Professional Documents

Culture Documents

Test 5 (Sol)

Test 5 (Sol)

Uploaded by

yazdan2250Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test 5 (Sol)

Test 5 (Sol)

Uploaded by

yazdan2250Copyright:

Available Formats

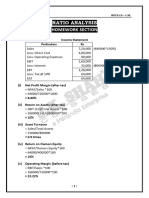

CAF-01: FAR1 Suggested Solution: Test 5

Solution 1 M

Hayat Industries Limited (HIL)

Notes to the Financial statements

For the year ended June 30, 2020 1.25

1. Property, plant and

equipment: Land Buildings Plant Vehicles

-------------- Rs. in '000' --------------

Gross carrying amount

Opening balance 100,000 70,000 180,000 8,800 1

Transfer - (17,500) - - 0.25

Revaluation (W-1) : (W-2) 20,000 (17,500) - - 0.5

Addition (W-3) - - 102,840 1,800 0.5

Disposal - - - (1,000) 0.25

Closing balance 120,000 35,000 282,840 9,600

Accumulated depreciation

Opening balance - 14,000 60,000 4,000 0.75

Depreciation (W-2) : (W-4) - 3,500 14,571 1,068 0.75

Transfer - (17,500) - 0.25

Disposal (W-4.1) - - (352) 0.25

Closing balance (-) (-) (74,571) (4,716)

Written down value 120,000 35,000 208,269 4,884 1

1.1

Measurement basis Revaluation Revaluation Cost model Cost model

2

Useful life / depreciation rate Infinte 15 years 10-15 years 20%

Straight

Depreciation method - line Straight line

1.2 The last revaluation was performed on 30 June 2020 by Samajhdar Consultants, an 0.5

independent firm of valuers.

1.3 Had there been no revaluation, the carrying value of land and buildings as on

30 June 2020 would have been: Land Buildings

------- Rs. in '000' ------

Cost (100,000 + 12,000) : (70,000 - 20,000) 112,000 50,000 2

Less: Accumulated depreciation - (12,500) 0.5

Written down value 112,000 37,500

Umair Sheraz Utra, ACA Page |1

1.4 Movement in revaluation surplus Land Buildings

------- Rs. in '000' -------

Opening (1.7.2019) (12,000) 16,000 0.5

Arose during the year 20,000 - 0.25

Transferred to retained earnings / adjusted - (16,000) 0.25

Closing (30.6.2020) 8,000 -

Workings

1 Revaluation of land

Date Description Land R/S P/L

30.6.2019 WDV 100,000 (12,000) 0.5

30.6.2020 Revaluation surplus (bal.) 20,000 8,000 12,000 0.75

30.6.2020 Revalued amount 120,000 8,000 -

2 Revaluation of buildings

Date Description Buildings R/S P/L

30.6.2019 WDV (70,000 - 14,000) 56,000 16,000 0.5

30.6.2020 Dep. (56,000 / 16) : (16,000 / 16) (3,500) (1,000) 0.5

30.6.2020 WDV 52,500 15,000

30.6.2020 Revaluation surplus (bal.) (17,500) (15,000) (2,500) 0.75

30.6.2020 Revalued amount 35,000 - (2,500)

3 Cost of plant

Construction payments 120,000 0.25

Borrowing cost capitalised (W-3.1) 2,840 0.25

Government grant (20,000) 0.25

102,840

3.1 Borrowing cost to be capitalised

Interest expense on general loan:

(12,000 x 12% x 7 / 12) 840

(48,000 x 12 % x 5 / 12) 2,400 3,240 0.5

Interest saving due to grant (20,000 x 12% x 2 / 12) (400) 0.25

2,840

4 Depreciation expense for the year ended 30.06.2020

Plant

On opening (180,000 / 15) 12,000 0.25

On addition (102,840 / 10) x 3 / 12 2,571 0.25

14,571

Vehicle

On opening [(8,800 - 4,000) - 720 (W-4.1)] x 20% 816 0.75

On addition (1,800 x 20%) x 6 / 12 180 0.25

On disposal (W-4.1) 72 0.25

1,068

Umair Sheraz Utra, ACA Page |2

4.1 Acc. Dep. and WDV of disposal

1.1.18 Cost 1,000

30.6.18 Depreciation (1,000 x 20%) x 6 / 12 (100)

30.6.18 WDV 900

30.6.19 Depreciation (900 x 20%) (180)

30.6.19 WDV 720

1.1.20 Depreciation (720 x 20%) x 6 / 12 (72)

1.1.20 WDV 648 0.5

Accumulated depreciation (1,000 - 648) 352 0.5

20

Umair Sheraz Utra, ACA Page |3

You might also like

- This Study Resource WasDocument4 pagesThis Study Resource WasDerista septhiana100% (1)

- Statement of Comprehensive Income: Problem 1: True or FalseDocument17 pagesStatement of Comprehensive Income: Problem 1: True or FalsePaula Bautista100% (3)

- 9706 s12 Ms 22 PDFDocument6 pages9706 s12 Ms 22 PDFmarryNo ratings yet

- 4 5807634410916285735Document5 pages4 5807634410916285735magwazagroup33No ratings yet

- Spring 2024 Mgt401 1 SolDocument3 pagesSpring 2024 Mgt401 1 SolIrfan AhmedNo ratings yet

- Tutorial Pack On PpeDocument14 pagesTutorial Pack On PpeAyandiswa NdebeleNo ratings yet

- Chapter 21 - QB - Q1 - SolutionDocument4 pagesChapter 21 - QB - Q1 - SolutionRichard SibekoNo ratings yet

- Problems On Total IncomeDocument12 pagesProblems On Total IncomedipakNo ratings yet

- QuizDocument4 pagesQuizRinconada Benori ReynalynNo ratings yet

- IAS 36 Impairment of Assets (QB - S)Document16 pagesIAS 36 Impairment of Assets (QB - S)Johannes MoyoNo ratings yet

- 2018 - Exam 1 - Q1 - Sug SolDocument4 pages2018 - Exam 1 - Q1 - Sug SolmamitjasNo ratings yet

- SS - TEST FAR270 - NOV 2022 Set 2 StudentDocument5 pagesSS - TEST FAR270 - NOV 2022 Set 2 Studentsharifah nurshahira sakinaNo ratings yet

- Comparative Income StatementDocument12 pagesComparative Income StatementBISHAL ROYNo ratings yet

- Test 7 (Sol)Document2 pagesTest 7 (Sol)yazdan2250No ratings yet

- ACCC 121 2020 First Opp Memo-1Document11 pagesACCC 121 2020 First Opp Memo-1danphjrjordaan218No ratings yet

- Government Accounting (Chapter 13 and 14) - Florentin, Shaniah Racelle D. - BSA 3BDocument10 pagesGovernment Accounting (Chapter 13 and 14) - Florentin, Shaniah Racelle D. - BSA 3BRacelle FlorentinNo ratings yet

- F-1919-B.b.a. - Semester-Iv - Paper - 119-Financial ManagementDocument2 pagesF-1919-B.b.a. - Semester-Iv - Paper - 119-Financial Managementhimanshu ranjanNo ratings yet

- Cacn040 Test 3 - 2023 Suggested Solution - 008Document18 pagesCacn040 Test 3 - 2023 Suggested Solution - 008Given RefilweNo ratings yet

- Acct6005 Company Accounting: Assessment 2 Case StudyDocument8 pagesAcct6005 Company Accounting: Assessment 2 Case StudyRuhan SinghNo ratings yet

- ASS 1 2021 Part A SolutionDocument4 pagesASS 1 2021 Part A SolutionOdzulaho DemanaNo ratings yet

- Assessment 1 Far-2 SolutionDocument3 pagesAssessment 1 Far-2 SolutionHadeed HafeezNo ratings yet

- Part A Not Relevant Part B - Practical Questions Question 1 (14 Marks)Document7 pagesPart A Not Relevant Part B - Practical Questions Question 1 (14 Marks)Aamir SaeedNo ratings yet

- Financial Accounting N 6 Test MG 2nd Semester 2017Document8 pagesFinancial Accounting N 6 Test MG 2nd Semester 2017professional accountantsNo ratings yet

- B2 2021 Nov AnsDocument13 pagesB2 2021 Nov AnsRashid AbeidNo ratings yet

- JAN 2024 (1)Document3 pagesJAN 2024 (1)Nur Alya DamiaNo ratings yet

- Semester-6 Chapter-5Document10 pagesSemester-6 Chapter-5bharatipaul42No ratings yet

- PRACTICE CLASS 3, 4 and 5Document6 pagesPRACTICE CLASS 3, 4 and 5Zain JamilNo ratings yet

- CH 4 Comprehensive ProblemDocument5 pagesCH 4 Comprehensive ProblemLNo ratings yet

- 47246mtpbosicai Sa p1 Sr2Document13 pages47246mtpbosicai Sa p1 Sr2AnsariMohammedShoaibNo ratings yet

- FF - Karil Koiriyah - 180421621551 - Tugas 4Document92 pagesFF - Karil Koiriyah - 180421621551 - Tugas 4karinaNo ratings yet

- FAC1601-oct2014 Suggested Sol eDocument7 pagesFAC1601-oct2014 Suggested Sol ePhelane FNo ratings yet

- Description Income Expenses Assets LiabilitiesDocument12 pagesDescription Income Expenses Assets LiabilitiesNipuna Perera100% (1)

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- 13.4 IAS 21 - SolutionsDocument21 pages13.4 IAS 21 - SolutionsStaid LynxNo ratings yet

- Orlando (Inventory + PPE) : C 19: IAS 21 - F C I F SDocument1 pageOrlando (Inventory + PPE) : C 19: IAS 21 - F C I F S.No ratings yet

- 5 6215195415390715991Document16 pages5 6215195415390715991RITIK AGARWALNo ratings yet

- Depreciation Allowance (Parts 1 & 2) Tutorial Questions 1Document4 pagesDepreciation Allowance (Parts 1 & 2) Tutorial Questions 1ting ting shihNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- FAC2601 Assignment 02Document4 pagesFAC2601 Assignment 02SibongileNo ratings yet

- Test 2 SolutionDocument2 pagesTest 2 Solutiontaswaraliarain4No ratings yet

- 73264bos59105 Inter P1aDocument12 pages73264bos59105 Inter P1aRaish QURESHINo ratings yet

- Far1 Artt Ias 36 Test SolDocument2 pagesFar1 Artt Ias 36 Test SolHassan TanveerNo ratings yet

- ACC 401-2023 GA 2-EvenDocument3 pagesACC 401-2023 GA 2-EvenOhene Asare PogastyNo ratings yet

- Corporate Reporting - ND2020 - Suggested - Answers - Review by SBDocument13 pagesCorporate Reporting - ND2020 - Suggested - Answers - Review by SBTamanna KinnoreNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- Chandragiri 071-072 ProvsionalDocument9 pagesChandragiri 071-072 ProvsionalBright Tone Music InstituteNo ratings yet

- IFRS-9 SolutionDocument2 pagesIFRS-9 SolutionWaseim khan Barik zaiNo ratings yet

- Income Taxes - Moments LTD Rupert LTD MemoDocument5 pagesIncome Taxes - Moments LTD Rupert LTD Memoandiswa zuluNo ratings yet

- CA India Financial ManagementDocument30 pagesCA India Financial Managementomkumardepani070805No ratings yet

- Xii AccDocument4 pagesXii AccSanjayNo ratings yet

- AFI3512 FA-1B Supplementary Exam Question 2022Document11 pagesAFI3512 FA-1B Supplementary Exam Question 2022kevgoat217No ratings yet

- AFI3512 Test 4 2022 QuestionDocument6 pagesAFI3512 Test 4 2022 Questionkevgoat217No ratings yet

- ABC Chap 9 SolmanDocument11 pagesABC Chap 9 SolmanKimberly ToraldeNo ratings yet

- B2 Nov 2022 AnsDocument15 pagesB2 Nov 2022 AnsRashid AbeidNo ratings yet

- Liabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Document3 pagesLiabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Amit GodaraNo ratings yet

- Example Problem Petro EconomyDocument68 pagesExample Problem Petro Economyal zam zamNo ratings yet

- Additional Illustrations-5Document19 pagesAdditional Illustrations-5goyalmanasvi06No ratings yet

- AFA IIP.L III SolutionJune 2016Document4 pagesAFA IIP.L III SolutionJune 2016HossainNo ratings yet

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- Accounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Document6 pagesAccounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Michael JimNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Metabical Case Study SolutionDocument7 pagesMetabical Case Study SolutionAshutosh PatkarNo ratings yet

- JBMA 13 020mohajanDocument9 pagesJBMA 13 020mohajanManjare Hassin RaadNo ratings yet

- PriyanshiRaichada 210929230 MechatronicsDocument1 pagePriyanshiRaichada 210929230 Mechatronicspriyanshiraichada15No ratings yet

- Specialized Government BanksDocument5 pagesSpecialized Government BanksCarazelli AysonNo ratings yet

- DNV - GL - Life Boat S - No - 18 - 2019 - WebDocument4 pagesDNV - GL - Life Boat S - No - 18 - 2019 - Webahmed shreifNo ratings yet

- Chapter 2 - A Biotechnology Entrepreneur S Legacy - Hen - 2020 - Biotechnology EDocument11 pagesChapter 2 - A Biotechnology Entrepreneur S Legacy - Hen - 2020 - Biotechnology EazizaNo ratings yet

- Free PDF Chikitsa Nyaya ShastraDocument30 pagesFree PDF Chikitsa Nyaya ShastraDR RAGESH RAINo ratings yet

- Allowable DeductionsDocument4 pagesAllowable Deductionswind snip3r reojaNo ratings yet

- Assistant Manager Maintenance Mechanical, Electrical ProjectDocument4 pagesAssistant Manager Maintenance Mechanical, Electrical ProjectBIKASH MOHANTYNo ratings yet

- Zomato 10 Minutes Delivery Plan Survey QuestionnaireDocument8 pagesZomato 10 Minutes Delivery Plan Survey QuestionnaireJuhi BhattacharjeeNo ratings yet

- Galbreath, 2008Document30 pagesGalbreath, 2008AbrahamNo ratings yet

- Buletin Mutiara - English/Chinese/Tamil - Mac #1 IssueDocument28 pagesBuletin Mutiara - English/Chinese/Tamil - Mac #1 IssueChan LilianNo ratings yet

- Villanueva vs. Gonzaga 498 SCRA 285Document8 pagesVillanueva vs. Gonzaga 498 SCRA 285Eunice Anne MitoNo ratings yet

- DocumentDocument5 pagesDocumentyogitaNo ratings yet

- Bhiwandi Electricity Distribution Franchisee: Project DescriptionDocument9 pagesBhiwandi Electricity Distribution Franchisee: Project DescriptionRomit AgarwalNo ratings yet

- St. Paul University Philippines Tuguegarao City, Cagayan: Requirement For The Degree of Master of Business AdministrationDocument3 pagesSt. Paul University Philippines Tuguegarao City, Cagayan: Requirement For The Degree of Master of Business AdministrationSam MatammuNo ratings yet

- Balanced Score Card For Sales ManagerDocument1 pageBalanced Score Card For Sales ManagerJammigumpula PriyankaNo ratings yet

- AM Tax Working New RegimeDocument6 pagesAM Tax Working New RegimeabhishekmenonNo ratings yet

- FTFCS 2022-03-23 1648030351701Document15 pagesFTFCS 2022-03-23 1648030351701Charles Goodwin100% (2)

- Complete Final Year Project ReportDocument78 pagesComplete Final Year Project ReportAsad LaghariNo ratings yet

- Marketing Management Final Exam Case StuDocument2 pagesMarketing Management Final Exam Case Stumahmoud sakrNo ratings yet

- STRATC2 Activity 4Document4 pagesSTRATC2 Activity 4Micaela EncinasNo ratings yet

- Inocentes Et Al Vs RSCIDocument2 pagesInocentes Et Al Vs RSCIRex Regio100% (1)

- Letter From Banker John Alton To Secretary of State John Hay Regarding The Chinese Exclusion ActDocument3 pagesLetter From Banker John Alton To Secretary of State John Hay Regarding The Chinese Exclusion ActJulia FlemingNo ratings yet

- Economic CSEC Study GuideDocument3 pagesEconomic CSEC Study GuideDannyelle PhillipNo ratings yet

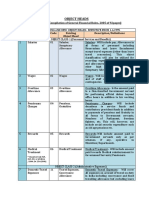

- Object Head List PDFDocument6 pagesObject Head List PDFLal ZahawmaNo ratings yet

- Full Download Operations Management 5th Edition Reid Test BankDocument12 pagesFull Download Operations Management 5th Edition Reid Test Bankgayoyigachy100% (38)

- Law 1Document1 pageLaw 1Cyrille Keith FranciscoNo ratings yet

- Tropy 2015Document258 pagesTropy 2015Jamie TanNo ratings yet