Professional Documents

Culture Documents

Copy of Business Plan

Copy of Business Plan

Uploaded by

Stefanus Pasanto KurniawanCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- ch14 Exercises (Written Q) Q+A - WACCDocument4 pagesch14 Exercises (Written Q) Q+A - WACCNurayGulNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cobalt Systems and Silverlight Electronics Planning Document For Cobalt SystemsDocument2 pagesCobalt Systems and Silverlight Electronics Planning Document For Cobalt SystemsAndrea Moreno0% (1)

- BUSINESS FINANCE 12 - Q1 - W4 - Mod4Document21 pagesBUSINESS FINANCE 12 - Q1 - W4 - Mod4LeteSsie60% (5)

- Corp Financial ReportingDocument7 pagesCorp Financial ReportingJustin L De ArmondNo ratings yet

- R36 The Arbitrage Free Valuation Model Slides PDFDocument22 pagesR36 The Arbitrage Free Valuation Model Slides PDFPawan Rathi0% (1)

- AccountingDocument21 pagesAccountingDonna MarieNo ratings yet

- Acc030 Test 1 May 2023-Qq (Set 2)Document5 pagesAcc030 Test 1 May 2023-Qq (Set 2)Aisyah NasriyahNo ratings yet

- Template - 24 - 1655438656Document4 pagesTemplate - 24 - 1655438656Ranjit SinghNo ratings yet

- Ros Rof S773384Document2 pagesRos Rof S773384SHRINIVAS ANDURENo ratings yet

- N2N Connect Berhad - Poised For Further26Document14 pagesN2N Connect Berhad - Poised For Further26axapiNo ratings yet

- IDFCSHRIRAMMERGERDocument8 pagesIDFCSHRIRAMMERGERMee MeeNo ratings yet

- QAFD Project SolverDocument5 pagesQAFD Project SolverUJJWALNo ratings yet

- #2 - Note On The Current PE RangeDocument4 pages#2 - Note On The Current PE Rangeatul gawaliNo ratings yet

- MMW Lesson 14 Week 14 MATHEMATICS OF FINANCE CREDIT CARDS AND CONSUMER LOANSDocument9 pagesMMW Lesson 14 Week 14 MATHEMATICS OF FINANCE CREDIT CARDS AND CONSUMER LOANStuazonkyla7No ratings yet

- Giverny Capital - Annual Letter 2015Document19 pagesGiverny Capital - Annual Letter 2015hedgie58No ratings yet

- Kuis AklDocument6 pagesKuis AklArista Yuliana SariNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsIan VinoyaNo ratings yet

- International Finance - 1Document109 pagesInternational Finance - 1Mohamed Fathy100% (1)

- HO 2 Installment Sales ActivitiesDocument3 pagesHO 2 Installment Sales ActivitiesddddddaaaaeeeeNo ratings yet

- Comparative and Common Size Financial StatementsDocument24 pagesComparative and Common Size Financial StatementsTanish Bohra100% (2)

- FNCE 491: Quantitative Finance: The General Black-Scholes-Merton Model and BeyondDocument4 pagesFNCE 491: Quantitative Finance: The General Black-Scholes-Merton Model and BeyondCLJACKSON04No ratings yet

- Nomor 1: Gain From Bargain Purchase $ - 9,000Document3 pagesNomor 1: Gain From Bargain Purchase $ - 9,000Sherlin KhuNo ratings yet

- Accounting For Derivatives and Hedging Activities-Sent2020 PDFDocument38 pagesAccounting For Derivatives and Hedging Activities-Sent2020 PDFTiara Eva TresnaNo ratings yet

- M01 Gitman50803X 14 MF C01Document52 pagesM01 Gitman50803X 14 MF C01RaniaNo ratings yet

- Alibaba Case StudyDocument3 pagesAlibaba Case StudyAhmed RefaatNo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 6th Edition Stickney Test BankDocument25 pagesFinancial Reporting Financial Statement Analysis and Valuation 6th Edition Stickney Test Bankcleopatramabelrnnuqf100% (30)

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDocument1 pageAlphaex Capital Candlestick Pattern Cheat Sheet Infographriki setiaNo ratings yet

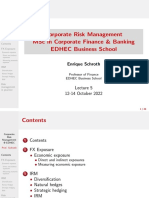

- CRM EDHEC LectureNotes6Document55 pagesCRM EDHEC LectureNotes6SASNo ratings yet

- Profit Test Modelling in Life Assurance Using Spreadsheets Part TwoDocument48 pagesProfit Test Modelling in Life Assurance Using Spreadsheets Part Twoulfa dianitaNo ratings yet

- Elite Life 2 One PagerDocument1 pageElite Life 2 One PagerFC KSKNo ratings yet

Copy of Business Plan

Copy of Business Plan

Uploaded by

Stefanus Pasanto KurniawanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Copy of Business Plan

Copy of Business Plan

Uploaded by

Stefanus Pasanto KurniawanCopyright:

Available Formats

Company Name Business

Plan

Business Plan Subtitle

Contact: Contact person name

Company Address, City, State Postal Code

Phone: 000-000-0000, Fax: 000-000-0000

Email: name@example.com, Web Site: www.company.com

Executive Summary

The Executive Summary must capture the essence of your proposed business venture. Try

Company Name Business Plan

to keep the summary as brief as possible. Whether you are preparing this proposal for a

venture capitalist, banker, or your boss, it is imperative that your summary be of the

highest quality. These individuals are flooded with requests for assistance. Since the

summary is a distillation of your plan, you might want to complete this section after you

complete the rest of your business plan. Or write the summary first, then create the

business plan and then go back to the summary, improve it and insure its consistency with

the rest of your plan.

Since your objective is to lure the reader to want more information, your summary should

have the following elements:

● It should be concise - you have one or two minutes to tell someone about your

business.

● It should be exciting

● It should communicate how your business concept is unique

No matter how long you spent developing and honing your business plan, the reader of the

plan will only spend five minutes reading it! It’s important to make those five minutes work

to your favor. You may have the most meticulous and well-crafted business plan imaginable

- in the end, however, the best plan is the one that entices the reader.

Surprisingly, many business plans neglect to include their formal name, address and

principal contact. Please insure that you leave a number that is attended. If the business

plan recipient can’t reach you in one or two attempts, they will move on to the next

proposal. Make sure this information is on your proposal - there is a prominent location on

the front cover to put this information. Feel free to repeat the information in the Executive

Summary.

Type of Business

This section answers the question - What business am I in - a non-trivial question. Deciding

what business you are in is probably the most important decision you will have to make. If

you know it, include the SIC code that describes your business. Indicate whether the

business is a start-up or an existing business.

Company or Business Summary

Here, you can briefly describe the history of the company. Is this a startup? An expansion of

an existing business? A division of a larger business that is launching a new product or

service? Is the business a sole proprietorship, partnership, or corporation? If your business

is a going concern, briefly describe the company’s historical performance. If the company is

introducing a new web site or if the web site is a critical component of the business

(retailing, business-to-business, virtual community, etc.), briefly describe the web site and

any significant future plans for that web site.

Financial Objectives

Clearly state the sales and profitability objectives and the underlying ways that you will

meet these objectives. Perhaps a chart from the Business Plan Excel workbook would

visually describe your goals. It is within this section that you can summarize sales and

profitability objectives for the five year planning period. Financial goals could be cash flow

related, described by financial ratios, by growth rates of sales, assets, cash flow, and profits,

Company Name Business Plan

or by cost and expense relationships.

Management Overview

Perhaps the biggest keys to success of any business are the people who run it. Be sure to

summarize the expertise of the management in this particular business. Since poor

management is a key contributor to business failure, describe why the cards are stacked in

your favor.

Products and Services

Describe the product or service you are offering and clearly state why the product is unique.

If the product is not unique, be sure to explain why it will succeed over existing products.

Name of Your Product - Here you can briefly describe the primary

characteristics of this product. Use copy and paste if you have

additional products.

Name of Your Product - Here you can briefly describe the primary

characteristics of this product. Use copy and paste if you have

additional products.

Funds Requested (optional)

If you are writing this proposal to an audience from which you are requesting funds, be

specific in your request. Select a number and explain why that amount is needed. Also state

whether the money you are raising is in the form of equity or debt. When you send the

proposal to organizations, you can save valuable time by understanding which types of

investments they make. Some investment companies do not make any equity investments

while others specialize in this investment.

If you are seeking debt financing, be prepared to discuss whether collateral is available. If

you are seeking an equity investment, be prepared to discuss the percentage ownership

position.

Here are some additional questions to consider when writing this section:

● What is the total amount of funds needed by your business? Is it needed immediately

or over the next two to five years?

● What part of this financing is being sought from the investors or lending institution

that will receive this business plan (including the amount, terms, and any related

security agreement)?

Company Name Business Plan

● For equity financing, what percentage of the company are you willing to give up and

what is the proposed return on investment and anticipated method of taking out the

investor (e.g., buy-back, public offering, sale)?

● For debt financing, what is your company’s proposed interest rate and repayment

schedule?

Use of proceeds (optional)

Be as specific as possible on how the proceeds will be spent. Include a chart or table to

describe this if you wish.

Exit (optional)

If you are requesting funds to grow your business, your investor will want to understand

how you are planning your exit strategy. Most investors want to realize a gain over a

medium term horizon. Don’t underestimate the time it will take to either take the company

public or sell the business. Most investors should be willing to wait for a three-year period

before their investment can be realized.

Company Background

The first part of a business plan should clearly define the Identification of Market

Opportunity. Be prepared to discuss the total dollar volume of the market, the rate that the

market is growing and the overall demand for the product or service that you are offering.

Business History

Give a brief history of the company’s business to date, when your product or service was

introduced, and the key milestones that you have met. Be sure to keep this section brief,

since your investor is primarily concerned about the future, not the past. Some of the

information you might include in this section could be:

● The firm’s date of origin.

● The names of the founders.

● A summary of the major milestones achieved or the stages of the life cycle through

which the firm may have passed.

● The major episodes or stages of development in the firm’s past.

● A brief description of any significant changes the business has undergone or

challenges that the company has faced up to.

● Other developmental indicators such as sales levels, net worth, market share, assets,

and company valuation.

● Company mission statement.

Growth and Financial Objectives

The objectives in your business plan can begin with a short list of what you hope to achieve

in the next year or so and those significant goals that you would like to achieve in later

planning periods. Objectives will vary according to your mission statement and where your

company is in the life cycle. For example, a start-up company might want to set a

short-term objective of profitability (to be profitable by year-end) or may take a longer-term

view and simply look to build a competitive business model by the end of year one.

Company Name Business Plan

State your growth and financial objectives as clearly as possible. You can start with the

sales chart for the five-year period and follow that up with the sales table broken down by

product line. Then you might want to explain how you plan to keep certain financial metrics

and use the Financial Highlights table to clearly portray your goals.

Follow this up with the sales table broken down by product line.

Then you might want to explain how you plan to keep certain financial metrics and use the

Financial Highlights table to clearly portray your goals.

Legal Structure and Ownership

Describe how the company is legally organized. This is a decision that is best made in the

early stages of the company. The decision to establish your company as a sole

proprietorship, a partnership or a corporation that will issue stock is an important one. You

may want to consult with an attorney and/or accountant before doing this.

Company Location and Facilities

State where the company conducts its business and what real estate the company owns or

leases. Be sure to address the issues regarding your future space requirements and how

this might determine your need to expand or move.

Name and/or address of your facility - Here you can briefly

describe the facility and location. Use copy and paste if you have

additional locations.

Name and/or address of your facility - Here you can briefly

describe the facility and location. Use copy and paste if you have

additional locations.

Plans for Financing the Business

Investors prefer to see a defined financing proposal which shows the capital needs of the

venture and the proposed equity or debt agreement. The financing proposal may refer to

the Start-Up Costs that are attached in the appendix if it is a start-up. If the company is a

start-up, or an ongoing concern, be sure to detail the use of the proceeds from the

financing. What collateral or personal guarantees will be offered for an equity or debt

investment?

Financial Plan and Analysis

Company Name Business Plan

The sections below contain text summaries of the workbooks that are attached in the

subsequent pages.

Start-Up Costs

Briefly describe the numbers in the report and on the chart.

Financial Highlights

This table includes key financial ratios - discuss the ones that might draw attention.

5-Year Income Statement

Describe these numbers.

5-Year Balance Sheet

Point out any key issues from this report.

Cash Budgets

There are two cash budgets - one for the first 12 months and one for a five-year period. Two

charts also depict these 12 month and 5 year cash balances. Use the ones that make sense

for your business and describe the cash trends.

Break-Even Analysis

Use the Break-Even analysis to compare your projected monthly sales with the break-even

point.

Supplemental Worksheets

Insert other worksheets that you may have developed or include the worksheets from some

of the supplemental files that come with the product to round out your specific plan.

Company Name Business Plan

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- ch14 Exercises (Written Q) Q+A - WACCDocument4 pagesch14 Exercises (Written Q) Q+A - WACCNurayGulNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cobalt Systems and Silverlight Electronics Planning Document For Cobalt SystemsDocument2 pagesCobalt Systems and Silverlight Electronics Planning Document For Cobalt SystemsAndrea Moreno0% (1)

- BUSINESS FINANCE 12 - Q1 - W4 - Mod4Document21 pagesBUSINESS FINANCE 12 - Q1 - W4 - Mod4LeteSsie60% (5)

- Corp Financial ReportingDocument7 pagesCorp Financial ReportingJustin L De ArmondNo ratings yet

- R36 The Arbitrage Free Valuation Model Slides PDFDocument22 pagesR36 The Arbitrage Free Valuation Model Slides PDFPawan Rathi0% (1)

- AccountingDocument21 pagesAccountingDonna MarieNo ratings yet

- Acc030 Test 1 May 2023-Qq (Set 2)Document5 pagesAcc030 Test 1 May 2023-Qq (Set 2)Aisyah NasriyahNo ratings yet

- Template - 24 - 1655438656Document4 pagesTemplate - 24 - 1655438656Ranjit SinghNo ratings yet

- Ros Rof S773384Document2 pagesRos Rof S773384SHRINIVAS ANDURENo ratings yet

- N2N Connect Berhad - Poised For Further26Document14 pagesN2N Connect Berhad - Poised For Further26axapiNo ratings yet

- IDFCSHRIRAMMERGERDocument8 pagesIDFCSHRIRAMMERGERMee MeeNo ratings yet

- QAFD Project SolverDocument5 pagesQAFD Project SolverUJJWALNo ratings yet

- #2 - Note On The Current PE RangeDocument4 pages#2 - Note On The Current PE Rangeatul gawaliNo ratings yet

- MMW Lesson 14 Week 14 MATHEMATICS OF FINANCE CREDIT CARDS AND CONSUMER LOANSDocument9 pagesMMW Lesson 14 Week 14 MATHEMATICS OF FINANCE CREDIT CARDS AND CONSUMER LOANStuazonkyla7No ratings yet

- Giverny Capital - Annual Letter 2015Document19 pagesGiverny Capital - Annual Letter 2015hedgie58No ratings yet

- Kuis AklDocument6 pagesKuis AklArista Yuliana SariNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsIan VinoyaNo ratings yet

- International Finance - 1Document109 pagesInternational Finance - 1Mohamed Fathy100% (1)

- HO 2 Installment Sales ActivitiesDocument3 pagesHO 2 Installment Sales ActivitiesddddddaaaaeeeeNo ratings yet

- Comparative and Common Size Financial StatementsDocument24 pagesComparative and Common Size Financial StatementsTanish Bohra100% (2)

- FNCE 491: Quantitative Finance: The General Black-Scholes-Merton Model and BeyondDocument4 pagesFNCE 491: Quantitative Finance: The General Black-Scholes-Merton Model and BeyondCLJACKSON04No ratings yet

- Nomor 1: Gain From Bargain Purchase $ - 9,000Document3 pagesNomor 1: Gain From Bargain Purchase $ - 9,000Sherlin KhuNo ratings yet

- Accounting For Derivatives and Hedging Activities-Sent2020 PDFDocument38 pagesAccounting For Derivatives and Hedging Activities-Sent2020 PDFTiara Eva TresnaNo ratings yet

- M01 Gitman50803X 14 MF C01Document52 pagesM01 Gitman50803X 14 MF C01RaniaNo ratings yet

- Alibaba Case StudyDocument3 pagesAlibaba Case StudyAhmed RefaatNo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 6th Edition Stickney Test BankDocument25 pagesFinancial Reporting Financial Statement Analysis and Valuation 6th Edition Stickney Test Bankcleopatramabelrnnuqf100% (30)

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDocument1 pageAlphaex Capital Candlestick Pattern Cheat Sheet Infographriki setiaNo ratings yet

- CRM EDHEC LectureNotes6Document55 pagesCRM EDHEC LectureNotes6SASNo ratings yet

- Profit Test Modelling in Life Assurance Using Spreadsheets Part TwoDocument48 pagesProfit Test Modelling in Life Assurance Using Spreadsheets Part Twoulfa dianitaNo ratings yet

- Elite Life 2 One PagerDocument1 pageElite Life 2 One PagerFC KSKNo ratings yet