Professional Documents

Culture Documents

Rem Annex a With Spa Loan and Mortgage Agreement 4-10-15

Rem Annex a With Spa Loan and Mortgage Agreement 4-10-15

Uploaded by

JayCopyright:

Available Formats

You might also like

- Film Finder's Fee AgreementDocument4 pagesFilm Finder's Fee AgreementThomas Verrette83% (6)

- Revolving Line of Credit AgreementDocument9 pagesRevolving Line of Credit AgreementRobert ArkinNo ratings yet

- Template Intercompany LoanDocument4 pagesTemplate Intercompany LoanRosa Alia S. Mendoza-Martelino100% (2)

- Loan Agreement - BaniDocument7 pagesLoan Agreement - BaniNonnatus P ChuaNo ratings yet

- Loan AgreementDocument6 pagesLoan Agreementrb100% (1)

- Western Money Management IncDocument8 pagesWestern Money Management IncNavid Al Galib50% (2)

- Mou For SamirDocument6 pagesMou For SamirJohn HudsonNo ratings yet

- Draft Loan Agreement With MortgageDocument7 pagesDraft Loan Agreement With Mortgagesheilasandiego100% (1)

- English Hypothecation LoanDocument12 pagesEnglish Hypothecation Loanswapnilmaher43No ratings yet

- Tripartite Escrow Agreement: DraftDocument5 pagesTripartite Escrow Agreement: DraftKyleNo ratings yet

- Credit Line Loan Facility AgreementDocument15 pagesCredit Line Loan Facility AgreementFranchette Kaye Lim100% (1)

- PN PH LN 450184Document6 pagesPN PH LN 450184raygerangaya0410No ratings yet

- Promissory 20220824010012Document11 pagesPromissory 20220824010012camilla ann manaloNo ratings yet

- 1654557191.969365 - Signed Contract Application 212143Document11 pages1654557191.969365 - Signed Contract Application 212143ella may sapilanNo ratings yet

- Escrow Agreement TemplateDocument5 pagesEscrow Agreement TemplatesamsarmaNo ratings yet

- Deed of Registered Mortgage 6.1.05Document25 pagesDeed of Registered Mortgage 6.1.05Satish KumarNo ratings yet

- Deed of Trust CATAYLODocument15 pagesDeed of Trust CATAYLOEL Filibusterisimo Paul CatayloNo ratings yet

- 1647868900.750639 - Signed Contract Application 240687Document11 pages1647868900.750639 - Signed Contract Application 240687Tricia Faith Dela CruzNo ratings yet

- Personal Loan Agreement: Bajaj Finance LimitedDocument12 pagesPersonal Loan Agreement: Bajaj Finance LimitedShafiah SheikhNo ratings yet

- Annex C CP No. 23 Dated 8 March 2017 Deed of TrustDocument4 pagesAnnex C CP No. 23 Dated 8 March 2017 Deed of TrustZethNo ratings yet

- LoanagreementDocument13 pagesLoanagreementKiran KumarNo ratings yet

- 4 - Loan AgreementDocument14 pages4 - Loan AgreementKavit ThakkarNo ratings yet

- PN-PH-LN-674064Document6 pagesPN-PH-LN-674064xianglimingdizong00No ratings yet

- Pn-Savii PHL Lna 2023 6 781285Document6 pagesPn-Savii PHL Lna 2023 6 781285Bobby EronicoNo ratings yet

- Escrow AgreementDocument9 pagesEscrow AgreementDiane JulianNo ratings yet

- Loan Agreement With Chattel Mortgage: 34 M.J. Cuenco Ave., Cebu CityDocument6 pagesLoan Agreement With Chattel Mortgage: 34 M.J. Cuenco Ave., Cebu CityManny DerainNo ratings yet

- 981116-Deedofloan enDocument16 pages981116-Deedofloan enDjibzlaeNo ratings yet

- Standby Letter of Credit FacilityDocument7 pagesStandby Letter of Credit FacilityKagimu Clapton ENo ratings yet

- LAP and SME Loan AgreementDocument31 pagesLAP and SME Loan AgreementDeepali RajputNo ratings yet

- Loan Agreement With Security LawRato2Document4 pagesLoan Agreement With Security LawRato2Arnav TaraiyaNo ratings yet

- Unra Staff Saving and Credit Cooperative Society LTD Loan AgreementDocument5 pagesUnra Staff Saving and Credit Cooperative Society LTD Loan Agreementjoseph taylorNo ratings yet

- (Revised) Loan AgreementDocument5 pages(Revised) Loan AgreementJennilyn TugelidaNo ratings yet

- 14 Loan Agreement - TEMPLATEDocument6 pages14 Loan Agreement - TEMPLATEMay&BenNo ratings yet

- LOAN AGREEMENT Diego PizzamiglioDocument8 pagesLOAN AGREEMENT Diego PizzamiglioEric WittNo ratings yet

- AgreementForm10045975 29-8-2023 113636Document33 pagesAgreementForm10045975 29-8-2023 113636greenrootfinancialservicesNo ratings yet

- Trust AgreementDocument10 pagesTrust AgreementDove MinajNo ratings yet

- Escrow Agreement (SRO)Document8 pagesEscrow Agreement (SRO)Bryan CuaNo ratings yet

- Real Estate Mortgage AgreementDocument7 pagesReal Estate Mortgage AgreementErikka Shanely LimpangugNo ratings yet

- Recognition Agreement - Co-OpDocument4 pagesRecognition Agreement - Co-OpAnalyn PagatpatanNo ratings yet

- Loan Agreement - Swiftbanq CreditDocument5 pagesLoan Agreement - Swiftbanq CreditcyrilNo ratings yet

- Loan Contract OrnopiaDocument5 pagesLoan Contract OrnopiaaizhelarcipeNo ratings yet

- Deed of Hypothecation - Draft TemplateDocument18 pagesDeed of Hypothecation - Draft Templateluvisfact7616100% (1)

- Real Estate Mortgage AgreementDocument6 pagesReal Estate Mortgage Agreementm.vangielimpangugNo ratings yet

- DOU TCT Without SPA TemplateDocument3 pagesDOU TCT Without SPA Templatekhimbiona49No ratings yet

- AgreementDocument21 pagesAgreementdevgdev2023No ratings yet

- Loan AgreementDocument20 pagesLoan AgreementAnjani DeviNo ratings yet

- AGREEMDocument4 pagesAGREEMshree.shree10010No ratings yet

- 0000 Aab - 1 Unjust EnrichmentDocument2 pages0000 Aab - 1 Unjust EnrichmentRogerNo ratings yet

- ta1Document4 pagesta1chittaranjan93pintuNo ratings yet

- Atok Finance Vs CADocument16 pagesAtok Finance Vs CAVeah CaabayNo ratings yet

- Trust Fund Agreement: Section 1. Definitions. As Used in This AgreementDocument9 pagesTrust Fund Agreement: Section 1. Definitions. As Used in This AgreementAriannaNo ratings yet

- Lampiran Loan AgreementDocument15 pagesLampiran Loan AgreementYusuf WahidNo ratings yet

- Indemnity FormDocument8 pagesIndemnity FormBang DizonNo ratings yet

- Et FurtherDocument31 pagesEt Furtherotto walikwaNo ratings yet

- Unra Staff Saving and Credit Cooperative Society LTD Loan AgreementDocument5 pagesUnra Staff Saving and Credit Cooperative Society LTD Loan Agreementjoseph taylorNo ratings yet

- RML Application FormDocument17 pagesRML Application Formkirubaharan2022No ratings yet

- Loan Agreement Bank 2.dotDocument20 pagesLoan Agreement Bank 2.dotlily kamwanaNo ratings yet

- Loan-Agreement TemplateDocument4 pagesLoan-Agreement TemplateAlan Taylor100% (1)

- Personal Loan Agreement Loan Amount Less Than 5 LakhsDocument14 pagesPersonal Loan Agreement Loan Amount Less Than 5 LakhsShivam KumarNo ratings yet

- DDER - 01 BlankDocument13 pagesDDER - 01 Blanksamslife.891No ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Wedding and Debut PackageDocument20 pagesWedding and Debut PackageJayNo ratings yet

- Espina Fatima Mae P RevisedDocument39 pagesEspina Fatima Mae P RevisedJayNo ratings yet

- Hotel Costa Brava - TaclobanDocument1 pageHotel Costa Brava - TaclobanJayNo ratings yet

- RDO No. 110 - General Santos City, South CotabatoDocument501 pagesRDO No. 110 - General Santos City, South CotabatoJayNo ratings yet

- Slides 07Document44 pagesSlides 07Vinay Gowda D MNo ratings yet

- Non Performing Assets - IdbiDocument7 pagesNon Performing Assets - IdbiKitten KittyNo ratings yet

- Banker Customer RelationshipDocument11 pagesBanker Customer Relationshipbeena antuNo ratings yet

- Sanction LetterDocument3 pagesSanction LetterPraveen KumarNo ratings yet

- Module 3 - DISCOUNT: Most Essential Learning OutcomesDocument19 pagesModule 3 - DISCOUNT: Most Essential Learning Outcomesedwin dumopoyNo ratings yet

- Granzo DLL Genmathmath11 Week1Document14 pagesGranzo DLL Genmathmath11 Week1KIMBERLYN GRANZONo ratings yet

- Bond Valuation JiteshDocument83 pagesBond Valuation Jiteshjitesh_talesaraNo ratings yet

- Bond Valuation Version 1.XlsbDocument14 pagesBond Valuation Version 1.XlsbAlie Dys100% (1)

- Nasty Bank Date Debit Credit 2020Document18 pagesNasty Bank Date Debit Credit 2020AnonnNo ratings yet

- Student JournalDocument95 pagesStudent JournalfbuameNo ratings yet

- Ibc - Question Bank DTQ AnsDocument31 pagesIbc - Question Bank DTQ AnsShekhar PanseNo ratings yet

- Ulars: Total Total Total Equity and LiabilitiesDocument4 pagesUlars: Total Total Total Equity and LiabilitiespritamNo ratings yet

- Chapter 5Document13 pagesChapter 5Khôi Nguyên0% (1)

- Assignment C7Document4 pagesAssignment C7matt100% (1)

- Slide AKT 405 Teori Akuntansi 8 GodfreyDocument30 pagesSlide AKT 405 Teori Akuntansi 8 GodfreypietysantaNo ratings yet

- Prospectus Procedure and Financial Position of Idbi BankDocument71 pagesProspectus Procedure and Financial Position of Idbi BankMayankNo ratings yet

- Learning Material 4 PROVISION: Contingent Liability A. Discussion of Accounting PrinciplesDocument11 pagesLearning Material 4 PROVISION: Contingent Liability A. Discussion of Accounting PrinciplesJay GoNo ratings yet

- Framework For The Preparation and Presentation of Financial StatementsDocument6 pagesFramework For The Preparation and Presentation of Financial Statementsg0025No ratings yet

- Group 2: Tybba A Abhilasha Mohan Ram A003 Mayank Beria A025 Mihirmandrekar A026 Monil Shah A027 Rohan Negi A035 Zoyakazi A053Document59 pagesGroup 2: Tybba A Abhilasha Mohan Ram A003 Mayank Beria A025 Mihirmandrekar A026 Monil Shah A027 Rohan Negi A035 Zoyakazi A053nitinjamesbondNo ratings yet

- Prnciples of Banking JAIIB 4Document91 pagesPrnciples of Banking JAIIB 4Poovizhi RajaNo ratings yet

- Confusion or Merger of Rights Art. 1275 1277Document13 pagesConfusion or Merger of Rights Art. 1275 1277Rizelle ViloriaNo ratings yet

- RepaymentDocument2 pagesRepaymentGetlozzAwabaNo ratings yet

- My Student DataDocument10 pagesMy Student Datadelaoz82No ratings yet

- Facultative, Joint, and Solidary ObligationsDocument9 pagesFacultative, Joint, and Solidary ObligationsLEVI ACKERMANNNo ratings yet

- Banking MoralesDocument39 pagesBanking MoralesJerome MoradaNo ratings yet

- Petitioner Respondents: MAYBANK PHILIPPINES, INC. (Formerly PNB-Republic Bank), Spouses Oscar and Nenita TarrosaDocument6 pagesPetitioner Respondents: MAYBANK PHILIPPINES, INC. (Formerly PNB-Republic Bank), Spouses Oscar and Nenita TarrosaKim Jan Navata BatecanNo ratings yet

- Drivers of Credit RiskDocument12 pagesDrivers of Credit RiskBhargav BharadwajNo ratings yet

- Pas 32 Finl Instruments PresentationDocument19 pagesPas 32 Finl Instruments PresentationRichard Dan Ilao ReyesNo ratings yet

- Module 4 - Ia2 FinalDocument43 pagesModule 4 - Ia2 FinalErika EsguerraNo ratings yet

Rem Annex a With Spa Loan and Mortgage Agreement 4-10-15

Rem Annex a With Spa Loan and Mortgage Agreement 4-10-15

Uploaded by

JayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rem Annex a With Spa Loan and Mortgage Agreement 4-10-15

Rem Annex a With Spa Loan and Mortgage Agreement 4-10-15

Uploaded by

JayCopyright:

Available Formats

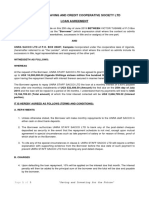

Annex A (REM)

LOAN AND MORTGAGE AGREEMENT

KNOW ALL MEN BY THESE PRESENTS:

This Agreement made and entered into by and between:

Insert name of Originator here , a corporation duly organized and

existing under Philippine laws, with principal place of business at

Insert place of business here

and herein represented by

Insert name of authorized representative here

, who is duly authorized for this purpose

(as evidenced by a Secretary’s Certificate/Board Resolution, attached as

ANNEX “D”), hereinafter referred to as "ORIGINATING INSTITUTION";

-and-

Insert name of principal borrower here of legal age, Filipino Citizen,

Indicate here if “single” or “married to followed by the name of spouse”

, with residence and postal address at

Insert address of principal borrower here

, hereinafter referred to as the "BORROWER".

(Insert name of Principal/s) herein represented by

(Insert name of Atty.-in-fact)

as his/her/their Attorney-in-fact, Special Power of

Attorney herein attached and made an integral part hereof.

WITNESSETH, THAT:

WHEREAS, the National Home Mortgage Finance Corporation (“NHMFC”) has launched

a Housing Loan Receivables Purchase Program (“HLRPP”).

WHEREAS, the ORIGINATING INSTITUTION finds the application in order and agrees to

extend the loan to the BORROWER, with the intention of subsequently assigning /transferring

all of ORIGINATING INSTITUTION’s rights, title and interests in the loan and its collaterals to

NHMFC in accordance with its HLRPP;

NOW THEREFORE, for and in consideration of the foregoing premises the parties agree

to the granting of a Housing Loan and the constitution of a Real Estate Mortgage to secure the

same, under the following terms and conditions:

ARTICLE I. THE LOAN

Section 1.01 Amount. The ORIGINATING INSTITUTION hereby extends to the

BORROWER a Housing Loan in the Principal amount of

Insert the amount of the Outstanding Principal Balance (OPB) here in words (Contact your Account Officer fo

(Php Insert amount in Arabic ) Philippine Currency.

Section 1.02 Purpose of Loan. The Proceeds of loan shall be used by the BORROWER

solely for this purpose: to acquire/construct the same property herein mortgaged.

Section 1.03 Loan Release. Upon compliance by the BORROWER and ORIGINATING

INSTITUTION with all the herein conditions, as well as, with the rules and guidelines of the

NHMFC’s HLRPP, the proceeds of the loan subject of the Purchase of Loan Agreement (PLA)

shall be released to the ORIGINATING INSTITUTION.

Section 1.04 Note. The loan shall be further evidenced by a Promissory Note executed

by BORROWER(S), co-signed by Insert name here; if none put N/A and made an integral

part hereof.

Section 1.05 Interest. The BORROWER shall pay interest on the unpaid principal

amount of the loan outstanding at the rate of Insert interest rate in words (

Insert interest rate in Arabic

%) per annum.

Provided, however, that the ORIGINATING INSTITUTION or NHMFC may adjust the rate

of interest chargeable on the loan within the limits allowed by law, in the event NHMFC’s

policy, as the case may be, require such adjustment.

Revised 04/10/15 (For accnts. with SPA) 1

Section 1.06 Repayment of the Loan. The BORROWER shall repay the loan in

Insert term in months here (in

consecutive

monthly installments, payment commencing on the same date of the month following the

release of the loan proceeds and succeeding repayment shall be made on the same date of the

succeeding months, thereafter until the loan shall have been fully paid.

Section 1.07 Prepayment. The BORROWER may prepay this loan, in whole or in part;

provided, however, that in case of partial prepayment of at least twelve (12) monthly

amortizations, the ORIGINATING INSTITUTION or its assignee/transferee shall either shorten

the term of the loan or lower the monthly amortizations in which case a new schedule of

payments shall be made.

Section 1.08 Penalty for late Payment/Default. Whenever the borrower fails to pay the

full monthly amortization and/or other loan obligations when due, for three (3) consecutive

months, there shall be an automatic permanent increase in the interest rate by 2%, applied to

the principal portion of the arrears.

Section 1.09 No Defense/No Set-off

a. Any action or remedy which BORROWER may have against the ORIGINATING

INSTITUTION for defects in planning, construction and development of the subdivision

or site shall not constitute a defense of the BORROWER from non-payment or cause for

suspension of payment of the amortizations due.

b. Upon assignment of this Loan and Mortgage Agreement to the NHMFC, the rights of

compensation or set-off which may exist as between the BORROWER and the

ORIGINATING INSTITUTION shall not be invoked and hereby waived and may not be

raised by the BORROWER and/or the ORIGINATING INSTITUTION against the NHMFC,

its transferees or successor-in-interest.

c. In case a judgment or order is made by a court or a quasi-judicial/administrative

agency/body of competent jurisdiction requiring NHMFC to reimburse the BORROWER

of any amount paid, in accordance with the Subdivision and Condominium Buyer's

Protection Decree (PD 957) or any law, the ORIGINATING INSTITUTION hereby grants to

NHMFC the right to: 1) require reimbursement from it of any amount paid by NHMFC to

the BORROWER or 2) take possession and to hold the subject property as security and

to sell the same and apply the proceeds as it may deem proper, at the sole option of

NHMFC.

d. For this purpose, the ORIGINATING INSTITUTION hereby appoints/designates the

NHMFC as attorney-in-fact and authorized to: 1) sell the property, whether in cash or

installment; 2) sign, execute and deliver the Deed of Absolute sale to the buyer; and, 3)

sign, execute and deliver all contracts, documents, papers and other instruments that

may be necessary and required to implement the above authorities.

ARTICLE II. THE REAL ESTATE MORTGAGES

Section 2.01 Mortgage. The BORROWER hereby secures the loan and other obligations

stipulated herein, by a first mortgage on real property (ies) and improvements now existing or

which may thereafter exist thereon absolutely owned by the BORROWER, free from all liens

and encumbrances of whatever nature, and which property is more particularly described

herein and/or in a supplementary page list appended hereto, (hereinafter referred to as the

“Mortgaged Property” irrespective of number). BORROWER is making this first mortgage in

favor of ORIGINATING INSTITUTION and subsequently the NHMFC or its assignee/ transferee.

The BORROWER further agrees and warrants:

a. that the loan proceeds were utilized to acquire/construct the same property herein

mortgaged.

b. to maintain the integrity, quality and sufficiency of the Mortgaged Property at a level

acceptable to or directed by the ORIGINATING INSTITUTION or its assignee/transferee;

c. to allow the ORIGINATING INSTITUTION or its assignee/transferee to inspect the

Mortgaged Property during reasonable hours to ascertain its condition or actual market

value;

d. to substitute the Mortgaged Property with new and/or provide additional collateral (s) if

the ORIGINATING INSTITUTION or its assignee/transferee finds that the Mortgaged

Property is lost, impaired or depreciated due to any cause whatsoever;

e. to duly pay or discharge all taxes, assessments, and charges on the Mortgaged Property

and submit to the ORIGINATING INSTITUTION or its assignee/transferee proof of such

payment;

Revised 04/10/15 (For accnts. with SPA) 2

f. not to subdivide, lease, sell, dispose, mortgage or encumber the Mortgaged Property

without the prior written consent of the ORIGINATING INSITUTION or its

assignee/transferee, nor commit any act which may impair directly or indirectly, the

value of the said mortgaged property; and,

g. to issue twenty-five (25) post-dated checks (PDCs) in favor of NHMFC to cover the

monthly amortizations for the first twenty-four (24) months from take-out date and (in

the 25th check, which may also be held to cover all penalties, surcharges and/or

liabilities incurred) the remaining outstanding balances every two (2) years until the

loan is fully paid.

In the event the mortgaged property is sold, disposed of or otherwise transferred in

whole or in part by the BORROWER, the BORROWER shall not be released from his liability

but shall be liable jointly and severally with the transferee unless expressly released therefrom

in writing under existing policy of the ORIGINATING INSTITUTION, the NHMFC or its

transferee and successor-in-interest. In all cases this mortgage shall constitute a first and

superior lien on the mortgaged property.

In case the BORROWER or his/her successor-in-interest fails or refuses to pay the loan

herein secured, or violates any term or conditions herein stipulated, the ORIGINATING

INSTITUTION, NHMFC or its assignee/transferee may, in addition to the remedies it may have

by law or under this Agreement, declare all amortizations on the loan immediately due and

payable and may immediately foreclose on this mortgage, judicially or extrajudicially.

In case of extrajudicial foreclosure under Act No.3135, as amended:

1. the auction sale shall take place in the city or capital of the province where any of the

mortgaged property is located;

2. effective upon the breach of any condition of the loan, the ORIGINATING

INSTITUTION or the NHMFC or its assignee/transferee is hereby appointed BORROWER’s

attorney-in-fact with full power of substitution and authority to perform such acts as may be

necessary to dispose of the Mortgaged Property in accordance with the provisions of Act No.

3135 as amended; and,

3. pending such disposition, to perform all other acts of administration and

management in the manner most advantageous to and for the best interest of the

ORIGINATING INSTITUTION or the NHMFC or its assignee/transferee. The latter hereby

reserves its right to bid at the appropriate public auction.

Section 2.02 Coverage. This mortgage shall likewise stand as security for the payment

of any Promissory Note (s) which the BORROWER has executed pursuant to this Agreement or

any renewal, extension or amendment thereof. If the BORROWER shall pay to the

ORIGINATING INSTITUTION or its assignee/transferee all the obligations secured by this

mortgage when due, and shall comply with all the covenants of this Agreement, then this

mortgage shall be void, otherwise it shall remain in full force and effect.

ARTICLE III. INSURANCE, TAXES, AND OTHER OBLIGATION

Section 3.01 Insurance Coverage. The BORROWER hereby authorizes the ORIGINATING

INSTITUTION or the NHMFC or its assignee/transferee to obtain from duly accredited

insurance companies for the BORROWER’s account and for the benefit of NHMFC the following

insurance policies under such terms/conditions and duration as the ORIGINATING

INSTITUTION or the NHMFC or its assignee/transferee may deem proper, to ensure payment in

whole or in part, of the loan, interest and such other amounts which may be due from the

BORROWER, to wit:

a. Mortgage Redemption Insurance;

b. Fire and Lightning Insurance;

c. and such other insurances as may hereinafter be required by NHMFC in accordance

with its home lending guidelines.

All insurance premiums shall be for the BORROWER’s account.

Section 3.02 Premium Payments. The premiums on the aforesaid coverage shall be

prepaid annually by the BORROWER. In the event of assignment /transfer of the loan and

mortgage to the NHMFC, the annual premiums due from the date of such assignment/transfer

shall be deducted by the NHMFC from the take-out proceeds. Thereafter, the prepayment for

the following and succeeding years after such assignment /transfer shall be distributed and

collected monthly together with the loan amortization for the current year.

Revised 04/10/15 (For accnts. with SPA) 3

Section 3.03 Assignment of Insurance Policy. Every insurance policy obtained in

connection with this Agreement is hereby assigned to the originating institution or NHMFC or

its assignee/transferee notwithstanding BORROWER’s failure to endorse or deliver said policy,

Accordingly, in case the risk insured against occurs, the ORIGINATING INSTITUTION or

NHMFC or its assignee/transferee is hereby authorized to settle or liquidate all claims on said

property and to apply the proceeds to settle in whole or in part BORROWER’s herein

obligations.

Section 3.04 Taxes, Assessments, Association Dues and Other Charges on the

Mortgaged Property. The BORROWER shall duly pay and discharge all taxes, assessments,

association dues, other legal liens and charges of whatever nature and by whomsoever levied

against the mortgaged property on or before their respective due dates, unless and to the

extent only that the same may be contested in good faith in appropriate proceedings by the

BORROWER. In case of tax foreclosure, the BORROWER agrees to pay the ORIGINATING

INSTITUTION or NHMFC the total obligation within thirty (30) days from the tax foreclosure

sale.

Section 3.05 Failure to Pay Premiums, Taxes and Other Charges. Upon failure of the

BORROWER to pay the insurance premiums, taxes, charges and assessments when due, the

ORIGINATING INSTITUTION or its assignee/transferee may advance the same, and in such

event, the legality and amount of the premiums, taxes, charges, or assessments as surcharges

thereon, if any, shall unconditionally be within the discretion of the ORIGINATING

INSTITUTION or its assignee/transferee to determine and settle. The BORROWER shall

reimburse such advances to the ORIGINATING INSTITUTION or its assignee/transferee upon

demand, with penalty due thereon in accordance with Section 1.09.

ARTICLE IV. DEFAULT

Section 4.01 Events of Default. The occurrence of any of the following shall constitute

an event of default:

a. Failure of the BORROWER to pay three (3) consecutive monthly amortizations;

b. Misrepresentation or fraud, committed by the BORROWER in securing the loan;

c. Any representation, statement, or warranty made by the BORROWER in this

Agreement, the Application Form, the Affidavit of Warranties, the mortgage document or

in any document executed by the BORROWER in connection with the loan shall prove

to be untrue or incorrect in any material respect;

d. The mortgaged property, as security, has become subordinated to the claim of any

person or entity, whether public or private;

e. The BORROWER violates the policies, rules regulations and guidelines of NHMFC

pertaining to its Housing Loan Receivables Purchase Program (HLRPP);

f. The mortgage shall for any cause cease to be in full force and effect; or is/otherwise

impaired or the required collateral value has been reduced;

g. The BORROWER shall become insolvent or unable to pay his debts as they mature, or

take advantage of insolvency, moratorium or other laws for the relief of debtors, whether

filed voluntarily or involuntarily or any judgment or order is entered by a court of

competent jurisdiction for the appointment of a receiver, trust, or the like to take charge

of all or substantially all of the assets of the BORROWER;

h. There shall have occurred a material change in the financial conditions of the

BORROWER which, in the reasonable opinion of the ORIGINATING INSTITUTION,

NHMFC, or their assignee, the BORROWER will be unable to perform his obligation

under this Agreement;

i. The BORROWER subdivides, leases, sells, transfers, assigns or otherwise disposes of

the mortgaged property without the prior written consent of the ORIGINATING

INSTITUTION or its assignee/transferee, or commit any act which may impair directly

or indirectly the value of the mortgaged property.

j. Whenever the borrower fails to pay the full monthly amortization and/or other loan

obligations when due, for three (3) consecutive months, there shall be an automatic

permanent increase in the interest rate by 2%, applied on the principal portion of the

arrears.

Section 4.02 Effects of Default. Upon the occurrence of an event of default, the

ORIGINATING INSTITUTION, NHMFC, or its assignee/transferee may:

a. Declare the outstanding Loan together with accrued interest and other herein

obligations immediately due and payable;

b. Foreclose the mortgage in accordance with Section 2.01;

Revised 04/10/15 (For accnts. with SPA) 4

c. Apply any of BORROWER’s funds in the possession of ORIGINATING INSTITUTION or

its assignee/transferee and/or NHMFC in full or partial payment of BORROWER’s

herein obligations and in the Promissory Note(s) and/or;

d. Avail of any other remedies provided for by law, this Agreement, and the HLRPP

Guidelines and any amendment thereto, including but not limited to recourse to the

insurance policies.

For purposes of Section 4.02 (c) above, the BORROWER further authorizes the

ORIGINATING INSTITUTION or NHMFC or its assignee/transferee to secure and apply without

prior notice to the BORROWER any fund belonging to him in the possession or control of the

ORIGINATING INSTITUTION, NHMFC or its assignee/transferee.

It is understood that the above remedies are cumulative and in the event that

ORIGINATING INSTITUTION or its assignee/transferee has to initiate any action or proceeding,

the latter shall be entitled to collect the costs and expenses of such action or proceeding,

including but not limited to Attorney’s fees equivalent to at least 25% of the total amount due.

ARTICLE V. MISCELLANEOUS

Section 5.01 Enforcement. The failure of the ORIGINATING INSTITUTION or its

assignee/transferee to strictly enforce any provisions of this Agreement shall not diminish the

herein obligations of the BORROWER nor constitute a waiver, loss or diminution of any right or

remedy of the ORIGINATING INSTITUTION or its assignee/transferee.

Section 5.02 Assignment. Without need of further notice, the BORROWER hereby

agrees to the eventual assignment/transfer by ORIGINATING INSTITUTION of this Agreement

and its corresponding Promissory Note (s) to the NHMFC, its assignee and successors-in-

interest. To this end, the BORROWER agrees to perform such acts and execute such

documents as may be deemed necessary to implement any such assignment/transfer.

As a consequence of such assignment, NHMFC is empowered, and for said purpose is

hereby appointed by the BORROWER as his attorney-in-fact, to perform such acts as may be

deemed necessary under the circumstances, including the power to issue cancellation and/or

release of mortgages, as well as deal with the Register of Deeds concerned in all aspects of the

transaction.

Section 5.03 Documentation/Registration Expenses. The BORROWER shall pay the

notarial fees, documentary stamps and all expenses in connection with this Agreement and its

corresponding Promissory Note (s) and all necessary agreements which may hereafter be

executed in connection herewith, and the fees for the registration of this and other documents

related thereto.

Section 5.04 Separability Clause. The declaration of any of the provisions of this

Agreement by a Court of competent jurisdiction invalid or unenforceable shall not affect the

validity or the enforceability of all the other provisions not otherwise so declared and the same

shall remain in full force and effect, and shall be enforceable in such manner as may be

provided by law.

Section 5.05 Discrepancies. In case there is a discrepancy between the provision of this

Agreement and the Promissory Notes, this Agreement shall prevail.

Section 5.06 Notices. All correspondence of whatever kind pursuant to or relative to this

Agreement, shall be sent to the BORROWER at the address given above. The mere act of the

ORIGINATING INSTITUTION or its assignee/transferee of mailing such correspondences

postage prepaid to said address shall be valid and effective notice to the BORROWER for all

legal purposes. In case of BORROWER’s change of address, BORROWER shall immediately

notify NHMFC of his new address.

Section 5.07 Incorporation by Reference. The NHMFC’s HLRPP Guidelines, including

any and all amendatory and supplementary circulars and policies which may hereafter be

promulgated are deemed incorporated herein by reference and made integral parts hereof.

Section 5.08 Incorporation of Documents. All documents, Promissory Note(s),

Application Form, Appraisal Report, Certification of Lot/House Acceptance, Certificate of

Completion and other papers filed in connection with the loan and mortgage are made integral

parts of this Contract and any violation thereof or misrepresentation therein shall constitute an

event of default.

Revised 04/10/15 (For accnts. with SPA) 5

Section 5.09 Other Provisions. In case the BORROWER prepays his loan before stated

maturity date which will subject NHMFC to the payment of gross receipts tax or any other form

of percentage or business tax imposed under the tax law or revenue regulations, the borrower

agrees to pay or reimburse NHMFC the amount paid/payable by reason of such

pretermination.

DESCRIPTION OF MORTGAGED PROPERTY

Complete Technical Description of Insert TCT/CCT No. here

Insert complete technical description here

IN WITNESS WHEREOF, we have hereunto set our hands, this __ th day of ____________,

20__ at the Province/City of _____________, Philippines.

Insert name of Principal Borrower here Insert name of Originator here

PRINCIPAL BORROWER ORIGINATING INSTITUTION

(Signature above printed name)

Represented by Represented by:

(Insert name of Atty.-in-fact here; indicate N/A if principal borrower has no representative)

as his/her Atty.-in-fact.

With my Marital Consent: Insert name of Originator’s representative here

Insert name of spouse here; indicate N/A if Principal (Signature above printed name)

borrower is single or not applicable

(Signature above printed name)

Represented by

(Insert name of Atty.-in-fact; indicate N/A if spouse has no representative)

as his/her Atty.-in-fact.

SIGNED IN THE PRESENCE OF:

Insert name of witness here Insert name of witness here

(Signature above printed name) (Signature above printed name)

ACKNOWLEDGMENT

REPUBLIC OF THE PHILIPPINES)

) S.S.

BEFORE ME, a Notary Public for and in ____________________, on this __th day of ___________, 20__,

personally appeared the following:

Name Competent proof of Identity Valid Until

(Valid Gov’t Issued I.D.Card)

Name of Originator’s Insert type of I.D. and No. here Insert date of validity here; put

Representative N/A otherwise

Name of Principal Borrower’s Insert type of I.D. and No. here Insert date of validity here; put

Representative of representative N/A otherwise

known to me to be the same persons who executed the foregoing instrument consisting of

Insert no. of pages here in words

( Insert no. of pages in Arabic ) pages including this page where the

Acknowledgment is written, which has been signed by the parties and their witnesses on the left hand

margin of every page and on the signature page. The parties/signatories acknowledged that this

constitutes their own free and voluntary act and deed and that of the Corporation/s represented.

WITNESS MY HAND AND SEAL, on the date and at the place first above written.

Doc. No. ______;

Page No. ______;

Book No.______;

Series of ______.

Revised 04/10/15 (For accnts. with SPA) 6

You might also like

- Film Finder's Fee AgreementDocument4 pagesFilm Finder's Fee AgreementThomas Verrette83% (6)

- Revolving Line of Credit AgreementDocument9 pagesRevolving Line of Credit AgreementRobert ArkinNo ratings yet

- Template Intercompany LoanDocument4 pagesTemplate Intercompany LoanRosa Alia S. Mendoza-Martelino100% (2)

- Loan Agreement - BaniDocument7 pagesLoan Agreement - BaniNonnatus P ChuaNo ratings yet

- Loan AgreementDocument6 pagesLoan Agreementrb100% (1)

- Western Money Management IncDocument8 pagesWestern Money Management IncNavid Al Galib50% (2)

- Mou For SamirDocument6 pagesMou For SamirJohn HudsonNo ratings yet

- Draft Loan Agreement With MortgageDocument7 pagesDraft Loan Agreement With Mortgagesheilasandiego100% (1)

- English Hypothecation LoanDocument12 pagesEnglish Hypothecation Loanswapnilmaher43No ratings yet

- Tripartite Escrow Agreement: DraftDocument5 pagesTripartite Escrow Agreement: DraftKyleNo ratings yet

- Credit Line Loan Facility AgreementDocument15 pagesCredit Line Loan Facility AgreementFranchette Kaye Lim100% (1)

- PN PH LN 450184Document6 pagesPN PH LN 450184raygerangaya0410No ratings yet

- Promissory 20220824010012Document11 pagesPromissory 20220824010012camilla ann manaloNo ratings yet

- 1654557191.969365 - Signed Contract Application 212143Document11 pages1654557191.969365 - Signed Contract Application 212143ella may sapilanNo ratings yet

- Escrow Agreement TemplateDocument5 pagesEscrow Agreement TemplatesamsarmaNo ratings yet

- Deed of Registered Mortgage 6.1.05Document25 pagesDeed of Registered Mortgage 6.1.05Satish KumarNo ratings yet

- Deed of Trust CATAYLODocument15 pagesDeed of Trust CATAYLOEL Filibusterisimo Paul CatayloNo ratings yet

- 1647868900.750639 - Signed Contract Application 240687Document11 pages1647868900.750639 - Signed Contract Application 240687Tricia Faith Dela CruzNo ratings yet

- Personal Loan Agreement: Bajaj Finance LimitedDocument12 pagesPersonal Loan Agreement: Bajaj Finance LimitedShafiah SheikhNo ratings yet

- Annex C CP No. 23 Dated 8 March 2017 Deed of TrustDocument4 pagesAnnex C CP No. 23 Dated 8 March 2017 Deed of TrustZethNo ratings yet

- LoanagreementDocument13 pagesLoanagreementKiran KumarNo ratings yet

- 4 - Loan AgreementDocument14 pages4 - Loan AgreementKavit ThakkarNo ratings yet

- PN-PH-LN-674064Document6 pagesPN-PH-LN-674064xianglimingdizong00No ratings yet

- Pn-Savii PHL Lna 2023 6 781285Document6 pagesPn-Savii PHL Lna 2023 6 781285Bobby EronicoNo ratings yet

- Escrow AgreementDocument9 pagesEscrow AgreementDiane JulianNo ratings yet

- Loan Agreement With Chattel Mortgage: 34 M.J. Cuenco Ave., Cebu CityDocument6 pagesLoan Agreement With Chattel Mortgage: 34 M.J. Cuenco Ave., Cebu CityManny DerainNo ratings yet

- 981116-Deedofloan enDocument16 pages981116-Deedofloan enDjibzlaeNo ratings yet

- Standby Letter of Credit FacilityDocument7 pagesStandby Letter of Credit FacilityKagimu Clapton ENo ratings yet

- LAP and SME Loan AgreementDocument31 pagesLAP and SME Loan AgreementDeepali RajputNo ratings yet

- Loan Agreement With Security LawRato2Document4 pagesLoan Agreement With Security LawRato2Arnav TaraiyaNo ratings yet

- Unra Staff Saving and Credit Cooperative Society LTD Loan AgreementDocument5 pagesUnra Staff Saving and Credit Cooperative Society LTD Loan Agreementjoseph taylorNo ratings yet

- (Revised) Loan AgreementDocument5 pages(Revised) Loan AgreementJennilyn TugelidaNo ratings yet

- 14 Loan Agreement - TEMPLATEDocument6 pages14 Loan Agreement - TEMPLATEMay&BenNo ratings yet

- LOAN AGREEMENT Diego PizzamiglioDocument8 pagesLOAN AGREEMENT Diego PizzamiglioEric WittNo ratings yet

- AgreementForm10045975 29-8-2023 113636Document33 pagesAgreementForm10045975 29-8-2023 113636greenrootfinancialservicesNo ratings yet

- Trust AgreementDocument10 pagesTrust AgreementDove MinajNo ratings yet

- Escrow Agreement (SRO)Document8 pagesEscrow Agreement (SRO)Bryan CuaNo ratings yet

- Real Estate Mortgage AgreementDocument7 pagesReal Estate Mortgage AgreementErikka Shanely LimpangugNo ratings yet

- Recognition Agreement - Co-OpDocument4 pagesRecognition Agreement - Co-OpAnalyn PagatpatanNo ratings yet

- Loan Agreement - Swiftbanq CreditDocument5 pagesLoan Agreement - Swiftbanq CreditcyrilNo ratings yet

- Loan Contract OrnopiaDocument5 pagesLoan Contract OrnopiaaizhelarcipeNo ratings yet

- Deed of Hypothecation - Draft TemplateDocument18 pagesDeed of Hypothecation - Draft Templateluvisfact7616100% (1)

- Real Estate Mortgage AgreementDocument6 pagesReal Estate Mortgage Agreementm.vangielimpangugNo ratings yet

- DOU TCT Without SPA TemplateDocument3 pagesDOU TCT Without SPA Templatekhimbiona49No ratings yet

- AgreementDocument21 pagesAgreementdevgdev2023No ratings yet

- Loan AgreementDocument20 pagesLoan AgreementAnjani DeviNo ratings yet

- AGREEMDocument4 pagesAGREEMshree.shree10010No ratings yet

- 0000 Aab - 1 Unjust EnrichmentDocument2 pages0000 Aab - 1 Unjust EnrichmentRogerNo ratings yet

- ta1Document4 pagesta1chittaranjan93pintuNo ratings yet

- Atok Finance Vs CADocument16 pagesAtok Finance Vs CAVeah CaabayNo ratings yet

- Trust Fund Agreement: Section 1. Definitions. As Used in This AgreementDocument9 pagesTrust Fund Agreement: Section 1. Definitions. As Used in This AgreementAriannaNo ratings yet

- Lampiran Loan AgreementDocument15 pagesLampiran Loan AgreementYusuf WahidNo ratings yet

- Indemnity FormDocument8 pagesIndemnity FormBang DizonNo ratings yet

- Et FurtherDocument31 pagesEt Furtherotto walikwaNo ratings yet

- Unra Staff Saving and Credit Cooperative Society LTD Loan AgreementDocument5 pagesUnra Staff Saving and Credit Cooperative Society LTD Loan Agreementjoseph taylorNo ratings yet

- RML Application FormDocument17 pagesRML Application Formkirubaharan2022No ratings yet

- Loan Agreement Bank 2.dotDocument20 pagesLoan Agreement Bank 2.dotlily kamwanaNo ratings yet

- Loan-Agreement TemplateDocument4 pagesLoan-Agreement TemplateAlan Taylor100% (1)

- Personal Loan Agreement Loan Amount Less Than 5 LakhsDocument14 pagesPersonal Loan Agreement Loan Amount Less Than 5 LakhsShivam KumarNo ratings yet

- DDER - 01 BlankDocument13 pagesDDER - 01 Blanksamslife.891No ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Wedding and Debut PackageDocument20 pagesWedding and Debut PackageJayNo ratings yet

- Espina Fatima Mae P RevisedDocument39 pagesEspina Fatima Mae P RevisedJayNo ratings yet

- Hotel Costa Brava - TaclobanDocument1 pageHotel Costa Brava - TaclobanJayNo ratings yet

- RDO No. 110 - General Santos City, South CotabatoDocument501 pagesRDO No. 110 - General Santos City, South CotabatoJayNo ratings yet

- Slides 07Document44 pagesSlides 07Vinay Gowda D MNo ratings yet

- Non Performing Assets - IdbiDocument7 pagesNon Performing Assets - IdbiKitten KittyNo ratings yet

- Banker Customer RelationshipDocument11 pagesBanker Customer Relationshipbeena antuNo ratings yet

- Sanction LetterDocument3 pagesSanction LetterPraveen KumarNo ratings yet

- Module 3 - DISCOUNT: Most Essential Learning OutcomesDocument19 pagesModule 3 - DISCOUNT: Most Essential Learning Outcomesedwin dumopoyNo ratings yet

- Granzo DLL Genmathmath11 Week1Document14 pagesGranzo DLL Genmathmath11 Week1KIMBERLYN GRANZONo ratings yet

- Bond Valuation JiteshDocument83 pagesBond Valuation Jiteshjitesh_talesaraNo ratings yet

- Bond Valuation Version 1.XlsbDocument14 pagesBond Valuation Version 1.XlsbAlie Dys100% (1)

- Nasty Bank Date Debit Credit 2020Document18 pagesNasty Bank Date Debit Credit 2020AnonnNo ratings yet

- Student JournalDocument95 pagesStudent JournalfbuameNo ratings yet

- Ibc - Question Bank DTQ AnsDocument31 pagesIbc - Question Bank DTQ AnsShekhar PanseNo ratings yet

- Ulars: Total Total Total Equity and LiabilitiesDocument4 pagesUlars: Total Total Total Equity and LiabilitiespritamNo ratings yet

- Chapter 5Document13 pagesChapter 5Khôi Nguyên0% (1)

- Assignment C7Document4 pagesAssignment C7matt100% (1)

- Slide AKT 405 Teori Akuntansi 8 GodfreyDocument30 pagesSlide AKT 405 Teori Akuntansi 8 GodfreypietysantaNo ratings yet

- Prospectus Procedure and Financial Position of Idbi BankDocument71 pagesProspectus Procedure and Financial Position of Idbi BankMayankNo ratings yet

- Learning Material 4 PROVISION: Contingent Liability A. Discussion of Accounting PrinciplesDocument11 pagesLearning Material 4 PROVISION: Contingent Liability A. Discussion of Accounting PrinciplesJay GoNo ratings yet

- Framework For The Preparation and Presentation of Financial StatementsDocument6 pagesFramework For The Preparation and Presentation of Financial Statementsg0025No ratings yet

- Group 2: Tybba A Abhilasha Mohan Ram A003 Mayank Beria A025 Mihirmandrekar A026 Monil Shah A027 Rohan Negi A035 Zoyakazi A053Document59 pagesGroup 2: Tybba A Abhilasha Mohan Ram A003 Mayank Beria A025 Mihirmandrekar A026 Monil Shah A027 Rohan Negi A035 Zoyakazi A053nitinjamesbondNo ratings yet

- Prnciples of Banking JAIIB 4Document91 pagesPrnciples of Banking JAIIB 4Poovizhi RajaNo ratings yet

- Confusion or Merger of Rights Art. 1275 1277Document13 pagesConfusion or Merger of Rights Art. 1275 1277Rizelle ViloriaNo ratings yet

- RepaymentDocument2 pagesRepaymentGetlozzAwabaNo ratings yet

- My Student DataDocument10 pagesMy Student Datadelaoz82No ratings yet

- Facultative, Joint, and Solidary ObligationsDocument9 pagesFacultative, Joint, and Solidary ObligationsLEVI ACKERMANNNo ratings yet

- Banking MoralesDocument39 pagesBanking MoralesJerome MoradaNo ratings yet

- Petitioner Respondents: MAYBANK PHILIPPINES, INC. (Formerly PNB-Republic Bank), Spouses Oscar and Nenita TarrosaDocument6 pagesPetitioner Respondents: MAYBANK PHILIPPINES, INC. (Formerly PNB-Republic Bank), Spouses Oscar and Nenita TarrosaKim Jan Navata BatecanNo ratings yet

- Drivers of Credit RiskDocument12 pagesDrivers of Credit RiskBhargav BharadwajNo ratings yet

- Pas 32 Finl Instruments PresentationDocument19 pagesPas 32 Finl Instruments PresentationRichard Dan Ilao ReyesNo ratings yet

- Module 4 - Ia2 FinalDocument43 pagesModule 4 - Ia2 FinalErika EsguerraNo ratings yet