Professional Documents

Culture Documents

ACFrOgBHfm0tSm6qtGIc9zC4jbYT3XH3X0krbMeiTvKuaRxFri7p0JViYpdQmL8kHiA20z_oSO3oSPXcNPzlpZdysnH-AIgBwIYwCLqgo84L1AIPn3Hl4fBHt0QrTaA=

ACFrOgBHfm0tSm6qtGIc9zC4jbYT3XH3X0krbMeiTvKuaRxFri7p0JViYpdQmL8kHiA20z_oSO3oSPXcNPzlpZdysnH-AIgBwIYwCLqgo84L1AIPn3Hl4fBHt0QrTaA=

Uploaded by

rio HENRYCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACFrOgBHfm0tSm6qtGIc9zC4jbYT3XH3X0krbMeiTvKuaRxFri7p0JViYpdQmL8kHiA20z_oSO3oSPXcNPzlpZdysnH-AIgBwIYwCLqgo84L1AIPn3Hl4fBHt0QrTaA=

ACFrOgBHfm0tSm6qtGIc9zC4jbYT3XH3X0krbMeiTvKuaRxFri7p0JViYpdQmL8kHiA20z_oSO3oSPXcNPzlpZdysnH-AIgBwIYwCLqgo84L1AIPn3Hl4fBHt0QrTaA=

Uploaded by

rio HENRYCopyright:

Available Formats

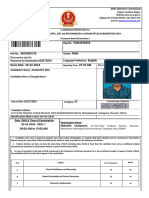

QUOTATION SLIP

Reff No. 23.05.01121/QS/MH/PTBJ

Type of Insurance : Marine Hull;

Form : MAR 91

Quotation Valid Until : June 12, 2023

General Information of The Insured

The Insured : PT Pelayaran Teluk Bajau Lestari

Trading Area : Indonesia waters only

Period of Insurance : TBA

Terms & Conditions of Cover on To cover loss of or damage to subject matter insured and/or Insured\\'s Liability(s) as

described in the terms and conditions mentioned bellow

Interest Insured : Hull and Machinery including but not limited to Crane, Materials, Machinery, Outfit, Equipment of

every description, and spares and everything connected therewith :

Vessel Name: K-VIII

Type: Barge

YOB: 2005

GT: 3137

Class: BKI

Port: Jakarta

Value of Vessel : IDR 14,068,000,000.00

Coverages : Institute Time Clauses Total Loss Only 1/10/83 – Cl. 289 (Excluding Salvage, Salvage Charges,

and Sue & Labour) amended to delete clause 1.2

Conditions : - The cost of temporary repairs and the excess cost of overtime incurred in connection with repairs

to damage caused by an insured peril shall be deemed as part of the reasonable cost of repairs;

- Ranging damage sustained during cargo operations at each port shall be deemed as damage

caused by a single accident or occurrence;

- It is noted and agreed that any claim under this policy shall be settled at no longer than 30 (Thirty)

days after the date of final adjustment report has been agreed by both the Lead Underwriter and the

Assured. This clause is in place in compliance with ;

- The Insured Vessels shall be considered fully insured for the purpose of claims under the policy in

This is a computer generated document and therefore no signature required. 1/5

Created by Bayya Ziqra on 2023-05-30 11:40:27 doc. number: 01121/QS.Checked by M Husni Barkah, SE, APAI, CIIB, ANZIIF (Snr. Assoc), CIP.

respect of General Average, Salvage, Salvage Charges, and Sue and Labour;

- The measure of indemnity in respect of claims for unrepaired damage shall be estimated cost of

repair at the time of this insurance terminates;

- For the purpose of any claims under this policy, it is agreed that the Total Sum Insured of the

subject matter insured shall be deemed and/or considered to be her actual sound values at time

accident;

- When vessel missing for 6 (six) consecutive months from the date of sailing from the last port

shall be presumed to be an “Actual Total Loss”;

- All claims for loss, damage or expense resulting from any one occurrence or series of occurrence

out of any event, shall be deemed as damage casued by a single accident and adjusted as one

claim.;

Deductibles/Excess : - IDR. 200,000,000.00 anyone accident/occurrence for all claims with additional deductible 20% of

claim payable in respect of any loss/damage derived from the vessel being stranded/grounded

and/or capsized whatsoever caused;

Clauses : 1. Banker’s Clause. if required;

2. Additional Notice of Claim Clause (30 days);

3. Adjuster Clause;

It is hereby noted and agreed that Assured or the Broker have the liberty to appoint one of the

following adjusters in respect of any claim on the policy :

1. PT. MCO Prima Indonesia

2. PT. Radita Hutama Internusa / Charles Taylor Adjusting

3. PT. Global Internusa Adjusting

4. As per above, Subject to subject to JWC Hull War, Piracy, Terrorism and Related Perils Listed

Areas dated 29th April 2021 (or as maybe updated) with Indonesia deleted from the Listed Areas at

nil additional premium;

5. Cancelling Return Only (No Lay Up Return);

6. Claimant's other than Shipowner Proof of Insurable Interest Clause (For use on Marine Hull &

Machinery Insurance); It is hereby agreed that every claimants of the policy benefit on this

insurance who is named as the Assured herein but not declared as the Shipowner in the Certificate

of Nationality/ Registry Certificate issued by the flag state of the insured vessels, they have a duty

to prove by legal documents or contracts when submitting a claim to Insurer that they stand in legal

& equitable relations with the Subject Matter of Insured covered hereunder with acknowledgment

from the registered Shipowner.

7. Communicable Disease Exclusion clause;

1. Notwithstanding any provision to the contrary within this insurance agreement, this insurance

agreement excludes any loss, damage, liability, claim, cost or expense of whatsoever nature,

directly or indirectly caused by, contributed to by, resulting from, arising out of, or in connection

with a Communicable Disease or the fear or threat (whether actual or perceived) of a

Communicable Disease regardless of any other cause or event contributing concurrently or in any

other sequence thereto.

2. As used herein, a Communicable Disease means any disease which can be transmitted by means

of any substance or agent from any organism to another organism where :

- the substance or agent includes, but is not limited to, a virus, bacterium, parasite or other

organism or any variation thereof, whether deemed living or not, and

- the method of transmission, whether direct or indirect, includes but is not limited to, airborne

transmission, bodily fluid transmission, transmission from or to any surface or object, solid, liquid

or gas or between organisms, and - the disease, substance or agent can cause or threaten damage to

human health or human welfare or can cause or threaten damage to, deterioration of, loss of value

of, marketability of or loss of use of property

8. Dispute Clause;

9. Exclude cover loss of hire;

10. Exclude cover P&I risk;

This is a computer generated document and therefore no signature required. 2/5

Created by Bayya Ziqra on 2023-05-30 11:40:27 doc. number: 01121/QS.Checked by M Husni Barkah, SE, APAI, CIIB, ANZIIF (Snr. Assoc), CIP.

11. Exclude cover wreck removal;

12. Exclude simultaneous settlement clause;

13. Full Annual Premium if Loss Clause;

14. Institute Cyber Attack Exclusion Clause 10/11/03 - Cl. 380;

15. Institute Notice of Cancellation Automatic Termination of Cover and War and Nuclear

Exclusion Clause – Hulls etc (Clause 359) 1/11/95;

16. Institute Radioactive Contamination, Chemical, Biological, Bio Chemical, Electromagnetic

Weapons Exclusion Clause (10/11/2003) – Cl. 370;

17. Institute War and Strikes Clauses – Hulls – Time 1/10/83 (Cl.281) amended to include

Vandalism and sabotage risks.;

18. IT Hazard clarification clause;

19. Law & Jurisdiction; This insurance shall be governed by and construed in accordance with the

laws of England and the exclusive jurisdiction of the Indonesian Courts.

20. Navigation Limitations for hull War, Strikes, Terrorism and Related Perils Endorsement

(JW2005/001A);

21. Payment on Account (25%); – for estimated claim amount above IDR 1,000,000,000 only

22. Sanction Limitation and Exclusion Clause JH2010/009;

23. Seepage and Pollution Exclusion Clause 01/01/89;

24. Subject to Navigation Limitations for Hull War, Strikes, Terrorism and Related Perils

Endorsement (JW2005/001A);

25. Surveyor Clause;

It is hereby noted and agreed that Assured or the Broker have the liberty to appoint one of the

following independent surveyors to attend on the Underwriter’s behalf in respect of any claim on

the policy :

1. PT. Maritim Surveindo Internusa

2. PT. Asuka Bahari Nusantara

26. The Underwriters agree to waive rights of subrogation against any subsidiary, associated,

affiliated, or interrelated companies of the Assured and all parties specified in the Assured Clause

and this insurance shall not be prejudiced;

Notes : - Warranty :

- Warranted vessel BKI Classed and Class maintained at the time of accident

- Warranted the insured vessels are complied with any statutory/regulatory provision, with valid

and maintained flag state certificates at the time of loss

- Warranted sailing permit from departure port authority

- Warranted single tow operation only

- Warranted no overdraft of the vessel at the time of accident related to relevant load line of the

vessel

- Seaworthiness warranty

- Warranted no overload passenger and/or cargo during operation

- Premium Warranty : In full within 60 days of inception date

- Trading Area : Indonesia water

- Subjectivity :

- No cover unless formally advised and agreed by insurance

- Subject to no outstanding premium for existing policy

- Subject to clean loss record for existing policy

- Subject to no loss until bind cover

- Sight & Review of Gross Akta before bind

- Subject to vessel’s not in laid up condition.

- Period to be informed prior to inception

- No Claim up to binding date or inception date whichever latest (not back date)

- Period must be informed before on risk

This is a computer generated document and therefore no signature required. 3/5

Created by Bayya Ziqra on 2023-05-30 11:40:27 doc. number: 01121/QS.Checked by M Husni Barkah, SE, APAI, CIIB, ANZIIF (Snr. Assoc), CIP.

Placement Information and Proposed Insurer(s)

Security : This quotation is supported up to (100%) of sum insured based on written confirmation from PT

Asuransi Jasa Indonesia (Persero) (50%) As a Leader, PT Asuransi Mitra Pelindung Mustika (15%)

as a member, PT Asuransi Takaful Umum (10%) as a member, PT Asuransi Candiutama (10%) as

a member, PT Asuransi Umum Bumiputera Muda 1967 (5%) as a member, PT Asuransi Umum

Videi (5%) as a member, PT Asuransi Bhakti Bhayangkara (5%) as a member.

Proposed (Leader) : - PT Asuransi Jasa Indonesia (Persero) (50%) As a Leader

(Policy Issuer) - PT Asuransi Mitra Pelindung Mustika (15%) as a member

- PT Asuransi Takaful Umum (10%) as a member

- PT Asuransi Candiutama (10%) as a member

- PT Asuransi Umum Bumiputera Muda 1967 (5%) as a member

- PT Asuransi Umum Videi (5%) as a member

- PT Asuransi Bhakti Bhayangkara (5%) as a member

Note:

We have done our placement to search for the best terms and conditions offered at the best rate of

premium, Fresnel is not responsible for insurer\\'s financial or managerial default, we encourage the

insured to inform us if there is any concern regarding any particular insurer(s) we propose in this

quotation or if there is any specific preference towards a certain insurer(s) upon such

communication, we will act accordingly as per your instruction.

Premium Calculation and Payment

Rate & Premium : Detail Rate as below :-

Calculation

H&M = 1,350% per annum

WAR = 0,025% per annum

Detail Premium Calculation as below :-

H&M : IDR 14,068,000,000.00 x 1,350% = IDR 189,918,000.00 per annum

WAR : IDR 14,068,000,000.00 x 0.025% = IDR 3,517,000.00 per annum

Total Premium Calculation : IDR 193,435,000 per annum

Excluding administration, policy cost and stamp duty

Payment : Within 60 days of inception date.

Note:

1. No claim will be honored and no liability under this insurance will be admitted by underwriter

before receiving the full amount of the premium in their account, subject otherwise to prior

written agreement. Please allow a reasonable time frame for us to process payment of your

premium to the insurer(s) so that they can receive the premium in time prior to the date stated

above for each payment.

2. Should you decide to cancel this policy once instructed and prior to the expiry, you are

obligated to pay for the premium during that validity period of the cover.

Jakarta, 29 May 2023

Signed for and on behalf of,

This is a computer generated document and therefore no signature required. 4/5

Created by Bayya Ziqra on 2023-05-30 11:40:27 doc. number: 01121/QS.Checked by M Husni Barkah, SE, APAI, CIIB, ANZIIF (Snr. Assoc), CIP.

PT. Fresnel Perdana Mandiri

M Husni Barkah, SE, APAI, CIIB, ANZIIF (Snr. Assoc), CIP

CIIB Reg. No. M20170457

This is a computer generated document and therefore no signature required. 5/5

Created by Bayya Ziqra on 2023-05-30 11:40:27 doc. number: 01121/QS.Checked by M Husni Barkah, SE, APAI, CIIB, ANZIIF (Snr. Assoc), CIP.

You might also like

- DUNOD DCG 2 Droit Des SociétésDocument497 pagesDUNOD DCG 2 Droit Des Sociétésbaptiste100% (14)

- London STandard Drilling Brage FormDocument8 pagesLondon STandard Drilling Brage Formgilang paskaNo ratings yet

- Paket MCU - Kontraktor Pertamina Hulu Mahakam 2020Document1 pagePaket MCU - Kontraktor Pertamina Hulu Mahakam 2020rio HENRYNo ratings yet

- Engineering Contracts, Specifications & EthicsDocument27 pagesEngineering Contracts, Specifications & EthicsJen CastilloNo ratings yet

- Application Under Section 96 C. P. C.Document2 pagesApplication Under Section 96 C. P. C.vishalfunckyman100% (2)

- QS MH - Pt. Gading Lautan Perkasa (6 Kapal)Document4 pagesQS MH - Pt. Gading Lautan Perkasa (6 Kapal)AKHMAD SHOQI ALBINo ratings yet

- PleadingDocument4 pagesPleadingMubashar Dilawar Khan KhattakNo ratings yet

- Vampire The Requiem - SAS - Into The VoidDocument31 pagesVampire The Requiem - SAS - Into The VoidCaio César100% (1)

- QS To Broker - PT MAZO ARMADA PASIFIK (PUTRI HARBOUR)Document3 pagesQS To Broker - PT MAZO ARMADA PASIFIK (PUTRI HARBOUR)AKHMAD SHOQI ALBINo ratings yet

- QS - PT Mazo Armada Pasifik (Putri Harbour)Document3 pagesQS - PT Mazo Armada Pasifik (Putri Harbour)AKHMAD SHOQI ALBINo ratings yet

- Commercial Law Review NotesDocument124 pagesCommercial Law Review NotesbeethovenmelodiaNo ratings yet

- Perils of The Sea Perils of The ShipDocument15 pagesPerils of The Sea Perils of The ShipEd Karell GamboaNo ratings yet

- 13 - Law On InsuranceDocument11 pages13 - Law On InsuranceBea GarciaNo ratings yet

- Insurance Syllabus With Laws RA 10607Document7 pagesInsurance Syllabus With Laws RA 10607Pring SumNo ratings yet

- Gulf Resorts Inc. V. Philippine Charter Insurance CorpDocument2 pagesGulf Resorts Inc. V. Philippine Charter Insurance CorpEunice KanapiNo ratings yet

- QS To Broker MH - PT. GADING LAUTAN PERKASA (6 KAPAL)Document4 pagesQS To Broker MH - PT. GADING LAUTAN PERKASA (6 KAPAL)AKHMAD SHOQI ALBINo ratings yet

- 17 02 00245-PS-MH-BTKDocument3 pages17 02 00245-PS-MH-BTKTri Jaya WidagdoNo ratings yet

- Underwriting Guidelines12 MarineDocument11 pagesUnderwriting Guidelines12 MarineFaheemNo ratings yet

- 129 - Placing Slip (MH) - PT. Sentra Makmur Lines - RevisiDocument4 pages129 - Placing Slip (MH) - PT. Sentra Makmur Lines - RevisiAKHMAD SHOQI ALBINo ratings yet

- RFBT 04 (Insurance)Document6 pagesRFBT 04 (Insurance)Ann MagsipocNo ratings yet

- Qs LiabilityDocument2 pagesQs LiabilitySukarman B. Lasmo100% (1)

- Penawaran Asuransi Ip Ibu 21 2375-Mop Mie MasbuchiDocument4 pagesPenawaran Asuransi Ip Ibu 21 2375-Mop Mie MasbuchiImaniar PratithaNo ratings yet

- ACFrOgDEnWK7QfFAn9EgpqQB-1g0B93iavAOYowWcToQjao8pNo3AmHwYoZxklilgKMU1iRGr7zKwEIoObpq4lSe5JK7sCbYn1-ulZUGBl4OOA96F51pFyQQwZx_4hM=Document4 pagesACFrOgDEnWK7QfFAn9EgpqQB-1g0B93iavAOYowWcToQjao8pNo3AmHwYoZxklilgKMU1iRGr7zKwEIoObpq4lSe5JK7sCbYn1-ulZUGBl4OOA96F51pFyQQwZx_4hM=rio HENRYNo ratings yet

- Institute Container Clauses - Time Total Loss, General Average, Salvage, Salvage Charges, Sue and LabourDocument2 pagesInstitute Container Clauses - Time Total Loss, General Average, Salvage, Salvage Charges, Sue and LabourFouad Ouazzani100% (1)

- Avanti 23 53580Document3 pagesAvanti 23 53580Fairel Atharizz NaekaNo ratings yet

- Insurance ReviewerDocument15 pagesInsurance ReviewerEd Karell GamboaNo ratings yet

- Marine Insurance Agreement-1Document8 pagesMarine Insurance Agreement-1kudit9443No ratings yet

- MN Shipping - MN TALOS - COE - 130323Document6 pagesMN Shipping - MN TALOS - COE - 130323ginesNo ratings yet

- Marine Cargo InsuranceDocument7 pagesMarine Cargo Insurancepauline1988No ratings yet

- 1MY03032200196 ClausesDocument13 pages1MY03032200196 ClausesMahendra AkbarNo ratings yet

- QS MH - Pt. Natalindo Eka Sejahtera Bina (Bina 305)Document4 pagesQS MH - Pt. Natalindo Eka Sejahtera Bina (Bina 305)AKHMAD SHOQI ALBINo ratings yet

- Mobile Insurance PolicyDocument5 pagesMobile Insurance Policyadeel shahidNo ratings yet

- Protection and Indemnity Endorsement - SP-23 Amended 01.07.04Document3 pagesProtection and Indemnity Endorsement - SP-23 Amended 01.07.04OleksandrNo ratings yet

- 36 Questions and AnswersDocument58 pages36 Questions and AnswersMoudgalya Vedam100% (5)

- J Calcutta HC Sejallahoti Dsnluacin 20201109 210948 1 12 PDFDocument12 pagesJ Calcutta HC Sejallahoti Dsnluacin 20201109 210948 1 12 PDFSejal LahotiNo ratings yet

- Marine Cargo Insurance Policy: OriginalDocument9 pagesMarine Cargo Insurance Policy: OriginalOchoa ErickNo ratings yet

- Institute Cargo Clauses C 1982Document2 pagesInstitute Cargo Clauses C 1982Mie SheinNo ratings yet

- Insurance 4 MlsDocument105 pagesInsurance 4 MlsBen DhekenzNo ratings yet

- x02 PasabogDocument3 pagesx02 Pasabogezmailer75No ratings yet

- Institute Cargo Clause A 1982Document2 pagesInstitute Cargo Clause A 1982Tien Minh CaoNo ratings yet

- 04 Insurance LawDocument6 pages04 Insurance Lawrandomlungs121223No ratings yet

- CommercialDocument230 pagesCommercialJho Harry ForcadasNo ratings yet

- Giay Chung Nhan Bao HiemDocument1 pageGiay Chung Nhan Bao HiemQuang TrãiNo ratings yet

- Itc Coal Clause - CL 267 PDFDocument2 pagesItc Coal Clause - CL 267 PDFbobyNo ratings yet

- Maritime Conference 2003: Sponsors: Royal & Sunalliance, Marsh Canada and Fernandes Hearn LLPDocument14 pagesMaritime Conference 2003: Sponsors: Royal & Sunalliance, Marsh Canada and Fernandes Hearn LLPmanojvarrierNo ratings yet

- Motor Third Party Liability Insurance: General ConditionsDocument14 pagesMotor Third Party Liability Insurance: General ConditionsTonySaabNo ratings yet

- Charterers Liability RU 1996Document4 pagesCharterers Liability RU 1996Harish IyerNo ratings yet

- Owner/Debtor: Marine InsuranceDocument5 pagesOwner/Debtor: Marine InsuranceHazel Martinii PanganibanNo ratings yet

- P.Slip - Sompo China - Cargo QS Facility 2021 - v2 (Clean)Document30 pagesP.Slip - Sompo China - Cargo QS Facility 2021 - v2 (Clean)Vuong Nguyen MinhNo ratings yet

- Airline Aircraft Hull All Risk Spare Liab Policy BrochureDocument27 pagesAirline Aircraft Hull All Risk Spare Liab Policy BrochureZoran DimitrijevicNo ratings yet

- Institute Air Cargo Clauses (All Risks) .: (Excluding Sendings by Post)Document2 pagesInstitute Air Cargo Clauses (All Risks) .: (Excluding Sendings by Post)huyềnNo ratings yet

- Insurance and Pre-Need1Document20 pagesInsurance and Pre-Need1girlNo ratings yet

- India Marine Insurance Act 1963Document21 pagesIndia Marine Insurance Act 1963Aman GroverNo ratings yet

- Dieu Khoan A 2009 - TaDocument6 pagesDieu Khoan A 2009 - TaBảo Hiểm Sức KhoẻNo ratings yet

- Insurer's Promise, The Insured Pays A PremiumDocument10 pagesInsurer's Promise, The Insured Pays A PremiumDianne YcoNo ratings yet

- Quote - Q200026307485Document3 pagesQuote - Q200026307485Deepali ChaudharyNo ratings yet

- Marine Open Cover - Broker Clauses (By Ahliasuransi)Document33 pagesMarine Open Cover - Broker Clauses (By Ahliasuransi)Amalia IstighfarahNo ratings yet

- BM 2024 HM Terms ConditionsDocument15 pagesBM 2024 HM Terms ConditionsAdam BanouraNo ratings yet

- Poliza de Seguro Internacinoal Institute Cargo Calse ADocument4 pagesPoliza de Seguro Internacinoal Institute Cargo Calse AANDRES LOPEZ JIMENEZNo ratings yet

- Póliza de Seguro de Transporte Internacional. Modalidad Institute Cargo Clauses ADocument4 pagesPóliza de Seguro de Transporte Internacional. Modalidad Institute Cargo Clauses AANDRES LOPEZ JIMENEZNo ratings yet

- Institute Cargo Clause A 1982Document2 pagesInstitute Cargo Clause A 1982Mie SheinNo ratings yet

- Marine InsuranceDocument15 pagesMarine InsuranceRanadeep PoddarNo ratings yet

- 23a P&I PolicyDocument6 pages23a P&I PolicyDELTA MARITIMENo ratings yet

- Azuelo, J. (Assignment)Document36 pagesAzuelo, J. (Assignment)Charmila SiplonNo ratings yet

- Institute Coal ClauseDocument4 pagesInstitute Coal ClauseImam MusjabNo ratings yet

- Budget Development FormDocument3 pagesBudget Development Formrio HENRYNo ratings yet

- 19frm-Fad-086 Rev 00 Monitoring PembayaranDocument20 pages19frm-Fad-086 Rev 00 Monitoring Pembayaranrio HENRYNo ratings yet

- Sample Copy TOWCON 2021Document24 pagesSample Copy TOWCON 2021rio HENRYNo ratings yet

- Video Company Profile (Violetta)Document13 pagesVideo Company Profile (Violetta)rio HENRYNo ratings yet

- Free Business Plan Template MyNBIDocument25 pagesFree Business Plan Template MyNBIrio HENRYNo ratings yet

- All ReqDocument7 pagesAll Reqrio HENRYNo ratings yet

- IIA Indonesia Jadwal TrainingDocument1 pageIIA Indonesia Jadwal Trainingrio HENRYNo ratings yet

- Leader Vs BossDocument8 pagesLeader Vs Bossrio HENRYNo ratings yet

- Curriculum Vitae: Personal IdentificationDocument3 pagesCurriculum Vitae: Personal Identificationrio HENRYNo ratings yet

- Comparation of Audit ApproachDocument1 pageComparation of Audit Approachrio HENRYNo ratings yet

- Medical Law and Ethics Thesis TopicsDocument5 pagesMedical Law and Ethics Thesis Topicsrqaeibifg100% (1)

- Completed Business Environment Assignment 2-Muleba MatafwaliDocument9 pagesCompleted Business Environment Assignment 2-Muleba MatafwaliMulebaNo ratings yet

- Staff Selection Commission: Constable (GD) in Capfs, SSF, and Rifleman (GD) in Assam Rifles Examination 2024Document3 pagesStaff Selection Commission: Constable (GD) in Capfs, SSF, and Rifleman (GD) in Assam Rifles Examination 2024gugulothanitha665No ratings yet

- Jatayu - Architecture DocumentDocument13 pagesJatayu - Architecture Documentdeepika shankarNo ratings yet

- CHAPTER 1 & 2 Power and Limitations of TaxationDocument47 pagesCHAPTER 1 & 2 Power and Limitations of TaxationCeej DalipeNo ratings yet

- Project Execution Plan FOR Feasibility Study For Repair of 1 No. Box Caisson of SMP, KolkataDocument15 pagesProject Execution Plan FOR Feasibility Study For Repair of 1 No. Box Caisson of SMP, Kolkatasanil petereNo ratings yet

- Administrative Law AssignmentsDocument3 pagesAdministrative Law AssignmentsShashwat SrivastavaNo ratings yet

- Chapter 6Document10 pagesChapter 6Rohish MehtaNo ratings yet

- 51J-12 10.13.21 Damian Williams Re Show Cause Order Civil and Criminal Contempt of Brady OrdersDocument9 pages51J-12 10.13.21 Damian Williams Re Show Cause Order Civil and Criminal Contempt of Brady OrdersThomas WareNo ratings yet

- Bail Bond Doj Guidelines Apr 2018Document5 pagesBail Bond Doj Guidelines Apr 2018Joel A. YbañezNo ratings yet

- List of Crimes Under KPDocument9 pagesList of Crimes Under KPJay-Arh0% (1)

- Sanjay Satyanarayan Bang PDFDocument34 pagesSanjay Satyanarayan Bang PDFPavithra MurugesanNo ratings yet

- Agmts - Sale of MassionetteDocument5 pagesAgmts - Sale of MassionetteKagimu Clapton ENo ratings yet

- Riders Tube Caddy Tube Substitution Guidebook 1960 34 PagesDocument61 pagesRiders Tube Caddy Tube Substitution Guidebook 1960 34 PagesJUNNo ratings yet

- 4 NkondeDocument7 pages4 Nkondechitundu kasondeNo ratings yet

- SBN-0761: Timbangan NG Bayan CentersDocument6 pagesSBN-0761: Timbangan NG Bayan CentersRalph RectoNo ratings yet

- ARTICLE IX (C)Document1 pageARTICLE IX (C)Felix III AlcarezNo ratings yet

- Occupier's Liability (Scotland) Act 1960Document4 pagesOccupier's Liability (Scotland) Act 1960Kean Phang TehNo ratings yet

- DSSB ClerkDocument4 pagesDSSB Clerkjfeb40563No ratings yet

- Principle of Common But Differentiated Responsibithe PrincipleDocument3 pagesPrinciple of Common But Differentiated Responsibithe PrincipleRANDAN SADIQNo ratings yet

- Educational Services (PVT.) LTD.: P.V Number: 6510000246651 Buyer Code: 6590004976034Document1 pageEducational Services (PVT.) LTD.: P.V Number: 6510000246651 Buyer Code: 6590004976034Storm PooperNo ratings yet

- Ebook Christianity in The WorkplaceDocument25 pagesEbook Christianity in The WorkplaceNjoh LarryNo ratings yet

- Notes Joint Stock CompanyDocument3 pagesNotes Joint Stock CompanyDinesh KumarNo ratings yet

- CIVREV-Arado Heirs Vs Alcoran PDFDocument19 pagesCIVREV-Arado Heirs Vs Alcoran PDFMark John Geronimo BautistaNo ratings yet

- StoryDocument10 pagesStoryArnelio Espino Remegio Jr.No ratings yet