Professional Documents

Culture Documents

Fayette Tax

Fayette Tax

Uploaded by

Ajay gadiparthiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fayette Tax

Fayette Tax

Uploaded by

Ajay gadiparthiCopyright:

Available Formats

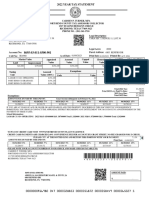

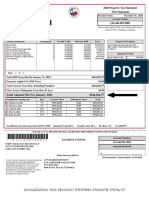

2023 Property Tax Statement Bill No.

Due Date

Current Prior Back

*Total Due*

Due Payment Taxes

Kristie King Paid

2023-28210 11/30/2023 $0.00 $4,167.84 $0.00

Fayette County Tax Commissioner 11/21/2023

P. O. Box 70

Fayetteville, GA 30214

Phone: (770) 461-3652, Fax: (770) 461-8443 Map: 053736004 Printed: 07/07/2024

Location: 165 PILGRIM WAY

MILLER D'NA

165 PILGRIM WAY • THERE WILL BE A FEE OF 2.5% FOR MOST CARDS IF PAID ONLINE.

FAYETTEVILLE, GA 30214 • YOUR NET MILLAGE RATE IS EQUAL TO YOUR COUNTY SCHOOL OR

CITY MILLAGE RATE LESS THE APPLICABLE SALES TAX CREDIT. REFER

TO THE REVERSE OF YOUR TAX BILL FOR INFORMATION ABOUT STATE

RETURN THIS PORTION WITH PAYMENT AND LOCAL EXEMPTIONS.

(Interest will be added per month if not paid by due date) • IF THIS BILL IS MARKED "APPEAL" IT IS CALCULATED AT 85% VALUE.

AN ADJUSTED BILL WILL BE ISSUED WHEN YOUR APPEAL IS FINALIZED.

Kristie King Tax Payer: MILLER D'NA

Fayette County Tax Commissioner Map Code: 053736004 Real

P. O. Box 70 Description: LOT 95 CANTERBURY PHASE 1

Fayetteville, GA 30214

Phone: (770) 461-3652, Fax: (770) 461-8443 Location: 165 PILGRIM WAY

Bill No: 2023-28210

District: 02

Payment Good

Building Value Land Value Acres Fair Market Value Due Date Billing Date Exemptions

through

276,300.00 66,000.00 0.0000 $342,300.00 11/30/2023

Adjusted Net Taxable Millage

Entity Exemptions Gross Tax Credit Net Tax

FMV Assessment Value Rate

STATE TAX $342,300 $136,920 $0 $136,920 0.000000 $0.00 $0.00 $0.00

COUNTY M&O $342,300 $136,920 $0 $136,920 5.843000 $800.02 $0.00 $800.02

EMERGENCY MEDICAL

$342,300 $136,920 $0 $136,920 0.500000 $68.46 $0.00 $68.46

SERVICE

911 SERVICES $342,300 $136,920 $0 $136,920 0.210000 $28.75 $0.00 $28.75

COUNTY SCHOOL M&O $342,300 $136,920 $0 $136,920 19.250000 $2,635.71 $0.00 $2,635.71

COUNTY SCHOOL BOND $342,300 $136,920 $0 $136,920 0.800000 $109.54 $0.00 $109.54

CITY - FAYETTEVILLE $342,300 $136,920 $0 $136,920 8.980000 $1,229.54 $0.00 $1,229.54

COUNTY SALES TAX CREDIT $342,300 $136,920 $0 $136,920 -1.809000 $0.00 -$247.69 $-247.69

FAYETTEVILLE SALES TAX

$342,300 $136,920 $0 $136,920 -3.334000 $0.00 -$456.49 $-456.49

CREDIT

TOTALS 30.440000 $4,872.02 -$704.18 $4,167.84

PAY BY DUE DATE TO AVOID PENALTY AND INTEREST CHARGES: Current Due $4,167.84

Penalty $0.00

• INTEREST WILL ACCRUE EACH MONTH AT AN ANNUAL RATE

Interest $0.00

EQUAL TO 3% PLUS THE FEDERAL PRIME RATE PUBLISHED AS OF

JANUARY 1, EACH YEAR. Other Fees $0.00

• A 5% PENALTY WILL BE ADDED 120 DAYS AFTER THE DUE DATE Previous Payments $4,167.84

AND AT EACH 120 DAY MARK UNTIL A 20% CAP IS REACHED.

Back Taxes $0.00

Total Due $0.00

Paid Date 11/21/2023

You might also like

- TD Statement Mar To AprrDocument4 pagesTD Statement Mar To Aprrslimple Smiles100% (2)

- Copy1 Paystub 1Document1 pageCopy1 Paystub 1raheemtimo1No ratings yet

- BillDocument5 pagesBill7cdqt5g66sNo ratings yet

- Statement For July 20, 2023Document1 pageStatement For July 20, 2023Brett RaadNo ratings yet

- PDF DocumentDocument8 pagesPDF DocumentMary WinsutNo ratings yet

- Utility BilDocument4 pagesUtility BilGarth Brooks100% (1)

- 3.31 Paystub 1Document1 page3.31 Paystub 1disipiw20No ratings yet

- Carsons Deed Tax BillDocument14 pagesCarsons Deed Tax BillBurton PhillipsNo ratings yet

- Liquidity Adjustment FacilityDocument11 pagesLiquidity Adjustment Facilityanujksaini03No ratings yet

- 231AA Order To Grant Refuse Reduced Rate of Withholding On Transaction in BankDocument2 pages231AA Order To Grant Refuse Reduced Rate of Withholding On Transaction in BankMuhammad Imran KhanNo ratings yet

- Tax Bill 2022Document1 pageTax Bill 2022LOUNGE HOMENo ratings yet

- Tax Bill 2022 120206 PDFDocument1 pageTax Bill 2022 120206 PDFLOUNGE HOMENo ratings yet

- Proof of Ownership KennethDocument1 pageProof of Ownership KennethRhoda TylerNo ratings yet

- 2023 Web Tax Statement: Owner ID: Parcel ID: Sequence: Account #: Owner Interest: Legal DescriptionDocument1 page2023 Web Tax Statement: Owner ID: Parcel ID: Sequence: Account #: Owner Interest: Legal Descriptionp13607091No ratings yet

- FB County Tax Statement-2022Document1 pageFB County Tax Statement-2022Sageer AbdullaNo ratings yet

- Creighton PaystubDocument1 pageCreighton Paystubraheemtimo1No ratings yet

- BHarris - 11032023 PayrollDocument1 pageBHarris - 11032023 Payrollbeautynfashion247No ratings yet

- Income Tax - Computation - 2021Document26 pagesIncome Tax - Computation - 2021umasankarNo ratings yet

- Adp Pay Stub TemplateDocument1 pageAdp Pay Stub Templatenurulamin00023No ratings yet

- HolaDocument4 pagesHolakoliveiraNo ratings yet

- Property Tax Bill SampleDocument1 pageProperty Tax Bill Sampleskyc41861No ratings yet

- Haven - 2020 Tax BillDocument1 pageHaven - 2020 Tax BillAisar UddinNo ratings yet

- File 1831Document1 pageFile 183176xzv4kk5vNo ratings yet

- Sarasota County Tax Collector FLDocument2 pagesSarasota County Tax Collector FLAjay gadiparthiNo ratings yet

- Broward County Real Estate 504209 18 0434 2022 Installment Bill 1Document1 pageBroward County Real Estate 504209 18 0434 2022 Installment Bill 1skycastleoaksNo ratings yet

- Account 505-275-7745 220: Billing Date Jul 22, 2023Document40 pagesAccount 505-275-7745 220: Billing Date Jul 22, 2023kathyta03No ratings yet

- 2Document1 page2dawndehayNo ratings yet

- Tax BillDocument1 pageTax BillBrenda SorensonNo ratings yet

- Horace Property Property Tax StatementDocument2 pagesHorace Property Property Tax StatementRob PortNo ratings yet

- 1242395_20220717001950_computation_2022Document16 pages1242395_20220717001950_computation_2022Jagbandhu MaharanaNo ratings yet

- Modern Paystyb Template PDF FormatDocument1 pageModern Paystyb Template PDF Formatbrenda smithNo ratings yet

- Xfinity 2023 RocioDocument5 pagesXfinity 2023 RocioRicardo Delvecchio0% (1)

- Paycheckstub AllDocument3 pagesPaycheckstub AllMyt WovenNo ratings yet

- Pay StatementDocument1 pagePay Statementsamuelkingori2017No ratings yet

- BHarris - 11172023 PayrollDocument1 pageBHarris - 11172023 Payrollbeautynfashion247No ratings yet

- TaxSys - Broward County Records, Taxes & Treasury DivDocument2 pagesTaxSys - Broward County Records, Taxes & Treasury DivAjay gadiparthiNo ratings yet

- Justice Brown: One Thousand Four Hundred Nine Dollars and 45/100 Justice BrownDocument1 pageJustice Brown: One Thousand Four Hundred Nine Dollars and 45/100 Justice BrownLindsay SimmsNo ratings yet

- Paystub 2Document1 pagePaystub 2Prosper DivignInLifeNo ratings yet

- Hello Michael Ray,: Your Bill at A GlanceDocument3 pagesHello Michael Ray,: Your Bill at A GlancegarrettloehrNo ratings yet

- Summary of Account Activity Payment Information: Account Number Ending in 9956Document4 pagesSummary of Account Activity Payment Information: Account Number Ending in 9956ggchpokeNo ratings yet

- Statement of Taxes DueDocument1 pageStatement of Taxes DueCynthia McCoyNo ratings yet

- Not-Oo Ob2420231216022549w4kDocument3 pagesNot-Oo Ob2420231216022549w4kSriniNo ratings yet

- 2023 12 Monthly Statement MAJORITY 1Document2 pages2023 12 Monthly Statement MAJORITY 1gabrielmoisesgon2210No ratings yet

- Billing Detail: Late PaymentDocument1 pageBilling Detail: Late Paymenttheodore moses antoine beyNo ratings yet

- Computation 2019Document16 pagesComputation 2019Giri SukumarNo ratings yet

- Rntreg d04Document3 pagesRntreg d04gomezgb95No ratings yet

- Chase Anders Aug 02 2023Document1 pageChase Anders Aug 02 2023Ademola GbaderoNo ratings yet

- Untitled - Paystubs TATIANA NADER-04-22-2024 ....Document1 pageUntitled - Paystubs TATIANA NADER-04-22-2024 ....froshbliss1No ratings yet

- Attachment 2 Guidance For AssessmentDocument5 pagesAttachment 2 Guidance For Assessmentultimatecombat92No ratings yet

- Paystub 01Document1 pagePaystub 01raheemtimo1No ratings yet

- Hello Kristen Espino A,: Your Bill at A GlanceDocument3 pagesHello Kristen Espino A,: Your Bill at A GlancegarrettloehrNo ratings yet

- Wifi 2Document2 pagesWifi 2VENKATA KARTEEKNo ratings yet

- Debit Account StatementDocument2 pagesDebit Account Statementbryanball928No ratings yet

- Casnetusa StatementDocument4 pagesCasnetusa StatementAresNo ratings yet

- Johnson Tax Statement 10.22.18Document2 pagesJohnson Tax Statement 10.22.18Andrew KochNo ratings yet

- Johnson Tax Statement 10.22.18Document2 pagesJohnson Tax Statement 10.22.18Andrew KochNo ratings yet

- Paystub E56da99c 5958 40f5 9b2a 8069ae22b175 PDFDocument8 pagesPaystub E56da99c 5958 40f5 9b2a 8069ae22b175 PDFLuis MartinezNo ratings yet

- AMOUNT DUE: $1,765.60: Charge DetailsDocument2 pagesAMOUNT DUE: $1,765.60: Charge DetailsfloresvNo ratings yet

- USA Fifth Third BankDocument1 pageUSA Fifth Third Bank19facio65No ratings yet

- USA Fifth Third BankDocument1 pageUSA Fifth Third BankonetwothreeNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Kachner Second ApeealDocument21 pagesKachner Second ApeealChaitali Dere100% (1)

- DynamicsDocument2 pagesDynamicsCoolman PoonNo ratings yet

- Credit Risk Analyst Interview Questions and Answers 1904Document13 pagesCredit Risk Analyst Interview Questions and Answers 1904MD ABDULLAH AL BAQUINo ratings yet

- Republic of The Philippine Vs TagleDocument7 pagesRepublic of The Philippine Vs TagleWillow SapphireNo ratings yet

- DLSU 2019 - Legal and Judicial Ethics - Green Notes PDFDocument72 pagesDLSU 2019 - Legal and Judicial Ethics - Green Notes PDFJaymee Andomang Os-ag100% (1)

- Karbi Anglong CaseDocument8 pagesKarbi Anglong CaseHasina MamtaNo ratings yet

- Seguro Médico para EstudiantesDocument2 pagesSeguro Médico para EstudiantesLuis Domenech GarciaNo ratings yet

- Appeal Section 374 CRPCDocument11 pagesAppeal Section 374 CRPCHet DoshiNo ratings yet

- Absentee (Petition For Presumptive Death)Document3 pagesAbsentee (Petition For Presumptive Death)Nino Louis BelarmaNo ratings yet

- Ajio 1682439106268Document2 pagesAjio 1682439106268Vish JainNo ratings yet

- Bill TodayDocument3 pagesBill Todaymansoorsain42No ratings yet

- BS 1139 Metal Scaffolding Part 4Document13 pagesBS 1139 Metal Scaffolding Part 4alliceyew100% (1)

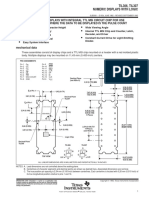

- TIL306, TIL307 Numeric Displays With LogicDocument9 pagesTIL306, TIL307 Numeric Displays With LogicNadjNo ratings yet

- Answer Petition SampleDocument7 pagesAnswer Petition SampleAmado Vallejo III100% (1)

- Crim 5Document92 pagesCrim 5Jeyarsi TVNo ratings yet

- Architect Acts 2016 PDFDocument92 pagesArchitect Acts 2016 PDFKelingwgongNo ratings yet

- SPG Minutes of The Meeting Election of New OfficersDocument4 pagesSPG Minutes of The Meeting Election of New OfficersJUNALYN JAVIER100% (3)

- Constitution With Suggestions From ROSDocument14 pagesConstitution With Suggestions From ROSadrianongliangkiatNo ratings yet

- Access Control PolicyDocument8 pagesAccess Control PolicyAkshat SinghNo ratings yet

- Affidavit of LossDocument1 pageAffidavit of LossIan Khay CastroNo ratings yet

- Santos vs. People (Full Text, Word Version)Document11 pagesSantos vs. People (Full Text, Word Version)Emir Mendoza100% (1)

- Pressure Gauge: Component DescriptionDocument6 pagesPressure Gauge: Component DescriptionHAI100% (1)

- RobertDocument9 pagesRobertHeavyNo ratings yet

- Komatsu Hydraulic Excavator Pc138us 10 Shop Manual Wenbm00011Document22 pagesKomatsu Hydraulic Excavator Pc138us 10 Shop Manual Wenbm00011sharonbutler150595fpq100% (122)

- Amicus Curiae Brief NCLA 22-3179Document19 pagesAmicus Curiae Brief NCLA 22-3179LeferianNo ratings yet

- GCCDocument20 pagesGCCRonald NyirendaNo ratings yet

- GOMs No 58Document14 pagesGOMs No 58PRAKASHNo ratings yet

- Leaflet - HDFC Balanced Advantage Fund - June 2024Document3 pagesLeaflet - HDFC Balanced Advantage Fund - June 2024DeepakNo ratings yet