No ratings yet

- Medplus 2119Document1 pageMedplus 2119Moseen AliNo ratings yet

- Inv WBL Insha Hp0099Document4 pagesInv WBL Insha Hp0099digitalseva.japanigateNo ratings yet

- 1Document1 page1BALRAMNo ratings yet

- M/S Jai Mata Di Construction & Suppliers: Tax InvoiceDocument10 pagesM/S Jai Mata Di Construction & Suppliers: Tax InvoiceHARSHIT GUPTANo ratings yet

- PASTDocument2 pagesPASTpatel harshadNo ratings yet

- + Eldlife I: 170,000.00 Total Amount Total Amount Before Tax 170,000.00 170,000.00Document1 page+ Eldlife I: 170,000.00 Total Amount Total Amount Before Tax 170,000.00 170,000.00Kaifi asgarNo ratings yet

- Income Tax - Computation - 2021Document26 pagesIncome Tax - Computation - 2021umasankarNo ratings yet

- Samsung Invoice 11036307428-7136600186-Z9NBI0032441Document1 pageSamsung Invoice 11036307428-7136600186-Z9NBI0032441mca2k15.manitNo ratings yet

- LA0122001372967Document1 pageLA0122001372967bidda samuelNo ratings yet

- No:-1900235370 - Issue Date 24.10.2022: Alliance Broadband Services Pvt. LTDDocument1 pageNo:-1900235370 - Issue Date 24.10.2022: Alliance Broadband Services Pvt. LTDSandeep SinghNo ratings yet

- Your Reliance Bill: Summary of Current Charges Amount (RS)Document4 pagesYour Reliance Bill: Summary of Current Charges Amount (RS)Anand KumarNo ratings yet

- Alliance Broadband Services PVT LTD: Tax InvoiceDocument1 pageAlliance Broadband Services PVT LTD: Tax InvoiceacctsagarwalNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Bank of BarodaDocument81 pagesBank of BarodalovelydineshNo ratings yet

- AMEX - Glossary (ENG-SPA) - 1686735355Document8 pagesAMEX - Glossary (ENG-SPA) - 1686735355RAUL RAMIREZNo ratings yet

- Global Aviation Human Resource Management ContempoDocument15 pagesGlobal Aviation Human Resource Management ContempoYonas BEZUNo ratings yet

- Scope and RelevanceDocument8 pagesScope and RelevanceParul JainNo ratings yet

- List of Publications-Dr I.O.AzeezDocument6 pagesList of Publications-Dr I.O.AzeezIsmail AZEEZNo ratings yet

- Sibelco Environmental, Social and Governance Version 3 October 2022 SRDocument24 pagesSibelco Environmental, Social and Governance Version 3 October 2022 SRJazmin Anabella CrognaleNo ratings yet

- Samara University College of Business and Economics: Department of Management EntrepreneurshipDocument54 pagesSamara University College of Business and Economics: Department of Management Entrepreneurshipfentaw melkie100% (1)

- ProjectDocument25 pagesProjectshubham agarwalNo ratings yet

- Panaji, 11th January, 2018 (Pausa 21, 1939) : Government of GoaDocument28 pagesPanaji, 11th January, 2018 (Pausa 21, 1939) : Government of Goaks1962No ratings yet

- ScribDocument22 pagesScribNadeem ManzoorNo ratings yet

- UAS ENGLISH FOR BANKING A SRI W-DikonversiDocument9 pagesUAS ENGLISH FOR BANKING A SRI W-DikonversiRizka TajriahNo ratings yet

- SAP Standard Reports Accounts Payable NewDocument17 pagesSAP Standard Reports Accounts Payable NewDavidNo ratings yet

- NIFTY 50 Reports For The WeekDocument52 pagesNIFTY 50 Reports For The WeekDasher_No_1No ratings yet

- In The Loop (Apr-Sept 2021)Document38 pagesIn The Loop (Apr-Sept 2021)Mian SaabNo ratings yet

- Eb Lecturer Guide 1.2Document100 pagesEb Lecturer Guide 1.2Marcel JonathanNo ratings yet

- MACHETE COMPLAN UpdatedDocument30 pagesMACHETE COMPLAN UpdatedRonald MacheteNo ratings yet

- Good GovernanceDocument1 pageGood GovernanceNaveen Kumar SinghNo ratings yet

- Management Accounting II: Assignment PresentationDocument6 pagesManagement Accounting II: Assignment PresentationPui YanNo ratings yet

- CLASS 12 Economics MCQsDocument116 pagesCLASS 12 Economics MCQsJamesNo ratings yet

- Personal Time OffDocument3 pagesPersonal Time OffDaniel RhamesNo ratings yet

- 施工设计服务合同 Construction Design ContractDocument7 pages施工设计服务合同 Construction Design ContractRebi HamzaNo ratings yet

- Value Chain For Services - JournalDocument30 pagesValue Chain For Services - JournalElma Awinda UtomoNo ratings yet

- Service Tax PolicyDocument2 pagesService Tax PolicyAnimesh SahaNo ratings yet

- TIẾN ĐỘ THE ALPHA - THE 9 STELLARS - Trang Tính1Document2 pagesTIẾN ĐỘ THE ALPHA - THE 9 STELLARS - Trang Tính1Đỗ Hoàng TháiNo ratings yet

- HSBC Global Emerging Markets EM Banks JPDocument166 pagesHSBC Global Emerging Markets EM Banks JPdouglas_ferrisNo ratings yet

- 8.3: The Profitability Index Definition: The Profitability Index Is A Method To Evaluate An Investment Project. It Is TheDocument2 pages8.3: The Profitability Index Definition: The Profitability Index Is A Method To Evaluate An Investment Project. It Is ThetedyfardiansyahNo ratings yet

- Financial Accounting IIDocument189 pagesFinancial Accounting IIbest OneNo ratings yet

- Business Economics MCQDocument14 pagesBusiness Economics MCQPriti ParmarNo ratings yet

- CV en AzmirDocument2 pagesCV en AzmirSiti FirzanaNo ratings yet