Professional Documents

Culture Documents

Ac5302 Far Mst i.docx

Ac5302 Far Mst i.docx

Uploaded by

aman malhotraCopyright:

Available Formats

You might also like

- Sample Paper 2023-24Document172 pagesSample Paper 2023-24shouryayadav87267% (3)

- Assignment-1 (Eco & Actg For Engineers) Exercise - 1Document4 pagesAssignment-1 (Eco & Actg For Engineers) Exercise - 1Nayeem HossainNo ratings yet

- AC5302_FAR_MST II.docxDocument2 pagesAC5302_FAR_MST II.docxaman malhotraNo ratings yet

- AccountancyDocument32 pagesAccountancysunil kumarNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- QP CODE: 23106190: Reg No: NameDocument5 pagesQP CODE: 23106190: Reg No: NameabhijathasanthoshNo ratings yet

- Accountancy Pre Board 2Document5 pagesAccountancy Pre Board 2Akshit kumar 10 pinkNo ratings yet

- II PUC Accountancy Paper Model PaperDocument6 pagesII PUC Accountancy Paper Model PaperCommunity Institute of Management Studies100% (1)

- 63 Question PaperDocument4 pages63 Question PaperSam NayakNo ratings yet

- 943 Question PaperDocument3 pages943 Question PaperPacific TigerNo ratings yet

- Corporate Accounting & Audit Q&ADocument20 pagesCorporate Accounting & Audit Q&ACreation of MoneyNo ratings yet

- Prepration of Financial StatementsDocument35 pagesPrepration of Financial StatementsMercy GamingNo ratings yet

- Intermediate Group I Test Papers PDFDocument88 pagesIntermediate Group I Test Papers PDFkrishna PNo ratings yet

- Final Accounts - That's It BatchDocument16 pagesFinal Accounts - That's It BatchKunika PimparkarNo ratings yet

- 3562 Question PaperDocument3 pages3562 Question PaperKimberly MataruseNo ratings yet

- Accounts Home Test 2Document7 pagesAccounts Home Test 2Ashish RaiNo ratings yet

- Corporate Account IIDocument7 pagesCorporate Account IIalphadark72No ratings yet

- Dissolution of Partnership FirmDocument5 pagesDissolution of Partnership FirmDark SoulNo ratings yet

- II PU Accountancy QPDocument13 pagesII PU Accountancy QPLokesh RaoNo ratings yet

- Single Entry (Accounts From Incomplete Records)Document11 pagesSingle Entry (Accounts From Incomplete Records)hk7012004No ratings yet

- Class Test 1Document4 pagesClass Test 1vsy9926No ratings yet

- ACMA Unit 5 Problems - CFS PDFDocument3 pagesACMA Unit 5 Problems - CFS PDFPrabhat SinghNo ratings yet

- Subject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100Document5 pagesSubject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100darla85nagarajuNo ratings yet

- Paper 1Document180 pagesPaper 1Please Ok0% (1)

- Paper - 1: Principles and Practice of Accounting: © The Institute of Chartered Accountants of IndiaDocument24 pagesPaper - 1: Principles and Practice of Accounting: © The Institute of Chartered Accountants of IndiaVijayasri KumaravelNo ratings yet

- Financial Accounting PaperDocument8 pagesFinancial Accounting PaperMuhammad Naeem SharifNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- Calculation of Rebate: Particular Dr. CRDocument12 pagesCalculation of Rebate: Particular Dr. CRDennis BijuNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Processing Accounting Information: QuestionsDocument57 pagesProcessing Accounting Information: QuestionsYousifNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument29 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementPhein ArtNo ratings yet

- 250 Question PaperDocument3 pages250 Question PaperSam NayakNo ratings yet

- Financial Accounting. (Sem-1) 2017-20Document39 pagesFinancial Accounting. (Sem-1) 2017-20Rahul DasNo ratings yet

- Bba Degree CBCS Regular Business Accounting July 2022 Question PaperDocument4 pagesBba Degree CBCS Regular Business Accounting July 2022 Question PaperhafizhaleequeNo ratings yet

- 2ND Puc Accountancy QPDocument5 pages2ND Puc Accountancy QPSuhail AhmedNo ratings yet

- 1ST Sem P.Y. Acct PaperDocument30 pages1ST Sem P.Y. Acct PaperSuraj KumarNo ratings yet

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- Discussion Question #5 Solution-Table 1.0 Shows The Order of Current Assets in Terms of Liquidity (Most To Least) Current AssetsDocument7 pagesDiscussion Question #5 Solution-Table 1.0 Shows The Order of Current Assets in Terms of Liquidity (Most To Least) Current AssetsRijul DUbeyNo ratings yet

- Group Assignment - March 2020Document10 pagesGroup Assignment - March 2020Dylan Rabin PereiraNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesAttempt Any Four Questions. All Questions Carry Equal MarksVishwas Srivastava 371No ratings yet

- Piecemeal Distribution NMIMSDocument4 pagesPiecemeal Distribution NMIMSShubham ChitkaraNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- Financial Accounting: Step by StepDocument8 pagesFinancial Accounting: Step by StepPankaj PandeyNo ratings yet

- Test - Section B - Corporate AccountingDocument3 pagesTest - Section B - Corporate AccountingNathoNo ratings yet

- 4 CO4CRT11 - Corporate Accounting II (T)Document5 pages4 CO4CRT11 - Corporate Accounting II (T)emildaraisonNo ratings yet

- W-2013 Cor PDFDocument21 pagesW-2013 Cor PDFKashif NiaziNo ratings yet

- Q.P. Code: 62202: Managerial AccountingDocument6 pagesQ.P. Code: 62202: Managerial Accountinganshul bhutangeNo ratings yet

- Indian Accounting Standard 101Document19 pagesIndian Accounting Standard 101RITZ BROWNNo ratings yet

- Double SystemDocument10 pagesDouble SystemNatasha MugoniNo ratings yet

- P6 June 2023 SY23Document5 pagesP6 June 2023 SY23Shivam GuptaNo ratings yet

- Framework - QB PDFDocument6 pagesFramework - QB PDFHindutav aryaNo ratings yet

- Financial Accounting - IVDocument6 pagesFinancial Accounting - IVMadhuram SharmaNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- CO3CRT07 - Corporate Accounting I (T)Document5 pagesCO3CRT07 - Corporate Accounting I (T)shemymuhammad289No ratings yet

- CacDocument218 pagesCacFirdous QureshiNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- Accountancy QP 1 (A) 2023Document5 pagesAccountancy QP 1 (A) 2023mohammedsubhan6651No ratings yet

- Weekly Test of AccountsDocument6 pagesWeekly Test of AccountsAMIN BUHARI ABDUL KHADER100% (1)

- FR Last 4 MTPDocument98 pagesFR Last 4 MTPSHIVSHANKER AGARWALNo ratings yet

- Activity MansuetoDocument5 pagesActivity MansuetoMansueto JreysonNo ratings yet

- Solutions Manual For Corporate Financial Accounting, 16th Edition by Carl Warren, Jeff JonesDocument54 pagesSolutions Manual For Corporate Financial Accounting, 16th Edition by Carl Warren, Jeff Jonesmoeez0591No ratings yet

- Dividend Decisions Study UnitDocument25 pagesDividend Decisions Study UnitTakudzwa MashiriNo ratings yet

- Chapter 6 Financial AssetsDocument6 pagesChapter 6 Financial AssetsAngelica Joy ManaoisNo ratings yet

- PART 2 (Chapter 2, Lessons 2.1 - 2.6)Document42 pagesPART 2 (Chapter 2, Lessons 2.1 - 2.6)نيكو كورونيلNo ratings yet

- Handout Fin Man 2302Document2 pagesHandout Fin Man 2302Ranz Nikko N PaetNo ratings yet

- FinanceDocument17 pagesFinancepriyawaykar5No ratings yet

- How To Download Ebook PDF Mergers Acquisitions and Corporate Restructurings 7Th Edition Ebook PDF Docx Kindle Full ChapterDocument36 pagesHow To Download Ebook PDF Mergers Acquisitions and Corporate Restructurings 7Th Edition Ebook PDF Docx Kindle Full Chaptersteve.books604100% (30)

- Acc 108 Current LiabilitiesDocument5 pagesAcc 108 Current Liabilitiesmkrisnaharq99No ratings yet

- Saito Solar-Teaching Notes ExhibitsDocument10 pagesSaito Solar-Teaching Notes Exhibitssebastien.parmentierNo ratings yet

- Chapter 16 Acctng For GovDocument7 pagesChapter 16 Acctng For GovJustine JaymaNo ratings yet

- Valuation B and S - Q & ADocument3 pagesValuation B and S - Q & Aaaaaa aaaaaNo ratings yet

- I3 eSOLUTIONS GIS 2020REVDocument12 pagesI3 eSOLUTIONS GIS 2020REVOgie FermoNo ratings yet

- Case 4 Matapang's Repair BusinessDocument13 pagesCase 4 Matapang's Repair BusinessCobie VillenaNo ratings yet

- Law On Private Corporation (Title 4)Document10 pagesLaw On Private Corporation (Title 4)Dahyun DahyunNo ratings yet

- 3 Sources of Capital For EntrepreneurshipDocument27 pages3 Sources of Capital For EntrepreneurshipSatendra JaiswalNo ratings yet

- Conceptual FrameworkDocument13 pagesConceptual FrameworkPeter BanjaoNo ratings yet

- 6FFLK017 Exam Paper 2019 - 20Document8 pages6FFLK017 Exam Paper 2019 - 20daphnekcllawNo ratings yet

- Accounts Theory 21 Marks CTC ClassesDocument8 pagesAccounts Theory 21 Marks CTC Classeskhushalpareek8584No ratings yet

- 3 Calcul Coc Level III - 2 (Yetesera)Document6 pages3 Calcul Coc Level III - 2 (Yetesera)rabbirraabullooNo ratings yet

- Assignment 3-Cap Budget-Cap Structure-Val-Student Version SP 2024Document15 pagesAssignment 3-Cap Budget-Cap Structure-Val-Student Version SP 2024salehaiman2019No ratings yet

- Basic Reconciliation StatementsDocument41 pagesBasic Reconciliation StatementsBeverly EroyNo ratings yet

- BigTech Analysis - Example AnswerDocument22 pagesBigTech Analysis - Example AnswerÚdita ShNo ratings yet

- Quiz Corporate LiquidationDocument4 pagesQuiz Corporate LiquidationCarmella DismayaNo ratings yet

- Chapter 2 Tutorial QuestionsDocument3 pagesChapter 2 Tutorial Questionssaule.yesbayevaNo ratings yet

- Igcse o Level Frankwoods Business Accounting 1 by Frank Wood Alan SangsterDocument2 pagesIgcse o Level Frankwoods Business Accounting 1 by Frank Wood Alan SangsterNasir AliNo ratings yet

- 11th Accountancy EM Book Back 1 Mark Questions 1 English Medium PDF DownloadDocument38 pages11th Accountancy EM Book Back 1 Mark Questions 1 English Medium PDF Downloadlnandhini023No ratings yet

- 2015 Audited Financial ReportDocument60 pages2015 Audited Financial ReportoyunnominNo ratings yet

Ac5302 Far Mst i.docx

Ac5302 Far Mst i.docx

Uploaded by

aman malhotraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ac5302 Far Mst i.docx

Ac5302 Far Mst i.docx

Uploaded by

aman malhotraCopyright:

Available Formats

Roll Number: ________________

Thapar Institute of Engineering & Technology

Deemed-to-be-University, Patiala (Derabassi Campus)

L M Thapar School of Management

Mid Semester Test I

MBA (I Semester) Subject: Financial Accounting and Reporting (AC5302)

Time: 1.0 hour; Max. Marks: 15 Faculty: Dr. Pradeep Kumar Gupta

Instructions:

1. Attempt all questions. Marks are indicated against each question.

2. Answering the questions in sequences either ascending or descending order is required

compulsorily. The penalty of five marks in total score is levied if it is not followed.

3. Use of calculator is allowed.

4. Working notes should form a part of your answers.

5. To the point answers of theoretical questions are expected.

6. No clarifications should be sought during the exam. The appropriate assumptions can be

written in case of doubt in any question.

7. Very neat and clean answers are desirable.

Q1:

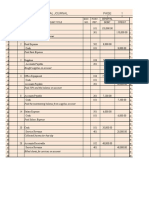

a. Identify the category (Non-current assets, Current assets, Current Liabilities, Non-current

Liabilities, Equity, and Reversals) of each Account balance appeared in the books of ABC Ltd. as

on 31.03.2019. (3)

S. No. Particulars Dr. Balances Cr. Balances

Amount (₹ in Lakhs) Amount (₹ in Lakhs)

1 Equity Share Capital 50.00

2 Term Loan 30.00

3 Long-Term Investment 1.00

4 Fixed assets 15.00

5 Sundry creditors 7.20

6 Purchases 7.65

7 Purchases returns 0.65

8 Sales 70.70

9 Cash in Hand 0.72

10 Cash in Bank 120.55

11 Sales returns 2.00

12 Discount Allowed 2.70

13 Rent paid 5.00

14 Debtors 15.70

15 Discount Received 0.27

16 Salaries & Wages 3.00

17 Bad debts 1.00

18 Insurance 7.00

19 Commission Earned 10.00

20 Deposits from Public 20.00

1 | Page AC5302: Financial Accounting and Reporting QPSet-2

21 Advertising expense 6.00

22 Interest expense 1.50

b. Ms. P Smith commenced a business on 31st January 2019 by transferring ₹5000 as capital from

her personal bank account into the business bank account opened on the same date. (3)

During the first week of February 2019 the following transactions occurred:

February 1: Business bought a motor van costing ₹800 paying by Cheque

February 2: Business bought goods on account from

J Jones ₹400

E Holmes ₹250

February 3: The goods costing ₹400 were sold for cash ₹600

February 4: Paid J Jones ₹400 in cash

February 5: Business again bought goods on account from

J Jones ₹200

A Turner ₹300

You are required to show the accounting equation at the end of each day’s transactions.

Q2:

a. Write the debit and credit rules of Assets, Liabilities and Equity. (2)

b. Why accounting is not done on cash basis? (2)

Q3:

a. Explain one of the recognition criteria of elements of financial statements - “the item

meeting the definition of an element has a cost or value that can be measured with

reliability”. (3)

b. Define the elements (Incomes and Expenses) directly related to the measurement of financial

performance, profit or loss, of a company. (2)

-------------x----------

2 | Page AC5302: Financial Accounting and Reporting QPSet-2

You might also like

- Sample Paper 2023-24Document172 pagesSample Paper 2023-24shouryayadav87267% (3)

- Assignment-1 (Eco & Actg For Engineers) Exercise - 1Document4 pagesAssignment-1 (Eco & Actg For Engineers) Exercise - 1Nayeem HossainNo ratings yet

- AC5302_FAR_MST II.docxDocument2 pagesAC5302_FAR_MST II.docxaman malhotraNo ratings yet

- AccountancyDocument32 pagesAccountancysunil kumarNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- QP CODE: 23106190: Reg No: NameDocument5 pagesQP CODE: 23106190: Reg No: NameabhijathasanthoshNo ratings yet

- Accountancy Pre Board 2Document5 pagesAccountancy Pre Board 2Akshit kumar 10 pinkNo ratings yet

- II PUC Accountancy Paper Model PaperDocument6 pagesII PUC Accountancy Paper Model PaperCommunity Institute of Management Studies100% (1)

- 63 Question PaperDocument4 pages63 Question PaperSam NayakNo ratings yet

- 943 Question PaperDocument3 pages943 Question PaperPacific TigerNo ratings yet

- Corporate Accounting & Audit Q&ADocument20 pagesCorporate Accounting & Audit Q&ACreation of MoneyNo ratings yet

- Prepration of Financial StatementsDocument35 pagesPrepration of Financial StatementsMercy GamingNo ratings yet

- Intermediate Group I Test Papers PDFDocument88 pagesIntermediate Group I Test Papers PDFkrishna PNo ratings yet

- Final Accounts - That's It BatchDocument16 pagesFinal Accounts - That's It BatchKunika PimparkarNo ratings yet

- 3562 Question PaperDocument3 pages3562 Question PaperKimberly MataruseNo ratings yet

- Accounts Home Test 2Document7 pagesAccounts Home Test 2Ashish RaiNo ratings yet

- Corporate Account IIDocument7 pagesCorporate Account IIalphadark72No ratings yet

- Dissolution of Partnership FirmDocument5 pagesDissolution of Partnership FirmDark SoulNo ratings yet

- II PU Accountancy QPDocument13 pagesII PU Accountancy QPLokesh RaoNo ratings yet

- Single Entry (Accounts From Incomplete Records)Document11 pagesSingle Entry (Accounts From Incomplete Records)hk7012004No ratings yet

- Class Test 1Document4 pagesClass Test 1vsy9926No ratings yet

- ACMA Unit 5 Problems - CFS PDFDocument3 pagesACMA Unit 5 Problems - CFS PDFPrabhat SinghNo ratings yet

- Subject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100Document5 pagesSubject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100darla85nagarajuNo ratings yet

- Paper 1Document180 pagesPaper 1Please Ok0% (1)

- Paper - 1: Principles and Practice of Accounting: © The Institute of Chartered Accountants of IndiaDocument24 pagesPaper - 1: Principles and Practice of Accounting: © The Institute of Chartered Accountants of IndiaVijayasri KumaravelNo ratings yet

- Financial Accounting PaperDocument8 pagesFinancial Accounting PaperMuhammad Naeem SharifNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- Calculation of Rebate: Particular Dr. CRDocument12 pagesCalculation of Rebate: Particular Dr. CRDennis BijuNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Processing Accounting Information: QuestionsDocument57 pagesProcessing Accounting Information: QuestionsYousifNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument29 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementPhein ArtNo ratings yet

- 250 Question PaperDocument3 pages250 Question PaperSam NayakNo ratings yet

- Financial Accounting. (Sem-1) 2017-20Document39 pagesFinancial Accounting. (Sem-1) 2017-20Rahul DasNo ratings yet

- Bba Degree CBCS Regular Business Accounting July 2022 Question PaperDocument4 pagesBba Degree CBCS Regular Business Accounting July 2022 Question PaperhafizhaleequeNo ratings yet

- 2ND Puc Accountancy QPDocument5 pages2ND Puc Accountancy QPSuhail AhmedNo ratings yet

- 1ST Sem P.Y. Acct PaperDocument30 pages1ST Sem P.Y. Acct PaperSuraj KumarNo ratings yet

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- Discussion Question #5 Solution-Table 1.0 Shows The Order of Current Assets in Terms of Liquidity (Most To Least) Current AssetsDocument7 pagesDiscussion Question #5 Solution-Table 1.0 Shows The Order of Current Assets in Terms of Liquidity (Most To Least) Current AssetsRijul DUbeyNo ratings yet

- Group Assignment - March 2020Document10 pagesGroup Assignment - March 2020Dylan Rabin PereiraNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesAttempt Any Four Questions. All Questions Carry Equal MarksVishwas Srivastava 371No ratings yet

- Piecemeal Distribution NMIMSDocument4 pagesPiecemeal Distribution NMIMSShubham ChitkaraNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- Financial Accounting: Step by StepDocument8 pagesFinancial Accounting: Step by StepPankaj PandeyNo ratings yet

- Test - Section B - Corporate AccountingDocument3 pagesTest - Section B - Corporate AccountingNathoNo ratings yet

- 4 CO4CRT11 - Corporate Accounting II (T)Document5 pages4 CO4CRT11 - Corporate Accounting II (T)emildaraisonNo ratings yet

- W-2013 Cor PDFDocument21 pagesW-2013 Cor PDFKashif NiaziNo ratings yet

- Q.P. Code: 62202: Managerial AccountingDocument6 pagesQ.P. Code: 62202: Managerial Accountinganshul bhutangeNo ratings yet

- Indian Accounting Standard 101Document19 pagesIndian Accounting Standard 101RITZ BROWNNo ratings yet

- Double SystemDocument10 pagesDouble SystemNatasha MugoniNo ratings yet

- P6 June 2023 SY23Document5 pagesP6 June 2023 SY23Shivam GuptaNo ratings yet

- Framework - QB PDFDocument6 pagesFramework - QB PDFHindutav aryaNo ratings yet

- Financial Accounting - IVDocument6 pagesFinancial Accounting - IVMadhuram SharmaNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- CO3CRT07 - Corporate Accounting I (T)Document5 pagesCO3CRT07 - Corporate Accounting I (T)shemymuhammad289No ratings yet

- CacDocument218 pagesCacFirdous QureshiNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- Accountancy QP 1 (A) 2023Document5 pagesAccountancy QP 1 (A) 2023mohammedsubhan6651No ratings yet

- Weekly Test of AccountsDocument6 pagesWeekly Test of AccountsAMIN BUHARI ABDUL KHADER100% (1)

- FR Last 4 MTPDocument98 pagesFR Last 4 MTPSHIVSHANKER AGARWALNo ratings yet

- Activity MansuetoDocument5 pagesActivity MansuetoMansueto JreysonNo ratings yet

- Solutions Manual For Corporate Financial Accounting, 16th Edition by Carl Warren, Jeff JonesDocument54 pagesSolutions Manual For Corporate Financial Accounting, 16th Edition by Carl Warren, Jeff Jonesmoeez0591No ratings yet

- Dividend Decisions Study UnitDocument25 pagesDividend Decisions Study UnitTakudzwa MashiriNo ratings yet

- Chapter 6 Financial AssetsDocument6 pagesChapter 6 Financial AssetsAngelica Joy ManaoisNo ratings yet

- PART 2 (Chapter 2, Lessons 2.1 - 2.6)Document42 pagesPART 2 (Chapter 2, Lessons 2.1 - 2.6)نيكو كورونيلNo ratings yet

- Handout Fin Man 2302Document2 pagesHandout Fin Man 2302Ranz Nikko N PaetNo ratings yet

- FinanceDocument17 pagesFinancepriyawaykar5No ratings yet

- How To Download Ebook PDF Mergers Acquisitions and Corporate Restructurings 7Th Edition Ebook PDF Docx Kindle Full ChapterDocument36 pagesHow To Download Ebook PDF Mergers Acquisitions and Corporate Restructurings 7Th Edition Ebook PDF Docx Kindle Full Chaptersteve.books604100% (30)

- Acc 108 Current LiabilitiesDocument5 pagesAcc 108 Current Liabilitiesmkrisnaharq99No ratings yet

- Saito Solar-Teaching Notes ExhibitsDocument10 pagesSaito Solar-Teaching Notes Exhibitssebastien.parmentierNo ratings yet

- Chapter 16 Acctng For GovDocument7 pagesChapter 16 Acctng For GovJustine JaymaNo ratings yet

- Valuation B and S - Q & ADocument3 pagesValuation B and S - Q & Aaaaaa aaaaaNo ratings yet

- I3 eSOLUTIONS GIS 2020REVDocument12 pagesI3 eSOLUTIONS GIS 2020REVOgie FermoNo ratings yet

- Case 4 Matapang's Repair BusinessDocument13 pagesCase 4 Matapang's Repair BusinessCobie VillenaNo ratings yet

- Law On Private Corporation (Title 4)Document10 pagesLaw On Private Corporation (Title 4)Dahyun DahyunNo ratings yet

- 3 Sources of Capital For EntrepreneurshipDocument27 pages3 Sources of Capital For EntrepreneurshipSatendra JaiswalNo ratings yet

- Conceptual FrameworkDocument13 pagesConceptual FrameworkPeter BanjaoNo ratings yet

- 6FFLK017 Exam Paper 2019 - 20Document8 pages6FFLK017 Exam Paper 2019 - 20daphnekcllawNo ratings yet

- Accounts Theory 21 Marks CTC ClassesDocument8 pagesAccounts Theory 21 Marks CTC Classeskhushalpareek8584No ratings yet

- 3 Calcul Coc Level III - 2 (Yetesera)Document6 pages3 Calcul Coc Level III - 2 (Yetesera)rabbirraabullooNo ratings yet

- Assignment 3-Cap Budget-Cap Structure-Val-Student Version SP 2024Document15 pagesAssignment 3-Cap Budget-Cap Structure-Val-Student Version SP 2024salehaiman2019No ratings yet

- Basic Reconciliation StatementsDocument41 pagesBasic Reconciliation StatementsBeverly EroyNo ratings yet

- BigTech Analysis - Example AnswerDocument22 pagesBigTech Analysis - Example AnswerÚdita ShNo ratings yet

- Quiz Corporate LiquidationDocument4 pagesQuiz Corporate LiquidationCarmella DismayaNo ratings yet

- Chapter 2 Tutorial QuestionsDocument3 pagesChapter 2 Tutorial Questionssaule.yesbayevaNo ratings yet

- Igcse o Level Frankwoods Business Accounting 1 by Frank Wood Alan SangsterDocument2 pagesIgcse o Level Frankwoods Business Accounting 1 by Frank Wood Alan SangsterNasir AliNo ratings yet

- 11th Accountancy EM Book Back 1 Mark Questions 1 English Medium PDF DownloadDocument38 pages11th Accountancy EM Book Back 1 Mark Questions 1 English Medium PDF Downloadlnandhini023No ratings yet

- 2015 Audited Financial ReportDocument60 pages2015 Audited Financial ReportoyunnominNo ratings yet