Professional Documents

Culture Documents

Banking Operations

Banking Operations

Uploaded by

vishalkumaran10Copyright:

Available Formats

You might also like

- Financial Services & MarketsDocument3 pagesFinancial Services & MarketsAbhishek SaravananNo ratings yet

- Law and Practice of BankingDocument2 pagesLaw and Practice of BankingJobin George100% (4)

- Banking LawDocument3 pagesBanking LawRajivCoolNo ratings yet

- Semester: III Finance Specialisation: Recommended BooksDocument12 pagesSemester: III Finance Specialisation: Recommended Booksshivaraj p yNo ratings yet

- Banking - Theory and Practices 18MBAFM31-1Document88 pagesBanking - Theory and Practices 18MBAFM31-1Nandeep Hêãrtrøbbér50% (2)

- 4.36 M.com Banking & FinanceDocument18 pages4.36 M.com Banking & FinancegoodwynjNo ratings yet

- Sem-IX Banking Law - Opt PDFDocument3 pagesSem-IX Banking Law - Opt PDFAlkaNo ratings yet

- Banking Law Optional Paper I & Ii Course Teacher: Dr. Kiran Kori Objectives of The CourseDocument3 pagesBanking Law Optional Paper I & Ii Course Teacher: Dr. Kiran Kori Objectives of The CourseNaveen SihareNo ratings yet

- Banking Laws - Updated Syllabus PDFDocument4 pagesBanking Laws - Updated Syllabus PDFjerinNo ratings yet

- Practice Banking SyllabusDocument2 pagesPractice Banking SyllabusSrinivas GowdaNo ratings yet

- Banking Theory and PracticeDocument1 pageBanking Theory and Practiceshivarajungeetha4048No ratings yet

- Banking LawDocument5 pagesBanking Lawrishabh1511900% (3)

- Banking System 1Document52 pagesBanking System 1Banshul KumarNo ratings yet

- Syllabus - Banking Law AugustDocument5 pagesSyllabus - Banking Law Augustshikah sidarNo ratings yet

- Mba-III-principles & Practices of Banking NotesDocument97 pagesMba-III-principles & Practices of Banking NotesTilak RokrNo ratings yet

- Banking and InsuranceDocument13 pagesBanking and InsuranceKiran Kumar50% (2)

- LLB Banking Syllabus 2023Document7 pagesLLB Banking Syllabus 2023Shivam ChoudharyNo ratings yet

- Law and Practice of Banking II Sem VIDocument3 pagesLaw and Practice of Banking II Sem VIvaibhavsalgaonkarpcNo ratings yet

- Banking Law Course Outline#Document3 pagesBanking Law Course Outline#Shouryaa ShubhamNo ratings yet

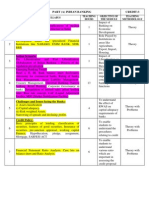

- Part (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching MethodologyDocument3 pagesPart (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching Methodologyrajat_177229No ratings yet

- Law & Practices of BankingDocument2 pagesLaw & Practices of BankingShahim MaindalaNo ratings yet

- BA7026 Banking Financial Services ManagementDocument120 pagesBA7026 Banking Financial Services ManagementchandrasekharNo ratings yet

- BankingDocument7 pagesBankingPiyush RewatkarNo ratings yet

- Banking Theory Law & Practice Notes Govt - CADocument70 pagesBanking Theory Law & Practice Notes Govt - CAmanjushreenambi.05No ratings yet

- Bfs Notes Old VtuliveDocument97 pagesBfs Notes Old VtuliveSyed MD FaizanNo ratings yet

- PPMB COMPLETE NOTES PDF (3)Document97 pagesPPMB COMPLETE NOTES PDF (3)Javeedali MjNo ratings yet

- Ba8c3banking and Financial InstitutionsDocument1 pageBa8c3banking and Financial InstitutionsAyush ChhabraNo ratings yet

- SyllabusDocument8 pagesSyllabusyamumini07100% (1)

- Law and Practice of Banking I Sem VIDocument4 pagesLaw and Practice of Banking I Sem VIvaibhavsalgaonkarpcNo ratings yet

- Tamil Nadu National Law University: Course ObjectivesDocument4 pagesTamil Nadu National Law University: Course ObjectivessriprasadNo ratings yet

- 3.6: Indian Financial System: Books For ReferenceDocument1 page3.6: Indian Financial System: Books For ReferencesanjeevseshannaNo ratings yet

- Ba7026 Banking Financial Services ManagemntDocument122 pagesBa7026 Banking Financial Services ManagemntRithesh RaNo ratings yet

- Banking Insurance and Operations Material (Final)Document113 pagesBanking Insurance and Operations Material (Final)NakulNo ratings yet

- 2 Financial Marek T and ServicesDocument2 pages2 Financial Marek T and Servicesbhaskarganesh0% (1)

- Banking Practice & Proc. Course OutlineDocument5 pagesBanking Practice & Proc. Course OutlineSuresh Vadde50% (2)

- BPP NotesDocument27 pagesBPP NotesVasanthan PughazendhiNo ratings yet

- PPB Notes PDFDocument97 pagesPPB Notes PDFShruthi RaghavendraNo ratings yet

- Banking & Insurance Law SyllabusDocument3 pagesBanking & Insurance Law Syllabusriko avNo ratings yet

- BKG Law and Practice - 1,2 & 3 UnitsDocument53 pagesBKG Law and Practice - 1,2 & 3 Unitskheman864No ratings yet

- Banking Laws Notesm - Com 4th SemDocument343 pagesBanking Laws Notesm - Com 4th SemYashaswini BohraNo ratings yet

- Merchant Banking SyllabusDocument4 pagesMerchant Banking SyllabusjeganrajrajNo ratings yet

- Commerce Syllabus FullDocument8 pagesCommerce Syllabus FullSatyabrata roulNo ratings yet

- Banking Law Study MaterialsDocument384 pagesBanking Law Study MaterialsAnjanaNairNo ratings yet

- 4.1 (5) B.com SyllabusDocument23 pages4.1 (5) B.com SyllabusAshleshNo ratings yet

- UG - B.B.A - English - 104 42 - Banking Law and Practice-II - English - 9280Document490 pagesUG - B.B.A - English - 104 42 - Banking Law and Practice-II - English - 9280Kathiravan SNo ratings yet

- FSBI Important QuestioinsDocument6 pagesFSBI Important QuestioinsNagarjuna SunkaraNo ratings yet

- Banking LawDocument7 pagesBanking LawPratyush ShanindNo ratings yet

- Financial ServicesDocument2 pagesFinancial ServicesAlok Ranjan100% (1)

- Probable Ques3 &4Document3 pagesProbable Ques3 &4avikumar001No ratings yet

- Co OperativeDocument220 pagesCo OperativeMeenukutty MeenuNo ratings yet

- Banking LawDocument23 pagesBanking LawHarshdeep groverNo ratings yet

- Banking Law Honors PaperDocument4 pagesBanking Law Honors PaperDudheshwar SinghNo ratings yet

- Syllabus For BankingDocument15 pagesSyllabus For BankingAnil NamosheNo ratings yet

- Mission FatehDocument8 pagesMission FatehrahulkutaNo ratings yet

- BComHons Sem V Syllabus CBCS 2017Document15 pagesBComHons Sem V Syllabus CBCS 2017Anoushka HarkarNo ratings yet

- Banking Law Practice VTH UNIT 1Document76 pagesBanking Law Practice VTH UNIT 1Swapnil PatelNo ratings yet

- b.com semester 4Document12 pagesb.com semester 4shivprakash chaubeyNo ratings yet

- Financial ServicesDocument2 pagesFinancial ServicesRasika KambliNo ratings yet

- Islamic Finance: The New Regulatory ChallengeFrom EverandIslamic Finance: The New Regulatory ChallengeRating: 1 out of 5 stars1/5 (1)

- CEPLDocument18 pagesCEPLSudhanshu BaranwalNo ratings yet

- Naiza Mae Ranara BinayaoDocument1 pageNaiza Mae Ranara BinayaoNaiza Mae R. BinayaoNo ratings yet

- Analyzing Farming Systems DeterminantsDocument12 pagesAnalyzing Farming Systems Determinantsadmirechawaz100% (1)

- One Shot Revision - Cash Flow StatementsDocument39 pagesOne Shot Revision - Cash Flow Statementssoumithansda286No ratings yet

- SAP Fioneer ESG WhitepaperDocument12 pagesSAP Fioneer ESG WhitepaperOphiuchus0% (1)

- e-StatementBRImo 032001017410501 Jan2024 20240116 181101Document3 pagese-StatementBRImo 032001017410501 Jan2024 20240116 181101Mobilkamu JakartaNo ratings yet

- Kolehiyo NG Lungsod NG LipaDocument72 pagesKolehiyo NG Lungsod NG LipaMJ ArandaNo ratings yet

- Blue and Yellow Simple Human Illustrative Investing Finance Tips Finance PresentationDocument18 pagesBlue and Yellow Simple Human Illustrative Investing Finance Tips Finance PresentationQaiffaGreenNo ratings yet

- Written Exam Bookkeeping NC Iii: I. Directions. Encircle The Correct Answer From The Given Options BelowDocument5 pagesWritten Exam Bookkeeping NC Iii: I. Directions. Encircle The Correct Answer From The Given Options BelowMay Ann VillanuevaNo ratings yet

- RDocument671 pagesRlinhtruong.31221024012No ratings yet

- Bank AuditDocument16 pagesBank AuditThunderHeadNo ratings yet

- Internal Control ChecklistDocument5 pagesInternal Control ChecklistPHILLIT CLASSNo ratings yet

- Investment BankingDocument19 pagesInvestment BankingYash JaiswalNo ratings yet

- 3.3.6 Mod EvaluationDocument6 pages3.3.6 Mod EvaluationWelshfyn ConstantinoNo ratings yet

- Sikkim Manipal University Sikkim Manipal University 4 Semester Spring 2011Document11 pagesSikkim Manipal University Sikkim Manipal University 4 Semester Spring 2011Alaji Bah CireNo ratings yet

- Screenshot 2021-04-16 at 13.53.59Document2 pagesScreenshot 2021-04-16 at 13.53.59Glenn JudoNo ratings yet

- Course Detail 7th Sem Mkm. BBADocument8 pagesCourse Detail 7th Sem Mkm. BBAHari AdhikariNo ratings yet

- Indice de Progreso GenuinoDocument7 pagesIndice de Progreso GenuinoAnonymous gTlOTsgeNo ratings yet

- Coaching Centre Liscensing & RegistrationsDocument3 pagesCoaching Centre Liscensing & RegistrationsshadabchistiNo ratings yet

- BSP Circular 1107Document7 pagesBSP Circular 1107Maya Julieta Catacutan-EstabilloNo ratings yet

- Family BudgetDocument3 pagesFamily BudgetThuoNo ratings yet

- eFDS 25 Pangunahing Kaalaman Sa PagbabangkoDocument5 pageseFDS 25 Pangunahing Kaalaman Sa PagbabangkoShai SdmpNo ratings yet

- Balance Sheet: Equity and LiabilitiesDocument1 pageBalance Sheet: Equity and LiabilitiessfdwhjNo ratings yet

- A Ratio Analysis Report On FINALDocument34 pagesA Ratio Analysis Report On FINALArsal AliNo ratings yet

- Webinar ISEI Jakarta 21 Juli 2022 Nailul HUdaDocument50 pagesWebinar ISEI Jakarta 21 Juli 2022 Nailul HUdanora lizaNo ratings yet

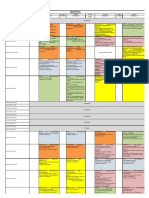

- Revitalization of City Core: Petta Zone, BangaloreDocument57 pagesRevitalization of City Core: Petta Zone, BangaloreArchiesivan22No ratings yet

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- OD119185277796277000Document4 pagesOD119185277796277000Awadhesh PalNo ratings yet

- 205 Finance Market & Banking OperationsDocument10 pages205 Finance Market & Banking Operationsxonline022No ratings yet

- MRP-I and MRP-IIDocument24 pagesMRP-I and MRP-IIakhil pillaiNo ratings yet

Banking Operations

Banking Operations

Uploaded by

vishalkumaran10Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking Operations

Banking Operations

Uploaded by

vishalkumaran10Copyright:

Available Formats

BA ECONOMICS HONOURS

SEMESTER III

BANKING OPERATIONS

Credits: 03 45

Hours

Course Objective: The course Banking Operations intends to explain the legal

protection of available to bankers and customers in different types of accounts and

special classes of accounts. The focus is on the technology and banking reforms and

functions of the Reserve Bank of India.

Course Outcomes:

CO1.Explain the banking functions and new developments

CO2. Discuss the legal protection of bankers and customers in types of

accounts and special classes of customers

CO3. Examine the lending principles of banks

CO4. Assess the banking reforms in India

CO5. Demonstrate knowledge about the operations of the Reserve Bank of

India

Module I: Introduction to Banking (09 Hours)

Nature and development of banking - History of banking in India - Banking evolution

and functions - Merger and acquisition - New Technology, automation and legal

aspects - Automatic teller machine and use of internet, Smart card, Use of expert

system, Credit Cards.

Module II: Banker and Customer relationship (09 Hours)

Legal Character - Banker’s lien - Protection of bankers - Customers-Nature and type

of accounts; Special classes of customers- lunatics, minor, partnership, corporations,

local authorities; Banking duty to customers.

Module III: Paying and Collecting Banks and their duties (09 Hours)

Consumer protection: banking as service - Lending by Banks - Good lending

principles - Lending to poor masses - Consortium Lending - Securities for advances -

Kinds of advances and their merits and demerits, Repayment of loans: rate of interest,

protection against penalty - Default and recovery; Debt recovery tribunal - Credit

Policy - Contract between banker and customer: their rights and duties.

Module IV: Reforms in Indian Banking (09 Hours)

Capital adequacy – Securitization and Reconstruction of Financial Assets and

Enforcement of Security Interest, 2002; Recovery of Debts due to Banks and

Financial Institutions Act, 1993 (DRT, Act) – Bank Merger – IBC -

Recommendations of Committees - Debt Recovery Tribunal – Capital adequacy ratio

- Non-Performing Assets – Insolvency and Bankruptcy Code– Bank Merger - Deposit

Insurance -The Deposit Insurance Corporation Act, 1961; objects and reasons -

Establishment of Capital of DIC.

Module V: Central Bank (09

Hours)

The Reserve Bank of India - Organizational Structure - Function of the RBI -

Regulation of monetary mechanism of the economy - Credit control – Monetary

Policy committee – Inflation targeting - Control of RBI over non-banking companies.

Reference texts

1.

2. Committee Report on Banking Supervision, 2001.

3. Bhole, L. M. ’Financial Institutions and Markets,’ Tata McGraw Hill Co. Ltd.

New Delhi, 2012.

4. C. Goodhart, The Central Bank and the Financial System, (1995). Mac Millan,

London.

5. Gordon and Natrajan, Banking theory, Law and practice, Himalaya

Publishing House

6. J.Dermine (ed). European Banking in the 199s (1993) Blackwell, Oxford.

7. Janakiraman Committee Report on Securities of Operation of Banks and

Financial Institution (1993)

8. K. Subrahmanyan, Banking Reforms in India (1997) Tata McGraw Hill, New

Delhi

9. K.C. Shekhar and Lekshmy Shekhar, Banking theory and practice, Vikas

Publication

10. L.C. Goyle, The Law of Banking and Bankers, (1995), Eastern. Lloyds of

London Press, London.

11. M.L. TannanTannan, Banking Law and Practice in India (1997) India Law

House, Maxwell, London, 2000).

12. Narasimham Committee Report on the Financial System (1991) – Second

Report (1999).

13. P. N. Varshney, KPM Sundharam, Banking Theory, Law and Practice

(Nineteenth Reprint)

14. Principles & Practices of Banking, Indian Institute of Banking &Finance,

Macmillan Publications

15. RBI Bulletins, Economic and Political Weekly issues, Prajnan [NIBM], Daily

the Economic Times etc.

16. Reports on Currency and Finance.

17. S.L.Gaur, Principles of Bank Management, Himalaya Publishing House,

Bombay

You might also like

- Financial Services & MarketsDocument3 pagesFinancial Services & MarketsAbhishek SaravananNo ratings yet

- Law and Practice of BankingDocument2 pagesLaw and Practice of BankingJobin George100% (4)

- Banking LawDocument3 pagesBanking LawRajivCoolNo ratings yet

- Semester: III Finance Specialisation: Recommended BooksDocument12 pagesSemester: III Finance Specialisation: Recommended Booksshivaraj p yNo ratings yet

- Banking - Theory and Practices 18MBAFM31-1Document88 pagesBanking - Theory and Practices 18MBAFM31-1Nandeep Hêãrtrøbbér50% (2)

- 4.36 M.com Banking & FinanceDocument18 pages4.36 M.com Banking & FinancegoodwynjNo ratings yet

- Sem-IX Banking Law - Opt PDFDocument3 pagesSem-IX Banking Law - Opt PDFAlkaNo ratings yet

- Banking Law Optional Paper I & Ii Course Teacher: Dr. Kiran Kori Objectives of The CourseDocument3 pagesBanking Law Optional Paper I & Ii Course Teacher: Dr. Kiran Kori Objectives of The CourseNaveen SihareNo ratings yet

- Banking Laws - Updated Syllabus PDFDocument4 pagesBanking Laws - Updated Syllabus PDFjerinNo ratings yet

- Practice Banking SyllabusDocument2 pagesPractice Banking SyllabusSrinivas GowdaNo ratings yet

- Banking Theory and PracticeDocument1 pageBanking Theory and Practiceshivarajungeetha4048No ratings yet

- Banking LawDocument5 pagesBanking Lawrishabh1511900% (3)

- Banking System 1Document52 pagesBanking System 1Banshul KumarNo ratings yet

- Syllabus - Banking Law AugustDocument5 pagesSyllabus - Banking Law Augustshikah sidarNo ratings yet

- Mba-III-principles & Practices of Banking NotesDocument97 pagesMba-III-principles & Practices of Banking NotesTilak RokrNo ratings yet

- Banking and InsuranceDocument13 pagesBanking and InsuranceKiran Kumar50% (2)

- LLB Banking Syllabus 2023Document7 pagesLLB Banking Syllabus 2023Shivam ChoudharyNo ratings yet

- Law and Practice of Banking II Sem VIDocument3 pagesLaw and Practice of Banking II Sem VIvaibhavsalgaonkarpcNo ratings yet

- Banking Law Course Outline#Document3 pagesBanking Law Course Outline#Shouryaa ShubhamNo ratings yet

- Part (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching MethodologyDocument3 pagesPart (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching Methodologyrajat_177229No ratings yet

- Law & Practices of BankingDocument2 pagesLaw & Practices of BankingShahim MaindalaNo ratings yet

- BA7026 Banking Financial Services ManagementDocument120 pagesBA7026 Banking Financial Services ManagementchandrasekharNo ratings yet

- BankingDocument7 pagesBankingPiyush RewatkarNo ratings yet

- Banking Theory Law & Practice Notes Govt - CADocument70 pagesBanking Theory Law & Practice Notes Govt - CAmanjushreenambi.05No ratings yet

- Bfs Notes Old VtuliveDocument97 pagesBfs Notes Old VtuliveSyed MD FaizanNo ratings yet

- PPMB COMPLETE NOTES PDF (3)Document97 pagesPPMB COMPLETE NOTES PDF (3)Javeedali MjNo ratings yet

- Ba8c3banking and Financial InstitutionsDocument1 pageBa8c3banking and Financial InstitutionsAyush ChhabraNo ratings yet

- SyllabusDocument8 pagesSyllabusyamumini07100% (1)

- Law and Practice of Banking I Sem VIDocument4 pagesLaw and Practice of Banking I Sem VIvaibhavsalgaonkarpcNo ratings yet

- Tamil Nadu National Law University: Course ObjectivesDocument4 pagesTamil Nadu National Law University: Course ObjectivessriprasadNo ratings yet

- 3.6: Indian Financial System: Books For ReferenceDocument1 page3.6: Indian Financial System: Books For ReferencesanjeevseshannaNo ratings yet

- Ba7026 Banking Financial Services ManagemntDocument122 pagesBa7026 Banking Financial Services ManagemntRithesh RaNo ratings yet

- Banking Insurance and Operations Material (Final)Document113 pagesBanking Insurance and Operations Material (Final)NakulNo ratings yet

- 2 Financial Marek T and ServicesDocument2 pages2 Financial Marek T and Servicesbhaskarganesh0% (1)

- Banking Practice & Proc. Course OutlineDocument5 pagesBanking Practice & Proc. Course OutlineSuresh Vadde50% (2)

- BPP NotesDocument27 pagesBPP NotesVasanthan PughazendhiNo ratings yet

- PPB Notes PDFDocument97 pagesPPB Notes PDFShruthi RaghavendraNo ratings yet

- Banking & Insurance Law SyllabusDocument3 pagesBanking & Insurance Law Syllabusriko avNo ratings yet

- BKG Law and Practice - 1,2 & 3 UnitsDocument53 pagesBKG Law and Practice - 1,2 & 3 Unitskheman864No ratings yet

- Banking Laws Notesm - Com 4th SemDocument343 pagesBanking Laws Notesm - Com 4th SemYashaswini BohraNo ratings yet

- Merchant Banking SyllabusDocument4 pagesMerchant Banking SyllabusjeganrajrajNo ratings yet

- Commerce Syllabus FullDocument8 pagesCommerce Syllabus FullSatyabrata roulNo ratings yet

- Banking Law Study MaterialsDocument384 pagesBanking Law Study MaterialsAnjanaNairNo ratings yet

- 4.1 (5) B.com SyllabusDocument23 pages4.1 (5) B.com SyllabusAshleshNo ratings yet

- UG - B.B.A - English - 104 42 - Banking Law and Practice-II - English - 9280Document490 pagesUG - B.B.A - English - 104 42 - Banking Law and Practice-II - English - 9280Kathiravan SNo ratings yet

- FSBI Important QuestioinsDocument6 pagesFSBI Important QuestioinsNagarjuna SunkaraNo ratings yet

- Banking LawDocument7 pagesBanking LawPratyush ShanindNo ratings yet

- Financial ServicesDocument2 pagesFinancial ServicesAlok Ranjan100% (1)

- Probable Ques3 &4Document3 pagesProbable Ques3 &4avikumar001No ratings yet

- Co OperativeDocument220 pagesCo OperativeMeenukutty MeenuNo ratings yet

- Banking LawDocument23 pagesBanking LawHarshdeep groverNo ratings yet

- Banking Law Honors PaperDocument4 pagesBanking Law Honors PaperDudheshwar SinghNo ratings yet

- Syllabus For BankingDocument15 pagesSyllabus For BankingAnil NamosheNo ratings yet

- Mission FatehDocument8 pagesMission FatehrahulkutaNo ratings yet

- BComHons Sem V Syllabus CBCS 2017Document15 pagesBComHons Sem V Syllabus CBCS 2017Anoushka HarkarNo ratings yet

- Banking Law Practice VTH UNIT 1Document76 pagesBanking Law Practice VTH UNIT 1Swapnil PatelNo ratings yet

- b.com semester 4Document12 pagesb.com semester 4shivprakash chaubeyNo ratings yet

- Financial ServicesDocument2 pagesFinancial ServicesRasika KambliNo ratings yet

- Islamic Finance: The New Regulatory ChallengeFrom EverandIslamic Finance: The New Regulatory ChallengeRating: 1 out of 5 stars1/5 (1)

- CEPLDocument18 pagesCEPLSudhanshu BaranwalNo ratings yet

- Naiza Mae Ranara BinayaoDocument1 pageNaiza Mae Ranara BinayaoNaiza Mae R. BinayaoNo ratings yet

- Analyzing Farming Systems DeterminantsDocument12 pagesAnalyzing Farming Systems Determinantsadmirechawaz100% (1)

- One Shot Revision - Cash Flow StatementsDocument39 pagesOne Shot Revision - Cash Flow Statementssoumithansda286No ratings yet

- SAP Fioneer ESG WhitepaperDocument12 pagesSAP Fioneer ESG WhitepaperOphiuchus0% (1)

- e-StatementBRImo 032001017410501 Jan2024 20240116 181101Document3 pagese-StatementBRImo 032001017410501 Jan2024 20240116 181101Mobilkamu JakartaNo ratings yet

- Kolehiyo NG Lungsod NG LipaDocument72 pagesKolehiyo NG Lungsod NG LipaMJ ArandaNo ratings yet

- Blue and Yellow Simple Human Illustrative Investing Finance Tips Finance PresentationDocument18 pagesBlue and Yellow Simple Human Illustrative Investing Finance Tips Finance PresentationQaiffaGreenNo ratings yet

- Written Exam Bookkeeping NC Iii: I. Directions. Encircle The Correct Answer From The Given Options BelowDocument5 pagesWritten Exam Bookkeeping NC Iii: I. Directions. Encircle The Correct Answer From The Given Options BelowMay Ann VillanuevaNo ratings yet

- RDocument671 pagesRlinhtruong.31221024012No ratings yet

- Bank AuditDocument16 pagesBank AuditThunderHeadNo ratings yet

- Internal Control ChecklistDocument5 pagesInternal Control ChecklistPHILLIT CLASSNo ratings yet

- Investment BankingDocument19 pagesInvestment BankingYash JaiswalNo ratings yet

- 3.3.6 Mod EvaluationDocument6 pages3.3.6 Mod EvaluationWelshfyn ConstantinoNo ratings yet

- Sikkim Manipal University Sikkim Manipal University 4 Semester Spring 2011Document11 pagesSikkim Manipal University Sikkim Manipal University 4 Semester Spring 2011Alaji Bah CireNo ratings yet

- Screenshot 2021-04-16 at 13.53.59Document2 pagesScreenshot 2021-04-16 at 13.53.59Glenn JudoNo ratings yet

- Course Detail 7th Sem Mkm. BBADocument8 pagesCourse Detail 7th Sem Mkm. BBAHari AdhikariNo ratings yet

- Indice de Progreso GenuinoDocument7 pagesIndice de Progreso GenuinoAnonymous gTlOTsgeNo ratings yet

- Coaching Centre Liscensing & RegistrationsDocument3 pagesCoaching Centre Liscensing & RegistrationsshadabchistiNo ratings yet

- BSP Circular 1107Document7 pagesBSP Circular 1107Maya Julieta Catacutan-EstabilloNo ratings yet

- Family BudgetDocument3 pagesFamily BudgetThuoNo ratings yet

- eFDS 25 Pangunahing Kaalaman Sa PagbabangkoDocument5 pageseFDS 25 Pangunahing Kaalaman Sa PagbabangkoShai SdmpNo ratings yet

- Balance Sheet: Equity and LiabilitiesDocument1 pageBalance Sheet: Equity and LiabilitiessfdwhjNo ratings yet

- A Ratio Analysis Report On FINALDocument34 pagesA Ratio Analysis Report On FINALArsal AliNo ratings yet

- Webinar ISEI Jakarta 21 Juli 2022 Nailul HUdaDocument50 pagesWebinar ISEI Jakarta 21 Juli 2022 Nailul HUdanora lizaNo ratings yet

- Revitalization of City Core: Petta Zone, BangaloreDocument57 pagesRevitalization of City Core: Petta Zone, BangaloreArchiesivan22No ratings yet

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- OD119185277796277000Document4 pagesOD119185277796277000Awadhesh PalNo ratings yet

- 205 Finance Market & Banking OperationsDocument10 pages205 Finance Market & Banking Operationsxonline022No ratings yet

- MRP-I and MRP-IIDocument24 pagesMRP-I and MRP-IIakhil pillaiNo ratings yet