Professional Documents

Culture Documents

4 - 16-Financial-Model-with-5-years-projection

4 - 16-Financial-Model-with-5-years-projection

Uploaded by

SobironCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 - 16-Financial-Model-with-5-years-projection

4 - 16-Financial-Model-with-5-years-projection

Uploaded by

SobironCopyright:

Available Formats

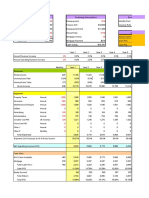

EXCEL BASEMENT Cover 07/16/2024 04:58:27

Excel Basement Five year projection

Color key Structure

Inputs

1.1 = Hard number assumption, can be changed. Assumptions Drivers, percentages, and constants

1.1 = Historical or given number. Do not change. Calcs Audit trails and supporting calculations

1.1 = Formula. Do not change. Debt Debt; interest income & expense calcs

Outputs

IncState Income statement, shareholder info

Circular references BalSheet Balance sheet

intentional circular references CashFlow Cash flow statement; cash analysis

Analysis

Summary Key drivers and accounts; ratios

© 2021 Excel Basement Private Limited Page 1 of 8

EXCEL BASEMENT Assumptions 07/16/2024 04:58:27

Excel Basement Hist. Proj. Proj. Proj. Proj. Proj.

Assumptions Year Year 1 Year 2 Year 3 Year 4 Year 5

Income statement

Sales growth 7.0% 7.0% 7.0% 7.0% 7.0% 7.0%

COGS as % of sales 68.0% 68.0% 68.0% 68.0% 68.0% 68.0%

SG&A as % of sales 23.0% 23.0% 23.0% 23.0% 23.0% 23.0%

Tax rate % of Income before taxes 30.0% 30.0% 30.0% 30.0% 30.0% 30.0%

Shareholder info

Dividend payout rate % of net income 20.1% 20.0% 20.0% 20.0% 20.0% 20.0%

Wgted avg common shares outstanding 12.2 12.2 12.2 12.2 12.2 12.2

PP&E

Annual depr. as % of previous PPE 8.0% 8.0% 8.0% 8.0% 8.0% 8.0%

Capital expenditures % of sales 0.0% 5.0% 5.0% 5.0% 5.0% 5.0%

Working capital

Accounts receivable as % of sales 10.0% 10.0% 10.0% 10.0% 10.0% 10.0%

Inventories % of COGS 7.7% 7.7% 7.7% 7.7% 7.7% 7.7%

Accounts payable % of COGS 8.8% 8.8% 8.8% 8.8% 8.8% 8.8%

Debt & interest

Interest % on cash 5.5% 5.5% 5.5% 5.5% 5.5%

Interest % on Revolver 9.0% 9.0% 9.0% 9.0% 9.0%

Issuance, Bank loan 70.0 5.0 0.0 0.0 0.0 0.0

Repayment schedule, Bank loan 0.0 5.0 5.0 5.0 5.0

Other assumptions

Common stock $ end balance 30.0 30.0 30.0 30.0 30.0 30.0

© 2021 Excel Basement Private Limited Page 2 of 8

EXCEL BASEMENT Calcs 07/16/2024 04:58:27

Excel Basement Hist. Proj. Proj. Proj. Proj. Proj.

Calculations Year Year 1 Year 2 Year 3 Year 4 Year 5

PP&E

Net PP&E, beginning balance 198.5 226.5 255.3 285.1 316.0

Capital expenditures 43.9 46.9 50.2 53.7 57.5

Annual depreciation 15.9 18.1 20.4 22.8 25.3

PP&E, ending balance 198.5 226.5 255.3 285.1 316.0 348.3

Retained earnings

Beginning balance 177.0 212.3 249.5 288.7 330.1

Net income 44.2 46.5 49.0 51.7 54.8

Dividends paid 8.8 9.3 9.8 10.3 11.0

Ending balance 177.0 212.3 249.5 288.7 330.1 373.9

Operating working capital

Accounts receivable 82.0 87.7 93.9 100.5 107.5 115.0

Inventories 43.2 45.9 49.2 52.6 56.3 60.2

Total current assets except cash 125.2 133.7 143.0 153.1 163.8 175.2

Accts payable 49.1 52.5 56.2 60.1 64.3 68.8

Operating working capital 76.1 81.2 86.9 92.9 99.4 106.4

© 2021 Excel Basement Private Limited Page 3 of 8

EXCEL BASEMENT Debt 07/16/2024 04:58:27

Excel Basement Hist. Proj. Proj. Proj. Proj. Proj.

Debt schedule Year Year 1 Year 2 Year 3 Year 4 Year 5

Short-term debt

Revolver

Amount of Revolver 0.0 0.0 0.0 0.0 0.0 0.0

Interest rate on Revolver 9.0% 9.0% 9.0% 9.0% 9.0% 9.0%

Interest expense 2.5 0.0 0.0 0.0 0.0 0.0

Long-term debt

7 1/2% bank drawdown loan

Beginning amount 0.0 70.0 75.0 70.0 65.0 60.0

Issuance 70.0 5.0 0.0 0.0 0.0 0.0

Scheduled repayment 0.0 0.0 5.0 5.0 5.0 5.0

Ending amount 70.0 75.0 70.0 65.0 60.0 55.0

Interest rate 7.5% 7.5% 7.5% 7.5% 7.5% 7.5%

Interest expense 2.6 5.4 5.4 5.1 4.7 4.3

Debt and interest expense summary

Short-term debt 0.0 0.0 0.0 0.0 0.0 0.0

Long-term debt 70.0 75.0 70.0 65.0 60.0 55.0

Total debt 70.0 75.0 70.0 65.0 60.0 55.0

Total interest expense ($) 5.1 5.4 5.4 5.1 4.7 4.3

Interest income calculation

Cash 2.4 9.7 7.3 5.6 4.6 4.2

Int. % on cash and cash equival 5.5% 5.5% 5.5% 5.5% 5.5% 5.5%

Interest income 0.5 0.3 0.5 0.4 0.3 0.2

© 2021 Excel Basement Private Limited Page 4 of 8

EXCEL BASEMENT IncState 07/16/2024 04:58:27

Excel Basement Hist. Proj. Proj. Proj. Proj. Proj.

Income statement Year Year 1 Year 2 Year 3 Year 4 Year 5

Revenues

Sales 820.0 877.4 938.8 1,004.5 1,074.9 1,150.1

COGS 557.6 596.6 638.4 683.1 730.9 782.1

Depreciation 13.8 15.9 18.1 20.4 22.8 25.3

Gross profit 248.6 264.9 282.3 301.0 321.1 342.7

Expenses

SG&A 188.6 201.8 215.9 231.0 247.2 264.5

Operating profit 60.0 63.1 66.4 70.0 73.9 78.2

Interest income 0.5

Interest expense 5.1

Net income before taxes 55.4 63.1 66.4 70.0 73.9 78.2

Taxes 16.6 18.9 19.9 21.0 22.2 23.5

Net income 38.8 44.2 46.5 49.0 51.7 54.8

Shareholder information

Weighted avg. shares outstandi 12.2 12.2 12.2 12.2 12.2 12.2

Dividends 7.8 8.8 9.3 9.8 10.3 11.0

Earnings per share $3.18 $3.62 $3.81 $4.02 $4.24 $4.49

© 2021 Excel Basement Private Limited Page 5 of 8

EXCEL BASEMENT BalSheet 07/16/2024 04:58:27

Excel Basement Hist. Proj. Proj. Proj. Proj. Proj.

Balance sheet Year Year 1 Year 2 Year 3 Year 4 Year 5

Assets

Current assets

Cash 2.4 9.7 7.3 5.6 4.6 4.2

Accounts receivable 82.0 87.7 93.9 100.5 107.5 115.0

Inventories 43.2 45.9 49.2 52.6 56.3 60.2

Total current assets 127.6 143.3 150.4 158.7 168.4 179.4

Non-current assets

Net PP&E 198.5 226.5 255.3 285.1 316.0 348.3

Total assets 326.1 369.8 405.7 443.8 484.4 527.7

Liabilities

Current liabilities

Revolver 0.0 0.0 0.0 0.0 0.0 0.0

Accounts payable 49.1 52.5 56.2 60.1 64.3 68.8

Total current liabilities 49.1 52.5 56.2 60.1 64.3 68.8

Non-current liabilities

Total long-term debt 70.0 75.0 70.0 65.0 60.0 55.0

Total liabilities 119.1 127.5 126.2 125.1 124.3 123.8

Equity

Common stock 30.0 30.0 30.0 30.0 30.0 30.0

Retained earnings 177.0 212.3 249.5 288.7 330.1 373.9

Total equity 207.0 242.3 279.5 318.7 360.1 403.9

Total Liab.& Equity 326.1 369.8 405.7 443.8 484.4 527.7

Balance? 0.0 0.0 0.0 0.0 0.0 0.0

© 2021 Excel Basement Private Limited Page 6 of 8

EXCEL BASEMENT Cash 07/16/2024 04:58:27

Excel Basement Hist. Proj. Proj. Proj. Proj. Proj.

Cash flow statement Year Year 1 Year 2 Year 3 Year 4 Year 5

Cash flow from operations

HINT:

Net income

From I/S 44.2 46.5 49.0 51.7 54.8

HINT:

Depreciation

Annual depr from Calcs 15.9 18.1 20.4 22.8 25.3

HINT:

(Increase

Subtract

in operating

currentworking

period from

capital)

previous period (Calcs)

(5.1) (5.7) (6.1) (6.5) (7.0)

HINT:

TotalSum

cash from operations 55.0 58.9 63.3 68.1 73.1

Cash flow from investing

HINT:

(Capital

From

expenditure)

Calcs. Notice signs and adjust if needed (43.9) (46.9) (50.2) (53.7) (57.5)

HINT:

TotalSum

cash from investing (43.9) (46.9) (50.2) (53.7) (57.5)

Cash flow from financing

HINT:

Increase

Do(decrease)

not includeinthe

LTD

Revolver! 5.0 (5.0) (5.0) (5.0) (5.0)

HINT:

Increase

Measure

(decrease)

change

in Common

on B/S from

stock

beg. to end of year; show

0.0 increase

0.0 as positive

0.0 0.0 0.0

HINT:

(Dividends)

From I/S (8.8) (9.3) (9.8) (10.3) (11.0)

HINT:

TotalSum

cash from financing (3.8) (14.3) (14.8) (15.3) (16.0)

HINT:

Total net

Sumchange

the three

in cash

subtotals 7.3 (2.3) (1.7) (1.0) (0.4)

How did cash change?

HINT:

Beginning

Amount

cashof cash the company had on hand at beginning

2.4 of year

9.7 7.3 5.6 4.6

HINT:

ChangeTotal

in cash

net from

changeCFSin cash, from above 7.3 (2.3) (1.7) (1.0) (0.4)

HINT:

Cash / Add

(Revolver)

beginning

at end

cashof and

yearchange in cash2.4 9.7 7.3 5.6 4.6 4.2

© 2021 Excel Basement Private Limited Page 7 of 8

EXCEL BASEMENT Summary 07/16/2024 04:58:27

Excel Basement Hist. Proj. Proj. Proj. Proj. Proj.

Summary Year Year 1 Year 2 Year 3 Year 4 Year 5

Size

From

Sales output sheet 820.0 877.4 938.8 1,004.5 1,074.9 1,150.1

From

Cash output

flow from

sheet

operations 0.0 55.0 58.9 63.3 68.1 73.1

From

Net income

output sheet 38.8 44.2 46.5 49.0 51.7 54.8

Profitability

From

Grossoutput

profit sheet 248.6 264.9 282.3 301.0 321.1 342.7

From

Operating

outputprofit

sheet 60.0 63.1 66.4 70.0 73.9 78.2

Op

Operating

profit tomargin

Sales 7.3% 7.2% 7.1% 7.0% 6.9% 6.8%

Net income/sales

margin 4.7% 5.0% 4.9% 4.9% 4.8% 4.8%

Net

Return

income/average

on assets total assets NA 12.7% 12.0% 11.5% 11.2% 10.8%

From

EPS Income Statement $3.18 $3.62 $3.81 $4.02 $4.24 $4.49

Leverage & Coverage

Total borrowed

debt to netfunds/Total

worth equity 33.8% 30.9% 25.0% 20.4% 16.7% 13.6%

Operating

EBIT profit + other income. Definitions vary;

60.0you might

63.1also want

66.4to include

70.0

interest 73.9

income. 78.2

Earnings

EBIT / Interest

before interest & taxes / interest 11.76

expensex 11.60 x 12.21 x 13.82 x 15.77 x 18.14 x

Asset management

From

Capital

output

expenditures

sheet 0.0 43.9 46.9 50.2 53.7 57.5

Capital expenditure to Sales 0.0% 5.0% 5.0% 5.0% 5.0% 5.0%

OWC to sales 9.3% 9.3% 9.3% 9.3% 9.3% 9.3%

Net PPE to Sales 39.8% 42.2% 43.2% 44.2% 45.1% 45.9%

© 2021 Excel Basement Private Limited Page 8 of 8

You might also like

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- The Warren Buffett Spreadsheet Final-Version - PreviewDocument335 pagesThe Warren Buffett Spreadsheet Final-Version - PreviewHari ganesh RNo ratings yet

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- 12 LBO Model Seven Days Case StudyDocument6 pages12 LBO Model Seven Days Case StudyDNo ratings yet

- Busi 331 Project 1 Marking Guide: HandbookDocument28 pagesBusi 331 Project 1 Marking Guide: HandbookDilrajSinghNo ratings yet

- Gainesboro SolutionDocument7 pagesGainesboro SolutionakashNo ratings yet

- Project Appraisal - Hotel Project in Sri LankaDocument15 pagesProject Appraisal - Hotel Project in Sri Lankachathura ravilal hapuarachchiNo ratings yet

- ACC 345 7-1 Final Project Milestone Three Final Statement Analysis and Valuation ReportDocument19 pagesACC 345 7-1 Final Project Milestone Three Final Statement Analysis and Valuation ReportKelly JohnsonNo ratings yet

- CFI 3 Statement Model CompleteDocument14 pagesCFI 3 Statement Model CompleteMAYANK AGGARWALNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- AMT Geninterest STD 2018Document9 pagesAMT Geninterest STD 2018Mai SuwanchaiyongNo ratings yet

- 3 Statement Modeling With Iterations SummaryDocument7 pages3 Statement Modeling With Iterations SummaryEmperor OverwatchNo ratings yet

- Economic Analysis: Company Name Suscok Jaya GemilangDocument1 pageEconomic Analysis: Company Name Suscok Jaya GemilangSamuel ArelianoNo ratings yet

- Nex Ed Financial ForecastingDocument9 pagesNex Ed Financial ForecastingNoor Mohammad NasimNo ratings yet

- Financial Modelling Mid Term: Do Not Hard Code Any Solution Hard Coded Solution Will Not Be Awarded Any MarksDocument7 pagesFinancial Modelling Mid Term: Do Not Hard Code Any Solution Hard Coded Solution Will Not Be Awarded Any MarksSAMBUDDHA ROYNo ratings yet

- Burton ExcelDocument128 pagesBurton ExcelJaydeep SheteNo ratings yet

- Anta Forecast Template STD 2023Document8 pagesAnta Forecast Template STD 2023Ronnie KurtzbardNo ratings yet

- Input: Eurmn - Dec Y/E 2015A 2016A 2017E 2018E 2019E 2020EDocument4 pagesInput: Eurmn - Dec Y/E 2015A 2016A 2017E 2018E 2019E 2020ERam persadNo ratings yet

- 3 Statement Model - BlankDocument6 pages3 Statement Model - BlankAina Michael100% (1)

- 3_Statement_Model_-_BlankDocument5 pages3_Statement_Model_-_Blankiacpa.aialmeNo ratings yet

- Financial Projections Template 08Document26 pagesFinancial Projections Template 08Clyde SakuradaNo ratings yet

- Financial Projections Model v6.8.4Document28 pagesFinancial Projections Model v6.8.4nikNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871franzmartiniiNo ratings yet

- Varma Capitals - Modeling TestDocument6 pagesVarma Capitals - Modeling TestSuper FreakNo ratings yet

- Amaha Advanced 3 - StatementModelDocument6 pagesAmaha Advanced 3 - StatementModelamahaktNo ratings yet

- Prospective Analysis - ForecastingDocument17 pagesProspective Analysis - ForecastingqueenbeeastNo ratings yet

- Technical Interview WSOmodel2003Document7 pagesTechnical Interview WSOmodel2003Li HuNo ratings yet

- BurtonsDocument6 pagesBurtonsKritika GoelNo ratings yet

- Inputs For Valuation Current InputsDocument6 pagesInputs For Valuation Current Inputsapi-3763138No ratings yet

- SFH Rental AnalysisDocument6 pagesSFH Rental AnalysisA jNo ratings yet

- Atherine S OnfectioneryDocument3 pagesAtherine S OnfectioneryVanshika SinghNo ratings yet

- The Warren Buffett Spreadsheet - PreviewDocument350 pagesThe Warren Buffett Spreadsheet - PreviewbysqqqdxNo ratings yet

- 539770228.xls Sources and Uses (2) 1Document5 pages539770228.xls Sources and Uses (2) 1prati gumrNo ratings yet

- Marvel LTDDocument4 pagesMarvel LTDWaleed ShafeiNo ratings yet

- LBO Model DetailedDocument10 pagesLBO Model Detailedpre.meh21No ratings yet

- Corporate Finance ProjectDocument7 pagesCorporate Finance ProjectAbhinav Akash SinghNo ratings yet

- Inputs For Valuation Current InputsDocument6 pagesInputs For Valuation Current InputsÃarthï ArülrãjNo ratings yet

- FcffevaDocument6 pagesFcffevaShobhit GoyalNo ratings yet

- Business Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualDocument19 pagesBusiness Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualStephanieParkerexbf100% (50)

- 9 Cash Flow TemplateDocument7 pages9 Cash Flow TemplateJay GuptaNo ratings yet

- 6.1 Financial Model Working - Lecture 30Document63 pages6.1 Financial Model Working - Lecture 30Alfred DurontNo ratings yet

- 2.1 Financial Model Working - Lecture 26Document51 pages2.1 Financial Model Working - Lecture 26Alfred DurontNo ratings yet

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- Student May Add To The List of AssumptionsDocument10 pagesStudent May Add To The List of AssumptionsAbhilash NNo ratings yet

- Income Statement Projections: Step 2: Calculate Historical Growth Rates and MarginsDocument2 pagesIncome Statement Projections: Step 2: Calculate Historical Growth Rates and MarginsNamitNo ratings yet

- APECS Financial Modelling Test (Updated) - by Keng YangDocument16 pagesAPECS Financial Modelling Test (Updated) - by Keng YangDarren WongNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument5 pagesThe Discounted Free Cash Flow Model For A Complete BusinessSanket DubeyNo ratings yet

- Hard Rock (Pty) LTD - SolutionDocument8 pagesHard Rock (Pty) LTD - SolutionNicolasNo ratings yet

- The Model (Blank)Document15 pagesThe Model (Blank)aftababbasNo ratings yet

- Byjus Base ModelDocument8 pagesByjus Base Modelsharma.kunal70No ratings yet

- ExcelDocument12 pagesExcelangel guptaNo ratings yet

- Cash Flow ModelDocument1 pageCash Flow ModelVinay KumarNo ratings yet

- Investment Banking ClassDocument20 pagesInvestment Banking Classlaiba mujahidNo ratings yet

- PGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1Document26 pagesPGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1nidhidNo ratings yet

- Theory & Practice of Financial Management Faraz Naseem Sunday, April 19th, 2020Document12 pagesTheory & Practice of Financial Management Faraz Naseem Sunday, April 19th, 2020Hassaan KhalidNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872franzmartiniiNo ratings yet

- APECS Financial Modelling Test (Updated) - DarrenDocument22 pagesAPECS Financial Modelling Test (Updated) - DarrenDarren WongNo ratings yet

- Soumya Lokhande 1353 - Manmouth CaseDocument13 pagesSoumya Lokhande 1353 - Manmouth CasednesudhudhNo ratings yet

- Lecture SlidesDocument21 pagesLecture SlidesmusthaqhassanNo ratings yet

- Refinance Risk Analysis Tool: Visit This Model's WebpageDocument4 pagesRefinance Risk Analysis Tool: Visit This Model's WebpageAyush PandeNo ratings yet

- IcsiDocument12 pagesIcsiUday NegiNo ratings yet

- Start File 3 Statement Model - v2Document8 pagesStart File 3 Statement Model - v2AndreNo ratings yet

- 4 - 19-HR-Best-Practices-ModelDocument20 pages4 - 19-HR-Best-Practices-ModelSobironNo ratings yet

- 4 - 21-Personal-Finance-Template-Monthly-BudgetDocument1 page4 - 21-Personal-Finance-Template-Monthly-BudgetSobironNo ratings yet

- 4 - 20-monthly-planner-template-2023Document3 pages4 - 20-monthly-planner-template-2023SobironNo ratings yet

- Serial key for acrobatDocument1 pageSerial key for acrobatSobironNo ratings yet

- Bahasa Inggeris (013) Tahun 4 2024Document15 pagesBahasa Inggeris (013) Tahun 4 2024SobironNo ratings yet

- Presentation AND Case Study ON Nivea: Made by Rishab Goenka Roll No.26 AND Sona Shyamsukha Roll No.32Document34 pagesPresentation AND Case Study ON Nivea: Made by Rishab Goenka Roll No.26 AND Sona Shyamsukha Roll No.32Rishab GoenkaNo ratings yet

- Module 3-WCM-Cash Budget Problems For LMS 2020Document2 pagesModule 3-WCM-Cash Budget Problems For LMS 2020sandeshNo ratings yet

- FM Revision 3rd YearDocument39 pagesFM Revision 3rd YearBharat Satyajit100% (1)

- DurgeshDocument1 pageDurgeshDavid AleNo ratings yet

- ESOP PresentationDocument19 pagesESOP Presentationneha_bahadurNo ratings yet

- Working Capital ManagementDocument73 pagesWorking Capital ManagementAnonymous 5r66EmHNo ratings yet

- SHELL Pakistan: Finnacial Ratios Formulas YearDocument2 pagesSHELL Pakistan: Finnacial Ratios Formulas YearAbdullah QureshiNo ratings yet

- Capacity PlanningDocument30 pagesCapacity PlanningZeeshan Munir100% (1)

- Bikanervala Foods Private Limited: Summary of Rated InstrumentsDocument7 pagesBikanervala Foods Private Limited: Summary of Rated InstrumentsDarshan ShahNo ratings yet

- 15.515 Financial Accounting Preliminary Final ReviewDocument21 pages15.515 Financial Accounting Preliminary Final ReviewAnant AgarwalNo ratings yet

- Statement On CARO, 2003Document357 pagesStatement On CARO, 2003Vikas Ralhan100% (1)

- Commissioner of Internal Revenue vs. Ateneo de Manila UniversityDocument2 pagesCommissioner of Internal Revenue vs. Ateneo de Manila UniversityBoogie San JuanNo ratings yet

- Payment of Bonus Form A, B, C & DDocument4 pagesPayment of Bonus Form A, B, C & Darun gupta0% (1)

- Mcdonal's Finanical RatiosDocument11 pagesMcdonal's Finanical RatiosFahad Khan TareenNo ratings yet

- 1967 - 202223 - REVISED - Revised 1 - Statement of IncomeDocument2 pages1967 - 202223 - REVISED - Revised 1 - Statement of IncomeSmita desaiNo ratings yet

- Joint Venture Master AgreementDocument176 pagesJoint Venture Master AgreementHaYoung KimNo ratings yet

- Auditing Theory TEST BANKDocument23 pagesAuditing Theory TEST BANKGelyn CruzNo ratings yet

- Markets For Factor Inputs, Labour Market Economic Rent: Chapter 10 & 11Document24 pagesMarkets For Factor Inputs, Labour Market Economic Rent: Chapter 10 & 11Sapna RohitNo ratings yet

- Summer Internship File Very ImportantDocument32 pagesSummer Internship File Very ImportantYash SharmaNo ratings yet

- DipIFR June 2015 - QuestionsDocument10 pagesDipIFR June 2015 - QuestionsSoňa SlovákováNo ratings yet

- Event Business Plan - v1Document11 pagesEvent Business Plan - v1Rajkumar TrimukheNo ratings yet

- Sbi Life Shield Used As A Keyman How To SubscribeDocument3 pagesSbi Life Shield Used As A Keyman How To SubscribeDADINMNo ratings yet

- Sales Tracker TemplateDocument9 pagesSales Tracker TemplateAL-Mawali87No ratings yet

- ECON 311 Review Questions For Exam 2/4Document9 pagesECON 311 Review Questions For Exam 2/4Pierre Rodriguez100% (1)

- Earnings ManagementDocument14 pagesEarnings ManagementSalma ChakrounNo ratings yet

- Journalizing TransactionsDocument38 pagesJournalizing TransactionsPratyush mishraNo ratings yet

- Transpek Industry LTDDocument6 pagesTranspek Industry LTDabhishekbasumallick100% (1)

- The Price System, Demand and Supply, and ElasticityDocument29 pagesThe Price System, Demand and Supply, and ElasticitySyifa034No ratings yet