Professional Documents

Culture Documents

Pinnacle-CPA-Review-Study-Guide-Sir-Brads-Version

Pinnacle-CPA-Review-Study-Guide-Sir-Brads-Version

Uploaded by

Ruiz, CherryjaneCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pinnacle-CPA-Review-Study-Guide-Sir-Brads-Version

Pinnacle-CPA-Review-Study-Guide-Sir-Brads-Version

Uploaded by

Ruiz, CherryjaneCopyright:

Available Formats

LECPA Review Study Guide (Sir Brad's Version)

Schedule of Topics

Finish review in 4 months (1 hr per day)

Note: we recommend 1.5x watching speed (or even 2x for other topics)

FAR AFAR MS TAX AT AP RFBT

Week 1

Mon > Cash and Cash Equivalents

Tue > Partnership Formation

Wed > Cost Concepts

Thur > General Principles

Fri > Overview of Audit

Sat > Audit of Accounts Receivable

Sun > Intellectual Property Code

Week 2

Mon > Bank Reconciliation

Tue > Partnership Operation

Wed > CVP Analysis

Thur > Individuals

Fri > System of Quality Control

Sat > Audit of Inventory

Sun > PDIC

Week 3

Mon > Trade and Other Receivables

Tue > Partnership Dissolution

Wed > Absorption Vs. Variable Costing

Thur > Corporations

Fri > Audit Planning

Sat > Audit of Investments

> Bank Secrecy

Sun

> Data Privacy Act

Week 4

Mon > Notes and Loan Receivable and Impairment

Tue > Partnership Liquidation

Wed > Standard Costing

Thur > Corporations

Fri > Audit Risk

Sat > Audit of PPE

> Electronic Commerce Act

Sun

> Corporate Governance

Week 5

Mon > Receivable Financing

Tue > Corporate Liquidation

Wed > Budgeting

> Partnership, JV, Co-

Thur ownership

> Estate and Trust

Fri > Understanding Internal Controls

Sat > Audit of Intangible Assets

> Ease of Doing Business

Sun

> Securities Regulations Code

Week 6

Mon > Inventory

Tue > Home Office and Branch

Wed > Relevant Costing

Thur > Gross Income

Fri > Testing of Controls (TOC)

Sat > Audit of SHE

> Bouncing Checks Law (BP 22)

Sun

> AMLA

Week 7

Mon > Inventory Estimation

Tue > Job Order Costing

Wed > Responsibility Accounting

Thur > Deductions

Fri > Audit Evidence

Sat > Audit of Liabilities

Sun > Obligations

Week 8

Mon > Investments

Tue > Process Costing

Wed > Transfer Pricing

> Fringe Benefits

Thur

> Installment Reporting

Fri > Audit Sampling

Sat > Error Correction

LECPA Review Study Guide (Sir Brad's Version)

Schedule of Topics

Finish review in 4 months (1 hr per day)

Note: we recommend 1.5x watching speed (or even 2x for other topics)

FAR AFAR MS TAX AT AP RFBT

Sun > Obligations

Week 9

> Investment in Associate

Mon > Joint Arrangement

> Investment Property

Tue > ABC Analysis

Wed > Capital Budgeting

Thur > Capital Asset

Fri > Completing the Audit

Sat > Audit of Cash

Sun > Contracts

Week 10

Mon > Property, Plant and Equipment

> Joint and By-Product Costing

Tue

> JIT and Backflush Costing, ABC

Analysis

Wed > Cost of Capital

Thur > Donor's Tax

Fri > Opinion and Auditor's Report

> Government Grant

Sat

> Borrowing Cost

> Sales

Sun

> Credit Transactions

Week 11

> Revaluation and Impairment

Mon

> Exploration Assets and Depletion

Tue > Forex

Wed > Financial Statement Analysis

Thur > Estate Tax

Fri > IT Audit

Sat > Intangible Assets

Sun > Corporations

Week 12

Mon > Biological Assets

Tue > Derivatives

Wed > Working Capital Management

Thur > Estate Tax

Fri > Code of Ethics

Sat > Shareholders’ Equity (FAR)

Sun > Corporations

Week 13

Mon > Leases

Tue > Business Combination

Wed > Quantitative Analysis

Thur > Value-Added Tax

Fri > RA 9298

> NCAHFS and Discontinued Operations (FAR)

Sat > Accounting Changes - Policies and

Estimates (FAR)

Sun > Partnership

Week 14

Events After The Reporting Period

Mon

Basic Accounting Concepts

Tue > Joint Arrangement

Wed > Economics

Thur > Value-Added Tax

Fri > Bonds Payable (FAR)

Sat > Employee Benefits (FAR)

Sun > Cooperatives

Week 15

Mon > Current Liabilities

Tue > Non-Profit Organization

Wed > Note Payable and Debt Restructure

> Other Percentage Tax

Thur

> Excise Tax and DST

> Interim Reporting

Fri

> Operating Segment

> Revised Conceptual Framework (FAR)

Sat

> Related Party Disclosures

> Truth in Lending Act

Sun

> Consumer Production

LECPA Review Study Guide (Sir Brad's Version)

Schedule of Topics

Finish review in 4 months (1 hr per day)

Note: we recommend 1.5x watching speed (or even 2x for other topics)

FAR AFAR MS TAX AT AP RFBT

Week 16

Mon > Income Tax

Tue > Government Accounting

Wed > Share-Based Compensation (FAR)

Thur > Local Taxes

Fri > Presentation of Financial Statements

Sat > Book Value Per Share and Quasi-Reorganization

> FRIA

Sun

> Government Procurement Law

Week 17

> Statement of Financial Position

Mon

> Statement of Comprehensive Income

Tue > IFRS 15

Wed > Statement of Cash Flows (FAR)

Thur > Preferential Taxation

Fri > Earnings per share (EPS)

Sat

> Philippine Competition Act

Sun > Amended Insurance Code

> Philippine Lemon Law

Week 18

Mon > SMEs

Tue

Wed

Thur > Remedies and Filing

Fri

Sat

> Labor Law

Sun

> Social Security Law

LECPA Review Study Guide (Sir Brad's Version)

Schedule of Topics

Finish review in 3 months (2 hrs per day)

Note: we recommend 1.5x watching speed (or even 2x for other topics)

FAR AFAR MS TAX AT AP RFBT

Week 1

> Cash and Cash Equivalents

Mon

> Bank Reconciliation

> Partnership Formation

Tue

> Partnership Operation

Wed > Cost Concepts

Thur > General Principles

Fri > Overview of Audit

Sat > Audit of Accounts Receivable

> Intellectual Property Code

Sun

> PDIC

Week 2

Mon > Trade and Other Receivables

Tue > Partnership Dissolution

> CVP Analysis

Wed

> Absorption Vs. Variable Costing

Thur > Individuals

Fri > System of Quality Control

Sat > Audit of Inventory

> Bank Secrecy

Sun

> Data Privacy Act

Week 3

> Notes and Loans Receivable and Impairment

Mon

> Receivable Financing

Tue > Partnership Liquidation

Wed > Standard Costing

Thur > Corporations

Fri > Audit Planning

Sat > Audit of Investments

> Electronic Commerce Act

Sun

> Corporate Governance

Week 4

> Inventory

Mon

> Inventory Estimation

Tue > Corporate Liquidation

> Budgeting

Wed

> Relevant Costing

> Partnership, JV, Co-

Thur ownership

> Estate and Trust

Fri > Audit Risk

Sat > Audit of PPE

> Ease of Doing Business

Sun

> Securities Regulations Code

Week 5

Mon > Investments

Tue > Home Office and Branch

> Responsibility Accounting

Wed

> Transfer Pricing

Thur > Gross Income

Fri > Understanding Internal Controls

Sat > Audit of Intangible Assets

> Bouncing Checks Law (BP 22)

Sun

> AMLA

Week 6

> Investment in Associate

Mon > Joint Arrangement

> Investment Property

> Job Order Costing

Tue

> ABC Analysis

> Capital Budgeting

Wed

> Cost of Capital

Thur > Deductions

Fri > Testing of Controls (TOC)

Sat > Audit of SHE

Sun > Obligations

Week 7

> Property, Plant and Equipment

Mon

> Revaluation and Impairment

Tue > Process Costing

LECPA Review Study Guide (Sir Brad's Version)

Schedule of Topics

Finish review in 3 months (2 hrs per day)

Note: we recommend 1.5x watching speed (or even 2x for other topics)

FAR AFAR MS TAX AT AP RFBT

Wed > Financial Statement Analysis

> Fringe Benefits

Thur

> Installment Reporting

Fri > Audit Evidence

Sat > Audit of Liabilities

Sun > Contracts

Week 8

> Exploration Assets and Depletion

Mon

> Government Grant

> Joint and By-Product Costing

Tue > JIT and Backflush Costing, ABC

Analysis

> Working Capital Management

Wed

> Quantitative Analysis

Thur > Capital Asset

Fri > Audit Sampling

Sat > Error Correction

> Sales

Sun

> Credit Transactions

Week 9

> Borrowing Cost

Mon

> Biological Assets

> Forex

Tue

> Derivatives

Wed > Economics

Thur > Donor's Tax

Fri > Completing the Audit

Sat > Audit of Cash

Sun Corporations

Week 10

Mon > Intangible Assets

Tue > Business Combination

Wed > Bonds Payable (FAR)

Thur > Estate Tax

Fri > Opinion and Auditor's Report

Sat > Leases (FAR)

> Partnership

Sun

> Cooperatives

Week 11

> Current Liabilities

Mon

> Note Payable and Debt Restructure

> Joint Arrangement

Tue

> Non-Profit Organization

Wed > Employee Benefits (FAR)

Thur > Value-Added Tax

Fri > IT Audit

Sat > Shareholders’ Equity (FAR)

> Truth in Lending Act

Sun

> Consumer Production

Week 12

Mon > Income Tax (FAR)

Tue > Government Accounting

> NCAHFS and Discontinued Operations

(FAR)

Wed

> Accounting Changes - Policies and

Estimates (FAR)

> Other Percentage Tax

Thur

> Excise Tax and DST

Fri > Code of Ethics

Events After The Reporting Period (FAR)

Sat

Basic Accounting Concepts (FAR)

> FRIA

Sun

> Government Procurement Law

Week 13

Mon > Share-Based Compensation (FAR)

Tue > IFRS 15

> Statement of Financial Position (FAR)

Wed

> Statement of Comprehensive Income

(FAR)

Thur > Local Taxes

Fri > RA 9298

Sat > Statement of Cash Flows (FAR)

LECPA Review Study Guide (Sir Brad's Version)

Schedule of Topics

Finish review in 3 months (2 hrs per day)

Note: we recommend 1.5x watching speed (or even 2x for other topics)

FAR AFAR MS TAX AT AP RFBT

> Philippine Competition Act

Sun

> Amended Insurance Code

Week 14

> Related Party Disclosures

Mon

> Interim Reporting

> Operating Segment

Tue > Presentation of Financial

Statements

> Book Value Per Share and Quasi-

Wed Reorganization

> Revised Conceptual Framework (FAR)

> Preferential Taxation

Thur

> Remedies and Filing

> SMEs (FAR)

Fri

> Earnings per share (EPS)

Sat > Philippine Lemon Law (RFBT)

> Labor Law

Sun

> Social Security Law

LECPA Review Study Guide (Sir Brad's Version)

Schedule of Topics

Finish review in 2 months (3 hrs per day)

Note: we recommend 1.5x watching speed (or even 2x for other topics)

FAR AFAR MS TAX AT AP RFBT

Week 1

> Cash and Cash Equivalents

Mon > Bank Reconciliation

> Trade and Other Receivables

> Partnership Formation

Tue

> Partnership Operation

> Cost Concepts

Wed

> CVP Analysis

> General Principles

Thur

> Individuals

> Overview of Audit

Fri

> System of Quality Control

> Audit of Accounts Receivable

Sat

> Audit of Inventory

> Intellectual Property Code

Sun > PDIC

> Bank Secrecy

Week 2

> Notes and Loans Receivable and Impairment

> Receivable Financing

Mon

> Inventory

> Inventory Estimation

> Partnership Dissolution

Tue

> Partnership Liquidation

> Absorption Vs. Variable

Wed Costing

> Standard Costing

Thur > Corporations

> Audit Planning

Fri

> Audit Risk

> Audit of Investments

Sat

> Audit of PPE

> Data Privacy Act

Sun > Electronic Commerce Act

> Corporate Governance

Week 3

> Investments

Mon > Investment in Associate

> Joint Arrangement

> Corporate Liquidation

Tue

> Home Office and Branch

> Budgeting

Wed

> Relevant Costing

> Partnership, JV, Co-

Thur ownership

> Estate and Trust

> Understanding Internal Controls

Fri

> Testing of Controls (TOC)

> Audit of Intangible Assets

Sat

> Audit of SHE

> Ease of Doing Business

> Securities Regulations Code

Sun

> Bouncing Checks Law (BP 22)

> AMLA

Week 4

> Investment Property

Mon

> Property, Plant and Equipment

> Job Order Costing

Tue

> Process Costing

> Responsibility Accounting

Wed

> Transfer Pricing

> Gross Income

Thur

> Deductions

Fri > Audit Evidence

> Audit of Liabilities

Sat

> Error Correction

Sun > Obligations

Week 5

> Revaluation and Impairment

Mon > Exploration Assets and Depletion

> Government Grant

> Joint and By-Product Costing

Tue > JIT and Backflush Costing

> ABC Analysis

> Capital Budgeting

Wed

> Cost of Capital

> Fringe Benefits

Thur > Installment Reporting

> Capital Asset

> Audit Sampling

Fri

> Completing the Audit

Sat > Audit of Cash

> Contracts

Sun > Sales

> Credit Transactions

Week 6

> Borrowing Cost

Mon > Biological Assets

> Intangible Assets

> Forex

Tue

> Derivatives

> Financial Statement Analysis

Wed

> Working Capital Management

LECPA Review Study Guide (Sir Brad's Version)

Schedule of Topics

Finish review in 2 months (3 hrs per day)

Note: we recommend 1.5x watching speed (or even 2x for other topics)

FAR AFAR MS TAX AT AP RFBT

> Donor's Tax

Thur

> Estate Tax

> Opinion and Auditor's Report

Fri

> IT Audit

> Shareholders’ Equity (FAR)

Sat

> Share-Based Compensation (FAR)

Sun Corporations

Week 7

> Current Liabilities

Mon

> Note Payable and Debt Restructure

Tue > Business Combination

> Quantitative Analysis

Wed

> Economics

Thur > Value-Added Tax

> Code of Ethics

Fri

> RA 9298

> Statement of Financial Position (FAR)

Sat > Statement of Comprehensive Income (FAR)

> Statement of Cash Flows (FAR)

> Partnership

Sun

> Cooperatives

Week 8

> Bonds Payable > Joint Arrangement

Mon

> Leases > Non-Profit Organization

Tue

> Income Tax (FAR)

Wed

> Employee Benefits (FAR)

> Other Percentage Tax

Thur > Excise Tax and DST

> Local Taxes

Events After The Reporting Period (FAR)

Fri Basic Accounting Concepts (FAR)

Presentation of Financial Statements

(FAR)

Sat > Revised Conceptual Framework (FAR)

> Truth in Lending Act

> Consumer Production

Sun > Philippine Lemon Law

> FRIA

> Government Procurement Law

Week 9

> Related Party Disclosures

> Interim Reporting

Mon > Operating Segment

> Government Accounting

> IFRS 15

Tue

> NCAHFS and Discontinued

Operations (FAR)

> Accounting Changes - Policies

Wed and Estimates (FAR)

> Preferential Taxation

Thur > Remedies and Filing

> Book Value Per Share and Quasi-

Reorganization (FAR)

Fri

> SMEs (FAR)

Sat > Earnings per share (EPS)

> Philippine Competition Act

> Amended Insurance Code

> Labor Law

Sun > Social Security Law

First and Final Preboard Exams

Coverage

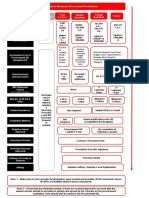

MAS AT TAX RFBT FAR AFAR

1 Cost Concepts 1 Overview of Audit 1 General Principles of Taxation 1 Intellectual Property Code 1 Cash and Cash Equivalents 1 Partnership Formation

2 CVP Analysis 2 System of Quality Management 2 Individuals 2 Banking Laws (PDIC, Bank Secrecy) 2 Bank Reconciliation 2 Partnership Operation

3 Absorption Vs. Variable Costing 3 Audit Planning 3 Corporations 3 Data Privacy Act 3 Trade and Other Receivables 3 Partnership Dissolution

4 Standard Costing 4 Audit Risk 4 Partnership, JV, Co-ownership 4 Electronic Commerce Act 4 Notes and Loans Receivable and Impairment 4 Partnership Liquidation

5 Budgeting 5 Understanding Internal Controls 5 Estate and Trust 5 Ease of Doing Business 5 Receivable Financing 5 Corporate Liquidation

6 Relevant Costing 6 Testing of Controls (TOC) 6 Gross Income 6 Securities Regulations Code 6 Inventory 6 Home Office and Branch

7 Responsibility Accounting 1st PB 7 Deductions 7 Bouncing Checks Law (BP 22) 7 Inventory Estimation 7 Job Order Costing

8 Transfer Pricing 8 Fringe Benefits 8 AMLA 8 Investments 8 Process Costing

1st PB 7 Audit Evidence 9 Installment Reporting 9 Obligations 9 Investment in Associate 9 Joint and By-Product Costing

8 Audit Sampling 10 Capital Asset 10 Contracts 10 Investment Property 10 JIT and Backflush Costing

9 Capital Budgeting 9 Completing the Audit 1st PB 11 Sales 11 Other LT Investments 11 Activity-Based Costing (ABC)

10 Cost of Capital 10 Forming an Opinion and Auditor's Report 12 Credit Transactions 12 Property, Plant & Equipment 1st PB

11 Financial Statement Analysis 11 IT Audit 11 Donor's Tax 1st PB 13 Revaluation and Impairment

12 Working Capital Management 12 Code of Ethics 12 Estate Tax 14 Wasting Assets and Depletion 12 Forex

13 Quantitative Analysis 13 RA 9298 13 Value-Added Tax 15 Government Grant 13 Derivatives

14 Economics Final PB (all topics) 14 Other Percentage Tax 13 Partnership 16 Borrowing Cost 14 Business Combination

Final PB (all topics) 15 Excise Tax and DST 14 Corporations & Corporate Governance 17 Biological Assets 15 Joint Arrangement

AP 16 Local Taxes 15 Cooperatives 18 Intangible Assets 16 Non-Profit Organization

1 Audit of AR 17 Preferential Taxation 16 Consumer Production 1st PB 17 Government Accounting

2 Audit of Inventory 18 Remedies 17 Philippine Lemon Law 18 IFRS 15

3 Audit of Investments Final PB (all topics) 18 Truth in Lending Act 1 Current Liabilities Final PB (all topics)

4 Audit of PPE 19 Financial Rehabilitation and Insolvency 2 Note Payable and Debt Restructure

1st PB 20 Insurance Code 3 Bonds Payable

21 Government Procurement Law 4 Leases

5 Audit of Intangible Assets 22 Philippine Competition Act 5 Income Taxes

6 Audit of SHE 23 Labor Standards 6 Employee Benefits

7 Audit of Liabilities 24 Social Security Law 7 Shareholders’ Equity

8 Correction of Errors Final PB (all topics) 8 Share-Based Compensation

9 Audit of Cash 9 Statement of Financial Position

Final PB (all topics) 10 Statement of Comprehensive Income

11 Statement of Cash Flows

12 Events After The Reporting Period

13 Revised Conceptual Framework

14 Basic Accounting Concepts and Process

15 Presentation of Financial Statements

16 Related Party Disclosures

17 Interim Reporting

18 Operating Segment

19 Noncurrent Asset Held For Sale and Discontinued Operations

20 Accounting Changes - Policies and Estimates

21 Book Value Per Share (BVPS)

22 Earnings Per Share (EPS)

23 Small And Medium-Sized Entities (SMEs)

Final PB (all topics)

Periodic Self-Assessment

Coverage

MAS AT TAX RFBT FAR AFAR

Cost Concepts Overview of Audit General Principles of Taxation Intellectual Property Code Cash and Cash Equivalents Partnership Formation

CVP Analysis System of Quality Control Individuals Banking Laws (PDIC, Bank Secrecy) Bank Reconciliation Partnership Operation

Absorption Vs. Variable Costing Audit Planning Corporations Data Privacy Act Trade and Other Receivables Partnership Dissolution

1st self-assessment 1st self-assessment Partnership, JV, Co-ownership Electronic Commerce Act Notes and Loans Receivable and Impairment Partnership Liquidation

Estate and Trust Corporate Governance Receivable Financing Corporate Liquidation

Responsibility Accounting Audit Evidence 1st self-assessment Ease of Doing Business Inventory Home Office and Branch

Transfer Pricing Audit Sampling Securities Regulations Code Inventory Estimation 1st self-assessment

Capital Budgeting Completing the Audit Donor's Tax Bouncing Checks Law (BP 22) Investments

Cost of Capital 2nd self-assessment Estate Tax AMLA Investment in Associate Forex

2nd self-assessment Value-Added Tax 1st self-assessment 1st self-assessment Derivatives

Other Percentage Tax Business Combination

AP 2nd self-assessment Cooperatives Current Liabilities Non-Profit Organization

Audit of AR Consumer Production Note Payable and Debt Restructure Government Accounting

Audit of Inventory Philippine Lemon Law Bonds Payable 2nd self-assessment

1st self-assessment Truth in Lending Act Leases

Financial Rehabilitation and Insolvency Income Tax

Audit of Intangible Assets Insurance Code Employee Benefits

Audit of Liabilities Government Procurement Law Shareholders’ Equity

Audit of SHE Philippine Competition Act Share-Based Compensation

2nd self-assessment Labor Standards 2nd self-assessment

Social Security Law

2nd self-assessment

You might also like

- Intermediate Financial Accounting & Reporting (ACC406) : Final ProjectDocument23 pagesIntermediate Financial Accounting & Reporting (ACC406) : Final ProjectNajjah Zainudin193No ratings yet

- Business Important NotesDocument8 pagesBusiness Important NotesHtike Myat PhyuNo ratings yet

- Updated Procurement Plan - Feb 2023Document4 pagesUpdated Procurement Plan - Feb 2023Susan KunkleNo ratings yet

- Onboarding ChecklistDocument1 pageOnboarding ChecklistAna BananaNo ratings yet

- Executive Compensation in Venture Stage CompaniesDocument13 pagesExecutive Compensation in Venture Stage CompaniesPradeep KumarNo ratings yet

- Revision 1Document12 pagesRevision 1Thư TrầnNo ratings yet

- WTO - Intellectual Property - Overview of TRIPS AgreementDocument2 pagesWTO - Intellectual Property - Overview of TRIPS Agreementvivek singhNo ratings yet

- Upload D e V I A Ti o N Remarks View PRI NT Save & Proceed: Credit Appraisal Memo (CAM)Document5 pagesUpload D e V I A Ti o N Remarks View PRI NT Save & Proceed: Credit Appraisal Memo (CAM)RAJESH MISHRANo ratings yet

- Kuliah - Week 1 (Pengantar Analbi)Document1 pageKuliah - Week 1 (Pengantar Analbi)Falisha RivienaNo ratings yet

- Topic 3: Analysis of Financial Statement 1. Industry Average Company's Ratio Vs Industry Average CommentDocument4 pagesTopic 3: Analysis of Financial Statement 1. Industry Average Company's Ratio Vs Industry Average CommentNguyen Hai AnhNo ratings yet

- BCom Professional Sem 1 & 2 Syllabus As Per Govt NEP GRDocument16 pagesBCom Professional Sem 1 & 2 Syllabus As Per Govt NEP GRShivam YadavNo ratings yet

- Action Plan: Areas of Concern Recommendation Timetable in ChargeDocument2 pagesAction Plan: Areas of Concern Recommendation Timetable in ChargeCleofe GuillermoNo ratings yet

- Project Preparation Advance To The Gambia State Owned Enterprises Restructuring Project - March 2019 1Document11 pagesProject Preparation Advance To The Gambia State Owned Enterprises Restructuring Project - March 2019 1Kimbeng TebeneNo ratings yet

- Operations Assignment_Team OpsPro_Ranjana_Vipin_Amoga (1)Document26 pagesOperations Assignment_Team OpsPro_Ranjana_Vipin_Amoga (1)RanjanaNo ratings yet

- Day-3 Going Concern SA 570 PDFDocument5 pagesDay-3 Going Concern SA 570 PDFAkshayaa B. R.No ratings yet

- Till 6 MayDocument16 pagesTill 6 Mayabdulmoizchohan35No ratings yet

- Prep For ACE Journey Q2 2023 Ivan Vlad S - MAPDocument1 pagePrep For ACE Journey Q2 2023 Ivan Vlad S - MAPshyamsundarsrNo ratings yet

- F8 Summary TopicDocument1 pageF8 Summary TopicChoi HongNo ratings yet

- SRDocument2 pagesSRShaheryar ShahidNo ratings yet

- Flowchart Keputusan SiakDocument1 pageFlowchart Keputusan SiakyudiadyjemberNo ratings yet

- Analisis Del Sistema CostosDocument6 pagesAnalisis Del Sistema CostosOmar Hernan MartinezNo ratings yet

- Option 1 Option 2 Option 3 Option 4 Answers: Shareholders Board of Directors Central Government State Government 1Document4 pagesOption 1 Option 2 Option 3 Option 4 Answers: Shareholders Board of Directors Central Government State Government 1King KongNo ratings yet

- Corrective Action Plan Template 07Document1 pageCorrective Action Plan Template 07Shahadat HossainNo ratings yet

- Luton Inc Exercise: Strictly ConfidentialDocument4 pagesLuton Inc Exercise: Strictly ConfidentialDavid JohnNo ratings yet

- Time Tracking Masterlist - The Bliss Bean v2Document1 pageTime Tracking Masterlist - The Bliss Bean v2VISALAKSHI100% (1)

- Quality Risk RegisterDocument1 pageQuality Risk RegisterImran ZamanNo ratings yet

- 10 Risk RegisterDocument4 pages10 Risk RegisterShannon MacDonaldNo ratings yet

- Topics Per SubjectDocument1 pageTopics Per SubjectNi’mah MustaphaNo ratings yet

- Notebook - Principle of AccountingDocument33 pagesNotebook - Principle of AccountingNguyễn Quỳnh AnhNo ratings yet

- SCR Proc Process OS LIDocument1 pageSCR Proc Process OS LISinzianaNo ratings yet

- Global Lint QuickBooks QuotationDocument1 pageGlobal Lint QuickBooks QuotationtedmasangoNo ratings yet

- Castler Real Estate DeckDocument14 pagesCastler Real Estate Deckpanshul.gupta3223No ratings yet

- MBP InsuranceDocument22 pagesMBP InsuranceMurtuza SadikotNo ratings yet

- Audit Consulting - - PVH audit - 中国验厂认证咨询网Document3 pagesAudit Consulting - - PVH audit - 中国验厂认证咨询网vinithaNo ratings yet

- Allyson Belden Resume 2023Document1 pageAllyson Belden Resume 2023Emdadul Hoque TusherNo ratings yet

- ADB GlossaryDocument2 pagesADB GlossaryAbbas SaqibNo ratings yet

- PM Meeting - #1 2-8-24Document4 pagesPM Meeting - #1 2-8-24james.rothmanNo ratings yet

- Chapter 9 (Sec 132, 134, 135)Document9 pagesChapter 9 (Sec 132, 134, 135)barnwalayush7531No ratings yet

- Test Scdeule L-VI Accounting 9706 2023Document2 pagesTest Scdeule L-VI Accounting 9706 2023Usman AttiqueNo ratings yet

- Proposal WEBDocument2 pagesProposal WEBJayesh JummaniNo ratings yet

- Revenue Cycle Lecture Notes 2Document6 pagesRevenue Cycle Lecture Notes 2Aldwin CalambaNo ratings yet

- PBx6Q NS DP BHA Training FlyerDocument2 pagesPBx6Q NS DP BHA Training FlyerAnonymous VNu3ODGav100% (2)

- JounalisingDocument1 pageJounalisingKingNo ratings yet

- Limits Delegation of AuthorityDocument13 pagesLimits Delegation of AuthoritySheikh Ahmer HameedNo ratings yet

- TS Prime BrochureDocument1 pageTS Prime BrochureyadbhavishyaNo ratings yet

- Global Exposure PolicyDocument19 pagesGlobal Exposure PolicyRajkot academyNo ratings yet

- 15 SRESubmissionReviewandApprovalCentral-System OkDocument7 pages15 SRESubmissionReviewandApprovalCentral-System OkAttyGalva22No ratings yet

- Blank UmlDocument1 pageBlank Umlapi-301516894No ratings yet

- Shruti Agrawal CVDocument1 pageShruti Agrawal CVswatmohitNo ratings yet

- 2019-215 MPERS A Complete Toolkit For SME Financial Reporting - v9Document2 pages2019-215 MPERS A Complete Toolkit For SME Financial Reporting - v9Mohd Fadzlullah RamleeNo ratings yet

- 10 Risk RegisterDocument2 pages10 Risk RegisterShannon MacDonaldNo ratings yet

- Week 3 AY2021-2022 Carilion Case StudyDocument20 pagesWeek 3 AY2021-2022 Carilion Case StudyChloe NgNo ratings yet

- VPBank AR 2016 English v1.2.4 Part 3Document92 pagesVPBank AR 2016 English v1.2.4 Part 3Phuong NguyenNo ratings yet

- UTI Fixed Income Investment Framework October 2021.20211025-054901Document18 pagesUTI Fixed Income Investment Framework October 2021.20211025-054901meghaNo ratings yet

- ReSA Batch 47 ScheduleDocument1 pageReSA Batch 47 ScheduleyshizamNo ratings yet

- Audit Pratical KnowledgeDocument114 pagesAudit Pratical Knowledgesonia shahNo ratings yet

- 03A Ic PartDocument19 pages03A Ic Partraghuraghu1490003No ratings yet

- Risk and Analytical Full PDFDocument41 pagesRisk and Analytical Full PDFabdulmoizchohan35No ratings yet

- Kinds of ObligationsDocument1 pageKinds of ObligationsRuiz, CherryjaneNo ratings yet

- HISTORYDocument3 pagesHISTORYRuiz, CherryjaneNo ratings yet

- 96 Calendar ActivitiesDocument2 pages96 Calendar ActivitiesRuiz, CherryjaneNo ratings yet

- Wells Fargo-A Case-Study On Corporate GovernanceDocument4 pagesWells Fargo-A Case-Study On Corporate GovernanceRuiz, CherryjaneNo ratings yet

- CH 19 Acctg For Foreign Currency TransacDocument35 pagesCH 19 Acctg For Foreign Currency TransacRuiz, CherryjaneNo ratings yet

- Proposal HearingDocument1 pageProposal HearingRuiz, CherryjaneNo ratings yet

- Chapter 3-8Document2 pagesChapter 3-8Ruiz, CherryjaneNo ratings yet

- Chapter 4 Sec CodeDocument19 pagesChapter 4 Sec CodeRuiz, CherryjaneNo ratings yet

- Chapter 3 Exercise 1 Group Activity PDFDocument2 pagesChapter 3 Exercise 1 Group Activity PDFRuiz, CherryjaneNo ratings yet

- PFRS 5 Discontinued OperationsDocument11 pagesPFRS 5 Discontinued OperationsRuiz, CherryjaneNo ratings yet

- Financial Management Chapter 1Document11 pagesFinancial Management Chapter 1Ruiz, CherryjaneNo ratings yet

- Activity2-Answer Key1Document9 pagesActivity2-Answer Key1Ruiz, CherryjaneNo ratings yet

- Wells Fargo Scandal Alternative SolutionDocument1 pageWells Fargo Scandal Alternative SolutionRuiz, CherryjaneNo ratings yet

- Midterm ForumDocument5 pagesMidterm ForumRuiz, CherryjaneNo ratings yet

- Financial Management Cabrera CH 1 - 5Document72 pagesFinancial Management Cabrera CH 1 - 5Ruiz, CherryjaneNo ratings yet

- Quiz 2Document2 pagesQuiz 2Ruiz, CherryjaneNo ratings yet

- Chapter 1 MasDocument18 pagesChapter 1 MasRuiz, CherryjaneNo ratings yet

- Part II. Chapter 5 Collection of Real Property TaxDocument39 pagesPart II. Chapter 5 Collection of Real Property TaxRuiz, CherryjaneNo ratings yet

- Chapter 1: Introduction To Business AnalyticsDocument5 pagesChapter 1: Introduction To Business AnalyticsRuiz, CherryjaneNo ratings yet

- Chapter 2Document10 pagesChapter 2Ruiz, CherryjaneNo ratings yet

- c1 - LiabilitiesDocument44 pagesc1 - LiabilitiesRuiz, CherryjaneNo ratings yet

- Solution Part Wells FargoDocument1 pageSolution Part Wells FargoRuiz, CherryjaneNo ratings yet

- IA 2 - NotesDocument3 pagesIA 2 - NotesRuiz, CherryjaneNo ratings yet

- Acctg 324 Seatwork 1Document1 pageAcctg 324 Seatwork 1Ruiz, CherryjaneNo ratings yet

- Bonds PayableDocument39 pagesBonds PayableRuiz, CherryjaneNo ratings yet

- Chapter 5 Bonds PayableDocument3 pagesChapter 5 Bonds PayableRuiz, CherryjaneNo ratings yet

- Other TopicsDocument42 pagesOther TopicsRuiz, CherryjaneNo ratings yet

- Part II. Chapter 3 Exemption From Real Property TaxesDocument30 pagesPart II. Chapter 3 Exemption From Real Property TaxesRuiz, CherryjaneNo ratings yet

- Part II. Chapter 4 Appraisal Assessment of Real Property TaxDocument69 pagesPart II. Chapter 4 Appraisal Assessment of Real Property TaxRuiz, Cherryjane100% (1)

- Part II. Chapter 2 Imposition of Real Property TaxDocument30 pagesPart II. Chapter 2 Imposition of Real Property TaxRuiz, CherryjaneNo ratings yet

- Fraud AccountingDocument124 pagesFraud AccountingAbhishek Varma100% (3)

- Example Letter of EngagementDocument10 pagesExample Letter of EngagementTheWritersNo ratings yet

- Financial ManagementDocument88 pagesFinancial ManagementSomevi Bright KodjoNo ratings yet

- CC Cash Over and ShortDocument3 pagesCC Cash Over and ShortDanica BalinasNo ratings yet

- 1 - Accounting - Crossword 3Document2 pages1 - Accounting - Crossword 3Mercy Dioselina Torres SantamariaNo ratings yet

- Account Classification and PresentationDocument3 pagesAccount Classification and PresentationYlenna EscalonNo ratings yet

- An Assessment of The Role of External Auditor in The Detection and Prevention of Fraud in Deposit Money Banks in Nigeria (2005-2014)Document24 pagesAn Assessment of The Role of External Auditor in The Detection and Prevention of Fraud in Deposit Money Banks in Nigeria (2005-2014)Shuhada Shamsuddin100% (1)

- Audit Program For InvestmentsDocument3 pagesAudit Program For Investmentsxstljvll100% (1)

- MSCO Firm's ProfileDocument19 pagesMSCO Firm's ProfileSalman LatifNo ratings yet

- Accounting Transaction CodeDocument18 pagesAccounting Transaction CodedptsapNo ratings yet

- Dashboard Pinnacle CPA Review Study Guide (Sir Brad's Version)Document43 pagesDashboard Pinnacle CPA Review Study Guide (Sir Brad's Version)Mica TolentinoNo ratings yet

- FS LK December 2017Document188 pagesFS LK December 2017arkee78No ratings yet

- 11 Accountancy Notes ch05 Depreciation Provision and Reserves 02 PDFDocument18 pages11 Accountancy Notes ch05 Depreciation Provision and Reserves 02 PDFVigneshNo ratings yet

- Finance Modeling LabDocument1,400 pagesFinance Modeling LabPradeep Krishnan89% (9)

- Pre - Board Examination - Accountancy - Class XII - (2022-23)Document12 pagesPre - Board Examination - Accountancy - Class XII - (2022-23)Shipra GumberNo ratings yet

- Financial Accounting The Impact On Decision Makers 10th Edition Porter Solutions ManualDocument41 pagesFinancial Accounting The Impact On Decision Makers 10th Edition Porter Solutions Manualhildabacvvz100% (29)

- CAso - Tire City ResueltoDocument11 pagesCAso - Tire City ResueltoJhoseph MoraNo ratings yet

- CFA - 6, 7 & 9. Financial Reporting and AnalysisDocument3 pagesCFA - 6, 7 & 9. Financial Reporting and AnalysisChan Kwok WanNo ratings yet

- Finance ManagerDocument3 pagesFinance Managerowakuza dotcomNo ratings yet

- Financial Statement Coca ColaDocument4 pagesFinancial Statement Coca ColaDane LavegaNo ratings yet

- Exercises On Cash Flow Statement AnalysisDocument3 pagesExercises On Cash Flow Statement AnalysisBoa HancockNo ratings yet

- CashFlow With SolutionsDocument82 pagesCashFlow With SolutionsHermen Kapello100% (2)

- ACCA SA Nov12 Fau f8 Audit Procedures PDFDocument5 pagesACCA SA Nov12 Fau f8 Audit Procedures PDFআরিফা আজহারীNo ratings yet

- Productos Ramo Sas (Colombia) : Emis 12Th Floor 30 Crown Place London, EC2A 4EB, United KingdomDocument4 pagesProductos Ramo Sas (Colombia) : Emis 12Th Floor 30 Crown Place London, EC2A 4EB, United KingdomAndres RamirezNo ratings yet

- Performance AuditDocument124 pagesPerformance AuditПавел Манжос100% (2)

- P12 CMA FinalDocument17 pagesP12 CMA FinalGanesh MouryaNo ratings yet

- Accounting For Oracle ReceivablesDocument13 pagesAccounting For Oracle ReceivablesAshokNo ratings yet

- Financial Management AssignmentDocument53 pagesFinancial Management Assignmentmuleta100% (1)

- Accounting in ActionDocument51 pagesAccounting in Actionlove D infintyNo ratings yet