Professional Documents

Culture Documents

Morningstar Research

Morningstar Research

Uploaded by

harshdeepbilaspurCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Morningstar Research

Morningstar Research

Uploaded by

harshdeepbilaspurCopyright:

Available Formats

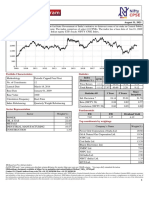

Portfolio X-Ray: No-sweat Savings

Overview

Updated on Jan 31, 2024

Asset Allocation Pie Chart

Asset Class Net % Bmark %

Stocks 19.99 25.42

Bonds 0.00 65.05

Cash 70.31 9.19

Other 9.70 0.34

Not Classified 0.00 0.00

Performance

Updated on Jan 31, 2024

Performance Graph 3 Years

12.90K This Portfolio

27.62

Conservative

12.14K

Allocation

26.42

11.38K

10.62K

9.86K

Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan

2021 2022 2023 2024

Trailing Returns

Portfolio % Bmark %

1 Month 1.02 0.79

3 Months 6.17 4.86

6 Months 7.15 5.00

1 Year 13.32 10.81

YTD 1.02 0.79

3 Years Annualised 8.47 8.13

5 Years Annualised 8.17 7.16

10 Years Annualised 7.11 7.52

Time Period Return

Best % Worst %

3 Months 6.17(Oct 23-Jan 24) −3.45(Dec 19-Mar 20)

6 Months 7.93(Mar 20-Sep 20) −1.67(Sep 19-Mar 20)

1 Year 13.32(Jan 23-Jan 24) 1.85(Mar 19-Mar 20)

3 Years Annualised 8.47(Jan 21-Jan 24) 4.40(Mar 17-Mar 20)

5 Years Annualised 8.17(Jan 19-Jan 24) 5.30(Mar 15-Mar 20)

10 Years Annualised –(–-–) –(–-–)

Fees & Expenses

Portfolio Weighted Average Fee 0.00

Management Fee 1.50

Asset Class

Updated on Jan 31, 2024

Stock Regions Greater Asia

Weight % Bmark %

Greater Asia 100.00 98.43

Japan 0.00 0.00

Australasia 0.00 0.00

Asia Developed 0.00 0.00

Asia Emerging 100.00 98.43

Not Classified 0.00 1.57

Stock Stats

Name Portfolio Benchmark

Price/Prospective Earnings 15.89 18.41

Price/Book Ratio 3.34 3.17

Price/Sales Ratio 1.97 2.33

Price/Cash Flow Ratio 12.55 14.40

Stock Style

Value Blend Growth

Large Growth Weight %

Large

73.43% 6 20 73 50+

25–49

10–24

0–9

0 0 0

Mid

Small

0 0 0

Fixed Income Sectors

Portfolio % Benchmark %

Government – 59.58

Municipal – –

Corporate – 29.15

Securitized – 0.42

Cash & Equivalents 100.00 10.85

Derivative – –

Holdings

Updated on Jan 31, 2024

Correlation Matrix

1 2 3

0.75 to 1.00

0.50 to 0.75

1.00 0.25 to 0.50

0.00 to 0.25

–0.25 to 0.00

–0.50 to –0.25

0.47 1.00 –0.75 to –0.50

–1.00 to –0.75

0.43 −0.01 1.00

Portfolio Holdings Top Underlying Holdings

Security Name Security Type Sector Weight %

Treps Cash - Repurchase Agreement – 70.01

Kotak Gold ETF Mutual Fund - ETF – 9.90

Trent Ltd Equity Con Cyclical 0.84

Bharat Electronics Ltd Equity Industrials 0.82

Shriram Finance Ltd Equity Financial Svs 0.71

Tata Power Co Ltd Equity Utilities 0.70

Hindustan Aeronautics Ltd Ordinary Shares Equity Industrials 0.65

Cholamandalam Investment and Finance Co Ltd Equity Financial Svs 0.63

Indian Oil Corp Ltd Equity Energy 0.59

TVS Motor Co Ltd Equity Con Cyclical 0.59

© Copyright 2024 Morningstar. All rights reserved.

You might also like

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- M and B 3 3rd Edition Dean Croushore Solutions ManualDocument35 pagesM and B 3 3rd Edition Dean Croushore Solutions Manualallodiumerrantialwmpi100% (27)

- Atal Pension Yojana (Apy) - Account Closure Form (Voluntary Exit)Document2 pagesAtal Pension Yojana (Apy) - Account Closure Form (Voluntary Exit)Rising Star CSC67% (3)

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Solution - Numericals Market Structure PDFDocument4 pagesSolution - Numericals Market Structure PDFpiyush kumarNo ratings yet

- Factsheet 1710581747733Document1 pageFactsheet 1710581747733mvkulkarni5No ratings yet

- Axis Triple Advantage FundDocument1 pageAxis Triple Advantage FundseshadriNo ratings yet

- Aehr Test SystemsDocument1 pageAehr Test SystemsYS FongNo ratings yet

- Nifty50 Value20Document2 pagesNifty50 Value20jerkrakeshNo ratings yet

- Factsheet_NiftyHousingDocument2 pagesFactsheet_NiftyHousingDEBANJAN DUTTANo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30swaroopr8No ratings yet

- LPKR 290011-110211Document10 pagesLPKR 290011-110211Aditya WidiyadiNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)arjunasahu1986No ratings yet

- Fundcard: Edelweiss Low Duration Fund - Direct PlanDocument4 pagesFundcard: Edelweiss Low Duration Fund - Direct PlanYogi173No ratings yet

- ValueResearchFundcard SBISmallCapFund DirectPlan 2019nov11Document4 pagesValueResearchFundcard SBISmallCapFund DirectPlan 2019nov11asddsffdsfNo ratings yet

- Factsheet NiftyHousingDocument2 pagesFactsheet NiftyHousingPersonal NNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankJessy JainNo ratings yet

- Fundcard: ICICI Prudential All Seasons Bond FundDocument4 pagesFundcard: ICICI Prudential All Seasons Bond FundPhani VemuriNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30Umesh ThawareNo ratings yet

- Nifty50 Value20Document2 pagesNifty50 Value20swaroopr8No ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankAshish SinghNo ratings yet

- ValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11Document4 pagesValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11jamsheer.aaNo ratings yet

- Corporate Finance PPT 002Document22 pagesCorporate Finance PPT 002Ashutosh VermaNo ratings yet

- HDFC Index Nifty Fund 31MAY2024Document1 pageHDFC Index Nifty Fund 31MAY2024Krishnanand GaurNo ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50Jose CANo ratings yet

- Factsheet Nifty50 ShariahDocument2 pagesFactsheet Nifty50 ShariahtabinzargarNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankVishal GandhleNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexSrikanth VgNo ratings yet

- Factsheet Nifty FinServ 25 50Document2 pagesFactsheet Nifty FinServ 25 50solankisanjay2875No ratings yet

- Factsheet NiftyMidSmallFinancialSevicesDocument2 pagesFactsheet NiftyMidSmallFinancialSevicesKrishna GoyalNo ratings yet

- Factsheet Nifty Alpha50Document2 pagesFactsheet Nifty Alpha50YadvendraNo ratings yet

- ValueResearchFundcard ICICIPrudentialBalancedAdvantageFund 2017dec18Document4 pagesValueResearchFundcard ICICIPrudentialBalancedAdvantageFund 2017dec18santoshk.mahapatraNo ratings yet

- ABSLI NiftyAlpha50 FundDocument2 pagesABSLI NiftyAlpha50 FundAbhinav SinghNo ratings yet

- Factsheet Nifty Alpha50Document2 pagesFactsheet Nifty Alpha50aimailid01No ratings yet

- BN ComponentsDocument2 pagesBN ComponentsAshwani PatelNo ratings yet

- Ind Nifty CPSEDocument1 pageInd Nifty CPSEAnjalidevi TNo ratings yet

- CCN 1014402Document11 pagesCCN 1014402richard87bNo ratings yet

- Factsheet NiftyNonCyclicalConsumerDocument2 pagesFactsheet NiftyNonCyclicalConsumerdheerendra sharmaNo ratings yet

- Nifty50 Value20Document2 pagesNifty50 Value20Jilla jilNo ratings yet

- HDFC Momentum150 FundDocument2 pagesHDFC Momentum150 Fundkrishnakumar kichaNo ratings yet

- HDFC Children Gift FundDocument1 pageHDFC Children Gift FundYogi173No ratings yet

- Nifty India Manufacturing IndexDocument2 pagesNifty India Manufacturing Indexkaygee.kapilgandhiNo ratings yet

- Ind Nifty MediaDocument2 pagesInd Nifty MediaUmeshGaikwadNo ratings yet

- Task 16: Ratios of SbiDocument5 pagesTask 16: Ratios of SbiBijosh ThomasNo ratings yet

- Factsheet Nifty500 ShariahDocument2 pagesFactsheet Nifty500 ShariahMazhar A ShaikhNo ratings yet

- Resources FundDocument2 pagesResources Fundb1OSphereNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30Kiran SunkuNo ratings yet

- Nifty Bank Weightage 2022Document2 pagesNifty Bank Weightage 2022Latnekar VNo ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50RajneeshNo ratings yet

- SBI Large & Midcap FundDocument1 pageSBI Large & Midcap FundGaurav RajNo ratings yet

- Mirae Asset Hybrid Equity Fund - Direct Plan-GrowthDocument1 pageMirae Asset Hybrid Equity Fund - Direct Plan-GrowthnnnNo ratings yet

- Factsheet_Nifty50_ShariahDocument2 pagesFactsheet_Nifty50_ShariahMohammad AleemNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty Bankjayeshrane2107No ratings yet

- Ind Nifty RealtyDocument2 pagesInd Nifty RealtyParth AsnaniNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial Servicesswaroopr8No ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Praise and worshipNo ratings yet

- Ashmore Investment Management Limited Asian High Yield Debt Class ZDocument3 pagesAshmore Investment Management Limited Asian High Yield Debt Class Zcena1987No ratings yet

- Morningstarreport 20230811090706Document1 pageMorningstarreport 20230811090706Sunny AhujaNo ratings yet

- Morningstarreport 20231222043231Document1 pageMorningstarreport 20231222043231vinodNo ratings yet

- UTI Monthly Income Scheme - Growth - June 2017Document2 pagesUTI Monthly Income Scheme - Growth - June 2017yaglarNo ratings yet

- Tyre Industry in IndiaDocument11 pagesTyre Industry in IndiaAlok ChowdhuryNo ratings yet

- Indian Economic and Political History: Rajesh Bhattacharya Email: Virtual Lounge: TBADocument14 pagesIndian Economic and Political History: Rajesh Bhattacharya Email: Virtual Lounge: TBANaunihal KumarNo ratings yet

- End Term Question Paper - FDM - Term V Batch 2020-22Document2 pagesEnd Term Question Paper - FDM - Term V Batch 2020-22sumit rajNo ratings yet

- Depreciation ExerciseDocument7 pagesDepreciation ExerciseMuskan LohariwalNo ratings yet

- Chapter 1 Introduction Corporate GovernanceDocument14 pagesChapter 1 Introduction Corporate GovernanceHM.No ratings yet

- NIOF-Dec 2020Document1 pageNIOF-Dec 2020chqaiserNo ratings yet

- Tax Unit 1-2 - 12Document1 pageTax Unit 1-2 - 12joy BoseNo ratings yet

- David RicardoDocument11 pagesDavid RicardoAditi MalaniNo ratings yet

- Pleting The CycleDocument21 pagesPleting The CycleAL Babaran CanceranNo ratings yet

- Inventory ClassificationDocument9 pagesInventory ClassificationkamelNo ratings yet

- Financial Management AssignmentDocument4 pagesFinancial Management AssignmentTwaha R. KabandikaNo ratings yet

- Lecture12 PartnershipsDocument23 pagesLecture12 PartnershipsHarishvardhanNo ratings yet

- Porters Five Force ModelDocument3 pagesPorters Five Force ModelShivaniNo ratings yet

- A Review of Dynamic Capabilities, Innovation Capabilities, Entrepreneurial Capabilities and Their ConsequencesDocument10 pagesA Review of Dynamic Capabilities, Innovation Capabilities, Entrepreneurial Capabilities and Their ConsequencessukorotoNo ratings yet

- Realme 7 (Mist Blue, 128 GB) : Keep This Invoice and Manufacturer Box For Warranty PurposesDocument1 pageRealme 7 (Mist Blue, 128 GB) : Keep This Invoice and Manufacturer Box For Warranty PurposesBishal KhatriNo ratings yet

- Correigendum SolarDocument49 pagesCorreigendum SolarKetav PatelNo ratings yet

- LAS - Q1W1 - Intro To Accounting1Document4 pagesLAS - Q1W1 - Intro To Accounting1marissa casareno almueteNo ratings yet

- Production FunctionDocument33 pagesProduction FunctionRence MarcoNo ratings yet

- Investment Portfolio Management - AssignmentDocument20 pagesInvestment Portfolio Management - AssignmentSahan RodrigoNo ratings yet

- Law 28Document7 pagesLaw 28ram RedNo ratings yet

- Receipt From STC Pay: Transaction ID: 31910248 Amount 10000.00 INR MTCN 8342234688Document1 pageReceipt From STC Pay: Transaction ID: 31910248 Amount 10000.00 INR MTCN 8342234688Aejaz AhmedNo ratings yet

- Rizki Permana Eka PutraDocument32 pagesRizki Permana Eka Putrakhoirunnisa ramadhanNo ratings yet

- CGTMSE - Claim Lodgment Part-IIDocument10 pagesCGTMSE - Claim Lodgment Part-IISunil KumarNo ratings yet

- MANAGERIAL ECONOMICS Module 3 DEMAND AND PRICINGDocument3 pagesMANAGERIAL ECONOMICS Module 3 DEMAND AND PRICINGJohn DelacruzNo ratings yet

- The Relationship Between The Usage of Xero Accounting Software and The Intellectual Capital of The Selected Companies in PampangaDocument56 pagesThe Relationship Between The Usage of Xero Accounting Software and The Intellectual Capital of The Selected Companies in PampangaAlvin GalangNo ratings yet

- Toothpaste Industry in IndiaDocument30 pagesToothpaste Industry in IndiaNaureen ShabnamNo ratings yet

- A Gift To My Children Summary - Jim Rogers - PDF DownloadDocument4 pagesA Gift To My Children Summary - Jim Rogers - PDF Downloadgato44450% (2)