Professional Documents

Culture Documents

assignment-5 retirement edited

assignment-5 retirement edited

Uploaded by

Anish AggarwalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

assignment-5 retirement edited

assignment-5 retirement edited

Uploaded by

Anish AggarwalCopyright:

Available Formats

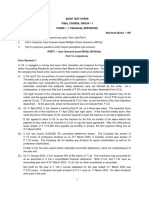

ACCOUNTANCY (CLASS XII)

ASSIGNMENT-5

RECONSTITUTION OF A PARTNERSHIPFIRM – RETIREMENT OF A

PARTNER

Q-1. State two adjustments to be made at the time of retirement of a partner.

Q-2.What do you mean by Gaining Ratio ?

Q-3 Bon,Ton and Don are partners in a firm sharing profits in the ratio 5:3:2. Don retires

from the firm. In which ratio Bon and Ton will share the future profits?

Q-4 X, Y and Z are partners sharing profits in the ratio of 4/9, 1/3 and 2/9. X retires and

surrenders 2/3rd of his share in the favour of Z. Calculate new profit sharing ratio and

gaining ratio.

Q-5 A, B and C are the partners sharing profits in the ratio of 4:3:2. B retires and the

goodwill of the firm is valued at 18,000.Pass journal entry for the treatment of goodwill

on B’s retirement.

Q-6 Shyam, Mohan and Sohan are partners in a firm sharing profits in the ratio

3:2:1.Mohan retires and Shyam and Sohan decided that the capital of the new firm shall

be fixed at 1,80,000 in their new profit sharing ratio. The capital accounts of Shyam and

Sohan after making all the adjustments are 1,25,000 and 50,000 respectively. Calculate

the actual cash to be paid off or to be bought in by the continuing partners and pass

necessary journal entries.

Q-7 A, B and C are partners in a firm sharing profits and losses in the ratio of 3:2:1.Their

Balance Sheet as at March 31 2019 is as under:

Liabilities Assets

Creditors 30,000 Cash in Hand 18,000

Bills Payable 16,000 Debtors 25,000

Less : provision 3,000

General Reserve 12,000 -------- 22,000

Workmen Compensation Furniture 30,000

Fund 10,000

Stock 18,000

Capital A/C

A 80,000 Machinery 70,000

B 70,000

C 30,000 1,80,000 Goodwill 10,000

---------

Land and building 80,000

1,68,000 1,68,000

B retired on 1st April,2019 on the following terms:

i) Provision for doubtful debts will be raised by 1,500.

ii) Stock will be depreciated by 5% and furniture by 10%.

iii) There is an outstanding claim for damages of 1,200 and it is to be provided for in the

books at 900.

iv) Creditors to be written back by 5,000

v) Goodwill of the firm is valued at 24,000.

vi) Workmen compensation claim is 12,000.

vii) B is paid with cash brought in by A and C in such a manner that their capitals are in

proportion to their profit sharing ratio 4:1.

Prepare necessary accounts to close the books of the firm.

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2024 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2024 Edition)No ratings yet

- Partnership Dec 2020 UpdatedDocument46 pagesPartnership Dec 2020 Updatedbinu100% (4)

- Afar TestbankDocument13 pagesAfar TestbankRanie MonteclaroNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Eli Amir - Marco Ghitti - Financial Analysis of Mergers and Acquisitions - Understanding Financial Statements and Accounting Rules With Case Studies-Springer International Publishing (2021)Document392 pagesEli Amir - Marco Ghitti - Financial Analysis of Mergers and Acquisitions - Understanding Financial Statements and Accounting Rules With Case Studies-Springer International Publishing (2021)Carolina LucínNo ratings yet

- assignment-4 admissionDocument2 pagesassignment-4 admissionAnish AggarwalNo ratings yet

- Class 12 CBSE ISC Accountancy Assignment 10Document15 pagesClass 12 CBSE ISC Accountancy Assignment 10studentNo ratings yet

- Acc Workshee - Admission of A PartnerDocument2 pagesAcc Workshee - Admission of A PartnerPrithvi RajNo ratings yet

- Accountancy 12th SPSDocument4 pagesAccountancy 12th SPSMahesh TandonNo ratings yet

- Accountancy Unit Test 1 Paper Shalom 2ndDocument4 pagesAccountancy Unit Test 1 Paper Shalom 2ndTûshar ThakúrNo ratings yet

- C. Retirement & Death Assingment UpdateDocument7 pagesC. Retirement & Death Assingment UpdateNishtha GargNo ratings yet

- Retirement WSDocument2 pagesRetirement WSarhamenterprises5401No ratings yet

- Partnership QsDocument3 pagesPartnership QsJAYARAJALAKSHMI IlangoNo ratings yet

- Worksheet AdmissionDocument3 pagesWorksheet AdmissionYogesh AdhikariNo ratings yet

- Unit 3 Admission of A Partner QuestionsDocument4 pagesUnit 3 Admission of A Partner QuestionsMitesh SethiNo ratings yet

- Additional Questions-5Document14 pagesAdditional Questions-5Shivam Kumar JhaNo ratings yet

- Bcom Semester Iii Accounts Mega Revision Cum Suggestion PDFDocument6 pagesBcom Semester Iii Accounts Mega Revision Cum Suggestion PDFAvirup ChakrabortyNo ratings yet

- Retirement of A PartnerDocument6 pagesRetirement of A Partnerprksh_451253087No ratings yet

- Retirement Hots and Application Based QuestionsDocument5 pagesRetirement Hots and Application Based Questionspriya longaniNo ratings yet

- DPP - 1 Accounts Chapter - Admission of A PartnerDocument27 pagesDPP - 1 Accounts Chapter - Admission of A PartnerShubham GuptaNo ratings yet

- ReSA B42 AFAR Final PB Exam - Questions, Answers - SolutionsDocument23 pagesReSA B42 AFAR Final PB Exam - Questions, Answers - SolutionsElaine Joyce GarciaNo ratings yet

- Navya and Radhey Were Partners Sharing Profits and Losses in The RatioDocument9 pagesNavya and Radhey Were Partners Sharing Profits and Losses in The RatioMohammad Tariq AnsariNo ratings yet

- Accountancy Worksheets 4Document15 pagesAccountancy Worksheets 4devanshubhattacharya018No ratings yet

- Sample Paper Class XII Subject-Accountancy Part ADocument5 pagesSample Paper Class XII Subject-Accountancy Part AKaran BhatnagarNo ratings yet

- Accountancy FinalDocument13 pagesAccountancy FinalVikram KaushalNo ratings yet

- XII Acc CW Practice Questions Ch4.6 (Retirement)Document2 pagesXII Acc CW Practice Questions Ch4.6 (Retirement)Vaidehi BagraNo ratings yet

- Basic Accounting and PartnershipDocument11 pagesBasic Accounting and PartnershipMichelle Chandria Bernardo-FordNo ratings yet

- Tls Cl-Xii Accountancy P.T 3 Q.P 2021-22Document13 pagesTls Cl-Xii Accountancy P.T 3 Q.P 2021-22Priyank DhadhiNo ratings yet

- Government AccountingDocument14 pagesGovernment AccountingNicole AgostoNo ratings yet

- Half Yearly XII AccDocument7 pagesHalf Yearly XII AccJahnavi GoelNo ratings yet

- 12 Accounts 2020 21 Practice Paper 2Document8 pages12 Accounts 2020 21 Practice Paper 2Vijey RamalingamNo ratings yet

- XII Acc CW Practice Questions Ch4.4 (Retirement)Document2 pagesXII Acc CW Practice Questions Ch4.4 (Retirement)Vaidehi BagraNo ratings yet

- Accounts WorksheetDocument3 pagesAccounts Worksheetneeraj sharmaNo ratings yet

- 15 Sample Papers Accountancy 2019-20Document119 pages15 Sample Papers Accountancy 2019-20hardik50% (2)

- Accounts Parntership TestDocument6 pagesAccounts Parntership TestdhruvNo ratings yet

- New Model Test Paper 1Document8 pagesNew Model Test Paper 1Harry AryanNo ratings yet

- Long QuizDocument5 pagesLong QuizMitch Tokong MinglanaNo ratings yet

- Assessment of Partnership Firms: Illustration 01Document8 pagesAssessment of Partnership Firms: Illustration 01kreshmith2No ratings yet

- 12 AccountancyDocument10 pages12 AccountancyBhaswati SurNo ratings yet

- XII Commerce Q.papersDocument14 pagesXII Commerce Q.papersDesai VivekNo ratings yet

- Sunil Panda Commerce Classes: Before Exam Practice Questions For Term 2 Boards Accounts - Retirement of A PartnerDocument2 pagesSunil Panda Commerce Classes: Before Exam Practice Questions For Term 2 Boards Accounts - Retirement of A PartnerHigi SNo ratings yet

- Parcor QuizbowlDocument38 pagesParcor QuizbowlKrestyl Ann GabaldaNo ratings yet

- Day 2 Class Work SPCCDocument8 pagesDay 2 Class Work SPCCSambhav GargNo ratings yet

- Midterms Advanced Finac Acctg Set ADocument9 pagesMidterms Advanced Finac Acctg Set ALuisitoNo ratings yet

- Vijaygarh Jyotish Ray College: Financial Accounting - Ii Internal Examinations-2021Document2 pagesVijaygarh Jyotish Ray College: Financial Accounting - Ii Internal Examinations-2021Aditya GanoriaNo ratings yet

- Retirement of Partners - Updated WorksheetDocument8 pagesRetirement of Partners - Updated WorksheetMisri SoniNo ratings yet

- ACFrOgC2YFRgQqgXGei2VAYXPoowOnZ2mbZMnxvBpiDVpg6usCOgH0 Jt8oFprOsbVV 07 C z432aPTAuHLeuscFZz3Lr7nZzxGlOXkbUF6py8GWKjo5YCkQTYkjM9i66mj0n8EaOUnse7l NZXDocument2 pagesACFrOgC2YFRgQqgXGei2VAYXPoowOnZ2mbZMnxvBpiDVpg6usCOgH0 Jt8oFprOsbVV 07 C z432aPTAuHLeuscFZz3Lr7nZzxGlOXkbUF6py8GWKjo5YCkQTYkjM9i66mj0n8EaOUnse7l NZXAditya srivastavaNo ratings yet

- Accounts First Term Grade 12Document5 pagesAccounts First Term Grade 12NivpreeNo ratings yet

- 19696ipcc Acc Vol2 Chapter14Document41 pages19696ipcc Acc Vol2 Chapter14Shivam TripathiNo ratings yet

- 588c69bdc763b - Sample Paper Accountancy - 230102 - 185610Document7 pages588c69bdc763b - Sample Paper Accountancy - 230102 - 185610sanchitchaudhary431No ratings yet

- Corporate Accounting Ii-1Document4 pagesCorporate Accounting Ii-1ARAVIND V KNo ratings yet

- admission of parrner 12thDocument2 pagesadmission of parrner 12thprince bhatiaNo ratings yet

- CBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot QuestionsDocument6 pagesCBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot Questionsdakshrwt06No ratings yet

- Additional Questions-7Document8 pagesAdditional Questions-7Ak AgarwalNo ratings yet

- TP 4 Pa 18 JuneDocument2 pagesTP 4 Pa 18 JuneAditya srivastavaNo ratings yet

- PartnershipDocument10 pagesPartnershipShaz NagaNo ratings yet

- CPT PaperDocument4 pagesCPT Paperpsawant77No ratings yet

- Retierment of PartnerDocument4 pagesRetierment of PartnerSaransh GhoshNo ratings yet

- AccountsDocument14 pagesAccountsshrutichoudhary436No ratings yet

- Accountancy Unit Test 2 - WorksheetDocument12 pagesAccountancy Unit Test 2 - WorksheetFawaz YoosefNo ratings yet

- 20CCP07/18CCP07 PSG College of Arts & Science Mcom (Ca) Degree Examination May 2021Document8 pages20CCP07/18CCP07 PSG College of Arts & Science Mcom (Ca) Degree Examination May 2021Jerry PonmaniNo ratings yet

- PENFinalExam1415 1lAdvancedFinancialAccountingandReportingPart1 COCDocument20 pagesPENFinalExam1415 1lAdvancedFinancialAccountingandReportingPart1 COCRhedeline LugodNo ratings yet

- IND As Vs As ComparisonDocument42 pagesIND As Vs As ComparisonGeetikaNo ratings yet

- Business CombinationDocument3 pagesBusiness CombinationMeghan Kaye LiwenNo ratings yet

- HandOut No. 3 ParCor Partnership DissolutionDocument9 pagesHandOut No. 3 ParCor Partnership Dissolutionnatalie clyde matesNo ratings yet

- Fa Iv Unit 3Document13 pagesFa Iv Unit 3misba shaikhNo ratings yet

- Internal Reconstruction P-1 Liabilities Rs Assets RsDocument8 pagesInternal Reconstruction P-1 Liabilities Rs Assets RsPaulomi LahaNo ratings yet

- IFRS vs. IFRS For SMEsDocument33 pagesIFRS vs. IFRS For SMEsLohraine DyNo ratings yet

- GRP 1 Series 1 MTP CompiledDocument72 pagesGRP 1 Series 1 MTP CompiledSairamNo ratings yet

- Capital AllowanceDocument34 pagesCapital AllowancesamuelNo ratings yet

- April 2013 PDFDocument22 pagesApril 2013 PDFJasonSpringNo ratings yet

- Jawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)Document5 pagesJawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)Mega RefiyaniNo ratings yet

- AfarDocument11 pagesAfarWilsonNo ratings yet

- TrademarksDocument82 pagesTrademarksanon_590742113No ratings yet

- Pas 36: Impairment of Assets: ObjectiveDocument6 pagesPas 36: Impairment of Assets: ObjectiveLEIGHANNE ZYRIL SANTOSNo ratings yet

- Conso NotesDocument17 pagesConso NotesShalini GazulaNo ratings yet

- Answer Key IntangiblesDocument8 pagesAnswer Key IntangiblesMikaela Francesca BeleyNo ratings yet

- 2013 Dse Bafs 2a MS 1Document8 pages2013 Dse Bafs 2a MS 1ryanNo ratings yet

- Asetts 2Document43 pagesAsetts 2librarypublisherNo ratings yet

- CorporateDocument28 pagesCorporateRalkan KantonNo ratings yet

- Adobe Scan 29 Aug 2022Document9 pagesAdobe Scan 29 Aug 2022kumardeepak5242No ratings yet

- Class XII - AccountancyDocument11 pagesClass XII - Accountancyumangchh2306No ratings yet

- Goodwill Valuation With ExamplesDocument6 pagesGoodwill Valuation With ExamplesVipin Mandyam KadubiNo ratings yet

- AccountingDocument5 pagesAccountingMoira C. VilogNo ratings yet

- Acco 420 Final Coursepack CoursepacAplusDocument51 pagesAcco 420 Final Coursepack CoursepacAplusApril MayNo ratings yet

- 3bsa-Tos 1S2223Document44 pages3bsa-Tos 1S2223Mary Joy Jessa Santiago BernardinoNo ratings yet

- Business Combination - Part 1Document5 pagesBusiness Combination - Part 1cpacpacpaNo ratings yet

- CFAS-Reviewer PAS32.33.34.36Document7 pagesCFAS-Reviewer PAS32.33.34.36PotatoNo ratings yet

- Chapter 21 Intangible AssetsDocument37 pagesChapter 21 Intangible AssetsDanna ClaireNo ratings yet

- Advanced Accounting 7e Hoyle - Chapter 3Document58 pagesAdvanced Accounting 7e Hoyle - Chapter 3Leni RosiyaniNo ratings yet