Professional Documents

Culture Documents

Omolo tax return acknowledgement

Omolo tax return acknowledgement

Uploaded by

adiomollo248Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Omolo tax return acknowledgement

Omolo tax return acknowledgement

Uploaded by

adiomollo248Copyright:

Available Formats

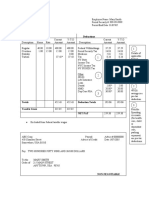

For General Tax Questions

e-Return Acknowledgment Contact KRA Call Centre

Tel: +254 (020) 4999 999

Receipt Cell: +254(0711)099 999

Email: callcentre@kra.go.ke

www.kra.go.ke

Personal Information and Return Filing Details

PIN A001166475U Return Period 01/01/2021 - 31/12/2021

Oduor Saulo Omolo

Name and Address

n/a, n/a, nairobi, Westlands District, 00800, 13629.

PIN of Wife Name of Wife

N.A N.A

(If Applicable) (If Applicable)

Tax Obligation(Form Income Tax Resident

Original or Amended Original

Name) Individual(IT1)

Station Mombasa South Acknowledgement 20/06/2022 14:42:15

Return Number KRA202210614217 Barcode

Return Summary

Sr. No. Particulars Self Amount (Ksh) Wife Amount (Ksh)

1. Adjusted Taxable Income 0.00 0.00

2. Employment Income 0.00 0.00

3. Income from Estate(s)/Trust(s) / Settlement(s) 0.00 0.00

4. Gross Total Income 0.00 0.00

5. Deductions 0.00 0.00

6. Taxable Income 0.00 0.00

7. Tax Payable 0.00 0.00

8. Reliefs 0.00 0.00

9. Tax Credits 35,488.00 0.00

10. Tax Due / (Refund Due) 0.00 0.00

11. Tax Due / (Refund Due) (Combined) -35,488.00

Note : We acknowledge receiving your Return through KRA Web Portal . You can track your status by using search

code from web portal.

Search Code: 267961567757LCV

Notice: Employers are reminded that the due date for PAYE Returns and remittance is the ninth day of each calendar month.

You might also like

- Pay Stub Portal3Document1 pagePay Stub Portal3cwhite2150No ratings yet

- 4133104Document1 page4133104Ann BenjaminNo ratings yet

- Lac It Cert 832987 PDFDocument1 pageLac It Cert 832987 PDFManoj Kumar0% (1)

- DTTL Tax Holdco Matrix EuropeDocument56 pagesDTTL Tax Holdco Matrix EuropeAnton KoublytskiNo ratings yet

- Sal FebDocument2 pagesSal FebHimanshu Sekhar SahuNo ratings yet

- Houzit Pty LTD: 1st Quarter Ended Sept - 2012 Actual Results Budget Q1 Actual Q1 $ VarianceDocument4 pagesHouzit Pty LTD: 1st Quarter Ended Sept - 2012 Actual Results Budget Q1 Actual Q1 $ VarianceHamza Anees100% (1)

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsIan OmwambaNo ratings yet

- ReceiptDocument1 pageReceiptMr TuchelNo ratings yet

- ReceiptDocument1 pageReceiptstevenkanyanjua1No ratings yet

- NICHOLASDocument1 pageNICHOLASvera atienoNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsOderoNo ratings yet

- ReceiptDocument1 pageReceiptJully MwongeliNo ratings yet

- ReceiptDocument1 pageReceiptalfacyber00No ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDon EdwinNo ratings yet

- Receipt (13)Document1 pageReceipt (13)josekajos37No ratings yet

- ReceiptDocument1 pageReceiptCOLLINS KIPROPNo ratings yet

- Receipt PDFDocument1 pageReceipt PDFArastus KadengeNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsHebron OdhiamboNo ratings yet

- ReceiptDocument1 pageReceiptIsaac GwangiNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing Detailssimon kinuthiaNo ratings yet

- ReceiptDocument1 pageReceiptcamilliancomputersNo ratings yet

- NaomiDocument1 pageNaomiADMINNo ratings yet

- receipt_(16)[1]Document1 pagereceipt_(16)[1]AllandexNo ratings yet

- ReceiptDocument1 pageReceiptvera atienoNo ratings yet

- Receipt (11)Document1 pageReceipt (11)sigeibrian21No ratings yet

- ReceiptDocument1 pageReceiptRay NeshNo ratings yet

- Vitalis KraDocument1 pageVitalis Kravera atienoNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsPeter JumreNo ratings yet

- ReceiptDocument1 pageReceiptisaiahkipkosgei36No ratings yet

- HalimaDocument1 pageHalimavera atienoNo ratings yet

- Income Tax Individual ResidentDocument1 pageIncome Tax Individual ResidentBengale Wa MangaleNo ratings yet

- Receipt - 2024-06-25T121729.102Document1 pageReceipt - 2024-06-25T121729.102ipadtechcyberNo ratings yet

- ReceiptDocument1 pageReceiptesther muthoniNo ratings yet

- Lenah KraDocument1 pageLenah KraKameneja LeeNo ratings yet

- ReceiptDocument1 pageReceiptipadtechcyberNo ratings yet

- ReceiptDocument1 pageReceiptEugene MmarengeNo ratings yet

- ReceiptDocument1 pageReceiptcamilliancomputersNo ratings yet

- TOROITICHDocument1 pageTOROITICHtoroitich Titus markNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsJacob MaganyaNo ratings yet

- ReceiptDocument1 pageReceiptGeorge LordsNo ratings yet

- receipt (1) (1)Document1 pagereceipt (1) (1)toncap enterprisesNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsAlfoz Muthyoi0% (1)

- ReceiptDocument1 pageReceiptNdavi KiangiNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsFaith OndiekiNo ratings yet

- Receipt 9Document1 pageReceipt 9evansasanda4No ratings yet

- Receipt 4Document1 pageReceipt 4Titus Odenyo OthienoNo ratings yet

- Receipt 35Document1 pageReceipt 35MUSA WANGILANo ratings yet

- Receipt - 2024-06-27T215529.849Document1 pageReceipt - 2024-06-27T215529.849INTEL CYBERNo ratings yet

- Receipt - 2024-06-30T203949.706Document1 pageReceipt - 2024-06-30T203949.706COUNTY CYBERNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing Detailsgabriel katamaNo ratings yet

- Nil Returns Receipt - 2023Document1 pageNil Returns Receipt - 2023Khalid Ali AbdallaNo ratings yet

- Kra 2Document1 pageKra 2makenaimmaculate7No ratings yet

- Kra ReturnsDocument1 pageKra Returnspenina Chepkemoi0% (1)

- ReceiptDocument1 pageReceiptCynthia MarimbuNo ratings yet

- receipt-257Document1 pagereceipt-257ngarijane126No ratings yet

- ReceiptDocument1 pageReceiptTitus LeteipaNo ratings yet

- Receipt 210Document1 pageReceipt 210emmanuel compsNo ratings yet

- ReceiptDocument1 pageReceiptBOBANSO KIOKONo ratings yet

- ReceiptDocument1 pageReceiptReuben OmondiNo ratings yet

- receiptDocument1 pagereceiptsoftware consultantsNo ratings yet

- Receipt - 2024-06-17T120004.494Document1 pageReceipt - 2024-06-17T120004.494shelmith cyberNo ratings yet

- ReceiptDocument1 pageReceiptMohamed WeyimiNo ratings yet

- receipt_(15)[1]Document1 pagereceipt_(15)[1]AllandexNo ratings yet

- receipt_(17)[1]Document1 pagereceipt_(17)[1]AllandexNo ratings yet

- ReceiptDocument1 pageReceiptFull Gospel KanduyiNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Mazars Central Eastern European Tax Guide 2017Document52 pagesMazars Central Eastern European Tax Guide 2017Jenő TompiNo ratings yet

- Nidhi Form 16 UpdateDocument3 pagesNidhi Form 16 UpdateAbhinav NigamNo ratings yet

- El Oriente Fabrica v. PosadasDocument2 pagesEl Oriente Fabrica v. PosadasJohn Paul LordanNo ratings yet

- NESTLEDocument38 pagesNESTLEarooba masoodNo ratings yet

- Cambodia: Country Partnership StrategyDocument18 pagesCambodia: Country Partnership StrategyDara DoungNo ratings yet

- Accounting Voucher 1Document1 pageAccounting Voucher 1Daksh BavawalaNo ratings yet

- 2 CREBA Vs ROMULO INCOME TAXATIONDocument2 pages2 CREBA Vs ROMULO INCOME TAXATIONSu Kings AbetoNo ratings yet

- Module 2 - Individuals Estates and Trusts Without Answer-2Document12 pagesModule 2 - Individuals Estates and Trusts Without Answer-2KarenFayeBadillesNo ratings yet

- 08 Spring 2015 BT AnsDocument8 pages08 Spring 2015 BT Anspabloescobar11yNo ratings yet

- Shalina Healthcare - CTC Details - Campus Nov22Document3 pagesShalina Healthcare - CTC Details - Campus Nov22Meow bunNo ratings yet

- Financial Statements: Historical Results 2012 2013 2014Document2 pagesFinancial Statements: Historical Results 2012 2013 2014yugyeom rojasNo ratings yet

- Introduction To Income TaxDocument23 pagesIntroduction To Income TaxPiyush SolankiNo ratings yet

- The Single Income TaxDocument421 pagesThe Single Income TaxnstenbergNo ratings yet

- TRAIN Slides RR 8-2018 PDFDocument183 pagesTRAIN Slides RR 8-2018 PDFpaulinoemersonpNo ratings yet

- Pay Stub TemplateDocument1 pagePay Stub TemplateMichael ShortNo ratings yet

- Dilbagh Singh Itr 2022-2023 - UnlockedDocument1 pageDilbagh Singh Itr 2022-2023 - UnlockedmohitNo ratings yet

- FH:J Gofoflws/0f P) GSF Gbe (DF 5nkmnDocument12 pagesFH:J Gofoflws/0f P) GSF Gbe (DF 5nkmnArtha SarokarNo ratings yet

- Tax.108 Allowed Deductions From Gross IncomeDocument10 pagesTax.108 Allowed Deductions From Gross IncomeLeshaira Jimeno100% (1)

- COMPENSATION INCOME EXERCISES AnnualDocument1 pageCOMPENSATION INCOME EXERCISES AnnualJoyce Marie SablayanNo ratings yet

- Payslip2 PDFDocument1 pagePayslip2 PDFSumanthNo ratings yet

- Tax Issues ENDocument7 pagesTax Issues ENJudd SuhNo ratings yet

- A5997127965bcea94666f1 PayslipDocument2 pagesA5997127965bcea94666f1 PayslipAshutosh GuptaNo ratings yet

- Employee Welfare and Benefits (Raul C. Cruz)Document16 pagesEmployee Welfare and Benefits (Raul C. Cruz)Bhenjhan AbbilaniNo ratings yet

- Chapter 13C Optional Standard DeductionsDocument3 pagesChapter 13C Optional Standard DeductionsJason Mables100% (1)

![receipt_(16)[1]](https://imgv2-1-f.scribdassets.com/img/document/749072211/149x198/59ae319ceb/1720522489?v=1)

![receipt_(15)[1]](https://imgv2-2-f.scribdassets.com/img/document/749072378/149x198/902b6f2553/1720522532?v=1)

![receipt_(17)[1]](https://imgv2-2-f.scribdassets.com/img/document/749071983/149x198/8155558a12/1720522406?v=1)