Professional Documents

Culture Documents

Financial Accountin 1

Financial Accountin 1

Uploaded by

ThagadurThangavelCopyright:

Available Formats

You might also like

- Financial Institution - Borrower: One Thousand One Hundred-Ten Dollars and 10/100Document1 pageFinancial Institution - Borrower: One Thousand One Hundred-Ten Dollars and 10/100MikeDouglas100% (13)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Oi Pulse Manual FileDocument297 pagesOi Pulse Manual FilePraveen C75% (4)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Accounting NotesDocument23 pagesAccounting Notesboiroy100% (1)

- Expected Credit Losses Simplified A BDO India Publication 2017 PDFDocument22 pagesExpected Credit Losses Simplified A BDO India Publication 2017 PDFAnonymous CSvZH6No ratings yet

- ACCT 101 Cheat SheetDocument1 pageACCT 101 Cheat SheetAndrea NingNo ratings yet

- Final and Capital Gains TaxDocument7 pagesFinal and Capital Gains TaxElla Marie LopezNo ratings yet

- CFP Mock Test Tax PlanningDocument8 pagesCFP Mock Test Tax PlanningDeep Shikha67% (3)

- Fundamentals of AccountingDocument39 pagesFundamentals of Accountingchaitra kiranNo ratings yet

- Mea Unit 3Document43 pagesMea Unit 3b21ai008No ratings yet

- Accounting Concepts AssingmentDocument13 pagesAccounting Concepts AssingmentKapilNo ratings yet

- Accounting concepts notes form 4 FBL and OSDocument12 pagesAccounting concepts notes form 4 FBL and OStshepoaidanNo ratings yet

- Accounting For Manager Complete NotesDocument105 pagesAccounting For Manager Complete NotesAARTI100% (2)

- MBA-AFM Theory QBDocument18 pagesMBA-AFM Theory QBkanikaNo ratings yet

- Financial, Cost and Management AccountingDocument82 pagesFinancial, Cost and Management Accountingmkpatidar100% (1)

- Bace 24 D 9Document149 pagesBace 24 D 9qamarunisha455No ratings yet

- Frsa Theory Notes Unit IDocument7 pagesFrsa Theory Notes Unit ISuganesh NetflixNo ratings yet

- Jaibb AccountingDocument13 pagesJaibb AccountingAriful Haque SajibNo ratings yet

- GFA06 - Financial Analysis and Appraisal of ProjectsDocument48 pagesGFA06 - Financial Analysis and Appraisal of ProjectswossenNo ratings yet

- Accounting Notes For EE SubjectDocument32 pagesAccounting Notes For EE SubjectSanjay YadavNo ratings yet

- AFM Short NotesDocument56 pagesAFM Short NotesthamiztNo ratings yet

- MEAUNIT3pdf RemovedDocument29 pagesMEAUNIT3pdf Removedb20cs099No ratings yet

- PAPER I Advance Financial ManagementDocument350 pagesPAPER I Advance Financial ManagementinstainstantuserNo ratings yet

- Course: Financial Accounting & AnalysisDocument16 pagesCourse: Financial Accounting & Analysiskarunakar vNo ratings yet

- Lecture Notes - Introduction To AccountingDocument21 pagesLecture Notes - Introduction To Accountinghua chen yuNo ratings yet

- Accounts Basic NotesDocument83 pagesAccounts Basic NotesJustin Walker100% (1)

- Handout Basic Accounting Concepts PDFDocument7 pagesHandout Basic Accounting Concepts PDFVįswáją KáŋnàNo ratings yet

- Financial Accounting For Managers Unit 1 Mba Sem 1Document13 pagesFinancial Accounting For Managers Unit 1 Mba Sem 1Mohit TripathiNo ratings yet

- Actbas1 - Lesson 1 2tay1112Document48 pagesActbas1 - Lesson 1 2tay1112Janelle GollabaNo ratings yet

- Accounting & Financial ManagementDocument92 pagesAccounting & Financial ManagementRajni Sinha VermaNo ratings yet

- ED Unit 3Document28 pagesED Unit 3sg.2312002No ratings yet

- Accounting Lec 1Document28 pagesAccounting Lec 1Swati OzaNo ratings yet

- BCA, BBA, BCOM-Financial AccountingDocument67 pagesBCA, BBA, BCOM-Financial AccountingThrisha Papa (Baby girl)No ratings yet

- Accounts NotesDocument12 pagesAccounts NotesRishi KumarNo ratings yet

- MCA-Account - Pandit (New) - Sem - IIDocument339 pagesMCA-Account - Pandit (New) - Sem - IIdeepshrm100% (1)

- Introduction To AccountingDocument19 pagesIntroduction To Accountingkarn.sakshi05No ratings yet

- Fundamentals of Accountancy, Business and Management 1: Module 2"Document68 pagesFundamentals of Accountancy, Business and Management 1: Module 2"Erica AlbaoNo ratings yet

- Majid 12 3762 1 Accounting Principles and ConceptsDocument5 pagesMajid 12 3762 1 Accounting Principles and ConceptsHasnain BhuttoNo ratings yet

- Fa Unit 1 - Notes - 20200718004241Document21 pagesFa Unit 1 - Notes - 20200718004241Vignesh CNo ratings yet

- Accounts NotesDocument12 pagesAccounts NotesRishi KumarNo ratings yet

- Introduction To AccountingDocument6 pagesIntroduction To AccountingNicole_Gella_G_1555No ratings yet

- Chapter 1Document6 pagesChapter 1Nlt20bca027 Mesak HmingthanmawiaNo ratings yet

- Accounting Concepts and Recording of Financial TransactionsDocument8 pagesAccounting Concepts and Recording of Financial Transactionsjunita bwaliNo ratings yet

- AE13A Introduction To AccountingDocument33 pagesAE13A Introduction To AccountingSherylLiquiganNo ratings yet

- The Management of The Finances of A Business / Organisation in Order To Achieve Financial ObjectivesDocument12 pagesThe Management of The Finances of A Business / Organisation in Order To Achieve Financial ObjectivesPrince GoyalNo ratings yet

- BEFA - Unit-4 NotesDocument43 pagesBEFA - Unit-4 Notesmadddy0769No ratings yet

- Account Full NotesDocument161 pagesAccount Full NotesAysha MariyamNo ratings yet

- FINANCIAL ACCOUNTING Notes PDFDocument134 pagesFINANCIAL ACCOUNTING Notes PDFMix Mixture67% (3)

- 20-155 Financial AccountingDocument5 pages20-155 Financial AccountingNoor FatimaNo ratings yet

- Rac 101 - Introduction Continued (Week 3)Document11 pagesRac 101 - Introduction Continued (Week 3)Kevin TamboNo ratings yet

- Accountancy ManualDocument61 pagesAccountancy ManualAhmad Fauzi MehatNo ratings yet

- Accounting NoteDocument96 pagesAccounting NoteFahomeda Rahman SumoniNo ratings yet

- Uniathena - Basic Accounting CourseDocument21 pagesUniathena - Basic Accounting CourseAdalia MahabirNo ratings yet

- FA NotesDocument340 pagesFA Notessanket100% (1)

- Unit 1 - Ffa Study Material-DrjDocument19 pagesUnit 1 - Ffa Study Material-DrjTushar Singh SanuNo ratings yet

- Meaning of AccountingDocument50 pagesMeaning of AccountingAyushi KhareNo ratings yet

- Ch1: Theoretical Framework Unit 1:vmeaning and Scope of AccountingDocument11 pagesCh1: Theoretical Framework Unit 1:vmeaning and Scope of Accountingvasantha mulpuriNo ratings yet

- Financial AccountingDocument33 pagesFinancial AccountingsureshNo ratings yet

- 2332 - Malik Muhammad Ali Advanced AcountingDocument25 pages2332 - Malik Muhammad Ali Advanced AcountingAli AgralNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Mastering Bookkeeping: Unveiling the Key to Financial SuccessFrom EverandMastering Bookkeeping: Unveiling the Key to Financial SuccessNo ratings yet

- Dollars and Sense: Demystifying Financial Records for Business OwnersFrom EverandDollars and Sense: Demystifying Financial Records for Business OwnersNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- 85-Medical Insurance Scheme For The Serving Officers & Employees Along With Option For Super Top Up FacilityDocument36 pages85-Medical Insurance Scheme For The Serving Officers & Employees Along With Option For Super Top Up FacilityParthasarathi LakshmanNo ratings yet

- Module 5 - PpsDocument4 pagesModule 5 - PpsMIGUEL JOSHUA VILLANUEVANo ratings yet

- Speciality ChemicalsDocument32 pagesSpeciality ChemicalsKeshav KhetanNo ratings yet

- Dealer Mapping FormDocument1 pageDealer Mapping FormHimanshuNo ratings yet

- Prompt Corrective Action: An Essential Element of Financial Stability FrameworkDocument19 pagesPrompt Corrective Action: An Essential Element of Financial Stability FrameworkSheril ThomasNo ratings yet

- Macro Economics 10 YearsDocument97 pagesMacro Economics 10 YearsManish Jha 2086No ratings yet

- New Microsoft Word DocumentDocument10 pagesNew Microsoft Word DocumentAditya RajputNo ratings yet

- IntroductionDocument14 pagesIntroductionTendai DzingiraiNo ratings yet

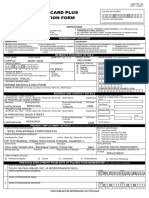

- PFF108 LoyaltyCardPlusApplicationForm V07 UPDATEDDocument2 pagesPFF108 LoyaltyCardPlusApplicationForm V07 UPDATEDjane deloviarNo ratings yet

- Definition of InterestDocument12 pagesDefinition of InterestCorolla SedanNo ratings yet

- 1.4 Partnership Template Answer SheetDocument14 pages1.4 Partnership Template Answer SheetCherry May PajutiningNo ratings yet

- Chapter 2 Business StructureDocument6 pagesChapter 2 Business StructurePaccarKtNo ratings yet

- Chapter Three Remittance: - 3.1 Outline of Remittance - 3.2 Procedure For Remittance - 3.3 Application of RemittanceDocument19 pagesChapter Three Remittance: - 3.1 Outline of Remittance - 3.2 Procedure For Remittance - 3.3 Application of Remittancevero100% (1)

- V12-021 Flash Boys PollDocument10 pagesV12-021 Flash Boys PolltabbforumNo ratings yet

- GBP Statement: Account Holder IBAN (To Receive GBP From UK Only) UK Sort CodeDocument1 pageGBP Statement: Account Holder IBAN (To Receive GBP From UK Only) UK Sort Code13KARATNo ratings yet

- ABM BusinessFinance Q4 Mod5 W1-2 TypesofInvestmentsDocument20 pagesABM BusinessFinance Q4 Mod5 W1-2 TypesofInvestmentsJayson AsencionNo ratings yet

- Life and Death Outline Natalie ChoateDocument27 pagesLife and Death Outline Natalie ChoateHilton GrandNo ratings yet

- Income From House PropertyDocument27 pagesIncome From House Propertyanon-713603100% (4)

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- Statement Date Account No Branch: 31/01/23 1 OF 1 11022024304855 Miri Tarikh Penyata Halaman Nombor Akaun CawanganDocument1 pageStatement Date Account No Branch: 31/01/23 1 OF 1 11022024304855 Miri Tarikh Penyata Halaman Nombor Akaun Cawangankanjou zokuNo ratings yet

- Current Stock Deal Settings - CFD PDFDocument257 pagesCurrent Stock Deal Settings - CFD PDFDuc TranNo ratings yet

- GST Update 14.10.2017Document35 pagesGST Update 14.10.2017dipaliNo ratings yet

- Insead Student Family Offices Global Landscape and Key Trends 2020Document34 pagesInsead Student Family Offices Global Landscape and Key Trends 2020Roshan GaikwadNo ratings yet

- Up Date DRR 26 FEB 2023Document76 pagesUp Date DRR 26 FEB 2023Shierly H. SihombingNo ratings yet

Financial Accountin 1

Financial Accountin 1

Uploaded by

ThagadurThangavelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accountin 1

Financial Accountin 1

Uploaded by

ThagadurThangavelCopyright:

Available Formats

SRI MOOGAMBIGAI COLLEGE OF ARTS AND SCIENCE (WOMEN)

PALACODE, DHARMAPURI, TN

B.COM

FINANCIAL ACCOUNTING - I

NAME:

Reg No:

Prepared By

Mr. R.SIVAKUMAR,

M.Com., M.Phil., MBA., D.T.Ed., B.Ed., D.Co-op.,

Assistant Professor,

PG Department of Commerce.

Mr.R.SIVAKUMAR, M.Com.,MBA., M.Phil., Asst. Professor, PG Department of Commerce Page 1

SRI MOOGAMBIGAI COLLEGE OF ARTS AND SCIENCE (WOMEN)

I-SEMESTER

CORE-I-FINANCIAL ACCOUNTING-I

UNIT-I Fundamental of Financial Accounting.

Financial Accounting Meaning Definition- Objective, Basic Accounting Concepts and Conventions

- Journal, Ledger Accounts Subsidiary Books - Trial Balance - Classification of Errors Error

Rectification of Preparation of Suspense Account - Bank Reconciliation Statement - Need and

preparation

1. What is meant by financial accounting?

Financial accounting is the process of recording, analysing, and summarizing the financial

transactions of an organization for an accounting period. It helps enterprises evaluate their

financial health and stability.

Definition of Financial Accounting

The American Institute of Certified Public Accountants define financial accounting as “the art of

recording, classifying and summarising in as significant manner and in terms of money

transactions and events which in part, at least of a financial character, and interpreting the results

thereof”

Accounting Principles

Accounting Concepts Accounting Conventions

a) Entity concept a) Disclosure

b) Dual aspect concept b Materiality

c) Going concern concept c) Consistency

d) Money measurement concept d) Conservatism

e) Cost concept

f) Cost attach concept

g) Accounting period concept

h) Accrual concept

i) Periodic matching of cost and Revenue concept

j) Realisation concept

k) Verifiable objective evidence concept

ACCOUNTING CONCEPTS

1. Business entity concept: A business and its owner should be treated separately as far as

their financial transactions are concerned.

2. Money measurement concept: Only business transactions that can be expressed in terms

of money are recorded in accounting, though records of other types of transactions may be

kept separately.

3. Dual aspect concept: For every credit, a corresponding debit is made. The recording of a

transaction is complete only with this dual aspect.

4. Going concern concept: In accounting, a business is expected to continue for a fairly long

time and carry out its commitments and obligations. This assumes that the business will

not be forced to stop functioning and liquidate its assets at “fire-sale” prices.

5. Cost concept: The fixed assets of a business are recorded on the basis of their original cost

in the first year of accounting. Subsequently, these assets are recorded minus depreciation.

No rise or fall in market price is taken into account. The concept applies only to fixed assets.

6. Accounting year concept: Each business chooses a specific time period to complete a cycle

of the accounting process—for example, monthly, quarterly, or annually—as per a fiscal or

a calendar year.

Mr.R.SIVAKUMAR, M.Com.,MBA., M.Phil., Asst. Professor, PG Department of Commerce Page 2

SRI MOOGAMBIGAI COLLEGE OF ARTS AND SCIENCE (WOMEN)

7. Matching concept: This principle dictates that for every entry of revenue recorded in a

given accounting period, an equal expense entry has to be recorded for correctly calculating

profit or loss in a given period.

8. Realisation concept: According to this concept, profit is recognised only when it is earned.

An advance or fee paid is not considered a profit until the goods or services have been

delivered to the buyer.

ACCOUNTING CONVENTIONS

There are four main conventions in practice in accounting: conservatism; consistency; full

disclosure; and materiality.

Conservatism is the convention by which, when two values of a transaction are available, the

lower-value transaction is recorded. By this convention, profit should never be overestimated, and

there should always be a provision for losses.

Consistency prescribes the use of the same accounting principles from one period of an

accounting cycle to the next, so that the same standards are applied to calculate profit and loss.

Materiality means that all material facts should be recorded in accounting. Accountants should

record important data and leave out insignificant information.

Full disclosure entails the revelation of all information, both favourable and detrimental to a

business enterprise, and which are of material value to creditors and debtors.

What is the Objective of Financial Accounting?

Record Financial Transactions: Financial accounting’s main goal is to record a company’s

money-related activities. It’s like keeping a detailed diary of where the money comes from and

where it goes.

Provide Clear Financial Picture: It aims to create financial statements like balance sheets and

income statements. These documents give a clear snapshot of how much money the company has,

how much it owes, and how much it’s making.

Ensure Accuracy: Financial accounting strives to ensure all the numbers are correct. Imagine

balancing your chequebook to avoid errors – it’s like that but on a larger scale.

Comply with Regulations: Companies must follow rules and laws when reporting their financial

information. Financial accounting ensures that the company plays by the rules, like a referee in a

game.

Help Decision-Making: Financial accounting data is used by company leaders and investors to

make smart decisions. It’s like having a map to choose the best route on a journey.

Attract Investors: Companies use financial statements to show potential investors how well they

do. It’s like a report card that can convince others to invest in the business.

Evaluate Performance: Financial accounting lets you compare the company’s performance over

time. It’s like looking at your grades from last year to see if you’re improving.

Assess Financial Health: It helps determine if the company is financially healthy or in trouble.

It’s like going to the doctor for a check-up to ensure everything’s okay.

Facilitate Accountability: Financial accounting holds everyone in the company accountable for

their financial actions. It’s like tracking who spent what in a shared household budget.

Support Transparency: It encourages companies to be open and honest about their financial

situation, which builds trust with customers, investors, and the public. It’s like having an open

book policy so everyone can see what’s happening.

HERE ARE SOME OF THE CHARACTERISTIC OR FEATURES:

Monetary recordkeeping: Financial accounts don’t record non-monetary transactions,

regardless of their importance from a business point of view.

Historical transaction recording: Financial accountants only track transactions that have

already taken place in the past.

Mr.R.SIVAKUMAR, M.Com.,MBA., M.Phil., Asst. Professor, PG Department of Commerce Page 3

SRI MOOGAMBIGAI COLLEGE OF ARTS AND SCIENCE (WOMEN)

Legal requirements: As law mandates, organizations must keep their financial accounts up-

to-date. They should also get financial statements audited to ensure accuracy.

Made for external use: Financial accounting reports inform customers, investors, suppliers,

and financial institutions about the financial performance of an organization.

Interim reports: Organizations treat financial account statements covering less than a year

as interim reports. These reports are useful for conveying the financial performance before a

full-year reporting cycle ends.

Forms the basis of other accounting branches: Financial accounting deals with raw data

from journals and ledgers. Therefore, it is the foundation for other accounting branches, such

as management accounting, cost accounting, and other advanced accounting methods.

What Are the Main Functions of Financial Accounting?

IMPORTANCE OF FINANCIAL ACCOUNTING

Financial accounting is of significant importance in the business world for several reasons:

Set of standard rules – By outlining a uniform set of regulations for the preparation of

financial statements, a standardised framework in financial accounting ensures coherence

across reporting periods and diverse companies.

Decreasing the risk – Through enhancing accountability, financial accounting mitigates risk

by bolstering transparency. External stakeholders such as lenders, regulatory bodies, and tax

authorities depend on financial information, and adherence to acceptable methodologies in

report preparation ensures that companies are held responsible for their performance.

Management insights – While managerial accounting may offer superior insights, financial

accounting can still facilitate strategic thinking if a company thoroughly evaluates its financial

outcomes and makes informed investment choices.

Trust in financial reporting – By establishing independent governing bodies to regulate

reporting standards, financial accounting fosters confidence in financial reporting. This

ensures that the foundation of reporting remains separate from management, providing a

dependable and trustworthy source of precise information.

Encourage transparency – Through the establishment of regulations and mandates, financial

accounting compels companies to divulge specific details regarding their operational status

and potential risks. Thus presenting an authentic depiction of financial performance,

irrespective of the company’s success or struggles. This emphasis on transparency ensures a

comprehensive understanding of the company’s financial condition.

ADVANTAGES OF FINANCIAL ACCOUNTING

1)Maintaining Business Records

Accounting helps in recording all financial transactions in the books of accounts in a systematic

manner. Therefore, we do not need to rely on human memory.

2)Preparing the Financial Statement

Accounting helps in determining the profit or loss as well as the financial position of the business

during a particular period. Accounting records and classification provide the relevant information

to the accountant for preparing financial statements.

3)Comparing Results

Accounting involves comparing the profits or loss in a given year with those of previous years. The

comparison helps in gathering important information and planning for the future operations.

4)Helping in Decision Making

It implies that accounting assists the management decision-making by providing significant

information for solving numerous problems, such as deciding the selling price of goods produced,

or deciding whether a part should be manufactured in the industrial unit or procured from outside.

5)Providing Information to Interested Groups

Mr.R.SIVAKUMAR, M.Com.,MBA., M.Phil., Asst. Professor, PG Department of Commerce Page 4

SRI MOOGAMBIGAI COLLEGE OF ARTS AND SCIENCE (WOMEN)

It implies that the accounting process provides appropriate information to various interested

parties, such as owners, creditors and management who are concerned about the accounting

information related to various aspects, such as, sales, production and profit.

6)Providing Legal Evidence

This refers to the documentary evidence of the accounting information for legal requirements.

This helps to prevent any misconduct or threats from rival organisations

Limitations of Financial Accounting

Focuses on Historical Data: Financial accounting mainly deals with past transactions. This

limits its ability to predict future financial performance.

Lacks Non-Financial Information: It does not include non-financial factors like employee

satisfaction or market competition. This can impact a company's valuation.

Adheres to Standards Strictly: The strict adherence to accounting standards may not always

reflect the actual economic situation of a business.

Subject to Manipulation: Financial statements can be manipulated through legal accounting

practices. This can mislead stakeholders.

Ignores Inflation: Financial accounting does not account for the effects of inflation on

reported financial results.

Time and Cost Intensive: The process of preparing financial statements according to

regulatory standards can be time-consuming and costly.

Provides Limited Scope for Analysis: It offers a limited scope for analysis by focusing

primarily on financial aspects, overlooking operational efficiencies.

Periodic Reporting: Financial accounting reports are generated at fixed intervals, which may

not provide timely information for decision-making.

Emphasis on Quantitative Data: It emphasizes quantitative data but it does overlook the

qualitative aspects that could affect a company's financial health. which lacks objectivity

What Are the Main Functions of Financial Accounting?

FUNCTIONS OF ACCOUNTING

(1) Recording: The basic function of accounting is recording the monetary aspect of all the

business transaction in an orderly manner for the purpose of memory and reference in a future

period, Recording is done in a book called Journal.

(2) Classifying: The transactions recorded in journal are classified and posted to the main book

of accounts known as Ledger.

(3) Summarizing: The transactions recorded in the ledger will be summarized and the balance in

each account will be ascertained and list of such balance is called Trial Balance will be prepared

at the end of accounting period.

(4) Interpreting: The final stage in the accounting process is analysing and interpreting the

financial data contained in the final account. It will help in planning for the future in a better way.

(5) Communicating: It communicates the results of the business to the various categories of

persons as owners, investors, creditors, employees, management, Government etc

Branches of accounting

Accounting has five main branches

Accounting Branches

1.Financial Accounting

2.Cost Accounting

3.Management Accounting

4.Social Responsibility Accounting

5.Human Resource Accounting

Mr.R.SIVAKUMAR, M.Com.,MBA., M.Phil., Asst. Professor, PG Department of Commerce Page 5

SRI MOOGAMBIGAI COLLEGE OF ARTS AND SCIENCE (WOMEN)

(1) Financial Accounting: Financial accounting is concerned with recording and processing all

transactions with outsiders and events affecting the financial position of the firm.

(2) Cost Accounting: Cost accounting seeks to ascertain the cost of each product or each job by

the firm. Cost accounting data is useful to the management.

(3) Management Accounting: Management accounting has the objective of collecting

systematically and regularly all such information as will help management in discharging its

functions of planning, control decision making.

(4) Social Responsibility Accounting: Social responsibility accounting describes the impact of

corporate decisions on environmental pollutions, the consumption of non-renewable resources

and ecological and groups on the maintenance of public services, on public safety, on health, and

education and many other such social concerns.

(5) Human Resource Accounting: Human resource accounting is a process to identify, qualify

and report investments made in human resources as employees are the assets of company, they

must be duly recognized

Mr.R.SIVAKUMAR, M.Com.,MBA., M.Phil., Asst. Professor, PG Department of Commerce Page 6

You might also like

- Financial Institution - Borrower: One Thousand One Hundred-Ten Dollars and 10/100Document1 pageFinancial Institution - Borrower: One Thousand One Hundred-Ten Dollars and 10/100MikeDouglas100% (13)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Oi Pulse Manual FileDocument297 pagesOi Pulse Manual FilePraveen C75% (4)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Accounting NotesDocument23 pagesAccounting Notesboiroy100% (1)

- Expected Credit Losses Simplified A BDO India Publication 2017 PDFDocument22 pagesExpected Credit Losses Simplified A BDO India Publication 2017 PDFAnonymous CSvZH6No ratings yet

- ACCT 101 Cheat SheetDocument1 pageACCT 101 Cheat SheetAndrea NingNo ratings yet

- Final and Capital Gains TaxDocument7 pagesFinal and Capital Gains TaxElla Marie LopezNo ratings yet

- CFP Mock Test Tax PlanningDocument8 pagesCFP Mock Test Tax PlanningDeep Shikha67% (3)

- Fundamentals of AccountingDocument39 pagesFundamentals of Accountingchaitra kiranNo ratings yet

- Mea Unit 3Document43 pagesMea Unit 3b21ai008No ratings yet

- Accounting Concepts AssingmentDocument13 pagesAccounting Concepts AssingmentKapilNo ratings yet

- Accounting concepts notes form 4 FBL and OSDocument12 pagesAccounting concepts notes form 4 FBL and OStshepoaidanNo ratings yet

- Accounting For Manager Complete NotesDocument105 pagesAccounting For Manager Complete NotesAARTI100% (2)

- MBA-AFM Theory QBDocument18 pagesMBA-AFM Theory QBkanikaNo ratings yet

- Financial, Cost and Management AccountingDocument82 pagesFinancial, Cost and Management Accountingmkpatidar100% (1)

- Bace 24 D 9Document149 pagesBace 24 D 9qamarunisha455No ratings yet

- Frsa Theory Notes Unit IDocument7 pagesFrsa Theory Notes Unit ISuganesh NetflixNo ratings yet

- Jaibb AccountingDocument13 pagesJaibb AccountingAriful Haque SajibNo ratings yet

- GFA06 - Financial Analysis and Appraisal of ProjectsDocument48 pagesGFA06 - Financial Analysis and Appraisal of ProjectswossenNo ratings yet

- Accounting Notes For EE SubjectDocument32 pagesAccounting Notes For EE SubjectSanjay YadavNo ratings yet

- AFM Short NotesDocument56 pagesAFM Short NotesthamiztNo ratings yet

- MEAUNIT3pdf RemovedDocument29 pagesMEAUNIT3pdf Removedb20cs099No ratings yet

- PAPER I Advance Financial ManagementDocument350 pagesPAPER I Advance Financial ManagementinstainstantuserNo ratings yet

- Course: Financial Accounting & AnalysisDocument16 pagesCourse: Financial Accounting & Analysiskarunakar vNo ratings yet

- Lecture Notes - Introduction To AccountingDocument21 pagesLecture Notes - Introduction To Accountinghua chen yuNo ratings yet

- Accounts Basic NotesDocument83 pagesAccounts Basic NotesJustin Walker100% (1)

- Handout Basic Accounting Concepts PDFDocument7 pagesHandout Basic Accounting Concepts PDFVįswáją KáŋnàNo ratings yet

- Financial Accounting For Managers Unit 1 Mba Sem 1Document13 pagesFinancial Accounting For Managers Unit 1 Mba Sem 1Mohit TripathiNo ratings yet

- Actbas1 - Lesson 1 2tay1112Document48 pagesActbas1 - Lesson 1 2tay1112Janelle GollabaNo ratings yet

- Accounting & Financial ManagementDocument92 pagesAccounting & Financial ManagementRajni Sinha VermaNo ratings yet

- ED Unit 3Document28 pagesED Unit 3sg.2312002No ratings yet

- Accounting Lec 1Document28 pagesAccounting Lec 1Swati OzaNo ratings yet

- BCA, BBA, BCOM-Financial AccountingDocument67 pagesBCA, BBA, BCOM-Financial AccountingThrisha Papa (Baby girl)No ratings yet

- Accounts NotesDocument12 pagesAccounts NotesRishi KumarNo ratings yet

- MCA-Account - Pandit (New) - Sem - IIDocument339 pagesMCA-Account - Pandit (New) - Sem - IIdeepshrm100% (1)

- Introduction To AccountingDocument19 pagesIntroduction To Accountingkarn.sakshi05No ratings yet

- Fundamentals of Accountancy, Business and Management 1: Module 2"Document68 pagesFundamentals of Accountancy, Business and Management 1: Module 2"Erica AlbaoNo ratings yet

- Majid 12 3762 1 Accounting Principles and ConceptsDocument5 pagesMajid 12 3762 1 Accounting Principles and ConceptsHasnain BhuttoNo ratings yet

- Fa Unit 1 - Notes - 20200718004241Document21 pagesFa Unit 1 - Notes - 20200718004241Vignesh CNo ratings yet

- Accounts NotesDocument12 pagesAccounts NotesRishi KumarNo ratings yet

- Introduction To AccountingDocument6 pagesIntroduction To AccountingNicole_Gella_G_1555No ratings yet

- Chapter 1Document6 pagesChapter 1Nlt20bca027 Mesak HmingthanmawiaNo ratings yet

- Accounting Concepts and Recording of Financial TransactionsDocument8 pagesAccounting Concepts and Recording of Financial Transactionsjunita bwaliNo ratings yet

- AE13A Introduction To AccountingDocument33 pagesAE13A Introduction To AccountingSherylLiquiganNo ratings yet

- The Management of The Finances of A Business / Organisation in Order To Achieve Financial ObjectivesDocument12 pagesThe Management of The Finances of A Business / Organisation in Order To Achieve Financial ObjectivesPrince GoyalNo ratings yet

- BEFA - Unit-4 NotesDocument43 pagesBEFA - Unit-4 Notesmadddy0769No ratings yet

- Account Full NotesDocument161 pagesAccount Full NotesAysha MariyamNo ratings yet

- FINANCIAL ACCOUNTING Notes PDFDocument134 pagesFINANCIAL ACCOUNTING Notes PDFMix Mixture67% (3)

- 20-155 Financial AccountingDocument5 pages20-155 Financial AccountingNoor FatimaNo ratings yet

- Rac 101 - Introduction Continued (Week 3)Document11 pagesRac 101 - Introduction Continued (Week 3)Kevin TamboNo ratings yet

- Accountancy ManualDocument61 pagesAccountancy ManualAhmad Fauzi MehatNo ratings yet

- Accounting NoteDocument96 pagesAccounting NoteFahomeda Rahman SumoniNo ratings yet

- Uniathena - Basic Accounting CourseDocument21 pagesUniathena - Basic Accounting CourseAdalia MahabirNo ratings yet

- FA NotesDocument340 pagesFA Notessanket100% (1)

- Unit 1 - Ffa Study Material-DrjDocument19 pagesUnit 1 - Ffa Study Material-DrjTushar Singh SanuNo ratings yet

- Meaning of AccountingDocument50 pagesMeaning of AccountingAyushi KhareNo ratings yet

- Ch1: Theoretical Framework Unit 1:vmeaning and Scope of AccountingDocument11 pagesCh1: Theoretical Framework Unit 1:vmeaning and Scope of Accountingvasantha mulpuriNo ratings yet

- Financial AccountingDocument33 pagesFinancial AccountingsureshNo ratings yet

- 2332 - Malik Muhammad Ali Advanced AcountingDocument25 pages2332 - Malik Muhammad Ali Advanced AcountingAli AgralNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Mastering Bookkeeping: Unveiling the Key to Financial SuccessFrom EverandMastering Bookkeeping: Unveiling the Key to Financial SuccessNo ratings yet

- Dollars and Sense: Demystifying Financial Records for Business OwnersFrom EverandDollars and Sense: Demystifying Financial Records for Business OwnersNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- 85-Medical Insurance Scheme For The Serving Officers & Employees Along With Option For Super Top Up FacilityDocument36 pages85-Medical Insurance Scheme For The Serving Officers & Employees Along With Option For Super Top Up FacilityParthasarathi LakshmanNo ratings yet

- Module 5 - PpsDocument4 pagesModule 5 - PpsMIGUEL JOSHUA VILLANUEVANo ratings yet

- Speciality ChemicalsDocument32 pagesSpeciality ChemicalsKeshav KhetanNo ratings yet

- Dealer Mapping FormDocument1 pageDealer Mapping FormHimanshuNo ratings yet

- Prompt Corrective Action: An Essential Element of Financial Stability FrameworkDocument19 pagesPrompt Corrective Action: An Essential Element of Financial Stability FrameworkSheril ThomasNo ratings yet

- Macro Economics 10 YearsDocument97 pagesMacro Economics 10 YearsManish Jha 2086No ratings yet

- New Microsoft Word DocumentDocument10 pagesNew Microsoft Word DocumentAditya RajputNo ratings yet

- IntroductionDocument14 pagesIntroductionTendai DzingiraiNo ratings yet

- PFF108 LoyaltyCardPlusApplicationForm V07 UPDATEDDocument2 pagesPFF108 LoyaltyCardPlusApplicationForm V07 UPDATEDjane deloviarNo ratings yet

- Definition of InterestDocument12 pagesDefinition of InterestCorolla SedanNo ratings yet

- 1.4 Partnership Template Answer SheetDocument14 pages1.4 Partnership Template Answer SheetCherry May PajutiningNo ratings yet

- Chapter 2 Business StructureDocument6 pagesChapter 2 Business StructurePaccarKtNo ratings yet

- Chapter Three Remittance: - 3.1 Outline of Remittance - 3.2 Procedure For Remittance - 3.3 Application of RemittanceDocument19 pagesChapter Three Remittance: - 3.1 Outline of Remittance - 3.2 Procedure For Remittance - 3.3 Application of Remittancevero100% (1)

- V12-021 Flash Boys PollDocument10 pagesV12-021 Flash Boys PolltabbforumNo ratings yet

- GBP Statement: Account Holder IBAN (To Receive GBP From UK Only) UK Sort CodeDocument1 pageGBP Statement: Account Holder IBAN (To Receive GBP From UK Only) UK Sort Code13KARATNo ratings yet

- ABM BusinessFinance Q4 Mod5 W1-2 TypesofInvestmentsDocument20 pagesABM BusinessFinance Q4 Mod5 W1-2 TypesofInvestmentsJayson AsencionNo ratings yet

- Life and Death Outline Natalie ChoateDocument27 pagesLife and Death Outline Natalie ChoateHilton GrandNo ratings yet

- Income From House PropertyDocument27 pagesIncome From House Propertyanon-713603100% (4)

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- Statement Date Account No Branch: 31/01/23 1 OF 1 11022024304855 Miri Tarikh Penyata Halaman Nombor Akaun CawanganDocument1 pageStatement Date Account No Branch: 31/01/23 1 OF 1 11022024304855 Miri Tarikh Penyata Halaman Nombor Akaun Cawangankanjou zokuNo ratings yet

- Current Stock Deal Settings - CFD PDFDocument257 pagesCurrent Stock Deal Settings - CFD PDFDuc TranNo ratings yet

- GST Update 14.10.2017Document35 pagesGST Update 14.10.2017dipaliNo ratings yet

- Insead Student Family Offices Global Landscape and Key Trends 2020Document34 pagesInsead Student Family Offices Global Landscape and Key Trends 2020Roshan GaikwadNo ratings yet

- Up Date DRR 26 FEB 2023Document76 pagesUp Date DRR 26 FEB 2023Shierly H. SihombingNo ratings yet