Professional Documents

Culture Documents

Sireesha Resume

Sireesha Resume

Uploaded by

sireeshapenubala7575Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sireesha Resume

Sireesha Resume

Uploaded by

sireeshapenubala7575Copyright:

Available Formats

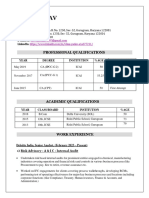

Sireesha

Cost Accountant Mobile no +91 7981422772

DOB: 01-11-1997 Email Id sireeshapenubala7575@gmail.com

Home town: 20-4-30/D1, Kotha palli, Chiranjeevi road, near nalandha school, Tirupati – 517501, Andhra Pradesh.

CAREER OBJECTIVE:

To secure a suitable position in a well-established Organization for the achievement of Organization goals

as well as to improve myself in accordance with Industry requirements in compatible with vision and mission

of my Organization.

WORK EXPERIENCE:

Record to Report Financial Analyst (RTR) @ Accenture Appreciations from CAT & Accenture:

Solutions Pvt. Ltd for Caterpillar (CAT) Client. (June’21

Received appreciation from Business

to Dec’22):

support manager (CAT), Accenture RTR

a. Responsible for Legal entity monthly/quarterly/annual book head, CFO from PRIPL for managing

closings and general accounting as per USGAAP and stat audit work.

IGAAP.

Recognized as “Employee of the quarter”

b. Responsible and Accountable for the month-end close, and given kudos award twice in 18

reporting and reconciliation, consolidation process in months’ time span in Accenture.

accordance with the agreed internal and external group

timetable. Ensure the completeness and the accuracy of

Exposure as Chartered Article assistant @

financial records.

M/S. E. Phalguna Kumar & Co- Tirupati

c. Coordinating with various departments to get data required (Feb’17 to Feb’20) & Cost Accountancy

for Balance sheet and Profit and Loss Variance Analysis Internship @ Annavarapu & Co (Feb’20 to

and follow up them for any concerns on timely basis. July’20):

d. Intercompany Discrepancy Report preparation and Income Tax filing, Accounting, Tax

analysis made. audits, Stat audits, internal audit and

other assignments:

e. Performing monthly reconciliations like Bank Recons,

TDS Recons, Inventory, Revenue etc., in CART tool and a. Engaged in Income tax filings of

clearing of open items from GL account. If any aged items Companies, Partnership firms, Societies

as per CAT Gov1.01 internal policy, used to escalate to and Individuals.

department heads.

b. Involved in GST return filing, Entries

f. Journal Entries prepared in CASE tool and MS office D365 recorded in Tally for various clients.

tool. c. Performed Statutory Audit for Private Ltd

companies like Partha dental care

g. Supported for Statutory Audit AS client – Progress Rail

India private limited. Audit Supporter in

Innovations Pvt, Ltd (PRIPL - part of CAT). Acted as spoc Internal audit of a listed company

for two FY statutory audits, prepared financial statements engaged in FMCG Industry for

and reviewed with CFO of PRIPL Entity. Conducted

Inventory, Accounts & Finance and

statutory audit meetings involving various internal Sales & distribution areas.

departments, auditors for smooth completion of audit. Acted

as coordinator for audit support to PWC AUDIT FIRM. d. Involved in in-depth vouching of Sales,

Purchases, Account receivables &

h. Engaged in Quarterly segment report preparation to Account payables using various MIS

analyze business segment performance which is also useful reports generated from SAP.

for advance tax calculation.

e. Involved in Budget preparation for

i. Annual conversion of local entity financial statements Term loan financing and working capital

as per Parent Global CAT requirements (GDX) in BPC tool. financing for few clients.

j. Involved in Indian compliance requirements applicable to f. Actively involved in financial

statements preparation (Division I –

Entity like FLA preparation as per RBI guidelines, MSME

Interest calculation for vendors. AS clients) and Tax audits.

k. Ensured all key controls operated in entity. Identified any

issues in reporting process and tried resolving on timely

basis.

KEY SKILLS: ACHIEVEMENTS:

a. Able to manage stress to complete work by agreed Received Employee of the quarter

deadlines. for successful completion of the Stat

b. Capable of achieving Target milestones. Audit process.

Principal Auditor appreciated for

c. Enjoys working in team and able to coordinate with all to work performance in tax filings, tax

strive for organizational goals. audits in article ship.

EDUCATION: TRAINING:

Chartered Accountancy – ICAI Completed 100 hours of compulsory

computer training specified by ICAI

Final-Group-2 – 53.50% i.e. ITT and Advanced ITT

IPCC-Group 1 – 50.75% Completed Orientation and soft skills,

communication programs conducted

IPCC-Group 2 – 65.67%

by ICAI and ICMAI.

CPT – 53.50%

Utilities – MS office applications, MS

Cost Accountancy – ICMAI (Cleared all Dynamics 365, CART, CASE tool,

levels in first attempt) (9 Exemptions SAP, TALLY.

secured)

INTERESTS AND HOBBIES:

CMA Final-Group-1 – 61.50% Singing

CMAFinal-Group-2 – 62.25% Listening music and

Playing shettle

CMA Inter-Group-1 – 61.50%

CMA Inter-Group-2 – 56.75% LANGUAGES KNOWN:

CMA Foundation – 60.00% Telugu, English, Hindi (Not very proficient)

BCOMAF– Indira Gandhi National Open

University 2020-21 - 58.17% Note:

I here by declare that the above mentioned

12thStandard– Board of Intermediate

data is true as per my knowledge.

Education. A.P (MEC) 2014-15 - 95.5%

10thStandard-Board of Secondary Education.

A.P 2013- 9.8 GPA

STRENGTHS:

Understanding and Working Knowledge in MS office

D365, little working knowledge in SAP.

Proficiency in MS Excel (using VLOOKUP, Hlookup &

pivot table founded numerous errors in audits).

Team worker, Self - motivated individual with strong

financial analytical skills.

Active listener, Good decision maker, can be flexible

according to deadlines and industry requirements.

You might also like

- I. Case BackgroundDocument7 pagesI. Case BackgroundHiya BhandariBD21070No ratings yet

- This Study Resource Was: Assignment in FA For Week 2 Case: Cepuros FoodsDocument2 pagesThis Study Resource Was: Assignment in FA For Week 2 Case: Cepuros FoodsShardul Karve100% (1)

- Thecp7 CompressedDocument2 pagesThecp7 CompressedChandra Prakash pareekNo ratings yet

- Sesha Krishna CVDocument3 pagesSesha Krishna CVG Yugandhar Alwaz UniqueNo ratings yet

- CA Rukesh ResumeDocument2 pagesCA Rukesh Resumesireeshapenubala7575No ratings yet

- CV Bhavuk Singhal PDFDocument2 pagesCV Bhavuk Singhal PDFMahesh Jajoo0% (1)

- Shweta Shahade: AddressDocument2 pagesShweta Shahade: AddressShweta TatheNo ratings yet

- Mohit Aggarwal - Professional - 5 Yrs 0 MonthDocument2 pagesMohit Aggarwal - Professional - 5 Yrs 0 MonthSantoshkumar MatkarNo ratings yet

- CV - Astha GuptaDocument2 pagesCV - Astha GuptaAmitNo ratings yet

- Legal DocumentDocument3 pagesLegal DocumentNaveenMehtaNo ratings yet

- Bharathraj CV-KochDocument3 pagesBharathraj CV-Kochbhavan pNo ratings yet

- Aadrish Bashir, ACA: Career ObjectiveDocument2 pagesAadrish Bashir, ACA: Career ObjectiveRukhshindaNo ratings yet

- 8 M CVGPD 9 JGD FVe OL630Document2 pages8 M CVGPD 9 JGD FVe OL630Jfieid EjejfjNo ratings yet

- Resume - Sikander - Gupta - (Accounts and Finance)Document2 pagesResume - Sikander - Gupta - (Accounts and Finance)Phanindra GaddeNo ratings yet

- Naval_Tayal cvDocument3 pagesNaval_Tayal cvnaval.gamer0508No ratings yet

- CV CA Ankit VatsaDocument1 pageCV CA Ankit Vatsadileep.jcmNo ratings yet

- Gopala Krishna FICO 6 Years ExpDocument5 pagesGopala Krishna FICO 6 Years Expnidhi.ratnaNo ratings yet

- Naeem Akhtar ACA - Chartered AccountantDocument2 pagesNaeem Akhtar ACA - Chartered Accountantmansoor akhterNo ratings yet

- SNR Management Accountant #218: Looking For A New Challenge? Main ResponsibilitiesDocument4 pagesSNR Management Accountant #218: Looking For A New Challenge? Main ResponsibilitiesTandolwethu MaliNo ratings yet

- CA Sumit Poddar - ResumeDocument2 pagesCA Sumit Poddar - Resumerohit agarwalNo ratings yet

- Naukri GauravBahuguna (3y 0m)Document2 pagesNaukri GauravBahuguna (3y 0m)taxmanagerNo ratings yet

- CV CA ShravyaKarnati IDocument2 pagesCV CA ShravyaKarnati IninjakidsofhydNo ratings yet

- Vikramjit Singh Walia: Core CompetenciesDocument6 pagesVikramjit Singh Walia: Core CompetenciesGift ChaliNo ratings yet

- CV Arie Akbar 2022Document1 pageCV Arie Akbar 2022Abay ImamNo ratings yet

- CV - Divya GoyalDocument1 pageCV - Divya GoyalGarima JainNo ratings yet

- Resume CA Shubhangi - FinanceDocument1 pageResume CA Shubhangi - FinanceSarvesh AgrawalNo ratings yet

- Vikas CVDocument2 pagesVikas CVlegalitis.inNo ratings yet

- Arun KumarDocument1 pageArun KumarPawan GuptaNo ratings yet

- Resume - SayanGhoshDocument1 pageResume - SayanGhoshSayan GhoshNo ratings yet

- Resume CA Dimpy Mittal-Stat.Document2 pagesResume CA Dimpy Mittal-Stat.dhruvkapoor2707No ratings yet

- Summer Internship Project: A Financial Statement Analysis and Interpretation of Certstore SolutionsDocument72 pagesSummer Internship Project: A Financial Statement Analysis and Interpretation of Certstore SolutionsDibyaranjan BeheraNo ratings yet

- PATTU.S CVDocument2 pagesPATTU.S CVAnuradha SriramNo ratings yet

- Satyarth Prakash Dwivedi-CvDocument5 pagesSatyarth Prakash Dwivedi-CvDesi Vanila IceNo ratings yet

- CV For Industrial TrainingDocument2 pagesCV For Industrial TrainingAshish MauryaNo ratings yet

- Naval CVDocument2 pagesNaval CVnaval.gamer0508No ratings yet

- CV DetailsDocument3 pagesCV DetailsRajanala indrasena ReddyNo ratings yet

- Skills: Address N149, Rua C, Polana Caniço A, Maputo, Mozambique Phone +258 845344491 Linkedin Dórica Dos SantosDocument2 pagesSkills: Address N149, Rua C, Polana Caniço A, Maputo, Mozambique Phone +258 845344491 Linkedin Dórica Dos Santosegidio juniorNo ratings yet

- Tarun Resume 11122022Document3 pagesTarun Resume 11122022CA TARUNNo ratings yet

- Resume SureshDocument2 pagesResume SureshSiva BandiNo ratings yet

- Santosh Kumar - CVDocument1 pageSantosh Kumar - CVMonish JayasuriyanNo ratings yet

- Resume Tanvi GargDocument1 pageResume Tanvi GargTarun BansalNo ratings yet

- Naseer+Cv (Updated)Document3 pagesNaseer+Cv (Updated)nasirNo ratings yet

- Ganesh Babanrao Shedge: Career ObjectivesDocument4 pagesGanesh Babanrao Shedge: Career ObjectivesPaul Vikash K MNo ratings yet

- Ali Asgar CA, CPA (USA) - OriginalDocument2 pagesAli Asgar CA, CPA (USA) - Originalayesha siddiquiNo ratings yet

- Kerala Road Fund Board: (A Statutory Body of The Government of Kerala)Document5 pagesKerala Road Fund Board: (A Statutory Body of The Government of Kerala)vishnuprasad4292No ratings yet

- Sarvani CV - FinanceDocument2 pagesSarvani CV - FinanceSarvani AdapaNo ratings yet

- CA-semi QualifiedDocument3 pagesCA-semi Qualifiedcabharath.katariNo ratings yet

- Kunal Kumar ResumeDocument3 pagesKunal Kumar Resumekunal kumarNo ratings yet

- Resuume Tarun 13122022Document3 pagesResuume Tarun 13122022John TanaseNo ratings yet

- CV Lakshya GuptaDocument3 pagesCV Lakshya Guptapuneetaswani1234No ratings yet

- LokeshDocument5 pagesLokeshSamir SahooNo ratings yet

- AshishhPassari InbondDocument2 pagesAshishhPassari InbondRahul KunniyoorNo ratings yet

- Naukri NikhilKwatra (11y 0m)Document3 pagesNaukri NikhilKwatra (11y 0m)ashu.mahendruNo ratings yet

- Balaji Santhanakrishnan 5395051Document4 pagesBalaji Santhanakrishnan 5395051amberNo ratings yet

- Raj Kumar CVDocument3 pagesRaj Kumar CVRaju DixitNo ratings yet

- RESUME Talha Ehsan PDFDocument3 pagesRESUME Talha Ehsan PDFFahim FerozNo ratings yet

- Vivek Agrawal - CV Updated 06.05.2019Document3 pagesVivek Agrawal - CV Updated 06.05.2019VikrantNo ratings yet

- CA Radhika Verma - CVDocument1 pageCA Radhika Verma - CVRADHIKA VERMANo ratings yet

- Fiaz (CV) 09-05-2023Document3 pagesFiaz (CV) 09-05-2023MisbhasaeedaNo ratings yet

- Naukri MeenalGarg (1y 5m)Document1 pageNaukri MeenalGarg (1y 5m)ssrhNo ratings yet

- Himanshu Jain: Mobile No-9911166504 Addre SsDocument5 pagesHimanshu Jain: Mobile No-9911166504 Addre SsHimanshu JainNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- EL201 Accounting Learning Module Lessons 51Document19 pagesEL201 Accounting Learning Module Lessons 51keanjervylingonNo ratings yet

- Tax Invoice: Siddhivinayak EnterpriseDocument3 pagesTax Invoice: Siddhivinayak EnterpriseVishal PandeyNo ratings yet

- SDCA LR G5 Green OCEA SP En-Las-Profundidades-Del-OcéanoDocument18 pagesSDCA LR G5 Green OCEA SP En-Las-Profundidades-Del-Océanomathew ruedaNo ratings yet

- Manufacturing ManagementDocument332 pagesManufacturing ManagementPugdug 209No ratings yet

- March-18 - Boost Your Productivity by Great Time ManagementDocument11 pagesMarch-18 - Boost Your Productivity by Great Time ManagementNazwa SeptianaNo ratings yet

- Lecture 2.2 Value Creation Revisited and Pro Forma Cash FlowsDocument37 pagesLecture 2.2 Value Creation Revisited and Pro Forma Cash FlowsWahidNo ratings yet

- DGS IA: Inquiry Process Document (IPD)Document5 pagesDGS IA: Inquiry Process Document (IPD)Hanani IzzahNo ratings yet

- Analyze and Interpret Production DataDocument16 pagesAnalyze and Interpret Production DataFelekePhiliphosNo ratings yet

- Fe Omt 12 ModularDocument2 pagesFe Omt 12 ModularRena Jocelle NalzaroNo ratings yet

- IGCSE Business Studies - External Influences On Business ActivityDocument1 pageIGCSE Business Studies - External Influences On Business ActivityNafisa MeghaNo ratings yet

- Ns 05 2023Document153 pagesNs 05 2023analuNo ratings yet

- Chapter 2: Overview of Business ProcessDocument16 pagesChapter 2: Overview of Business ProcessZoe McKenzieNo ratings yet

- UntitledDocument32 pagesUntitledUrban Monkey 2No ratings yet

- The Steel ManDocument5 pagesThe Steel ManRohan NakasheNo ratings yet

- HR Leaders Asia PH Post Event Report 2022Document19 pagesHR Leaders Asia PH Post Event Report 2022Robin PunoNo ratings yet

- Employee Id First Name Last Name Date Calc Start Calc EndDocument12 pagesEmployee Id First Name Last Name Date Calc Start Calc EndRaul MarunNo ratings yet

- Sales Invoice 000256: Bill To Invoice No. DateDocument1 pageSales Invoice 000256: Bill To Invoice No. DateKuru GovindNo ratings yet

- Question Bank 002 - 230907 - 234251Document360 pagesQuestion Bank 002 - 230907 - 234251nokx21100% (1)

- Technopreneurship-Quiz Oed 1-LRDocument15 pagesTechnopreneurship-Quiz Oed 1-LRAudreyNo ratings yet

- Algorithmic StrategiesDocument1 pageAlgorithmic Strategiesamir khNo ratings yet

- NMIMS M & A Presentation.1Document58 pagesNMIMS M & A Presentation.1Pratik KamaniNo ratings yet

- Unit 16 Product LaunchDocument5 pagesUnit 16 Product LaunchSyrill CayetanoNo ratings yet

- 2020 - VN Market Trend - Q - MeDocument15 pages2020 - VN Market Trend - Q - MeGame AccountNo ratings yet

- Encuesta de Satisfacción para Empresa de Paquetería-1Document6 pagesEncuesta de Satisfacción para Empresa de Paquetería-1patricia100% (1)

- RexDocument17 pagesRexErick KinotiNo ratings yet

- Ch4 - Focus On The Big Picture, Not The NumbersDocument40 pagesCh4 - Focus On The Big Picture, Not The Numberstaghavi1347No ratings yet

- Sameet Dhedhi FinanceDocument2 pagesSameet Dhedhi FinanceSmeet JasoliyaNo ratings yet

- Modul GE F35 MultilinDocument8 pagesModul GE F35 MultilinMr IlchamNo ratings yet