Professional Documents

Culture Documents

Sandeep Garg questions class 12

Sandeep Garg questions class 12

Uploaded by

nikhil070407mehtaCopyright:

Available Formats

You might also like

- Cockney MonologuesDocument2 pagesCockney MonologuesLaReceHawkins86% (7)

- Solar Water Heater Distributor Business PlanDocument32 pagesSolar Water Heater Distributor Business Planlutos267% (3)

- National Income QuestionDocument2 pagesNational Income QuestionShivani Karkera100% (1)

- National Income Class 12 WsDocument19 pagesNational Income Class 12 WsIsha BhattNo ratings yet

- Miscellaneous Numericals NI From ID MANGLA BookDocument16 pagesMiscellaneous Numericals NI From ID MANGLA Bookashwanikumar172006No ratings yet

- Question With Answer - National IncomeDocument3 pagesQuestion With Answer - National IncomeShardul100% (10)

- N Income Income and Exp Method NewDocument6 pagesN Income Income and Exp Method NewJ.Abishek SundarNo ratings yet

- 01 Ch1 Determination of National Income - Practice SheetDocument18 pages01 Ch1 Determination of National Income - Practice SheetVipul SharmaNo ratings yet

- Reference: Answers)Document11 pagesReference: Answers)Jaivardhan KanoriaNo ratings yet

- NI Problems For Practice: Employer's Contribution To Social 100 Security SchemeDocument4 pagesNI Problems For Practice: Employer's Contribution To Social 100 Security Schemesridharvchinni_21769No ratings yet

- Questions: Income AND Page 359,0Document17 pagesQuestions: Income AND Page 359,0anirudh sharmaNo ratings yet

- Worksheet 8 (Problems Based On Income and Expenditure Method)Document3 pagesWorksheet 8 (Problems Based On Income and Expenditure Method)PradeepNo ratings yet

- National IncomeDocument2 pagesNational IncomePUTERI SIDROTUL NABIHAH SAARANINo ratings yet

- The New Indian School, W.L.L Kingdom of Bahrain Class: Xii Economics Assignment National IncomeDocument3 pagesThe New Indian School, W.L.L Kingdom of Bahrain Class: Xii Economics Assignment National IncomeHannah Ann JacobNo ratings yet

- National Income Important QuestionsDocument4 pagesNational Income Important Questionsjb7114262No ratings yet

- Macro Unsolved Numericals English PDFDocument18 pagesMacro Unsolved Numericals English PDFNindoNo ratings yet

- Book 1 May 2024Document8 pagesBook 1 May 2024ayushsahni2915No ratings yet

- Test 2Document2 pagesTest 2Bhjan GargNo ratings yet

- National IncomeDocument4 pagesNational IncomeSPORTY JHANo ratings yet

- Economics Practice Sheets N22Document101 pagesEconomics Practice Sheets N22joyboyishehereNo ratings yet

- MycbseguideDocument10 pagesMycbseguideBinoy TrevadiaNo ratings yet

- National Income ProblemsDocument4 pagesNational Income ProblemsPriyankadevi PrabuNo ratings yet

- N.I NumericalsDocument7 pagesN.I NumericalsKushagra BhartiyaNo ratings yet

- Class_XII_Economics_1Document6 pagesClass_XII_Economics_1GSN KISHORENo ratings yet

- NI Sums PDFDocument3 pagesNI Sums PDFSHIVANG SADANINo ratings yet

- N I Value Added MethodDocument4 pagesN I Value Added MethodJ.Abishek SundarNo ratings yet

- Home Assignment Summer VactionsDocument3 pagesHome Assignment Summer VactionsLaraNo ratings yet

- ABANTI - GOSWAMIQuestion and Solutions (National Income) 2020-06-02question BankDocument4 pagesABANTI - GOSWAMIQuestion and Solutions (National Income) 2020-06-02question BankAPARNA NIMMAGADDANo ratings yet

- Test of Economics National Income (17!05!24)Document3 pagesTest of Economics National Income (17!05!24)MAHEE SHREE MITTALNo ratings yet

- Macro Numerical OS, COEDocument7 pagesMacro Numerical OS, COERiya JainNo ratings yet

- PBL - Macroeconomic (2) (1) NDocument9 pagesPBL - Macroeconomic (2) (1) NLiyana IsmailNo ratings yet

- Economics WorksheetDocument2 pagesEconomics Worksheetdennis greenNo ratings yet

- EcoDocument9 pagesEcoP Janaki RamanNo ratings yet

- National Income-1Document22 pagesNational Income-122babba050No ratings yet

- National Income Practice QuestionsDocument29 pagesNational Income Practice QuestionsSujalNo ratings yet

- National Income Numerical QDocument2 pagesNational Income Numerical QGongju Esya100% (1)

- Ational Income: Archanatrivedi/Nationalincome/Ws/2021-22Page 1Document4 pagesAtional Income: Archanatrivedi/Nationalincome/Ws/2021-22Page 1BlairNo ratings yet

- Eco XII Ass.Document5 pagesEco XII Ass.Kushagra VermaNo ratings yet

- National Income Math Part - 2Document8 pagesNational Income Math Part - 2Ibrahim MondolNo ratings yet

- CBSE Important Questions Class-12 Economics Chapter-5 National Income and Related AggregatesDocument6 pagesCBSE Important Questions Class-12 Economics Chapter-5 National Income and Related AggregatesVaibhavNo ratings yet

- National Income Sums - Value AddedDocument14 pagesNational Income Sums - Value AddedShreyas ParekhNo ratings yet

- Week 3-TutorialsDocument1 pageWeek 3-TutorialsSasi VisvaNo ratings yet

- Introduction To Macroeconomics Cat 1 and 2Document3 pagesIntroduction To Macroeconomics Cat 1 and 2jimNo ratings yet

- Eco211-Revision ExercisesDocument4 pagesEco211-Revision ExercisesfarahNo ratings yet

- National Income NumericalsDocument19 pagesNational Income Numericalsyuvrajput1111No ratings yet

- National Income Related AggregatesDocument4 pagesNational Income Related Aggregatessubs444subs10082002No ratings yet

- National Income Accounting AssignmentDocument8 pagesNational Income Accounting AssignmentNamit BhatiaNo ratings yet

- Numerical Problems For Module II and IIIDocument6 pagesNumerical Problems For Module II and IIIRiya LalNo ratings yet

- Macro Economics Five Years QP NewDocument23 pagesMacro Economics Five Years QP Newprarabdh shivhareNo ratings yet

- Exercises Chapter 2 Eco211 - Compress PDFDocument8 pagesExercises Chapter 2 Eco211 - Compress PDFNUR MAISARAH AQILAH MOHD ZAIDINo ratings yet

- 5th Sem (Macro-Economics) Exam Based Practical QuestionDocument5 pages5th Sem (Macro-Economics) Exam Based Practical Questionsadfeel145No ratings yet

- Macro Assignment Numericals-1Document14 pagesMacro Assignment Numericals-1mohantyseema84No ratings yet

- f7 (Int) FR SQB As j08Document90 pagesf7 (Int) FR SQB As j08Jamilya SNo ratings yet

- Questions NIDocument4 pagesQuestions NItyagi_rajat8918No ratings yet

- Revision Worksheet 4Document3 pagesRevision Worksheet 4Diya RathoreNo ratings yet

- REVISIONDocument3 pagesREVISIONnienaNo ratings yet

- 02 ICAN B1 FR Mock As (2019)Document19 pages02 ICAN B1 FR Mock As (2019)lashee938No ratings yet

- Wa0000.Document2 pagesWa0000.Adarsh SinghNo ratings yet

- M3 OPEX Decision Making Data Answer 2.10.21Document6 pagesM3 OPEX Decision Making Data Answer 2.10.21hanis nabilaNo ratings yet

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- Economics Half Yearly Question PaperDocument6 pagesEconomics Half Yearly Question PaperBhumika MiglaniNo ratings yet

- Part 5 of BST chapter 1 class 11Document2 pagesPart 5 of BST chapter 1 class 11nikhil070407mehtaNo ratings yet

- Class 11 BST chapter 1 part 2Document2 pagesClass 11 BST chapter 1 part 2nikhil070407mehtaNo ratings yet

- BST chapter 1 part 3Document2 pagesBST chapter 1 part 3nikhil070407mehtaNo ratings yet

- BST chapter 1 notes part 1Document2 pagesBST chapter 1 notes part 1nikhil070407mehtaNo ratings yet

- Big dataDocument3 pagesBig datanikhil070407mehtaNo ratings yet

- BE1 Final Without Recheckreassessment - 453112Document1 pageBE1 Final Without Recheckreassessment - 453112MoloNo ratings yet

- Herbert Morrison BooklistDocument2 pagesHerbert Morrison BooklistGillian HallNo ratings yet

- Staircase Lift Design For Elderly at HomeDocument19 pagesStaircase Lift Design For Elderly at Homesabareesh91mechNo ratings yet

- La Bugal V RamosDocument141 pagesLa Bugal V Ramosabo8008No ratings yet

- CONSORT-EHEALTH (V 1.6.1) - Submission/Publication Form: RequiredDocument49 pagesCONSORT-EHEALTH (V 1.6.1) - Submission/Publication Form: RequiredStefan HlNo ratings yet

- Bangalore Startups CompaniesDocument14 pagesBangalore Startups CompaniesAparna GanesenNo ratings yet

- Sankaran, Mahesh - Scogings, Peter F - Savanna Woody Plants and Large Herbivores (2020, John Wiley & Sons LTD)Document781 pagesSankaran, Mahesh - Scogings, Peter F - Savanna Woody Plants and Large Herbivores (2020, John Wiley & Sons LTD)Ariadne Cristina De AntonioNo ratings yet

- 1999 Aversion Therapy-BEDocument6 pages1999 Aversion Therapy-BEprabhaNo ratings yet

- LSM MockDocument5 pagesLSM MockKazi Rafsan NoorNo ratings yet

- Permanent Hair Dye ColorantsDocument37 pagesPermanent Hair Dye ColorantsAntonio Perez MolinaNo ratings yet

- Job Description - CRM Marketing SpecialistDocument1 pageJob Description - CRM Marketing SpecialistMichael-SNo ratings yet

- Iqra University - Karachi Faculty of Business AdministrationDocument31 pagesIqra University - Karachi Faculty of Business Administrationsyed aliNo ratings yet

- Manual Therapy in The Treatment of Facial WrinklesDocument4 pagesManual Therapy in The Treatment of Facial WrinklesKarolina MirosNo ratings yet

- The Russian Military Today and Tomorrow: Essays in Memory of Mary FitzgeraldDocument474 pagesThe Russian Military Today and Tomorrow: Essays in Memory of Mary FitzgeraldSSI-Strategic Studies Institute-US Army War College100% (1)

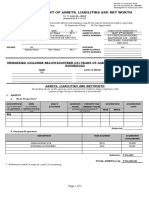

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthKal El DadiNo ratings yet

- 2 The Origin of LifeDocument39 pages2 The Origin of LifeRydel GreyNo ratings yet

- Rev JSRR 45765Document2 pagesRev JSRR 45765Amit BNo ratings yet

- 7 Eleven MalaysiaDocument10 pages7 Eleven MalaysiaKimchhorng HokNo ratings yet

- Colonialism and Imperialism by Usman KhanDocument2 pagesColonialism and Imperialism by Usman KhanUSMANNo ratings yet

- Getting The Call From Stockholm: My Karolinska Institutet ExperienceDocument31 pagesGetting The Call From Stockholm: My Karolinska Institutet ExperienceucsfmededNo ratings yet

- Architecture in EthDocument4 pagesArchitecture in Ethmelakumikias2No ratings yet

- Synopsis Car Showroom ManagementDocument18 pagesSynopsis Car Showroom ManagementRaj Bangalore50% (4)

- WikiHow Is An Online WikiDocument4 pagesWikiHow Is An Online Wikiksdnfi ouvynNo ratings yet

- Dolomite in Manila Bay A Big HitDocument3 pagesDolomite in Manila Bay A Big HitJoanaPauline FloresNo ratings yet

- Vu+Premium+2K+TV Specification 32UADocument2 pagesVu+Premium+2K+TV Specification 32UAMr jhonNo ratings yet

- B1.1-Self-Study Đã Sài XongDocument5 pagesB1.1-Self-Study Đã Sài XongVy CẩmNo ratings yet

- Wastestation Compact: Transport SavingDocument2 pagesWastestation Compact: Transport Savingaamogh.salesNo ratings yet

- Module 2 The Self From Philosophical and Anthropological PerspectivesDocument10 pagesModule 2 The Self From Philosophical and Anthropological PerspectivesAjhay BonghanoyNo ratings yet

Sandeep Garg questions class 12

Sandeep Garg questions class 12

Uploaded by

nikhil070407mehtaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sandeep Garg questions class 12

Sandeep Garg questions class 12

Uploaded by

nikhil070407mehtaCopyright:

Available Formats

Miscellaneous Practicals

21 Calculate National Income by Income and Expenditure method.

Particulars in crores

() Compensation of employees 1,200

(-) 20

(i) Net factor income from abroad

120

(iii) Net indirect tax

800

(iv) Profits

2,000

(V Private finalconsumption expenditure

770

(vi) Net domestic capital formation

130

(vi) Consumption of fixed capital

400

(vi) Rent

620

(ix) Interest

700

(x) Mixed income of self employed

()30

(xi) Net exports

1,100

(xi) Government final consumption expenditure

National Incomes= 3,700 crores

method and (b) expenditure method:

32. From the following data, calculate "national income" by (a) income (CBSE, A! India2009}

Zin crores

Particulars

150

(0) Interest

250

(ii) Rent

600

(ii) Government finalconsumption expenditure 1200

(iv) Private finalconsumption expenditure 640

(v) Profits 1000

(vi) Compensation of employees 30

(vii) Net factor income to abroad 60

(viii) Net indirect taxes (-)40

(ix) Net exports 50

(x) Consumption of fixed capital 340

(xi) Net domestic capital formation 2,010crores

(a)2,010crores; (b)

4.118 Introductory Macroeconomics

33. Calculate National Income by Income and Expenditure method.

Particulars in crores

() Compensation of employees 600

(i) Government final consumption expenditure 550

(üi) Net factor income from abroad (-)10

(iv) Net exports ()15

(v) Profit

400

(vi) Net indirect tax 60

(vii) Mixed income of self employed 350

(vii) Rent 200

(ix) Interest 310

(x) Private final consunmption expenditure 1,000

(xi) Net domestic capital formation 385

(xii) Consumption of fixed capital 65

National Income =71,850 crores

34. Calculate National Income by income method and expenditure method.

Particulars Tin crores

(i) Government final consumption expenditure 100

(ii) Interest, rent and profits 920

(ii) Gross Capital formation 620

(iv) Net exports ()10

(v) Change in stock 100

(vi) Net Factor income from abroad (-) 10

(vii) Subsidies 20

(vii) Private Final Consumption expenditure 800

(ix) Indirect tax 120

() Consumption of fixed Capital 60

(xi) Mixed income of the self employed 60

(xii) Compensationof employees 370

National Income=,340 crores

35. Calculate National Income by Income and Expenditure method.

Particulars in crores

7.351

(i) Government final consumption expenditure

8,834

(ii) Indirect tax

13,248

(ii) Gross fixed capital formation 28,267

employed

(iv) Mixed income of the self 1,120

(v) Subsidies 3,170

(vi) Change in stock

Chapter4 Measurement of National Income 4.119

(vii) Rent, interest and profits 9,637

(vii) Consumption of fixed capital 4,046

(ix) Private Final Consumption expenditure 51,177

(x) Imports of gods and services 5,674

(xi) Exports of goods and services 4,812

(xii) Net factor income from abroad (-) 255

Compensation of employees 24,420

(xi)

National Income =62,069 crores

36. Calculate National Income by Income and Expenditure method.

Particulars ?in crores

1,500

() Rent

50

(i) Net factor income from abroad

25,000

(ii) Wages and salaries

1,000

(iv) Indirect tax

11,200

(v) Government final consumption expenditure

300

(vi) Subsidies

200

(vii) Royalty

( 200

(vii) Net exports

6,400

(ix) Interest

200

(x) Corporate tax

4,000

(xi) Profit after tax

26,000

(xi) Households final consumption expenditure

100

(xii) Change in stock

600

(xiv) Net domestic fixed capital formation

institutions serving households 300

(xv) Final consumption expenditure of private non-profit

National Income = 37,350 crores

Hiture method

Chapter4 S Measurement of National Income

4.121

Calculate GNP at MP by Income and Expenditure method.

40. Ca

Particulars

7incrores

() Net exports 15

Private final consumption expenditure 600

i) Consumption of fixed capital 30

(iv) Operating surplus 190

(v) Net indirect taxes 105

(vi) Net factor income from abroad ()5

(vi) Wages and Salaries 520

(vi) Rent 60

(ix) Employers'contribution to social security schemes 100

(x) Government final consumption expenditure 200

(xi) Net capital formation 100

GNPat MP= 940 crores

41. Calculate GNP at MP by lncome and Expenditure method.

Particulars 1in crores

200

() Net capital formation

1,000

(i) Private final consumption expend

360

(Gi) Operating surplus

900

(iv) Wages and Salaries

50

(v) Employers' contribution to social security schemes

100

(vi) Rent

300

(vii) Government final consumption expenditure

50

(vii) Consumption of fixed capital 200

(ix) Net indirect taxes

(-) 10

(x) Net factor income from abroad

10

(xi) Net exports

GNP at MP= 1,550crores

athod and

Chapter 4 Measurement of National Income 4.109

3. Calculate net value added at factor cost from following data:

Particulars Zin crores

) Purchase of machinery to be used in the production unit 100

() Sales 200

(ii) Intermediate costs 90

(iv) Indirect taxes 12

10

(v) Change in stock

6

(vi) Goods and Services Tax

(vii) Stock of raw material

Net value added at factor cost = 108 Crores

4. Calculate NDPFc

Particulars Zin crores

1

(0) Subsidies

100

(ii) Sales

10

(ii) Closing stock

5

(iv) Indirect taxes

30

(v) Intermediate consumption

20

(vi) Opening stock

15

(vii) Consumption of fixed capital

NDP= 41crores

5. Calculate 'value of output' from the following data:

Particulars Zin lakhs

(0 Subsidy 10

(0) Internmediate consumption 150

(ii) Net addition to stocks (-)13

(iv) Depreciation 30

(v) Goods and Services Tax 20

(vi) Net value added at factor cost 250

Value of output = 440 lakhs

6. Calculatevalue of output and gross value added at market price

Particulars in crores

(0) Opening stock L,000

() Closing stock 800

(iii) Purchase of raw 200

materials

(iv) Sales 10,000

(v) Indirect taxes 250

(vi) Subsidies 50

9,800 crores Goss aue addedat MP 60COres

Value or output =

You might also like

- Cockney MonologuesDocument2 pagesCockney MonologuesLaReceHawkins86% (7)

- Solar Water Heater Distributor Business PlanDocument32 pagesSolar Water Heater Distributor Business Planlutos267% (3)

- National Income QuestionDocument2 pagesNational Income QuestionShivani Karkera100% (1)

- National Income Class 12 WsDocument19 pagesNational Income Class 12 WsIsha BhattNo ratings yet

- Miscellaneous Numericals NI From ID MANGLA BookDocument16 pagesMiscellaneous Numericals NI From ID MANGLA Bookashwanikumar172006No ratings yet

- Question With Answer - National IncomeDocument3 pagesQuestion With Answer - National IncomeShardul100% (10)

- N Income Income and Exp Method NewDocument6 pagesN Income Income and Exp Method NewJ.Abishek SundarNo ratings yet

- 01 Ch1 Determination of National Income - Practice SheetDocument18 pages01 Ch1 Determination of National Income - Practice SheetVipul SharmaNo ratings yet

- Reference: Answers)Document11 pagesReference: Answers)Jaivardhan KanoriaNo ratings yet

- NI Problems For Practice: Employer's Contribution To Social 100 Security SchemeDocument4 pagesNI Problems For Practice: Employer's Contribution To Social 100 Security Schemesridharvchinni_21769No ratings yet

- Questions: Income AND Page 359,0Document17 pagesQuestions: Income AND Page 359,0anirudh sharmaNo ratings yet

- Worksheet 8 (Problems Based On Income and Expenditure Method)Document3 pagesWorksheet 8 (Problems Based On Income and Expenditure Method)PradeepNo ratings yet

- National IncomeDocument2 pagesNational IncomePUTERI SIDROTUL NABIHAH SAARANINo ratings yet

- The New Indian School, W.L.L Kingdom of Bahrain Class: Xii Economics Assignment National IncomeDocument3 pagesThe New Indian School, W.L.L Kingdom of Bahrain Class: Xii Economics Assignment National IncomeHannah Ann JacobNo ratings yet

- National Income Important QuestionsDocument4 pagesNational Income Important Questionsjb7114262No ratings yet

- Macro Unsolved Numericals English PDFDocument18 pagesMacro Unsolved Numericals English PDFNindoNo ratings yet

- Book 1 May 2024Document8 pagesBook 1 May 2024ayushsahni2915No ratings yet

- Test 2Document2 pagesTest 2Bhjan GargNo ratings yet

- National IncomeDocument4 pagesNational IncomeSPORTY JHANo ratings yet

- Economics Practice Sheets N22Document101 pagesEconomics Practice Sheets N22joyboyishehereNo ratings yet

- MycbseguideDocument10 pagesMycbseguideBinoy TrevadiaNo ratings yet

- National Income ProblemsDocument4 pagesNational Income ProblemsPriyankadevi PrabuNo ratings yet

- N.I NumericalsDocument7 pagesN.I NumericalsKushagra BhartiyaNo ratings yet

- Class_XII_Economics_1Document6 pagesClass_XII_Economics_1GSN KISHORENo ratings yet

- NI Sums PDFDocument3 pagesNI Sums PDFSHIVANG SADANINo ratings yet

- N I Value Added MethodDocument4 pagesN I Value Added MethodJ.Abishek SundarNo ratings yet

- Home Assignment Summer VactionsDocument3 pagesHome Assignment Summer VactionsLaraNo ratings yet

- ABANTI - GOSWAMIQuestion and Solutions (National Income) 2020-06-02question BankDocument4 pagesABANTI - GOSWAMIQuestion and Solutions (National Income) 2020-06-02question BankAPARNA NIMMAGADDANo ratings yet

- Test of Economics National Income (17!05!24)Document3 pagesTest of Economics National Income (17!05!24)MAHEE SHREE MITTALNo ratings yet

- Macro Numerical OS, COEDocument7 pagesMacro Numerical OS, COERiya JainNo ratings yet

- PBL - Macroeconomic (2) (1) NDocument9 pagesPBL - Macroeconomic (2) (1) NLiyana IsmailNo ratings yet

- Economics WorksheetDocument2 pagesEconomics Worksheetdennis greenNo ratings yet

- EcoDocument9 pagesEcoP Janaki RamanNo ratings yet

- National Income-1Document22 pagesNational Income-122babba050No ratings yet

- National Income Practice QuestionsDocument29 pagesNational Income Practice QuestionsSujalNo ratings yet

- National Income Numerical QDocument2 pagesNational Income Numerical QGongju Esya100% (1)

- Ational Income: Archanatrivedi/Nationalincome/Ws/2021-22Page 1Document4 pagesAtional Income: Archanatrivedi/Nationalincome/Ws/2021-22Page 1BlairNo ratings yet

- Eco XII Ass.Document5 pagesEco XII Ass.Kushagra VermaNo ratings yet

- National Income Math Part - 2Document8 pagesNational Income Math Part - 2Ibrahim MondolNo ratings yet

- CBSE Important Questions Class-12 Economics Chapter-5 National Income and Related AggregatesDocument6 pagesCBSE Important Questions Class-12 Economics Chapter-5 National Income and Related AggregatesVaibhavNo ratings yet

- National Income Sums - Value AddedDocument14 pagesNational Income Sums - Value AddedShreyas ParekhNo ratings yet

- Week 3-TutorialsDocument1 pageWeek 3-TutorialsSasi VisvaNo ratings yet

- Introduction To Macroeconomics Cat 1 and 2Document3 pagesIntroduction To Macroeconomics Cat 1 and 2jimNo ratings yet

- Eco211-Revision ExercisesDocument4 pagesEco211-Revision ExercisesfarahNo ratings yet

- National Income NumericalsDocument19 pagesNational Income Numericalsyuvrajput1111No ratings yet

- National Income Related AggregatesDocument4 pagesNational Income Related Aggregatessubs444subs10082002No ratings yet

- National Income Accounting AssignmentDocument8 pagesNational Income Accounting AssignmentNamit BhatiaNo ratings yet

- Numerical Problems For Module II and IIIDocument6 pagesNumerical Problems For Module II and IIIRiya LalNo ratings yet

- Macro Economics Five Years QP NewDocument23 pagesMacro Economics Five Years QP Newprarabdh shivhareNo ratings yet

- Exercises Chapter 2 Eco211 - Compress PDFDocument8 pagesExercises Chapter 2 Eco211 - Compress PDFNUR MAISARAH AQILAH MOHD ZAIDINo ratings yet

- 5th Sem (Macro-Economics) Exam Based Practical QuestionDocument5 pages5th Sem (Macro-Economics) Exam Based Practical Questionsadfeel145No ratings yet

- Macro Assignment Numericals-1Document14 pagesMacro Assignment Numericals-1mohantyseema84No ratings yet

- f7 (Int) FR SQB As j08Document90 pagesf7 (Int) FR SQB As j08Jamilya SNo ratings yet

- Questions NIDocument4 pagesQuestions NItyagi_rajat8918No ratings yet

- Revision Worksheet 4Document3 pagesRevision Worksheet 4Diya RathoreNo ratings yet

- REVISIONDocument3 pagesREVISIONnienaNo ratings yet

- 02 ICAN B1 FR Mock As (2019)Document19 pages02 ICAN B1 FR Mock As (2019)lashee938No ratings yet

- Wa0000.Document2 pagesWa0000.Adarsh SinghNo ratings yet

- M3 OPEX Decision Making Data Answer 2.10.21Document6 pagesM3 OPEX Decision Making Data Answer 2.10.21hanis nabilaNo ratings yet

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- Economics Half Yearly Question PaperDocument6 pagesEconomics Half Yearly Question PaperBhumika MiglaniNo ratings yet

- Part 5 of BST chapter 1 class 11Document2 pagesPart 5 of BST chapter 1 class 11nikhil070407mehtaNo ratings yet

- Class 11 BST chapter 1 part 2Document2 pagesClass 11 BST chapter 1 part 2nikhil070407mehtaNo ratings yet

- BST chapter 1 part 3Document2 pagesBST chapter 1 part 3nikhil070407mehtaNo ratings yet

- BST chapter 1 notes part 1Document2 pagesBST chapter 1 notes part 1nikhil070407mehtaNo ratings yet

- Big dataDocument3 pagesBig datanikhil070407mehtaNo ratings yet

- BE1 Final Without Recheckreassessment - 453112Document1 pageBE1 Final Without Recheckreassessment - 453112MoloNo ratings yet

- Herbert Morrison BooklistDocument2 pagesHerbert Morrison BooklistGillian HallNo ratings yet

- Staircase Lift Design For Elderly at HomeDocument19 pagesStaircase Lift Design For Elderly at Homesabareesh91mechNo ratings yet

- La Bugal V RamosDocument141 pagesLa Bugal V Ramosabo8008No ratings yet

- CONSORT-EHEALTH (V 1.6.1) - Submission/Publication Form: RequiredDocument49 pagesCONSORT-EHEALTH (V 1.6.1) - Submission/Publication Form: RequiredStefan HlNo ratings yet

- Bangalore Startups CompaniesDocument14 pagesBangalore Startups CompaniesAparna GanesenNo ratings yet

- Sankaran, Mahesh - Scogings, Peter F - Savanna Woody Plants and Large Herbivores (2020, John Wiley & Sons LTD)Document781 pagesSankaran, Mahesh - Scogings, Peter F - Savanna Woody Plants and Large Herbivores (2020, John Wiley & Sons LTD)Ariadne Cristina De AntonioNo ratings yet

- 1999 Aversion Therapy-BEDocument6 pages1999 Aversion Therapy-BEprabhaNo ratings yet

- LSM MockDocument5 pagesLSM MockKazi Rafsan NoorNo ratings yet

- Permanent Hair Dye ColorantsDocument37 pagesPermanent Hair Dye ColorantsAntonio Perez MolinaNo ratings yet

- Job Description - CRM Marketing SpecialistDocument1 pageJob Description - CRM Marketing SpecialistMichael-SNo ratings yet

- Iqra University - Karachi Faculty of Business AdministrationDocument31 pagesIqra University - Karachi Faculty of Business Administrationsyed aliNo ratings yet

- Manual Therapy in The Treatment of Facial WrinklesDocument4 pagesManual Therapy in The Treatment of Facial WrinklesKarolina MirosNo ratings yet

- The Russian Military Today and Tomorrow: Essays in Memory of Mary FitzgeraldDocument474 pagesThe Russian Military Today and Tomorrow: Essays in Memory of Mary FitzgeraldSSI-Strategic Studies Institute-US Army War College100% (1)

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthKal El DadiNo ratings yet

- 2 The Origin of LifeDocument39 pages2 The Origin of LifeRydel GreyNo ratings yet

- Rev JSRR 45765Document2 pagesRev JSRR 45765Amit BNo ratings yet

- 7 Eleven MalaysiaDocument10 pages7 Eleven MalaysiaKimchhorng HokNo ratings yet

- Colonialism and Imperialism by Usman KhanDocument2 pagesColonialism and Imperialism by Usman KhanUSMANNo ratings yet

- Getting The Call From Stockholm: My Karolinska Institutet ExperienceDocument31 pagesGetting The Call From Stockholm: My Karolinska Institutet ExperienceucsfmededNo ratings yet

- Architecture in EthDocument4 pagesArchitecture in Ethmelakumikias2No ratings yet

- Synopsis Car Showroom ManagementDocument18 pagesSynopsis Car Showroom ManagementRaj Bangalore50% (4)

- WikiHow Is An Online WikiDocument4 pagesWikiHow Is An Online Wikiksdnfi ouvynNo ratings yet

- Dolomite in Manila Bay A Big HitDocument3 pagesDolomite in Manila Bay A Big HitJoanaPauline FloresNo ratings yet

- Vu+Premium+2K+TV Specification 32UADocument2 pagesVu+Premium+2K+TV Specification 32UAMr jhonNo ratings yet

- B1.1-Self-Study Đã Sài XongDocument5 pagesB1.1-Self-Study Đã Sài XongVy CẩmNo ratings yet

- Wastestation Compact: Transport SavingDocument2 pagesWastestation Compact: Transport Savingaamogh.salesNo ratings yet

- Module 2 The Self From Philosophical and Anthropological PerspectivesDocument10 pagesModule 2 The Self From Philosophical and Anthropological PerspectivesAjhay BonghanoyNo ratings yet