Professional Documents

Culture Documents

PSIB Brochure

PSIB Brochure

Uploaded by

toadityarajput1999Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PSIB Brochure

PSIB Brochure

Uploaded by

toadityarajput1999Copyright:

Available Formats

PSIB

PSIB is a New Generation Finishing School which

develops Professionals for the Banking/KPO

sector, primarily through a process of

Education, Training, Counseling and

Professional Coaching.

About PSIB

PSIB is a New Generation Finishing School which develops

Professionals for the Banking/KPO sector, primarily

through a process of Education, Training, Counseling and

Professional Coaching.

PSIB offers host of Industry related Training Programs to

groom candidates to be Job-ready for the Financial

Sector. Our Programs has/have been designed keeping in

mind the needs of the BFSI sector.

PSIB offers a thorough practical learning initiative to

candidates, which is aimed to develop overall personality

of the candidate. Using the gained/imbibed knowledge, A

PSIBian can have a career with accelerated growth in the

Bank/Company.

PSIB is run by BFSI Professionals, having 100 years of

collective BFSI experience.

Placement

Salary

Our

Record Range Recruiters

95% 3-4 LPA 50+

What Could You Become ?

Finance Analyst Investment Banking Associate Risk Management Cosultant

Money Market Analyst Global Finance Researcher Financial Makret Advisor

Key Highlights

Program Duration Program Delivery Mentors Support Assistance Online Course Data

2 Months Live Classes Industry Specialised 24/7 PDF Available

PSIB Recruiters

To be a premier institute for developing and

nurturing competent professionals in Banking

field.

Vision

To develop professionally qualified and competent

Banking professionals primarily through a process

of education, training, examination, counselling

and continuing professional development

programs. Mission

Certificate on Completion!

Upon Completing The PSIB Banking Course, You Will Receive An Industry-

Recognized, Internationally Accredited Certificate Of Excellence.

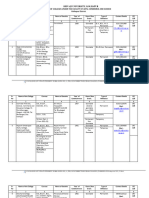

CURRICULUM

KYC/AML Analyst Program

The recently introduced KYC/AML Analyst Program by PSIB offers Aspiring candidates a long-term opportunity to

make a mark in this ever-growing field, with great potential for next 25 years.

Post Completion of the 1-Months Training Program, the candidate will have deep domain knowledge of KYC/AML

Verticals and can have multiple opportunities in back-end Analyst Profiles in both Banks an MNC’s.

The Training Imparted under this Program covers both Theoretical Concepts and Practical Case Studies, which is pre-

requisite of the profile.

Programme Highlights:

Extensive 70 Hours Training Program with Case Studies.

Post Training, the Candidate can opt for Analyst/Back-end Roles both in MNC and Banks

Program offers potential to work indirectly for foreign banks with on-site opportunities.

Program Coverage:

KYC AML Money Laundering

KYC Introduction AML Compliance Program Black Money Sources

KYC Guidelines Sanction Screening ML Basics & Role of Shells

Types of KYC’s Role of CDD and EDD ML Steps

Mandatory Reporting by Banks AML – Red Flags ML Traditional Techniques

KYC for Different Account Types AML – Emerging Trends ML In Financial Markets

CBRP – Certified Bank Ready Program

The CBRP Program offered by PSIB is dedicated towards offering end-to-end Banking Training to Aspiring Bankers

who want to Join the Branch Banking Operations.

Post Completion of the 2-Month Extensive Training Program, the candidate will be hired for various Branch Banking

Operations Roles like - Teller Executive, Welcome Desk Officer, Remittance Officer, Cheque Clearing Officer etc.

In addition to introducing all aspects of Banking, the CBRP Program also focuses on soft-skills and cross-selling of

various third-party products, which have become integral to a branch-operations profile.

CBRP Program is carefully structured and stitched to include all pre-requisites for this role and it allows PSIB

Candidates to easily amalgamate in the Bank, with minimal training at the Bank’s end.

Programme Highlights:

150-hours program spread across 2 months.

Training by domain specialist Senior Bankers/Ex-Bankers

Hands on Finacle Software Training.

Program Coverage:

Banking Basics Products & Services Third Party Products

Banking Overview Loans Types & Basics Financial Markets Basics

Banking Operations - Deposits Paper Based Payments Stocks & Bonds

KYC Guidelines in Banking Electronic Payments Mutual Funds as Investment

Teller Operations Debit & Credit Cards Insurance Basics & Types

Financial Inclusion Cheque Clearing Operations Sales of third-party products

Retail, Business & NRI Banking Customer Service

CIBP – Certified Investment Banking Program

The CIBP Program of PSIB offers Aspiring Investment Bankers an excellent opportunity to join leading Financial

Institutions/KPO’s in the Investment Domain.

Post Completion of the 2-Months Training Program, the candidate will have deep domain knowledge of Capital

Markets and related Verticals.

The Training Imparted under this Program covers both Theoretical Concepts and Practical Case Studies for

Implementing the gained knowledge.

Programme Highlights:

Extensive 120 Hours Training Program.

Training by domain specialist who have prior IB industry experience.

Broad Spectrum Program Coverage offering additional Financial Planning Training.

Program Coverage:

Investment Basics Investment Products Financial Planning (FP)

Financial Markets Overview Basics of Stocks Financial Planning Need

Financial Markets Components Stock Markets Financial Planning Basics

Capital Markets Bonds as Investment Components of a FP

Bond Markets Mutual Funds Wealth Management

Money Market Govt Bonds & T-Bills WM Vs FP

Investment Importance & Need

Loans & Cards Analyst Program

The Loans & Cards Analyst Program offered by PSIB provides opportunity to candidates to kick-start their career in

Underwriting & Fraud Backend Profiles in Both Banks and MNC’s.

Post Completion of the 1-Month Training Program, the candidate will have focused domain knowledge of

Underwriting, Credit Cards, KYC and Fraud related modules.

Both Underwriting & Fraud Related Profiles are here to stay for next many more years, hence this program offers a

great career opportunity for long-term.

Programme Highlights:

Extensive 60 Hours Training Program.

Dual Opportunity to start career either in Banks or MNC’s in Backend Roles.

Unique Opportunity to work in Fraud Analyst related Roles

Program Coverage:

Banking Basics Products & Services Third Party Products

Loans Basics Cards Basics & Debit Cards KYC Basics & Guidelines

Types of Loans Cards - Parameters Transaction Monitoring Process

Risks in Loans Fraud Basics Reporting Requirements

Creditworthiness Checks Fraud Types KYC Documentation for various

Underwriting Parameters & Frauds – Customer Diligence Accounts

Process Frauds – Bank Diligence RE-KYC, E-KYC & Video KYC

KYC Documents for Loans

We Train The Bankers Of Tomorrow

Since our inception, PSIB is preparing the bankers from the basics to professional standard through the usage of

smart learning during our diploma of Banking & Finance & we inspire new ways of how to be successful in banking

operations.

We Create Our Own Content — Trainers & Experts at PSIB have formulated their own set of

content that has proved to be beneficial towards the better learning curve for both of our

programs.

We Build Relationships — The real reason we get to train our students so well is because of

the fact that our trainers are just not another teacher in the classroom. They are more of an

advisor, a friend & a long lasting support to make to achieve the unimaginable.

We create Maximum Job Opportunities — We have the association to the most reputed

brands who have been showering our students with various job opportunities in the banking

& private finance sectors.

It’s Always a WIN-WIN with PSIB — None of our students have been left out while learning

during the classes or with the assistance for job from our placement cell. We take care of

everything.

What You Get By Enrolling In PSIB

After completion of Certified Post Graduate Retail Banking program, students would understand Banking a core business

function and basic principles of Retail Banking and its products.

This program enable the students to capture dynamic realities of Financial Inclusion while emphasizing on different aspects

of banking, prospecting and CASA acquisition, complaint resolution and other elements of customer service.

For the successful completion of the program, the candidate should have 90% attendance and 70% marks in the internal

exams.

On the basis of attendance, punctuality & content knowledge, PSIB certify the candidates for Certified Retail Banking

Program that enables them to work with a Bank as an Officer.

This program enable the students to

capture dynamic realities of Financial Programme Fees:

Inclusion while emphasizing on different

aspects of banking, prospecting and CASA Rs. 15,000

Rs. 40,000

Finacle & Study Training Fees (After

acquisition, complaint resolution and Material Fees (At the receiving the offer

time of enrollment) letter)

other elements of customer service.

PSIB Placement Cell

Student Testimonials

Dev Gupta Simran Sharma Bhawna Chauhan

a Month ago a Month ago a Month ago

Thanks PSIB for giving all kinds of support in placing me in Excellent institute with 100% transparency student The learning experience was very good here in PSIB. I

WNS. special thanks to JATIN SIR, SAKSHI MAM, for all your approach is very honest transparent , training is practical would recommend specially freshers to join this institute

teaching And motivation. it was a great experience with excellent. Got placed with kotak Mahindra bank in service to get placed in banking sector. I got placed in WNS....ans

PSIB. offer role in Ghaziabad location. To all the freshers trust its a training institute which gives the training on banking.

Psib - the effort they put in to make a students career is Thanku you for Jatin sir and Sakshi ma’am.

what differentiates them from other institutes . PSIB is

better then any MBA college too.

Thanks psib.

Shruti N Shakya Vansh Sharma Anjali Sachdeva

a Month ago a Month ago a Month ago

I have really good experience with the PSIB team from Thanks psib for giving me the opportunity start my carrer Thanks Psib for placing me in ICICI bank as a CSO. The

training to placement into right job. I'm thankful to the PSIB as an employee in a reputed bank like Kotak Mahindra as training provided by PSIB helped me to get a great

team for their dedication and efforts for brighten up the a CSM. PSIB is a great platform for freshers, to find the best platform and make my career in banking. The training is

future of candidates.

way to start their carrer in a professional field. really helpful. PSIB provides good opportunies for those

Most importantly the structure of working which is very who wants to work in bank.

much clear and transparent with all satisfactory results.

I got my job because of PSIB and I owe big thanks and

wishes for their success.

Tushar Rana Neha Mahi Gurlal Singh Pannu

a Month ago a Month ago a Month ago

I had an amazing experience with psib I got selected in Thank you PSIB for such an amazing opportunity. I got Thanks to psib for placing me as assistant manager in

kotak mahindra bank as service officer. I have learnt placed in ICICI bank as a Value Banker.

kotak mahindra bank and also thanks to jatin sir they

finacle and all banking terms here. I have got what Special thanks to Jatin Sir for giving me positive thoughts.

supported us and trained us.

actually is good for my carrier growth .thanx a lot psib.. I have completed my two months banking training

specially Jatin sir & sakshi man. modules and one month finacale banking software. I

highly recommend this to all those who want to work in

banking sector.

Pragati Rajpal Nitu Upadhyay Rajan Singh

a Month ago a Month ago a Month ago

My experience at PSIB was very nice. This institute provides Thanx alot to PSIB to make easy for me getting my dream My name is Rajan Singh and I did my banking training

a complete training programme to make us capable to job. i would like to thank all faculty members of PSIB diploma from PSIB as I wanted to make my career in the

become a professional banker. They not only provide the special thanks to Jatin Sir & Sakshi Ma’am. In PSIB i banking domain. My experiencd at PSIB was very

theoretical knowledge but also focus on the practical gained lots of knowledge which is very beneficial for my knowledgeable as the focus was on pure practical

aspect of banking to make us bank ready. The faculty at career. In my cource i have learnet everthink about concepts skills of banking and after my training I got

PSIB is very cooperative and supporting.

banking sector (2 months class room 1 month finacle placed in kotak mahindra bank as Asst Manager.

I would like to thank PSIB for placing me at KOTAK traning) thank you PSIB for Placing me in ICICI BANK as

MAHINDRA BANK as service officer. AM in noida.

Contact Information

+91 9910-650-029 info@psib.edu.in

Office No- 910, Galleria Tower, DLF , Phase 4, Near IFFCO Chawk,

Metro Station, Gurgaon.

http://psib.ebslon.com/

https://www.linkedin.com/in/professional-school-of-indian-banking-51a5796b/

https://www.facebook.com/ProfessionalSchoolOfIndianBanking

https://www.youtube.com/channel/UCdjMr Ylsntwy 2I0JjwKiA 8 _

https://www.instagram.com/psib india/ _

You might also like

- Certified Financial PlannerDocument2 pagesCertified Financial Plannersd1207No ratings yet

- Balance Statement ReportingDocument12 pagesBalance Statement ReportingahnaflionheartNo ratings yet

- SIPT. BrochureDocument23 pagesSIPT. BrochureSaloni SumanNo ratings yet

- WWW - Asps.edu - In: Get A Professional Edge..Document6 pagesWWW - Asps.edu - In: Get A Professional Edge..Charu KaushikNo ratings yet

- MF 847 inDocument24 pagesMF 847 inThota pavan kumarNo ratings yet

- Bits Pilani BrochureDocument23 pagesBits Pilani Brochureharshita.agarwaldulbNo ratings yet

- Nanyang Mba Career ReportDocument18 pagesNanyang Mba Career ReportRyanNo ratings yet

- b.com. Gapa Tcsc Brochure.Document24 pagesb.com. Gapa Tcsc Brochure.ideam6435No ratings yet

- creating-together-graduate-opportunitiesDocument9 pagescreating-together-graduate-opportunitiesbradleyvenom55No ratings yet

- CPBFI College Brochure BEYONDDocument8 pagesCPBFI College Brochure BEYONDcsoni7991No ratings yet

- Adif 2020Document9 pagesAdif 2020Asadullah HassanNo ratings yet

- Post Graduate Diploma in Banking Management - Flagship Course - TimesProDocument18 pagesPost Graduate Diploma in Banking Management - Flagship Course - TimesProTimes PNo ratings yet

- Investment Banking & Capital Markets: Post Graduation Program inDocument8 pagesInvestment Banking & Capital Markets: Post Graduation Program inRose martinNo ratings yet

- Iibf Amp Brochure Xiii - 2024-25Document28 pagesIibf Amp Brochure Xiii - 2024-25Deepak DhamechaNo ratings yet

- AF Brochure Low ResDocument4 pagesAF Brochure Low Resduality bbwNo ratings yet

- Job DetailsDocument3 pagesJob DetailsAbhi ShekNo ratings yet

- AUH CRC Job Notice - Hike Education - For UG, PG 2024 Passing BatchDocument2 pagesAUH CRC Job Notice - Hike Education - For UG, PG 2024 Passing BatchKunal DhankharNo ratings yet

- ISB PCPDM Batch 9 BrochureDocument26 pagesISB PCPDM Batch 9 Brochurejtbpvkj8gfNo ratings yet

- FinShiksha Learning Championship 2019 - IIM Calcutta PDFDocument18 pagesFinShiksha Learning Championship 2019 - IIM Calcutta PDFAyush ChamariaNo ratings yet

- HRD 5B Group 5Document13 pagesHRD 5B Group 5Vinay PeriwalNo ratings yet

- BSE Institute Limited KolkataDocument14 pagesBSE Institute Limited KolkataGaurav Singh, RajputNo ratings yet

- Fin For Non Fin BochureDocument7 pagesFin For Non Fin Bochureankit rankaNo ratings yet

- Quintedge IB BrochureDocument15 pagesQuintedge IB Brochurehimanshibatra2005No ratings yet

- FP&a Manama Bahrain AugusDocument6 pagesFP&a Manama Bahrain AugusVashirAhmadNo ratings yet

- Sda IembDocument18 pagesSda IembJayNo ratings yet

- UWA X Sasin - GMBA Brochure 24 - 11 - 2023Document28 pagesUWA X Sasin - GMBA Brochure 24 - 11 - 2023Geo EstebanNo ratings yet

- ITMedelweissbrochureDocument2 pagesITMedelweissbrochureAnwesha MukherjeeNo ratings yet

- Section Head, Investment Bank Audit: RHB Banking GroupDocument2 pagesSection Head, Investment Bank Audit: RHB Banking Groupnurulhanim023No ratings yet

- SD - BSBINS603 Simulation Pack TemplateDocument17 pagesSD - BSBINS603 Simulation Pack TemplatejhamespstNo ratings yet

- 11 Month Imarticus PGP in New Age BankingDocument12 pages11 Month Imarticus PGP in New Age BankingPuja YadavNo ratings yet

- Bsi Indonesia Training Schedule 2024Document26 pagesBsi Indonesia Training Schedule 2024Ekklesia Bema PrasyantiNo ratings yet

- MBA Propeller (Brochure)Document8 pagesMBA Propeller (Brochure)Aashutosh RathodNo ratings yet

- DFBE Placement Report 2021 22Document10 pagesDFBE Placement Report 2021 22Devesh SinghNo ratings yet

- BSI Indonesia Training Schedule 2024Document26 pagesBSI Indonesia Training Schedule 2024Reza WijayaNo ratings yet

- FinShiksha Course Brochure - 2019Document18 pagesFinShiksha Course Brochure - 2019SiddarthanSrtNo ratings yet

- Full Time ProgramsDocument3 pagesFull Time Programsrajeevv_6No ratings yet

- PDP Concept Paper v1.2Document7 pagesPDP Concept Paper v1.2Abdul RaufNo ratings yet

- PGDM Hybrid - 3 Fold Leaflet - WebDocument6 pagesPGDM Hybrid - 3 Fold Leaflet - Websakshi.desaiNo ratings yet

- Cmi Qualifications in Management & Leadership (Level 3, 5 and 7)Document7 pagesCmi Qualifications in Management & Leadership (Level 3, 5 and 7)Navaneeth PurushothamanNo ratings yet

- FinX - Fintso Internship Program For College Students 23 Jan 2022Document4 pagesFinX - Fintso Internship Program For College Students 23 Jan 2022Master FahimNo ratings yet

- FinX - Fintso Internship Program For College Students 23 Jan 2022Document4 pagesFinX - Fintso Internship Program For College Students 23 Jan 2022Master FahimNo ratings yet

- I Ibf Vision Feb 22 Final 220211Document8 pagesI Ibf Vision Feb 22 Final 220211RAGHU RNo ratings yet

- Heena Siddiqui: ObjectiveDocument2 pagesHeena Siddiqui: Objectiveheena siddiquiNo ratings yet

- UG Business StudiesaDocument26 pagesUG Business StudiesaMarya AliNo ratings yet

- Summer Training Project Report: Sales Promotion, Recruitment, Training & Development of Life AdvisorsDocument92 pagesSummer Training Project Report: Sales Promotion, Recruitment, Training & Development of Life AdvisorsAbhishek GuptaNo ratings yet

- SeemaMohanta (13 0)Document4 pagesSeemaMohanta (13 0)rajnishsinghNo ratings yet

- FRM BrochureDocument6 pagesFRM BrochureDekhsNo ratings yet

- LD Axis BankDocument14 pagesLD Axis BankZenish KhumujamNo ratings yet

- PSBF Cima E-BrochureDocument21 pagesPSBF Cima E-BrochureVipin SachdevaNo ratings yet

- CFP Syllabus Module 1 FPSB Investment Planning Specialist GuideDocument41 pagesCFP Syllabus Module 1 FPSB Investment Planning Specialist Guideanand maheshwariNo ratings yet

- Cfa BrochureDocument14 pagesCfa BrochureAnshNo ratings yet

- Brochure PGCPIBDocument8 pagesBrochure PGCPIBRuhani RathoreNo ratings yet

- Business Administration: Achieve Real World Success With An MBA or PgdbaDocument4 pagesBusiness Administration: Achieve Real World Success With An MBA or PgdbajohnNo ratings yet

- Exicutive MBADocument10 pagesExicutive MBALady RedNo ratings yet

- Ritwika Marar ResumeDocument3 pagesRitwika Marar ResumeLinkD ResourcesNo ratings yet

- AMP Brochure 2022-23Document24 pagesAMP Brochure 2022-23Rahul SinghNo ratings yet

- Botswana ProspectusDocument32 pagesBotswana Prospectusttmothetho99No ratings yet

- Kotak Mahindra Bank (HRM)Document16 pagesKotak Mahindra Bank (HRM)DivyaNo ratings yet

- MBA in Business Analytics Brochure - Jan 25Document28 pagesMBA in Business Analytics Brochure - Jan 25arvindyadavNo ratings yet

- CFX - Employablity Program - Brochure - CompressedDocument8 pagesCFX - Employablity Program - Brochure - Compressedsujal JainNo ratings yet

- A Glimpse Into Your Project Management Future: 8 Certifications That Can Work For YouFrom EverandA Glimpse Into Your Project Management Future: 8 Certifications That Can Work For YouNo ratings yet

- Activity Performance Worksheet In: Computer Systems ServicingDocument8 pagesActivity Performance Worksheet In: Computer Systems ServicingSACATA NATIONAL HIGH SCHOOLNo ratings yet

- Carrie Lettiere Resume 2023Document3 pagesCarrie Lettiere Resume 2023api-251825190No ratings yet

- International Trade SyllabusDocument3 pagesInternational Trade SyllabusDialee Flor Dael BaladjayNo ratings yet

- Concept Note For College ConferenceDocument6 pagesConcept Note For College Conferencesujal JainNo ratings yet

- High School Franchise Rs. 8.02 Million Sep-2020Document19 pagesHigh School Franchise Rs. 8.02 Million Sep-2020Zeeshan NazirNo ratings yet

- Leading On The Edge of Chaos: Emmett C. Murphy Mark A. MurphyDocument16 pagesLeading On The Edge of Chaos: Emmett C. Murphy Mark A. MurphyVinay ChagantiNo ratings yet

- Successful Cross-Cultural ManagementDocument188 pagesSuccessful Cross-Cultural ManagementHajua LeoNo ratings yet

- 1 Tools and Analysis of The Furniture IndustryDocument15 pages1 Tools and Analysis of The Furniture Industrytiko bakashviliNo ratings yet

- Consumer Studies-ENTREPRENEURSHIP FinalDocument77 pagesConsumer Studies-ENTREPRENEURSHIP Finalcianjacob46No ratings yet

- Strategy: Discussion QuestionsDocument11 pagesStrategy: Discussion QuestionsTTNo ratings yet

- Online Book StoreDocument25 pagesOnline Book Store20D2039 PRANAV KUMAR GOSWAMYNo ratings yet

- Editorial Consolidation (March) 2023Document49 pagesEditorial Consolidation (March) 2023Atul AnandNo ratings yet

- NSTP Report Group 4Document3 pagesNSTP Report Group 4torno amielNo ratings yet

- 2022 TVET Glossary of TermsDocument158 pages2022 TVET Glossary of TermsZ FNo ratings yet

- Bowman - The Waste Management Analysis ToolDocument188 pagesBowman - The Waste Management Analysis ToolAna Desiree Abing-Gallo Lastimosa-PojasNo ratings yet

- Gmail - CADC - Chegg India - Placement Drive B.Tech (All Branches), MBA - 2023 BatchDocument2 pagesGmail - CADC - Chegg India - Placement Drive B.Tech (All Branches), MBA - 2023 BatchHarshit gargNo ratings yet

- CH 2 Sectors of Indian Economy Practice MSDocument6 pagesCH 2 Sectors of Indian Economy Practice MSARSHAD JAMILNo ratings yet

- MARK101 213 AUT Assessment Brief 2022 - TaggedDocument7 pagesMARK101 213 AUT Assessment Brief 2022 - Taggedcaprice burrellNo ratings yet

- Final Presentation - The Body Shop LmuDocument26 pagesFinal Presentation - The Body Shop LmuJancy RoyNo ratings yet

- ExcellenceDocument268 pagesExcellenceKunwarbir Singh lohatNo ratings yet

- Semester 1 Live Class Session Schedule BcomDocument4 pagesSemester 1 Live Class Session Schedule BcomshiwangNo ratings yet

- College List 2021 - 22Document98 pagesCollege List 2021 - 22Suyash KerkarNo ratings yet

- Business Management and Behavioural Studies: Certificate in Accounting and Finance Stage ExaminationDocument3 pagesBusiness Management and Behavioural Studies: Certificate in Accounting and Finance Stage ExaminationSYED ANEES ALINo ratings yet

- Instructor Manual For Intermediate Accounting 11th Edition by Loren A Nikolai John D Bazley Jefferson P JonesDocument24 pagesInstructor Manual For Intermediate Accounting 11th Edition by Loren A Nikolai John D Bazley Jefferson P JonesJasonLewiscpkx100% (41)

- Entrep Module 6Document7 pagesEntrep Module 6Marie VillanuevaNo ratings yet

- 2020 Search Fund PrimerDocument78 pages2020 Search Fund PrimerLiorNo ratings yet

- Small Business Success - A Review of The Literature (Linda Shonesy, Et Al, 1998) PDFDocument17 pagesSmall Business Success - A Review of The Literature (Linda Shonesy, Et Al, 1998) PDFregineNo ratings yet

- 100 Years of Corporate Planning - From Industrial Capitalism To Intellectual Monopoly Capitalism Through The Lenses of The HBR (1922-2021)Document40 pages100 Years of Corporate Planning - From Industrial Capitalism To Intellectual Monopoly Capitalism Through The Lenses of The HBR (1922-2021)Gabriel DAnnunzioNo ratings yet

- Strategic Alliances For Corporate Sustainability Innovation - 2022 - Long RangeDocument20 pagesStrategic Alliances For Corporate Sustainability Innovation - 2022 - Long RangeHisham HeedaNo ratings yet