Professional Documents

Culture Documents

Bank Fund Management

Bank Fund Management

Uploaded by

omijr74580 ratings0% found this document useful (0 votes)

1 views12 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views12 pagesBank Fund Management

Bank Fund Management

Uploaded by

omijr7458Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 12

Bangladesh Army International University

of Science and Technology

(BAIUST)

Bank Fund Management

Course Code: FIN 4811

Fatema Tuz Zuhora Tarin

Lecturer, Finance, Bangladesh Army International

University of Science & Technology.

Nur E Fahim

Mahfuza Nur

Esty

4110022

4109013

Tahomid Uddin Hanin sultana

4110046 4110047

Sumit Mondal Jafrina Afroj

4110053 4110078

Money market basically refers to a section of the

financial market where financial instruments with

high liquidity and short-term maturities are traded.

Money market has become a component of the

financial market for buying and selling of securities

of short-term maturities, of one year or less, such

as treasury bills and commercial papers.

Capital markets refer to the venues where

funds are exchanged between suppliers and

those who seek capital for their own use.

Suppliers in capital markets are typically

banks and investors while those who seek

capital are businesses, governments, and

individuals.

Money Capital

Market Market

They pay interest, but some Bring buyers and sellers

issuers offer account holders together to trade stocks,

limited rights to occasionally bonds, currencies, and

withdraw money or write other financial assets.

checks against the account.

Bankers’ Acceptance, Government Bonds, Treasury bills, Repurchase

Agreements, Commercial paper, Certificate of Deposit, Banker’s Acceptance.

Merits/Advantages Demerits/ Disadvantages

High liquidity also means

They are practically like a volatile opportunities. If

bank account with higher the instruments that

interest rates. We can these funds invest in are

earn considerably higher withdrawn or cancelled

amounts of interest on a in their term, the money

money market fund than market fund could lose

on a regular savings the invested money very

account due to the low- quickly and customers

risk nature of these can even lose their

funds. invested capital.

Merits/Advantages Demerits/ Disadvantages

• No legal obligation to • Expensive source

pay fixed dividend of finance

• Provide long term • Dividend is not tax

capital deductible

• Do not carry voting • Market price of

rights so no dilution shares keep

of control fluctuating

• Superior security over • Rate of dividend is

equity shares generally low

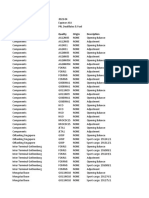

Current Scenario of Investment Portfolio of Banking Industry.

Banks in Bangladesh typically invest in both money

market and capital market portfolios.

Money market investments

include short-term, highly

Money

liquid assets like treasury

Market So they usually allocate

bills, certificates of deposit,

and commercial papers. investments across both

money market and capital

market instruments based

on their risk appetite and

Capital market investments

investment strategies.

involve longer-term

Capital securities such as stocks,

Market bonds, and mutual funds.

Banks diversify their

portfolios to manage risk

and optimize returns.

Where Bangladesh Bank is investing more capital market or money market?

Money Market Capital market

The primary issues and

The money market secondary trading of

comprises banks and equity securities of capital

financial institutions as market take place through

intermediaries, 20 of them two (02) stock exchanges-

are primary dealers in Dhaka Stock Exchange

treasury securities. and Chittagong Stock

Interbank clean and repo Exchange. The

based lending, BB's repo, instruments in these

reverse repo auctions, BB exchanges are equity

bills auctions, treasury bills securities (shares),

auctions are primary debentures and corporate

operations in the money bonds. The capital market

market, there is also active is regulated by

secondary trade in treasury Bangladesh Securities and

bills (upto 1 year maturity). Exchange Commission

(BSEC).

You might also like

- Test Answers For Accounts Payable 2015 - ElanceDocument14 pagesTest Answers For Accounts Payable 2015 - ElancesnezalatasNo ratings yet

- Financial Markets and InstitutionsDocument4 pagesFinancial Markets and InstitutionsRA T UL100% (1)

- Different Types of CostDocument15 pagesDifferent Types of CostMd Abdul MoinNo ratings yet

- Capital Market and Money MarketDocument17 pagesCapital Market and Money MarketSwastika Singh100% (1)

- PRINCIPLES OF Economics Submitted By:: University of Engineering and Technology, LahoreDocument6 pagesPRINCIPLES OF Economics Submitted By:: University of Engineering and Technology, LahoreHafiz Muhammad TahirNo ratings yet

- Chapter 7Document10 pagesChapter 7hudaNo ratings yet

- Attachment Financial Systemt PDFDocument13 pagesAttachment Financial Systemt PDFAnand Shanker RaiNo ratings yet

- Financial Market Institution and Financial ServicesDocument8 pagesFinancial Market Institution and Financial Servicessuraj agarwalNo ratings yet

- Busu CursDocument173 pagesBusu CursAndreea Cristina DiaconuNo ratings yet

- 3-Diff Bet Money MKT & Capital MKTDocument4 pages3-Diff Bet Money MKT & Capital MKTDarshit AhirNo ratings yet

- Amanpreet Singh - Financial Market AssignmentDocument8 pagesAmanpreet Singh - Financial Market AssignmentSiddharth JainNo ratings yet

- Group Presentation Finance FinalDocument25 pagesGroup Presentation Finance FinalSajib Chandra RoyNo ratings yet

- Ipm - M2Document3 pagesIpm - M2miyanoharuka25No ratings yet

- 8526 1uniDocument18 pages8526 1uniMs AimaNo ratings yet

- Chapter 10 - Financial Markets PDFDocument4 pagesChapter 10 - Financial Markets PDFKelrina D'silvaNo ratings yet

- Overview of Indian Financial MarketDocument22 pagesOverview of Indian Financial MarketPrinky SweetiepieNo ratings yet

- TOPIC 3 Types of Market - Money MarketDocument26 pagesTOPIC 3 Types of Market - Money Marketbojing.valenzuelaNo ratings yet

- Money Market:-: Financial InstitutionsDocument3 pagesMoney Market:-: Financial InstitutionspraveenNo ratings yet

- Muhammad Abdullah (6772) Capital & Money MarketDocument5 pagesMuhammad Abdullah (6772) Capital & Money MarketMuhammad AbdullahNo ratings yet

- Indian Financial MarketDocument20 pagesIndian Financial MarketRahulJainNo ratings yet

- Underwriter Facilitates The Issuance of Securities. The: Physical Asset MarketsDocument5 pagesUnderwriter Facilitates The Issuance of Securities. The: Physical Asset MarketsMeng DanNo ratings yet

- MCM Tutorial 1Document5 pagesMCM Tutorial 1SHU WAN TEHNo ratings yet

- Financial Markets 2020Document35 pagesFinancial Markets 2020Nancy SrivastavaNo ratings yet

- IFS - Chapter 2Document17 pagesIFS - Chapter 2riashahNo ratings yet

- Financial Market AnalyticsDocument51 pagesFinancial Market Analyticsupvoteintern06No ratings yet

- Financial MarktDocument15 pagesFinancial Marktlakshitas2007No ratings yet

- Finance Vs Financial SystemDocument61 pagesFinance Vs Financial Systempriyasumit100% (1)

- Money Market and Capital MarketDocument1 pageMoney Market and Capital MarketshaneNo ratings yet

- MBA - FM6 With Added SlidesDocument46 pagesMBA - FM6 With Added SlidescharithNo ratings yet

- What Is The Money Market?Document12 pagesWhat Is The Money Market?Vishnu AgrawalNo ratings yet

- Financial Markets and Institutions - PART1Document75 pagesFinancial Markets and Institutions - PART1shweta_46664100% (3)

- Introduction To Financial Systems and Financial MarketsDocument22 pagesIntroduction To Financial Systems and Financial MarketsDiana Rose L. BautistaNo ratings yet

- Unit 2 Financial Markets and Institutions: ObjectivesDocument13 pagesUnit 2 Financial Markets and Institutions: ObjectivesSHYAM GOELNo ratings yet

- Indian Capital Market: Current Scenario & Road Ahead: Prof Mahesh Kumar Amity Business SchoolDocument44 pagesIndian Capital Market: Current Scenario & Road Ahead: Prof Mahesh Kumar Amity Business SchoolasifanisNo ratings yet

- Capital Mkt. SEM 3Document117 pagesCapital Mkt. SEM 3Údita ShNo ratings yet

- Money MarketDocument12 pagesMoney MarketNicole AndayanNo ratings yet

- Financial Markets and InstitutionsDocument78 pagesFinancial Markets and Institutionsamol_more37100% (1)

- Case StudiesDocument5 pagesCase StudiesShalu PurswaniNo ratings yet

- Blackbook Project On Money Market 163426471Document66 pagesBlackbook Project On Money Market 16342647104 Chaudhary SohanlalNo ratings yet

- An Overview of Indian Financial SystemDocument39 pagesAn Overview of Indian Financial SystemPankaj AgriNo ratings yet

- Markfin ReviewerDocument3 pagesMarkfin ReviewerMeilin Denise MEDRANANo ratings yet

- Raja Shekar ReddyDocument42 pagesRaja Shekar ReddypavithrajiNo ratings yet

- Blackbook Project On Money Market 163426Document67 pagesBlackbook Project On Money Market 163426Neha MauryaNo ratings yet

- Financial/ Securities Markets Notes: For Sebi Grade A & Rbi Grade BDocument10 pagesFinancial/ Securities Markets Notes: For Sebi Grade A & Rbi Grade BAadeesh JainNo ratings yet

- Financial MarketsDocument33 pagesFinancial Marketsarshita sharmaNo ratings yet

- Indian Capital Market: Current Scenario & Road AheadDocument45 pagesIndian Capital Market: Current Scenario & Road AheadUbaid DarNo ratings yet

- IB M2 Class Notes CombinedDocument110 pagesIB M2 Class Notes Combinedsahil dateraoNo ratings yet

- An Overview of Indian Financial SystemDocument17 pagesAn Overview of Indian Financial Systemankitspx2010No ratings yet

- Types and OF: Money Market and Capital MarketDocument39 pagesTypes and OF: Money Market and Capital MarketDikshita NavaniNo ratings yet

- FF2022 PS Eco Financial MarketDocument18 pagesFF2022 PS Eco Financial MarketSakshi UikeyNo ratings yet

- Capital MarketsDocument4 pagesCapital MarketsMd Fahim Muntasir HeavenNo ratings yet

- CM Notes FinalDocument75 pagesCM Notes FinalkamaltrilochanNo ratings yet

- Abm 4 Module 2Document3 pagesAbm 4 Module 2Argene AbellanosaNo ratings yet

- Investment NotesDocument30 pagesInvestment Notesshantanu100% (2)

- Capital Market Vs Money MarketDocument4 pagesCapital Market Vs Money Market6tpnwtfmzyNo ratings yet

- Blackbook Project On Money Market 163426471Document64 pagesBlackbook Project On Money Market 163426471Ashwathi SumitraNo ratings yet

- Global Finance - Chapter 2Document3 pagesGlobal Finance - Chapter 2Gwen AgrimorNo ratings yet

- Topic 2Document6 pagesTopic 2Regine TorrelizaNo ratings yet

- Capital MarketDocument2 pagesCapital MarketT MnNo ratings yet

- Mastering the Market: A Comprehensive Guide to Successful Stock InvestingFrom EverandMastering the Market: A Comprehensive Guide to Successful Stock InvestingNo ratings yet

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- Chapter 13 GuerreroDocument40 pagesChapter 13 GuerreroJose Sas100% (2)

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument3 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceNishi GuptaNo ratings yet

- ICC PE Forms 1-7 For PPP ProjectsDocument9 pagesICC PE Forms 1-7 For PPP ProjectsAmapola BulusanNo ratings yet

- Customer StatementDocument6 pagesCustomer StatementEMEKA SAMSONNo ratings yet

- Calculating Average Rate Hubbart FormulaDocument3 pagesCalculating Average Rate Hubbart FormulaJoseph NtambaraNo ratings yet

- V Semester Bba Management Accounting-Ratio Analysis: Questions & Answers ContinuedDocument6 pagesV Semester Bba Management Accounting-Ratio Analysis: Questions & Answers ContinuedFalak Falak fatimaNo ratings yet

- 2023-04 Valuation Report - PRL Destillates & FuelDocument6 pages2023-04 Valuation Report - PRL Destillates & FuelJianyun ZhouNo ratings yet

- Journal of Corporate Finance: Jeffry Netter, Annette Poulsen, Mike StegemollerDocument9 pagesJournal of Corporate Finance: Jeffry Netter, Annette Poulsen, Mike StegemollerSyed Mukkarram HussainNo ratings yet

- FINA 4011 Exam 2 OutlineDocument4 pagesFINA 4011 Exam 2 OutlineRavi PatelNo ratings yet

- Exercise 2.3Document2 pagesExercise 2.3lheamaecayabyab4No ratings yet

- Order-In The Matter of PAFL Industries LimitedDocument19 pagesOrder-In The Matter of PAFL Industries LimitedShyam SunderNo ratings yet

- Promissory Estoppel - Journal PDFDocument8 pagesPromissory Estoppel - Journal PDFsrvshNo ratings yet

- Delgado Marrufo Ing 1 PafDocument107 pagesDelgado Marrufo Ing 1 PafmathiasNo ratings yet

- Call) - I Began The Estimation by Inquiring First Our Youngest Friend About What SheDocument2 pagesCall) - I Began The Estimation by Inquiring First Our Youngest Friend About What SheMelanie SamsonaNo ratings yet

- Chapter 13.Document6 pagesChapter 13.perdana findaNo ratings yet

- Final IND AS Summary For Nov 19-CA PS BeniwalDocument15 pagesFinal IND AS Summary For Nov 19-CA PS BeniwalChirag AggarwalNo ratings yet

- SNGPL - Web Bill Jan 2019Document1 pageSNGPL - Web Bill Jan 2019Hamid AliNo ratings yet

- February 5, 2015 by Surbhi S - 3 Comments: Comparison Chart Key Differences Similarities ConclusionDocument3 pagesFebruary 5, 2015 by Surbhi S - 3 Comments: Comparison Chart Key Differences Similarities ConclusionwinwinNo ratings yet

- EDHEC Comments On The Amaranth Case: Early Lessons From The DebacleDocument23 pagesEDHEC Comments On The Amaranth Case: Early Lessons From The DebaclePablo TrianaNo ratings yet

- Finance and Accounting Lecture 4Document47 pagesFinance and Accounting Lecture 4Mustafa MoatamedNo ratings yet

- Types of Investment Risk TemplateDocument3 pagesTypes of Investment Risk TemplateShaari HusinNo ratings yet

- Reyhan Huseynova Business Management Sun/4/03/2021 Activity: 28.5 28.6 28.7 28.8 28.10 Activity 28.5Document6 pagesReyhan Huseynova Business Management Sun/4/03/2021 Activity: 28.5 28.6 28.7 28.8 28.10 Activity 28.5ReyhanNo ratings yet

- Fundamentals of Accounting Course OutlineDocument5 pagesFundamentals of Accounting Course OutlineMahad Shakeel KhanNo ratings yet

- BSBFIN401 Assessment 2Document10 pagesBSBFIN401 Assessment 2Kitpipoj PornnongsaenNo ratings yet

- Actions of The Government and The Increase in PricesDocument3 pagesActions of The Government and The Increase in PricesAndrej KovljenićNo ratings yet

- National Federation-Junior Philippine Institute of Accountants - Region 3 Council FEDERATION YEAR 2018-2019Document21 pagesNational Federation-Junior Philippine Institute of Accountants - Region 3 Council FEDERATION YEAR 2018-2019Rommel CruzNo ratings yet

- A Comprehensive Introduction To Accounting AssetsDocument12 pagesA Comprehensive Introduction To Accounting AssetsShaurya PalitNo ratings yet

- Consolidated Policy ScheduleDocument4 pagesConsolidated Policy ScheduleNeem LalNo ratings yet