Professional Documents

Culture Documents

RECEIPT OF DRIVER_May2024

RECEIPT OF DRIVER_May2024

Uploaded by

Payal Sethi Khera0 ratings0% found this document useful (0 votes)

0 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

0 views1 pageRECEIPT OF DRIVER_May2024

RECEIPT OF DRIVER_May2024

Uploaded by

Payal Sethi KheraCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

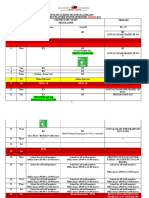

RECEIPT OF DRIVER’S SALARY

INVOICE# 155

I Sandeep Bhati (Driver’s Name) have received amount of Rs. 10000 as my salary towards driving

assistance from Mr. Vikas Khera (Employee Name) for the month of July 2024.

Signature of the Employee Signature of Driver

Name of Employee – Vikas Khera Name of Driver – Sandeep Bhati

Employee Code – 3198226 Date –3rd July 2024

Note:

1.The employee can claim the Driving Assistance Expenses only “ONE” vehicle under Driving

Assistance Expenses head.

2. The Vehicle must be in the name of employee / Rental car provided by company for which the

Driving Assistance Expenses is being claimed.

3.Employee should have incurred expense towards Driving Assistance for claiming these benefits as a

set off from their Special Allowance and get the benefit of Tax rebate

Confidential Page 1 Driver Salary

You might also like

- Renewal of Your Easy Health Individual Standard Insurance PolicyDocument5 pagesRenewal of Your Easy Health Individual Standard Insurance PolicyHeena BhatNo ratings yet

- RECEIPT OF DRIVER_June2024Document1 pageRECEIPT OF DRIVER_June2024Payal Sethi KheraNo ratings yet

- Driver Salary MayDocument1 pageDriver Salary MayPayal Sethi KheraNo ratings yet

- Nagarro - Receipt For Claiming Drivers SalaryDocument1 pageNagarro - Receipt For Claiming Drivers SalaryNitin YadavNo ratings yet

- May SalaryDocument1 pageMay SalaryFarhan MallickNo ratings yet

- Driver Salary AprilDocument1 pageDriver Salary AprilFarhan MallickNo ratings yet

- Driver Salary ReceiptsDocument12 pagesDriver Salary ReceiptsKrishnaveni GurralaNo ratings yet

- Premium Receipt 1Document1 pagePremium Receipt 1dinesh 407No ratings yet

- POCMVPC0100108319Document14 pagesPOCMVPC0100108319BIKRAM KUMAR BEHERANo ratings yet

- Payment Process:: Guidelines For Claiming Flexible Allowance FY 2019-20Document3 pagesPayment Process:: Guidelines For Claiming Flexible Allowance FY 2019-20Tanveer BhushanNo ratings yet

- Ahmed Faisal 43222080 2023 RewardDocument2 pagesAhmed Faisal 43222080 2023 RewardGeorge KelvinNo ratings yet

- Driver Salary-FebDocument1 pageDriver Salary-FebicelebrateNo ratings yet

- FY08 Car Lease Document V2Document3 pagesFY08 Car Lease Document V2Swanidhi SinghNo ratings yet

- PRASHANTRAI40001Document2 pagesPRASHANTRAI40001Prashant RaiNo ratings yet

- Driver Salary ReceiptDocument1 pageDriver Salary ReceiptalankarmcNo ratings yet

- Premium Receipt 2Document1 pagePremium Receipt 2dinesh 407No ratings yet

- PREMIUM-RECEIPT DineshDocument1 pagePREMIUM-RECEIPT Dineshdinesh 407No ratings yet

- Liability Only Policy - Private CarDocument7 pagesLiability Only Policy - Private CarSatish AggarwalNo ratings yet

- Commercial Motor Passenger CarryingDocument14 pagesCommercial Motor Passenger Carryingromeoahmed687No ratings yet

- Driver Salary MayDocument1 pageDriver Salary Maycoolsaurabh18No ratings yet

- Preliminary Consent LetterDocument1 pagePreliminary Consent LetterJayesh BajpaiNo ratings yet

- Gaurav 3 189321 Offer LetterDocument4 pagesGaurav 3 189321 Offer LetterNaveen KumarNo ratings yet

- F22164 RohanSurjan OfferLetterDocument4 pagesF22164 RohanSurjan OfferLettergsanskar2000No ratings yet

- Commercial Motor Goods CarryingDocument17 pagesCommercial Motor Goods CarryingAbhay SrivastavaNo ratings yet

- Insurance Pump ICICI Policy 310521Document18 pagesInsurance Pump ICICI Policy 310521expert2advisoryNo ratings yet

- Driver Salary - MarDocument1 pageDriver Salary - MaricelebrateNo ratings yet

- Car Lease Policy Ver 2.0Document5 pagesCar Lease Policy Ver 2.0PF SOLUTIONSNo ratings yet

- Sanjay Birua Pending Dues AirindiaDocument3 pagesSanjay Birua Pending Dues AirindiaNur IslamNo ratings yet

- Commercial Motor Goods CarryingDocument17 pagesCommercial Motor Goods CarryingADHAR SHARMANo ratings yet

- Provident Funding SalaryDocument13 pagesProvident Funding Salaryaimaabbasi1112No ratings yet

- Driver Salary Template 2Document1 pageDriver Salary Template 2Calori YuaNo ratings yet

- Driver Salary Template 2Document1 pageDriver Salary Template 2Calori YuaNo ratings yet

- MMMMDocument1 pageMMMMParthiban ManiNo ratings yet

- Sureti PlacementDocument4 pagesSureti Placementvinith kumar100% (1)

- Xuv Car-Insurance-PolicyDocument4 pagesXuv Car-Insurance-PolicySarath KumarNo ratings yet

- Bajaj Allianz Life Insurance Co. LTD.: Date:09-03-2024Document1 pageBajaj Allianz Life Insurance Co. LTD.: Date:09-03-2024kumarmadhesh84No ratings yet

- Policy BreakdownDocument4 pagesPolicy BreakdownSparsh Panwar 067 F2No ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyAarti BalmikiNo ratings yet

- Gaurav 3 192669 Offer LetterDocument4 pagesGaurav 3 192669 Offer LetterNaveen KumarNo ratings yet

- Solara Active AbridgedDocument12 pagesSolara Active AbridgedhaadritiNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid AcknowledgementSIVANo ratings yet

- Bishram Singh (Ssa)Document16 pagesBishram Singh (Ssa)Akhand SinghNo ratings yet

- Midnight of 01-1-2015 Cubic Capacity: Issued Through Nsureplus Application SoftwareDocument2 pagesMidnight of 01-1-2015 Cubic Capacity: Issued Through Nsureplus Application Softwareavinash9085No ratings yet

- Renewal of Your Easy Health Floater Standard Insurance PolicyDocument4 pagesRenewal of Your Easy Health Floater Standard Insurance PolicyAhesan Ali MominNo ratings yet

- Bhavani Sbi Delh Satyam AtmDocument16 pagesBhavani Sbi Delh Satyam AtmUMANG COMPUTERSNo ratings yet

- Notice of Agm 2016Document9 pagesNotice of Agm 2016siddharthjain98160No ratings yet

- Driver Salary Template 2Document1 pageDriver Salary Template 2Calori YuaNo ratings yet

- Claim FormsDocument10 pagesClaim FormsMohit AggarwalNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument12 pagesRenewal of Your Optima Restore Floater Insurance PolicymonarcclansNo ratings yet

- RenewalNoticeBRONew UpdatedDocument2 pagesRenewalNoticeBRONew UpdatedSHARATHNo ratings yet

- Health InsuranceDocument4 pagesHealth Insurancemanik.ahuja4634No ratings yet

- 18 Audit and Auditors 1657952321Document102 pages18 Audit and Auditors 1657952321Jayesh MPNo ratings yet

- Godrej & Boyce AnnualReportAccounts2018Document90 pagesGodrej & Boyce AnnualReportAccounts2018ProjectinsightNo ratings yet

- Mahindra FinanaceDocument14 pagesMahindra FinanaceIshita BhagatNo ratings yet

- MR - Quddus Ahmed AbdulDocument14 pagesMR - Quddus Ahmed AbdulHunter RoccoNo ratings yet

- Acord 61 Id 2009 01Document1 pageAcord 61 Id 2009 01betsabe12366No ratings yet

- 27TW5105 KR SbiDocument14 pages27TW5105 KR Sbibalajiautofin.kotireddyNo ratings yet

- Commercial Motor Goods CarryingDocument14 pagesCommercial Motor Goods CarryingJANAKI BABJEENo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- RECEIPT OF DRIVER_June2024Document1 pageRECEIPT OF DRIVER_June2024Payal Sethi KheraNo ratings yet

- Identifying Equal Parts: Circle The 7 Shapes That Have Been Split Into Equal Parts. TrianglesDocument2 pagesIdentifying Equal Parts: Circle The 7 Shapes That Have Been Split Into Equal Parts. TrianglesPayal Sethi KheraNo ratings yet

- Pitstop Questionaire 1Document556 pagesPitstop Questionaire 1Payal Sethi KheraNo ratings yet

- DCStudio ProdDocument14 pagesDCStudio ProdPayal Sethi KheraNo ratings yet

- Test Case TemplateDocument58 pagesTest Case TemplatePayal Sethi KheraNo ratings yet

- Human Body and SystemsDocument6 pagesHuman Body and SystemsPayal Sethi KheraNo ratings yet

- Circular - Online ClassesDocument1 pageCircular - Online ClassesPayal Sethi KheraNo ratings yet

- Need and WantsDocument1 pageNeed and WantsPayal Sethi KheraNo ratings yet

- Asm1 3746Document3 pagesAsm1 3746Payal Sethi KheraNo ratings yet

- Class Time Table 11th Jan 2024Document1 pageClass Time Table 11th Jan 2024Payal Sethi KheraNo ratings yet

- Play Pacakages October23Document6 pagesPlay Pacakages October23Payal Sethi KheraNo ratings yet

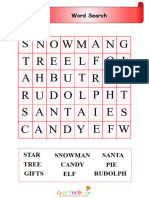

- Christmas Activity Pack 14rbxmDocument30 pagesChristmas Activity Pack 14rbxmPayal Sethi KheraNo ratings yet

- 2024 Gully Cafe Party Menu GurgaonDocument2 pages2024 Gully Cafe Party Menu GurgaonPayal Sethi KheraNo ratings yet

- Re Opening of Schools 1Document1 pageRe Opening of Schools 1Payal Sethi KheraNo ratings yet

- Lunch BoxDocument23 pagesLunch BoxPayal Sethi KheraNo ratings yet

- Kosmic Kingdom - Menu - 12.09.2023Document2 pagesKosmic Kingdom - Menu - 12.09.2023Payal Sethi KheraNo ratings yet