Professional Documents

Culture Documents

2

2

Uploaded by

dawndehay0 ratings0% found this document useful (0 votes)

1 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views1 page2

2

Uploaded by

dawndehayCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

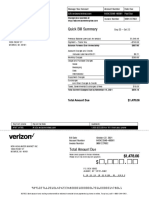

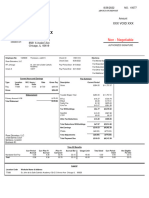

2021 Property Tax Statement Alternate ID# Due Date

Current Prior Back *Total

Due Payment Taxes Due*

2021-1297524 11/17/2021 $0.00 $37873.14 $0.00 Paid

FALCON ONE LLC ATTN: FURMAN WOOD

LORA ABNEY

900

1518 CIRCLE 75 PKWY

VERSAILLES STE 720

RD #109 Map: 13044C C002

ATLANTA,

LEXINGTON,GAKY

30339

40505 Location: 242 FALCON DR 30297

RETURN THIS PORTION WITH PAYMENT

(Interest will be added per month if not paid by due date)

FALCON ONE LLC ATTN: FURMAN

Tax Payer: LORA ABNEY

WOOD

Map Code: 13044C C002 Real

Location: 242 FALCON DR 30297

Alternate ID#: 2021-1297524

District: 3 - FOREST PARK

Payment Good

Building Value Land Value Acres Fair Market Value Due Date Billing Date Exemptions

through

2,517,000.00 208,000.00 1.6650 $2,725,000.00 11/17/2021 04/13/2022

Adjusted Net Taxable Millage

Entity Exemptions Gross Tax Credit Net Tax

FMV Assessment Value Rate

COUNTY OPER $2,725,000 $1,090,000 $0 $1,090,000 18.535000 $20,203.15 $0.00 $20,203.15

SALES TAX ROLLBACK CREDIT $2,725,000 $1,090,000 $0 $1,090,000 -3.789000 $0.00 $4,130.01 $0.00

SCHOOL OPER $2,725,000 $1,090,000 $0 $1,090,000 20.000000 $21,800.00 $0.00 $21,800.00

TOTALS 34.746000 $42,003.15 -$4,130.01 $37,873.14

Current Due $37,873.14

Penalty $0.00

Interest $0.00

Other Fees $0.00

Previous Payments $37,873.14

Back Taxes $0.00

Total Due $0.00

You might also like

- BSCM 1 PDFDocument54 pagesBSCM 1 PDFmenages100% (5)

- City of Union City: Detailed Tax SummaryDocument2 pagesCity of Union City: Detailed Tax SummaryAlicia RuckerNo ratings yet

- Tax Bill 2022Document1 pageTax Bill 2022LOUNGE HOMENo ratings yet

- Sarasota County Tax Collector FLDocument2 pagesSarasota County Tax Collector FLAjay gadiparthiNo ratings yet

- Deed To HouseDocument2 pagesDeed To HouseAlexander Barno AlexNo ratings yet

- Property Tax BillDocument2 pagesProperty Tax Billdipan.routNo ratings yet

- Tax Bill 2022 120206 PDFDocument1 pageTax Bill 2022 120206 PDFLOUNGE HOMENo ratings yet

- PP May 2022Document1 pagePP May 2022Jhob MertensNo ratings yet

- DavidsonCounty NashvilleDocument2 pagesDavidsonCounty Nashvilledipan.routNo ratings yet

- BillSummary - 2021 10 22Document43 pagesBillSummary - 2021 10 22iyas14No ratings yet

- BHarris - 11032023 PayrollDocument1 pageBHarris - 11032023 Payrollbeautynfashion247No ratings yet

- Amount Due $8,168.44Document3 pagesAmount Due $8,168.44roblondon77No ratings yet

- 98-05 67th Ave 5th Floor, #34C, Rego Park DeedDocument4 pages98-05 67th Ave 5th Floor, #34C, Rego Park DeedEstrada Pence HoseaNo ratings yet

- Town of Newbury Actual Real Estate Tax Bill: Fiscal Year 2022 3Rd QuarterDocument1 pageTown of Newbury Actual Real Estate Tax Bill: Fiscal Year 2022 3Rd Quarterharsha.kNo ratings yet

- Payment Statement Capital Fund 1 Nov 5 2022Document2 pagesPayment Statement Capital Fund 1 Nov 5 2022Donn SchulmanNo ratings yet

- Tax BillDocument1 pageTax BillGOWTHAM NandaNo ratings yet

- Oct. 28-Declaración de PagoDocument1 pageOct. 28-Declaración de Pagochristianseda26No ratings yet

- Proyecto y Departamento de Carlos Loret, Están Registrados en 2 PARAISOS FISCALES Parte 1Document1 pageProyecto y Departamento de Carlos Loret, Están Registrados en 2 PARAISOS FISCALES Parte 1enlapolitikaNo ratings yet

- Report 1Document2 pagesReport 1Raashid Qyidar Aqiel ElNo ratings yet

- Fayette TaxDocument1 pageFayette TaxAjay gadiparthiNo ratings yet

- Miami Dade Real Estate 30 3115 017 0451 2023 Annual BillDocument1 pageMiami Dade Real Estate 30 3115 017 0451 2023 Annual BillPatricio SotomayorNo ratings yet

- Bill.20063636.201912.15908600 SDocument2 pagesBill.20063636.201912.15908600 SMarjorie StewartNo ratings yet

- BHarris - 11172023 PayrollDocument1 pageBHarris - 11172023 Payrollbeautynfashion247No ratings yet

- Sales Tax 4th QTR 2021Document1 pageSales Tax 4th QTR 2021KingNo ratings yet

- Earnings Statement: Zalena K Mcclenic 11 Sixth ST Westbury, Ny 11590Document1 pageEarnings Statement: Zalena K Mcclenic 11 Sixth ST Westbury, Ny 11590mellishagrant11No ratings yet

- Statement Chase PDFDocument4 pagesStatement Chase PDFN N100% (1)

- Online Payments Are For 2018 Only: Tax Paid Receipt Tax Bill Details - Choose A Tax Year - Get Tax Payoff InfoDocument2 pagesOnline Payments Are For 2018 Only: Tax Paid Receipt Tax Bill Details - Choose A Tax Year - Get Tax Payoff InfoAnonymous puqCYDnQNo ratings yet

- Paycheck - 2022 08 28 - 2022 09 03Document1 pagePaycheck - 2022 08 28 - 2022 09 03Sandra RíosNo ratings yet

- 24042400104981IBKL ChallanReceiptDocument1 page24042400104981IBKL ChallanReceiptaccounthoNo ratings yet

- OWNERSHIP STATEMENT #25 - Kareema Taki & Dheyaa Ali: MR Kareema Taki 13 Manna Way Mill Park, Vic, 3082Document2 pagesOWNERSHIP STATEMENT #25 - Kareema Taki & Dheyaa Ali: MR Kareema Taki 13 Manna Way Mill Park, Vic, 3082Dheyaa AliNo ratings yet

- Poo Aaron HadlerDocument1 pagePoo Aaron HadlerdaveNo ratings yet

- 23080300051201HDFC ChallanReceiptDocument2 pages23080300051201HDFC ChallanReceiptmahesh rahejaNo ratings yet

- Robert StatementDocument1 pageRobert Statementsafe wayNo ratings yet

- 23120500288895UTIB ChallanReceiptDocument1 page23120500288895UTIB ChallanReceiptbinitashah11573No ratings yet

- Tax Invoice: Account Summary FOR METER # 2358773 Due DateDocument1 pageTax Invoice: Account Summary FOR METER # 2358773 Due DateCj CjNo ratings yet

- 692104594-Nathan Ross Lees-December-UtilityDocument1 page692104594-Nathan Ross Lees-December-UtilityAlex NeziNo ratings yet

- 24022900002170SBIN ChallanReceiptDocument1 page24022900002170SBIN ChallanReceipteppothumpadiNo ratings yet

- Water-Bill-ExampleDocument2 pagesWater-Bill-ExampleeramayonanNo ratings yet

- 23120500253875UTIB ChallanReceiptDocument1 page23120500253875UTIB ChallanReceiptbinitashah11573No ratings yet

- Income Tax Department: Challan ReceiptDocument2 pagesIncome Tax Department: Challan Receiptutailor69No ratings yet

- Texas - Maryland.pennsylvania - New York - Ohio.illinois - Massachusetts.georgia - Connecticut.new Jersey BILLDocument6 pagesTexas - Maryland.pennsylvania - New York - Ohio.illinois - Massachusetts.georgia - Connecticut.new Jersey BILLmassinissamassinissamassinissaNo ratings yet

- 23071000063268RBIS ChallanReceiptDocument2 pages23071000063268RBIS ChallanReceiptAnuj BeniwalNo ratings yet

- 24030701385192SBIN ChallanReceiptDocument1 page24030701385192SBIN ChallanReceiptFiroz AliNo ratings yet

- Statements 7344Document4 pagesStatements 7344Валентина ШвечиковаNo ratings yet

- 24050600482999SBIN ChallanReceiptDocument1 page24050600482999SBIN ChallanReceipttaxhouse37No ratings yet

- How To Get Your Deals DoneDocument1 pageHow To Get Your Deals DonejayNo ratings yet

- Summary of Account Activity Payment InformationDocument2 pagesSummary of Account Activity Payment InformationZack JNo ratings yet

- 23092400074562SBIN ChallanReceiptDocument1 page23092400074562SBIN ChallanReceiptSundararajan GopalakrishnanNo ratings yet

- Rac-Statement.0678-610922.12-11-2020 2Document2 pagesRac-Statement.0678-610922.12-11-2020 2holt.krista21No ratings yet

- BillSummary - 2021 09 22Document48 pagesBillSummary - 2021 09 22iyas14No ratings yet

- 1st CheckDocument1 page1st CheckMoeez MaalikNo ratings yet

- Novo DocumentoDocument1 pageNovo DocumentoPepe DecaroNo ratings yet

- Second PaystubDocument1 pageSecond Paystubjohnathan greyNo ratings yet

- 515 Central Ave Tax BillDocument1 page515 Central Ave Tax Billkory carlsonNo ratings yet

- 23080300055186HDFC ChallanReceiptDocument2 pages23080300055186HDFC ChallanReceiptmahesh rahejaNo ratings yet

- 24030400014921RBIS ChallanReceiptDocument1 page24030400014921RBIS ChallanReceiptaccounthoNo ratings yet

- Billing Detail: Late PaymentDocument1 pageBilling Detail: Late Paymenttheodore moses antoine beyNo ratings yet

- 23102700178839MAHB_ChallanReceipt.pdfDocument2 pages23102700178839MAHB_ChallanReceipt.pdfYogesh TurkarNo ratings yet

- Pay Slip - 1007868 - Aug-22Document1 pagePay Slip - 1007868 - Aug-22Renu AmbaniNo ratings yet

- Capital Budgeting Techniques:: Relative Income Generating Capacity and Rank Them in Order of Their DesirabilityDocument16 pagesCapital Budgeting Techniques:: Relative Income Generating Capacity and Rank Them in Order of Their DesirabilityNmg KumarNo ratings yet

- Latest Pilot Jobs - List MathtestDocument1 pageLatest Pilot Jobs - List MathtestantonioNo ratings yet

- 05 Activity 1 BAdoneDocument1 page05 Activity 1 BAdoneTyron Franz AnoricoNo ratings yet

- Municipal Corporation of DelhiDocument2 pagesMunicipal Corporation of DelhisunilchhindraNo ratings yet

- EXEMPTIONDocument15 pagesEXEMPTIONAndrey PavlovskiyNo ratings yet

- Quanto Skew: Peter J Ackel First Version: 25th July 2009 This Version: 4th June 2016Document9 pagesQuanto Skew: Peter J Ackel First Version: 25th July 2009 This Version: 4th June 2016Hans WeissmanNo ratings yet

- Islamic Banking in Bangladesh Progress and PotentialsDocument23 pagesIslamic Banking in Bangladesh Progress and Potentialssumaiya sumaNo ratings yet

- Khaitan ANAROCK - IBC Report - Dec 2022Document29 pagesKhaitan ANAROCK - IBC Report - Dec 2022re.research.rockNo ratings yet

- Shanghai: GDP Apostasy Macro Economics Wac Submission By: LT 3 Word Count: 1281 Plagiarism Check: 0%Document6 pagesShanghai: GDP Apostasy Macro Economics Wac Submission By: LT 3 Word Count: 1281 Plagiarism Check: 0%Subhajit BoseNo ratings yet

- Insights Reg PlantationsDocument69 pagesInsights Reg PlantationsNasya YenitaNo ratings yet

- فرع شركة كات انترناشيونال 3-2-2024Document3 pagesفرع شركة كات انترناشيونال 3-2-2024fares hammoudNo ratings yet

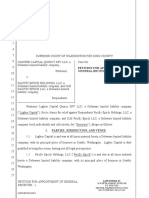

- Lighter Capital's Petition For A Court-Appointed ReceiverDocument66 pagesLighter Capital's Petition For A Court-Appointed ReceiverGeekWireNo ratings yet

- QuizDocument2 pagesQuizrysii gamesNo ratings yet

- Configurations of Desire in THDocument188 pagesConfigurations of Desire in THlpNo ratings yet

- Chapter 22 Economic Growth: Parkin/Bade, Economics: Canada in The Global Environment, 8eDocument31 pagesChapter 22 Economic Growth: Parkin/Bade, Economics: Canada in The Global Environment, 8ePranta SahaNo ratings yet

- Foreign Currency Accounts TransactionsDocument1,024 pagesForeign Currency Accounts TransactionsSalman Fateh AliNo ratings yet

- MT4 EA StrategyDocument3 pagesMT4 EA StrategykorraniNo ratings yet

- Lesson 3 - History of International Trade and AgreementsDocument19 pagesLesson 3 - History of International Trade and AgreementsIris Cristine GonzalesNo ratings yet

- Spiceland GE2 SM Ch7.1Document98 pagesSpiceland GE2 SM Ch7.1夜晨曦No ratings yet

- Tutorial Questions 1 - CHP 1 4Document2 pagesTutorial Questions 1 - CHP 1 4Samantha NarayanNo ratings yet

- Past Exam QuestionDocument2 pagesPast Exam QuestionVioletaNo ratings yet

- Apr AminiaDocument8 pagesApr AminiaClyde ThomasNo ratings yet

- Business CombiDocument14 pagesBusiness CombiJohn Cesar PaunatNo ratings yet

- Critical Analysis of Rostow's Growth Theory With Reference To PakistanDocument11 pagesCritical Analysis of Rostow's Growth Theory With Reference To PakistanRabia Saeed100% (17)

- Angel One Limited: Daily Margin Statement For The Day: 20/10/2022Document1 pageAngel One Limited: Daily Margin Statement For The Day: 20/10/2022Ankit SharmaNo ratings yet

- Business StudyDocument4 pagesBusiness Studymurganv2006No ratings yet

- 4.1 Case Study Based AssignmentDocument4 pages4.1 Case Study Based AssignmentfaysalNo ratings yet

- Brochure Foundation of Stock Market InvestingDocument10 pagesBrochure Foundation of Stock Market InvestingRahul SharmaNo ratings yet

- Time Value of MoneyDocument17 pagesTime Value of Moneyabdiel100% (3)