Professional Documents

Culture Documents

IS_SAMMI_SA-1264-4

IS_SAMMI_SA-1264-4

Uploaded by

Bronlin Kyle KloppersCopyright:

Available Formats

You might also like

- The Security I Like BestDocument7 pagesThe Security I Like Bestneo269100% (4)

- The Best Deal GiIlette Could Get - Procter & Gamble's Acquisition of GilletteDocument366 pagesThe Best Deal GiIlette Could Get - Procter & Gamble's Acquisition of Gillettejk kumarNo ratings yet

- Diversified JulyDocument1 pageDiversified JulyPiyushNo ratings yet

- Diversified Equity FundDocument1 pageDiversified Equity FundHimanshu AgrawalNo ratings yet

- December Fund-Factsheets-Individual1Document2 pagesDecember Fund-Factsheets-Individual1Navneet PandeyNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- Z MJW-CSSTDDocument1 pageZ MJW-CSSTDNik Ahmad ZukwanNo ratings yet

- Capital Growth FundDocument1 pageCapital Growth FundHimanshu AgrawalNo ratings yet

- Allard Growth Fund December 2016Document3 pagesAllard Growth Fund December 2016James HoNo ratings yet

- Fund 8322 Black Rock Us Equity IndexDocument1 pageFund 8322 Black Rock Us Equity IndexMikeNo ratings yet

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaNo ratings yet

- JULY 2009: Monthly UpdateDocument33 pagesJULY 2009: Monthly UpdatepuneetggNo ratings yet

- Discovery DecDocument1 pageDiscovery DecGauravNo ratings yet

- Ashmore Investment Management Limited Asian High Yield Debt Class ZDocument3 pagesAshmore Investment Management Limited Asian High Yield Debt Class Zcena1987No ratings yet

- 2022 Asset Wealth ManagementDocument22 pages2022 Asset Wealth ManagementSankaty LightNo ratings yet

- Discovery Fund April 23Document1 pageDiscovery Fund April 23Satyajeet AnandNo ratings yet

- Nedgroup Investments Global Flexible Fund ADocument2 pagesNedgroup Investments Global Flexible Fund Amakhathe mabitleNo ratings yet

- Product Snapshot: DSP 10Y G-Sec FundDocument2 pagesProduct Snapshot: DSP 10Y G-Sec FundManoj SharmaNo ratings yet

- RPCF May 2014 (English)Document1 pageRPCF May 2014 (English)Anonymous fS6Znc9No ratings yet

- HBL Asset Management FM LTD - PPTX UpdatedDocument16 pagesHBL Asset Management FM LTD - PPTX UpdatedMisbah Khan100% (1)

- Annual Report - Quant Mutual Fund - Financial Year 2022-23Document105 pagesAnnual Report - Quant Mutual Fund - Financial Year 2022-23R RNo ratings yet

- Case Study #1 Case Study #2Document2 pagesCase Study #1 Case Study #2Eugin FranciscoNo ratings yet

- HDFC Standard Life InsuranceDocument11 pagesHDFC Standard Life InsuranceanuradhaagrawalNo ratings yet

- 7-Year Asset Class Real Return Forecasts : As of January 31, 2021Document1 page7-Year Asset Class Real Return Forecasts : As of January 31, 2021Ericko Marvin KweknotoNo ratings yet

- MP - 3 - Peso Growth FundDocument2 pagesMP - 3 - Peso Growth FundFrank TaquioNo ratings yet

- HDFC Diversified Equity FundDocument1 pageHDFC Diversified Equity FundMayank RajNo ratings yet

- Blue Chip JulyDocument1 pageBlue Chip JulyPiyushNo ratings yet

- Term Deposit Rate Sheet: ShajarDocument1 pageTerm Deposit Rate Sheet: ShajarchqaiserNo ratings yet

- LiquiLoans - Prime Retail Fixed Income Investment Opportunity - Oct. 2022Document25 pagesLiquiLoans - Prime Retail Fixed Income Investment Opportunity - Oct. 2022Vivek SinghalNo ratings yet

- Model Description: Ticker NameDocument14 pagesModel Description: Ticker NameOleg KondratenkoNo ratings yet

- Wealth Insights Newsletter June 2021Document42 pagesWealth Insights Newsletter June 2021Ram PrasadNo ratings yet

- Kempen Global Small Cap Review Q1Document35 pagesKempen Global Small Cap Review Q1Andrei FirteNo ratings yet

- Fortnightly Banking Update: Deposit Growth Moderated But Bank Credit Growth Moderates Even MoreDocument3 pagesFortnightly Banking Update: Deposit Growth Moderated But Bank Credit Growth Moderates Even Morekumar ganeshNo ratings yet

- Launching The Credit Card in Asia PacificDocument10 pagesLaunching The Credit Card in Asia PacificNaveenParameswarNo ratings yet

- Edelweiss US Value Equity FundDocument20 pagesEdelweiss US Value Equity FundArmstrong CapitalNo ratings yet

- Financial ModellingDocument13 pagesFinancial ModellingBrendon McNo ratings yet

- Projected Rates of Profit July 2020 Active ProductsDocument1 pageProjected Rates of Profit July 2020 Active ProductsMansoor AliNo ratings yet

- FD BeaterDocument5 pagesFD BeaterMove OnNo ratings yet

- Canara Robeco Emerging Equities: For Private CirculationDocument1 pageCanara Robeco Emerging Equities: For Private CirculationAadeesh JainNo ratings yet

- FIMCF PresentationDocument70 pagesFIMCF Presentationkmkm1993No ratings yet

- Vietnam Digital Landscape 2023Document119 pagesVietnam Digital Landscape 2023gis3d.bhsNo ratings yet

- State Government Scheme - 0Document1 pageState Government Scheme - 0Vishwajeet DasNo ratings yet

- Case Processing SummaryDocument3 pagesCase Processing SummaryVandita KhudiaNo ratings yet

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarNo ratings yet

- FHLB Chicago 1117Document1 pageFHLB Chicago 1117tallindianNo ratings yet

- FDIC Certificate # 9092 Salin Bank and Trust CompanyDocument31 pagesFDIC Certificate # 9092 Salin Bank and Trust CompanyWaqas Khalid KeenNo ratings yet

- Allard Growth Fund August 2016Document3 pagesAllard Growth Fund August 2016James HoNo ratings yet

- 2015 Investor Presentation Oppenheimer 4x3Document27 pages2015 Investor Presentation Oppenheimer 4x3valueinvestor123No ratings yet

- 01 - M&A Conference - 2023 Year of The DealDocument25 pages01 - M&A Conference - 2023 Year of The Dealjm petitNo ratings yet

- Market Pulse Q4 Report - Nielsen Viet Nam: Prepared by Nielsen Vietnam February 2017Document8 pagesMarket Pulse Q4 Report - Nielsen Viet Nam: Prepared by Nielsen Vietnam February 2017K57.CTTT BUI NGUYEN HUONG LYNo ratings yet

- Equity Fund: % Top 10 Holding As On 31st March 2019Document1 pageEquity Fund: % Top 10 Holding As On 31st March 2019Sajith KumarNo ratings yet

- ARM Factsheets JanuaryDocument10 pagesARM Factsheets JanuaryJon RolexNo ratings yet

- Liquidity FundDocument3 pagesLiquidity Fundtangkc09No ratings yet

- CCP - One PagerDocument1 pageCCP - One PagerSandeep BorseNo ratings yet

- 2022 The Benefit of Benchmarking IOFMDocument12 pages2022 The Benefit of Benchmarking IOFMCRISNo ratings yet

- Bank of Kigali Announces AuditedDocument10 pagesBank of Kigali Announces AuditedinjishivideoNo ratings yet

- Ers. Co M: JANA Master Fund, Ltd. Performance Update - December 2010 Fourth Quarter and Year in ReviewDocument10 pagesErs. Co M: JANA Master Fund, Ltd. Performance Update - December 2010 Fourth Quarter and Year in ReviewVolcaneum100% (2)

- 12.max Life Diversified Equity FundDocument1 page12.max Life Diversified Equity Fundgourab.1996paulNo ratings yet

- Discretionary vs. Systematic:: Two Contrasting Hedge Fund ApproachesDocument3 pagesDiscretionary vs. Systematic:: Two Contrasting Hedge Fund ApproachesNorbert DurandNo ratings yet

- Compare Fund - MutualfundindiaDocument2 pagesCompare Fund - MutualfundindiaSujesh SasiNo ratings yet

- Market Research .: Problem Definition/ObjectiveDocument51 pagesMarket Research .: Problem Definition/Objectivekppandey87No ratings yet

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Interview Questions & AnswersDocument22 pagesInterview Questions & AnswersPrakashMhatre0% (1)

- Acct Statement - XX4027 - 21092023Document35 pagesAcct Statement - XX4027 - 21092023ralesh694No ratings yet

- Written Assignment Unit 3 - Analysis of Parasailing Business ExpansionDocument5 pagesWritten Assignment Unit 3 - Analysis of Parasailing Business Expansionkuashask2No ratings yet

- Meaning and Nature of InvestmentDocument43 pagesMeaning and Nature of InvestmentVaishnavi GelliNo ratings yet

- Valuation Part 2Document82 pagesValuation Part 2Dương Thu TràNo ratings yet

- 10 Dollars To Naira Black Market - Google SearchDocument1 page10 Dollars To Naira Black Market - Google SearchDickson ChibuzorNo ratings yet

- Chapter 6: Introduction To Capital BudgetingDocument3 pagesChapter 6: Introduction To Capital BudgetingDeneree Joi EscotoNo ratings yet

- Marius Barys, Cfa: Vilnius, LithuaniaDocument2 pagesMarius Barys, Cfa: Vilnius, LithuaniaPaulius KaminskasNo ratings yet

- Company Analysis - Electricite de France SA - FR0010242511 - EDF FP EquityDocument8 pagesCompany Analysis - Electricite de France SA - FR0010242511 - EDF FP EquityQ.M.S Advisors LLCNo ratings yet

- Valuation Concepts Module 12 PDFDocument4 pagesValuation Concepts Module 12 PDFJisselle Marie CustodioNo ratings yet

- P4AFM SQB As - d09 PDFDocument108 pagesP4AFM SQB As - d09 PDFTaariq Abdul-MajeedNo ratings yet

- 29mm Cotton Futures - 27042023 - 1682599040Document25 pages29mm Cotton Futures - 27042023 - 1682599040Shrinath AnbalaganNo ratings yet

- Hedging With Financial DerivativesDocument71 pagesHedging With Financial Derivativeshabiba ahmedNo ratings yet

- Lesson53 OA Exchange Rate Policy ANSWERSDocument3 pagesLesson53 OA Exchange Rate Policy ANSWERSDaniela Gonzalez SanchezNo ratings yet

- How The Brand Transformed The Cosmetic Industry: Entrepreneurship DevelopmentDocument26 pagesHow The Brand Transformed The Cosmetic Industry: Entrepreneurship DevelopmentArundhati ChatterjeeNo ratings yet

- Ch02HullOFOD7thEd UpdatedDocument37 pagesCh02HullOFOD7thEd Updateddelight photostateNo ratings yet

- BlockchainDocument25 pagesBlockchainCash Cash Cash100% (1)

- Chapter 3-Evaluation of Financial Performance: Multiple ChoiceDocument23 pagesChapter 3-Evaluation of Financial Performance: Multiple ChoiceKyla Ramos DiamsayNo ratings yet

- International Equity Market PDFDocument16 pagesInternational Equity Market PDFShreyas Dicholkar0% (1)

- 21 09 21 Tastytrade ResearchDocument5 pages21 09 21 Tastytrade ResearchtrungNo ratings yet

- Merchant Banking (Cir. 17.10.2023)Document26 pagesMerchant Banking (Cir. 17.10.2023)Akshaya SwaminathanNo ratings yet

- Lesson-3 EeDocument15 pagesLesson-3 EeChristian MagdangalNo ratings yet

- Through The Looking Glass #17 - Dream International (1126 HK)Document12 pagesThrough The Looking Glass #17 - Dream International (1126 HK)bodaiNo ratings yet

- Demat Account Closure FormDocument1 pageDemat Account Closure Formkumar kattasarvanNo ratings yet

- How To Trade This Volatile MarketDocument19 pagesHow To Trade This Volatile MarketmeganmaoNo ratings yet

- Securities Market The BattlefieldDocument14 pagesSecurities Market The BattlefieldJagrityTalwarNo ratings yet

- Edelweissmf Booksummary RicherwiserhappierDocument4 pagesEdelweissmf Booksummary Richerwiserhappierpablo pereira magnereNo ratings yet

- P24139 Noria Commercial Paper Weekly 20211105Document29 pagesP24139 Noria Commercial Paper Weekly 20211105NiltonBarbosaNo ratings yet

IS_SAMMI_SA-1264-4

IS_SAMMI_SA-1264-4

Uploaded by

Bronlin Kyle KloppersCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IS_SAMMI_SA-1264-4

IS_SAMMI_SA-1264-4

Uploaded by

Bronlin Kyle KloppersCopyright:

Available Formats

Mediclinic Retirement Fund Growth

Mediclinic Growth March 2024

Launch date Fund size Risk profile

January 2011 R 5.9 billion

Benchmark description

AF Investable Global LMW Median: Alexander Forbes produces a survey that

showcases the performance of balanced portfolios with exposure to both

global and local assets, subject to the restrictions imposed by Regulation 28 of

the Pension Funds Act. The Mediclinic Growth portfolio aims to outperform the

median manager’s performance within this survey.

Portfolio description

Mediclinic Retirement Fund Growth portfolio invests 100% into the AF Performer Combined portfolio as a building block. Performer is a moderate-to-high risk

balanced portfolio and targets CPI inflation beating returns over the long term. The portfolio adopts Living*Investing as a philosophy, which entails a risk-based

forward-thinking investment approach, with the aim to achieve client outcomes with a greater degree of certainty. The asset allocation is dynamic to allow the

portfolio to participate on the upside and to protect on the downside in falling markets which means accumulating from a higher base, thus adding value in the

long term. The portfolio blends diversified strategies including alternatives, both locally and offshore, to capture different sources of returns.

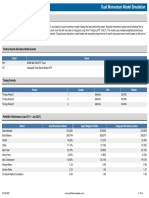

Value of R 100 invested since inception Portfolio returns

Gross Benchmark

1 Month 1.24% 1.24%

3 Months 2.96% 1.68%

YTD 2.96% 1.68%

1 Year 11.41% 9.86%

3 Years 10.77% 9.87%

5 Years 10.84% 9.42%

10 Years 9.46% 8.30%

Since Inception 11.44% 10.32%

Net CPI

Manager weightings 1 Month 1.21% 0.98%

3 Months 2.89% 1.06%

Manager Weight

YTD 2.89% 1.06%

Performer Domestic Balanced 51.7%

1 Year 11.09% 5.56%

Performer International 39.3%

3 Years 10.34% 6.08%

Performer Domestic Hedge Fund 4.7%

5 Years 10.44% 5.14%

Private Markets SA 2.5%

10 Years 9.13% 5.10%

Performer Africa 1.3%

Since Inception 11.04% 5.32%

Banker 0.5%

Transition Portfolio AM 0.0%

Underlying returns (1 month to March 2024)

Total 100.0%

Risk stats over 3 Years

Portfolio Benchmark

Annualised standard deviation 7.6% 8.4%

Sharpe ratio 0.7 0.5

Maximum drawdown 5.2% 5.8%

Positive months 66.7% 63.9%

Total expense ratio and Transaction cost breakdown¹

Period (Annualised, rolling three-year period): 01 Mar 2021 to 29 Feb 2024

Average annual service charge (incl VAT) 0.36%

Underlying manager performance fee expense 0.09%

Underlying global manager expense 0.08%

Underlying fund expense 0.24% Asset allocation

Local Africa Global Combined

Other expenses 0.00%

Equity Excluding Property 35.0% 0.8% 32.9% 68.7%

Total Expense Ratio (TER)¹ 0.77%

Property 1.4% 0.0% 1.0% 2.5%

Transaction Costs (TC)² 0.11% Bonds 14.6% 0.0% 2.5% 17.1%

Total Investment Charges (TER + TC)³ 0.88% Cash 2.2% 0.0% 1.4% 3.5%

Commodities 0.3% 0.0% 0.1% 0.4%

Alternatives 6.0% 0.4% 1.2% 7.7%

Balanced 0.0% 0.0% 0.0% 0.0%

Total 59.6% 1.2% 39.2% 100.0%

FAIS notice and disclaimer

Alexander Forbes Investments Limited is a licensed financial services provider in terms of Section 8 of the Financial Advisory and Intermediary Services Act, 37 of 2002, as amended,

FAIS licence number 711. This information is not advice as defined and contemplated in the Financial Advisory and Intermediary Services Act, 37 of 2002, as amended. Past

investment returns are not indicative of future returns. This product is not guaranteed. Please be advised that there may be representatives acting under supervision. Company

Registration Number: 1997/000595/06. Pension Fund Administrator No.24/217. Long Term Insurance Act No. 00018/001. Postal address: P.O. Box 786055, Sandton 2146. Physical

Address: 115 West Street, Sandown, 2196. Telephone number: +27 (11) 505 6000. The complaints policy and conflict of interest management policy can be found on the Alexander

Forbes Investments website: http:www.alexforbes.com.

Notes

1. Total Expense Ratio (TER): The percentage of the value of the portfolio that was incurred as expenses relating to the administration (charges, levies and fees) of the portfolio. TER is

calculated over a rolling three year period (or since inception where applicable) and annualised. A higher TER does not necessarily imply a poor return, nor does a low TER imply a

good return. The current TER may not necessarily be an accurate indication of future TERs. Transaction cost (TC): The percentage of the value of the portfolio that was incurred as

costs relating to the buying and selling of the assets underlying the portfolio. Transaction costs are a necessary cost in administering the Fund and impacts returns. It should not be

considered in isolation as returns may be impacted by many other factors over time, including market returns, the type of financial product, the investment decisions of the

investment manager and the TER. Calculations are based on actual data where possible and best estimates where actual data is not available. Total investment charge (TIC): This

percentage of the portfolio was incurred as costs relating to the investment of the portfolio. It is the sum of the TER and TC.

2. Market data is sourced from Datastream. The FTSE/JSE Africa Index Series is calculated by FTSE International Limited ("FTSE") in conjunction with the JSE Securities Exchange

South Africa ("JSE") in accordance with standard criteria. The FTSE/JSE Africa Index Series is the proprietary information of FTSE and the JSE. All copyright subsisting in the

FTSE/JSE Africa Index Series index values and constituent lists vests in FTSE and the JSE jointly. All their rights are reserved.

3. All holdings information is based on latest available data.

4. There may be differences in totals due to rounding.

5. All returns quoted are before the deduction of all fees charged. Returns for periods exceeding one year are annualized and all returns are quoted in Rands. Past investment returns

are not indicative of future returns.

ffs30

You might also like

- The Security I Like BestDocument7 pagesThe Security I Like Bestneo269100% (4)

- The Best Deal GiIlette Could Get - Procter & Gamble's Acquisition of GilletteDocument366 pagesThe Best Deal GiIlette Could Get - Procter & Gamble's Acquisition of Gillettejk kumarNo ratings yet

- Diversified JulyDocument1 pageDiversified JulyPiyushNo ratings yet

- Diversified Equity FundDocument1 pageDiversified Equity FundHimanshu AgrawalNo ratings yet

- December Fund-Factsheets-Individual1Document2 pagesDecember Fund-Factsheets-Individual1Navneet PandeyNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- Z MJW-CSSTDDocument1 pageZ MJW-CSSTDNik Ahmad ZukwanNo ratings yet

- Capital Growth FundDocument1 pageCapital Growth FundHimanshu AgrawalNo ratings yet

- Allard Growth Fund December 2016Document3 pagesAllard Growth Fund December 2016James HoNo ratings yet

- Fund 8322 Black Rock Us Equity IndexDocument1 pageFund 8322 Black Rock Us Equity IndexMikeNo ratings yet

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaNo ratings yet

- JULY 2009: Monthly UpdateDocument33 pagesJULY 2009: Monthly UpdatepuneetggNo ratings yet

- Discovery DecDocument1 pageDiscovery DecGauravNo ratings yet

- Ashmore Investment Management Limited Asian High Yield Debt Class ZDocument3 pagesAshmore Investment Management Limited Asian High Yield Debt Class Zcena1987No ratings yet

- 2022 Asset Wealth ManagementDocument22 pages2022 Asset Wealth ManagementSankaty LightNo ratings yet

- Discovery Fund April 23Document1 pageDiscovery Fund April 23Satyajeet AnandNo ratings yet

- Nedgroup Investments Global Flexible Fund ADocument2 pagesNedgroup Investments Global Flexible Fund Amakhathe mabitleNo ratings yet

- Product Snapshot: DSP 10Y G-Sec FundDocument2 pagesProduct Snapshot: DSP 10Y G-Sec FundManoj SharmaNo ratings yet

- RPCF May 2014 (English)Document1 pageRPCF May 2014 (English)Anonymous fS6Znc9No ratings yet

- HBL Asset Management FM LTD - PPTX UpdatedDocument16 pagesHBL Asset Management FM LTD - PPTX UpdatedMisbah Khan100% (1)

- Annual Report - Quant Mutual Fund - Financial Year 2022-23Document105 pagesAnnual Report - Quant Mutual Fund - Financial Year 2022-23R RNo ratings yet

- Case Study #1 Case Study #2Document2 pagesCase Study #1 Case Study #2Eugin FranciscoNo ratings yet

- HDFC Standard Life InsuranceDocument11 pagesHDFC Standard Life InsuranceanuradhaagrawalNo ratings yet

- 7-Year Asset Class Real Return Forecasts : As of January 31, 2021Document1 page7-Year Asset Class Real Return Forecasts : As of January 31, 2021Ericko Marvin KweknotoNo ratings yet

- MP - 3 - Peso Growth FundDocument2 pagesMP - 3 - Peso Growth FundFrank TaquioNo ratings yet

- HDFC Diversified Equity FundDocument1 pageHDFC Diversified Equity FundMayank RajNo ratings yet

- Blue Chip JulyDocument1 pageBlue Chip JulyPiyushNo ratings yet

- Term Deposit Rate Sheet: ShajarDocument1 pageTerm Deposit Rate Sheet: ShajarchqaiserNo ratings yet

- LiquiLoans - Prime Retail Fixed Income Investment Opportunity - Oct. 2022Document25 pagesLiquiLoans - Prime Retail Fixed Income Investment Opportunity - Oct. 2022Vivek SinghalNo ratings yet

- Model Description: Ticker NameDocument14 pagesModel Description: Ticker NameOleg KondratenkoNo ratings yet

- Wealth Insights Newsletter June 2021Document42 pagesWealth Insights Newsletter June 2021Ram PrasadNo ratings yet

- Kempen Global Small Cap Review Q1Document35 pagesKempen Global Small Cap Review Q1Andrei FirteNo ratings yet

- Fortnightly Banking Update: Deposit Growth Moderated But Bank Credit Growth Moderates Even MoreDocument3 pagesFortnightly Banking Update: Deposit Growth Moderated But Bank Credit Growth Moderates Even Morekumar ganeshNo ratings yet

- Launching The Credit Card in Asia PacificDocument10 pagesLaunching The Credit Card in Asia PacificNaveenParameswarNo ratings yet

- Edelweiss US Value Equity FundDocument20 pagesEdelweiss US Value Equity FundArmstrong CapitalNo ratings yet

- Financial ModellingDocument13 pagesFinancial ModellingBrendon McNo ratings yet

- Projected Rates of Profit July 2020 Active ProductsDocument1 pageProjected Rates of Profit July 2020 Active ProductsMansoor AliNo ratings yet

- FD BeaterDocument5 pagesFD BeaterMove OnNo ratings yet

- Canara Robeco Emerging Equities: For Private CirculationDocument1 pageCanara Robeco Emerging Equities: For Private CirculationAadeesh JainNo ratings yet

- FIMCF PresentationDocument70 pagesFIMCF Presentationkmkm1993No ratings yet

- Vietnam Digital Landscape 2023Document119 pagesVietnam Digital Landscape 2023gis3d.bhsNo ratings yet

- State Government Scheme - 0Document1 pageState Government Scheme - 0Vishwajeet DasNo ratings yet

- Case Processing SummaryDocument3 pagesCase Processing SummaryVandita KhudiaNo ratings yet

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarNo ratings yet

- FHLB Chicago 1117Document1 pageFHLB Chicago 1117tallindianNo ratings yet

- FDIC Certificate # 9092 Salin Bank and Trust CompanyDocument31 pagesFDIC Certificate # 9092 Salin Bank and Trust CompanyWaqas Khalid KeenNo ratings yet

- Allard Growth Fund August 2016Document3 pagesAllard Growth Fund August 2016James HoNo ratings yet

- 2015 Investor Presentation Oppenheimer 4x3Document27 pages2015 Investor Presentation Oppenheimer 4x3valueinvestor123No ratings yet

- 01 - M&A Conference - 2023 Year of The DealDocument25 pages01 - M&A Conference - 2023 Year of The Dealjm petitNo ratings yet

- Market Pulse Q4 Report - Nielsen Viet Nam: Prepared by Nielsen Vietnam February 2017Document8 pagesMarket Pulse Q4 Report - Nielsen Viet Nam: Prepared by Nielsen Vietnam February 2017K57.CTTT BUI NGUYEN HUONG LYNo ratings yet

- Equity Fund: % Top 10 Holding As On 31st March 2019Document1 pageEquity Fund: % Top 10 Holding As On 31st March 2019Sajith KumarNo ratings yet

- ARM Factsheets JanuaryDocument10 pagesARM Factsheets JanuaryJon RolexNo ratings yet

- Liquidity FundDocument3 pagesLiquidity Fundtangkc09No ratings yet

- CCP - One PagerDocument1 pageCCP - One PagerSandeep BorseNo ratings yet

- 2022 The Benefit of Benchmarking IOFMDocument12 pages2022 The Benefit of Benchmarking IOFMCRISNo ratings yet

- Bank of Kigali Announces AuditedDocument10 pagesBank of Kigali Announces AuditedinjishivideoNo ratings yet

- Ers. Co M: JANA Master Fund, Ltd. Performance Update - December 2010 Fourth Quarter and Year in ReviewDocument10 pagesErs. Co M: JANA Master Fund, Ltd. Performance Update - December 2010 Fourth Quarter and Year in ReviewVolcaneum100% (2)

- 12.max Life Diversified Equity FundDocument1 page12.max Life Diversified Equity Fundgourab.1996paulNo ratings yet

- Discretionary vs. Systematic:: Two Contrasting Hedge Fund ApproachesDocument3 pagesDiscretionary vs. Systematic:: Two Contrasting Hedge Fund ApproachesNorbert DurandNo ratings yet

- Compare Fund - MutualfundindiaDocument2 pagesCompare Fund - MutualfundindiaSujesh SasiNo ratings yet

- Market Research .: Problem Definition/ObjectiveDocument51 pagesMarket Research .: Problem Definition/Objectivekppandey87No ratings yet

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Interview Questions & AnswersDocument22 pagesInterview Questions & AnswersPrakashMhatre0% (1)

- Acct Statement - XX4027 - 21092023Document35 pagesAcct Statement - XX4027 - 21092023ralesh694No ratings yet

- Written Assignment Unit 3 - Analysis of Parasailing Business ExpansionDocument5 pagesWritten Assignment Unit 3 - Analysis of Parasailing Business Expansionkuashask2No ratings yet

- Meaning and Nature of InvestmentDocument43 pagesMeaning and Nature of InvestmentVaishnavi GelliNo ratings yet

- Valuation Part 2Document82 pagesValuation Part 2Dương Thu TràNo ratings yet

- 10 Dollars To Naira Black Market - Google SearchDocument1 page10 Dollars To Naira Black Market - Google SearchDickson ChibuzorNo ratings yet

- Chapter 6: Introduction To Capital BudgetingDocument3 pagesChapter 6: Introduction To Capital BudgetingDeneree Joi EscotoNo ratings yet

- Marius Barys, Cfa: Vilnius, LithuaniaDocument2 pagesMarius Barys, Cfa: Vilnius, LithuaniaPaulius KaminskasNo ratings yet

- Company Analysis - Electricite de France SA - FR0010242511 - EDF FP EquityDocument8 pagesCompany Analysis - Electricite de France SA - FR0010242511 - EDF FP EquityQ.M.S Advisors LLCNo ratings yet

- Valuation Concepts Module 12 PDFDocument4 pagesValuation Concepts Module 12 PDFJisselle Marie CustodioNo ratings yet

- P4AFM SQB As - d09 PDFDocument108 pagesP4AFM SQB As - d09 PDFTaariq Abdul-MajeedNo ratings yet

- 29mm Cotton Futures - 27042023 - 1682599040Document25 pages29mm Cotton Futures - 27042023 - 1682599040Shrinath AnbalaganNo ratings yet

- Hedging With Financial DerivativesDocument71 pagesHedging With Financial Derivativeshabiba ahmedNo ratings yet

- Lesson53 OA Exchange Rate Policy ANSWERSDocument3 pagesLesson53 OA Exchange Rate Policy ANSWERSDaniela Gonzalez SanchezNo ratings yet

- How The Brand Transformed The Cosmetic Industry: Entrepreneurship DevelopmentDocument26 pagesHow The Brand Transformed The Cosmetic Industry: Entrepreneurship DevelopmentArundhati ChatterjeeNo ratings yet

- Ch02HullOFOD7thEd UpdatedDocument37 pagesCh02HullOFOD7thEd Updateddelight photostateNo ratings yet

- BlockchainDocument25 pagesBlockchainCash Cash Cash100% (1)

- Chapter 3-Evaluation of Financial Performance: Multiple ChoiceDocument23 pagesChapter 3-Evaluation of Financial Performance: Multiple ChoiceKyla Ramos DiamsayNo ratings yet

- International Equity Market PDFDocument16 pagesInternational Equity Market PDFShreyas Dicholkar0% (1)

- 21 09 21 Tastytrade ResearchDocument5 pages21 09 21 Tastytrade ResearchtrungNo ratings yet

- Merchant Banking (Cir. 17.10.2023)Document26 pagesMerchant Banking (Cir. 17.10.2023)Akshaya SwaminathanNo ratings yet

- Lesson-3 EeDocument15 pagesLesson-3 EeChristian MagdangalNo ratings yet

- Through The Looking Glass #17 - Dream International (1126 HK)Document12 pagesThrough The Looking Glass #17 - Dream International (1126 HK)bodaiNo ratings yet

- Demat Account Closure FormDocument1 pageDemat Account Closure Formkumar kattasarvanNo ratings yet

- How To Trade This Volatile MarketDocument19 pagesHow To Trade This Volatile MarketmeganmaoNo ratings yet

- Securities Market The BattlefieldDocument14 pagesSecurities Market The BattlefieldJagrityTalwarNo ratings yet

- Edelweissmf Booksummary RicherwiserhappierDocument4 pagesEdelweissmf Booksummary Richerwiserhappierpablo pereira magnereNo ratings yet

- P24139 Noria Commercial Paper Weekly 20211105Document29 pagesP24139 Noria Commercial Paper Weekly 20211105NiltonBarbosaNo ratings yet