Professional Documents

Culture Documents

2024-07-13T06-34 Transaction #7659493220834303-7717099761740320

2024-07-13T06-34 Transaction #7659493220834303-7717099761740320

Uploaded by

infocrystalinstituteCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2024-07-13T06-34 Transaction #7659493220834303-7717099761740320

2024-07-13T06-34 Transaction #7659493220834303-7717099761740320

Uploaded by

infocrystalinstituteCopyright:

Available Formats

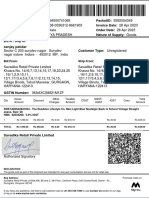

Tax invoice for Crystal Kollam

Account ID: 287715311403903

Tax invoice ID

ADS704-103550618

Document date

13 Jul 2024, 06:34 Paid

936.37 INR

Payment method

Prepaid balance

Transaction ID Subtotal: 793.53 INR

7659493220834303-7717099761740320 IGST (18%): 142.84 INR

Ad costs since your last bill.

Product type

Meta ads

Line no. Campaigns – Advertising service HSN code/SAC code: 998365

1 [06/01/2024] Promoting https://facebook.com/crystalinstitute

154.99 INR

From 12 Jul 2024, 00:00 to 12 Jul 2024, 23:59

[06/01/2024] Promoting https://facebook.com/crystalinstitute 10,148 Impressions 154.99 INR

2 [10/07/2024] Promoting https://facebook.com/crystalinstitute

482.71 INR

From 12 Jul 2024, 00:00 to 12 Jul 2024, 23:59

[10/07/2024] Promoting https://facebook.com/crystalinstitute 69,268 Impressions 482.71 INR

3 [06/01/2024] Promoting tel:+917594042043

155.83 INR

From 12 Jul 2024, 00:00 to 12 Jul 2024, 23:59

[06/01/2024] Promoting tel:+917594042043 19,812 Impressions 155.83 INR

CRYSTAL INSTITUTE

KMC XVII 904 905, JK MALLIKA,

CHINNAKKADA

Facebook India Online Services Pvt. Ltd. KOLLAM 691001, KL

DLF Atria Block N, Jacaranda Marg India

DLF City Phase II, Gurugram – 122002 Haryana State code: 32

India Place of Supply: Kerala

GSTIN : 06AABCF5150G1ZZ GSTIN: 32AAJFC3993M1Z1

PAN : AABCF5150G PAN: AAJFC3993M

Supplies against this invoice are not subject to reverse charge.

Tax deducted at source (TDS) at applicable rate applies on the pre-GST Advertising spend and is directly payable to the Central Board of Direct Taxes. Where

such TDS is applied, kindly follow the process outlined: here

Powered by TCPDF (www.tcpdf.org)

You might also like

- Bandhan Bank Statement.Document1 pageBandhan Bank Statement.ssbajajbethua22No ratings yet

- 2024-06-02T06-27 Transaction #7610885279028433-14554975Document2 pages2024-06-02T06-27 Transaction #7610885279028433-14554975infocrystalinstituteNo ratings yet

- 2023-12-02T06-14 Transaction #6576161719162810-13540790Document1 page2023-12-02T06-14 Transaction #6576161719162810-13540790Shivendra SinghNo ratings yet

- 2024-06-01T06-27 Transaction #7582361308547501-14551030Document1 page2024-06-01T06-27 Transaction #7582361308547501-14551030infocrystalinstituteNo ratings yet

- 2023-06-23T06-30 Transaction #6627440717372541-12448174Document1 page2023-06-23T06-30 Transaction #6627440717372541-12448174digital.arun999No ratings yet

- 2022-02-13T06-33 Transaction #4838387546271530-9188245Document1 page2022-02-13T06-33 Transaction #4838387546271530-9188245Suraj PanditNo ratings yet

- 2024-04-13T06-42 Transaction #7211007965676812-14346242Document1 page2024-04-13T06-42 Transaction #7211007965676812-14346242gladsonnadar007No ratings yet

- 2023-12-01T06-54 Transaction #6675640839214896-13533383Document1 page2023-12-01T06-54 Transaction #6675640839214896-13533383Shivendra SinghNo ratings yet

- 2023-12-03T06-14 Transaction #6740386379407003-13547473Document1 page2023-12-03T06-14 Transaction #6740386379407003-13547473Shivendra SinghNo ratings yet

- 2024-05-28T06-46 Transaction #7564411917005458-7543628625750462Document2 pages2024-05-28T06-46 Transaction #7564411917005458-7543628625750462Shailendra Singh ChaharNo ratings yet

- 2023-05-30T10-54 Transaction #6015470455230964-12460831 (1)Document1 page2023-05-30T10-54 Transaction #6015470455230964-12460831 (1)rednetijNo ratings yet

- 2024-02-26T07-15 Transaction #7045429588900648-14294356Document1 page2024-02-26T07-15 Transaction #7045429588900648-14294356deccankitchen20No ratings yet

- 2024-03-01T06-01 Transaction #7236427403137835-14127429Document1 page2024-03-01T06-01 Transaction #7236427403137835-14127429cscpancarddmoNo ratings yet

- 2024-06-09T06-59 Transaction #7360547284056218-7553247591452844 (1)Document2 pages2024-06-09T06-59 Transaction #7360547284056218-7553247591452844 (1)gladsonnadar007No ratings yet

- 2024-02-16T06-52 Transaction #6932775730168019-14224971Document2 pages2024-02-16T06-52 Transaction #6932775730168019-14224971OFC accountNo ratings yet

- 2024-05-19T06-47 Transaction #7374544042656536-14497665 (1)Document2 pages2024-05-19T06-47 Transaction #7374544042656536-14497665 (1)gladsonnadar007No ratings yet

- Popular Agencies (Cycles) (Inv... 27300184)Document2 pagesPopular Agencies (Cycles) (Inv... 27300184)Prasann JeetNo ratings yet

- 2022-05-29T19-16 Transaction #4974283512683938-9956431Document2 pages2022-05-29T19-16 Transaction #4974283512683938-9956431Rupesh AsthanaNo ratings yet

- 2024-06-07T06-59 Transaction #7350722158372064-7473092462801698 (1)Document2 pages2024-06-07T06-59 Transaction #7350722158372064-7473092462801698 (1)gladsonnadar007No ratings yet

- 2022-06-27T06-24 Transaction #5053937604723719-10062773Document1 page2022-06-27T06-24 Transaction #5053937604723719-10062773burnfitjaipurNo ratings yet

- SCS202243656Document2 pagesSCS202243656Jyotiprakash SahooNo ratings yet

- 2024-05-26T06-19 Transaction #7439011296209727-14556293Document1 page2024-05-26T06-19 Transaction #7439011296209727-14556293manask0786No ratings yet

- 2024-06-08T06-59 Transaction #7469039093207030-7433927383384869 (1)Document2 pages2024-06-08T06-59 Transaction #7469039093207030-7433927383384869 (1)gladsonnadar007No ratings yet

- 2024-06-01T06-33 Transaction #7176980792417065-14571030Document2 pages2024-06-01T06-33 Transaction #7176980792417065-14571030anudevsohaliNo ratings yet

- 2024-04-14T06-42 Transaction #7188093477968264-14350141Document1 page2024-04-14T06-42 Transaction #7188093477968264-14350141gladsonnadar007No ratings yet

- 2024-04-15T06-42 Transaction #7192168547560757-14353986Document1 page2024-04-15T06-42 Transaction #7192168547560757-14353986gladsonnadar007No ratings yet

- 2024-06-10T07-00 Transaction #7536603593117245-7379761302134812 (1)Document2 pages2024-06-10T07-00 Transaction #7536603593117245-7379761302134812 (1)gladsonnadar007No ratings yet

- Statement Mar 21 XXXXXXXX3935Document1 pageStatement Mar 21 XXXXXXXX3935Raja SekharNo ratings yet

- 2024-03-19T06-05 Transaction #7151383194972557-14280654Document2 pages2024-03-19T06-05 Transaction #7151383194972557-14280654Pranav WadhwaNo ratings yet

- 2023-10-09T06-21 Transaction #6673900286057604-13278862Document1 page2023-10-09T06-21 Transaction #6673900286057604-13278862ashishmeenahomeNo ratings yet

- Account Statement 301022 280423Document9 pagesAccount Statement 301022 280423Saransh Garg (The eXponent)No ratings yet

- 2024-04-16T06-42 Transaction #7148137798630500-14358006Document1 page2024-04-16T06-42 Transaction #7148137798630500-14358006gladsonnadar007No ratings yet

- 2023-08-20T06-24 Transaction #6521886351260625-13054226Document1 page2023-08-20T06-24 Transaction #6521886351260625-13054226Purnima Swami (Lecturer & Promoter)No ratings yet

- 2023-11-13T10-24 Transaction #6594857127291331-13551980Document1 page2023-11-13T10-24 Transaction #6594857127291331-13551980vaibhavap203No ratings yet

- InvoiceDocument1 pageInvoiceKaran RamchandaniNo ratings yet

- Date Narration Chq/Ref No Withdrawal (DR) / Deposit (CR) BalanceDocument34 pagesDate Narration Chq/Ref No Withdrawal (DR) / Deposit (CR) Balancepawanjagarwad97No ratings yet

- BTI-434 Machine JamnagarDocument2 pagesBTI-434 Machine Jamnagareducationgarima9No ratings yet

- IIGM Private Limited: QuotationDocument1 pageIIGM Private Limited: Quotationlovetwr82No ratings yet

- Tax Invoice For 468976748241833: Line No. Campaigns - Advertising Service HSN code/SAC Code: 998365Document2 pagesTax Invoice For 468976748241833: Line No. Campaigns - Advertising Service HSN code/SAC Code: 998365Rupesh AsthanaNo ratings yet

- Receipt For Vivek Dwivedi: Campaigns - Advertising Service HSN code/SAC Code: 998365Document1 pageReceipt For Vivek Dwivedi: Campaigns - Advertising Service HSN code/SAC Code: 998365Vivek DwivediNo ratings yet

- 2023-03-05T06-40 Transaction #5665091936934929-11734289Document2 pages2023-03-05T06-40 Transaction #5665091936934929-11734289Aadijay’s Biryani and KebabsNo ratings yet

- URMILADocument1 pageURMILApuja9015709658No ratings yet

- 2024-02-29T06-53 Transaction #7342307139216520-14123040Document1 page2024-02-29T06-53 Transaction #7342307139216520-14123040cscpancarddmoNo ratings yet

- MH20FU1546 FASTag Statement 1717694664082Document2 pagesMH20FU1546 FASTag Statement 1717694664082Kiran DubeleNo ratings yet

- Item Invoice DownloadDocument3 pagesItem Invoice DownloadVishal BawaneNo ratings yet

- 2024-06-08-17-42-11Jun-24Document3 pages2024-06-08-17-42-11Jun-24godwaysfineNo ratings yet

- ASHOKDocument1 pageASHOKashokmahankuda975No ratings yet

- Account Statement 250622 140722Document1 pageAccount Statement 250622 140722Comred ComredNo ratings yet

- Wa0024.Document2 pagesWa0024.vineethrv1822No ratings yet

- 2021 06 03T00 00 - Transaction - 3724102451033709 7636941Document1 page2021 06 03T00 00 - Transaction - 3724102451033709 7636941Parimala PoduriNo ratings yet

- Item Invoice DownloadDocument3 pagesItem Invoice DownloadAmandeep SinghNo ratings yet

- CREATIONDocument1 pageCREATIONemamoddin ahemadNo ratings yet

- 2024-02-26T07-15 Transaction #7045429448900662-14294355Document1 page2024-02-26T07-15 Transaction #7045429448900662-14294355deccankitchen20No ratings yet

- Inv 2024 01 0046Document1 pageInv 2024 01 0046Muhaiminul Islam MubinNo ratings yet

- Travel Expense Statement (Simulation) : ItineraryDocument4 pagesTravel Expense Statement (Simulation) : ItineraryvijayNo ratings yet

- 2023 09 01 2024 01 27 - Meta - Invoice - SummaryDocument3 pages2023 09 01 2024 01 27 - Meta - Invoice - SummaryRam kunwar KumawatNo ratings yet

- Hathway 1058683603Document1 pageHathway 1058683603Satyasheel ChandaneNo ratings yet

- 2024-06-15T06-48 Transaction #7963489213767630-14680251Document1 page2024-06-15T06-48 Transaction #7963489213767630-14680251manojkumarntt11No ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument3 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total Amountsanjay patidarNo ratings yet

- Monzo Bank Statement 2020 03 08 117259Document1 pageMonzo Bank Statement 2020 03 08 11725913KARATNo ratings yet

- Notice Under Section 138 of The Negotiable Instrum225Document2 pagesNotice Under Section 138 of The Negotiable Instrum225Anmol SinghNo ratings yet

- Patanjali Foods Annual Report 2021 22Document207 pagesPatanjali Foods Annual Report 2021 22Amit ShenwaiNo ratings yet

- What Is The Issue? Why Is The Issue Important?Document3 pagesWhat Is The Issue? Why Is The Issue Important?Louise Victoria BeltranNo ratings yet

- BC Sessions 1 10Document99 pagesBC Sessions 1 10MANOHARA NIKHILNo ratings yet

- Dena BankDocument25 pagesDena BankJaved ShaikhNo ratings yet

- Ajmal 2108 4311 1 Final ProjectDocument13 pagesAjmal 2108 4311 1 Final ProjectRaiana TabithaNo ratings yet

- Week 11Document37 pagesWeek 11Izzah HzmhNo ratings yet

- Unit 1 ReadingDocument4 pagesUnit 1 Readingbaonguyen.erNo ratings yet

- The Use of The Kano Model To Enhance Customer Satisfaction: Laura Južnik Rotar, Mitja KOZARDocument13 pagesThe Use of The Kano Model To Enhance Customer Satisfaction: Laura Južnik Rotar, Mitja KOZARCristinaNo ratings yet

- Design ThinkingDocument23 pagesDesign ThinkingShubham BhatNo ratings yet

- Tata Mutual Fund: Account StatementDocument4 pagesTata Mutual Fund: Account StatementKirti Kant SrivastavaNo ratings yet

- Math108x - Document - w09GroupAssignment (7) - 1589530813Document10 pagesMath108x - Document - w09GroupAssignment (7) - 1589530813Poline Pauline KitiliNo ratings yet

- Foreign Aid and Remittance: Crash Course Economics Video AnalysisDocument7 pagesForeign Aid and Remittance: Crash Course Economics Video AnalysisElise Smoll (Elise)No ratings yet

- Tom Lives On An Island and Has 20 Coconut TreesDocument1 pageTom Lives On An Island and Has 20 Coconut Treestrilocksp SinghNo ratings yet

- Copy CHAPTER 4 Decision TheoryDocument6 pagesCopy CHAPTER 4 Decision Theoryclariza.consulta0716No ratings yet

- 1 Spouses Raymundo V BandongDocument2 pages1 Spouses Raymundo V BandongseentherellaaaNo ratings yet

- IM Naming ConventionDocument16 pagesIM Naming ConventionPedro NevesNo ratings yet

- Loctite Liofol Op 1450-EnDocument2 pagesLoctite Liofol Op 1450-EnCharly DtNo ratings yet

- Efront Insight Benchmark ReportDocument8 pagesEfront Insight Benchmark ReportNick AbacaNo ratings yet

- Pre Class Notes and Assignment PDFDocument18 pagesPre Class Notes and Assignment PDFShah SujitNo ratings yet

- Generally Accepted Accounting Principles (GAAP) and The Accounting EnvironmentDocument29 pagesGenerally Accepted Accounting Principles (GAAP) and The Accounting Environmentmehul100% (3)

- India Cements Limited: A Study On "Capital Budgeting" ATDocument4 pagesIndia Cements Limited: A Study On "Capital Budgeting" ATKothapalle InthiyazNo ratings yet

- Prabhu S - w21036 - Cs End TermDocument4 pagesPrabhu S - w21036 - Cs End TermContact InfoNo ratings yet

- Marketing Strategy of Muscle BlazeDocument22 pagesMarketing Strategy of Muscle BlazeKashyap PulipatiNo ratings yet

- EDU CAT EN ASM FF V5-6R2015 ToprintDocument301 pagesEDU CAT EN ASM FF V5-6R2015 ToprintBosse BoseNo ratings yet

- Digital Marketing Sem 4 QPDocument2 pagesDigital Marketing Sem 4 QPprathmeshNo ratings yet

- BD Interest Rate Matrix PDFDocument1 pageBD Interest Rate Matrix PDFMukaddes HossainNo ratings yet

- Module 5 - Assessment ActivitiesDocument4 pagesModule 5 - Assessment Activitiesaj dumpNo ratings yet

- Classification of HotelsDocument15 pagesClassification of HotelsJeevesh ViswambharanNo ratings yet