Professional Documents

Culture Documents

Business Valuation Management (III PA Elective)

Business Valuation Management (III PA Elective)

Uploaded by

loganathanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Valuation Management (III PA Elective)

Business Valuation Management (III PA Elective)

Uploaded by

loganathanCopyright:

Available Formats

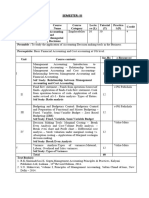

SEMESTER V

[Common for B.Com, B.Com (PA), B.Com (CA)and B.Com (ABA) Programmes]

Course Course Lecture Tutorial Practical

Type Category Credit

Code Name (L) (T) (P)

Business

Core

22BPA5EB0 Valuation Application 60 - - 4

Elective - 2

Management

Preamble: To gain knowledge in different techniques in the valuation of assets and liabilities.

Prerequisite: Financial Reporting

Unit Course contents Hours

Business Valuation – Nature and Scope of Valuation – Objectives –

I 12

Importance –Types of Values – Factors Determining Values.

Elements of Business Valuation – Valuation Approaches – Relative Valuation

II 12

– Advantages of Relative Valuation – Disadvantages of Relative Valuation.

Valuation of Mergers and Acquisitions–Driving Factors – Types of Mergers –

III 12

Legal Procedures – Challenges (Simple Problems)

Valuation of Assets and Liabilities-Valuation of fixed assets - Valuation of

IV inventories –Intellectual Capital – Classification -Components of Intellectual 12

Capital. (Simple Problems)

Valuation of Goodwill - Valuation of brands- Valuation of real estate –

V 12

Human resource accounting - Relevant accounting standards. (Theory Only)

Total 60

Note :80% Theory & 20% Problems

1.Text Book(s):Robert F. Reilly and Robert P. Schweihs, “Handbook of Business Valuation and

Intellectual Property Analysis”, McGraw-Hill Publishing, 2004.

Reference Book(s):

1.Gupta, G.C, “Valuation of Immovable Properties”, Bharat Law House (p) Ltd,New

Delhi Edition 2000, 2.Banerjee, D.N and John .A. Parks, “Principles and Practice of

Valuation”, Eastern Law House, Calcutta.2005.

3.VadapalliRavindhar, “Mergers, Acquisitions & Business Valuation”Excel books, New

Delhi, 2007. 4.Pratt, Shannon, and Alina V. Niculita. “Valuing a Business”. McGraw-Hill,

New York, 5th edition 2008.

Focus of Course: Skill Development

E-Resource/e-Content URL:

https://study.com/academy/exam/topic/businessvaluation-concepts.html

Course Designer: BoSChairman

Mr.S.Madheswaran :Dr.I.Siddiq

Asst.Professor,

Department of B.ComPA, STC.

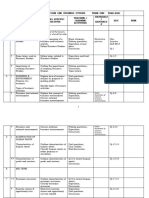

Course Outcomes (COs) :

On Successful completion of this course the students will able to:

Blooms Taxonomy

CONumber Course Outcome(CO)Statement

Knowledge Level

To recollect the basic concepts of business

CO1 K1

valuation.

To compare the concept of Merger

CO2 and Acquisitions K2

To understand the principles of valuation of assets

CO3 K2

and liabilities.

CO4 To Interpret the valuation of the goodwill K3

Mapping with Programme Outcome and Programme Specific Outcome

Cos / POs PO1 PO2 PO3 PO4 PO5 PSO1 PSO2 PSO3 PSO4 PSO5

CO1 S L M M S S L M S S

CO2 L L S S M S M L S S

CO3 L M L L M S L M L S

CO4 L S M S M L M S S M

S – Strong; L – Low; M – Medium

You might also like

- iQMS IT QuizzDocument2 pagesiQMS IT QuizzGopakumar K86% (7)

- Is 325 2019Document128 pagesIs 325 2019John LiebermanNo ratings yet

- Syllabus InvestmentDocument2 pagesSyllabus InvestmentLoganathan KrishnasamyNo ratings yet

- Subramanyam FSA Chapter 01 - ETJDocument44 pagesSubramanyam FSA Chapter 01 - ETJMaya AngrianiNo ratings yet

- Harley Davidson BriefDocument3 pagesHarley Davidson BriefIshraq Dhaly100% (1)

- Accounting and Managerial DecisionsDocument2 pagesAccounting and Managerial DecisionsloganathanNo ratings yet

- A Course outline 2023-24Document10 pagesA Course outline 2023-24ankit aggarwalNo ratings yet

- S. P. Mandali'S Prin L. N. Welingkar Institute of Management Development & ResearchDocument6 pagesS. P. Mandali'S Prin L. N. Welingkar Institute of Management Development & ResearchNavil BordiaNo ratings yet

- Batch 22-24 - ACT 5001 - Financial Accounting - CODocument5 pagesBatch 22-24 - ACT 5001 - Financial Accounting - COadharsh veeraNo ratings yet

- MBBA128L - Basic Financial AccountingDocument4 pagesMBBA128L - Basic Financial AccountingAashna AhujaNo ratings yet

- (MBA ACC Major OBE CO) Financial Statement AnalysisDocument7 pages(MBA ACC Major OBE CO) Financial Statement AnalysisMahfuz Ur RahmanNo ratings yet

- 150C2B Madras UniversityDocument3 pages150C2B Madras Universityriharajput88No ratings yet

- Indian Institute of Management, Kashipur: Post Graduate Program in ManagementDocument6 pagesIndian Institute of Management, Kashipur: Post Graduate Program in ManagementsumanNo ratings yet

- Fundamentals of Business Laws and Business Communication (I PA)Document2 pagesFundamentals of Business Laws and Business Communication (I PA)loganathanNo ratings yet

- Portfolio and Risk AnalyticsDocument7 pagesPortfolio and Risk Analyticspooja pNo ratings yet

- BCOM Syllabus Session 2023-24 VI SemesterDocument12 pagesBCOM Syllabus Session 2023-24 VI Semesteraizah25102000No ratings yet

- Financial Statement Analysis - CODocument4 pagesFinancial Statement Analysis - COHaardik GandhiNo ratings yet

- Fundamentals of Financial Management - Preetha ChandranDocument7 pagesFundamentals of Financial Management - Preetha ChandranAditya KumarNo ratings yet

- Course Outline Principle of Accounting BESE10 2K21 Final VersionDocument14 pagesCourse Outline Principle of Accounting BESE10 2K21 Final VersionHasan AhmedNo ratings yet

- Management Accounting - Course Handout - 3Document4 pagesManagement Accounting - Course Handout - 3DiptNo ratings yet

- 23-24 Approved Syllabus MAA SEM III SharedDocument3 pages23-24 Approved Syllabus MAA SEM III Sharedbhavishsalian2004No ratings yet

- Fybim - Revised SyllabusDocument50 pagesFybim - Revised Syllabusnishchalshetty1323No ratings yet

- Business ValuationsDocument5 pagesBusiness ValuationsCarrots TopNo ratings yet

- Accounting Fundamentals Sem 1 MineDocument4 pagesAccounting Fundamentals Sem 1 MineUndead banNo ratings yet

- foundation course syllabus 1st semDocument2 pagesfoundation course syllabus 1st semPriya DharshiniNo ratings yet

- Business FinanceDocument5 pagesBusiness FinanceTanmay SinghalNo ratings yet

- Fiannce Accounting Efpm 2020 Outline PDFDocument6 pagesFiannce Accounting Efpm 2020 Outline PDFHarsh MaheshwariNo ratings yet

- Be&baDocument4 pagesBe&baURVANSH AGARWALNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisPANDYA DHRUMILKUMARNo ratings yet

- RPS Intermediate Accounting IIDocument10 pagesRPS Intermediate Accounting II04. Dewanda DaffaNo ratings yet

- IT Account Management - ITS 6011 Course OutlineDocument4 pagesIT Account Management - ITS 6011 Course OutlineRaju GhoshNo ratings yet

- Understanding Financial Accounting Canadian 2nd Edition Burnley Solutions ManualDocument25 pagesUnderstanding Financial Accounting Canadian 2nd Edition Burnley Solutions ManualIsabellaNealaiys100% (36)

- Poa Scheme of Work - September To December 2020 (Form 4)Document8 pagesPoa Scheme of Work - September To December 2020 (Form 4)pratibha jaggan martinNo ratings yet

- 150E2ADocument3 pages150E2Ariharajput88No ratings yet

- Fin401, Corporate Finance PDFDocument3 pagesFin401, Corporate Finance PDFKRZ. Arpon Root HackerNo ratings yet

- Course Outline POA Fall 2022Document4 pagesCourse Outline POA Fall 2022Pritam ChakrabortyNo ratings yet

- Business Studies Form 1 2020 Schemes of Work 1Document14 pagesBusiness Studies Form 1 2020 Schemes of Work 1Mark MisokaNo ratings yet

- Services Marketing (Course Handout) - Nov2022Document5 pagesServices Marketing (Course Handout) - Nov2022DiptNo ratings yet

- (MBA ACC Major OBE CO) Corporate Tax ManagementDocument5 pages(MBA ACC Major OBE CO) Corporate Tax ManagementMahfuz Ur RahmanNo ratings yet

- Businesss Analysis StudentDocument24 pagesBusinesss Analysis StudentThịnh Đỗ QuốcNo ratings yet

- Course Framework Semester IDocument88 pagesCourse Framework Semester INandhini D.PNo ratings yet

- Indian Institute of Foreign Trade, Delhi: MBA IB 2017-19Document5 pagesIndian Institute of Foreign Trade, Delhi: MBA IB 2017-19Kunal SinghNo ratings yet

- 022 1.1.3 B.com BC404 2018-19Document1 page022 1.1.3 B.com BC404 2018-19AankuNo ratings yet

- Poa Scheme of Work - September To December 2022 (Form 4)Document10 pagesPoa Scheme of Work - September To December 2022 (Form 4)pratibha jaggan martinNo ratings yet

- Final CurriculumDocument26 pagesFinal CurriculumSK WASIMUDDINNo ratings yet

- Financial Accounting PracticesDocument6 pagesFinancial Accounting PracticesdimazNo ratings yet

- BSC Ecs SyllabusDocument9 pagesBSC Ecs SyllabusKRISHNA MOORTHY.P 18BEC029No ratings yet

- File 1647930802 0007971 CorporateFinance-SyllabusDocument3 pagesFile 1647930802 0007971 CorporateFinance-SyllabusTanya gargNo ratings yet

- VABusinessValuationpdf 2023 01 25 08 51 39Document2 pagesVABusinessValuationpdf 2023 01 25 08 51 39Rahul PopatNo ratings yet

- Semester 2 - Course PlanDocument8 pagesSemester 2 - Course PlansantoshNo ratings yet

- Programme Course Code(s) TitleDocument2 pagesProgramme Course Code(s) Titleadharsh vasudevanNo ratings yet

- CH - 02 - Conceptual FrameworkDocument32 pagesCH - 02 - Conceptual FrameworkMd. Abu SayeedNo ratings yet

- UG-CO-COMMERCE (1)Document143 pagesUG-CO-COMMERCE (1)janakinallathambi0703No ratings yet

- TLP Fra 2023 24Document7 pagesTLP Fra 2023 24AnanyaNo ratings yet

- Name of The Faculty: Dr. Mohammed Iqbal Email Id Mobile No.: 7598438962Document5 pagesName of The Faculty: Dr. Mohammed Iqbal Email Id Mobile No.: 7598438962SSNo ratings yet

- FIN 401-FM Course Outline-NAmin-Fall2022Document5 pagesFIN 401-FM Course Outline-NAmin-Fall2022Hafsah AnwarNo ratings yet

- T-4 Business Valuation - Course OutlineDocument3 pagesT-4 Business Valuation - Course OutlinePalash AroraNo ratings yet

- Ba4203 HRM Model QPDocument2 pagesBa4203 HRM Model QPLivingston's VlogsNo ratings yet

- Financial Investments - SyllabusDocument5 pagesFinancial Investments - SyllabusLeyla SuleymanliNo ratings yet

- New SyllabusDocument4 pagesNew SyllabusSiya ChughNo ratings yet

- Departments of Computer Science and EngineeringDocument6 pagesDepartments of Computer Science and EngineeringRajavarmanNo ratings yet

- Depreciation Reports in British Columbia: The Strata Lots Owners Guide to Selecting Your Provider and Understanding Your ReportFrom EverandDepreciation Reports in British Columbia: The Strata Lots Owners Guide to Selecting Your Provider and Understanding Your ReportNo ratings yet

- Fundamentals of Business Laws and Business Communication (I PA)Document2 pagesFundamentals of Business Laws and Business Communication (I PA)loganathanNo ratings yet

- Business Valuation Tutorials Unit IDocument24 pagesBusiness Valuation Tutorials Unit IloganathanNo ratings yet

- Business Law Unit I TutorialsDocument10 pagesBusiness Law Unit I TutorialsloganathanNo ratings yet

- Calculations Sheet (Dec 2023)Document5 pagesCalculations Sheet (Dec 2023)loganathanNo ratings yet

- Establishment of Reserve Bank of IndiaDocument7 pagesEstablishment of Reserve Bank of IndialoganathanNo ratings yet

- Equity and Financial Derivatives: Program Starts On 21 AugDocument4 pagesEquity and Financial Derivatives: Program Starts On 21 AugloganathanNo ratings yet

- F D P On EntrepreneurshipDocument3 pagesF D P On EntrepreneurshiploganathanNo ratings yet

- Sixty One Years of Professional ExcellenceDocument59 pagesSixty One Years of Professional ExcellenceloganathanNo ratings yet

- Course Work SapmDocument9 pagesCourse Work SapmloganathanNo ratings yet

- EAC Proposal 2018-19 29Document36 pagesEAC Proposal 2018-19 29loganathanNo ratings yet

- EXIM Finance Unit IIDocument11 pagesEXIM Finance Unit IIloganathanNo ratings yet

- Part Iii - Core - Customs Duty and Goods and Services Tax (N6BPA6T73)Document11 pagesPart Iii - Core - Customs Duty and Goods and Services Tax (N6BPA6T73)loganathanNo ratings yet

- Advanced Production System Design: Yilmaz UygunDocument32 pagesAdvanced Production System Design: Yilmaz UygunDally KunNo ratings yet

- Quitclaim With SettlementDocument1 pageQuitclaim With SettlementDebby Gilsyl M. Plana100% (1)

- Lean Canvas PDFDocument25 pagesLean Canvas PDFMritunjay YadavNo ratings yet

- Oracle Applications Accounting Review Session: Beverly Baker-Harris Sr. Project Manager OracleDocument50 pagesOracle Applications Accounting Review Session: Beverly Baker-Harris Sr. Project Manager OracleBeverly Baker-HarrisNo ratings yet

- Sustainable Design PrinciplesDocument15 pagesSustainable Design PrinciplesyaraNo ratings yet

- QuestionsDocument12 pagesQuestionsHemal TailiNo ratings yet

- Project Charter Word TemplateDocument3 pagesProject Charter Word TemplateDessy Lina - Marketing Executive BalikpapanNo ratings yet

- History of Labor RelationsDocument4 pagesHistory of Labor RelationsLordannie John LanzoNo ratings yet

- Cover Letter For Web Developer Job ApplicationDocument5 pagesCover Letter For Web Developer Job Applicationwrbmnkrmd100% (1)

- Assess Business Impact With Scenarios ASMLDocument4 pagesAssess Business Impact With Scenarios ASMLvargascesar5No ratings yet

- BDM Introduction DeckDocument10 pagesBDM Introduction DeckJunelle Siege GarciaNo ratings yet

- EnglishFile4e Upp-Int TG PCM Comm RevisionDocument1 pageEnglishFile4e Upp-Int TG PCM Comm RevisionletimanfrediNo ratings yet

- Db-799pof+999-77m-Ecoucd Usa-Raiff-Albania-171117Document2 pagesDb-799pof+999-77m-Ecoucd Usa-Raiff-Albania-171117almawest.llpNo ratings yet

- Planning DefinitionDocument9 pagesPlanning Definitionparvati anilkumarNo ratings yet

- Revised Guidelines For The Entrepreneurial Profile Assignment - March 2021Document3 pagesRevised Guidelines For The Entrepreneurial Profile Assignment - March 2021NikhilNo ratings yet

- EXAMPLE 20.1: Hotel Reservations: Inventory ManagementDocument2 pagesEXAMPLE 20.1: Hotel Reservations: Inventory Managementkael invokerNo ratings yet

- 1 The Declining Authority of StatesDocument28 pages1 The Declining Authority of StatesJuanIbañezNo ratings yet

- Tender Library Documnet 2021 WITH BOQDocument31 pagesTender Library Documnet 2021 WITH BOQTender 247No ratings yet

- List of Documents Required For Visa File - AustraliaDocument4 pagesList of Documents Required For Visa File - AustraliaHks HksNo ratings yet

- Pune MumbaiDocument10 pagesPune Mumbaiakshay daudNo ratings yet

- Backtesting-MethodsDocument14 pagesBacktesting-MethodsDL SantosNo ratings yet

- CrawfordDocument23 pagesCrawfordnaveen gunjalNo ratings yet

- Form G: Application For Admission/transfer To Graduate MembershipDocument4 pagesForm G: Application For Admission/transfer To Graduate MembershipcrayonleeNo ratings yet

- Gvaus - 5065918 - 00001 2Document2 pagesGvaus - 5065918 - 00001 2Pat SofriNo ratings yet

- Strategic Corporate FinanceDocument3 pagesStrategic Corporate FinanceNawaz GodilNo ratings yet

- Awfis 800133506Document2 pagesAwfis 800133506keyurpatel971495No ratings yet

- Nobles Acct10 Tif 21Document205 pagesNobles Acct10 Tif 21Marqaz MarqazNo ratings yet