Professional Documents

Culture Documents

Trimegah CF INKP 20231115 - A hiccup in 3Q

Trimegah CF INKP 20231115 - A hiccup in 3Q

Uploaded by

Saham IhsgCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trimegah CF INKP 20231115 - A hiccup in 3Q

Trimegah CF INKP 20231115 - A hiccup in 3Q

Uploaded by

Saham IhsgCopyright:

Available Formats

Company Focus │ November 15, 2023

Buy

Indah Kiat Pulp and Paper Previous TP

(maintain)

Target Price IDR18,000 (+112% ups.)

IDR18,300

A hiccup in 3Q Current Price IDR8,475

Weak 3Q23 result amid lower ASP but expecting recovery in 4Q

3Q23 net profit fell sharply to $52mn (-62% QoQ, -79% YoY). This brings 9M23

net profit to $321mn (-50% YoY), accounting to 62%/50% of ours and consensus

FY23 estimates respectively. The company emphasizes that there was no

operational hiccup during the quarter as total sales volume increased by +1% QoQ.

However, revenue fell sharply despite hardwood pulp price registering a positive

uptrend during 3Q23 (fig. 3). This was on the back of a 1–2-month ASP lag. Figure

4 shows assuming a 2-month ASP lag, 3Q23 pulp price corrected by -33% QoQ.

Another reason why INKP’s earnings in 3Q23 dropped significantly was due to pulp

price dropping similar to their cash cost level. Huge part of INKP’s cash cost came

from woodchips (raw material for pulp), which was more influenced by fuel price

rather than benchmark pulp prices (company notes that transportation accounts

for ~40% of wood price). We expect earnings to recover in 4Q23F considering pulp

price rose by 11% QTD (fig. 4) and to recover significantly in 2024F when pulp Willinoy Sitorus

price stabilizes >$600/t ($90mn in 4Q23F and $502mn in 2024F). willinoy.sitorus@trimegah.com

021 - 2924 9107

We expect hardwood price to continue hovering around ~$600/t

Alpinus Dewangga

We maintain our view that the hardwood pulp price can be maintained >$600/t as alpinus.raditya@trimegah.com

this is the cash cost level of Chinese pulp producers. We’d like to highlight that any 021 – 2924 6322

price increase to ~$700 may incentivize Chinese pulp producers to

resume/increase production, potentially causing a short-term correction in the

prices and vice versa. Note that YTD pulp demand was mainly driven by China (fig Stock Data & Indices

7). Bloomberg Code INKP.IJ

JCI Member IDXBASIC

Earnings revision MSCI Indonesia Yes

We revised our 2023F-25F hardwood pulp price assumption by 3%/2%/0% to JII No

$600/610/620 per ton. Despite increasing our pulp price assumption, we lower our LQ45 Yes

profit target by -22%/-7%/0% to $411/502/404mn to account for the 1–2-month Kompas 100 Yes

ASP lag. It's important to note that the YoY drop in 2025F is attributed to interest

expenses coming into play after the new Karawang factory starts. Key Data

Issued Shares (mn) 5,471

Free Float (%) 42.1%

Maintain buy rating with TP of Rp18,000

Mkt. Cap (IDRbn) 46,366

We maintain our buy rating with a TP of IDR18,000/sh (+112% upside). Our DCF-

Mkt. Cap (USDmn) 2,992

based TP assumes a 12% WACC with LT growth of 1.4%. Our TP implies a 2024F 11,625/6,775

52 Wk-range

P/E ratio of 12.7, which is still at a -12% discount compared to peers. Note that

this is without earnings contribution from the new factory, which we expect to

operate at full capacity by 2027F/28. Our TP implies a 2027F P/E of 5.8x. INKP is

currently trading at an undemanding 5.96x 24F P/E, a -58% discount compared to Performance (%)

global peers. Key risk: volatility in pulp prices and later-than-expected new factory YTD 1m 3m 12m

commencement. Absolute -2.9 -19.5 -15.9 -16.7

Relative to

JCI -0.9 -16.3 -13.2 -11.4

Company Data

Year end Dec 2021 2022 2023F 2024F 2025F

Revenue (USD mn) 3,517 4,003 3,520 3,782 4,619

EBITDA (USD mn) 1,129 1,391 1,013 1,134 1,337

Core Profit (USD mn) 494 737 402 502 403

EV/ EBITDA (x) 5.0 3.6 5.4 6.1 5.3

Core EPS (IDR) 1,322 2,001 1,140 1,421 1,142

Core P/E (x) 6.41 4.24 7.43 5.96 7.42

Core EPS growth (%) 92.4 51.3 -43.0 24.6 -19.6

P/ BV (x) 0.66 0.53 0.50 0.46 0.44

ROE (%) 11.0 15.3 6.8 7.7 5.9

Div. Yield (%) 0.58 0.59 0.62 0.69 0.84

PT Trimegah Sekuritas Indonesia Tbk – www.trimegah.com 1

Income Statement

Year end Dec (USD mn) 2021 2022 2023F 2024F 2025F

Revenue 3,517 4,003 3,520 3,782 4,619

Gross Profit 1,228 1,590 1,112 1,266 1,381 Company Background

Operating Profit 858 1,138 758 879 938

EBITDA 1,129 1,391 1,013 1,134 1,337 PT Indah Kiat Pulp & Paper Tbk is

Net Interest expense/(Exp) -240 -238 -251 -247 -401 engaged in manufacturing of

Gain/(loss) Forex 12 67 -29 0 0 paper, pulp, and packaging paper.

Total other Income (Expense) 42 148 11 0 0 INKP is part of APP (Asia Pulp and

Pre-tax Profit 661 1,047 517 632 537 Paper), a holding owned by

Income Tax Expense -134 -190 -107 -130 -134 Sinarmas family

Net profit 526 857 411 502 403

Core profit 494 737 402 502 403

Dividend payout ratio 6.3 3.5 2.2 5.0 5.0

Major Shareholders

Balance Sheet PT Purinusa Ekapersada 52.7%

Year end Dec (Rp bn) 2021 2022 2023F 2024F 2025F Public 47.3%

Cash and equivalents 1,059 1,265 1,570 857 1,476

Other curr asset 3,643 4,211 4,059 4,282 4,235

Net fixed asset 3,430 3,263 4,233 5,922 6,458

Other asset 846 902 902 902 902

Total asset 8,978 9,641 10,763 11,964 13,072

ST debt 1,172 1,833 2,226 2,619 3,013

SWOT Analysis

Other curr liab 366 407 417 417 427

LT debt 2,397 1,523 1,850 2,177 2,504

Other LT Liab 279 272 272 272 272 Strength Weakness

Total Liabilities 4,214 4,036 4,766 5,485 6,215

Minority interest 1 1 1 1 1

Vertical pulp Still exposed

Shareholder’s Equity 4,765 5,605 5,997 6,479 6,857 and paper by pulp price

Net Debt (Cash) 2,509 2,091 2,506 3,939 4,040 integration volatility

Cash Flow

Year end Dec (Rp bn) 2021 2022 2023F 2024F 2025F

Net Profit 526 857 411 502 403

Depr / Amort 271 253 255 255 399

Chg in Working Cap -99 -528 191 -137 57

Others -19 -177 -29 -86 0

CF's from oprs 679 406 828 533 859

Capex -408 -173 -1,225 -1,945 -935

Others 8 28 0 0 0

CF's from investing -400 -146 -1,225 -1,945 -935 Opportunity Threat

Net change in debt -92 -212 720 720 720 Capacity Significant drop

Others 0 147 -19 -21 -25 expansion in pulp price

CF's from financing -92 -65 701 699 695

Net cash flow 187 195 305 -713 619

Cash at BoY 871 1,060 1,265 1,570 857

Cash at EoY 1,060 1,265 1,570 857 1,476

Free Cashflow 271 233 -397 -1,412 -76

Ratio Analysis

Year end Dec 2021 2022 2023F 2024F 2025F

Profitability (%)

Gross Margin 34.9 39.7 31.6 33.5 29.9

Opr Margin 24.4 28.4 21.5 23.2 20.3

EBITDA Margin 32.1 34.8 28.8 30.0 29.0

Net Margin 14.0 18.4 11.4 13.3 8.7

ROAE 11.7 16.5 7.1 8.0 6.0

ROAA 6.0 9.2 4.0 4.4 3.2

Stability (x)

Current ratio 2.1 2.4 2.1 1.7 1.7

Net Debt to Equity 0.5 0.4 0.4 0.6 0.6

Net Debt to EBITDA 2.2 1.5 2.5 3.5 3.0

Interest Coverage 3.6 4.6 2.8 3.3 2.3

Efficiency (days)

A/P collection 34 34 34 34 34

A/R payment 140 147 180 180 180

Inv. turnover 64 70 65 65 65

PT Trimegah Sekuritas Indonesia Tbk – www.trimegah.com 2

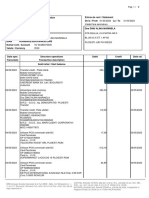

Figure 1. INKP 3Q23 result: below (before earnings adjustment)

Source: Company, Bloomberg, Trimegah Research

Snapshot

• 3Q23 net profit fell sharply to $52mn (-62% QoQ, -79% YoY). This is mainly driven by lower revenue at $756mn (-14%

QoQ, -28% YoY). This brings 9M23 net profit to $321mn (-50% YoY), accounting 62%/50% of ours and consensus FY23

estimates respectively.

• Operational volume: Total (pulp, paper, packaging) 9M23 sales volume increased +4-5% YoY, production increased +2-4%

YoY. 3Q23 sales volume increased +1% QoQ. Company emphasizes there is no operational hiccup during the quarter.

• 3Q pulp revenue down -33% QoQ, and down -44% YoY, while both paper and packaging, only down -4% QoQ respectively.

Note that more than 50% of its pulp are sold to export markets (the remaining is for internal use for its paper segment mostly).

• The revenue fell sharply despite hardwood pulp price registering a positive uptrend during the 3Q23. This was on the back

of a 1–2-month ASP lag. (refer to fig. 4)

• There is a large capex jump in 3Q amounting to $261mn. If rightly so, we assume this is for its packaging expansion project

in Karawang.

PT Trimegah Sekuritas Indonesia Tbk – www.trimegah.com 3

Figure 2. Hardwood and softwood pulp prices

1,100

1,010

1,000

900

865

800

754

$/t

696

700

648 640

600 629

552

500

475

400

Nov-22

Nov-20

Apr-21

Jun-21

Nov-21

Apr-22

Jun-22

Apr-23

Jun-23

Aug-20

Feb-21

Mar-21

Jul-21

Feb-22

Mar-22

Jul-22

Feb-23

Mar-23

Jul-23

Aug-21

Aug-23

Sep-20

Oct-20

Dec-20

Jan-21

May-21

Sep-21

Oct-21

Dec-21

Jan-22

May-22

Aug-22

Sep-22

Oct-22

Dec-22

Jan-23

May-23

Sep-23

Oct-23

Hardwood Softwood Hardwood avg ('09-'19)

Source: RISI, Trimegah Research

Figure 3. Pulp price assuming no lag Figure 4. Pulp price with 2-month lag

Pulp price quarterly 2 month lag

$/t 1Q23 2Q23 3Q23 QTD %QoQ ($/t) 1Q23 2Q23 3Q23 QTD %QoQ

Hardwood 757 521 532 595 11.7% Hardwood 840 704 498 553 11.1%

Softwood 895 692 670 744 11.0% Softwood 906 863 663 696 4.9%

Source: RISI, Trimegah Research Source: RISI, Trimegah Research

Figure 5. China pulp and paper import volume is improving Figure 6. China pulp and paper export volume is growing

compared to last year steadily in the past months

China pulp and paper export volume China pulp and paper export volume

450 135

430

125

410

390

115

370

350 105

330

95

310

290

85

270

250 75

Source: RISI, Trimegah Research Source: RISI, Trimegah Research

PT Trimegah Sekuritas Indonesia Tbk – www.trimegah.com 4

Figure 7. BCP shipment to China climbed 28% year on year, offsetting declines in other parts of the world

Global BCP shipment Monthly YTD

thousand tonnes Jul-22 Jul-23 %YoY 7M22 7M23 %YoY

China 1,505 2,230 48% 11,045 14,135 28%

Europe 1,370 1,150 -16% 10,030 8,285 -17%

Other Asia 755 765 1% 5,905 5,045 -15%

USA 550 505 -8% 3,945 3,525 -11%

RoW 370 410 11% 2,740 3,005 10%

Total 4,550 5,060 11% 33,665 33,995 1%

Source: Hawkins Wright, Trimegah research

Figure 8. Earnings revision

Current Previous Changes

(USDmn) FY23F FY24F FY25F FY23F FY24F FY25F FY23F FY24F FY25F

Pulp price (USD/ton) 600 610 620 580 600 620 3% 2% 0%

ASP (USD/ton)

Pulp 570 580 589 551 570 589 3% 2% 0%

Paper 912 869 884 827 855 884 10% 2% 0%

Packaging and other 542 637 630 606 627 630 -11% 2% 0%

Sales volume (mn tonnes)

Pulp 1,916 2,116 1,965 2,116 2,116 1,965 -9% 0% 0%

Paper 1,412 1,397 1,397 1,397 1,397 1,397 1% 0% 0%

Packaging and other 2,105 2,105 2,105 2,105 2,105 2,105 0% 0% 0%

Revenue breakdown

Pulp 1,092 1,226 1,157 1,166 1,206 1,157 -6% 2% 0%

Paper 1,288 1,214 1,234 1,154 1,194 1,234 12% 2% 0%

Packaging and other 1,140 1,342 1,327 1,276 1,320 1,327 -11% 2% 0%

Karawang factory 0 0 901 0 0 901 NA NA 0%

Revenue 3,520 3,782 4,619 3,596 3,720 4,619 -2% 2% 0%

Gross Profit 1,112 1,266 1,381 1,293 1,314 1,381 -14% -4% 0%

Operating Profit 758 879 938 903 934 938 -16% -6% 0%

EBITDA 1,013 1,134 1,337 1,158 1,189 1,337 -12% -5% 0%

Net profit 411 502 403 517 542 405 -21% -7% 0%

Core profit 402 502 403 517 542 405 -22% -7% 0%

Gross Margin 32% 33% 30% 36% 35% 30%

Opr Margin 22% 23% 20% 25% 25% 20%

EBITDA Margin 29% 30% 29% 32% 32% 29%

Net Margin 12% 13% 9% 14% 15% 9%

Core Net Margin 11% 13% 9% 14% 15% 9%

Source: RISI, Trimegah Research

PT Trimegah Sekuritas Indonesia Tbk – www.trimegah.com 5

Figure 9. Valuation

DCF valuation of consolidated INKP

Assumption 2024F 2025F 2026F 2027F 2028F TV

Risk free rate 6.50% (+) EBIT (1-tax) 698 704 956 1,454 1,553

Market premium 7.89% (+) Chg in NWC -137 57 162 182 44

Beta 1.11 (+) Depreciation 255 399 399 399 399

Ke 15.3% (-) Capex -1,945 -935 -935 -390 -390

Kd 8.0% FCFF -1,129 225 581 1,645 1,606

WACC 12.2% Discounted FCFF -1,129 201 462 1,166 1,015 9,708

Sum FCFF 11,421

(-) 2024F debt 4,796

(+) 2024F cash 857

(-) 2024F minority 1

Equity Value 7,482

Execution risk disc -15%

Equity Value after disc 6,360

USD/IDR 15,500

Equity value (IDR bn) 98,576

#of shares 5,471

Rounded 18,000

Source: RISI, Trimegah Research

Figure 10. Peers’ comparison

Ticker Market cap PER (x) PBV (x) EV/EBITDA (x) ROE (%)

(USDMn) 2023Y 2024Y 2023Y 2024Y 2023Y 2024Y 2023Y 2024Y

*as of 11/15/2023

Pulp&Paper

SUZANO SA SUZB3 BZ EQUITY 15,023 6.53 14.48 1.82 1.61 7.27 7.22 30.69 12.73

KLABIN SA - UNIT KLBN11 BZ EQUITY 5,528 10.49 11.99 2.42 2.53 7.94 7.71 26.94 16.59

EMPRESAS COPEC SA COPEC CI Equity 9,137 16.54 12.25 0.72 0.69 8.14 7.35 5.85 7.17

NINE DRAGONS PAPER HOLDINGS 2689 HK Equity 2,695 #N/A N/A 9.44 0.44 0.42 18.08 8.76 -4.27 4.72

Average 8,096 11.19 12.04 1.35 1.31 10.36 7.76 14.80 10.30

Packaging

US

AVERY DENNISON CORP AVY US EQUITY 14,503 22.92 19.13 6.84 5.86 14.14 12.46 30.62 32.56

GRAPHIC PACKAGING HOLDING CO GPK US EQUITY 6,626 7.60 7.90 2.47 2.05 6.40 6.49 36.13 25.08

WESTROCK CO WRK US EQUITY 9,802 12.87 14.56 0.93 0.89 6.36 6.48 7.05 6.46

INTERNATIONAL PAPER CO IP US EQUITY 11,450 15.73 16.69 1.35 1.38 7.31 7.30 8.66 7.95

AMCOR PLC AMCR US EQUITY 13,109 12.49 13.18 3.27 3.19 10.08 10.12 26.50 24.22

Average 11,098 14.32 14.29 2.97 2.67 8.86 8.57 21.79 19.25

Asia pacific

NIPPON PAPER INDUSTRIES CO L 3863 JT Equity 966 #N/A N/A 9.24 0.38 0.36 22.41 10.68 -12.03 3.90

AMCOR PLC-CDI AMC AU Equity 12,977 12.37 13.05 3.23 3.16 10.02 10.05 26.50 24.22

SCG PACKAGING PCL SCGP TB Equity 4,345 27.99 23.09 1.56 1.50 11.46 10.19 5.51 6.35

Average 6,096 20.18 15.13 1.72 1.67 14.63 10.31 6.66 11.49

Europe

SMURFIT KAPPA GROUP PLC SKG LN Equity 9,004 9.33 9.82 1.48 1.36 5.69 5.78 16.52 14.74

STORA ENSO OYJ-R SHS STERV FH EQUITY 10,082 148.94 18.08 0.80 0.79 13.30 8.76 0.26 4.39

SIG GROUP AG SIGN SW EQUITY 8,743 25.10 22.26 2.62 2.58 13.24 12.25 10.46 11.19

Average 9,276 61.12 16.72 1.63 1.58 10.74 8.93 9.08 10.11

Packaging average 9,237 29.53 15.18 2.27 2.10 10.95 9.14 14.20 14.64

Overall peers average 8,933 25.30 14.34 2.02 1.89 10.79 8.77 14.36 13.48

INKP 3,165 7.43 5.96 0.50 0.46 5.43 6.11 6.85 7.74

Premium (disc) vs Overall average -70.6% -58.4% -75.3% -75.6% -49.7% -30.3% -52.3% -42.6%

Premium (disc) vs pulp and paper's peers -33.6% -50.5% -63.1% -64.8% -47.6% -21.3% -53.7% -24.9%

Premium (disc) vs packaging's peers -74.8% -60.7% -78.0% -78.0% -50.4% -33.2% -51.8% -47.1%

Source: Bloomberg, Trimegah Research

PT Trimegah Sekuritas Indonesia Tbk – www.trimegah.com 6

Key takeaways from our meeting with INKP:

Undemanding 3Q results were due to lower ASP

• Operational volume: Total (pulp, paper, packaging) 9M23 sales volume increased +4-5% YoY, production increased +2-

4% YoY. 3Q23 sales volume increased +1% QoQ. The company emphasizes there is no operational hiccup during the

quarter.

• There is a 1–2-month ASP lag. INKP published a PO (pre-order) price, and shipment will follow in 1-2 months using the

PO price. Revenue is only recognized after shipment.

• Industrial paper segment is a combination of 60% brown paper and 40% white paper packaging, which is why industrial

paper segment GPM softens following a lower pulp price.

• Woodchips (raw material for pulp) is more affected by fuel price rather than benchmark pulp prices. Compamy notes that

transportation accounts for ~40% of the wood price.

What to expect in 4Q23

• 4Q23F result will assume a $553/t pulp price (+11% QoQ) assuming a 2-month ASP lag, which is still lower compared to

2Q23 at $704/t.

• Company is expecting a slight sales uptick in 4Q23 on the back of Chinese New Year restocking.

New Karawang factory update

• All main machinery equipment has been ordered. Machinery will come in multiple parts and will be assembled in the

factory.

• Civil work reached 40-50% completion

• Wood chips will be delivered from Kalimantan to Patimban Port in Subang. The company's internal calculation shows

shipping wood from Kalimantan is cheaper compared to shipping from Sulawesi.

PT Trimegah Sekuritas Indonesia Tbk – www.trimegah.com 7

Research Team

Willinoy Sitorus Head of Research, Strategy, Energy willinoy.sitorus@trimegah.com +62-21 2924 9105

Fakhrul Fulvian Economics, Fixed Income fakhrul.fulvian@trimegah.com +62-21 2924 9097

Adi Prabowo Banks, and Financial-related adi.prabowo@trimegah.com +62-21 2924 9107

Heribertus Ariando Consumer, Media and Healthcare heribertus.ariando@trimegah.com +62-21 2924 9106

Richardson Raymond Telco, Auto and Tech richardson.raymond@trimegah.com +62-21 2924 6325

Kharel Devin Fielim Property, CPO, Cement, Toll, Small Caps kharel.devin@trimegah.com +62-21 2924 9106

Jonathan Gunawan Economics and Fixed Income jonathan.gunawan@trimegah.com +62-21 2924 9096

Ignatius Samon Consumer, Healthcare and Media & Tech ignatius.samon@trimegah.com +62-21 2924 9143

Sabrina Telco infra, ESG and Small Caps sabrina@trimegah.com +62-21 2924 9018

Alpinus Dewangga Energy-related alpinus.raditya@trimegah.com +62-21 2924 6322

Alberto Jonas Kusuma Auto, CPO and Small Caps alberto.kusuma@trimegah.com +62-21 2924 9103

Corporate Access

Nur Marini Corporate Access marini@trimegah.com +62-21 2924 6323

Institutional Sales Team

Beatrix Susanto Head of Institutional Sales beatrix.susanto@trimegah.com +62-21 2924 9086

Henry Sidarta, CFTe Head of Institutional Dealing henry.sidarta@trimegah.com +62-21 3043 6309

Raditya Andyono Equity Institutional Sales raditya.andyono@trimegah.com +62-21 2924 9146

Calvina Karmoko Equity Institutional Sales calvina.karmoko@trimegah.com +62-21 2924 9080

Stefanus Indarto Equity Institutional Sales stefanus.indarto@trimegah.com +62-21 2924 9080

Morgan Gindo Equity Institutional Sales morgan.gindo@trimegah.com +62-21 2924 9076

Retail Sales Team

Billy Budiman Head of Retail Equity Sales billy.budiman@trimegah.com +62-21 3043 6310

Hasbie Sukaton Deputy Head of Retail Sales hasbie.sukaton@trimegah.com +62-21 2924 9088

Jakarta Area

Ignatius Candra Perwira Kelapa Gading, Jakarta ignatius.perwira@trimegah.com +62-21 8061 7270

Robby Jauhari BSD, Jakarta robby.jauhari@trimegah.com +62-21 5089 8959

Sumatera

Alfon Ariapati Medan, Sumatera Utara alfon.ariapati@trimegah.com +62-61 4100 0000

Eastern Indonesia

Carlo Ernest Frits Coutrier Makasar, Sulawesi Selatan carlo.coutrier@trimegah.com +62-411 3604 379

East Java

Pandu Wibisono Surabaya, Jawa Timur pandu.wibisono@trimegah.com +62-31 2973 18000

Central Java, Area

Aloysius Primasyah Semarang, Jawa Tengah primasyah.kristanto@trimegah.com +62-24 8600 2310

Laili Ma’muroh Solo, Jawa Tengah laili.mamuroh@trimegah.com +62-271 6775 590

West Java

Bhisma Herlambang Bandung, Jawa Barat bhisma.herlambang@trimegah.com +62-22 8602 6290

Renny Nurhayati Hidayat Cirebon, Jawa Barat renny.nurhayati@trimegah.com +62-231 8851 009

PT Trimegah Sekuritas Indonesia Tbk – www.trimegah.com 8

Disclaimer

This report has been prepared by PT Trimegah Sekuritas Indonesia Tbk on behalf of itself and its affiliated companies and is

provided for information purposes only. Under no circumstances is it to be used or considered as an offer to sell, or a solicitation

of any offer to buy. This report has been produced independently and the forecasts, opinions and expectations contained herein

are entirely those of PT Trimegah Sekuritas Indonesia Tbk.

While all reasonable care has been taken to ensure that information contained herein is not untrue or misleading at the time

of publication, PT Trimegah Sekuritas Indonesia Tbk makes no representation as to its accuracy or completeness and it should

not be relied upon as such. This report is provided solely for the information of clients of PT Trimegah Sekuritas Indonesia Tbk

who are expected to make their own investment decisions without reliance on this report. Neither PT Trimegah Sekuritas

Indonesia Tbk nor any officer or employee of PT Trimegah Sekuritas Indonesia Tbk accept any liability whatsoever for any

direct or consequential loss arising from any use of this report or its contents. PT Trimegah Sekuritas Indonesia Tbk and/or

persons connected with it may have acted upon or used the information herein contained, or the research or analysis on which

it is based, before publication. PT Trimegah Sekuritas Indonesia Tbk may in future participate in an offering of the company’s

equity securities.

This report is not intended for media publication. The media is not allowed to quote this report in any article whether in full or

in parts without permission from PT Trimegah Sekuritas Indonesia Tbk. For further information, the media can contact the

head of research of PT Trimegah Sekuritas Indonesia Tbk.

This report was prepared, approved, published and distributed by PT Trimegah Sekuritas Indonesia Tbk located outside of the

United States (a “non-US Group Company”). Neither the report nor any analyst who prepared or approved the report is subject

to U.S. legal requirements or the Financial Industry Regulatory Authority, Inc. (“FINRA”) or other regulatory requirements

pertaining to research reports or research analysts. No non-US Group Company is registered as a broker-dealer under the

Exchange Act or is a member of the Financial Industry Regulatory Authority, Inc. or any other U.S. self-regulatory organization.

INVESTMENT RATING RULE:

Buy : Share price is expected to exceed more than 10% over the next 12 months

Neutral : Share price is expected to trade within the range of 0%-10% over the next 12 months

Sell : Share price is expected to trade below 0% over the next 12 months

Not Rated : The company is not within Trimegah research coverage

PT Trimegah Sekuritas Indonesia Tbk – www.trimegah.com 9

Analysts Certification

The research analyst(s) of PT Trimegah Sekuritas Indonesia Tbk. primarily responsible for the content of this research

report, in whole or in part, certifies that with respect to the companies or relevant securities that the analyst(s) covered in

this report: (1) all of the views expressed accurately reflect his or her personal views on the company or relevant securities

mentioned herein; (2) no part of his or her remuneration was, is, or will be, directly or indirectly, connected with his or her

specific recommendations or views expressed in the research report; and (3) the report does not contain any material non-

public information.

The disclosure column in the following table lists the important disclosures applicable to each company that has been rated

and/or recommended in this report:

Company Ticker Disclosure (as applicable)

INKP -

Trimegah Disclosure Data

Trimegah represents that:

1. Within the past year, it has managed or co-managed a public offering for this company, for which it received fees.

2. It had an investment banking relationship with this company in the last 12 months.

3. It received compensation for investment banking services from this company in the last 12 months.

4. It expects to receive or intends to seek compensation for investment banking services from the subject company/ies

in the next 3 months.

5. It beneficially owns 1% or more of any class of common equity securities of the subject company.

6. It makes a market in securities in respect of this company.

7. The analyst(s) or an individual who assisted in the preparation of this report (or a member of his/her household) has

a financial interest position in securities issued by this company. The financial interest is in the common stock of the

subject company, unless otherwise noted.

8. The analyst (or a member of his/her household) is an officer, director, employee or advisory board member of this

company or has received compensation from the company.

PT Trimegah Sekuritas Indonesia Tbk – www.trimegah.com 10

You might also like

- Internship Report Sample 1Document14 pagesInternship Report Sample 1Sleek ChicNo ratings yet

- Panca Mitra Multiperdana: Tailwinds AheadDocument6 pagesPanca Mitra Multiperdana: Tailwinds AheadSatria BimaNo ratings yet

- Astra Agro Lestari TBK: Soaring Financial Performance in 3Q20Document6 pagesAstra Agro Lestari TBK: Soaring Financial Performance in 3Q20Hamba AllahNo ratings yet

- Trimegah CF 20220715 ADMR - Long Term Gain Will Offset The ST PainDocument8 pagesTrimegah CF 20220715 ADMR - Long Term Gain Will Offset The ST PainHeryadi IndrakusumaNo ratings yet

- Verdhana - AKRA - Solid Moat To Drive Growth - 231213Document7 pagesVerdhana - AKRA - Solid Moat To Drive Growth - 231213bagus.dpbri6741No ratings yet

- 2020 01 15 Trimegah WOOD - Back in Growth PhaseDocument19 pages2020 01 15 Trimegah WOOD - Back in Growth PhaseRizki Jauhari IndraNo ratings yet

- Adi Sarana Armada: Express GrowthDocument8 pagesAdi Sarana Armada: Express GrowthIkhlas SadiminNo ratings yet

- Nomura - May 6 - CEATDocument12 pagesNomura - May 6 - CEATPrem SagarNo ratings yet

- ITMGDocument5 pagesITMGjovalNo ratings yet

- Danareksa Company Update 3Q22 CTRA 2 Nov 2022 Maintain Buy TP Rp1Document5 pagesDanareksa Company Update 3Q22 CTRA 2 Nov 2022 Maintain Buy TP Rp1BrainNo ratings yet

- DR - ADRO (2 Mei 2019)Document7 pagesDR - ADRO (2 Mei 2019)siput_lembekNo ratings yet

- Telekomunikasi Indonesia: 1Q18 Review: Weak But Within ExpectationsDocument4 pagesTelekomunikasi Indonesia: 1Q18 Review: Weak But Within ExpectationsAhmad RafifNo ratings yet

- DMASDocument6 pagesDMASrfbejsxNo ratings yet

- BRI Agroniaga: Access of Capital For The New MSME (Gig Economy)Document20 pagesBRI Agroniaga: Access of Capital For The New MSME (Gig Economy)Yulwido AdiNo ratings yet

- BRI Agroniaga: Access of Capital For The New MSME (Gig Economy)Document20 pagesBRI Agroniaga: Access of Capital For The New MSME (Gig Economy)Agus SuwarnoNo ratings yet

- Indofood Sukses Makmur: Equity ResearchDocument4 pagesIndofood Sukses Makmur: Equity ResearchAbimanyu LearingNo ratings yet

- Jasa Armada Indonesia: Equity ResearchDocument4 pagesJasa Armada Indonesia: Equity ResearchyolandaNo ratings yet

- AKR Corporindo: (Akra Ij) Maintain Continued Strong Start With SEZ Title For JIIPEDocument9 pagesAKR Corporindo: (Akra Ij) Maintain Continued Strong Start With SEZ Title For JIIPEMuhammad FadelNo ratings yet

- India Grid Q3FY18 - Result Update - Axis Direct - 22012018 - 22!01!2018 - 14Document5 pagesIndia Grid Q3FY18 - Result Update - Axis Direct - 22012018 - 22!01!2018 - 14saransh saranshNo ratings yet

- Indigo - 4QFY21 - HSIE-202106081507125073883Document9 pagesIndigo - 4QFY21 - HSIE-202106081507125073883Sanchit pandeyNo ratings yet

- London Sumatra Indonesia TBK: Still Positive But Below ExpectationDocument7 pagesLondon Sumatra Indonesia TBK: Still Positive But Below ExpectationHamba AllahNo ratings yet

- Q3FY22 Result Update Indo Count Industries LTD: Steady Numbers FY22E Volume Guidance ReducedDocument10 pagesQ3FY22 Result Update Indo Count Industries LTD: Steady Numbers FY22E Volume Guidance ReducedbradburywillsNo ratings yet

- Phillip Capital ISAT - Growth Momentum ContinuesDocument8 pagesPhillip Capital ISAT - Growth Momentum Continuesgo joNo ratings yet

- Shinsegae (004170 KS - Buy)Document7 pagesShinsegae (004170 KS - Buy)PENo ratings yet

- Siminvest Company Upadate TSPC 18 Jan 2024 - Not RatedDocument4 pagesSiminvest Company Upadate TSPC 18 Jan 2024 - Not RatedReds MenNo ratings yet

- Kino Indonesia: Equity ResearchDocument5 pagesKino Indonesia: Equity ResearchHot AsiNo ratings yet

- Q3FY22 Result Update DLF LTD.: Strong Residential Performance ContinuesDocument10 pagesQ3FY22 Result Update DLF LTD.: Strong Residential Performance ContinuesVanshika BiyaniNo ratings yet

- Kajaria Ceramics: Higher Trading Kept Growth IntactDocument4 pagesKajaria Ceramics: Higher Trading Kept Growth IntactearnrockzNo ratings yet

- UNVR SekuritasDocument7 pagesUNVR Sekuritasfaizal ardiNo ratings yet

- SMGR Ugrade - 4M17 Sales FinalDocument4 pagesSMGR Ugrade - 4M17 Sales FinalInna Rahmania d'RstNo ratings yet

- Jarir GIB 2022.10Document15 pagesJarir GIB 2022.10robynxjNo ratings yet

- Mirae Asset Sekuritas Indonesia Indocement Tunggal PrakarsaDocument7 pagesMirae Asset Sekuritas Indonesia Indocement Tunggal PrakarsaekaNo ratings yet

- TP: ID7,875: Indofood Sukses Makmur PX: IDR6,675Document6 pagesTP: ID7,875: Indofood Sukses Makmur PX: IDR6,675Abimanyu LearingNo ratings yet

- Mark-To-Actual Revision of Lower Provision, But Headwind Trend RemainsDocument11 pagesMark-To-Actual Revision of Lower Provision, But Headwind Trend RemainsbodaiNo ratings yet

- Mitra Adiperkasa: Indonesia Company GuideDocument14 pagesMitra Adiperkasa: Indonesia Company GuideAshokNo ratings yet

- Bahana Sekuritas SMGR - Underperforming Sales Volume May Lead To Weak 1H19 ResultsDocument7 pagesBahana Sekuritas SMGR - Underperforming Sales Volume May Lead To Weak 1H19 ResultsKPH BaliNo ratings yet

- ICICI Securities LTD ResultDocument8 pagesICICI Securities LTD Resultchandan_93No ratings yet

- Britannia Industries: IndiaDocument6 pagesBritannia Industries: Indiasps fetrNo ratings yet

- Q2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsDocument10 pagesQ2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsbradburywillsNo ratings yet

- Adi Sarana Armada: Anteraja's Collaboration With Grab and GojekDocument7 pagesAdi Sarana Armada: Anteraja's Collaboration With Grab and Gojekbobby prayogoNo ratings yet

- Ramco Cement Q2FY24 ResultsDocument8 pagesRamco Cement Q2FY24 ResultseknathNo ratings yet

- UltratechCement Edel 190118Document15 pagesUltratechCement Edel 190118suprabhattNo ratings yet

- IDBI Diwali Stock Picks 2019Document12 pagesIDBI Diwali Stock Picks 2019Akt ChariNo ratings yet

- Telkom Indonesia: Equity ResearchDocument6 pagesTelkom Indonesia: Equity ResearchMochamad IrvanNo ratings yet

- Indofood CBP: Navigating WellDocument11 pagesIndofood CBP: Navigating WellAbimanyu LearingNo ratings yet

- Hindalco Industries LTD - Q3FY24 Result Update - 14022024 - 14-02-2024 - 14Document9 pagesHindalco Industries LTD - Q3FY24 Result Update - 14022024 - 14-02-2024 - 14Nikhil GadeNo ratings yet

- Trimegah Company Focus 3Q23 JSMR 14 Dec 2023 Maintain Buy HigherDocument10 pagesTrimegah Company Focus 3Q23 JSMR 14 Dec 2023 Maintain Buy HigheredwardlowisworkNo ratings yet

- Overweight: Going Through Steep PathsDocument6 pagesOverweight: Going Through Steep PathsPutu Chantika Putri DhammayantiNo ratings yet

- Phillip Capital PT Astra Agro Lestari TBK AALI Mounting HeadwindsDocument7 pagesPhillip Capital PT Astra Agro Lestari TBK AALI Mounting HeadwindsOnggo iMamNo ratings yet

- Mirae Asset Sekuritas Indonesia UNVR 3 Q22 5a7e62f034Document11 pagesMirae Asset Sekuritas Indonesia UNVR 3 Q22 5a7e62f034reza.macanNo ratings yet

- Nazara Technologies - Prabhu - 14022022140222Document8 pagesNazara Technologies - Prabhu - 14022022140222saurabht11293No ratings yet

- Indopremier Company Update SIDO 5 Mar 2024 Reiterate Buy HigherDocument7 pagesIndopremier Company Update SIDO 5 Mar 2024 Reiterate Buy Higherprima.brpNo ratings yet

- Mirae Asset Sekuritas Indonesia SCMA 3 Q22 697cf1eab1Document9 pagesMirae Asset Sekuritas Indonesia SCMA 3 Q22 697cf1eab1Ira KusumawatiNo ratings yet

- Mirae Asset Sekuritas Indonesia INDF 2 Q23 Review A86140c7a2Document8 pagesMirae Asset Sekuritas Indonesia INDF 2 Q23 Review A86140c7a2Dhanny NuvriyantoNo ratings yet

- Cpin 130524 PtosDocument4 pagesCpin 130524 Ptosmaradona ligaNo ratings yet

- Butterfly Gandhimathi Appliances LTD - Stock Update - 01.12.2021-1Document12 pagesButterfly Gandhimathi Appliances LTD - Stock Update - 01.12.2021-1sundar iyerNo ratings yet

- Reliance by Motilal OswalDocument34 pagesReliance by Motilal OswalQUALITY12No ratings yet

- CDSL 10 02 2021 HDFCDocument2 pagesCDSL 10 02 2021 HDFCJessy PadalaNo ratings yet

- Indopremier Company Update 4Q23 ACES 1 Apr 2024 Upgrade To Buy TPDocument6 pagesIndopremier Company Update 4Q23 ACES 1 Apr 2024 Upgrade To Buy TPfinancialshooterNo ratings yet

- Diwali Dhanotsav Portfolio 2023Document22 pagesDiwali Dhanotsav Portfolio 2023pramodkgowda3No ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Skydrugz Harga Terendah 1 Year 19 Apr 2024 Sesi 1Document8 pagesSkydrugz Harga Terendah 1 Year 19 Apr 2024 Sesi 1Saham IhsgNo ratings yet

- Money Management by LilyDocument21 pagesMoney Management by LilySaham IhsgNo ratings yet

- List Saham Fundamental - 010424Document4 pagesList Saham Fundamental - 010424Saham IhsgNo ratings yet

- Harga_Saham_Skydrugz_Anjlok_Lebih_Dalam_Dari_Laba_18_Juni_2024Document171 pagesHarga_Saham_Skydrugz_Anjlok_Lebih_Dalam_Dari_Laba_18_Juni_2024Saham IhsgNo ratings yet

- Skydrugz LK Full Year 2023 6 Maret 2024Document21 pagesSkydrugz LK Full Year 2023 6 Maret 2024Saham IhsgNo ratings yet

- SMC + WWAPDocument14 pagesSMC + WWAPSaham IhsgNo ratings yet

- Rekap Saham Bank Skydrugz 29 Juni 2024Document202 pagesRekap Saham Bank Skydrugz 29 Juni 2024Saham IhsgNo ratings yet

- Skydrugz LK Full Year 2023 5 Maret 2024Document12 pagesSkydrugz LK Full Year 2023 5 Maret 2024Saham IhsgNo ratings yet

- Skydrugz LK Full Year 2023 4 Maret 2024Document6 pagesSkydrugz LK Full Year 2023 4 Maret 2024Saham IhsgNo ratings yet

- EXCL - Soon to Be Second Largest FBB ProviderDocument4 pagesEXCL - Soon to Be Second Largest FBB ProviderSaham IhsgNo ratings yet

- Harum Energy TBK Billingual Consol 31maret2024 PDFDocument131 pagesHarum Energy TBK Billingual Consol 31maret2024 PDFSaham IhsgNo ratings yet

- Technical review - 290624Document18 pagesTechnical review - 290624Saham IhsgNo ratings yet

- Technical Review - 280123Document20 pagesTechnical Review - 280123Saham IhsgNo ratings yet

- f-31645742-0 ARCI Public Expose 31645742 Lamp2 PDFDocument11 pagesf-31645742-0 ARCI Public Expose 31645742 Lamp2 PDFSaham IhsgNo ratings yet

- 05 Mei EngDocument1 page05 Mei EngSaham IhsgNo ratings yet

- GoTo Investor Update Dec 2023 - UploadDocument6 pagesGoTo Investor Update Dec 2023 - UploadSaham IhsgNo ratings yet

- 许多年以后 - Few Years LaterDocument2 pages许多年以后 - Few Years LaterSaham IhsgNo ratings yet

- 2016 Puma Energy Annual ReportDocument212 pages2016 Puma Energy Annual ReportKA-11 Єфіменко ІванNo ratings yet

- Axe in Pakistan PDFDocument22 pagesAxe in Pakistan PDFAdarsh BansalNo ratings yet

- Ilovepdf MergedDocument100 pagesIlovepdf MergedsaiyuvatechNo ratings yet

- Rupa ProjectDocument73 pagesRupa ProjectJhansi Janu100% (1)

- STUDENT COPY - SCM SHORT CASE - 1 - GRAINGER McMASTERDocument2 pagesSTUDENT COPY - SCM SHORT CASE - 1 - GRAINGER McMASTERGuiliano Grimaldo FERNANDEZ JIMENEZNo ratings yet

- The O. M. Scott & Sons CompanyDocument4 pagesThe O. M. Scott & Sons Companycarolina120209100% (1)

- Intuiit Case Summary (Siddarth Nyati)Document2 pagesIntuiit Case Summary (Siddarth Nyati)snyatiNo ratings yet

- Wa0009 PDFDocument109 pagesWa0009 PDFSimha SimhaNo ratings yet

- Holistic Marketing Concept & Updating 4Ps: The Whole Is More Than The Sum of Its Parts'Document35 pagesHolistic Marketing Concept & Updating 4Ps: The Whole Is More Than The Sum of Its Parts'Hiba KhanNo ratings yet

- Ikea Modern Slavery Statement PDFDocument11 pagesIkea Modern Slavery Statement PDFXhevat ZiberiNo ratings yet

- Sample - FSA Full AssignmentDocument20 pagesSample - FSA Full AssignmentLiew SallyNo ratings yet

- Module 3 - AssignmentDocument6 pagesModule 3 - AssignmentaatishexplossiveNo ratings yet

- BUSTRAT Assignment 4Document2 pagesBUSTRAT Assignment 4Meilin MedranaNo ratings yet

- Follow Up Game PlanDocument18 pagesFollow Up Game PlanEduardo AlvarezNo ratings yet

- Robinhood Users Get To Own Robinhood - BloombergDocument10 pagesRobinhood Users Get To Own Robinhood - BloombergRafael AlejandroNo ratings yet

- SV90483973000 2023 05Document9 pagesSV90483973000 2023 05Alina DinuNo ratings yet

- Shiprocket Manifest: To Be Filled by Delhivery Surface Logistics ExecutiveDocument8 pagesShiprocket Manifest: To Be Filled by Delhivery Surface Logistics ExecutiveBodyPower AcademyNo ratings yet

- Red and White Beans Market Assessment in Oromiya and SNNP Regional StatesDocument24 pagesRed and White Beans Market Assessment in Oromiya and SNNP Regional StatesYoseph AshenafiNo ratings yet

- Some Suggestions Regarding Forecast AssumptionsDocument2 pagesSome Suggestions Regarding Forecast AssumptionsNicu BotnariNo ratings yet

- Challenges Encountered by The Micro-Enterprises in The During and Post-Pandemic Stage in Lucena CityDocument40 pagesChallenges Encountered by The Micro-Enterprises in The During and Post-Pandemic Stage in Lucena CityJhon larry DalisayNo ratings yet

- 2024 Edelman Trust Barometer Special Report Brands and Politics FinalDocument57 pages2024 Edelman Trust Barometer Special Report Brands and Politics Finaltitusgroan73No ratings yet

- Proforma Invoice: Our Bank DetailDocument2 pagesProforma Invoice: Our Bank DetailIrawan KhanNo ratings yet

- Global Electrical Electronics Retail Market Value Chain Analysis 61423Document20 pagesGlobal Electrical Electronics Retail Market Value Chain Analysis 61423ShoaibNo ratings yet

- Bare Act Service Rules - Other Acts 1989Document6 pagesBare Act Service Rules - Other Acts 1989Guru charan ReddyNo ratings yet

- The Product Life Cycle (PLC)Document5 pagesThe Product Life Cycle (PLC)tejaNo ratings yet

- NG, JOHN LOUIS A. - ACTIVITY - 1 - (Section 2548) - PA 205 Fundamentals of StatisticsDocument2 pagesNG, JOHN LOUIS A. - ACTIVITY - 1 - (Section 2548) - PA 205 Fundamentals of StatisticsLouis NgNo ratings yet

- Solution Manual For Principles of Supply Chain Management A Balanced Approach 3rd Edition by WisnerDocument36 pagesSolution Manual For Principles of Supply Chain Management A Balanced Approach 3rd Edition by Wisnerkatevargasqrkbk100% (34)

- Mod 17Document1 pageMod 17hamzafarooqNo ratings yet

- Case Study - Soaring Into The High Skies: SSRN Electronic Journal November 2016Document10 pagesCase Study - Soaring Into The High Skies: SSRN Electronic Journal November 2016akanksha kumariNo ratings yet