Professional Documents

Culture Documents

TX MYS D24-S25 syllabus and study guide - final

TX MYS D24-S25 syllabus and study guide - final

Uploaded by

Frankie YswCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TX MYS D24-S25 syllabus and study guide - final

TX MYS D24-S25 syllabus and study guide - final

Uploaded by

Frankie YswCopyright:

Available Formats

Taxation – Malaysia (TX-MYS)

TAXATION – MALAYSIA (TX-MYS)

Syllabus and

study guide

DECEMBER 2024 TO SEPTEMBER 2025

Designed to help with planning study and to

provide detailed information on what could be

assessed in any examination session

1 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

Contents

1. Introduction to the syllabus................................................................................................ 3

2. Main capabilities ............................................................................................................... 4

3. Intellectual levels ............................................................................................................... 5

4. The syllabus ...................................................................................................................... 6

5. Detailed study guide.......................................................................................................... 8

6. Summary of changes to Taxation – Malaysia (TX-MYS) ................................................. 17

7. Reading List .................................................................................................................... 17

8. Approach to examining syllabus ...................................................................................... 18

9. Relational diagram linking Taxation – Malaysia (TX-MYS) with other exams................... 18

........................................................................................................................................ 18

10. Guide to ACCA examination structure and delivery mode ............................................. 19

11. The structure of ACCA qualification .............................................................................. 21

12. Guide to ACCA examination assessment ...................................................................... 21

13. Learning hours and education recognition ..................................................................... 22

2 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

1. Introduction to the syllabus

The aim of the syllabus is to develop knowledge and skills relating to the tax system as

applicable to individuals and companies.

The syllabus for Taxation - Malaysia (TX-MYS) introduces candidates to the subject of

taxation and provides the core knowledge of the underlying principles and major technical

areas of taxation, as they affect the activities of individuals and businesses.

Candidates are introduced to the rationale behind and the functions of the tax system. The

syllabus then considers the separate taxes that an accountant would need to have a detailed

knowledge of, such as income tax from self employment, employment and investments; the

income tax liability of companies and the sales and service tax liabilities of businesses.

Having covered the core areas of the basic taxes, the candidate should be able to compute

tax liabilities, explain the basis of their calculations, apply tax planning techniques for

individuals and companies and identify the compliance issues for each major tax through a

variety of business and personal scenarios and situations.

Section G of the syllabus contains outcomes relating to the demonstration of appropriate

digital and employability skills in preparing for and taking the examination. This includes

being able to access and open exhibits, requirements and response options from different

sources and being able to use the relevant functionality and technology to prepare and

present response options in a professional manner. These skills are specifically developed

by practicing and preparing for the exam, using the learning support content for computer-

based exams available via the practice platform and the ACCA website and will need to be

demonstrated during the live exam.

3 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

2. Main capabilities

On successful completion of this exam, candidates should be able to:

A Explain the operation and scope of the tax system and the obligations of taxpayers,

taxable person, employers and/or their agents and the implications of non-compliance

B Explain and compute the income tax liabilities of individuals

C Explain and compute the income tax liabilities of companies

D Explain and compute real property gains tax

E Explain and compute sales tax

F Explain and compute service tax

G Demonstrate employability and technology skills

Relational diagram of the main capabilities

This diagram illustrates the flows and links between the main capabilities (sections) of the

syllabus and should be used as an aid to planning teaching and learning in a structured way.

4 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

3. Intellectual levels

The syllabus is designed to progressively broaden and deepen the knowledge, skills and

professional values demonstrated by the student on their way through the qualification.

The specific capabilities within the detailed syllabuses and study guides are assessed at one

of three intellectual or cognitive levels:

Level 1: Knowledge and comprehension

Level 2: Application and analysis

Level 3: Synthesis and evaluation

Very broadly, these intellectual levels relate to the three cognitive levels at which the Applied

Knowledge, the Applied Skills and the Strategic Professional exams are assessed.

Each subject area in the detailed study guide included in this document is given a 1, 2, or 3

superscript, denoting intellectual level, marked at the end of each relevant learning outcome.

This gives an indication of the intellectual depth at which an area could be assessed within

the examination. However, while level 1 broadly equates with Applied Knowledge, level 2

equates to Applied Skills and level 3 to Strategic Professional, some lower level skills can

continue to be assessed as the student progresses through each level. This reflects that at

each stage of study there will be a requirement to broaden, as well as deepen capabilities. It

is also possible that occasionally some higher level capabilities may be assessed at lower

levels.

5 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

4. The syllabus 2. Income chargeable to income tax

3. The comprehensive computation of

A The Malaysian tax system and its income tax liability

administration

1. The overall function and purpose of 4. The use of exemptions and reliefs in

taxation in a modern economy deferring and minimising income tax

liabilities

2. Principal sources of revenue law and

practice D Real property gains tax

3. The systems for self-

assessment/assessment and the making 1. The scope of real property gains tax

of returns

2. The basic principles of computing

4. The time limits for the submission of chargeable gains and allowable losses

information, claims and payment of tax,

including payments on account

3. Gains and losses on the disposal of real

property

5. Withholding of tax at source

4. The computation of the real property

6. The procedures relating to enquiries, gains tax payable

appeals and disputes

5. The use of exemptions and reliefs in

7. Penalties for non-compliance deferring and minimising tax liabilities

arising on the disposal of real property

B Income tax liabilities (individuals)

E Sales tax

1. The scope of income tax

1. The scope of sales tax

2. Income from employment

2. The sales tax registration requirements

3. Income from self-employment 3. The computation of sales tax liabilities

4. Income from investments and other 4. The collection, recovery, drawback,

sources refund and remission of, and exemption

from, sales tax

5. The comprehensive computation of F Service tax

chargeable income and income tax

liability 1. The scope of service tax

6. The use of exemptions and reliefs in 2. The service tax registration

deferring and minimising income tax requirements

liabilities

3. The computation of service tax liabilities

C Income tax liabilities (companies) 4. The collection, recovery, refund, and

remission of, and exemption from,

1. The scope of income tax service tax

6 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

G Employability and technology skills

1. Use computer technology to efficiently

access and manipulate relevant

information

2. Work on relevant response options,

using available functions and

technology, as would be required in the

workplace

3. Navigate windows and computer screens

to create and amend responses to exam

requirements, using the appropriate tools

4. Present data and information effectively,

using the appropriate tools

7 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

5. Detailed study guide d) Explain the obligations of taxable

persons for the purposes of sales and

services tax (SST).[2]

A The Malaysian tax system

4. The time limits for the submission of

and its administration

information, claims and payment of

1. The overall function and purpose of tax, including payments on account

taxation in a modern economy

a) Recognise the time limits that apply to

a) Describe the purpose (economic, social the filing of returns and the making of

etc) of taxation in a modern economy.[2] claims.[2]

b) Identify the different types of capital and b) Recognise the due dates for the

revenue tax.[1] payment of tax under the self-

assessment system.[2]

c) Explain the difference between direct

and indirect taxation.[2] c) Recognise the due dates for the

payment of sales and services tax

2. Principal sources of revenue law and (SST).[2]

practice

d) Compute payments on account and

a) Describe the overall structure of the balancing payments/repayments for

Malaysian tax system.[1] individuals.[2]

b) State the different sources of revenue e) Explain how and when companies are

law.[1] required to make a tax estimate/revised

estimate.[2]

c) Explain the difference between tax

avoidance and tax evasion.[1] f) List the information and records that

taxpayers need to retain for tax

d) Explain the need for an ethical and purposes.[1]

professional approach.[2]

5. Withholding of tax at source

Excluded topics

a) Describe the obligations of persons to

• Anti-avoidance legislation. withhold tax on making certain types of

payment to non-residents and explain

3. The systems for self-assessment/ the consequences of non-compliance or

assessment and the making of late compliance.[2]

returns

6. The procedures relating to enquiries,

a) Explain and apply the features of appeals and disputes

the self-assessment system as it

applies to individuals.[2] a) Explain the circumstances in which the

Director General of Inland Revenue can

b) Explain and apply the features of enquire into a self-assessment tax

the self-assessment system as it return.[2]

applies to companies.[2]

b) Explain the procedures for dealing with

c) Explain the responsibilities and appeals and disputes.[1]

obligations of employers under the

Income Tax Act.[2]

8 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

7. Penalties for non-compliance b) Recognise the basis of assessment for

employment income.[2]

a) Calculate penalties on overdue income

tax.[2] c) Explain the basis period to which gross

income from an employment is related.[2]

b) Compute the penalties that can be

charged on underestimates of income d) Explain the income derived/deemed

tax.[2] derived from Malaysia.[2]

c) Compute the penalties that can be e) Compute the statutory income.[2]

charged on a person other than a

company when the tax payable under f) Recognise the allowable deductions,

an assessment exceeds the total of the including travelling expenses.[2]

instalments payable resulting from an

application by the taxpayer to vary the g) Explain the Monthly Tax Deduction

instalment payment.[2] (MTD) system.[1]

d) Explain the circumstances in which late h) Compute the amount of benefits

registration penalties apply for sales and assessable.[2]

service tax (SST) purposes.[2]

i) Discuss the prescribed value method of

e) Explain the circumstances in which late calculating car benefits.[2]

payment penalties apply for sales and

service tax (SST) purposes.[2] j) Recognise benefits assessable under

s.13(1)(a) and s.13(1)(b) respectively.[2]

f) Understand and compute the fines for

an incorrect SST return and tax evasion k) Explain the tax treatment of living

and fraud.[2] accommodation provided by an

employer.[2]

B Income tax liabilities

(individuals) l) Explain and calculate lump sums

received by employees, including

1. The scope of income tax retirement lump sums, golden

goodbyes, service excellence awards

a) Explain how the residence of an and long service awards.[2]

individual is determined.[1]

Excluded topics

b) Recognise the income of non-residents

which is subject to withholding tax.[2] • Share and share option incentive

schemes for employees.

c) Foreign income.[2]

• The formula method of calculating car

Excluded topics benefits.

• Double taxation relief. • Payments on the termination of

employment received by employees.

• Income from trusts and settlements.

3. Income from self-employment

2. Income from employment

a) Recognise the basis of assessment for

a) Recognise the factors that determine self-employment income.[2]

whether an engagement is treated as

employment or self-employment.[2]

9 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

b) Describe and apply the badges of i) Partnerships

trade.[2] i) Define partnership and explain how

income from a partnership is

c) Recognise the expenditure that is assessed to tax.[2]

allowable in calculating the adjusted ii) Compute the statutory income from a

income.[2] partnership for each partner.[2]

iii) Compute the statutory income for

d) Explain the treatment of domestic or each partner following a change in

private expenses and the private use of the profit sharing ratio.[2]

a car.[2] iv) Compute the statutory income for

each partner following a change in

e) Recognise the expenditure that is the membership of the partnership.[2]

specifically not allowable in calculating v) Describe the relief available to a

the adjusted income.[2] partner in respect of an adjusted

loss.[1]

f) Compute the statutory income from a

business source.[2] Excluded topics

g) Capital allowances • Research and development capital

i) Define plant and machinery for expenditure incentives.

capital allowances purposes.[1]

ii) Compute annual allowances and • Tax relief for increased exports.

initial allowances.[2]

iii) Compute capital allowances for • Capital allowances on a disposal

motor cars.[2] subject to control.

iv) Compute balancing allowances and

balancing charges.[2] • Clawback provisions for disposals within

v) Explain the treatment of small value two years of acquisition.

assets.[2]

vi) Define an industrial building for • Forest expenditure.

industrial buildings allowance

purposes.[1] • Capital expenditure on mines.

vii)Compute industrial buildings

allowance.[2] • Expenditure on prospecting operations.

viii) Compute the balancing allowance or

balancing charge on the disposal of • Taxation of special types of activity.

an industrial building. [2]

ix) Compute agriculture allowances and • Taxation of special persons.

charges.[2]

• Taxation of Islamic instruments and

h) Relief for business losses transactions.

i) Understand how relief for current

year adjusted losses can be claimed • Tax incentives.

against aggregate income.[2]

ii) Explain how unabsorbed adjusted • Limited liability partnerships.

losses can be carried forward.[2]

iii) Understand how unabsorbed • Business trusts.

adjusted losses brought forward can

be claimed against the total amount 4. Income from investments and other

of statutory income of all sources

businesses.[2]

a) Compute the income from each source

i) Dividends, interest or discounts[2]

10 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

ii) Rents, royalties or premiums[2] d) Explain the tax implications of a married

iii) Pensions, annuities or other couple under joint/separate

periodical payments not falling under assessment.[2]

any of the foregoing paragraphs.[2]

iv) Gains or profits not falling under any C Income tax liabilities

of the foregoing paragraphs.[2] (companies)

5. The comprehensive computation of 1. The scope of income tax

chargeable income and income tax

liability a) Define the terms ‘basis year’, ‘basis

period’ and ‘accounting period’.[1]

a) Prepare a basic income tax

computation involving different types of b) Determine the basis period

income.[2] i) Recognise the factors that will

influence the choice of accounting

b) Calculate the amount of personal reliefs date.[2]

and other deductions for an individual, ii) Determine the basis period on

and for a married couple under the commencement of operations.[2]

joint/separate assessment.[2]

c) Explain how the residence of a

c) Compute the amount of income tax company is determined.[2]

payable under joint/separate

assessment.[2] d) Describe and apply the badges of

trade.[2]

d) The taxability of maintenance and

alimony received and reliefs for the Excluded topics

payments.[2]

• Change of accounting date.

e) Compute tax rebates.[2]

• Group relief for losses.

f) Recognise the deductions allowable

against aggregate income.[2] • Investment companies.

Excluded topics • Companies in receivership or

liquidation.

• The income of minor children.

• Reorganisations.

6. The use of exemptions and reliefs in

deferring and minimising income tax • The purchase by a company of its own

liabilities shares.

a) Explain and compute the relief given • Taxation of special types of activity.

for insurance premiums.[2]

• Taxation of special persons.

b) Describe the relief given for

contributions to approved provident • Taxation of Islamic instruments and

funds.[1] transactions.

c) Explain how a married couple can • Tax relief for increased exports.

minimise their tax liabilities.[2]

• Tax incentives.

11 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

2. Income chargeable to income tax • Capital allowances on a disposal

subject to control.

a) Recognise the expenditure that is

allowable in calculating the adjusted • Capital expenditure on mines.

income.[2] • Forest expenditure.

b) Explain how relief can be obtained for

pre-commencement expenditure.[1] • Expenditure on prospecting operations.

c) Compute capital allowances (as for • Tax incentives.

income tax liabilities of individuals).[2]

3. The comprehensive computation

d) Compute income from business and non of income tax liability

business sources.[2]

a) Compute the income tax liability and

e) Recognise the expenditure that is apply appropriate tax rates.[2]

allowed for double deduction in

calculating the adjusted income.[2] b) Explain how exemptions and reliefs can

defer or minimise income tax liabilities.[2]

f) Explain the treatment of approved

donations and other deductions that can c) Explain the treatment of unabsorbed

be set off against the aggregate losses and unabsorbed capital

income.[2] allowances brought forward from the

previous year of assessment.[2]

g) Understand how adjusted losses can be

carried forward.[2] d) Compute the amount of unabsorbed

losses and unabsorbed capital

h) Understand how current year adjusted allowances from the previous year of

losses can be claimed against the assessment that can be set off against

aggregate income of the current basis the income of the current year of

period.[2] assessment.[2]

i) Recognise the expenditure that is Excluded topics

specifically allowed/disallowed under the

provisions of the Income Tax Act and • The effect of a change in shareholding

PU orders as guided by the IRB’s Public of a company on unabsorbed losses

Rulings.[2] and unabsorbed capital allowances.

j) Explain the tax implications of non 4. The use of exemptions and reliefs in

compliance with the withholding tax deferring and minimising income tax

provisions.[2] liabilities.

[The use of such exemptions and

k) Compute income chargeable to income reliefs is implicit within all of the

tax.[2] above sections 1 to 3 of part C of the

syllabus, concerning income tax (on

Excluded topics companies)]

• Gains or profits from the disposal of

capital assets

• Research and development capital

expenditure incentives.

12 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

D Real property gains tax • Contingent liabilities.

1. The scope of real property gains tax • Dealings for enforcement of security.

a) Describe the scope of real property 3. Gains and losses on the disposal of

gains tax.[2] real property

b) Explain the cases where the acquirer a) Define the terms ‘real property’, ‘land’,

may be assessed.[2] ‘acquire’, and ‘dispose’[1]

Excluded topics b) Explain what constitutes acquisition and

disposal.[2]

• Bodies of persons, partnerships and co-

proprietorship. c) Determine the date of acquisition

and date of disposal.[2]

• Incapacitated persons.

d) Explain the determination of “acquisition

• Real property companies. price” and “disposal price”.[2]

2. The basic principles of computing Excluded topics

chargeable gains and allowable

losses. • The disposal of leases and the creation

of sub-leases.

a) Compute real property gains.[2]

• Transfer of assets between companies

b) Calculate the allowable losses.[2] in the same group.

c) Explain how acquisition price and • Transfer of assets to controlled

disposal price are calculated.[2] companies.

d) List the incidental costs.[1] • Real property companies – gains on the

disposal of RPC shares and shares

e) Recognise the expenditure that is issued in exchange for the transfer of

excluded in computing acquisition price property.

and disposal price.[1]

• Distribution of assets of a partnership.

f) Explain the meaning of ‘permitted

expenses’[2] • Dealings by nominees and certain

trustees.

g) Explain the tax implications of transfers

between husband and wife.[2] • Trustees and partners.

Excluded topics 4. The computation of the real property

gains tax payable

• Real property acquired prior to 1

January 1970. a) Calculate the Schedule 4 exemption on

a chargeable gain accruing to

• Transfers related to death or individuals.[2]

inheritance.

b) Compute the gain and explain the

• Conditional contracts. application of the exemption on the

disposal of private residences.[2]

• Leases and options.

13 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

c) Compute the amount of real property b) Describe the types of registration for

gains tax payable.[2] sales tax including mandatory and

voluntary registrations.[1]

5. The use of exemptions and reliefs in

deferring and minimising tax c) Explain the scope and definition of

liabilities arising on the disposal of manufacturing for the purposes of sales

real property tax. [1]

a) Recognise the tax advantage on the d) Explain the circumstances for the

disposal of private residences.[1] cessation of liability to be registered /

cancellation of registration.[2]

b) Identify the appropriate timing for the

disposal of real property.[2] 3. The computation of sales tax

liabilities

E Sales tax

a) Determine the taxable period.[1]

1. The scope of sales tax b) Explain how sales tax is accounted for

and administered.[2]

a) Describe the scope of sales tax.[2]

c) Recognise transactions that are

b) Explain the charge on taxable goods regarded as a ‘sale’ for sales tax.[2]

and taxable persons.[2]

d) List the information that must be given

c) Describe the places deemed to be on an invoice.[1]

outside Malaysia.[2]

e) Explain and apply the principles of sales

d) Describe the circumstances in which value, including the rules of valuation.[2]

sales tax is not applicable.[2]

f) Calculate the amount of sales tax.[2]

e) Understand the basic principles of sales

tax as it applies to the import and export

of goods. [2] 4. The collection, recovery, refund,

drawback, and remission of, and

Excluded topics exemption from, sales tax

• Special provisions dealing with a) Explain the circumstances for the

designated areas (Labuan, Langkawi reduction of sales tax by the issue of

and Tioman) debit and credit notes.[2]

• Special provisions dealing with Special b) List the particulars that must be

Areas contained in the debit and credit note.[1]

• Special provisions dealing with c) Explain the circumstances for

petroleum drawback.[2]

2. The sales tax registration d) Explain the circumstances for refund

requirements and remission.[2]

a) Recognise the circumstances in which a e) Compute the amount of refund of bad

person is liable to register for sales tax debts for sales tax paid and the

including sub-contractors.[2] repayment of the refund to the Customs

Department when the bad debts are

subsequently recovered. [2]

14 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

f) Compute the amount of refund of sales f) Understand the basic principles of

tax paid for bad debts written off and the export of services.[2]

repayment of the refund to the Customs

Department when the bad debts are 2. The service tax registration

subsequently recovered.[2] requirements

g) Explain the circumstances for specific a) Recognise the circumstances in which a

exemption for persons and from person must register for service tax.[2]

registration.[2]

b) Compute the total annual sales turnover

h) Describe the facilities available for of a person to determine the threshold

goods or class of goods to persons limit.[2]

including manufacturers of specific

exempted goods or registered c) Explain the circumstances for the

manufacturers to acquire materials free cessation of liability to be registered /

of sales tax in manufacturing taxable cancellation of registration.[1]

goods as provided in Schedule A, B and

C.[2] 3. The computation of service tax

liabilities

Excluded topics

a) Explain how service tax is accounted for

• Transitional provisions. and administered.[2]

• The direction to treat persons as a b) Define the terms ‘goods’ and ‘taxable

single taxable person. period’.[2]

• Liquidator of company to give notice of c) List the information that must be given

winding-up, and set aside tax. on an invoice. [1]

• Appointment of receiver to be notified to d) Determine the charge and value of a

the Director General. taxable service including the taxable

service for the sale of goods.[2]

• Provisions dealing with petroleum.

e) Explain how service tax is levied.[2]

F Service tax

f) Calculate the amount of service tax.[2]

1. The scope of service tax

g) Explain disbursements and

a) Describe the scope of service tax. [2] reimbursements.[2]

b) List the taxable services and taxable

persons and prescribed goods and 4. The collection, recovery, refund, and

services.[1] remission of, and exemption from,

service tax

c) Describe the places deemed to be

outside Malaysia.[1] a) Explain the circumstances for the

reduction of service tax by the issue of

d) Describe the circumstances in which debit and credit notes.[2]

service tax is not applicable.[2]

b) Explain the circumstances for refund

e) Describe the reverse charge and remission.[2]

mechanism on imported services.[1]

c) Compute the amount of refund of bad

debts for service tax paid for bad debts

written off and the repayment of the

15 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

refund to the Customs Department

when the bad debts are subsequently

recovered.[2]

d) Describe the procedure for refund.[2]

Excluded topics

• Transitional Provisions

• The direction to treat persons as a

single taxable person.

• Taxable services provided by a

company in a group of companies.

• Liquidator of company to give notice of

winding-up, and set aside tax.

• Appointment of receiver to be notified.

G Employability and technology

skills

1. Use computer technology to efficiently

access and manipulate relevant

information

2. Work on relevant response options, using

available functions and technology, as

would be required in the workplace

3. Navigate windows and computer screens

to create and amend responses to exam

requirements, using the appropriate tools

4. Present data and information effectively,

using the appropriate tools

16 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

6. Summary of changes to Taxation – Malaysia (TX-MYS)

ACCA periodically reviews its qualification syllabuses so that they fully meet the needs of

stakeholders such as employers, students, regulatory and advisory bodies and learning

providers.

There are no changes to the syllabus for December 2024 – September 2025.

Table 1 – Amendments to syllabus

Section and subject Syllabus content

area

C2 Income chargeable to Excluded topics now has an additional

income tax item: “Gains or profits from the disposal of

capital assets”.

It should be noted that the said exclusion

is expected to apply only for the exam

year of December 2024 to September

2025.

The reason for the exclusion is that the

subject matter has not been fully

introduced by way of legislation as at the

cut-off date of 31 March 2024.

7. Reading List

Relevant articles on ACCA global website

ACCA TX Taxation (MYS) BPP Learning Media

The Income Tax Act 1967, Latest edition

The Real Property Gains Tax Act 1976, Latest edition

Sales Tax Act 2018 and Service Tax Act 2018, Latest edition

Malaysian Taxation - Principles & Practice, Choong Kwai Fatt, Latest edition, Infoworld

Malaysian Taxation, Alan Yeo Miow Cheng, Latest Edition, YSB Management Sdn Bhd

Thornton's Malaysian Tax commentaries, Richard Thornton, Latest edition, Sweet & Maxwell

Asia

Malaysian Master Tax Guide, Latest edition, CCH

Relevant Articles in Tax Guardian, CTIM

17 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

8. Approach to examining syllabus

The syllabus is assessed by a three-hour computer-based examination.

The paper will be predominantly computational and all questions are compulsory.

Section A of the exam comprises 15 multiple choice questions of 2 marks each.

Section B of the exam comprises four 10 mark questions and two 15 mark questions.

The two 15 mark questions will focus on income tax liabilities of individuals (syllabus area B)

and income tax liabilities of companies (syllabus area C).

The section A questions and the other questions in section B can cover any areas of the

syllabus.

9. Relational diagram linking Taxation – Malaysia (TX-MYS)

with other exams

This diagram shows links between this exam and other exams preceding or following it.

Some exams are directly underpinned by other exams such as Advanced Taxation –

Malaysia (ATX-MYS) by Taxation – Malaysia (TX-MYS).

This diagram indicates where students are expected to have underpinning knowledge and

where it would be useful to review previous learning before undertaking study.

18 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

10. Guide to ACCA examination structure and delivery

mode

The pass mark for all ACCA Qualification examinations is 50%.

The structure and delivery mode of examinations varies.

Applied Knowledge

The Applied Knowledge examinations contain 100% compulsory questions to encourage

candidates to study across the breadth of each syllabus. These are assessed by a two-hour

computer-based examination.

Applied Skills

The Corporate and Business Law exam is a two-hour computer-based objective test

examination for English and Global.

For the format and structure of the Corporate and Business Law or Taxation variant exams,

refer to the ‘Approach to examining the syllabus’ section of the relevant syllabus and study

guide.

The other Applied Skills examinations (PM, TX-UK, FR, AA, and FM) contain a mix of

objective and longer type questions with a duration of three hours for 100 marks. These are

assessed by a three-hour computer-based exam. Prior to the start of each exam there will

be time allocated for students to be informed of the exam instructions.

The longer (constructed response) question types used in the Applied Skills exams

(excluding Corporate and Business Law) require students to effectively mimic what they do

in the workplace. Students will need to use a range of digital skills and demonstrate their

ability to use spreadsheets and word processing tools in producing their answers, just as

they would use these tools in the workplace. These assessment methods allow ACCA to

focus on testing students’ technical and application skills, rather than, for example, their

ability to perform simple calculations.

Strategic Professional

Essentials:

Strategic Business Leader is ACCA’s case study examination at Strategic Professional and

is examined as a closed book exam of 3 hours and 15 minutes, including reading, planning

and reflection time which can be used flexibly within the examination.

Pre-seen information for the Strategic Business Leader exam will be released two weeks

before the exam sitting. The pre-seen information contains background and contextual

details in order for students to familiarise themselves with the fictitious organisation that they

will be examined on and the industry in which it operates.

The Strategic Business Leader exam will contain new information in the form of exhibits and

students are required to complete several tasks. All questions are compulsory and each

examination will contain a total of 80 technical marks and 20 professional skills marks.

As this is a closed book exam, the pre-seen information is also available within the

examination.

Strategic Business Reporting is a three-hour 15 minutes exam. It contains two sections and

all questions are compulsory. This exam contains four professional marks.

19 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

Options:

The Strategic Professional Options are all three hours and 15 minutes computer-based

exams. All contain two sections and all questions are compulsory.

All option exams contain a total of 80 technical marks and 20 professional skills marks.

The question types used at Strategic Professional require students to effectively mimic what

they would do in the workplace.

These exams offer ACCA the opportunity to focus on the application of knowledge to

scenarios, using a range of tools including word processor, spreadsheets and presentation

slides - not only enabling students to demonstrate their technical and professional skills but

also their use of the technology available to today’s accountants.

Time management

ACCA encourages students to take time to read questions carefully and to plan answers but

once the exam time has started, there are no additional restrictions as to when students may

start producing their answer.

Students should ensure that all the information and exam requirements are properly read

and understood.

20 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

11. The structure of ACCA qualification

12. Guide to ACCA examination assessment

ACCA reserves the right to examine anything contained within the study guide. This includes

knowledge, techniques, principles, theories, and concepts as specified. For the financial

accounting, audit and assurance, law and tax exams except where indicated otherwise,

ACCA will publish examinable documents once a year to indicate exactly what regulations

and legislation could potentially be assessed within identified examination sessions.

For most examinations (not tax), regulations issued or legislation passed on or before 31

August annually, will be examinable from 1 September of the following year to 31 August of

21 © ACCA 2024-2025 All rights reserved.

Taxation – Malaysia (TX-MYS)

the year after that. Please refer to the examinable documents for the exam (where relevant)

for further information.

For the MYS variant, tax exams falling within the period 1 December to 30 September will be

based on legislation passed before the previous 31 March annually, i.e. examinations falling

in the period 1 December 2024 to 30 September 2025 will be based on legislation passed

before the previous 31 March 2024.

For the avoidance of doubt, examinations falling in the period 1 December 2024 to 30

September 2025 will be based on Finance Act 2 of 2023 (Act 851) gazetted on 29 December

2023, plus relevant supplementary legislation (PU Orders) gazetted by 31 March 2024.

Since the 2023 Finance Act was passed on 31 May 2023, it will be examinable. Please refer

to the examinable documents for further information.

Regulations issued or legislation passed in accordance with the above dates will not be

examinable if the effective date is in the future, unless explicitly stated otherwise in this

syllabus and study guide or examinable documents.

The terms ‘issued’ or ‘passed’ relate to when regulations or legislation have been formally

approved.

The term ‘effective’ relates to when regulations or legislation must be applied to an entity’s

transactions and business practices.

The study guide offers more detailed guidance on the depth and level at which the

examinable documents will be examined. The study guide should therefore be read in

conjunction with the examinable documents list.

13. Learning hours and education recognition

The ACCA qualification does not prescribe or recommend any particular number of learning

hours for examinations because study and learning patterns and styles vary greatly between

people and organisations. This also recognises the wide diversity of personal, professional

and educational circumstances in which ACCA students find themselves.

As a member of the International Federation of Accountants, ACCA seeks to enhance the

education recognition of its qualification on both national and international education

frameworks, and with educational authorities and partners globally. In doing so, ACCA aims

to ensure that its qualification is recognised and valued by governments, regulatory

authorities and employers across all sectors. To this end, the ACCA qualification is currently

recognised on the education frameworks in several countries. Please refer to your national

education framework regulator for further information.

Each syllabus is organised into main subject area headings which are further broken down

to provide greater detail on each area.

22 © ACCA 2024-2025 All rights reserved.

You might also like

- New CITG Exams Scheme & SyllabusDocument35 pagesNew CITG Exams Scheme & SyllabussamuelNo ratings yet

- Tax Planning Project - Final 2022Document60 pagesTax Planning Project - Final 2022sreeja kandula789100% (1)

- IFA Coaching Session PlannerDocument2 pagesIFA Coaching Session Plannerabdesslam chamamiNo ratings yet

- Word FormationDocument38 pagesWord FormationBasil Angelis67% (3)

- TX-UK J24-M25 Syllabus and Study Guide - FinalDocument24 pagesTX-UK J24-M25 Syllabus and Study Guide - FinalKhin Lapyae TunNo ratings yet

- Foundations in Taxation FTX (UK) Jun-Dec 20 - FinalDocument19 pagesFoundations in Taxation FTX (UK) Jun-Dec 20 - FinalBurhanMTHNo ratings yet

- Final Level Advanced Taxation 2: ObjectiveDocument5 pagesFinal Level Advanced Taxation 2: Objectiveadibahhanaffi01No ratings yet

- 2 Advanced Stage TAX Module Outline Sept 2018Document5 pages2 Advanced Stage TAX Module Outline Sept 2018Aniss1296No ratings yet

- Instructional Materials For Income TaxationDocument126 pagesInstructional Materials For Income TaxationNadi HoodNo ratings yet

- Acc 247 Module Outline - 113249Document3 pagesAcc 247 Module Outline - 113249nyashatakura26No ratings yet

- ACCO 20133 Income TaxationDocument113 pagesACCO 20133 Income Taxationrhoshelle beleganio100% (1)

- Advanced Taxation (Cuac 408) Module NotesDocument89 pagesAdvanced Taxation (Cuac 408) Module Notesprecious mountainsNo ratings yet

- Tax 2 Flexible Obtl Midyear 2021Document13 pagesTax 2 Flexible Obtl Midyear 2021Jamaica DavidNo ratings yet

- Fa Ffa Syllandsg Sept19 Aug20 PDFDocument16 pagesFa Ffa Syllandsg Sept19 Aug20 PDFÄlï RäżäNo ratings yet

- IM ACCO 20033 Financial Accounting and Reporting Part 1Document95 pagesIM ACCO 20033 Financial Accounting and Reporting Part 1Montales, Julius Cesar D.No ratings yet

- Taxation (UK) : Aim of The CourseDocument2 pagesTaxation (UK) : Aim of The CourseHasan Ali BokhariNo ratings yet

- Direct Taxation (Section A) : The Institute of Cost Accountants of IndiaDocument628 pagesDirect Taxation (Section A) : The Institute of Cost Accountants of IndiakrupithkNo ratings yet

- ACC318Document171 pagesACC318TolaNo ratings yet

- Accounting Level IIIDocument94 pagesAccounting Level IIIteshome neguse100% (7)

- PGDTDocument68 pagesPGDTFahmi AbdullaNo ratings yet

- Professional Taxation TemplateDocument4 pagesProfessional Taxation Templateobiri nyakenywaNo ratings yet

- Accounting Level IIIDocument95 pagesAccounting Level IIIteshome neguseNo ratings yet

- Nust Tax Module Jan 2018Document180 pagesNust Tax Module Jan 2018Phebieon MukwenhaNo ratings yet

- Managing Costs and Finances (MA2) : Syllabus and Study GuideDocument13 pagesManaging Costs and Finances (MA2) : Syllabus and Study GuideArishba RizwanNo ratings yet

- ICB L4CT SyllabusDocument12 pagesICB L4CT SyllabusCristinaNo ratings yet

- F2 Management Accounting PDFDocument15 pagesF2 Management Accounting PDFmuhammad saadNo ratings yet

- EBS 508 Advanced Taxation OutlineDocument5 pagesEBS 508 Advanced Taxation OutlineObeng CliffNo ratings yet

- SBR-UK S24-J25 Syllabus and Study Guide - FinalDocument18 pagesSBR-UK S24-J25 Syllabus and Study Guide - Finaljanani0% (1)

- Ca (GH), Mgim, Emba F.I.M.S. (Dip. IMS), FIPFM, FCFM: FinanceDocument6 pagesCa (GH), Mgim, Emba F.I.M.S. (Dip. IMS), FIPFM, FCFM: FinanceAndrews DwomohNo ratings yet

- Draft Exam Practice Kit For CA Professional Level Tax Planning & Compliance Covering Finance Act 2018Document303 pagesDraft Exam Practice Kit For CA Professional Level Tax Planning & Compliance Covering Finance Act 2018Optimal Management Solution100% (1)

- P15 - New - CmaDocument640 pagesP15 - New - Cmaideal100% (1)

- ICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKDocument206 pagesICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKSaiful Islam MozumderNo ratings yet

- Management Accounting (MA/FMA) : Syllabus and Study GuideDocument15 pagesManagement Accounting (MA/FMA) : Syllabus and Study Guideduong duongNo ratings yet

- Taxation Syllabus ACCADocument4 pagesTaxation Syllabus ACCAMadina NugmetNo ratings yet

- Unit A Administrative FrameworkDocument14 pagesUnit A Administrative Frameworklloyd madanhireNo ratings yet

- Public Finance and Taxation - 1 Nbaa Cpa-1Document265 pagesPublic Finance and Taxation - 1 Nbaa Cpa-1Osmund100% (1)

- Ab Fab Syllandsg Sept19 Aug20 PDFDocument18 pagesAb Fab Syllandsg Sept19 Aug20 PDFAshwin JainNo ratings yet

- Acco 20173 Business TaxesDocument26 pagesAcco 20173 Business TaxesBea BonitaNo ratings yet

- Direct Taxation: IntermediateDocument550 pagesDirect Taxation: IntermediateShreya JainNo ratings yet

- Infonet College: Learning GuideDocument13 pagesInfonet College: Learning Guidemac video teachingNo ratings yet

- 2855study Manual of Tax-II (2022) FinalDocument601 pages2855study Manual of Tax-II (2022) FinalMd. Ferdowsur RahmanNo ratings yet

- Icaew Cfab Pot 2019 SyllabusDocument10 pagesIcaew Cfab Pot 2019 SyllabusAnonymous ulFku1vNo ratings yet

- Syllabus - Principles of Accounting I (ACCT2200-01 & 06 - Spring 2021Document10 pagesSyllabus - Principles of Accounting I (ACCT2200-01 & 06 - Spring 2021SYED HUSSAINNo ratings yet

- 2022 2023 - Fina 6005Document8 pages2022 2023 - Fina 6005Shanawaz KhanNo ratings yet

- RPS Akuntansi Menengah IIDocument18 pagesRPS Akuntansi Menengah IIAnyaaNo ratings yet

- DipIFR D24-J25 Syllabus and Study Guide - FinalDocument15 pagesDipIFR D24-J25 Syllabus and Study Guide - FinalFrans R. Calderon MendozaNo ratings yet

- Competency Appraisal 2022 Modular Plan - Second Semester, 2021-2022Document10 pagesCompetency Appraisal 2022 Modular Plan - Second Semester, 2021-2022Ben Vallecer Espiritu Jr.No ratings yet

- Principles of Taxation Study Manual 2013 PDFDocument316 pagesPrinciples of Taxation Study Manual 2013 PDFDimitar StoevNo ratings yet

- CH 1Document102 pagesCH 1senayNo ratings yet

- Professional TaxationDocument15 pagesProfessional Taxationobiri nyakenywaNo ratings yet

- Tax Laws June2020 Old Syllabus - CS ExecutiveDocument824 pagesTax Laws June2020 Old Syllabus - CS ExecutivePravinNo ratings yet

- Learning Guide (Specific To TAX03A3)Document18 pagesLearning Guide (Specific To TAX03A3)fisekilenhlapoNo ratings yet

- Module 1 Conceptual FrameworkDocument8 pagesModule 1 Conceptual FrameworkHeart Erica AbagNo ratings yet

- Tax-Technician-Student-Handbook-2022_PrintDocument41 pagesTax-Technician-Student-Handbook-2022_Printaparnavelicheti23No ratings yet

- AC415 Mar To Apr 2022Document7 pagesAC415 Mar To Apr 2022portiafadzaiNo ratings yet

- CUAC 408 Advanced Taxation Course Outline 2023Document9 pagesCUAC 408 Advanced Taxation Course Outline 2023Fungai ManganaNo ratings yet

- Curricullem Accounts and Budget Support Level IIIDocument70 pagesCurricullem Accounts and Budget Support Level IIIMebrahatu Gebrewahad100% (1)

- Local Media1181068412465603613Document13 pagesLocal Media1181068412465603613Ma. Trina AnotnioNo ratings yet

- Icwai: The Institute of Cost and Works Accountants of India (ICWAI)Document12 pagesIcwai: The Institute of Cost and Works Accountants of India (ICWAI)mknatoo1963No ratings yet

- Corporate Tax PlanningDocument85 pagesCorporate Tax PlanningLavi KambojNo ratings yet

- Tool Kit for Tax Administration Management Information SystemFrom EverandTool Kit for Tax Administration Management Information SystemRating: 1 out of 5 stars1/5 (1)

- Diagnostic-Test English5 2022-2023Document5 pagesDiagnostic-Test English5 2022-2023Queen Ve NusNo ratings yet

- Tide Times and Tide Chart For Dammam PDFDocument8 pagesTide Times and Tide Chart For Dammam PDFAnonymous g5nMjONo ratings yet

- Hispanic Tradition in Philippine ArtsDocument14 pagesHispanic Tradition in Philippine ArtsRoger Pascual Cuaresma100% (1)

- RunEco EP600 Datasheet 2018Document2 pagesRunEco EP600 Datasheet 2018widnu wirasetiaNo ratings yet

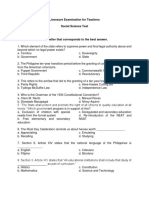

- Licensure Examination For TeachersDocument14 pagesLicensure Examination For Teachersonin saspaNo ratings yet

- 107 Hand Tool Field Maintenance v0311Document8 pages107 Hand Tool Field Maintenance v0311rabbit_39No ratings yet

- Physiology of LactationDocument29 pagesPhysiology of Lactationcorzpun16867879% (14)

- Green AlgaeDocument3 pagesGreen AlgaeGladys CardonaNo ratings yet

- Kitex Annual Report - WEB View - 2017-18Document160 pagesKitex Annual Report - WEB View - 2017-18ashokvardhnNo ratings yet

- Perlengkapan Bayi Ellena and FamilyDocument9 pagesPerlengkapan Bayi Ellena and FamilyintanchairranyNo ratings yet

- Perfecto Floresca Vs Philex Mining CorporationDocument11 pagesPerfecto Floresca Vs Philex Mining CorporationDelsie FalculanNo ratings yet

- HetzerDocument4 pagesHetzerGustavo Urueña ANo ratings yet

- Industry ProfileDocument9 pagesIndustry ProfilesarathNo ratings yet

- Trades About To Happen - David Weiss - Notes FromDocument3 pagesTrades About To Happen - David Weiss - Notes FromUma Maheshwaran100% (1)

- Question Bank: Metabolite Concentration ( - )Document2 pagesQuestion Bank: Metabolite Concentration ( - )Kanupriya TiwariNo ratings yet

- Songs of SaintsDocument8 pagesSongs of SaintsDhong ZamoraNo ratings yet

- Adetunji CVDocument5 pagesAdetunji CVAdetunji AdegbiteNo ratings yet

- Abcp Offering CircularDocument2 pagesAbcp Offering Circulartom99922No ratings yet

- Masonic SymbolismDocument19 pagesMasonic SymbolismOscar Cortez100% (7)

- MBA Final Year ReportDocument9 pagesMBA Final Year ReportmmddugkyfinanceNo ratings yet

- Module 2 The Self From Philosophical and Anthropological PerspectivesDocument10 pagesModule 2 The Self From Philosophical and Anthropological PerspectivesAjhay BonghanoyNo ratings yet

- Explore (As) : Types of Commission and InterestsDocument4 pagesExplore (As) : Types of Commission and InterestsTiffany Joy Lencioco GambalanNo ratings yet

- CAN LIN ProtocolDocument60 pagesCAN LIN ProtocolBrady BriffaNo ratings yet

- Gayatri MantraDocument2 pagesGayatri MantraAnandh ShankarNo ratings yet

- Joaquin E. David v. Court of Appeals and People of The Philippines, G.R. Nos. 111168-69. June 17, 1998Document1 pageJoaquin E. David v. Court of Appeals and People of The Philippines, G.R. Nos. 111168-69. June 17, 1998Lemrose DuenasNo ratings yet

- 7 Eleven MalaysiaDocument10 pages7 Eleven MalaysiaKimchhorng HokNo ratings yet

- Aromaterapia Emocional - doTERRADocument2 pagesAromaterapia Emocional - doTERRAAlvaro Andre Diaz100% (1)

- Sample QuestionsDocument15 pagesSample QuestionsAnonymous MtKJkerbpUNo ratings yet